- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

4696 Consultant courses

CompTIA Security+ Certification SY0-601: The Total Course

By Packt

This video course is designed to prepare you to achieve the internationally recognized fundamental IT training certification, CompTIA Security+ Certification SY0-601 exam. The course covers all the major domains needed for the certification and will help you develop the basics of IT and computers with the help of examples and quizzes.

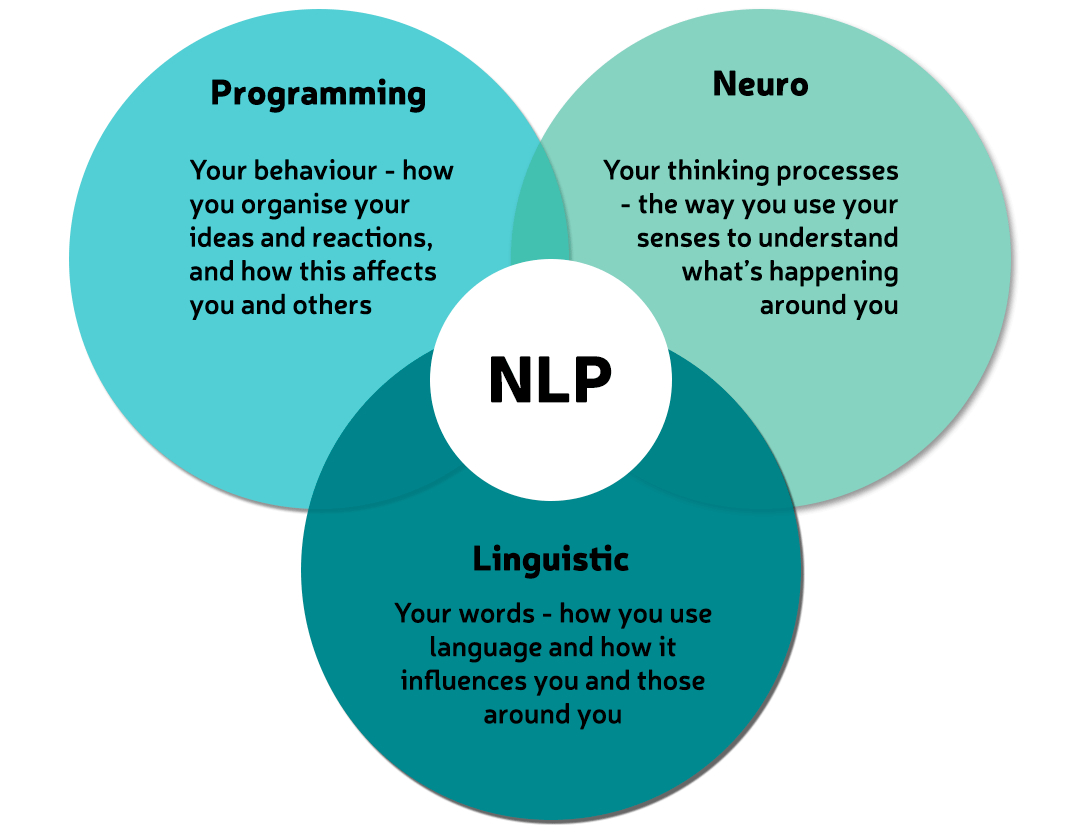

NLP Diploma

By Proactive NLP Ltd

NLP Diploma training & certification with Proactive NLP Ltd is your first step towards self-mastery. Start getting what you want from life.

