- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

M.D.D PRIVATE COUNSELLING PACKAGE (SELF IMPROVEMENT)

4.9(27)By Miss Date Doctor Dating Coach London, Couples Therapy

Introducing Private Counselling Package: Personalized Support for Your Mental and Emotional Well-Being Are you looking for private and confidential support to address personal challenges, improve your emotional well-being, and enhance your overall quality of life? Miss Date Doctor’s Private Counselling Package offers you individualized sessions with experienced therapists who are dedicated to helping you navigate life’s difficulties and achieve personal growth. Private counselling provides you with a safe and supportive environment to explore your thoughts, feelings, and concerns without judgment. Our skilled therapists are committed to understanding your unique needs and providing you with personalized guidance to promote healing and positive change. Here’s how the Private Counselling Package can support you: Personalized Assessment: Our private counsellors will conduct a thorough assessment to gain a comprehensive understanding of your unique challenges and aspirations. Individualized Approach: Your counselling sessions will be tailored to address your specific concerns, ensuring that you receive the most relevant and effective support. Emotional Support: Our therapists provide a compassionate and empathetic space where you can freely express your feelings and experiences. Confidentiality: Private counselling ensures complete confidentiality, allowing you to discuss sensitive topics with confidence and peace of mind. Coping Strategies: We’ll equip you with practical coping strategies to manage stress, anxiety, and other emotional difficulties. Self-Exploration: Private counselling encourages self-discovery and personal growth, helping you gain insights into your thoughts, behaviours, and motivations. Goal Setting: Together with your counsellor, you’ll set achievable goals to work towards positive change and improved well-being. Flexible Sessions: Private counselling offers flexibility in scheduling sessions, making it convenient for your busy lifestyle. The Private Counselling Package at Miss Date Doctor is designed to provide you with personalized support and guidance on your journey to emotional well-being and personal growth. Our skilled therapists are committed to helping you overcome challenges, enhance your resilience, and lead a more fulfilling life. Invest in your mental and emotional health and take the first step towards positive change with the Private Counselling Package. Embrace the opportunity to explore your thoughts and feelings in a confidential and supportive environment. Let our experienced counsellors guide you towards a brighter and more empowered future. 3 x 1 hour https://relationshipsmdd.com/product/private-counselling-package/

M.D.D DIVORCE THERAPY PACKAGE (SINGLES)

4.9(27)By Miss Date Doctor Dating Coach London, Couples Therapy

Introducing Divorce Therapy Package: Navigating the Challenges, Healing, and Finding Renewed Purpose Are you going through the difficult process of divorce and seeking support to cope with the emotional challenges and transitions? Miss Date Doctor’s Divorce Therapy Package offers you a compassionate and understanding space to navigate the complexities of divorce, heal from the emotional wounds, and find renewed purpose in life. Divorce is a life-altering event that can lead to a wide range of emotions, including grief, anger, sadness, and uncertainty about the future. Our experienced therapists are here to help you process these emotions, gain clarity, and develop coping strategies to move forward positively. Here’s how the Divorce Therapy Package can support you: Emotional Healing: Our therapists provide a safe and non-judgmental space where you can freely express your emotions related to the divorce. We’ll help you process grief and loss, anger, and other challenging emotions to facilitate healing. Navigating Transitions: Divorce often involves significant life changes. We’ll guide you in navigating these transitions, such as adjusting to single life, co-parenting, or re-entering the dating scene. Coping Strategies: Divorce therapy equips you with coping strategies to manage stress, anxiety, and uncertainty during this period of change. Gaining Clarity: Our therapists will work with you to gain clarity about your goals and aspirations, helping you find a new sense of purpose and direction in life. Communication Skills: Divorce therapy can also address communication issues, helping you effectively communicate with your ex-partner and children during the divorce process and beyond. Building Resilience: Divorce therapy fosters resilience, empowering you to bounce back from challenges and embrace a new chapter in life with strength and determination. Self-Discovery: Divorce can be an opportunity for self-discovery and personal growth. We’ll help you explore your values, strengths, and interests, creating a foundation for a fulfilling future. Supportive Environment: Our therapists provide unwavering support throughout your divorce journey, offering guidance and empathy as you work towards healing and renewal. The Divorce Therapy Package at Miss Date Doctor offers you a transformative experience during a challenging time in your life. Our therapists understand the complexities of divorce and are committed to helping you navigate this transition with grace and resilience. Invest in your emotional well-being and take the first step towards healing and renewal with the Divorce Therapy Package. Embrace the opportunity for growth and self-discovery as you embark on a journey of healing and empowerment. Let our skilled therapists guide you towards finding strength, purpose, and a brighter future beyond divorce. 3 X 1 hour https://relationshipsmdd.com/product/divorce-therapy-package/

