- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Just Pass

By Just Pass

Just Pass School of Motoring, with a premier driving instructor in Birmingham, is committed to excellence in driver education. Our certified instructors provide personalised, comprehensive lessons tailored to fit each student's unique learning style and pace. With a focus on safety, confidence, and skill-building, we equip learners with the knowledge and practice needed to navigate the roads adeptly. Whether you're a beginner or looking to polish your driving abilities, Just Pass offers a supportive, encouraging environment to ensure you succeed. Choose Just Pass School of Motoring, your expert driving instructor in Birmingham, for a journey towards driving mastery. Phone No. :- 0800 073 0789 Email Id :- admin@justpass.co.uk

This foundational course will help all managers better understand what a procurement function does, including the processes, tools and techniques it employs to reach its goals and how it measures its business performance. PARTICIPANTS WILL LEARN HOW TO: Explain the contribution of procurement to the overall business objectives. Explain the added value that can be obtained by a business when it manages its procurement activities efficiently and effectively. Understand the complex activity of procurement and the challenges it presents for risk management. Develop good quality procurement practices that will manage the expectations of all stakeholders Identify methods by which a procurement function can be measured and performance monitored. Perform contract management activities. Understand ways in which improvements might be identified and implemented. COURSE TOPICS INCLUDE: Procurement and business objectives Stakeholder Management Commercial Specifications Whole Life Costing Targeted procurement Procurement planning Supplier Appraisal and selection RFQ & ITT & Evaluation Contract Management

Service Level Agreements (SLAs) are extensively utilised to define the scope of work and key responsibilities between a customer and a service provider. It is fundamental that all relevant personnel are familiar with the defining characteristics of SLAs and how the design and implementation of these contracts can impact operational efficiency and brand reputation. PARTICIPANTS WILL LEARN HOW TO: Understand why SLAs are so important for good business management Apply a process to develop effective SLAs that define service level expectations and drive desired behaviours Identify methods by which the SLA can be measured and performance monitored Have an understanding of KPI’s and the relevance of critical success factors COURSE TOPICS INCLUDE: Procurement cycle, process structure and tendering Best practice contract management and the 3 C’s Supplier performance measurement and KPIs SLA use, benefits and application The SLA development process The monitoring and control of SLAs

The core principles gained from this course will help delegates have a better understanding of how to manage the relationships between sales and marketing stakeholders on the demand side and the manufacturing and other operational stakeholders on the supply side. PARTICIPANTS WILL LEARN HOW TO: • Take a different perspective on traditional data such as sales history and forecasts, as well as time-phased inventory projections and production capacity. • Recognise how their forecasts impact manufacturing schedules and inventory levels. • Assess whether they are producing enough products to meet sales demand. • Recognise how production is tied to finance and see the financial impact of production decisions, so appropriate adjustments may be then undertaken. COURSE TOPICS INCLUDE: What is S&OP? – Introduction – Definition and benefits S&OP processes – What information is required? – The stages of the S&OP process (including inputs & outputs) The integration of S&OP into a business – Critical success factors for an effective implementation – Typical roles and responsibility matrix

