- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

19993 Step courses

Overview Land managers are required to manage land and natural resources for public or private projects. In this Land Management Training, you'll learn about improved land management technologies to manage land the best way. The Land Management Training covers a wide range of techniques for managing land resources. Training with us, you'll identify the steps involved in land use planning and understand the soil management principles. In addition, you'll discover the strategies to manage soil degradation processes and learn the methods for weed and irrigation management. Finally, you'll learn about the principles of land law in the UK. Course Preview Learning Outcomes Improve your knowledge in managing the use and development of land resources. Understand the concept of land use and land use planning Gain an excellent understanding of soil management Know how to manage and control land degradation Find a comprehensive introduction to land law Why Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Meticulously crafted engaging and informative tutorial videos and materials Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email What Skills Will You Learn from This Course? Land resources management Land use planning Soil management Who Should Take this Land Management Training? Whether you're an existing practitioner or an aspiring professional, this course is an ideal training opportunity. It will elevate your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Land Management Training is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Certificate of Achievement After completing this course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates & Transcripts can be obtained either in Hardcopy at £14.99 or in PDF format at £11.99. Career Pathâ Land Management Training provides essential skills that will make you more effective in your role. It would be beneficial for any related profession in the industry, such as: Land Manager Land Management Projects Officer Ecologist Surveyor Forester Module 01: Land Management: An Introduction Land Management An Introduction 00:26:00 Module 02: Land Use and Land Use Planning Land Use and Land Use Planning 00:33:00 Module 03: Soil Management Soil Management 00:35:00 Module 04: Land Degradation and Management Land Degradation and Management 00:26:00 Module 05: Weed Management Weed Management 00:36:00 Module 06: Watershed Management Watershed Management 00:21:00 Module 07: Irrigation Management Irrigation Management 00:29:00 Module 08: Land Tenure, Administration and Transection Land Tenure and Transection 00:41:00 Module 09: Land Registration and Acquisition Land Registration and Acquisition 00:36:00 Module 10: Land Law Land Law 00:39:00 Order Your Certificates and Transcripts Order Your Certificates and Transcripts 00:00:00

