- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

45236 PE courses

Hypnotherapy Practitioner Diploma Course : Oct-Dec 2024

By Hypnotic Solutions Training

Hypnotherapy Training Course

Advanced Architecting on AWS

By Nexus Human

Duration 3 Days 18 CPD hours This course is intended for This course is intended for Solution Architects Overview At the end of this course, you will be able to: Apply the AWS Well-Architected Framework Manage multiple AWS accounts for your organization Connect an on-premises datacenter to AWS cloud Move large data from an on-premises datacenter to AWS Design large datastores for AWS cloud Understand different architectural designs for scalability Protect your infrastructure from DDoS attack Secure your data on AWS with encryption Enhance the performance of your solutions Select the most appropriate AWS deployment mechanism Building on concepts introduced in Architecting on AWS, Advanced Architecting on AWS is intended for individuals who are experienced with designing scalable and elastic applications on the AWS platform. Building on concepts introduced in Architecting on AWS, this course covers how to build complex solutions which incorporate data services, governance, and security on AWS. This course introduces specialized AWS services, including AWS Direct Connect and AWS Storage Gateway to support Hybrid architecture. It also covers designing best practices for building scalable, elastic, secure, and highly available applications on AWS. Module 1: AWS Account Management Multiple accounts Multi-account patterns License management Manage security and costs with multiple accounts AWS Organizations AWS Directory Service Hands-on lab: Multi-VPC connectivity using a VPN Module 2: Advanced Network Architectures Improve VPC network connections Enhance performance for HPC workloads VPN connections over AWS AWS Direct Connect AWS Transit Gateway Amazon Route 53 Exercise: Design a hybrid architecture Module 3: Deployment Management on AWS Application lifecycle management Application deployment using containers AWS Elastic Beanstalk AWS OpsWorks AWS CloudFormation Module 4: Data Optimize Amazon S3 storage Amazon ElastiCache AWS Snowball AWS Storage Gateway AWS DataSync Backup and archival considerations Database migration Designing for big data with Amazon DynamoDB Hands-on lab: Build a failover solution with Amazon Route 53 and Amazon RDS Module 5: Designing for large scale applications AWS Auto Scaling Migrating over-provisioned resources Blue-green deployments on AWS Hands-on lab: Blue-green deployment with AWS Module 6: Building resilient architectures DDoS attack overview AWS Shield AWS WAF Amazon GuardDuty High availability using Microsoft SQL Server and Microsoft SharePoint on AWS High availability using MongoDB on Amazon EC2 AWS Global Accelerator Hands-on lab: CloudFront content delivery and automating AWS WAF rules Module 7: Encryption and data security Encryption primer DIY key management in AWS AWS Marketplace for encryption products AWS Key Management Service (AWS KMS) Cloud Hardware Security Module (HSM) Comparison of key management options Hands-on lab: AWS KMS with envelope encryption

ILM Level 5 Certificate in Leadership & Management

By Challenge Consulting

ILM Level 5 Certificate in Leadership & Management – 9 day Accredited training course delivered in Nottingham This is a prestigious qualification for middle and aspiring middle managers. Participants should be operational managers with responsibilities for managing resources and/or teams of individuals within the scope of their role. Delegates are required to identify an opportunity for improvement in the organisation; research and analyse options and create an implementation plan for the business. Our client businesses tell us that this alone often pays many times over the for the course fee.

HV & MV Power System Design, Protection & Coordination - Virtual Instructor-Led Training (VILT)

By EnergyEdge - Training for a Sustainable Energy Future

Enhance your expertise in HV/MV power system design and protection coordination with EnergyEdge's virtual instructor-led training. Join now!

HV & MV Power System Design, Protection & Coordination - Virtual Instructor-Led Training (VILT)

By EnergyEdge - Training for a Sustainable Energy Future

Enhance your expertise in HV/MV power system design and protection coordination with EnergyEdge's virtual instructor-led training. Join now!

IT Management and Leadership Executive (ITMLE) Certification

By Nexus Human

Duration 3 Days 18 CPD hours This course is intended for The ITMLE Certification class is ideal for seasoned IT Managers and IT Directors (Managers of Managers). Overview Developed by an experienced CIO, and then vetted by a board of senior industry executives, ITMLE certifies that those who successfully complete the ITMLE Final Exam bring credible and validated industry knowledge to the organizations they serve appropriate to a senior-level IT executive. This three-day, fast-moving and highly interactive workshop contains topics specifically designed to prepare mid-level IT executives in large IT shops for higher levels of management responsibility and provide CIOs of smaller IT shops (about 40 people or less) with additional tools to help maximize their business impact. Knowledge, Roles, Methodology, and Change Thinking Like a CIO IT?s (and Your) Four Roles in the Organization Living in a Waterfall, Agile, Wagile World IT as an Agent of Change Process, Productivity, and Governance IT Strategic Planning and Thinking IT and Organizational Productivity IT and Data Governance Innovation, Staff Growth, and Negotiation Fostering IT Innovation Coaching, Mentoring, and Team Development IT Project and Vendor Negotiating

