- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Parallel Parking Pro

By Julie Hazell

Unlock the secret to confident parallel parking with our 30-minute formula! Empower yourself to teach your teenager to parallel park without traditional driving lessons. Pass on the same method used by Professional Driving Instructors and boost your teen's chances of acing their driving test.

3 Day Vinyasa Course

By Namaste Hatha Yoga

A three-day course of videos to give you a taste of Vinyasa yoga. The videos include a full-body vinyasa flow, core strength yoga and eagle pose

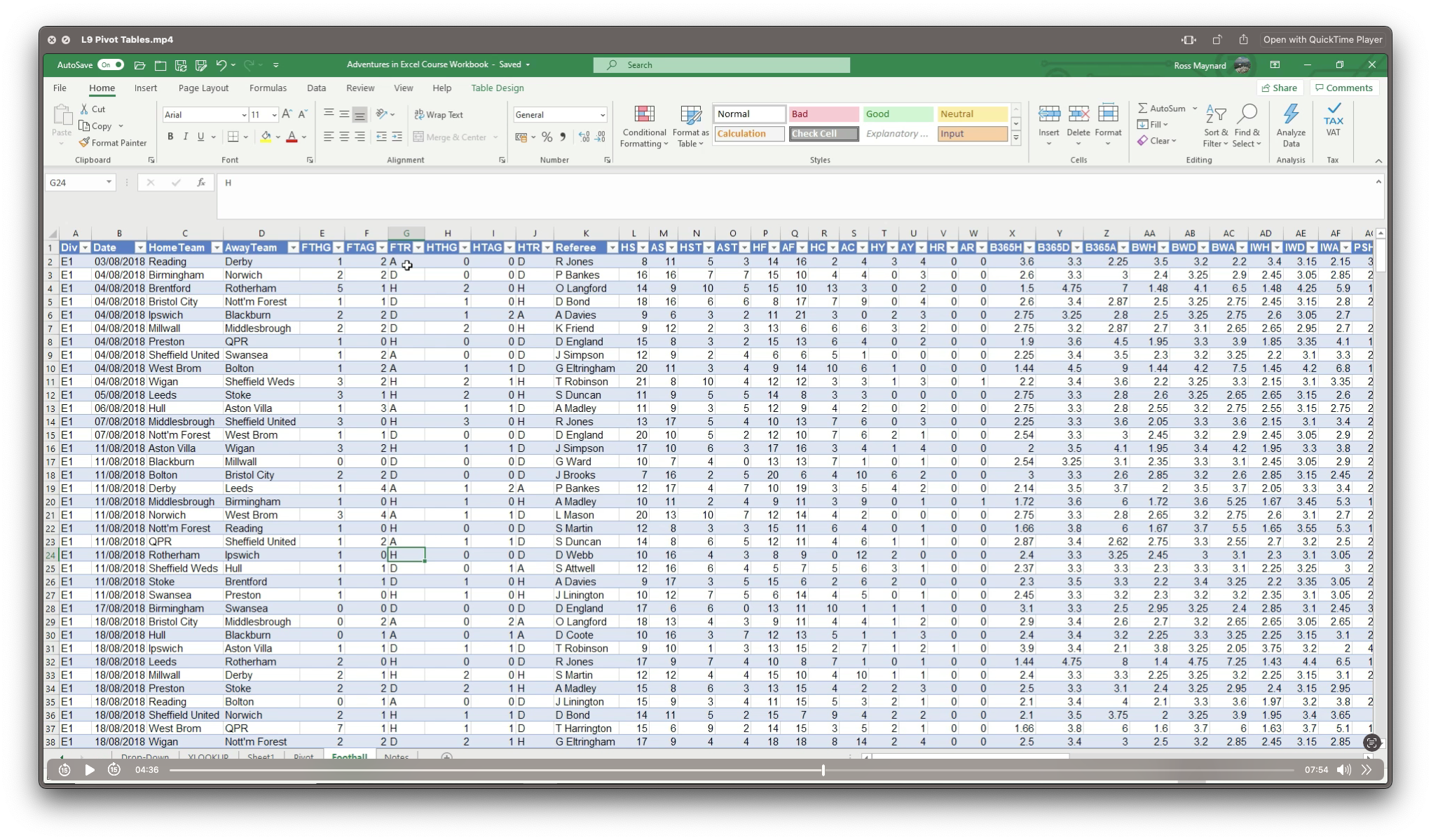

Adventures in Excel

By Ideas Into Action

Description Microsoft Excel has hundreds, if not thousands, of functions and features. This course aims to cover some of the best – that is the ones I find most useful. In “Adventures in Excel”, I cover the simple-to-use but powerful functions that I use most often: Basic features including products and powers Key date functions including the calculation of due dates and days past due Generating random numbers and random dates The new IFS functions (new to Office365) Text functions The most useful logical functions and IS functions How to create a drop-down list The new XLOOKUP function Pivot tables These functions are easy to use, and, unless your role is extremely specialised, they are probably the ones you’ll use 90% of the time. I hope you find the course helpful. Learning Outcomes Participants in this course will learn: Basic Excel functions including SUM, AVERAGE, MIN, MAX, PRODUCT, POWER and SQRT Useful date functions including TODAY, EOMONTH, EDATE, and DAYS Generating random numbers using RAND and RANDBETWEEN; generating random dates; and randomly picking an item from a list or table The new RANDARRAY function in Office365 The new IFS functions in Office365 including AVERAGEIFS, MAXIFS, MINIFS, COUNTIFS, and SUMIFS Text functions including TRIM, LOWER, UPPER, PROPER, LEFT, MID, RIGHT, FIND, TEXTJOIN and CONCATENATE Logical functions AND, OR, and NOT and IS functions ISTEXT, ISNUMBER, ISBLANK and ISERROR How to create a drop-down list The new SORT and FILTER functions in Office365 VLOOKUP and the new XLOOKUP function How to create a Pivot table and analyse data with one Course Requirements There are no pre-course requirements. Additional Resources Course Spreadsheet with the examples covered. About Ross Ross Maynard is a Fellow of the Chartered Institute of Management Accountants in the UK. He is director of Ideas2Action Process Excellence Ltd and has 30 years’ experience as a process improvement consultant and facilitator. Ross is also a professional author of online training courses for accountants. Ross lives in Scotland with his wife, daughter and Cocker Spaniel

Ultimate Photography Level 3 - by Top Rated Instructor

By Course Cloud

Photography Level 3 Course by Top Rated Instructor

Sage 50 Payroll for Beginners

By Course Cloud

