- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Tableau Desktop Training - Analyst

By Tableau Training Uk

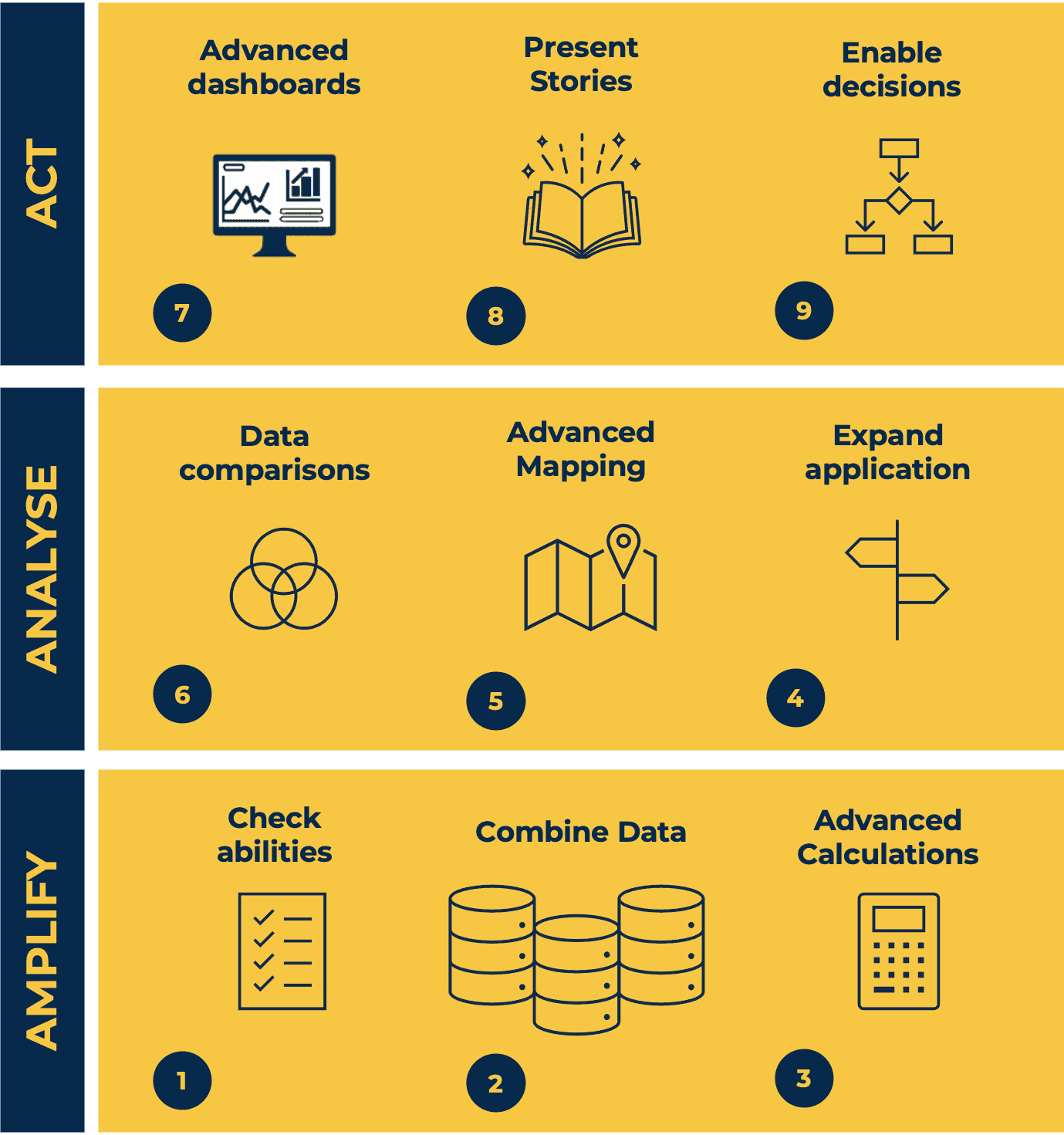

This Tableau Desktop Training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course is split into 3 phases and 9 modules: Phase 1: AMPLIFY MODULE 1: CHECK ABILITIES Revision – What I Should Know What is possibleHow does Tableau deal with dataKnow your way aroundHow do we format chartsHow Tableau deals with datesCharts that compare multiple measuresCreating Tables MODULE 2: COMBINE DATA Relationships Joining Tables – Join Types, Joining tables within the same database, cross database joins, join calculations Blending – How to create a blend with common fields, Custom defined Field relationships and mismatched element names, Calculated fields in blended data sources Unions – Manual Unions and mismatched columns, Wildcard unions Data Extracts – Creating & Editing Data extracts MODULE 3: ADVANCED CALCULATIONS Row Level v Aggregations Aggregating dimensions in calculations Changing the Level of Detail (LOD) of calculations – What, Why, How Adding Table Calculations Phase 2: ANALYSE MODULE 4: EXPAND APPLICATION Making things dynamic with parameters Sets Trend Lines How do we format charts Forecasting MODULE 5: ADVANCED MAPPING Using your own images for spatial analysis Mapping with Spatial files MODULE 6: DATA COMPARISONS Advanced Charts Bar in Bar charts Bullet graphs Creating Bins and Histograms Creating a Box & Whisker plot Phase 3: ACT MODULE 7: ADVANCED DASHBOARDS Using the dashboard interface and Device layout Dashboard Actions and Viz In tooltips Horizontal & Vertical containers Navigate between dashboards MODULE 8: PRESENT STORIES Telling data driven stories MODULE 9: ENABLE DECISIONS What is Tableau Server Publishing & Permissions How can your users engage with content This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must bring their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium “Steve not only provided a comprehensive explanation of the content of the course, but also allowed time for discussing particular business issues that participants may be facing. That was really useful as part of my learning process.”Juan C., Financial Conduct Authority “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium

CHILD PROTECTION AWARENESS ONE DAY COURSE

By Child Protection Training Uk

