- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

8222 Compliance courses

CDM Regulations: 20-in-1 Premium Online Courses Bundle

By Compete High

Step confidently into the construction sector with the CDM Regulations: 20-in-1 Premium Online Courses Bundle. This comprehensive qualification package prepares you to work across planning, health and safety compliance, and site operations—three of the most sought-after areas in UK construction today. With 20 job-relevant courses in one streamlined package, this bundle boosts your hireability in contracting firms, development projects, and public infrastructure works. Description Construction projects need more than bricks—they need professionals who understand compliance, coordination, and responsibility. From CDM to cost estimation, site safety to procurement, this bundle equips you to step into regulatory, managerial, or technical support roles across a wide range of construction environments. Perfect for those pursuing roles such as CDM Coordinator, Assistant Site Manager, Construction Administrator, or Health & Safety Officer, this all-in-one training path helps you meet the expectations of employers in a highly regulated sector. With construction compliance increasingly under scrutiny, being multi-skilled and regulation-aware gives you a distinct edge. Don't wait for opportunities—be prepared when they arrive. FAQ Q: What roles does this bundle align with? A: CDM Coordinator, Assistant Site Manager, Safety Compliance Assistant, Procurement Officer, Construction Admin. Q: Does it suit those new to construction? A: Yes. It’s ideal for beginners or career changers wanting to break into construction roles with confidence. Q: Will it help with CDM 2015 compliance understanding? A: While not a legal qualification, this training supports foundational knowledge relevant to the UK construction industry. Q: Is the course bundle flexible? A: Yes—study at your pace with lifetime access to all 20 courses. Q: Is this better than a standalone CDM course? A: Absolutely. You gain 19 additional complementary qualifications—maximising your employability without extra cost.

