- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Overview This 3-day course focuses on covering the foundations of equity markets, including practical experience with equity swaps and options. During this course you will learn: How to use equity swaps, dividend swaps, equity index options and single name options. Applications of these products are shown across a variety of strategies across volatility trading, corporate finance and investment management. Key issues in pricing and risk management. Who the course is for Equity and Derivative sales, traders, structurers, quants and relevant IT personnel Asset allocation managers and equity portfolio managers Company finance executives, corporate treasurers and investment bankers Risk managers, finance, IPV professionals, auditors and accountants Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview A 1-day course on inflation-linked bonds and derivatives, focusing on the UK market in particular. We examine how inflation is defined and quantified, the choice of index (RPI vs. CPI), and the most common cash flow structures for index-linked securities. We look in detail at Index-linked Gilts, distinguishing between the old-style and new-style quotation conventions, and how to calculate the implied breakeven rate. Corporate bond market in the UK, and in particular the role of LPI in driving pension fund activity. Inflation swaps and other derivatives, looking at the mechanics, applications and pricing of inflation swaps and caps/floors. The convexity adjustment for Y-o-Y swaps is derived intuitively. Who the course is for Front-office sales product control research Traders Risk managers Fund managers Project finance and structured finance practitioners Accountants, auditors, consultants Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This course covers distressed debt analysis and investing, focusing primarily on corporates but also including financial institutions and sovereign debt as special topics. The programme begins with the foundations of the distressed debt market, causes of and early warning signals, possible outcomes and how to evaluate the probability of outcomes in different scenarios. Restructuring is reviewed in detail, as well as estimation of sustainable debt levels, business valuation and the importance of capital and group structure. Differences between active control and passive non-control investments are highlighted, including stakeholder tactics and due diligence. Case studies cover a variety of companies across sectors and geographies, challenging delegates to make investment decisions on real distressed debt situations. Who the course is for Distressed debt investors, Loan portfolio managers and Private equity investors Hedge fund managers High yield credit analysts and Equity analysts High yield asset managers and Mergers and acquisitions bankers Debt capital markets/leveraged finance bankers Business turnaround/restructuring accountants/corporate finance professionals Lawyers Strategy consultants Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

This 3 Days programme will equip you to use, price, manage and evaluate interest rate and cross-currency derivatives. The course starts with the building blocks of money markets and futures, through yield curve building to interest-rate and cross-currency swaps, and applications. The approach is hands-on and learning is enhanced through many practical exercises covering hedging, valuation, and risk management. This course also includes sections on XVA, documentation and settlement. The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation.

Online Options

Show all 7298The Real Estate Analyst course has been taught non-stop to global real estate firms over the last 25 years, and is without doubt the core financial modelling training in your career portfolio. Whether you have an upcoming financial modelling test for a new job or an APC exam, the Real Estate Analyst course is the choice for you.

DEI Masterclass - Bringing The DEI Playbook To Life!

By Starling

This one day masterclass is designed to provide a practical application of the content that is covered within The DEI Playbook and is aimed at anyone tasked with launching and implementing diversity and inclusion within their organisation.

ITIL© 4 Foundation

By Nexus Human

Duration 3 Days 18 CPD hours This course is intended for This course is designed for anyone who needs an understanding of IT Service Management to help deliver better value to customers. It is appropriate for all IT staff and management, as well as customers who work closely with IT to support business requirements. This course is also designed for students who are seeking the ITIL© 4 Foundation certification and who want to prepare for ITIL© 4 Foundation exam. Overview By the completion of this course, you will have a deep understanding of the 7 Guiding Principles, 4 Dimensions of Service Management, 34 ITIL© Practices, and the new Service Value Chain that incorporate the core of ITIL© version 4. ITIL© is the world?s leading best practice framework for implementing IT Service Management. ITIL version 4 introduces IT Service Management through the lens of a Service Value System (SVS), which provides a holistic end-to-end view of how to successfully contribute to business value, and also how to leverage concepts from models such as Lean IT, Agile, DevOps and Organizational Change Management. This foundational course immerses you in the guiding principles, dimensions, and practices of ITIL© 4. This course will earn you 21 PDUs. This class includes an exam voucher. 1 - ITIL 4 OVERVIEW Introduction to ITIL Key Concepts of ITIL 2 - The ITIL Framework The Four Dimensions of Service Management The ITIL Service Value System 3 - The ITIL Guiding Principles Focus on Value Start Where You Are Progress Iteratively with Feedback Collaborate and Promote Visibility Think and Work Holistically Keep It Simple and Practical Optimize and Automate 4 - THE ITIL SERVICE VALUE SYSTEM (SVS) Governance The Service Value Chain Continual Improvement 5 - Key ITIL Practices Continual Improvement Service Level Management Change Control Incident Management Service Request Management Service Desk Problem Management 6 - Other ITIL Practices General Management Practices Service Management Practices Technical Management Practices

Design your Dream Life Vision Board

By Sinéad Robertson

𝐃𝐢𝐝 𝐘𝐨𝐮 𝐤𝐧𝐨𝐰? 😍Vision Boards improves your chance of success! Here's just a few benefits from the process of vision boarding ⤵️ 🔸 Helps you to connect with what you truly want from life; 🔸 Shift your mindset; 🔸 Provides a tool to align and focus your goals And are a great opportunity to meet new and like minded people! I'm looking forward to hosting this vision board workshop with you. 🙏🏻Give me a shout if you have any questions.