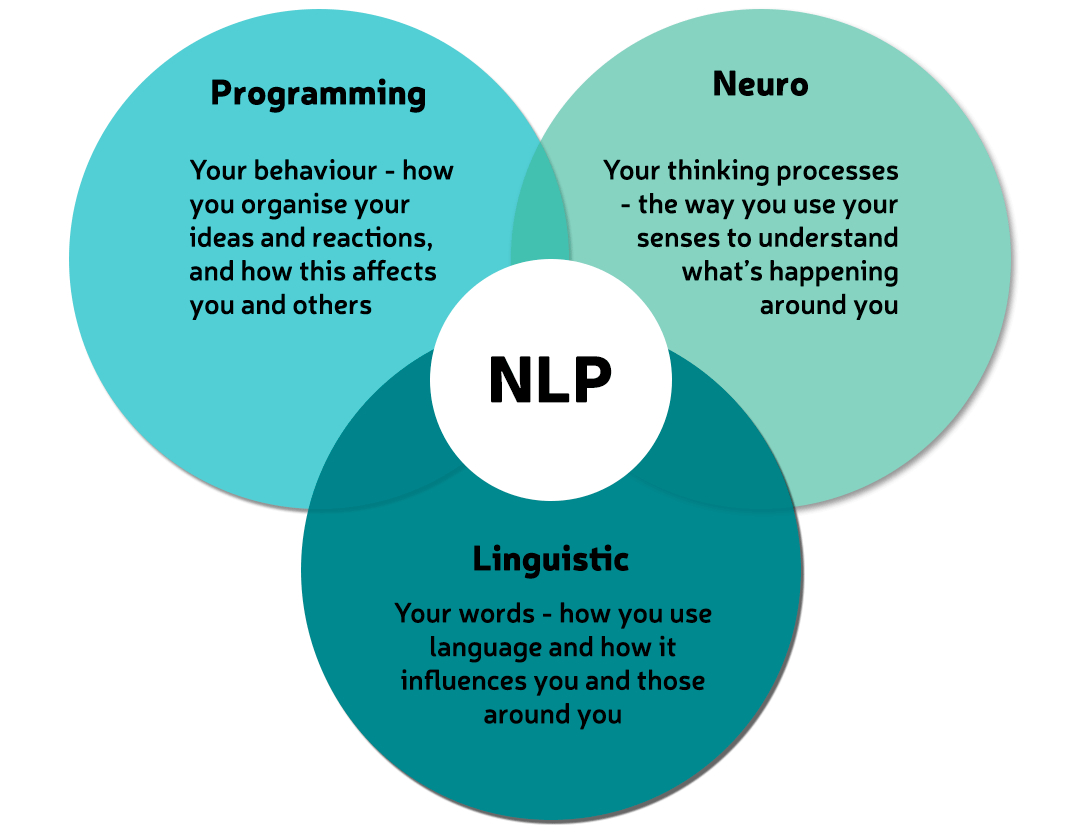

NLP Business Diploma (Fundamentals of Collaborative Working)

By Proactive NLP Ltd

NLP Business Diploma - The Fundamentals of Collaborative Relationships training & certification with Proactive NLP Ltd is your first step towards developing collaborative leadership and collaborative cultures. Start transforming your projects now!