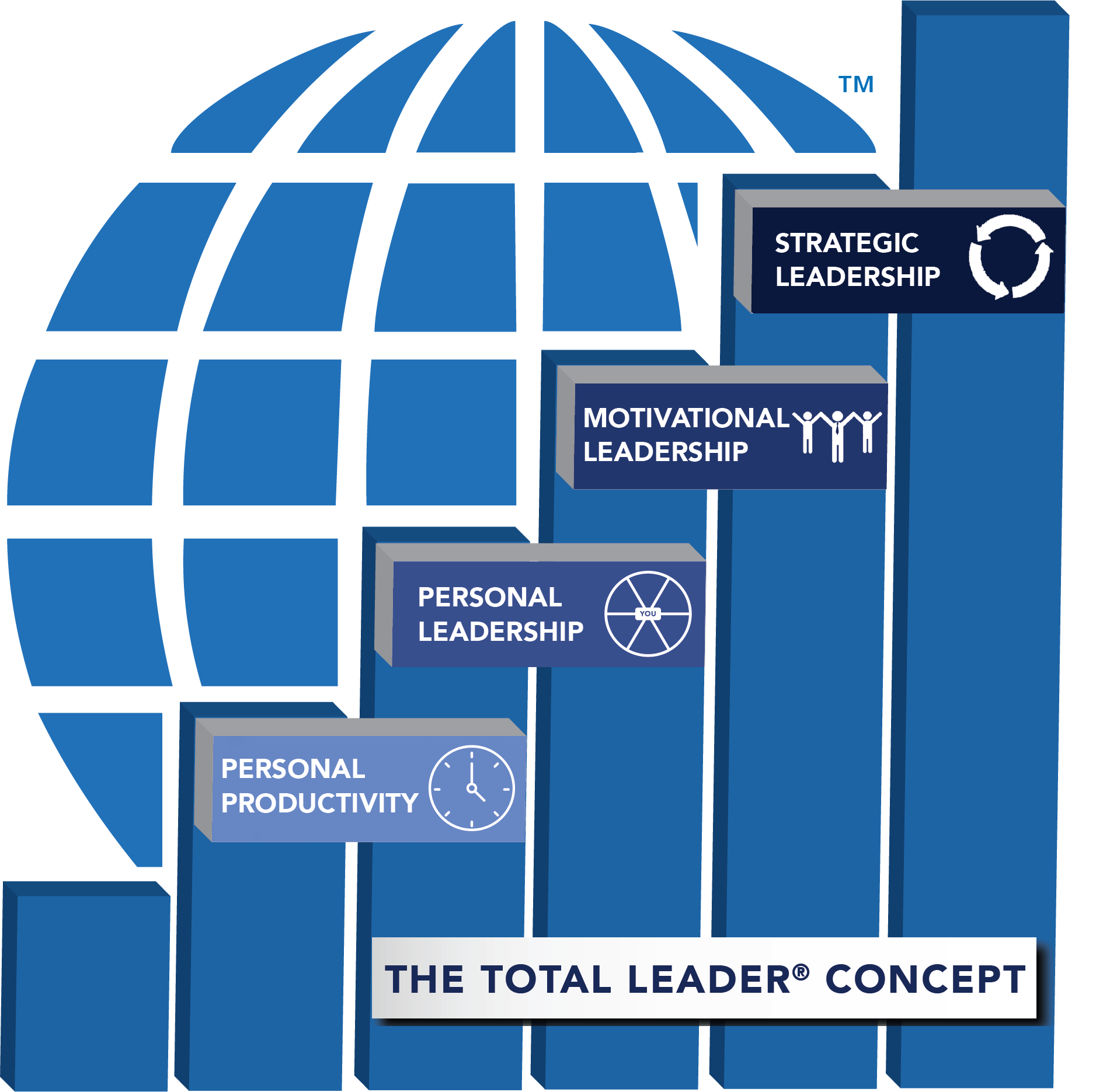

Foundations of Success

By Leadership Management International (LMI) UK

The LMI Foundations of Success workshop introduces the concepts and practical tools used to help countless individuals within thousands of organisations, of all sizes and complexity in both the public and private sector, realise more of their true potential.

Definition of Safeguarding Legislation & agreed ways of working Definition of Safeguarding Legislation & agreed ways of working Every child matters guidance Myths and statistics Effects on young people Leadership/worker skills Common indicators of abuse Reporting of abuse and potential abuse Barriers to reporting abuse Understanding the types of abuse Recognising acts, signs and symptoms of abuse Who is vulnerable / at risk The role of dignity in safeguarding Legislation and policies and procedure What to do should you have a concern Overview of prevent How to respond to an individual should they disclose a concern