AAT Level 3 Diploma in Accounting

By London School of Science and Technology

Students will learn and develop skills needed for a range of financial processes, including maintaining cost accounting records, advanced bookkeeping and the preparation of financial reports and returns. Course Overview This qualification covers a range of essential and higher-level accounting techniques and disciplines. Students will learn and develop skills needed for a range of financial processes, including maintaining cost accounting records, advanced bookkeeping and the preparation of financial reports and returns. Study the Level 3 Diploma to learn higher accounting techniques and disciplines and qualify for AAT bookkeeping membership (AATQB). The jobs it can lead to: • Accounts assistant • Accounts payable clerk • Audit trainee • Credit controller • Payroll administrator/supervisor • Practice bookkeeper • Finance assistant • Tax assistant • Accounts payable and expenses supervisor Entry requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success we recommend that students begin their studies with a good standard of English and maths. Course Content: Business Awareness: This unit provides students with an understanding of the business, its environment and the influences that this has on an organisation’s structure, the role of its accounting function and its performance. Students will examine the purpose and types for businesses that exist and the rights and responsibilities of the key stakeholders, as well as gain an understanding of the importance of professional ethics and ethical management within the finance function. Learning outcomes: • Understand business types, structure and governance and the legal framework in which they operate. • Understand the impact of the external and internal environments on business, their performance and decisions. • Understand how businesses and accounts comply with principles of professional ethics. • Understand the impact of new technologies in accounting and the risks associated with data security. • Communicate information to stakeholders. Financial Accounting: Preparing Financial Statements: This unit provides students with the skills required to produce statements of profit or loss and statements for financial position for sole traders and partnerships, using a trial balance. Students will gain the double-entry bookkeeping skills needed to record financial transactions into an organisation’s accounts using a manual bookkeeping system. Learning outcomes: • Understand the accounting principles underlaying final accounts preparation. • Understand the principles of advanced double-entry bookkeeping. • Implement procedures for the acquisition and disposal of non-current assets. • Prepare and record depreciation calculations. • Record period end adjustments. • Produce and extend the trial balance. • Produce financial statements for sole traders and partnerships. • Interpret financial statements using profitability ratios. • Prepare accounting records from incomplete information. Management Accounting Techniques: This unit provides students with the knowledge and skills needed to understand the role of management accounting in an organisation, and how organisations use such information to aid decision making. Students will learn the principles that underpin management accounting methodology and techniques, how costs are handled in organisations and why organisations treat costs in different ways. Learning outcomes: • Understand the purpose and use of management accounting within organisations. • Use techniques required for dealing with costs. • Attribute costs according to organisational requirements. • Investigate deviations from budgets. • Use spreadsheet techniques to provide management accounting information. • Use management accounting techniques to support short-term decision making. • Understand principles of cash management. Tax Processes for Businesses: This unit explores tax processes that influence the daily operations of businesses and is designed to develop students’ skills in understanding, preparing and submitting Value Added Tax (VAT) returns to HM Revenue and Customs (HMRC). The unit provides students with the knowledge and skills that are needed to keep businesses, employers and clients compliant with laws and practices that apply to VAT and payroll. Learning outcomes: • Understand legislation requirements relating to VAT. • Calculate VAT. • Review and verify VAT returns. • Understand principles of payroll. • Report information within the organisation. DURATION 250-300 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Foundations of Positive Behaviour Support

By Guardian Angels Training

Gain a comprehensive understanding of positive behavior support principles, strategies, and techniques with our course. Ideal for educators, caregivers, and professionals working with individuals with developmental disabilities, mental health issues, or behavioral challenges.