The Diploma in Travel, Tourism and Hospitality Management course covers all the necessary areas of tourism and Hospitality management. The course is divided into two parts. The first part deals with travel and tourism where you will learn how to do in travel and tour, the Traveling Pointers & Pitfalls, and the basic travel guide. Then the course will focus on Hospitality management and teaches you the essential skills of hospitality such as communication, accommodation, safety, and more. Who is the course for? People interested in travelling across the world and learn its benefits Professionals wanting to learn about the various travel destinations for their job Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam, you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hardcopy at the cost of £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognized accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: Diploma in Travel, Tourism and Hospitality Management course is a useful qualification to possess and would be beneficial for any related profession or industry such as: Tourist guides Travel agency consultant Start up travel companies People interested in travelling Module 1 Introduction to Travel & Tourism 00:30:00 History of Tourism 00:30:00 Integrated Model of Tourism 00:30:00 The Meaning of Travel Tourism and Tourist 01:00:00 Types of Tourism 00:15:00 The Products & Services of Tourism 00:30:00 Tourism-Destinations 01:00:00 Managing Tourism 01:00:00 Managing Tour Operations 00:30:00 Transportation 01:00:00 Quality Management 01:00:00 The Impacts of Tourism 01:00:00 Conclusion 00:15:00 Module 2 Introduction to Hospitality 00:15:00 Characteristics of the Hospitality Industry 00:15:00 Relationship Between the Hospitality Industry and Tourism 00:15:00 Types of Accommodation 00:15:00 Types of Room 00:30:00 Types of Hotel Guests 00:15:00 Module 3 Introduction to Hospitality Management 00:30:00 Influences Which Affect the Industry 00:15:00 The Development of the Hospitality Industry 00:30:00 Hospitality Brands 00:15:00 Accommodation 00:30:00 Food Service 00:30:00 Successful Quality Management 00:30:00 Module 4 Pointers for Gaining Access to Money While Traveling on the Road 00:30:00 A 'Must-Do' Before Going on a Trip 01:00:00 Practical Packing Tips 00:30:00 Wellness Tips 01:00:00 Transportation Techniques 00:30:00 Shopping Pitfalls 00:30:00 Food and Dining Tips 00:30:00 Money, Money, Money Wits 00:30:00 The 6 Top Airport Scams and What to Do to Guard against Them 01:00:00 A Commonly Hidden Foreign Airport Warning 00:30:00 Don't Prepay for that Gas 00:15:00 Surefire Ways to Guard against Air-Travel Tiredness 00:30:00 What to Do if a Person Becomes Ill While Traveling in Air? 01:00:00 The Best but Affordable Places to Eat while Traveling 00:30:00 How to Get Paid while Taking a Vacation 00:30:00 Module 5 Africa Safari Travel Temptations 00:30:00 Australia Travel Temptations 00:30:00 Booking Travel Temptations 00:15:00 Costa Rica Travel Temptations 00:30:00 Disneyland Travel Temptations 00:30:00 Disney World Travel Temptations 00:30:00 Egypt Travel Temptations 00:30:00 Exotic Travel Temptations 00:30:00 Travel Temptations 00:15:00 Hilo Travel Temptations 00:15:00 Hot Spots in Travel Temptations 00:15:00 How Online Travel Temptations Work 00:15:00 Indiana Travel Temptations 01:00:00 Key West Travel Temptations 00:15:00 Mexico Travel Temptations 00:30:00 Michigan Travel Temptations 01:00:00 Ohio Travel Temptations 00:30:00 Panama Travel Temptations 00:30:00 RIU Paradise Island Travel Temptations 00:15:00 San Diego Travel Temptations 00:30:00 Sandy Point Travel Temptations 00:15:00 Singapore Travel Temptations 00:30:00 Tennessee Travel Temptations 01:00:00 Travel Agents and Travel Temptations 00:15:00 Travel Destination to Alaska 01:00:00 Travel Destination to New Mexico 00:30:00 Travel Temptations in Amsterdam 00:30:00 Travel Temptations in Iowa 00:30:00 Travel temptations on a Nile River Cruise Liner 00:15:00 Travel temptations through Nevada 00:30:00 Travel Temptations in Antigua 00:30:00 Travel Temptations in California 00:30:00 Travel Temptations in Canada 00:30:00 Travel Temptations in Chicago 00:30:00 Travel temptations in Colorado 00:30:00 Travel temptations in Hawaii 00:30:00 Travel temptations in Kentucky 00:30:00 Travel temptations in Montana 00:30:00 Travel temptations in New York 00:30:00 Travel Temptations in North Carolina 00:30:00 Travel Temptations in South Carolina 00:30:00 Travel Temptations in Oregon 00:30:00 Travel Temptations in Rome 00:30:00 Travel Temptations in South Dakota 00:30:00 Travel Temptations in the Bahamas 01:00:00 Travel Temptations in the Caribbean 00:30:00 Travel Temptations in the UK 00:30:00 Travel Temptations in Washington DC 00:30:00 Wisconsin Travel Temptations 00:30:00 Conclusion to Diploma in Travel & Tourism 00:15:00 Mock Exam Mock Exam- Diploma in Travel, Tourism and Hospitality Management 00:30:00 Final Exam Final Exam- Diploma in Travel, Tourism and Hospitality Management 00:30:00