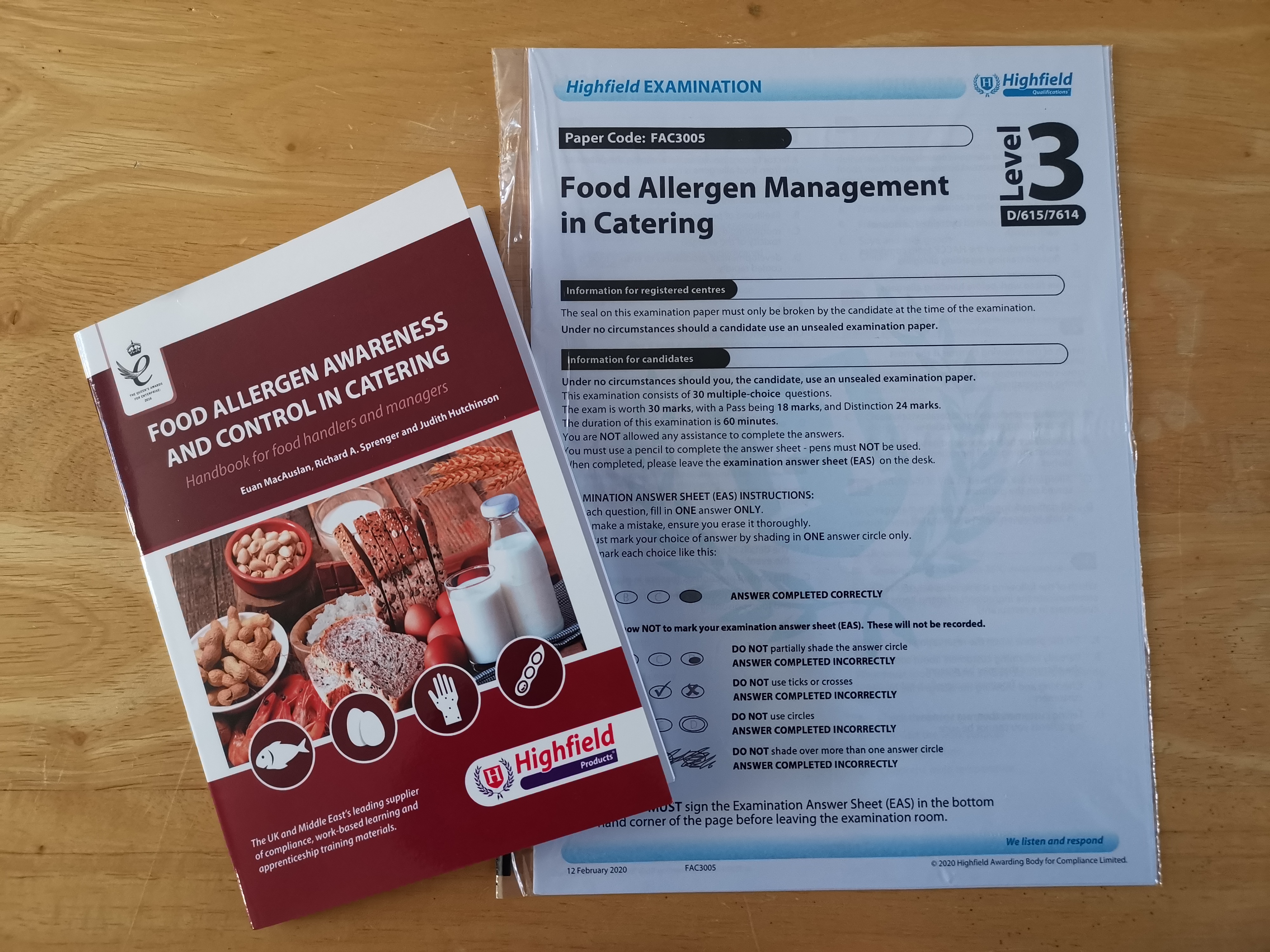

This Highfield accredited course is the answer to managing food allergens in hospitality and catering. You, and your staff members, will learn about food allergies, intolerances, coeliac disease, and other diet affected conditions. Helping you to identify the top 14 allergens, which must be declared when they are ingredients in your dishes, by their various forms and names. Giving an understanding of how to meet compliance with the law surrounding food allergen information for your customers. You will be able to produce your own allergen policy specific to your business.

Employment Law, HR Management & Recruitment Process

By Compliance Central

Are you looking to enhance your Employment Law, HR Management & Recruitment Process skills? If yes, then you have come to the right place. Our comprehensive course on Employment Law, HR Management & Recruitment Process will assist you in producing the best possible outcome by mastering the Employment Law, HR Management & Recruitment Process skills. The Employment Law, HR Management & Recruitment Process course is for those who want to be successful. In the Employment Law, HR Management & Recruitment Process course, you will learn the essential knowledge needed to become well versed in Employment Law, HR Management & Recruitment Process. Our Employment Law, HR Management & Recruitment Process course starts with the basics of Employment Law, HR Management & Recruitment Process and gradually progresses towards advanced topics. Why would you choose the Employment Law, HR Management & Recruitment Process course from Compliance Central: Lifetime access to Employment Law, HR Management & Recruitment Process course materials Full tutor support is available from Monday to Friday with the Employment Law, HR Management & Recruitment Process course Learn Employment Law, HR Management & Recruitment Process skills at your own pace from the comfort of your home Gain a complete understanding of Employment Law, HR Management & Recruitment Process course Accessible, informative Employment Law, HR Management & Recruitment Process learning modules designed by expert instructors Get 24/7 help or advice from our email and live chat teams with the Employment Law, HR Management & Recruitment Process bundle Study Employment Law, HR Management & Recruitment Process in your own time through your computer, tablet or mobile device. A 100% learning satisfaction guarantee with your Employment Law, HR Management & Recruitment Process course Curriculum Breakdown of the Employment Law Course Module 01: Basic of Employment Law Module 02: Legal Recruitment Process Module 03: Employment Contracts Module 04: Employee Handbook Module 05: Disciplinary Procedure Module 06: National Minimum Wage & National Living Wage Module 07: Parental Right, Sick Pay & Pension Scheme Module 08: Discrimination in the Workplace Module 09: Health & Safety at Work Module 10: Dismissal, Grievances and Employment Tribunals Module 11: Workplace Monitoring & Data Protection Curriculum Breakdown of the HR Management Course Section 01: Introduction Section 02: Core Concepts Section 03: Best Employee Retention Strategies That Actually Work Section 04: Employee Benefits & Retention Strategies Used by World's Top Companies Section 05: Practical Tips to Retain Employees in Your Organisation More...... Curriculum Breakdown of the Recruitment Process Course Module 01: Introduction to Recruitment: Importance and Implications Module 02: An Overview of the Recruitment Industry Module 03: The UK Recruitment Legislation Module 04: Sales and Selling in the Recruitment Industry Module 05: The Recruitment Process More..... CPD 30 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Employment Law, HR Management & Recruitment Process course helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in Employment Law, HR Management & Recruitment Process. Requirements To enrol in this Employment Law, HR Management & Recruitment Process course, all you need is a basic understanding of the English Language and an internet connection. Career path The Employment Law, HR Management & Recruitment Process course will enhance your knowledge and improve your confidence in exploring opportunities in various sectors. Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