Overview of Telesales Executive Training Learn the golden rules to maintain strong relationships with customers and close deals over the phone by taking this Telesales Executive Training. This Telesales Executive Training will teach you the telesales strategies to boost your sales. The course will introduce you to the skills and responsibilities expected of a telesales executive. Then, it will take you through the best practices for lead generation and sales presentation techniques to close more deals. From the easy-to-follow modules, you'll also learn how to make the perfect telesales pitch for your services and make a high volume of outbound calls to prospective customers. Finally, you'll explore the steps to handle demanding clients over the phone. Course Preview Learning Outcomes Learn how to make calls to potential clients to generate sales. Understand how to deliver effective sales presentations Learn the telemarketing techniques to achieve your sales target Be able to maintain up-to-date and accurate records of customer interactions Learn good telephone etiquette to make a positive impression on customers Why Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Meticulously crafted engaging and informative tutorial videos and materials Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email Who Should Take this Telesales Executive Training? Whether you're an existing practitioner or an aspiring professional, this course is an ideal training opportunity. It will elevate your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Telesales Executive Training is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Certification After completing and passing the Telesales Executive Training successfully, you will be able to obtain a Recognised Certificate of Achievement. Learners can obtain the certificate in hard copy at £14.99 or PDF format at £11.99. Career Pathâ The Telesales Executive Training provides essential skills that will make you more effective in your role. It would be beneficial for any related profession in the industry, such as: Telemarketer Customer Service Advisor Telesales Agent Telesales Executive Telesales Representative Module 01: Introduction to Telesales Introduction to Telesales 00:13:00 Module 02: Prospecting and Lead Generation Prospecting and Lead Generation 00:15:00 Module 03: Sales Techniques and Strategies Sales Techniques and Strategies 00:18:00 Module 04: Call Preparation Call Preparation 00:08:00 Module 05: Call Response Call Response 00:11:00 Module 06: Staging the Call Staging the Call 00:11:00 Module 07: Dealing with Difficult Situations Dealing with Difficult Situations 00:11:00 Module 08: Closing the Call Closing the Call 00:09:00 Module 09: Telephone Etiquette Telephone Etiquette 00:23:00 Module 10: Sales Metrics and Performance Managemen Sales Metrics and Performance Managemen 00:14:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Overview Solid skills in interactive media design can be the turning point for your career in the interactive media industry. Grab the chance to secure this valuable skill set without stepping out of your house with our Interactive Media Design Course. Through this comprehensive course you will receive an in-depth understanding of interactive media design. The informative modules will educate you on the difference between UX and UI. along with that, you will be able to grasp a solid understanding of media tools and technologies and multimedia integration. By the end of this course, you will acquire the ability to design multiple platforms. So, if you are ready to take your skills to the next level enrol now! Course Preview Learning Outcomes Introduce yourself to the fundamentals of interactive media design Understand the differences between UX and UI Learn about interactive media tools and technologies Grasp the process of multimedia integration Develop the skills for designing multiple platforms Why Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Engaging tutorial videos, materials from the industry-leading experts Opportunity to study in a user-friendly, advanced online learning platform Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email. What Skills Will You Learn from This Course? UX design UI design Multimedia integration Who Should Take This Interactive Media Design Course? Whether you're an existing practitioner or an aspiring professional, this course is an ideal training opportunity. It will elevate your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Interactive Media Design Course is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Certificate of Achievement After completing this course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates & Transcripts can be obtained either in Hardcopy at £14.99 or in PDF format at £11.99. Career Pathâ This exclusive Interactive Media Design Course will equip you with effective skills and abilities and help you explore career paths such as Wed Designer Animator Digital Marketer Video Editor Module 01: Introduction to Interactive Media Design Introduction to Interactive Media Design 00:19:00 Module 02: Principles of Design Principles of Design 00:17:00 Module 03: User Experience (UX) and User Interface (UI) Design User Experience (UX) and User Interface (UI) Design 00:18:00 Module 04: Interactive Media Tools and Technologies Interactive Media Tools and Technologies 00:21:00 Module 05: Multimedia Integration Multimedia Integration 00:16:00 Module 06: Interactive Storytelling Interactive Storytelling 00:13:00 Module 07: Designing for Multiple Platforms Designing for Multiple Platforms 00:21:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Overview A bad debt can lead to poverty. Often, mortgages can get people into debt instead of getting into property. Here comes the need for mortgage advisors. They are dedicated to helping people protect their homes and families, stay prepared for the worst, and save money. This Mortgage Advice Course will teach you how to advise your clients on different mortgage products. Here, you'll get a comprehensive overview of the mortgage market to help your clients purchase properties. Again, the course will introduce you to different mortgage types, structures, policies, and regulations. You'll also learn about mortgage documentation and processes, mortgage protection options, mortgage advertising, and promotion. Finally, you'll learn the skills to build strong client relationships and succeed as a mortgage advisor. Course Preview Learning Outcomes Explore the fundamentals of mortgages Identify the steps of the mortgage process Explore the various laws and policies for mortgages Learn about mortgage life insurance and its advantages Understand the process of mortgage insurance application Improve your understanding of mortgage market analysis Why Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Meticulously crafted engaging and informative tutorial videos and materials Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email What Skills Will You Learn From This Course? Mortgage Management Mortgage Insurance Application Mortgage Market Analysis Who Should Take This Mortgage Advice Course? Whether you're an existing practitioner or an aspiring professional, this course is an ideal training opportunity. It will elevate your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Mortgage Advice Course is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Certificate of Achievement After completing this course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates & Transcripts can be obtained either in Hardcopy at £14.99 or in PDF format at £11.99. Career Pathâ Mortgage Advice Course provides essential skills that will make you more effective in your role. It would be beneficial for any related profession in the industry, such as: Mortgage Advisor Broker Financial Advisor Banking Advisor Underwriter Processor Module 1: Introduction to Mortgage Advice Introduction to Mortgage Advice 00:17:00 Module 2: Mortgage Types and Structures Mortgage Types and Structures 00:17:00 Module 3: Mortgage Market Analysis Mortgage Market Analysis 00:19:00 Module 4: Mortgage Advice and Recommendations Mortgage Advice and Recommendations 00:16:00 Module 5: Mortgage Documentation and Processes Mortgage Documentation and Processes 00:14:00 Module 6: Mortgage Protection and Insurance Mortgage Protection and Insurance 00:18:00 Module 7: Mortgage Regulations and Compliance Mortgage Regulations and Compliance 00:18:00 Module 8: Professional Skills and Client Management Professional Skills and Client Management 00:16:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