Formally Safeguarding Children Level 1: One Day Course 10am - 3.30pm Working Together to Safeguard Children 2018 & Keeping Children Safe in Education (2022) Updated This Course can also be run within your organisation for your staff group at a reduced cost contact us for a quote or if you have any other questions about this course talk to an adviser now online.

Coaching and Mentoring for Managers

By Dickson Training Ltd

The 2-day Coaching and Mentoring for Managers course is designed for organisations that want their managers and team leaders to apply practical coaching and mentoring skills in everyday work situations in order to develop the performance of those they are responsible for, as well as improving communication within the business. Previous attendees have included chief executives, general managers, and HR managers, right through to production line supervisors and office staff. In fact, anybody that has to work as part of a team and relies on other people's efforts will benefit from this programme. Course Syllabus The syllabus of the Coaching and Mentoring for Managers course is comprised of four modules, covering the following: Module One Introduction to Coaching and Mentoring Exploding the myths surrounding coaching Benefits of coaching and mentoring The role of a coach and mentor How to avoid everyday interference that takes your time away from coaching people to achieve results How motivation works The difference between mentoring, coaching, directing, supporting & delegating, and learning when it is necessary to apply them Why coaching is an action orientated partnership purely focused on measurable results Coaching and mentoring outcomes Module Two Managing a Coaching Session The most important skills of a business coach The key characteristics of a good coach How to ask powerful coaching questions Opportunity to role-play using the STAR/GROW model Module Three Mentoring in Action Mentoring suggestions The first meeting Between first and second meetings The second meeting The Experiential learning cycle Model discussions Frequent questions asked by Mentors Duration of mentoring End of relationships Module Four Putting Learning into Practice Building a bank of great coaching questions Demonstration of what has been taught in a live coaching/mentoring meeting Individual feedback from a professional coach Creating SMART action plans Getting started as a work coach/mentor Group review and feedback on new learning Action steps for new coaches Scheduled Courses Unfortunately this course is not one that is currently scheduled as an open course, and is only available on an in-house basis. Please contact us for more information.