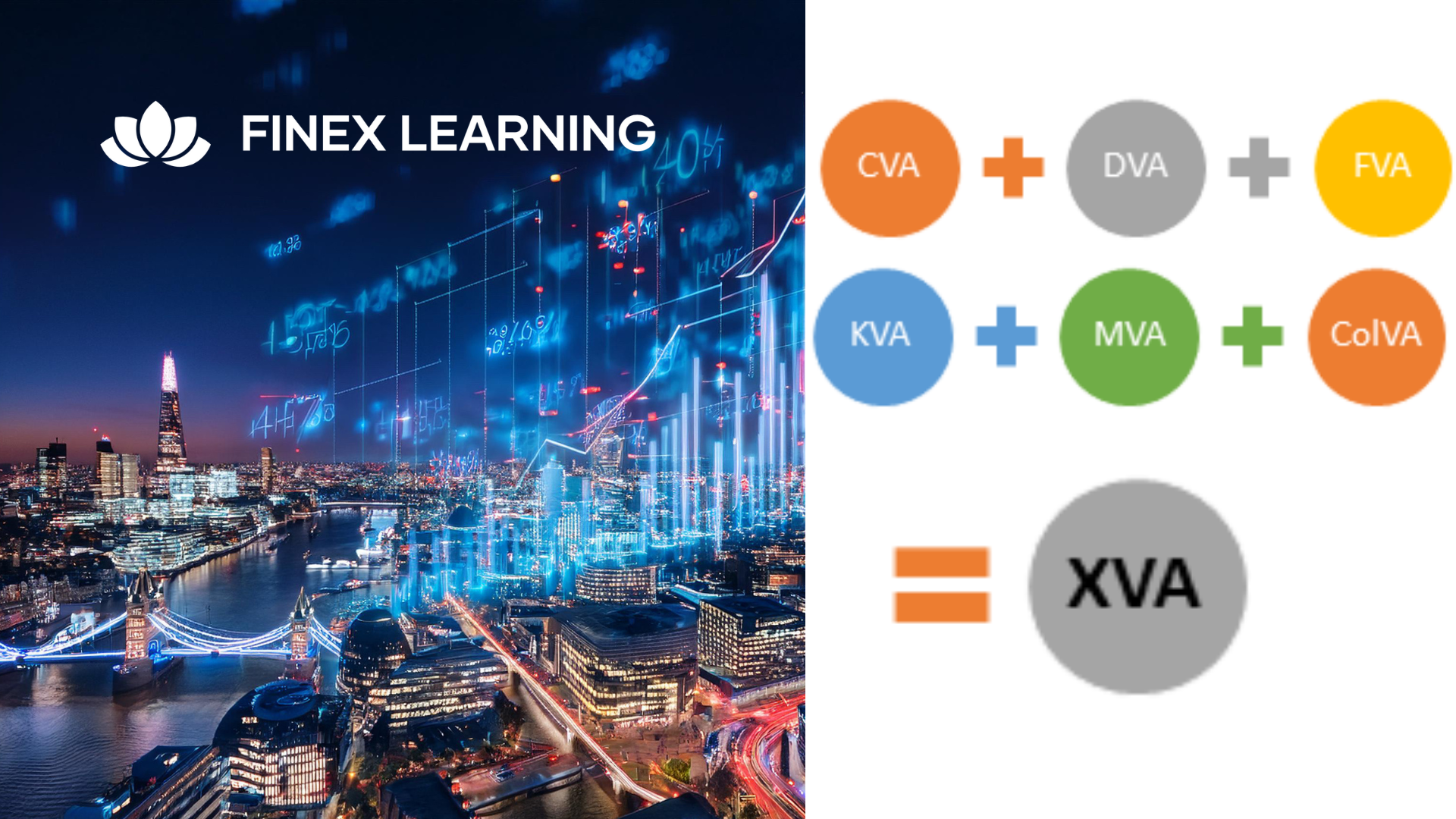

Overview This 1 day course focus on comprehensive review of the current state of the art in quantifying and pricing counterparty credit risk. Learn how to calculate each xVA through real-world, practical examples Understand essential metrics such as Expected Exposure (EE), Potential Future Exposure (PFE), and Expected Positive Exposure (EPE) Explore the ISDA Master Agreement, Credit Support Annexes (CSAs), and collateral management. Gain insights into hedging strategies for CVA. Gain a comprehensive understanding of other valuation adjustments such as Funding Valuation Adjustment (FVA), Capital Valuation Adjustment (KVA), and Margin Valuation Adjustment (MVA). Who the course is for Derivatives traders, structurers and salespeople xVA desks Treasury Regulatory capital and reporting Risk managers (market and credit) IT, product control and legal Quantitative researchers Portfolio managers Operations / Collateral management Consultants, software providers and other third parties Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This is a 2 day applied course on XVA for anyone interested in going beyond merely a conceptual understanding of XVA and wants practical examples of Monte Carlo simulation of market risk factors to create exposure distributions and profiles for derivatives used for XVA pricing Learn how to do Monte Carlo simulation of key market risk factors across major asset classes to create exposure distributions and profiles (with and without collateral) for derivatives used for XVA pricing. Learn how to calculate each XVA. Learn sensitivities of each XVA and how XVA desks manage these. Learn regulatory capital treatment of counterparty credit risk (both for CCR and CVA volatility) and how to stress test this within ICAAP or system-wide external, supervisor-led capital stress test. Who the course is for Anyone involved in OTC derivatives XVA traders XVA quants Derivatives traders and salespeople Risk management Treasury staff Internal audit and finance Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This is a 2 day course on understanding credit markets converting credit derivatives, from plain vanilla credit default swaps through to structured credit derivatives involving correlation products such as nth to default baskets, index tranches, synthetic collateralized debt obligations and more. Gain insights into the corporate credit market dynamics, including the role of ratings agencies and the ratings process. Delve into the credit triangle, relating credit spreads to default probability (PD), exposure (EAD), and expected recovery (LGD). Learn about CDS indices (iTRAXX and CDX), their mechanics, sub-indices, tranching, correlation, and the motivation for tranched products. The course also includes counterparty risk in derivatives market where you learn how to managed and price Counterparty Credit Risk using real-world, practical examples Understand key definitions of exposure, including Mark-to-Market (MTM), Expected Exposure (EE), Expected