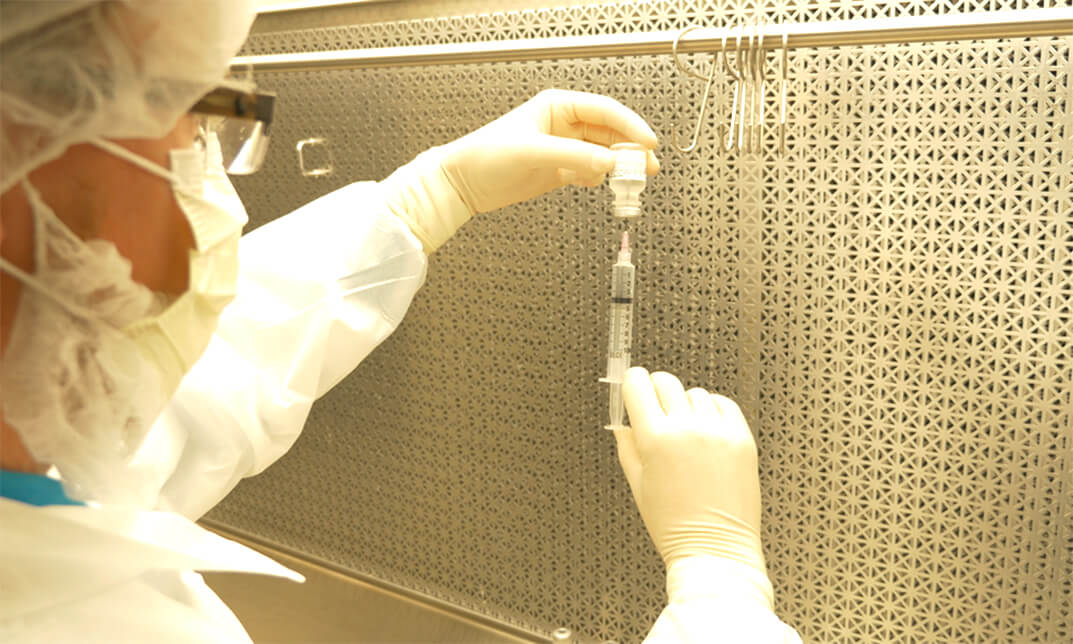

[vc_row][vc_column][vc_column_text] Description: Want to become a Sterile Compounding Pharmacy Technician and learn how to work with sterile products? You have come to the right place. Throughout this Sterile Compounding Techniques course, you will be introduced to the basic concept of pharmaceutical compounding in an easy to grasp manner. You will develop your understanding of sterile and non-sterile compounding and will be able to differentiate sterile from non-sterile compounding, including USP 797 versus USP 795. Over multiple interactive and engaging modules, you will develop your understanding of different techniques for sterile pharmaceutical compounding. On completion, you will be fully equipped with the practical skills to take the Certified Compounded Sterile Preparation Technician⢠(CSPTâ¢) Exam by the Pharmacy Technician Certification Board (PTCB). This sterile compounding course is ideal for beginners and aspiring pharmacy technicians. Take steps to become a trained pharmacist and fast-track your career with this certificate program. Assessment: To successfully complete the course you must submit two assignment questions. The answers should be in the form of written work in pdf or word. Students can write the answers at their own convenience time. Each answer needs to be around 200 words (1 Page). After submission of the assignment, the tutor will check and assess the work. Certification: After completing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? Sterile Compounding Techniques is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Sterile Compounding Techniques is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. [/vc_column_text][/vc_column][/vc_row] Introduction Introduction 00:01:00 Universal Precautions Hand Washing 00:01:00 Complete Garbing 00:03:00 The Laminar Air Flow Hood (LAF) 3 lectures Cleaning the Laminar Flow Hood 00:02:00 Cleaning a Horizontal Flow Hood 00:02:00 Cleaning a Vertical Flow Hood 00:01:00 Sterile Compounding Pharmaceuticals Demonstrations Sterile Pharmaceutical Products Preparation Demo 1 00:24:00 Sterile Pharmaceutical Products Preparation Demo 2 00:13:00 Compounding Pharmacy Math Solute, Solvent, and Solution 00:15:00 Percentage ww, vv, wv 00:06:00 Alligation and Dilution 00:04:00 Alligation and Dilution Practice Problems 00:17:00 Therapeutic Dose versus Lethal Dose 00:02:00 Dosage Calculation 00:08:00 More Dosage Calculation Practice Problems 00:07:00 BONUS DO's and DONT's in Sterile Compounding 00:30:00 REVIEW OF THE STERILE COMPOUNDING PROCESS Part 1- Garbing 00:03:00 Part 2- Laminar Air Flow Hood 1 00:01:00 Part 3- Laminar Air Flow Hood 2 00:04:00 Part 4- Reconstitution and Compounding 00:08:00 Part 5- Compounding Continued 00:17:00 Assessment Assignment - Sterile Compounding Techniques 00:00:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Take your most significant steps to help people break free from addiction. This Diploma in Addiction Therapy and Psychology course will enhance your knowledge of addiction therapy and psychology. In this Diploma in Addiction Therapy and Psychology course, you'll discover the psychological approaches to addiction