- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2138 Courses

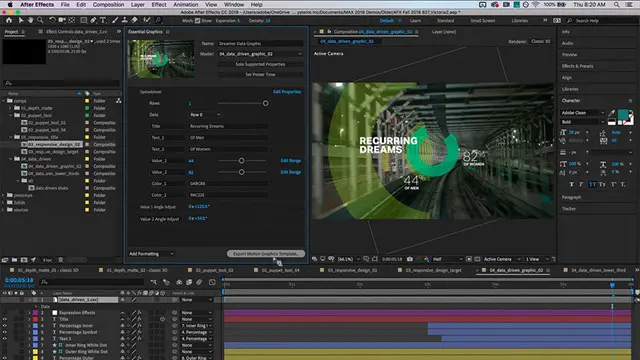

Adobe After Effects Basic to Advanced level training course 1-2-1

By Real Animation Works

AFTEREFFECTS face to face training customised and bespoke.

Register on the Data Engineering with Google BigQuery & Google Cloud today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get an e-certificate as proof of your course completion. The Data Engineering with Google BigQuery & Google Cloud is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Data Engineering with Google BigQuery & Google Cloud Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certification Upon successful completion of the course, you will be able to obtain your course completion e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Data Engineering with Google BigQuery & Google Cloud, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Unit 01: Introduction Module 01: Welcome to This Course 00:01:00 Module 02: How to Get Maximum Value from This Course 00:06:00 Module 03: Course Structure & Coverage 00:02:00 Module 04: Technology in This Course 00:02:00 Unit 02: Introducing Data Warehouse & BigQuery Module 01: Data Warehouse 00:07:00 Module 02: Start With BigQuery 00:05:00 Module 03: BigQuery Web User Interface 00:04:00 Unit 03: First Exploration Module 01: First Data 00:04:00 Module 02: Basic Exploration 00:16:00 Module 03: Functions 00:14:00 Module 04: Common Data Types 00:07:00 Module 05: Different Query 00:01:00 Module 06: Exploring Common Data Types 00:25:00 Module 07: Converting Data Types 00:07:00 Unit 04: Data Flow Basic Module 01: Data Quality 00:06:00 Module 02: Clean & Transform 00:13:00 Module 03: Store Data 00:06:00 Module 04: Upgrading From Sandbox Account 00:01:00 Module 05: Clean & Transform With Dataprep 00:25:00 Module 06: Scheduled Query 00:04:00 Module 07: Analyze Data 00:05:00 Module 08: Data Visualization 00:06:00 Unit 08: Intermediate Query Module 01: Essential BigQuery 00:15:00 Module 02: Load Data into BigQuery (Part 1) - The Basic 00:36:00 Module 03: Tip: Mock Data 00:01:00 Module 04: Load Data into BigQuery (Part 2) - Handling Errors 00:22:00 Module 05: Load Data into BigQuery (Part 3) - Efficient Load 00:14:00 Module 06: Load Data into BigQuery (Part 4) - From Your Data to BigQuery 00:23:00 Module 07: Load Data into BigQuery (Part 5) - In Microservice Architecture 00:20:00 Module 08: Tip: Message Broker Overview 00:08:00 Module 09: Load Data into BigQuery (Part 6) - Recurring Load 00:12:00 Unit 05: Diving into BigQuery Module 01: BigQuery View 00:06:00 Unit 06: Virtual Data using View Module 01: What We Will Learn 00:01:00 Module 02: Google Sheets & BigQuery 00:10:00 Module 03: Google Data Studio 00:13:00 Unit 07: Data Visualization Module 01: Using Join - Theory 00:04:00 Module 02: Using Join - Hands On 00:16:00 Module 03: Union & Intersect 00:06:00 Module 04: Basic Statistical Functions 00:05:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Calculus Basics