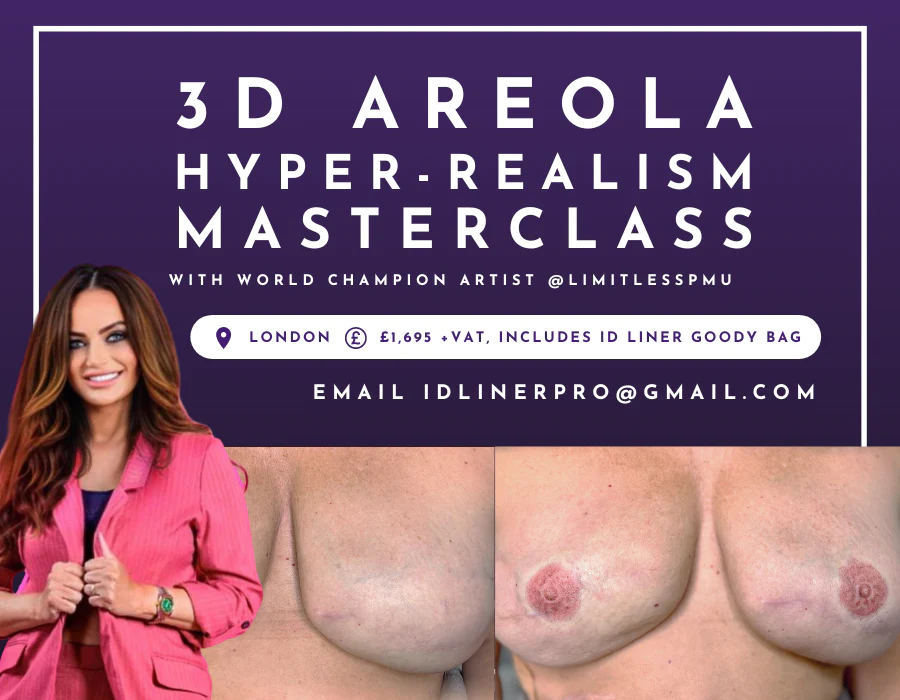

3D Areola Hyper-Realism Masterclass | @LimitlessPMU - Small Group Learning

By ID Liner | Permanent Makeup Training & Supplies

TREATMENT USES A NEW AREOLA TATTOOING TECHNIQUE DESIGNED BY AWARD-WINNING WORLD MASTER ARTIST MIRIAM BEGANOVA (@LIMITLESSPMU)

RSPH Level 4 Managing Food Safety and Hygiene - on-site training

By Kitchen Tonic Training Company and Food Safety Consultants

We can come to you and deliver Food Safety courses at your business premises. RSPH Level 4 Managing Food Safety and Hygiene Catering Course! This Level 4 course is perfect for those looking to enhance their knowledge and skills in food safety and hygiene in the catering industry. Throughout the course, you will learn about advanced food safety management, HACCP principles, and how to effectively implement food safety procedures. Special Offer: Book on this Level 4 Food Safety Training from July to August 2024 Contact us for a quote or to schedule training.

Supervising Your Team Course

By DG Legal

Managing people and teams is consistently the biggest challenge raised by new managers (and even many experienced managers). This 3 hour course is aimed at introducing new and existing supervisors and managers to key supervisory skills, allowing them to develop their competence as supervisors. The course covers: Understanding your role as a supervisor SRA obligations and competence expectations Setting expectations and effective delegation Monitoring progress and quality Managing performance in difficult situations Top tips for impactful feedback By the end of this course participants will have had an opportunity to consider their current skills; develop new skills; and think about further development needs. Target Audience This online course is aimed at managers, team leaders and other supervisors. Please note that this course does NOT meet the LAA requirements as a Supervisor Course. If you need a Legal Aid Supervisor course, then please check out our Supervision & Managing Performance Course. Resources Course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Matthew Howgate, Consultant, DG Legal Matt is a non-practising solicitor who has considerable experience in regulatory issues and advising on complex issues of compliance and ethics. He is also an expert in data protection, UK GDPR and on the civil legal aid scheme. Matthew is a lead trainer on and co-developed the LAPG Certificate in Practice Management (a training programme for legal managers and law firm owners) as well as regularly providing training on legal aid Supervision, costs maximisation, data protection and security and on general SRA compliance.

Search By Location

- PE Courses in London

- PE Courses in Birmingham

- PE Courses in Glasgow

- PE Courses in Liverpool

- PE Courses in Bristol

- PE Courses in Manchester

- PE Courses in Sheffield

- PE Courses in Leeds

- PE Courses in Edinburgh

- PE Courses in Leicester

- PE Courses in Coventry

- PE Courses in Bradford

- PE Courses in Cardiff

- PE Courses in Belfast

- PE Courses in Nottingham