AAT Level 2 Certificate in Bookkeeping

By London School of Science and Technology

Gain the skills and essential knowledge needed for completing the manual bookkeeping activities that underpin all accountancy and finance roles. Course Overview Students studying this qualification will develop practical accountancy skills in the double-entry bookkeeping system and in using associated documents and processes. They will cover transactions for accuracy, make entries in appropriate books and ledgers and calculate sales invoices and credit notes. Gain the skills and essential knowledge needed for completing the manual bookkeeping activities that underpin all accountancy and finance roles. The jobs it can lead to: • Trainee bookkeeper • Finance assistant • Accounts administrator • Clerical assistant Entry Requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Introduction to Bookkeeping: This unit provides students with an understanding of manual and digital bookkeeping systems, including the associated documents and processes. Students will learn the basic principles that underpin the double-entry bookkeeping systems. Learning outcomes: • Understand how to set up bookkeeping systems. • Process customer transactions. • Process supplier transactions. • Process receipts and payments. • Process transactions into the ledger accounts. Principles of Bookkeeping Controls: This unit builds on the knowledge and skills acquired from studying Introduction to Bookkeeping and explores control accounts, journals and reconciliations. Students will develop the ability to prepare the value added tax (VAT) control accounts as well as the receivables and payables ledger accounts. They will use the journal to record a variety of transactions, including the correction errors. Students will be able to redraft the initial trial balance, following adjustments. Learning outcomes: • Use control accounts. • Reconcile a bank statement with the cash book. • Use the journal. • Produce trial balances. DURATION 3 Months WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

