Booking options

£45 - £430

£45 - £430

On-Demand course

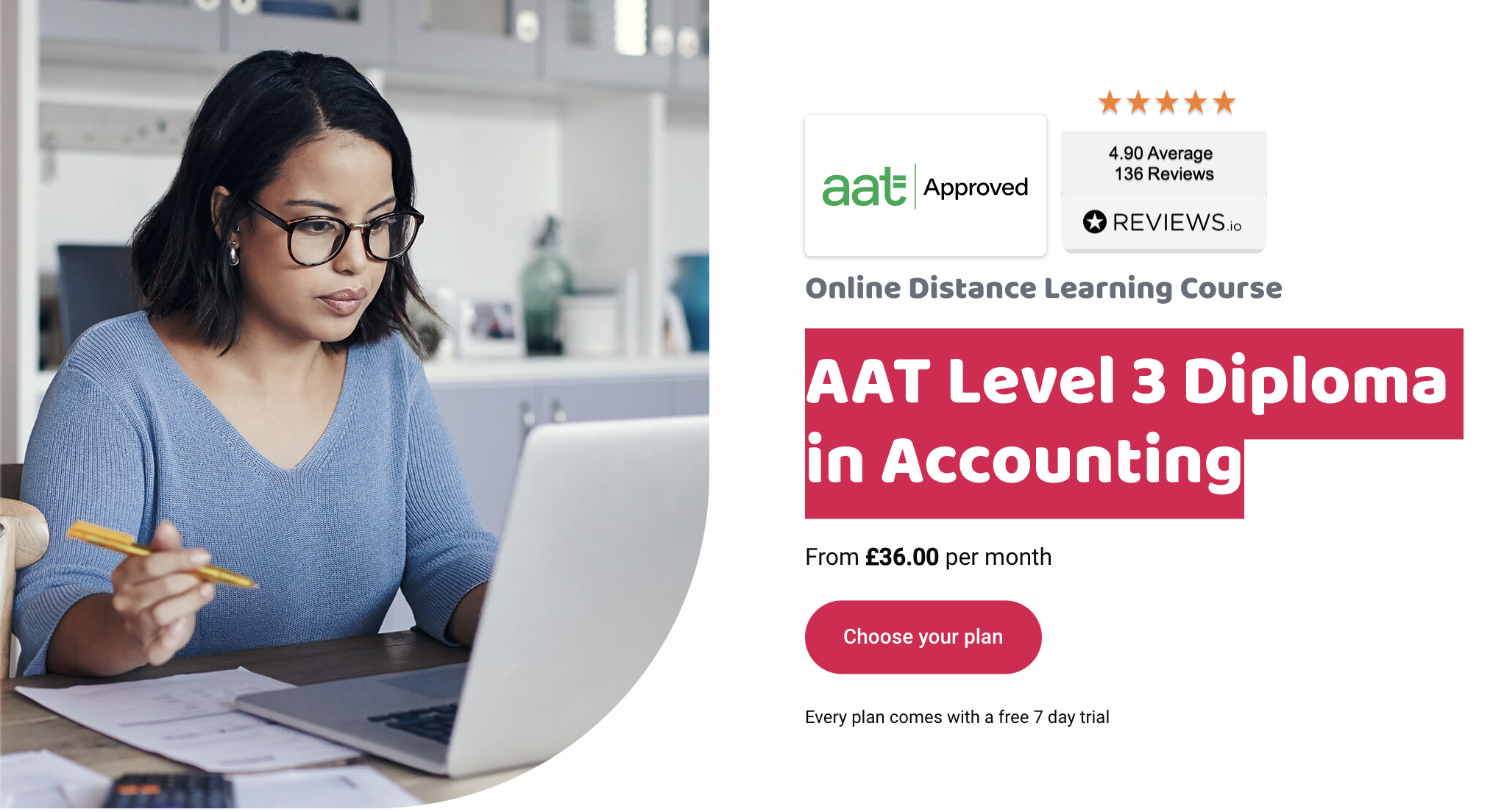

Are you looking to progress your career in accountancy? Have you got a solid understanding of accounting processes? Studying AAT Level 3 Diploma in Accounting could be the next step in your journey to becoming a qualified accountant.