Sage 50 Payroll for Beginners Course Overview Mastering payroll is essential for any business operation, and Sage 50 Payroll is one of the UK’s most widely used systems for managing employee payments, tax, pensions, and more. This beginner-level course is designed to introduce you to the complete payroll process using Sage 50, from setting up company details to running year-end reports. Whether you’re looking to work in payroll, start a role in HR or finance, or simply want to enhance your accounting knowledge, this course provides step-by-step training to help you build a solid foundation. You’ll start by exploring payroll basics and navigating company and legislation settings. Then, you’ll dive into practical tasks such as adding employees, entering payments, generating reports, and handling submissions. You’ll also gain insights into essential year-end procedures and how to process final payments correctly, giving you confidence in real-world scenarios. No prior payroll experience is required, making this course ideal for aspiring payroll administrators or small business owners looking to manage staff payments in-house. With flexible online learning and practical modules, this course ensures that you can develop your Sage 50 skills at your own pace — ready to take on payroll duties with efficiency and accuracy. Extra Included: Free Accredited Certificate Included Lifetime Access Free Student ID Card Learning Outcome Understand the fundamentals of Sage 50 Payroll software Learn how to set up company and legislation settings correctly Gain the skills to add new and existing employees to the payroll system Process payrolls and update employee records efficiently Handle statutory payments and employee departures with confidence Master e-submissions and produce accurate reports and year-end summaries Who is this Sage 50 Payroll for Beginners Course for? This Sage 50 Payroll for Beginners course is ideal for aspiring payroll administrators and HR assistants who want to develop practical skills in managing payroll processes. It’s also perfectly suited for small business owners looking to handle their company’s payroll operations in-house. In addition, accountancy or finance students aiming to enhance their career prospects will benefit greatly from this course. Whether you're starting from scratch or looking to refresh your knowledge, this course provides the foundation you need to confidently use Sage 50 Payroll. Entry Requirements There are no formal prerequisites for this course. It is open to anyone interested in learning payroll using Sage 50, regardless of previous experience. A basic understanding of computer use is helpful, but not essential. All you need is a stable internet connection and a desire to learn! Accredited Certification After successfully completing the course, you can get a UK and internationally accepted certificate to share your achievement with potential employers or include it in your CV. For the PDF certificate, you’ll need to pay £9.99. You can get the hard copy for 15.99, which will reach your doorstep by post.