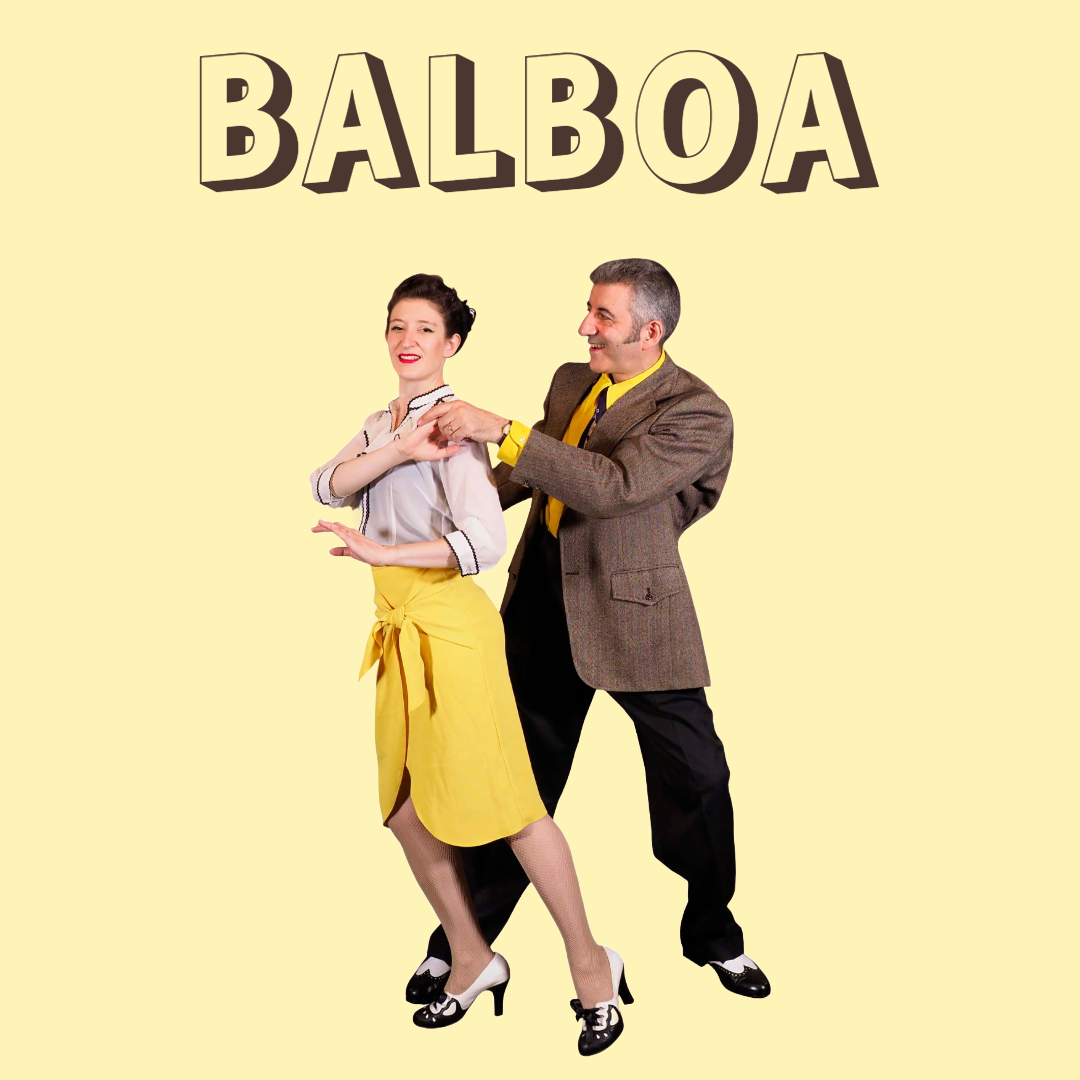

Fast Beginners Balboa Workshop with Simon Selmon Learn this popular 1930s Swing dance. Join Simon, one of the first UK Balboa dancers of the Swing resurgence and learn the basics you need to dance the Balboa and how to incorporate it into your Lindy Hop or Jive. Class will include the Uphold, Downhold, Rock Step basics, Come Around, Grapevine and Lollies. Suitable for those who have tried couple of taster classes before or you have other dance experience.

AAT Level 2 Certificate in Accounting

By London School of Science and Technology

This qualification delivers a solid foundation in finance administration and core accounting skills, including double-entry bookkeeping, basic costing and an understanding of purchase, sales and general ledgers. Course Overview This qualification delivers a solid foundation in finance administration and core accounting skills, including double-entry bookkeeping, basic costing and an understanding of purchase, sales and general ledgers. Students will also learn about accountancy related business and personal skills and be introduced to the four key themes embedded in the qualification: ethics, technology, communications and sustainability. The jobs it can lead to: • Account administrator • Accounts assistant • Accounts payable clerk • Purchase/sales ledger clerk • Trainee accounting technician • Trainee finance assistant Entry requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Introduction to Bookkeeping: This unit provides students with an understanding of manual and digital bookkeeping systems, including the associated documents and processes. Students will learn the basic principles that underpin double-entry bookkeeping systems. Learning outcomes: • Understand how to set up bookkeeping systems. • Process customer transactions. • Process supplier transactions. • Process receipts and payments. • Process transactions into the ledger accounts. Principles of Bookkeeping Controls: This unit builds on the knowledge and skills acquired from studying Introduction to Bookkeeping and explores control accounts, journals and reconciliations. Students will develop the ability to prepare the value added tax (VAT) control accounts as well as the receivables and payables ledger accounts. They’ll use the journal to record a variety of transactions, including the correction errors. Students will be able to redraft the initial trial balance, following adjustments. Learning outcomes: • Use control accounts. • Reconcile a bank statement with the cash book. • Use the journal. • Produce trial balances. Principles of Costing: This unit gives students an introduction to the principles of basic costing and builds a solid foundation in the knowledge and skills required for more complex costing and management accounting tasks. Students will learn the importance of the costing system as a source of information that allows management to plan, make decisions and control costs. Learning outcomes: • Understand the cost recording system within an organisation. • Use cost recording techniques. • Provide information on actual and budgeted cost and income. • Use tools and techniques to support cost calculations. The Business Environment: This unit provides knowledge and understanding of key business concepts and their practical application in the external and internal environment in which students will work. Students will gain an understanding of the legal system and principles of contract law and an appreciation of the legal implications of setting up a business and the consequences this may have. This unit will also give an understanding of how organisations are structured and where the finance function fits. Learning outcomes: • Understand the principles of contract law. • Understand the external business environment. • Understand the key principles of corporate social responsibility (CSR), ethics and sustainability. • Understand the impact of setting up different types of business entity. • Understand the finance function within an organisation. • Produce work in appropriate formats and communicate effectively. • Understand the importance of information to business operations. DURATION 170-190 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Green Hydrogen Production from Offshore Wind