Positive Exposure (EPE), Potential Future Exposure (PFE), Exposure at Default (EAD), and Expected Loss (EL) Explore the role of collateral and netting in managing counterparty risk, including the key features and mechanics of the Credit Support Annex (CSA) Briefly touch upon other XVA adjustments, including Margin Valuation Adjustment (MVA), Capital Valuation Adjustment (KVA), and Collateral Valuation Adjustment (CollVA). Who the course is for Credit traders and salespeople Structurers Asset managers ALM and treasury (Banks and Insurance Companies) Loan portfolio managers Product control, finance and internal audit Risk managers Risk controllers xVA desk IT Regulatory capital and reporting Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

The Best NDA Coaching in Dehradun at Dronacharya Academy

By Dronacharya Academy

Our team of highly skilled and knowledgeable faculty members at Dronacharya Academy takes great pleasure in their commitment to offering the best NDA coaching in Dehradun.

About Honeyoung Stationery

By Meroy

HoneyoungHoneyoung Stationery is a distinguished stationery supplier from China with 25 years of industry expertise. We specialize in tailored solutions for B2B clients, including renowned stationery brands and large retailers. Our commitment to quality and innovation sets us apart as a trusted partner. With a diverse range of customizable products, we export excellence worldwide. Choose Honeyoung Stationery for a partnership built on 25 years of reliability and creative solutions. Let’s create success together – Inquire now for a win-win collaboration!

GENERAL ENGLISH COURSE

By Castleforbes College English School Dublin

General English is the most popular course at Castleforbes College. Structured to provide the knowledge to deal with everyday situations. It is based around fun and dynamic lessons that will help you become fluent. Our methodology is founded on practice, conversation and entertainment. Our General English course will also teach you the idioms and colloquial terms used in everyday Irish culture, improving your communication skills in Ireland. This process will be done using a variety of textbooks, audio and video recordings, and group activities amongst students. Every student’s programme is overseen by our Director of Studies and teaching staff, from the first day to the last, supporting, answering questions and evaluating their progress as they follow their learning path. The school receives students from all over the world, as General English courses also allow students from outside the EU to learn English in Ireland with a Work-Study Visa.

Search By Location

- Sup Courses in London

- Sup Courses in Birmingham

- Sup Courses in Glasgow

- Sup Courses in Liverpool

- Sup Courses in Bristol

- Sup Courses in Manchester

- Sup Courses in Sheffield

- Sup Courses in Leeds

- Sup Courses in Edinburgh

- Sup Courses in Leicester

- Sup Courses in Coventry

- Sup Courses in Bradford

- Sup Courses in Cardiff

- Sup Courses in Belfast

- Sup Courses in Nottingham