Diploma In HR and Payroll Management Description: HR management and Payroll are big parts of all businesses. They are mainly responsible for handling employees and their wages respectively. Often times companies will merge both these jobs into one as a way to save money and that is where this Diploma in HR and Payroll Management course could prove to be a stand out addition to your resume. This diploma-level course is divided into three sections each focusing on HR & leadership, Human Resource Management and Managing Payroll respectively. In the first chapter you will learn of bigger concepts such as leadership and building up your team management skills and how to think outside the box, along with other HR-related topics. The next chapter focuses solely on HR managementas you get to explore recruitment, interviewing, health & safety and so much more. Finally, in the payroll management section, you look into principles of payroll systems, ways to improve payroll effectiveness and efficiency, personnel filing and other similar topics. The course is well structured as it is divided into three sections and if you chose to get this course now it would help you stand out from your competition when you are job hunting. Who is the Diploma in HR and Payroll Management course for? People who want to work in human resources People looking to be successful in interviews by learning how interviewers think Professionals wanting to improve their skills in Payroll management Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam, you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hardcopy at the cost of £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognized accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: The Diploma In HR and Payroll Management course is a useful qualification to possess and would be beneficial for any professions or career from any industry you are in such as: Payroll Administrator HR Manager Recruitment Consultant Manager Team Leader Diploma in HR, Bookkeeping and Payroll Management - Updated Version HR Introduction to Human Resources 00:20:00 Employee Recruitment and Selection Procedure 00:35:00 Employee Training and Development Process 00:24:00 Performance Appraisal Management 00:22:00 Employee Relations 00:19:00 Motivation and Counselling 00:22:00 Ensuring Health and Safety at the Workplace 00:19:00 Employee Termination 00:18:00 Employer Records and Statistics 00:17:00 Essential UK Employment Law 00:30:00 Introduction to Payroll Management Introduction to Payroll Management 00:10:00 An Overview of Payroll 00:17:00 The UK Payroll System Running the payroll - Part 1 00:14:00 Running the payroll - Part 2 00:18:00 Manual payroll 00:13:00 Benefits in kind 00:09:00 Computerised systems 00:11:00 Total Photo scenario explained 00:01:00 Brightpay Brightpay conclude 00:03:00 Find software per HMRC Brightpay 00:03:00 Add a new employee 00:14:00 Add 2 more employees 00:10:00 Payroll Settings 00:15:00 Monthly schedule - 1 Sara 00:14:00 Monthly schedule - Lana 00:14:00 Monthly schedule - James 00:08:00 Directors NI 00:02:00 Reports 00:02:00 Paying HMRC 00:05:00 Paying Pensions 00:04:00 RTI Submission 00:02:00 Coding Notices 00:01:00 Journal entries 00:07:00 Schedule 00:03:00 AEO 00:06:00 Payroll run for Jan & Feb 2018 00:13:00 Leavers - p45 00:03:00 End of Year p60 00:02:00 Installing Brightpay 00:13:00 Paye, Tax, NI PAYE TAX 00:13:00 NI 00:11:00 Pensions 00:06:00 Online calculators 00:07:00 Payslips 00:03:00 Journal entries 00:07:00 Conclusion and Next Steps Conclusion and Next Steps 00:07:00 Diploma in HR, Bookkeeping and Payroll Management - Old Version HR & Leadership Leader and HR Management 00:30:00 Commitment and HR Management 01:00:00 Team Management 00:30:00 Build A Mastermind Group 02:00:00 People Recognition in HR Management 00:30:00 Performance, Goals and Management 00:30:00 Think Outside The Box 00:30:00 Be Passionate about Your Work 00:30:00 The Importance Of A Good Team Leader 00:30:00 Human Resource Management Module One - Getting Started 00:30:00 Module Two - Human Resources Today 01:00:00 Module Three - Recruiting and Interviewing 01:00:00 Module Four - Retention and Orientation 01:00:00 Module Five - Following Up With New Employees 01:00:00 Module Six - Workplace Health & Safety 01:00:00 Module Seven - Workplace Bullying, Harassment, and Violence 01:00:00 Module Eight - Workplace Wellness 01:00:00 Module Nine - Providing Feedback to Employees 01:00:00 Module Ten - Disciplining Employees 01:00:00 Module Eleven - Terminating Employees 01:00:00 Module Twelve - Wrapping Up 00:30:00 Managing Payroll What Is Payroll? 00:30:00 Principles Of Payroll Systems 01:00:00 Confidentiality And Security Of Information 00:30:00 Effective Payroll Processing 01:00:00 Increasing Payroll Efficiency 01:00:00 Risk Management in Payroll 00:30:00 Time Management 00:30:00 Personnel Filing 00:30:00 When Workers Leave Employment 01:00:00 Hiring Employees 00:30:00 Paye and Payroll for Employers 01:00:00 Tell HMRC about a New Employee 01:00:00 Net And Gross Pay 00:30:00 Statutory Sick Pay 00:30:00 Minimum Wage for Different types of Work 01:00:00 Refer A Friend Refer A Friend 00:00:00 Mock Exam Mock Exam- Diploma in HR and Payroll Management 00:30:00 Final Exam Final Exam- Diploma in HR and Payroll Management 00:30:00 Order Your Certificates and Transcripts Order Your Certificates and Transcripts 00:00:00

