- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

56221 Courses delivered Online

Online-Sew Beautiful Quilted Baskets

By Loopy's Place

Learn to make addictive fabric baskets! Easy-to-follow online class for beginners and experienced sewers. Create beautiful, functional baskets with a fun and simple technique. Enjoy lifetime access to video tutorials, patterns, and support. Discover your inner crafter today!

30 Day Psychological Resilience Challenge

By Simon Lee Maryan Lt

Course curriculum Week 1: Understanding Negative Thoughts Introduction from Simon Lee Maryan Day 1: Introduction to the Challenge Day 1.1: Fasting Day 1.2: Cold Water Exposure Day 2: Identifying Negative Thought Patterns Day 3: Effects of Negative Thinking Day 4: Journaling for Self-Awareness Day 5: Cognitive Restructuring Day 6: Practicing Mindfulness Day 7: Weekly Reflection Day 1.2.1: Leading From the Front 2 Week 2: Managing Stress Day 8: Understanding Stress Day 9: Effects of Stress on the Body Day 10: Stress Reduction Techniques Day 11: Time Management and Stress Day 12: Stress-Reducing Habits Day 13: Emotional Regulation and Psychological Resilience Day 14: Weekly Reflection 3 Week 3: Combating Fatigue Day 15: Understanding Fatigue Day 16: Effects of Fatigue Day 17: Circadian Rhythm and Good Sleep Hygiene Day 18: Energy-Boosting Nutrition and Psychological Resilience Day 19: Physical Activity for Energy Day 20: Mindfulness for Fatigue Management Day 21: Weekly Reflection 4 Week 4: Maintaining Positivity Day 22: Building Positive Habits Day 23: Gratitude and Positivity Day 24: Positive Affirmations Day 25: Social Support and Positivity Day 26: Resilience and Positivity Day 27: Final Reflection End of Challenge Reflective Feedback Day 28: Recap and Celebration Day 29: Your Next Steps Day 30: Additional Resources 5 Bonus Resources An Interview About Some of My Experiences

Entry Level 1 Online Football Coaching Qualification Course

By NLP Sports

Coaching Course Level 1 - Provides an introduction to coaching practices at an academy level

Level 3 Online Football Agent Qualification Course

By NLP Sports

Football Agent Course Level 3 - Provides extended insight into an agents day to day activities including contracts, player recruitment and placement

BANKING TAXATION

By Mojitax

This course is for tax professionals, students of ADIT (sitting the Banking module) and other persons interested in gaining enhanced knowledge of tax issues in the banking and finance sector. Persons on this course will learn about global and regional tax policies and how they relate to investment banking, capital markets, global markets, asset financing, asset management, private banking and wealth management. Learning: Self Paced Mode of assessment: 50 MCQs (80% Pass mark) Award : MOJITAX certificate of knowledge, and ADIT Module 3.05 (exam preparation). Author: MojiTax Start date: NA Duration: Self Paced ADIT/MOJITAX Blended Syllabus The curriculum of the course encompasses the syllabus of the Chartered Institute of Taxation's Advanced Diploma in International Taxation, Module 3.05. Additionally, practical concerns for tax practitioners are also covered. Upon completion of the module, participants are expected to have solid understanding of Banking taxation and confidently pass the ADIT Module 3.05 Banking option in either June or December. Professional Exam Focused At MojiTax, we understand that our students want to be well-prepared for their Advanced Diploma in International Taxation (ADIT) professional exam. That's why our Banking training is exam-focused. Our course is structured to cover all the topics and concepts needed for success on the exam. We also align our training with the ADIT syllabus, ensuring that each section of our program corresponds to the exam's content. How we support our students MojiTax supports students on the course in several ways. Firstly, the course is self-paced, meaning students can work through the material at their own pace and have access to it 24/7. Secondly, the course is designed to be exam-focused, ensuring that students are well-prepared to take the ADIT professional exam. Finally, MojiTax aims to respond to all inquiries from students within 24 working hours, ensuring that students receive prompt support and assistance when needed. Our resources Our students have access to a range of training materials and assessments designed to support their learning and progress. These include: Presentations: E-Textbook: Intergovernmental Materials: Access to relevant intergovernmental materials, such as tax treaties, OECD guidelines, and other relevant publications. Multiple-Choice Questions: ADIT Revision Questions: MojiTax Exam 01 Introduction Introduction to Mojitax Banking TaxationIntroduction to MojiTax Banking TaxationADIT/CIOT websiteADIT Syllabus: Banking 02 Part 1: Fundamental tax issues - 10% Presentation: Fundamental tax issuesChapter 1: Fundamental tax issuesQuiz 1: Test your knowledge 03 Part 2: Banking regulations and tax implications of bank operating models and capital/funding allocations - 20% Presentation: Banking regulations and tax implications of bank operating models and capital/funding allocationsChapter 2: Banking regulations and tax implications of bank operating models and capital/funding allocationsQuiz 2: Test your knowledgeADIT Style Questions with Model Answers 04 Part 3: Tax implications for banking activities - 20% Presentation: Tax implications for banking activitiesChapter 3: Tax implications for banking activitiesQuiz 3: Test your knowledgeADIT Style Questions with Model Answers 05 Part 4: Transaction taxes and withholding taxes - 15% Presentation: Transaction taxes and withholding taxesChapter 4: Transaction taxes and withholding taxesQuiz 4: Test your knowledgeADIT Style Questions with Model Answers 06 Part 5: Special topics - 20% Presentation: Special topicsChapter 5: Special topicsQuiz 5: Test your knowledgeADIT Style Questions with Model Answers 07 Part 6: The OECD and EU context - 15% Presentation: OECD and EU contextChapter 6: OECD and EU contextQuiz 6: Test your knowledgeADIT Style Questions with Model Answers 08 Examination & Certificate Assessment GuidanceAssessment & Certificate PortalModule Feedback