Spill Management Training

By Compliance Central

Spill Management Training course is for those who want to advance in this field. Throughout this course, you will learn the essential skills and gain the knowledge needed to become well versed in Spill Management Training. Our course starts with the basics of Spill Management Training and gradually progresses towards advanced topics. Therefore, each lesson of this Spill Management Training is intuitive and easy to understand. So, stand out in the job market by completing the Spill Management Training course. Get an accredited certificate and add it to your resume to impress your employers. Along with the Spill Management Training course, you also get: Lifetime Access Unlimited Retake Exam & Tutor Support Easy Accessibility to the Course Materials- Anytime, Anywhere - From Any Smart Device (Laptop, Tablet, Smartphone Etc.) 100% Learning Satisfaction Guarantee Learn at your own pace from the comfort of your home, as the rich learning materials of this course are accessible from any place at any time. The curriculums are divided into tiny bite-sized modules by industry specialists. And you will get answers to all your queries from our experts. So, enrol and excel in your career with Compliance Central. Course Curriculum: Module 01: Introduction to Spill Management Topics to Be Covered: Introduction Dealing With Spills Key Points Regulatory Authorities Pollution Prevention: Do's and Don'ts Module 02: Hazardous Substances Topics to Be Covered: What are Hazardous Substances? Know Your Hazards Identify All the Hazardous Substances Human Health Effects Physical Damage to Property Module 03: Pollution Incident Response Planning Topics to Be Covered: Prepare Plan Practice Pollution Control Equipment Module 04: Managing a Spill Topics to Be Covered: Pollution Control Options and Equipment Contain at Source Contain Close to Source Contain on the Surface Contain in the Drainage System Pipe Blockers Improvised Equipment Module 05: Spill Clean-Up Guideline Topics to Be Covered: The Clean-Up Process Waste Management and Legal Duty of Care Sewer Jetting Road and Highway Clean-Up Residue Clean-Up Neutralising Agents Animal Carcass Removal Site Remediation Module 06: Spills on a Road or Highway Topics to Be Covered: Incident Response Plan Correct Signage Vehicle Spill Kits and Training Emergency Responders Module 07: Diesel Spillages: An Overview Topics to Be Covered: Causes of Diesel Spillages Effect of Diesel Spillages Traditional Clean-Up Using Sand Spillage Reporting System General Clean-Up Procedure Step By Step Clean-Up Procedure Module 08: Site-Specific Pollution Control Options Topics to Be Covered: Containment Lagoons and Ponds Tanks Sacrificial Areas Pits and Trenches Module 09: Spill Prevention & Control Checklist Topics to Be Covered: Risk Assessment Control Measures Storage Site Planning and Design Transport and Handling Management Review & Inspections Module 10: Ways to Encourage Best Practice Topics to Be Covered: Enforcement Information and Training Business Benefits Rewards Using the Influence of Larger Organisations Environmental Certification CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Spill Management Training course. Requirements To enrol in this Spill Management Training course, all you need is a basic understanding of the English Language and an internet connection. Career path After completing this course, you can explore trendy and in-demand jobs related to Spill Management Training. Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