Revit One to One Basic to Advance Weekends Online or Face to Face

By Real Animation Works

Revit face to face training customised and bespoke. Online or Face to Face

Ethical Hacking and CompTIA PenTest+ Exam Prep (PT0-002)

By Packt

The course focuses on the five domains that should be known for the CompTIA PenTest+ PT0-002 exam. Learn to successfully plan and scope a pen test engagement with a client, find vulnerabilities, exploit them to get into a network, then report on those findings to the client with the help of this comprehensive course.

Embark on a transformative journey into the realm of AutoCAD Plugin Development using VB.NET and Windows Forms with our meticulously crafted course. From the intricacies of Windows Form and Controls to the hands-on development of diverse projects like DrawRectangle, Automate Update Layer, and Multiple Object Extractor, this course promises to be a dynamic exploration of VB.NET's potential in the AutoCAD ecosystem. Delve into the heart of coding as you master the creation of utility classes, design intuitive user interfaces, and seamlessly integrate controls such as ComboBox, TextBox, RadioButton, and Checkbox. Elevate your programming prowess through real-world applications, ensuring you not only understand the theoretical foundations but also acquire the practical skills needed to thrive in the world of AutoCAD Plugin Development. Unlock the mysteries of AutoCAD Plugin Development as you navigate through engaging modules, honing your skills with each meticulously crafted project. By the end, you'll emerge not just as a student but as a proficient developer ready to create powerful plugins that enhance AutoCAD functionalities. Learning Outcomes Gain a comprehensive understanding of Windows Form and Controls, mastering their implementation in AutoCAD Plugin Development. Develop practical expertise in coding essential controls like ComboBox, TextBox, RadioButton, and Checkbox for seamless integration into your projects. Acquire the skills to design and execute diverse projects, from DrawRectangle to Multiple Object Extractor, elevating your proficiency in VB.NET. Learn the art of creating utility classes, a fundamental aspect of building robust and scalable AutoCAD plugins. Explore automation in AutoCAD through projects like Automate Update Layer and Multiple Plot DWG to PDF, enhancing your capabilities in streamlining tasks. Why choose this AutoCAD Plugin Development Using VB.NET and Windows Forms course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments are designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the AutoCAD Plugin Development Using VB.NET and Windows Forms Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Who is this AutoCAD Plugin Development Using VB.NET and Windows Forms course for? Aspiring developers eager to specialize in AutoCAD Plugin Development. Professionals seeking to expand their skill set in VB.NET and Windows Forms for application in the AutoCAD environment. Students pursuing a career in computer programming with a keen interest in CAD software development. Architects and engineers looking to customize and enhance AutoCAD functionalities for their specific needs. Individuals interested in exploring the intersection of coding and design within the AutoCAD ecosystem. Career path CAD Plugin Developer: £35,000 - £45,000 Automation Engineer in CAD: £40,000 - £50,000 VB.NET Developer: £30,000 - £40,000 Software Integration Specialist: £45,000 - £55,000 AutoCAD Customization Consultant: £50,000 - £60,000 Prerequisites This AutoCAD Plugin Development Using VB.NET and Windows Forms does not require you to have any prior qualifications or experience. You can just enrol and start learning.This AutoCAD Plugin Development Using VB.NET and Windows Forms was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Course Outline Module 01: Landing Page 00:02:00 Module 02: Course Outline 00:03:00 Introduction Module 01: Introduction 00:05:00 Module 02: Who is this course for? 00:04:00 Module 03: Tools Needed for this Course 00:01:00 What Will