- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Leadership Professional - Mastery Programme

By Mpi Learning - Professional Learning And Development Provider

Four half-day Leadership modules with mini work placed projects to bring the learning into action in the workplace.

ITIL 4 Strategist: Direct, Plan and Improve

By IIL Europe Ltd

ITIL® 4 Strategist: Direct, Plan and Improve The ITIL® 4 Strategist: Direct, Plan, and Improve course is based on the ITIL® 4 Strategist Direct, Plan, and Improve candidate syllabus from AXELOS. This course is based on the ITIL® 4 Strategist: Direct, Plan and Improve IT exam specifications from AXELOS. With the help of ITIL® 4 concepts and terminology, exercises, and examples included in the course, candidates acquire the relevant knowledge required to pass the certification exam. This course provides the practical skills necessary to create a 'learning and improving' IT organization, with a strong and effective strategic direction. It was designed to provide practitioners with a practical and strategic method for planning and delivering continual improvement with necessary agility. It covers both practical and strategic elements, making it the universal module that is a key component to both ITIL® 4 Managing Professional and ITIL® 4 Strategic Leader streams. What You Will Learn At the end of this course, participants will be able to: Understand the key concepts of direction, planning, improvement Understand the scope of what is to be directed and/or planned and know how to use key principles and methods of direction and planning in that context Understand the role of GRC and know how to integrate the principles and methods into the service value system Understand and know how to use the key principles and methods of continual improvement for all types of improvements Understand and know how to use the key principles and methods of Communication and Organizational Change Management to direction, planning and improvement Understand and know how to use the key principles and methods of measurement and reporting in direction, planning, and improvement Understand and know how to direct, plan, and improve value streams and practices Course Introduction Let's Get to Know Each Other Course Overview ITIL® 4 Certification Scheme Course Learning Objectives Course Components Course Agenda Exercises Case Study: Axle Car Hire Case Study: HandyPerson on Demand Exam Details Core Concepts of DPI Key Terms Covered in the Module Module Learning Objectives Basics of Direction Basics of Planning Basics of Improvement Other Core Elements DPI through Service Value Chain and Guiding Principles Key Terms Covered in the Module Module Learning Objectives DPI of the SVS DPI of Guiding Principles Role of Direction in Strategy Management Key Terms Covered in the Module Introducing Strategy Management Developing Effective Strategies Implementation of Strategies Key Terms Covered in the Module Module Learning Objectives Managing Risks Making Decisions through Portfolio Management Directing via Governance, Risk, and Compliance (GRC) Introduction to Assessment and Planning Key Terms Covered in the Module Module Learning Objectives Core Concepts of Assessment Conducting Effective Assessments Core Concepts of Planning Assessment and Planning through VSM Key Terms Covered in the Module Module Learning Objectives Introducing VSM Developing Value Stream Maps Knowing More About VSM Measurement, Reporting, and Continual Improvement Key Terms Covered in the Module Module Learning Objectives Measurement and Reporting Alignment of Measurements and Metrics Success Factors and Key Performance Indicators Continual Improvement Measurements and Continual Improvement through Dimensions and SVS Key Terms Covered in the Module Module Learning Objectives Measurements for the Four Dimensions Continual Improvement of the Service Value Chain and Practices OCM Principles and Methods Key Terms Covered in the Module Module Learning Objectives Basics of OCM OCM throughout DPI and Service Value Chain Resistance and Reinforcement Communication Principles and Methods Key Terms Covered in the Module Module Learning Objectives Basics of Effective Communication Communication with Stakeholders SVS Development Using Four Dimensions Key Terms Covered in the Module Module Learning Objectives Organizations and People in the SVS Partners and Suppliers in the SVS Value Streams and Processes in the SVS Information and Technology in the SVS

Promoting Best Practice in Basic Life Support Instruction

By Guardian Angels Training

Learn to teach basic life support effectively with our "Promoting Best Practice in Basic Life Support Instruction" course. Ideal for healthcare professionals, educators, and individuals interested in life-saving interventions.