Entry Level 1 Online Football Scouting Qualification Course

By NLP Sports

Football Scouting Course Level 1 - Provides an insight into the process of scouting a player at an elite level and what it entails

Taxation of Energy Resources

By Mojitax

The MojiTax Energy Resources module is meticulously tailored to align with the ADIT syllabus, specifically addressing Energy Resources Option 3.04, and is designed to empower students to excel in their examinations. To guarantee relevance and accuracy, the content is regularly updated to reflect the latest in energy taxation policies and global trends. By staying abreast of changes and ensuring that the study material is consistently aligned with the ADIT exam requirements, MojiTax is committed to providing students with a robust and cutting-edge preparation resource that significantly enhances their chances of success. Learning: Self Paced Mode of assessment: 50 MCQs (80% Pass mark) Award : MOJITAX certificate of knowledge, and ADIT Module 3.04 (exam preparation). Author: MojiTax Start date: NA Duration: Self Paced ADIT/MOJITAX Blended Syllabus The curriculum of the course encompasses the syllabus of the Chartered Institute of Taxation's Advanced Diploma in International Taxation, Module 3.04. Additionally, practical concerns for tax practitioners are also covered. Upon completion of the module, participants are expected to have a solid understanding of the International Taxation of Energy Resources and confidently pass the ADIT Module 3.04, exam in either June or December. Professional Exam Focused At MojiTax, we understand that our students want to be well-prepared for their Advanced Diploma in International Taxation (ADIT) professional exam. That's why our Energy Resources training is exam-focused. Our course is structured to cover all the topics and concepts needed for success on the exam. We also align our training with the ADIT syllabus, ensuring that each section of our program corresponds to the exam's content. How we support our students MojiTax supports students on the course in several ways. Firstly, the course is self-paced, meaning students can work through the material at their own pace and have access to it 24/7. Secondly, the course is designed to be exam-focused, ensuring that students are well-prepared to take the ADIT professional exam. Finally, MojiTax aims to respond to all inquiries from students within 24 working hours, ensuring that students receive prompt support and assistance when needed. Our resources Our students have access to a range of training materials and assessments designed to support their learning and progress. These include: Presentations: E-Textbook: Intergovernmental Materials: Access to relevant intergovernmental materials, such as tax treaties, OECD guidelines, and other relevant publications. Multiple-Choice Questions: ADIT Revision Questions: MojiTax Exam: 01 Introduction Introduction to MojiTax Energy ResourcesADIT/CIOT websiteADIT Syllabus: Energy Resources 02 Part 1: Fundamental tax issues - 5% Presentation: Fundamental tax issuesChapter 1: Fundamental tax issuesQuiz 1: Test your knowledge 03 Part 2: Tax and fiscal regimes - 15% Presentation: Tax and fiscal regimesChapter 2: Tax and fiscal regimesQuiz 2: Test your knowledge 04 Part 3: Country tax examples - 5% Presentation: Country tax examplesChapter 3: Country tax examplesQuiz 3: Test your knowledge 05 Part 4: Permanent establishments - 10% Presentation: Permanent establishmentsChapter 4: Permanent establishmentsQuiz 4: Test your knowledge 06 Part 5: Technical services - 10% Presentation: Technical servicesChapter 5: Technical servicesQuiz 5: Test your knowledge 07 Part 6: Mergers and acquisitions - 5% Presentation: Merger and acquisitionsChapter 6: Mergers and acquisitionsQuiz 6: Test your knowledge 08 Part 7: Intellectual Property (IP) - 5% Presentation: Intellectual propertyChapter 7: Intellectual propertyQuiz 7: Test your knowledge 09 Part 8: Leasing - 5% Presentation: LeasingChapter 8: LeasingQuiz 8: Test your knowledge 10 Part 9: Financing - 5% Presentation: FinancingChapter 9: FinancingQuiz 9: Test your knowledge 11 Part 10: Profit repatriation - 5% Presentation: Profit repatriationChapter 10: Profit repatriationQuiz 10: Test your knowledge 12 Part 11: Trading - 2.5% Presentation: TradingChapter 11: TradingQuiz 11: Test your knowledge 13 Part 12: Transfer pricing - 5% Presentation: Transfer pricingChapter 12: Transfer pricingQuiz 12: Test your knowledge 14 Part 13: Governance of natural energy resources - 5% Presentation: Governance of natural energy resourcesChapter 13: Governance of natural energy resourcesQuiz 13: Test your knowledge 15 Part 14: Arbitration of disputes - 2.5% Presentation: Arbitration of disputesChapter 14: Arbitration of disputesQuiz 14: Test your knowledge 16 Part 15: Tax issues relating to decommissioning of assets - 5% Presentation: Tax issues relating to decommissioning of assetsChapter 15: Tax issues relating to decommissioning of assetsQuiz 15: Test your knowledge 17 Part 16: Tax policy considerations of climate change - 10% Presentation: Tax policy considerations of climate changeChapter 16: Tax policy considerations of climate changeQuiz 16: Test your knowledge 18 Examination & Certificate Assessment GuidanceAssessment & Certificate Portal