This course is suitable if you have previous accountancy experience, through study or work experience, and you’re looking to develop your skills further so you can become qualified and work in a variety of accounting roles.

If you work in accounts or have studied accountancy before (such as AAT Level 2 Certificate), you may be able to start at this level.

If you don’t have any previous accountancy experience, we recommend starting at Level 2. You’ll also need a good grasp of Maths and English skills to complete the course. We recommend that you register with AAT before starting this course. You’ll be given your AAT student number, which enables you to enter for assessments.

AAT Level 3 Diploma syllabus

By the end of the AAT Level 3 Diploma course, you will be able to prepare Sole Traders and Partnership Financial Statements, do depreciation calculations, understand management accounting techniques, and know how to apply VAT legislation. You’ll also learn about different business types and how technology impacts business.

Financial Accounting: Preparing Financial Statements (FAPS)

The accounting principles underlying financial accounts preparation

The principles of advanced double-entry bookkeeping

How to implement procedures for the acquisition and disposal of non-current assets

How to prepare and record depreciation calculations

How to record period end adjustments

How to produce and extend the trial balance

How to produce financial statements for sole traders and partnerships

How to interpret financial statements using profitability ratios

How to prepare accounting records from incomplete information

Management Accounting Techniques (MATS)

The purpose and use of management accounting within organisations

The techniques required for dealing with costs

How to attribute costs according to organisational requirements

How to investigate deviations from budgets

Spreadsheet techniques to provide management accounting information

Management accounting techniques to support short-term decision making

Principles of cash management

Tax Processes for Businesses (TPFB)

The legislation requirements relating to VAT

How to calculate VAT

How to review and verify VAT returns

The principles of payroll

How to report information within the organisation

Business Awareness (BUAW)

Business types, structures and governance, and the legal framework in which they operate

The impact of the external and internal environments on businesses, their performance and decisions

How businesses and accountants comply with the principles of professional ethics.

The impact of new technologies in accounting and the risks associated with data security

How to communicate information to stakeholders

How is this course assessed?

The Level 3 course is assessed by unit assessments. A unit assessment only tests knowledge and skills taught in that unit. At Level 3 they are:

Available on demand

Scheduled by and sat at AAT approved assessment venues

Mostly marked by the computer

Getting your results

Computer marked assessment results are available in your MyAAT account within 24 hours.* For assessments marked by the AAT, you can expect to receive your results within six weeks.

* For a short period, Q2022 results may take up to 15 days.

Grading

To be awarded the AAT Level 3 Advanced Diploma in Accounting qualification you must achieve at least a 70% competency level in each unit assessment.

Resits

You can resit an assessment to improve your grade. Results from the assessment with the highest marks will be used to calculate your final grade. There are no resit restrictions or employer engagement requirements for any fee paying student on any of our AAT courses.

What’s included, and what support will I get?

Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe.

Unlimited access to the AAT Level 3 content with the use of all other levels. Empowering you to progress when you’re ready, or recap previous levels at no extra cost.

Instant access to our unique comprehensive Study Buddy learning guide.

Access to Consolidation and Progress Tests, and computer and self marked Mock Exams.

You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours.

You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you.

Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials.

What could I do next?

After completing this level, you could go onto job roles such as a finance officer, assistant accountant and an advanced bookkeeper, earning salaries of up to £25,000. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can continue your studies and move onto the AAT Level 4 Diploma in Professional Accounting at no additional cost.

You are required to become a member of the Association of Accounting Technicians (AAT) launch to fulfil your qualification. Fees associated with admission and exam fees are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre.

AAT One off Level 3 Registration Fee: £225

AAT Assessment Fees: £70 to £80 per unit but this can vary depending on where you sit your assessment.

Please be aware that these are subject to change.

Eagle subscription courses provide an affordable way to...