Promoting Best Practice in Teaching and Assessing Medicines Management (Medication Train the Trainer)

By Guardian Angels Training

"Empower educators and healthcare professionals with evidence-based teaching strategies and practical assessment methods through our 'Promoting Best Practice in Teaching and Assessing Medicines Management' course. Ensure safe and competent medication administration practices among healthcare learners. Enroll now."

If you have at least 5 years working experience and you would like to attain Gold Card status via the Experienced Worker route by joining the City & Guilds 2346 NVQ Level 3, you will also need to hold the below two pre-requisite qualifications: City & Guilds 2391-52 Inspection and Testing Course C&G 2382-22 BS7671 18th Edition

ILM Level 5 Certificate in Leadership & Management

By Challenge Consulting

ILM Level 5 Certificate in Leadership & Management – 9 day Accredited training course delivered in Nottingham This is a prestigious qualification for middle and aspiring middle managers. Participants should be operational managers with responsibilities for managing resources and/or teams of individuals within the scope of their role. Delegates are required to identify an opportunity for improvement in the organisation; research and analyse options and create an implementation plan for the business. Our client businesses tell us that this alone often pays many times over the for the course fee.

ILM Level 2 Award in Leadership and Team Skills

By Challenge Consulting

ILM Level 2 Award in Leadership & Team Skills – 4 day Accredited training course delivered in Nottingham This course is suitable for both established team leaders and those who find themselves newly promoted into a team leader role and is designed to help navigate the issues related to managing and co-ordinating the work of small teams. It covers all of the core elements required to build confidence when managing others including how to set and manage goals for individuals and teams, communicate effectively, give timely feedback in the right way and create conditions for productive working.

Hydrogen Production with Integrated CO2 Capture and Geological Storage (CCS) – Shaping A Sustainable Hydrogen Ecosystem

By EnergyEdge - Training for a Sustainable Energy Future

Discover the future of sustainable energy with EnergyEdge's expert-led training on hydrogen production, CO2 capture, and geological storage. Shape a greener world today!

AAT Level 3 Diploma in Accounting

By London School of Science and Technology

Students will learn and develop skills needed for a range of financial processes, including maintaining cost accounting records, advanced bookkeeping and the preparation of financial reports and returns. Course Overview This qualification covers a range of essential and higher-level accounting techniques and disciplines. Students will learn and develop skills needed for a range of financial processes, including maintaining cost accounting records, advanced bookkeeping and the preparation of financial reports and returns. Study the Level 3 Diploma to learn higher accounting techniques and disciplines and qualify for AAT bookkeeping membership (AATQB). The jobs it can lead to: • Accounts assistant • Accounts payable clerk • Audit trainee • Credit controller • Payroll administrator/supervisor • Practice bookkeeper • Finance assistant • Tax assistant • Accounts payable and expenses supervisor Entry requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success we recommend that students begin their studies with a good standard of English and maths. Course Content: Business Awareness: This unit provides students with an understanding of the business, its environment and the influences that this has on an organisation’s structure, the role of its accounting function and its performance. Students will examine the purpose and types for businesses that exist and the rights and responsibilities of the key stakeholders, as well as gain an understanding of the importance of professional ethics and ethical management within the finance function. Learning outcomes: • Understand business types, structure and governance and the legal framework in which they operate. • Understand the impact of the external and internal environments on business, their performance and decisions. • Understand how businesses and accounts comply with principles of professional ethics. • Understand the impact of new technologies in accounting and the risks associated with data security. • Communicate information to stakeholders. Financial Accounting: Preparing Financial Statements: This unit provides students with the skills required to produce statements of profit or loss and statements for financial position for sole traders and partnerships, using a trial balance. Students will gain the double-entry bookkeeping skills needed to record financial transactions into an organisation’s accounts using a manual bookkeeping system. Learning outcomes: • Understand the accounting principles underlaying final accounts preparation. • Understand the principles of advanced double-entry bookkeeping. • Implement procedures for the acquisition and disposal of non-current assets. • Prepare and record depreciation calculations. • Record period end adjustments. • Produce and extend the trial balance. • Produce financial statements for sole traders and partnerships. • Interpret financial statements using profitability ratios. • Prepare accounting records from incomplete information. Management Accounting Techniques: This unit provides students with the knowledge and skills needed to understand the role of management accounting in an organisation, and how organisations use such information to aid decision making. Students will learn the principles that underpin management accounting methodology and techniques, how costs are handled in organisations and why organisations treat costs in different ways. Learning outcomes: • Understand the purpose and use of management accounting within organisations. • Use techniques required for dealing with costs. • Attribute costs according to organisational requirements. • Investigate deviations from budgets. • Use spreadsheet techniques to provide management accounting information. • Use management accounting techniques to support short-term decision making. • Understand principles of cash management. Tax Processes for Businesses: This unit explores tax processes that influence the daily operations of businesses and is designed to develop students’ skills in understanding, preparing and submitting Value Added Tax (VAT) returns to HM Revenue and Customs (HMRC). The unit provides students with the knowledge and skills that are needed to keep businesses, employers and clients compliant with laws and practices that apply to VAT and payroll. Learning outcomes: • Understand legislation requirements relating to VAT. • Calculate VAT. • Review and verify VAT returns. • Understand principles of payroll. • Report information within the organisation. DURATION 250-300 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