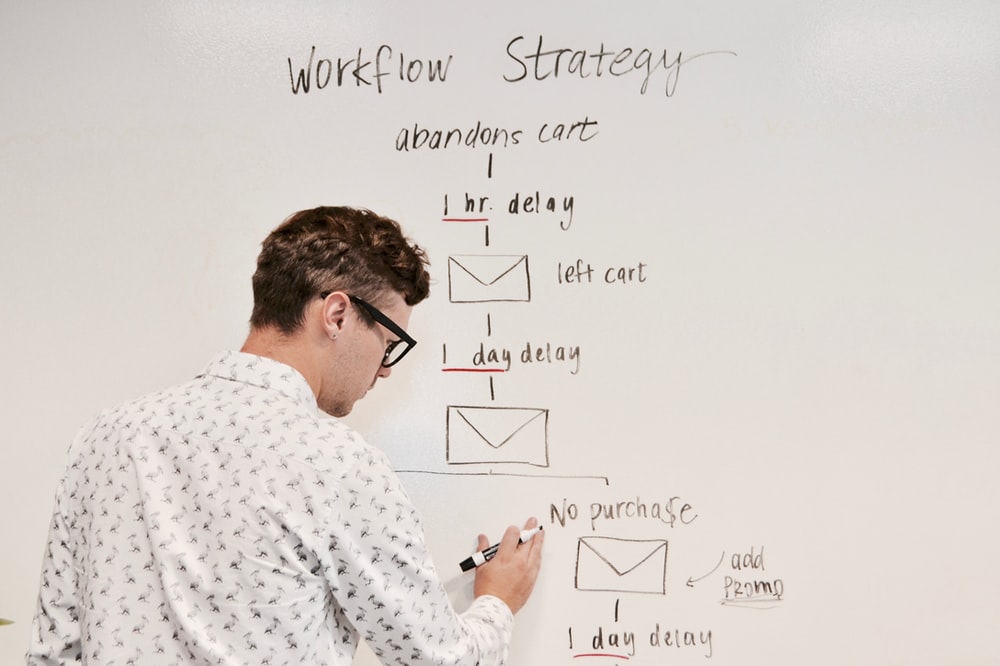

Create a Powerful Positioning Strategy

By Entreprenure Now

How do your customers see you? Market positioning is at the intersection of your offering and your customers – in the form of both the promise you make in the form of messaging, and customer perceptions of how well you deliver on that promise. Your goal is to uniquely claim a niche in the marketplace that encapsulates the value you deliver to your audience. To help define your claim, this learning stream provides a six-step framework for honing your positioning. You’ll examine the facets of your business to find the elements you deliver that resonate most with customers, use starter wording templates as a jumping-off point, and validate your work with seven key criteria. Multiple examples from product, technology, and service companies are discussed throughout – including how poor repositioning of one of American’s best-known brands damaged the company. Workshop exercises will guide you through creation of positioning statements that will form the basis of your marketing and messaging strategy at launch and beyond.

ZOOM Full Moon gathering - Peace Kirtan circle

By Alva Yoga

Full Moon Kirtan & Cacao meditation circle

No Time For Me Time

By Nurturing Neurodiversity

A practical and realistic discussion on how to take care of yourself whilst also taking care of your children. A webinar with Naomi Fisher and Heidi Steel that will leave you with three things that you can weave into your life right now and a booklet with Five Ways You Can Reconsider Your Self Care.