treatment. The course will thoroughly introduce you to the psychological models and theories of addiction. On top of that, you'll gain valuable insights into counselling and therapy to help addicted individuals. The course will also teach you about alcohol and drug issues in the workplace. Finally, you'll explore the must-have skills to become an addiction counsellor. Learning Outcomes Familiarise yourself with the addiction theories Learn about the psychological model of addiction Enrich your knowledge of addiction treatments Determine the purpose of alcohol and drug education Understand the role of a counsellor in addiction recovery Who is this Course for? Anyone interested in learning the fundamentals of addiction treatment and psychology can take this Diploma in Addiction Therapy and Psychology Course. The in-demand skills and knowledge gained from this training will help learners with tremendous career opportunities in the relevant field. Entry Requirement This course is available to all learners of all academic backgrounds. Learners should be aged 16 or over. Good understanding of the English language, numeracy, and ICT skills are required to take this course. Certification After you have successfully completed the course, you will obtain an Accredited Certificate of Achievement. And, you will also receive a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hardcopy for £39 or in PDF format at the cost of £24. The PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why Choose Us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos and materials from the industry-leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; United Kingdom & internationally recognised accredited qualification; Access to course content on mobile, tablet and desktop from anywhere, anytime; Substantial career advancement opportunities; 24/7 student support via email. Career Path The Diploma in Addiction Therapy and Psychology Course provides essential skills that will make you more effective in your role. It would be beneficial for any related profession in the industry, such as: Addiction Counsellor Nurse Health Counsellor About Promo Video FREE 00:02:00 Introduction: About instructor & the course 00:02:00 Theories of Addiction The Moral Model 00:06:00 The Psychological Model 00:07:00 The Medical / Disease Model 00:09:00 The Socio-Cultural Model 00:05:00 Addiction Treatments Pharmacotherapy 00:03:00 The Minnesota Model 00:04:00 Counselling and Therapy 00:07:00 Harm Reduction Model 00:05:00 Treatments in Practice 00:05:00 Addiction in Society Drug policies, Legislation and Decriminalisation 00:09:00 Community change, Outreach, Harm Reduction or Abstinence 00:06:00 Alcohol and Drug education 00:06:00 Alcohol- and drug related issues in the workplace 00:05:00 Addiction in Families Codependency, Children of alcoholic families, parenting styles, family factors 00:08:00 Relapse for families, 'letting go', dependent attitudes and dependent behaviours 00:07:00 Al-Anon 00:05:00 The Intervention Approach 00:05:00 Working with Addiction Why be a 'helper' 00:03:00 'Helper' qualities and attitudes 00:04:00 Counselling / 'helping' skills 00:04:00 Certification Order Your Certificate 00:00:00