You Learn From This Course? Module 01: What will you learn from this Course - Overview 00:06:00 Windows Form And Controls Module 01: Windows Form and Controls - Overview 00:04:00 Module 02: ControlsDemo Project - Overview 00:03:00 Module 03: ControlsDemo Project - Creating the Project 00:04:00 Module 04: Controls Demo Project - Designing the Form 00:19:00 Module 05: ControlsDemo Project - Creating the Utility Class 00:10:00 Module 06: ControlsDemo Project - Coding the Combobox Control 00:15:00 Module 07: ControlsDemo Project - Coding the Textbox Control 00:10:00 Module 08: ControlsDemo Project - Coding the Radiobutton Control 00:08:00 Module 09: ControlsDemo Project - Coding the Checkbox Control 00:17:00 Developing Projects Module 01: Draw Rectangle Project - Overview 00:03:00 Module 02: Creating the DrawRectangle Project 00:04:00 Module 03: DrawRectangle Project - Creating the Utility Class 00:20:00 Module 04: DrawRectangle Project - Designing the Form 00:15:00 Module 05: DrawRectangle Project - Coding the User Interface Part 1 00:24:00 Module 06: DrawRectangle Project - Coding the User Interface Part 2 00:18:00 Module 07: DrawRectangle Project - Running the Program 00:06:00 Module 08: Automate Update Layer Project - Overview 00:02:00 Module 09: Creating the AutomateUpdateLayer Project 00:03:00 Module 10: Automate Update Layer Project - Creating the Utility Class 00:17:00 Module 11: AutomateUpdateLayer Project - Designing the User Interface 00:07:00 Module 12: AutomateUpdateLayer Project - Coding the Form 00:18:00 Module 13: AutomateUpdateLayer Project - Running the Program 00:07:00 Module 14: Automatic Block Extractor Project - Overview 00:03:00 Module 15: AutomaticBlockExtractor Project - Creating the Project 00:03:00 Module 16: AutomaticBlockExtractor Project - Creating the User Interface 00:09:00 Module 17: AutomaticBlockExtractor Project - Coding the Form 00:27:00 Module 18: AutomaticBlockExtractor Project - Creating the Utility Class 00:27:00 Module 19: AutomaticBlockExtractor Project - Running the Program 00:10:00 Module 20: AutomateUpdateTextStyles Project - Overview 00:03:00 Module 21: AutomateUpdateTextStyle Project - Creating the Project 00:02:00 Module 22: AutomateUpdateTextStyle Project - Creating the User Interface 00:09:00 Module 23: AutomateUpdateTextStyle Project - Coding the Form 00:20:00 Module 24: AutomateUpdateTextStyle Project - Coding the Utility Class 00:16:00 Module 25: AutomateUpdateTextStyle Project - Running the Program 00:08:00 Module 26: Multiple Plot DWG to PDF Project - Overview 00:03:00 Module 27: MultiplePlotDWGtoPDF Project - Creating the Project 00:04:00 Module 28: MultiplePlotDWGtoPDF Project - Creating the User Interface 00:09:00 Module 29: MultiplePlotDWGtoPDF Project - Coding the Form 00:20:00 Module 30: MultiplePlotDWGtoPDF Project - Creating the Utility Class 00:30:00 Module 31: MultiplePlotDWGtoPDF Project - Running the Program 00:13:00 Module 32: Multiple Object Extractor Project - Overview 00:03:00 Module 33: MultipleObjectExtractor Project - Creating the Project 00:02:00 Module 34: MultipleObjectExtractor Project - Creating the User Interface 00:15:00 Module 35: MultipleObjectExtractor Project - Coding the Form Load Event 00:05:00 Module 36: MultipleObjectExtractor Project - Coding the Browse Buttons 00:10:00 Module 37: MultipleObjectExtractor Project - Coding the Extract Button 00:20:00 Module 38: MultipleObjectExtractor Project - Coding the ProcessDrawing Method 00:09:00 Module 39: MultipleObjectExtractor Project - Coding the ProcessObjectExtraction Method 00:11:00 Module 40: MultipleObjectExtractor Project - Coding the ExtractLine Method 00:09:00 Module 41: MultipleObjectExtractor Project - Coding the ExtractCircle Method 00:03:00 Module 42: MultipleObjectExtractor Project - Coding the ExtractPolyline Method 00:09:00 Module 43: MultipleObjectExtractor Project - Coding the ExtractMText Method 00:05:00 Module 44: MultipleObjectExtractor Project - Coding the ExtractBlock Method 00:05:00 Module 45: MultipleObjectExtractor Project - Running the Program 00:15:00