Visual Merchandising and Store Design Training for Visual Merchandiser

By Compliance Central

Have you ever wondered how stores influence your shopping behaviour? Discover the secrets that marketers use to make shoppers buy! In an age of self-service stores, saturated markets, and ever more demanding customers, the creative and science-driven design of the point of sale has become a crucial success factor for both retailers and service businesses. In this visual merchandising course, you will be introduced to the marketing secrets of how colours, scents, store layouts, and merchandise presentations influence our purchase decisions. You will learn to understand shopping behaviour and how to optimise the design of retail stores and service environments to increase customer satisfaction and sales. Also, discover lucrative opportunities in Visual Merchandising and Retail Display. With salaries ranging from £16K to £50K annually, this dynamic sector welcomes skilled professionals in store layout design, display coordination, and visual enhancement. Join this industry to contribute visually captivating displays and enjoy rewarding career growth. Why would you choose the Visual Merchandising course from Compliance Central: Lifetime access to Visual Merchandising course materials Full tutor support is available from Monday to Friday with the Visual Merchandising course Learn Visual Merchandising skills at your own pace from the comfort of your home Gain a complete understanding of Visual Merchandising course Accessible, informative Visual Merchandising learning modules designed by experts Get 24/7 help or advice from our email and live chat teams with the Visual Merchandising course Study Visual Merchandising in your own time through your computer, tablet or mobile device. A 100% learning satisfaction guarantee with your Visual Merchandising course Visual Merchandising Curriculum Breakdown of the Visual Merchandising Course Course Outline: Module 01: Introduction to Visual Merchandising Module 02: Store Layouts Module 03: Exterior Design Module 04: In-Store Design Module 05: Mannequins in Visual Merchandising Module 06: Display Fixtures Visual Merchandising Course Learning Outcomes: Grasp fundamental concepts for effective visual merchandising strategies. Plan layouts considering traffic flow, product placement, and experience. Design appealing exteriors with attention to signage and curb appeal. Arrange merchandise, optimise space, and enhance overall store aesthetics. Utilise mannequins to showcase products and create compelling narratives. Select and place fixtures for functional and aesthetic product presentation. CPD 10 CPD hours / points Accredited by CPD Quality Standards Introduction to Visual Merchandising 13:49 1: Introduction to Visual Merchandising 13:49 Store Layouts 08:43 2: Store Layouts 08:43 Exterior Design 10:15 3: Exterior Design 10:15 In-Store Design 14:14 4: In-Store Design 14:14 Mannequins in Visual Merchandising 12:28 5: Mannequins in Visual Merchandising 12:28 Display Fixtures 08:14 6: Display Fixtures 08:14 Order Your CPD Quality Standard Certificate (Optional) 01:00 7: CPD Certificate (Optional) 01:00 Who is this course for? The Visual Merchandising course helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in Visual Merchandising. It is also great for professionals who are already working in Visual Merchandising and want to get promoted at work. Requirements To enrol in this Visual Merchandising course, all you need is a basic understanding of the English Language and an internet connection. Career path Visual Merchandiser: £20,000 to £40,000 per year Retail Store Manager: £25,000 to £45,000 per year Visual Display Designer: £22,000 to £40,000 per year Retail Buyer: £25,000 to £45,000 per year Marketing Coordinator: £20,000 to £35,000 per year E-commerce Merchandiser: £22,000 to £40,000 per year Certificates Reed Courses Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed. CPD Quality Standard Certificate Digital certificate - £7.99

Search By Location

- Compliance Courses in London

- Compliance Courses in Birmingham

- Compliance Courses in Glasgow

- Compliance Courses in Liverpool

- Compliance Courses in Bristol

- Compliance Courses in Manchester

- Compliance Courses in Sheffield

- Compliance Courses in Leeds

- Compliance Courses in Edinburgh

- Compliance Courses in Leicester

- Compliance Courses in Coventry

- Compliance Courses in Bradford

- Compliance Courses in Cardiff

- Compliance Courses in Belfast

- Compliance Courses in Nottingham