The SHARE Project - Self-Help & Relaxation Exercises for SEN/EBSA Parent Carers (click for dates)

By AUsomeMums

Self-help and relaxation skills and exercises for stressed, burned out SEN parents and carers

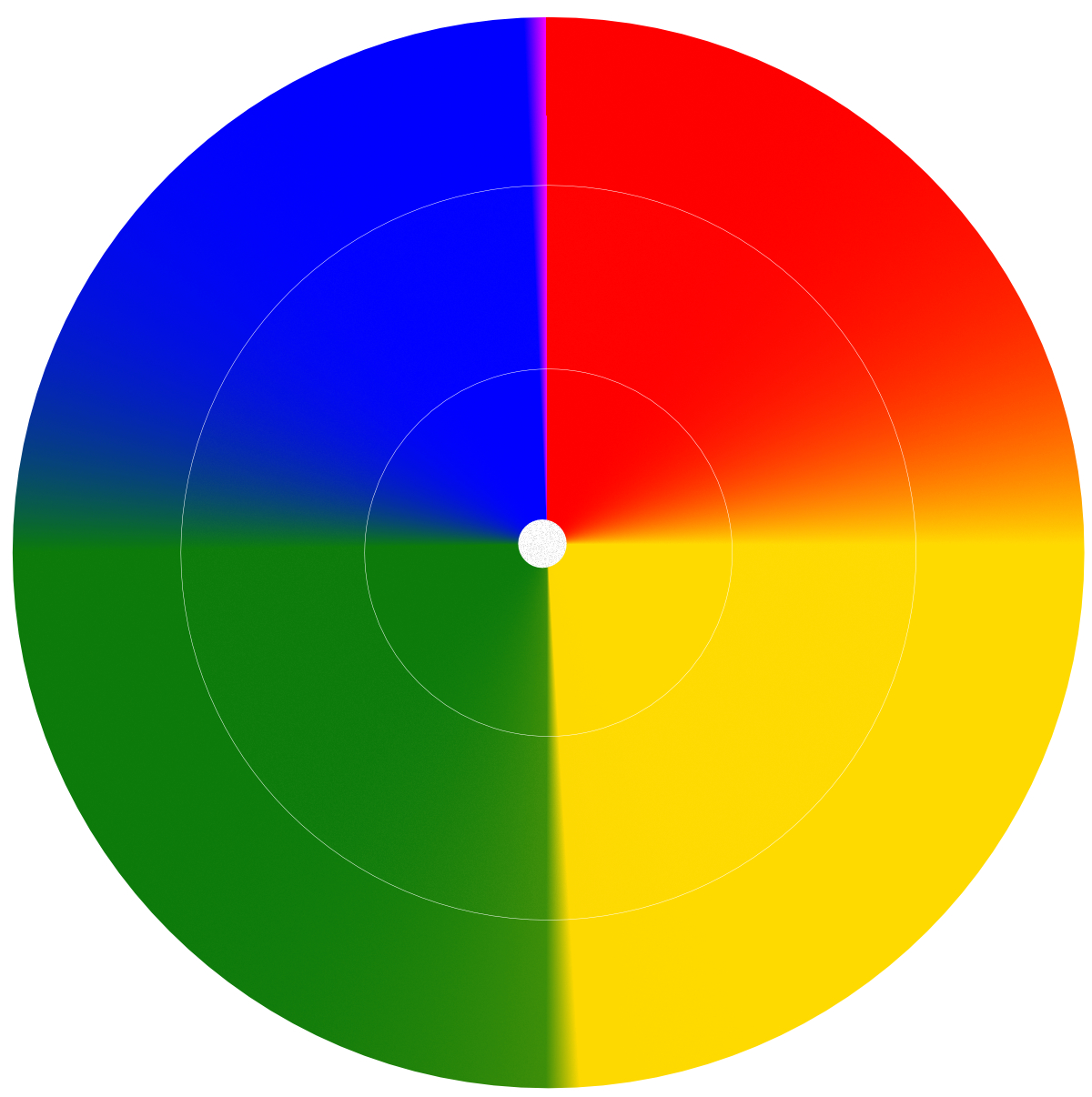

The 4 Colour Energies - Building Influence & Selling Skills

By colour-energies.com

The four colour energies will give you the insights to transform your teams ability to influence customers and tailor their approach to different customers preferences. By building deep rapport and creating trust your customers will strengthen their bond with your organisation. Watch as your sales and profits exceed your expectations.