By The Teachers Training

Calculus Basics is yet another 'Teacher's Choice' course from Teachers Training for a complete understanding of the fundamental topics. You are also entitled to exclusive tutor support and a professional CPD-accredited certificate in addition to the special discounted price for a limited time. Just like all our courses, this Calculus Basics and its curriculum have also been designed by expert teachers so that teachers of tomorrow can learn from the best and equip themselves with all the necessary skills. Consisting of several modules, the course teaches you everything you need to succeed in this profession. The course can be studied part-time. You can become accredited within 16 hours studying at your own pace. Your qualification will be recognised and can be checked for validity on our dedicated website. Why Choose Teachers Training Some of our website features are: This is a dedicated website for teaching 24/7 tutor support Interactive Content Affordable price Courses accredited by the UK's top awarding bodies 100% online Flexible deadline Entry Requirements No formal entry requirements. You need to have: Passion for learning A good understanding of the English language Be motivated and hard-working Over the age of 16. Certification CPD Certification from The Teachers Training Successfully completing the MCQ exam of this course qualifies you for a CPD-accredited certificate from The Teachers Training. You will be eligible for both PDF copy and hard copy of the certificate to showcase your achievement however you wish. You can get your digital certificate (PDF) for £4.99 only Hard copy certificates are also available, and you can get one for only £10.99 You can get both PDF and Hard copy certificates for just £12.99! The certificate will add significant weight to your CV and will give you a competitive advantage when applying for jobs. Unit 01: Supplements 1.1 Number Sets 00:10:00 1.2 Graphing Tools 00:06:00 Unit 02: Functions 2.1 Introduction 00:01:00 2.2 Functions 00:15:00 2.3 Evaluating a Function 00:13:00 2.4 Domain 00:16:00 2.5 Range 00:05:00 2.6 One to One Function 00:09:00 2.7 Inverse Functions 00:10:00 2.8 Exponential Functions 00:05:00 2.9 The Natural Exponential Function 00:06:00 2.10 Logarithms 00:13:00 2.11 Natural Logarithms 00:07:00 2.12 Logarithm Laws 00:06:00 2.13 Trigonometric Ratios 00:15:00 2.14 Evaluating Trig Functions and Points 00:18:00 2.15 Inverse Trigonometric Functions 00:12:00 Unit 03 Limits 3.1 Introduction 00:01:00 3.2 What is a Limit? 00:17:00 3.3 Examples 00:15:00 3.4 One-Sided Limits 00:12:00 3.5 The Limit Laws 00:08:00 3.6 Examples 00:15:00 3.7 More Examples 00:15:00 3.8 The Squeeze (Sandwich) Theorem 00:09:00 3.9 Examples 00:10:00 3.10 Precise Definition of Limits 00:08:00 3.11 Examples 00:15:00 3.12 limits at Infinity 00:21:00 3.13 Examples 00:15:00 3.14 Asymptotes and Limits at Infinity 00:10:00 3.15 Infinite Limits 00:12:00 Unit 04: Continuity 4.1 Introduction 00:01:00 4.2 Continuity 00:12:00 4.3 Types of Discontinuity 00:12:00 4.4 Examples 00:17:00 4.5 Properties of Continuous Functions 00:11:00 4.6 Intermediate Value Theorem for Continuous Functions 00:06:00 Unit 05: Derivatives 5.1 Introduction 00:01:00 5.2 Average Rate of Change 00:09:00 5.3 Instantaneous Rate of Change 00:12:00 5.4 Derivative Definition 00:14:00 5.5 Examples 00:10:00 5.6 Non-Differentiability 00:06:00 5.7 Constant and Power Rule 00:09:00 5.8 Constant Multiple Rule 00:07:00 5.9 Sum and Difference Rule 00:07:00 5.10 Product Rule 00:14:00 5.11 Quotient Rule 00:08:00 5.12 Chain Rule 00:14:00 5.13 Examples 00:09:00 5.14 Derivative Symbols 00:04:00 5.15 Graph of Derivatives 00:10:00 5.16 Higher Order Derivatives 00:08:00 5.17 Equation of the Tangent Line 00:07:00 5.18 Derivative of Trig Functions 00:07:00 5.19 Examples 00:19:00 5.20 Derivative of Inverse Trig Functions 00:08:00 5.21 Examples 00:12:00 5.22 Implicit Differentiation 00:17:00 5.23 Derivative of Inverse Functions 00:13:00 5.24 Derivative of the Natural Exponential Function 00:11:00 5.25 Derivative of the Natural Logarithm Function 00:07:00 5.26 Derivative of Exponential Functions 00:06:00 5.27 Derivative of Logarithmic Functions 00:06:00 5.28 Logarithmic Differentiation 00:15:00 Unit 06: Application of Derivatives 6.1 Introduction 00:01:00 6.2 Related Rates 00:08:00 6.3 Examples 00:13:00 6.4 More Example 00:09:00 6.5 More Example 00:10:00 6.6 Optimisation 00:16:00 6.7 Example 00:11:00 6.8 More Example 00:07:00 6.9 Extreme Values of Functions 00:12:00 6.10 Critical Points 00:08:00 6.11 Examples (First Derivative Test) 00:16:00 6.12 More Examples 00:18:00 6.13 Concavity 00:15:00 6.14 Examples 00:13:00 6.15 Second Derivative Test 00:08:00 6.16 Graphing Functions 00:08:00 6.17 Examples 00:21:00 6.18 L' HoÌpital's Rule 00:12:00 6.19 Other Indeterminate Forms 00:15:00 6.20 Rolle's Theorem 00:09:00 6.21 The Mean Value Theorem 00:19:00 6.22Application of the Mean Value Theorem 00:04:00 Resources Resource - Fundamentals of Calculus 00:00:00