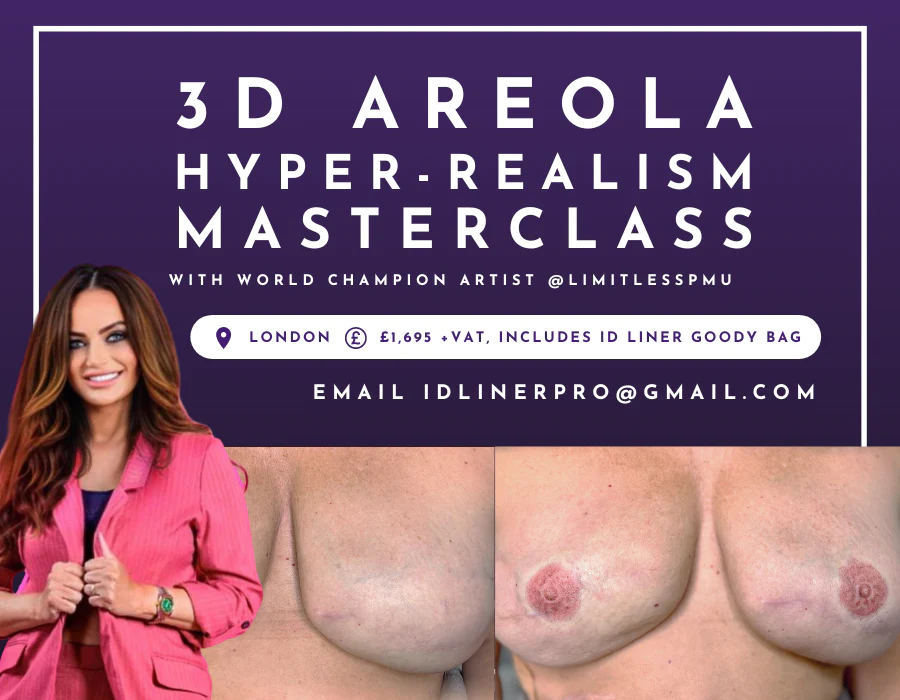

3D Areola Hyper-Realism Masterclass | @LimitlessPMU - Small Group Learning

By ID Liner | Permanent Makeup Training & Supplies

TREATMENT USES A NEW AREOLA TATTOOING TECHNIQUE DESIGNED BY AWARD-WINNING WORLD MASTER ARTIST MIRIAM BEGANOVA (@LIMITLESSPMU)

Search By Location

- Ski Courses in London

- Ski Courses in Birmingham

- Ski Courses in Glasgow

- Ski Courses in Liverpool

- Ski Courses in Bristol

- Ski Courses in Manchester

- Ski Courses in Sheffield

- Ski Courses in Leeds

- Ski Courses in Edinburgh

- Ski Courses in Leicester

- Ski Courses in Coventry

- Ski Courses in Bradford

- Ski Courses in Cardiff

- Ski Courses in Belfast

- Ski Courses in Nottingham