Essential Selling Skills

By Dickson Training Ltd

Some people naturally possess an ability to sell and others over time develop their own style. We have created a highly practical course to give you the confidence and ability to sell over the phone or face to face. We focus the exercises, theory and discussion on your own job role and experiences to ensure you can return to the workplace to deliver tangible results. This 2-day course is designed for individuals who are new to selling, those in a sales role but have not received any formal training, or professionals who would like to brush up and enhance their current selling skills and learn some new techniques. Course Syllabus The syllabus of the Essential Selling Skills course is comprised of seven modules, covering the following: Module One Understanding the Customer The importance of good customer care Selling vs. selling attitude The reasons people buy Adopting a positive approach Module Two Self-Awareness Understanding your selling style Adapting your selling style to your customer Understanding your customers buying style Module Three Effective Communication and Rapport Building Why does communication need to be effective? Actively listening to your customers' needs Right question at the right time The impact of positive and emotive language Module Four Taking a Consultative Approach Different styles of selling Taking a consultative approach to selling Preparation techniques Buyer behaviour and motivation A selling approach to match the buyers mind Module Five Presenting the Solution Selling the benefits Sales tool kit Unique sales points Advanced questioning techniques Module Six Gaining Commitment Recognising and acting upon buying signals Dealing with customers concerns No means no? How to cope in stressful situations Module Seven Confirming the Sale Confirming or closing? Effective confirming techniques Going the extra mile Benefits For you as an individual This course will increase your confidence and ability to sell, having provided you with tools and techniques to achieve maximum results. Delegates always leave with fresh ideas, energy and motivation to succeed. For an employer The attitude of the delegates and the results they deliver will speak for themselves. All techniques are easy to apply back into the workplace for an immediate impact. What will I learn? By the end of the course, participants will be able to: Appreciate the need for preparation before a sales appointment Effectively identify and meet needs with advanced questioning techniques Identify verbal and non-verbal buying signals Construct professional answers to questions and possible objections Present your products and/or services with the buyer in mind Identify and use a selling style appropriate to capture the buyer's attention Recognise and overcome major objection types How to apply effective confirmation techniques with the buyer in mind Real Play Option We offer an innovative solution to engage the learners and bring real negotiation and closing scenarios to life. We use actors who improvise scenarios which have been specified by the group. The group is split the group into 2 sub-groups, one with the actor, the other with the trainer. Each group has a brief and has to instruct their trainer/actor on how to approach the scenario supplied. The actor and trainer perform the role play(s) as instructed by their respective teams; however during the action they can be paused for further recommendations or direction. The outcome is the responsibility of the team(s) - not the performers. Scheduled Courses This course is not one that is currently scheduled as an open course, and is only available on an in-house basis. For more information please contact us.