Introduction to Applied Accounting

By Course Cloud

Introduction to Applied Accounting Course Overview The Introduction to Applied Accounting course is the perfect starting point for anyone looking to build a strong foundation in the world of accounting. Covering everything from basic accounting principles to financial reporting, management accounting, and cost analysis, this course offers a well-rounded view of real-world accounting practices. You'll explore key topics like the accounting cycle, double-entry bookkeeping, balance sheets, cash flow management, working capital, and even cost accounting techniques. Whether you're aiming to kickstart a new career or sharpen your skills for business success, this course provides essential knowledge delivered in an easy-to-follow and practical way. With businesses increasingly relying on accurate financial data to drive decisions, there's never been a better time to master the fundamentals of accounting and open new career opportunities! Extra Included: Free Course Included: Basic of Accounting Lifetime Access Free Student ID Card Learning Outcome Understand the core concepts and principles of accounting. Master the accounting cycle and double-entry system. Analyse financial statements including balance sheets and income statements. Explore key financial ratios to assess business health. Manage working capital, liquidity, and cash flows. Gain insights into cost accounting, budgeting, and financial reporting. Identify the limitations of accounting systems and recognise intangible assets. Understand internal and external auditing processes. Who is this Introduction to Applied Accounting Course for? This course is ideal for anyone interested in developing a solid foundation in accounting. It's perfect for beginners considering a career in finance, small business owners managing their own accounts, professionals looking to refresh or formalise their knowledge, and students planning to pursue further studies in accounting or business. Entry Requirements There are no formal prerequisites for this course. It is open to anyone with an interest in British Sign Language, particularly those who have completed a basic BSL course or have prior exposure to the language. A foundational understanding of BSL is beneficial to get the most out of the advanced content. Accredited Certification After successfully completing the course, you can get a UK and internationally accepted certificate to share your achievement with potential employers or include it in your CV. For the PDF certificate, you’ll need to pay £9.99. You can get the hard copy for 15.99, which will reach your doorstep by post.

Tax Accounting

By Course Cloud

Tax Accounting Course Overview Tax Accounting teaches you everything you need to know about taxation in the UK from the ground up, helping you earn a professional certificate for free to boost your career profile. This Tax Accounting course is a comprehensive, instructor-guided programme designed to give you a thorough understanding of the tax system and your responsibilities within it. To excel in today’s competitive financial sector, having specialist tax knowledge is essential. Through this in-depth training, you will develop the critical skills needed to start or enhance your career in tax accounting, whether you’re a beginner or an experienced professional looking to refine your expertise. The learning materials are accessible online, giving you the flexibility to study at your own pace and accelerate your journey towards a successful and rewarding career in accounting and finance. Extra Included: Free Course Included: Accounting Masterclass Lifetime Access Free Student ID Card Learning Outcome Understand the structure of the UK tax system and administration processes. Calculate and manage income tax, corporation tax, VAT, and capital gains tax. Complete and submit self-assessment tax returns accurately. Manage payroll taxes, national insurance contributions, and employee wages. Grasp advanced concepts of income taxation and financial analysis. Apply double-entry accounting principles in taxation contexts. Explore professional career paths and responsibilities of a tax accountant. Why Choose This Course? The Tax Accounting course provides practical, job-ready training that covers real-world tax scenarios. You’ll gain hands-on skills highly valued by employers and small businesses. Whether you're aiming to start your career, grow your freelance services, or simply understand tax accounting better for personal or business needs, this course offers the clarity and confidence you need to succeed. Who Is This Course For Aspiring tax accountants or payroll professionals Finance and accounting students Small business owners managing their own taxes Professionals seeking to expand their tax knowledge Entry Requirements There are no specific prerequisites for this course. It is open to anyone interested in learning about tax accounting. Accredited Certification After successfully completing the course, you can get a UK and internationally accepted certificate to share your achievement with potential employers or include it in your CV. For the PDF certificate, you’ll need to pay £9.99. You can get the hard copy for 15.99, which will reach your doorstep by post.