Experience the Rhythm of Reggaeton! Get ready to heat up your week with our dynamic Reggaeton classes, part of our exciting weekly dance program. Whether you're joining online or in-person, we've got the perfect vibe for you.

Complete English Course - Intermediate Level

By Course Cloud

Certification After successfully completing the course, you will be able to get the UK and internationally accepted certificate to share your achievement with potential employers or include it in your CV. The PDF Certificate + Transcript is available at £6.99 (Special Offer - 50% OFF). In addition, you can get a hard copy of your certificate for £12 (Shipping cost inside the UK is free, and outside the UK is £9.99).

https://www.facebook.com/virtualeducators.co.uk/ https://www.instagram.com/virtualeducators.co.uk https://www.linkedin.com/groups/8980893/ https://www.tiktok.com/@virtualeducatorsltd https://www.tiktok.com/@virtualeducatorsltd https://www.youtube.com/@virtualeducatorsltd6561

Developing on AWS

By Nexus Human

Duration 3 Days 18 CPD hours This course is intended for This course is intended for: Intermediate software developers Overview In this course, you will learn to: Set up the AWS SDK and developer credentials for Java, C#/.NET, Python, and JavaScript Interact with AWS services and develop solutions by using the AWS SDK Use AWS Identity and Access Management (IAM) for service authentication Use Amazon Simple Storage Service (Amazon S3) and Amazon DynamoDB as data stores Integrate applications and data by using AWS Lambda, Amazon API Gateway, Amazon Simple Queue Service (Amazon SQS), Amazon Simple Notification Service (Amazon SNS), and AWS Step Functions Use Amazon Cognito for user authentication Use Amazon ElastiCache to improve application scalability Leverage the CI/CD pipeline to deploy applications on AWS In this course, you learn how to use the AWS SDK to develop secure and scalable cloud applications using multiple AWS services such as Amazon DynamoDB, Amazon Simple Storage Service, and AWS Lambda. You explore how to interact with AWS using code and learn about key concepts, best practices, and troubleshooting tips. Module 0: Course Overview Agenda Introductions Student resources Module 1: Introduction to AWS Introduction to the AWS Cloud Cloud scenarios Infrastructure overview Introduction to AWS foundation services Module 2: Introduction to Developing on AWS Getting started with developing on AWS Introduction to developer tools Introduction to management tools Module 3: Introduction to AWS Identity and Access Management Shared responsibility model Introduction to IAM Use authentication and authorization Module 4: Introduction to the Lab Environment Introduction to the lab environment Lab 1: Getting started and working with IAM Module 5: Developing Storage Solutions with Amazon Simple Storage Service Overview of AWS storage options Amazon S3 key concepts Best practices Troubleshooting Scenario: Building a complete application Lab 2: Developing storage solutions with Amazon S3 Module 6: Developing Flexible NoSQL Solutions with Amazon DynamoDB Introduction to AWS database options Introduction to Amazon DynamoDB Developing with DynamoDB Best practices Troubleshooting Scenario: Building an end-to-end app Lab 3: Developing flexible NoSQL solutions with Amazon DynamoDB Module 7: Developing Event-Driven Solutions with AWS Lambda What is serverless computing? Introduction to AWS Lambda Key concepts How Lambda works Use cases Best practices Scenario: Build an end-to-end app Module 8: Developing Solutions with Amazon API Gateway Introduction to Amazon API Gateway Developing with API Gateway Best practices Introduction to AWS Serverless Application Model Scenario: Building an end-to-end app Lab 4: Developing event-driven solutions with AWS Lambda Module 9: Developing Solutions with AWS Step Functions Understanding the need for Step Functions Introduction to AWS Step Functions Use cases Module 10: Developing Solutions with Amazon Simple Queue Service and Amazon Simple Notification Service Why use a queueing service? Developing with Amazon Simple Queue Service Developing with Amazon Simple Notification Service Developing with Amazon MQ Lab 5: Developing messaging solutions with Amazon SQS and Amazon SNS Module 11: Caching Information with Amazon ElastiCache Caching overview Caching with Amazon ElastiCache Caching strategies Module 12: Developing Secure Applications Securing your applications Authenticating your applications to AWS Authenticating your customers Scenario: Building an end-to-end app Module 13: Deploying Applications Introduction to DevOps Introduction to deployment and testing strategies Deploying applications with AWS Elastic Beanstalk Scenario: Building an end-to-end app Lab 6: Building an end-to-end app Module 14: Course wrap-up Course overview AWS training courses Certifications Course feedback