ILM Level 2 Award in Leadership and Team Skills

By Dickson Training Ltd

An accredited qualification to prepare supervisors and team leaders for a future management role. This programme gives Team Leaders & Managers the skills, disciplines and confidence to manage their team effectively and add a great deal more value to the organisation - where they have to apply their learning in order to achieve the highly coveted ILM qualification. In order for a business to obtain maximum results, it is important that employees are motivated and supported in their job roles. It is the responsibility of the team leader or supervisor to lead their team effectively and present feedback to management. This 3-day programme will guarantee to boost your performance as a team leader and help you make the transition from working in a team to leading a team. We use a combination of theory and practical to help you develop yourself, and a toolkit of resources to use in the workplace. This is an internationally accredited course which not only carries kudos but it ensures you apply the learning back into the workplace for an immediate impact. All of our ILM Programmes are provided in partnership with BCF Group Limited, which is the ILM Approved Centre we deliver under. Course Syllabus The syllabus of the ILM Level 2 Award in Leadership and Team Skills course is split into three main modules, covering the following: Module One Developing Yourself as a Team Leader Learning the various roles, functions and responsibilities of a team leader - depending on workplace Recognising limits of authority and accountability, and how these are defined Developing personal skills and abilities for effective team leading Using reflective learning skills to improve performance Identifying areas of strength and possible improvement Finding ways of obtaining feedback from others Receiving and responding positively to feedback Module Two Workplace Communications Learning stages in the communication process Consideration of the recipient's needs Spotting barriers to communication and how to overcome them Establishing a range of direct communication methods relevant to the team Collating a range of direct communication methods relevant to people outside own area of responsibility. This includes written, telephone, e-mail and face-to-face Recognising the aspects of face-to-face communication, including appearance, impact, body language Realising the importance of succinct and accurate records of one-to-one oral communication Reasons for maintaining records of one-to-one communication (e.g. potential disciplinary or legal issues) Module Three Managing Yourself Setting SMART objectives and using them to prioritise own actions Learning simple time management techniques Developing an awareness of own skills and abilities Giving yourself personal objectives in relation to team objectives Developing flexibility and responding to daily changing circumstances Diagnosing the causes and impacts of stress at work Identifying symptoms of stress in yourself Knowing the implications of stress for workplace and non-work activities/relationships Developing simple stress management techniques Available sources of support Action planning and review techniques Accreditation As with all ILM accredited programmes, participants will need to complete the post-programme activity in order to achieve their full ILM Level 2 Award in Team Leading. This element is designed to show to ILM that you are able to apply what you have learned in the workplace. Who Is It For? This programme is ideal for practising or aspiring team leaders, in any industry sector, who is looking to gain a solid foundation or develop their existing skills as a team leader. This internationally recognised course will give you a solid understanding of what is needed to be a successful team leader, how to delegate, motivate and how to implement these skills in to your work place. What Will I Learn? At the end of the course, successful candidates will: Have a good understanding of the team leader role Apply a range of effective communication skills to overcome barriers Know how to motivate, build confidence and gain the best from their teams Identify, build and encourage effective team behaviours Apply practical skills and knowledge to be transferred to the workplace Gain an internationally recognised qualification What Is Required? There are no formal entry requirements, but participants will normally be either practising or aspiring team leaders, with the opportunity to meet the assessment demands and have a background that will enable them to benefit from the programme. Scheduled Courses Unfortunately this course is not one that is currently scheduled as an open course, and is only available on an in-house basis. For more information about running this course in-house at your premises, please contact us for more information.