Cost Control Process and Management Level 3

By Course Cloud

Cost Control Process and Management Level 3 Course Overview Cost Control Process and Management Level 3 provides a thorough, step-by-step understanding of how to monitor, manage, and reduce costs in the food and hospitality industry. Whether you're managing a restaurant, running a kitchen, or simply want to optimise your business processes, this course breaks down everything you need to know — from inventory terms and purchasing controls to recipe costing and menu engineering. This instructor-guided, self-paced course is packed with practical examples and real-world insights that will help you reduce waste, increase profitability, and maintain operational efficiency. With lifetime access to the course materials, you can learn at your own speed and revisit content anytime you need a refresher. Extra Included: Free Accredited Certificate Included Lifetime Access Free Student ID Card Learning Outcome Understand key cost control terms and inventory principles Set up effective PAR levels and re-order points Manage purchasing, receiving, and storing processes efficiently Apply recipe cards, buffet costing, and menu pricing strategies Perform butcher tests, bar checks, and spot recipe testing Monitor slow/non-moving stock and control production Use reports and checklists for daily/monthly food cost tracking Implement menu engineering reports to boost profitability Why Choose This Cost Control Process and Management Level 3 Course? This course has been designed to provide you with job-ready skills that are directly applicable in real-world cost control environments. You’ll gain both the theoretical understanding and the hands-on techniques needed to streamline operations and cut unnecessary costs. All content is accessible online and supported by expert guidance. Whether you're aiming to enhance your current role or preparing for a new career path, this course will help you stand out in the food & beverage industry. Who is this Cost Control Process and Management Level 3 Course for? This course is ideal for individuals looking to strengthen their expertise in the subject area, whether you're a complete beginner aiming to build foundational knowledge, a professional seeking to enhance your current role, or a business owner wanting to manage specific operations in-house. It's also beneficial for career changers exploring new opportunities, or anyone eager to gain practical, industry-relevant skills to boost their employability. Entry Requirements There are no formal requirements to enrol in this course. A basic understanding of food service or hospitality operations will be helpful but not essential. Accredited Certification After successfully completing the course, you can get a UK and internationally accepted certificate to share your achievement with potential employers or include it in your CV. For the PDF certificate, you’ll need to pay £9.99. You can get the hard copy for 15.99, which will reach your doorstep by post.

Credit Control

By Course Cloud

Credit Control Course Overview Credit Control teaches you everything on the topic thoroughly from scratch so you can achieve a professional certificate to showcase your achievement in professional life. This Credit Control course is a comprehensive, instructor-guided programme designed to provide a deep understanding of the principles and practices behind effective credit management and your key roles within it. To become successful in your profession, you must have a specific set of skills to succeed in today’s competitive world. In this in-depth training course, you’ll develop essential credit control and debt recovery skills to kickstart your career, as well as upgrade your existing knowledge and confidence in managing credit and financial risk. The training materials are available online, allowing you to learn at your own pace and fast-track your career in finance or administration with ease. Extra Included: Free Accredited Certificate Included Lifetime Access Free Student ID Card Learning Outcome Understand the fundamentals of credit control and credit risk Explore methods of credit scoring and assessing financial risk Manage overdue payments and handle debt recovery professionally Ensure compliance with relevant credit control regulations Use financial analysis tools for better decision-making Get familiar with modern technologies used in credit control Who is this Credit Control Course for? This course is ideal for individuals looking to strengthen their expertise in the subject area, whether you're a complete beginner aiming to build foundational knowledge, a professional seeking to enhance your current role, or a business owner wanting to manage specific operations in-house. It's also beneficial for career changers exploring new opportunities, or anyone eager to gain practical, industry-relevant skills to boost their employability. Entry Requirements There are no academic entry requirements for this course, and it is open to students from all academic backgrounds. Accredited Certification After successfully completing the course, you can get a UK and internationally accepted certificate to share your achievement with potential employers or include it in your CV. For the PDF certificate, you’ll need to pay £9.99. You can get the hard copy for 15.99, which will reach your doorstep by post.