Description: Do you love art? Want to know the techniques of Pencil art and sketch? Then enrol the Pencil Art and Sketching Diploma course and explore the techniques of pencil art and sketching. The course is divided into two parts - at first, you will learn about the techniques and skills of art and painting such as how to paint, types of brush, choose the right brush, etc. Then the course teaches you how to draw sketches. After finishing the course, it is hoped that you will be able to art using [pencil and able to do sketches. Who is the course for? Artists or painters who want home paintings as a business. People who have an interest in professional painting Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam, you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. PDF certificate's turnaround time is 24 hours and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognised accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. Pencil Drawing INTRODUCTION 01:00:00 BRIEF HISTORY OF PENCIL DRAWING 00:15:00 GETTING STARTED 01:00:00 LEARNING THE BASICS OF DRAWING AND SKETCHING 01:00:00 Basic Perspectives on Drawing 01:00:00 Basic Elements of Light, Shadows, and Shading 01:00:00 Different Shading Techniques 00:15:00 How to Add Tones and Values? 00:30:00 FINISHING TOUCHES 00:30:00 MIXED MEDIA APPLICATIONS 01:00:00 Drawing with Pencils in Oil Painting 01:00:00 CONCLUSION 00:15:00 Sketch Drawing Starting With Pencil Drawing and the Great Tips 00:30:00 A Good Drawing Artist and the Qualities 00:30:00 How to Become a Professional Drawing Artist 00:30:00 Drawing Artist 00:30:00 Different Techniques Used by Drawing Artist 00:30:00 Business Start Your Own Art Business 00:15:00 Steps to Creating a Successful Business from Your Art 01:00:00 How to Write an Artist Business Plan 00:30:00 Mock Exam Mock Exam- Pencil Art and Sketching Diploma 00:30:00 Final Exam Final Exam- Pencil Art and Sketching Diploma 00:30:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

This course presents the value of showcasing yourself as a complete package by using a resume as an introduction to an employer and backing it up with a portfolio presented at the interview. The job market continues to change, as should your job seeking options. In order to make the most of this course, it is better if participants have already applied to few jobs that they want or went through the basic job seeking application processes. This is very important in order to feel the whole process in steps. The job market has never been this dynamic before. This is truly an exciting yet a challenging time to be alive; more so for the thriving large number of talented millennial population. Learning Outcomes: Speak for yourself using descriptive language. Apply the essential elements of cover letters and resumes. Understand the need for pre-employment testing and what to expect in your target market. Design a personalized portfolio. Develop a plan that moves you to a new job within 60 days. Assessment: At the end of the course, you will be required to sit for an online MCQ test. Your test will be assessed automatically and immediately. You will instantly know whether you have been successful or not. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? Guide To Employment is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Guide To Employment is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. Module: 1 Who Are You? 00:30:00 Writing the Resume 01:00:00 Creating a Noticeable Package 00:30:00 Cover Letters 00:30:00 The Portfolio 00:30:00 Dealing with Awkward Points 00:30:00 Getting to a New Job in 60 Days 00:30:00 Goal Setting 00:15:00 Thank-You Notes 00:30:00 Module: 2 Change and Transitions 00:30:00 The Important Stuff 00:30:00 Skill and Ability 00:30:00 Vocation and Strategy 00:30:00 Resources 00:30:00 The Job Market 00:45:00 Invite Your Network 00:15:00 Ready, Set, Goal! 00:15:00 Thinking Unconventionally to Get What You Want 00:15:00 Module: 3 Understanding the Interview 00:30:00 Types of Questions 00:15:00 Getting Ready 00:30:00 Unwinding for the Interview 00:15:00 Common Problems and Solutions 00:30:00 Phase Two 00:30:00 Practice Makes Perfect 00:15:00 Sealing the Deal 00:30:00 Getting What You're Worth 00:15:00 Order Your Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