AS24 IBM System Operator Workshop for IBM i

By Nexus Human

Duration 4 Days 24 CPD hours This course is intended for This course is intended for the person who has responsibility for daily system operations. Overview Send, display, and respond to messages Use the online help and reference materials Monitor and control job queues, active jobs, and output queues Create and change user profiles Use authorization lists and group profiles Start and stop Power Systems with IBM i Manage system devices, user display stations, and printers Save and restore objects and libraries Monitor job and history logs Diagnose a system problem Order, receive, and install PTFs This course enables a new system operator to develop basic to intermediate level skills needed for day-to-day operations of the Power System with IBM i Power Systems and IBM i concepts and overview . Reference material and support . Overview of 5250 emulation and help . Overview of System i Navigator . Overview of IBM Navigator for i . Messaging concepts . Messaging with 5250 emulation . Messaging with System i Navigator . Messaging with IBM Navigator for i . CL command concepts . CL commands with 5250 emulation . Concepts: Object, library, and the IFS . Object management with 5250 emulation . Object management with System i Navigator . Object management with IBM Navigator for i . Introduction to work management . Work management with 5250 emulation . Job control with 5250 emulation . Job control with System i Navigator . Job control with IBM Navigator for i . Print concepts . Print control with 5250 emulation . Print control with System i Navigator . Print control with IBM Navigator for i . Starting and stopping the system . System security concepts . System security with 5250 emulation . System security with System i Navigator . System security with IBM Navigator for i . System configuration overview . Configuration with 5250 emulation . Configuration with System i Navigator . Configuration with IBM Navigator for i . Save concepts . Save with 5250 emulation . Save with System i Navigator . Save with IBM Navigator for i . Restore concepts and overview . Problem determination with 5250 emulation . Problem determination with System i Navigator . Overview of the PTF process . PTFs with 5250 Emulation . Class summary . Additional course details: Nexus Humans AS24 IBM System Operator Workshop for IBM i training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the AS24 IBM System Operator Workshop for IBM i course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

Search By Location

- Intermediate Courses in London

- Intermediate Courses in Birmingham

- Intermediate Courses in Glasgow

- Intermediate Courses in Liverpool

- Intermediate Courses in Bristol

- Intermediate Courses in Manchester

- Intermediate Courses in Sheffield

- Intermediate Courses in Leeds

- Intermediate Courses in Edinburgh

- Intermediate Courses in Leicester

- Intermediate Courses in Coventry

- Intermediate Courses in Bradford

- Intermediate Courses in Cardiff

- Intermediate Courses in Belfast

- Intermediate Courses in Nottingham