Driver CPC - 1 Day Periodic 7 Hour Course - Security Training & Emergency Aid

By Total Compliance

This 1-day Driver CPC Periodic Training course focuses on critical areas of Emergency Aid and Security for professional drivers. Designed to meet Driver CPC requirements, this course equips drivers with essential skills for handling emergency situations and enhancing security awareness on the road. Who Should Attend: This course is ideal for all professional drivers required to complete Driver CPC Periodic Training to maintain their Driver CPC Licence. It’s tailored to both experienced drivers and those new to the field, providing relevant, up-to-date skills and knowledge. Learning Objectives: The aim of this course is to confirm and expand on each driver’s current knowledge and skills, ensuring they are informed about the latest legislation, best practices, and critical safety procedures. This training is designed to enhance drivers’ confidence and preparedness in managing emergencies and maintaining security awareness, helping them navigate the responsibilities of their role effectively. Course Format: Online Join us to reinforce your skills, stay compliant, and improve your on-road safety practices!

Mental Health in Education Update

By Brightcore Consultancy

During this live-online masterclass we will focus on understanding recent developments in the mental health and wellbeing of children in the UK, including looking at the impact of cultural and technological changes over recent years and the impact this is having in schools.

Rally Navigation - Regularity for Improvers

By Rally Navigation Training Services

Historic Road Rallying training webinar on Regularity focusing on Average Speed Table style regularities.

Introduction to Good Manufacturing Practice

By Research Quality Association

Course Information This course offers foundational guidance and practical support tailored for individuals operating within Good Manufacturing Practice (GMP) frameworks. Explore the fundamental prerequisites of a pharmaceutical quality system (PQS) and delve into the application of quality risk management (QRM) principles, aligning with current regulations and guidance. Gain insights into pivotal aspects such as requirements, roles, and responsibilities, encompassing change control, document management, and key documentation essential for effective implementation of GMP with a focus on regulatory inspections and common findings. Is this course for you? Ideal for professionals engaged in GMP across various sectors, including: Research and Development (R&D) Contract Manufacturing Organisations Manufacturing Units Quality Control (QC) Laboratories Auditing Roles. What will you learn? Event objectives - by the end of the course, delegates shall: Have an awareness of the basic requirements of GMP Be aware of UK and EU GMP Rules and Guidance and relevant publications Understand the roles and responsibilities associated with GMP Be able to contribute to and maintain quality documentation Have a basic understanding of product lifecycle and manufacturing Understand the requirements of GMP in the QC laboratory context Have a basic understanding of risk management and mitigation principles Understand the need for quality systems and quality assurance activities Be aware of common regulatory findings. Learning outcomes: delegates will be able to: Implement their role within GMP with confidence and knowledge of the principle requirements Contribute effectively to the GMP quality system and their organisation’s compliance Comprehend where their organisation’s activities sit within the larger GMP arena Know where to seek further information within the published rules and guidance, UK Legislation, European Commission Directives, ICH Guidance and other relevant publications, as well as via the internet. Tutors Tutors will be comprised of (click the photos for biographies): Louise Handy Director, Handy Consulting Ltd Programme Please note timings may be subject to alteration. Day 1 09:30 Introductions and Scope of the Course Understand the group requirements and the tutor's background and experience. 09:45 Background and Regulatory Environment Setting the scene, understanding the context, key legislation. 10:30 Principles of GMP Key points and requirements. 11:15 Break 11:30 Personnel and Responsibilities Management and staff, duties and accountabilities. 12:00 Overview of GMP Manufacturing Basics of the product life cycle. 12:30 Lunch 13:15 Risk Management Workshop Practical exploration of risk and mitigation activities. 14:30 QC Laboratories Activities and practicalities. 15:15 Break 15:30 Compliance Quality Assurance and Self Inspection. 16:15 Question Time A chance for questions on the practicalities of GMP. 16:30 Close of Course Extra Information Course Material This course will be run completely online. You will receive an email with a link to our online system, which will house your licensed course materials and access to the remote event. Please note this course will run in UK timezone. The advantages of this include: Ability for delegates to keep material on a mobile device Ability to review material at any time pre and post course Environmental benefits – less paper being used per course Access to an online course group to enhance networking. You will need a stable internet connection, a microphone and a webcam. CPD Points 7 Points Development Level Learn

Educators matching "focus"

Show all 59Search By Location

- focus Courses in London

- focus Courses in Birmingham

- focus Courses in Glasgow

- focus Courses in Liverpool

- focus Courses in Bristol

- focus Courses in Manchester

- focus Courses in Sheffield

- focus Courses in Leeds

- focus Courses in Edinburgh

- focus Courses in Leicester

- focus Courses in Coventry

- focus Courses in Bradford

- focus Courses in Cardiff

- focus Courses in Belfast

- focus Courses in Nottingham