[vc_row][vc_column][vc_column_text] Description: Want to learn the secrets of the stock market? If you're considering becoming a stock market trader, take the steps to fast and smart cash with this stock market trading course and learn how to trade stocks online. This Diploma in Stock Market Course is designed to explore the online stock market and financial markets in detail. You will learn all about stocks and shares investments, and their variable differences. In this stock market masterclass, you will get an introduction to market trends, understand currency conversion and statistics, and explore the risks and rewards of trading. Every stock trader should be aware of the risks and in this course, you will learn the basics of risk management. You will also gain an understanding of when to invest and review different options in trading. Throughout this stock trading course, you will familiarise with the role of a professional trader and trading strategies, as well as common mistakes to avoid in stock trading. Other topics covered include Forex trading, buzz words and technical analysis. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hardcopy at a cost of £39 or in PDF format at a cost of £24. PDF certificate's turnaround time is 24 hours and for the hard copy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognized accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. [/vc_column_text][/vc_column][/vc_row] Stock Market Basics Introduction To Stocks Basics 00:30:00 About Share Basics 00:30:00 The Difference Between Stocks And Shares 00:30:00 Concept Of Fundamentals Of The Stock Market 00:30:00 How Exactly Do Stock Prices Get Determined? 00:30:00 Benefits Of Using Stocks And Shares 01:00:00 When To Get Out Of The Stock Market 00:30:00 Wrapping Up 00:15:00 Stock Market Statistics Understanding the stock market 01:00:00 Identifying trends 01:00:00 What is Forex? 01:00:00 Basics of currency conversion 01:00:00 Understanding Statistics 01:00:00 Forex Volatility And Market Expectation 01:00:00 Aspects Of The Trade 01:00:00 Risk Management 01:00:00 'Buzz' Words 01:00:00 Expert Trading Options 01:00:00 Other Trading Options 01:00:00 In Review 01:00:00 One Final Option 00:30:00 Refer A Friend Refer A Friend 00:00:00 Mock Exam Mock Exam- Diploma in Stock Market 00:30:00 Final Exam Final Exam- Diploma in Stock Market 00:30:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Overview of Strategies for Teaching Students with Learning Disabilities Course A little care and support in the classroom can help children with learning disabilities live healthy and prosperous lives. This course will explore the successful strategies for teaching children with learning difficulties in inclusive classrooms. Our Strategies for Teaching Students with Learning Disabilities Course will give you an overall understanding of the characteristics, types and effects of learning disabilities. Moving forward, you'll understand what IEP is and explore the several core steps in creating an effective IEP. Then, you'll discover the best practices for creating a supportive and inclusive classroom environment. The course also covers the teaching strategies for reading problems, math difficulties and writing expression. Finally, you'll understand how to teach social skills and promote positive behaviour in the classroom. Course Preview Learning Outcomes Find a comprehensive guide to teaching children with learning difficulties Identify the IEP goals for special education students Understand how to modify lessons for students with learning difficulties Learn how to help children learn and understand mathematics Explore the techniques to improve reading skills in children with learning disabilities Discover the strategies for a behaviour intervention plan Why Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Meticulously crafted engaging and informative tutorial videos and materials Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email Who Should Take this Strategies for Teaching Students with Learning Disabilities Course? Whether you're an existing practitioner or an aspiring professional, this course is an ideal training opportunity. It will elevate your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Strategies for Teaching Students with Learning Disabilities Course is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Certificate of Achievement After completing this course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates & Transcripts can be obtained either in Hardcopy at £14.99 or in PDF format at £11.99. Career Pathâ Strategies for Teaching Students with Learning Disabilities Course provides essential skills that will make you more effective in your role. It would be beneficial for any related profession in the industry, such as: Special Education Teacher Learning Support Assistant Behaviour Analyst School Counsellor Educational Consultant Special Education Coordinator Module 1: Introduction to Learning Disabilities Introduction to Learning Disabilities 00:15:00 Module 2: Types of Learning Disabilities Types of Learning Disabilities 00:21:00 Module 3: Understanding Individualised Education Plans (IEPs) Understanding Individualised Education Plans (IEPs) 00:15:00 Module 4: Classroom Adaptations for Students with Learning Disabilities Classroom Adaptations for Students with Learning Disabilities 00:18:00 Module 5: Teaching Strategies for Reading Difficulties Teaching Strategies for Reading Difficulties 00:17:00 Module 6: Teaching Strategies for Written Expression Teaching Strategies for Written Expression 00:15:00 Module 7: Teaching Strategies for Math Difficulties Teaching Strategies for Math Difficulties 00:19:00 Module 8: Behaviour Management and Social Skills for Students Behaviour Management and Social Skills for Students 00:15:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Search By Location

- Step Courses in London

- Step Courses in Birmingham

- Step Courses in Glasgow

- Step Courses in Liverpool

- Step Courses in Bristol

- Step Courses in Manchester

- Step Courses in Sheffield

- Step Courses in Leeds

- Step Courses in Edinburgh

- Step Courses in Leicester

- Step Courses in Coventry

- Step Courses in Bradford

- Step Courses in Cardiff

- Step Courses in Belfast

- Step Courses in Nottingham