Gardening - Garden Design Level 5

By NextGen Learning

Course Overview The "Gardening - Garden Design Level 5" course offers an in-depth exploration of the principles, processes, and components that define successful garden design. Learners will develop a comprehensive understanding of the key elements of garden layout, plant selection, and the design process itself. The course is designed to equip learners with the necessary skills and knowledge to create aesthetically pleasing and functional gardens, regardless of scale. By the end of the course, learners will have the expertise to approach a wide range of garden design challenges, from residential to commercial projects. This course will provide a solid foundation in garden design theory, while also fostering the ability to make informed decisions about materials, planting, and sustainable design practices. Course Description In this course, learners will explore a range of topics related to garden design, beginning with an introduction to the role of the garden designer and the key principles that underpin successful designs. The course covers essential topics, such as the design process, selecting suitable plants, and designing a rain garden for water management. Learners will also gain insight into the tools and machinery required for effective garden design, as well as the importance of maintenance and the associated costs. Throughout the course, learners will be encouraged to develop their design thinking, as they will gain the ability to plan, conceptualise, and implement garden designs suited to a variety of client needs. By the end of the course, learners will have acquired both theoretical knowledge and practical skills essential for a career in garden design. Course Modules Module 01: Introduction to Garden Design Module 02: The Role of the Garden Designer Module 03: The Basic Principles of Garden Design Module 04: Components of Garden Design Module 05: Garden Design Process Module 06: Designing a Rain Garden Module 07: Essential Tools & Machinery Module 08: Plant Selection and Material Guide Module 09: Garden Maintenance Module 10: Costing and Estimation (See full curriculum) Who is this course for? Individuals seeking to pursue a career in garden design. Professionals aiming to enhance their skills in landscaping and horticulture. Beginners with an interest in garden design and landscaping. Anyone looking to start a garden design business or enhance their current practices. Career Path Garden Designer Landscape Architect Horticulturalist Landscape Consultant Garden Maintenance Specialist Sustainability Consultant for Green Spaces