By EnergyEdge - Training for a Sustainable Energy Future

About this Virtual Instructor Led Training (VILT) Hydrogen will play an increasingly critical role in the future of energy system as it moves forward to supplement and potentially replace fossil fuels in the long run. Offshore wind offers a clean and sustainable renewable resource for green hydrogen production. However, it can also be volatile and presents inherent risks that need to be managed. Even though offshore production of hydrogen has yet to achieve a high state of maturity, many current projects are already dealing with the conditions and effects of offshore production of hydrogen and are grappling with the technological requirements and necessary gas transportation with grid integration. This 2 half-day Virtual Instructor Lead Training (VILT) course will examine the technological options for on-site production of hydrogen by electrolysis (onshore or offshore directly at the platform) as well as the transport of hydrogen (pipeline or ship). This VILT course will also explore the economic considerations and the outlook on future market opportunities. There will be exercises for the participants to work on over the two half-days. This course is delivered in partnership with Fraunhofer IEE. Training Objectives By the end of this VILT course, participants will be able to: Understand the technological attributes and options for green hydrogen production based on electricity from offshore wind. Explore the associated economic analysis for offshore wind hydrogen production, including CAPEX, OPEX, LCOE and LCOH Identify the critical infrastructure and technical configuration required for offshore green hydrogen including transportation networks and grid connectivity Learn from recent findings from current Research & Development projects concerning the differences between onshore and offshore hydrogen production. Target Audience This VILT course is intended: Renewable energy developers and operators Offshore oil & gas operators Energy transport and marine operators Energy policy makers and regulators IPPs and power utilities Training Methods The VILT course will be delivered online in 2 half-day sessions comprising 4 hours per day, including time for lectures, discussion, quizzes and short classroom exercises. Course Duration: 2 half-day sessions, 4 hours per session (8 hours in total). Trainer Trainer 1: Your expert course leader is Director of Energy Process Technology Division at the Fraunhofer Institute for Energy Economics and Energy System Technology, IEE. The research activities of the division link the areas of energy conversion processes and control engineering. The application fields covered are renewable energy technologies, energy storage systems and power to gas with a strong focus on green hydrogen. From 2006 - 2007, he worked as a research analyst of the German Advisory Council on Global Change, WBGU, Berlin. He has extensive training experience from Bachelor and Master courses at different universities as well as in the context of international training activities - recently on hydrogen and PtX for partners in the MENA region and South America. He holds a University degree (Diploma) in Physics, University of Karlsruhe (KIT). Trainer 2: Your expert course leader is Deputy Head of Energy Storage Department at Fraunhofer IEE. Prior to this, he was the director of the Grid Integration Department at SMA Solar Technology AG, one of the world's largest manufacturers of PV power converters. Before joining SMA, he was manager of the Front Office System Planning at Amprion GmbH (formerly RWE TSO), one of the four German transmission system operators. He holds a Degree of Electrical Engineering from the University of Kassel, Germany. In 2003, he finished his Ph.D. (Dr.-Ing.) on the topic of wind power forecasting at the Institute of Solar Energy Supply Technology (now known as Fraunhofer IEE) in Kassel. In 2004, he started his career at RWE TSO with a main focus on wind power integration and congestion management. He is Chairman of the IEC SC 8A 'Grid Integration of Large-capacity Renewable Energy (RE) Generation' and has published several papers about grid integration of renewable energy source and forecasting systems on books, magazines, international conferences and workshops. Trainer 3: Your expert course leader is Deputy Director of the Energy Process Technology division and Head of the Renewable Gases and Bio Energy Department at Fraunhofer IEE. His work is mainly focused on the integration of renewable gases and bioenergy systems into the energy supply structures. He has been working in this field since more than 20 years. He is a university lecturer in national and international master courses. He is member of the scientific advisory council of the European Biogas Association, member of the steering committee of the Association for Technology and Structures in Agriculture, member of the International Advisory Committee (ISAC) of the European Biomass Conference and member of the scientific committees of national bioenergy conferences. He studied mechanical engineering at the University of Darmstadt, Germany. He received his Doctoral degree on the topic of aerothermodynamics of gas turbine combustion chambers. He started his career in renewable energies in 2001, with the topic of biogas fired micro gas turbines. Trainer 4: Your expert course leader has an M. Sc. and she joined Fraunhofer IEE in 2018. In the Division of Energy Process Technology, she is currently working as a Research Associate on various projects related to techno-economic analysis of international PtX projects and advises KfW Development Bank on PtX projects in North Africa. Her focus is on the calculation of electricity, hydrogen and derivative production costs (LCOE, LCOH, LCOA, etc) based on various methods of dynamic investment costing. She also supervises the development of models that simulate different PtX plant configurations to analyze the influence of different parameters on the cost of the final product, and to find the configuration that gives the lowest production cost. She received her Bachelor's degree in Industrial Engineering at the HAWK in Göttingen and her Master's degree in renewable energy and energy efficiency at the University of Kassel. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information about post training coaching support and fees applicable for this. Accreditions And Affliations

Search By Location

- Lead Courses in London

- Lead Courses in Birmingham

- Lead Courses in Glasgow

- Lead Courses in Liverpool

- Lead Courses in Bristol

- Lead Courses in Manchester

- Lead Courses in Sheffield

- Lead Courses in Leeds

- Lead Courses in Edinburgh

- Lead Courses in Leicester

- Lead Courses in Coventry

- Lead Courses in Bradford

- Lead Courses in Cardiff

- Lead Courses in Belfast

- Lead Courses in Nottingham