Ushering The Team Back To The Workplace

By Dickson Training Ltd

Most organisations and businesses are trying to navigate the best way back to a functional working framework. But two things need to happen - 1. The working practices need to be efficient, sustainable and compatible for meeting the demands and needs of the organisation; it’s clients, it’s workforce and it’s Leaders 2. The culture needs to be welcoming, authentic and supportive otherwise there will be disenfranchisement and potentially a churn of staff and loss of talent What has been proven to be a very successful approach to mitigate the dangers of demotivated team members and poor efficiency levels is a bespoke ‘Ushering the Team Back to the Workplace’ workshop. Programme Outline Below is a template of an actual Programme that has been delivered very successfully for clients such as the NHS; Claranet; Jotun Paints & Workspace. This, however, can be modified to suit any group or size. It will be designed to reflect the Organisation’s preferred Hybrid working framework and communication systems. The options of having the innovative Real Play technique to help handle delicate conversations is especially effective. The biggest gain is to reconnect the relationships via the activities and exercises, which would be selected carefully. Key commitments and buy-in is always the priority outcomes - which this programme will help deliver in just 1 day. The objectives include: Making the transition back to working as a collaborative team Enhancing the Leadership skills of the team Reviewing/establishing the Hybrid working protocols Galvanising the Team spirit Maintain inclusivity among full-time; part-time and Region based team members Energising and motivational Fun! Exercise – Round the Bend The team are to follow the instructions delivered as they walk (and jump) through the route – always keeping a safe distance apart. The instructions become more complicated as they progress. Debriefing points: Dealing with Change Attention to Detail Adapting approach Optimising results Exercise - Number Crunch (3 x Cohorts of 12/13) The team must be effectively led and motivated to work as one unified group to reach their objective of visiting each numbered location within a very tight deadline. Debriefing points: Support and co-ordination Strategy and planning Adapting approach Optimising results Tutorial – Team Dynamics Tuckman model Phases of Development towards Maturity Exercise - Juggling (3 x Cohorts of 12/13) The group(s) will be invited to optimise the number of ‘clients’ (juggling balls) they can manage at one time. This involves devising a sequence between the group to achieve maximum results without making any mistakes. We introduce different balls which represent different degrees of complexity, challenging the group’s preparation and approach to a variety ‘customers’ needs. Debriefing points: Ensuring effective communication Clarifying the approach for dealing with the unexpected Setting expectations and reviewing delivery Treating every colleague with care and respect Tutorial - Email Etiquette The primary standards – best practices ABSURD model Preparation and planning Top Tips World Cafe The team are split into 5-6 sub-groups – each with a specific review focus:- What recommendations do you have to engage the team back into the Workplace? How do we ensure the framework is efficient? What are the best ways to optimise team working strategically when most/all team members are in the office? What potential barriers are there? How do we accommodate for the Regional team members? What are the benefits to bringing the team back to the workplace? Each session has 2 – 3 rounds with each table’s ‘host’ sharing feedback for applying to the Team Action Plan – or Charter. Debriefing points: Each Syndicate’s recommendations and capture the key actions they generate 'Real Play' We offer an innovative solution to bring real Leadership/team scenarios to life. We use actors who improvise scenarios which have been specified by the group. The group is split the group into 2 sub-groups, one with the Actor, the other with the Trainer. Each group has a brief and has to instruct their Trainer/Actor on how to approach the scenario supplied. The Actor and Trainer perform the role play(s) as instructed by their respective teams; however, during the action they can be paused for further recommendations or direction. The outcome is the responsibility of the team(s) – not the performers Assign 24 x ‘Directors’ (4 for each Player – Phil & Julia – for each Real Play. Potential Real Play Scenarios: Engaging with a team member as to how the new working plans will be applied. Overcoming concerns to the new working practices/framework Addressing issues where a team member feels excluded from the teamworking practices/culture Debrief the Programme Individual Action Plans Team Priorities for application into the workplace

Internal Workplace Mediation Skills Course (5 days)

By Buon Consultancy

Workplace Mediation

Fire Safety Awareness

By Prima Cura Training

This course is ideal to give all members of staff basic fire training to increase awareness and cooperation in the event of a fire in the workplace.

Health & Safety Level 2

By Prima Cura Training

This Health & Safety in the Care Sector Course works alongside, and helps, learners understand Standard 13 of the Care Certificate. This Standard touches on the legislation, policies & responsibilities relating to Health & Safety in the care sector, as well as looking at accidents and sudden illnesses.

Telephone Training - New! - 3CX

By Telephone Trainers Ltd

Handset Training on Yealink & Fanvil handsets 3CX Web Client User Training 3CX Phone App iOS & Android Mobile Apps Voicemail User Receptionist/Switchboard Supervisor/Agent 3CX Web Client Admin Training (FREE/SMB/STARTUP) 3CX Management Console Admin Training (PRO/ENT) 3CX CFD (Call Flow Designer) **Coming soon! XIMA CCAAS on 3CX Agent, Realtime, Recording and Reporting

Search By Location

- Design Courses in London

- Design Courses in Birmingham

- Design Courses in Glasgow

- Design Courses in Liverpool

- Design Courses in Bristol

- Design Courses in Manchester

- Design Courses in Sheffield

- Design Courses in Leeds

- Design Courses in Edinburgh

- Design Courses in Leicester

- Design Courses in Coventry

- Design Courses in Bradford

- Design Courses in Cardiff

- Design Courses in Belfast

- Design Courses in Nottingham