48-Hour Knowledge Knockdown! Prices Reduced Like Never Before! This Diploma in Barista Training at QLS Level 6 course is endorsed by The Quality Licence Scheme and accredited by CPDQS (with 150 CPD points) to make your skill development & career progression more accessible than ever! Are you looking to improve your current abilities or make a career move? If yes, our unique Barista Training at QLS Level 6 course might help you get there! It is an expertly designed course which ensures you learn everything about the topic thoroughly. Expand your expertise with high-quality training from the Barista Training at QLS Level 6 course. Due to Barista Training at QLS Level 6's massive demand in the competitive market, you can use our comprehensive course as a weapon to strengthen your knowledge and boost your career development. Learn Barista Training at QLS Level 6 from industry professionals and quickly equip yourself with the specific knowledge and skills you need to excel in your chosen career. The Barista Training at QLS Level 6 course is broken down into several in-depth modules to provide you with the most convenient and rich learning experience possible. Upon successful completion of the Barista Training at QLS Level 6 course, an instant e-certificate will be exhibited in your profile that you can order as proof of your skills and knowledge. Add these amazing new skills to your resume and boost your employability by simply enrolling in this Barista Training at QLS Level 6 course. Learning Outcomes of Barista Training Demonstrate a comprehensive understanding of coffee types, origins, and brewing methods. Operate espresso machines and grinders with precision and efficiency. Master the techniques of espresso extraction and milk frothing. Create stunning latte art designs. Develop and manage a coffee shop menu. Understand the operational aspects of a behind-the-bar environment. This Barista Training at QLS Level 6 training can help you to accomplish your ambitions and prepare you for a meaningful career. So, join us today and gear up for excellence! Why Choose Us? Get a Free QLS endorsed Certificate upon completion of Barista Training Get a free student ID card with Barista Training program (£10 postal charge will be applicable for international delivery) The Barista Training is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Get Lifetime access to the Barista Training course materials The Barista Training comes with 24/7 tutor support Take a step toward a brighter future with our Barista Training! *** Course Curriculum of Barista Training at QLS Level 6 *** Here is the curriculum breakdown of the Barista Training at QLS Level 6 course: Section 01: Introduction to Coffee Section 02: Espresso Machine Section 03: Espresso Grinder Section 04: Introduction to Espresso & Espresso Mechanics Section 05: Let's Wrap Up Section 06: Milk Frothing Section 07: Latte Art Section 08: Menu Section 09: Behind The Bar Assessment Process You have to complete the assignment questions given at the end of the Barista Training course and score a minimum of 60% to pass each exam. Our expert trainers will assess your assignment and give you feedback after you submit the assignment. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you have completed all of the Diploma in Barista Training at QLS Level 6 exams. CPD 150 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Barista Training at QLS Level 6 course is perfect for highly motivated people who want to improve their technical skills and prepare for the career they want! This Barista course is also ideal for: Coffee Enthusiasts Aspiring Baristas Cafe Owners Food Service Professionals Requirements No prior background or expertise is required in this Barista Training. Career path The Barista Training at QLS Level 6 course will boost your CV and aims to help you get the job or even the long-awaited promotion of your dreams. Barista Cafe Manager Coffee Roaster Trainer Consultant Entrepreneur Certificates CPDQS Accredited Certificate Digital certificate - Included Diploma in Barista Training at QLS Level 6 Hard copy certificate - Included Show off Your New Skills with a Certificate of Completion After successfully completing the Diploma in Barista Training at QLS Level 6, you can order an original hardcopy certificate of achievement endorsed by the Quality Licence Scheme and also you can order CPDQS Accredited Certificate that is recognised all over the UK and also internationally. The certificates will be home-delivered, completely free of cost.

Search By Location

- Consultant Courses in London

- Consultant Courses in Birmingham

- Consultant Courses in Glasgow

- Consultant Courses in Liverpool

- Consultant Courses in Bristol

- Consultant Courses in Manchester

- Consultant Courses in Sheffield

- Consultant Courses in Leeds

- Consultant Courses in Edinburgh

- Consultant Courses in Leicester

- Consultant Courses in Coventry

- Consultant Courses in Bradford

- Consultant Courses in Cardiff

- Consultant Courses in Belfast

- Consultant Courses in Nottingham