- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Whether starting from scratch or beginning again as an adult after regretting giving up at an earlier age (a most common scenario!), I'm confident you will find what you need here to have a most satisfying hobby or interest that can be done at any age and at any time.

WYLLIE FOX ART TUITION

By Wyllie Fox Tuition

Francesca Wyllie (BA Hons Fine Art) has an amazing north-facing art studio at El Retiro in Andalucia, which was purpose-built to accommodate painting groups. Bespoke painting and sculpture workshops can be arranged or Francesca can travel locally to guide you in your own studios or locations.

Bravery & Womanhood

By Person Irresponsible

bravery and women, overcoming fears of solo travel, the great outdoors alone

When The Party's Over: substance use, addictions and workplace support

By Mindmaps Wellbeing

When The Party's Over: Substance use, addictions and workplace support We use substances for all sorts of reasons—to manage stress or illness, to sleep, to unwind, to have fun, to cope. It may not always be healthy, but it often makes sense. “Substance use” spans a wide spectrum of meaning and social acceptability—and that context shapes how we judge others, and ourselves. The word “drugs” often conjures up extremes, but the reality spans everything from your morning coffee and after work drinks, to your vape break, to prescription medications, to substances that are illegal to buy, or taboo to use. What society chooses to label as acceptable—or not—sometimes has less to do with harm, and more to do with social and cultural norms and values. As we explore in this workshop, feelings of judgement and shame frequently perpetuate the cycle of substance addiction; so how can we successfully modify our behaviour if we can’t talk about it, or ask for help and support, especially at work? This workshop is not a lesson about the dangers or symptoms of drug misuse, It is an engaging, thought-provoking exploration designed to increase understanding and compassion. Workshop outline: Reframing the drug landscape – breaking down the stigma Challenging the misconceptions about substance use and addiction Exploring useful strategies to support progress and prevent relapse How to better recognise the signs of difficulty and hold empathetic conversations Navigate self-help, peer, and professional support options for the workplace FIND OUT MORE HERE Build your own training package At Mindmaps Wellbeing, we know that every business is unique, and no team is the same. That’s why we’ve developed our range of short, specialist wellbeing and mental health themed workshops—a fully flexible approach to workplace wellbeing training. Because all of our workshops are short and impactful, you can build a package that truly meets your organisation’s needs. Perhaps you’re looking to manage stress, challenge stigma, or avoid burnout? Maybe your team would benefit from some training on self-care, starting difficult conversations or coping with remote working? Or You choose the sessions that suit your team best. Contact us to start building your unique package for workplace wellbeing!

Effective Selling Strategies

By Leadership Management International (LMI) UK

Develop your consultative selling skills through 6 practical modules: Define your target market Approaches that sell The Sales Interview Discovering prime buying motives How to close sales Overcoming stalls and objections In addition, learn to develop effective work habits, daily / weekly / monthl

Awareness of First Aid for Mental Health

By Prima Cura Training

The half-day First Aid for Mental Health Awareness course provides a concise yet impactful overview of essential mental health concepts. Participants gain a foundational understanding of common mental health conditions, learn to recognize signs and symptoms, and explore effective communication strategies.

Dementia Care – Level 2

By Prima Cura Training

Dementia affects around 820,000 people in the UK. This figure is likely to rise to one million by 2025 and two million by 2051. It is one of the main causes of disability in later life and with research being desperately underfunded, it costs the UK over £26 billion a year. Understanding dementia and the person-centred care that is required is fundamental to high quality care.

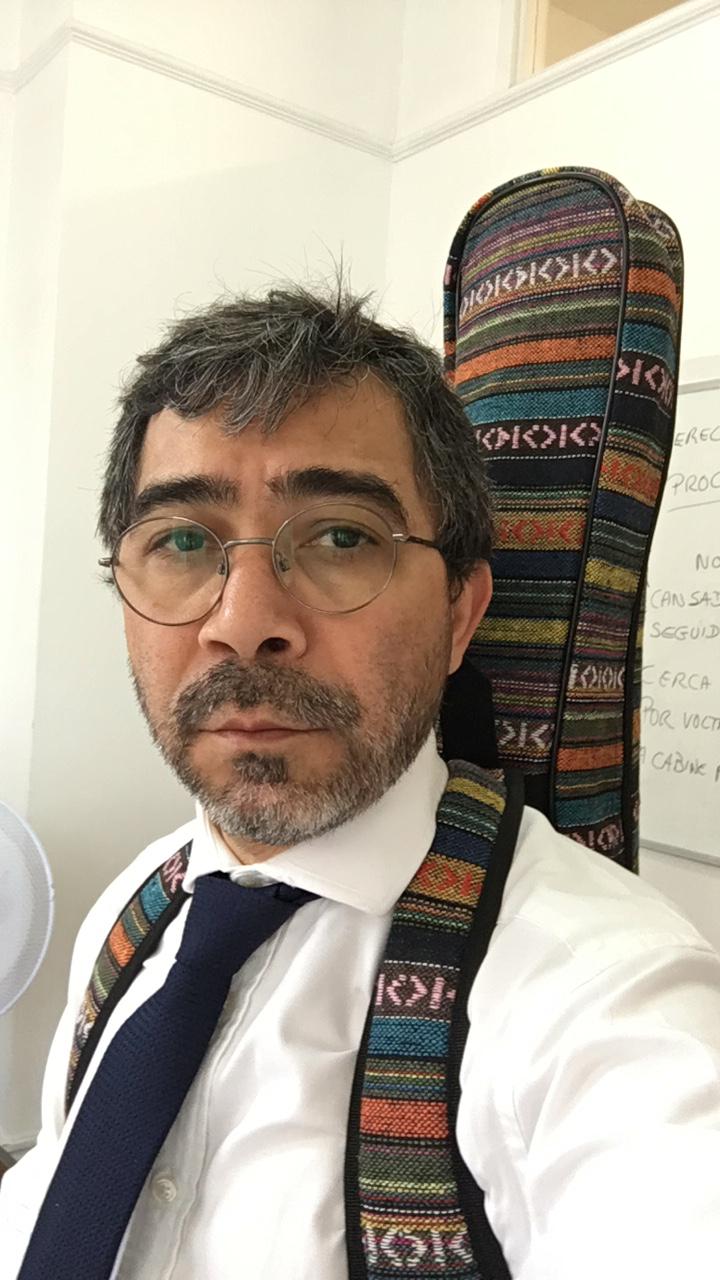

Qualified and experienced Brazilian Portuguese teacher - online or face-to-face lessons.

By Eddie Santos

I am a qualified and experienced Brazilian Portuguese teacher with over 30 years of experience teaching children, teenagers and adults. I teach Brazilian Portuguese for general purposes but also prepare students for GCSE, A-levels and CELPE-Bras. I have also been an exame conductor for many years in several schools across London. I love teaching and helping my students speaking as a native Brazilian.

Individual Development Programme (IDP)

By CORE theatre arts training

Maximise your potential with bespoke individual development

Casting Workshop for Actors and Physical theatre artists Coventry, 17 August

By CORE theatre arts training

www.touchpoint-productions.uk

Search By Location

- OV Courses in London

- OV Courses in Birmingham

- OV Courses in Glasgow

- OV Courses in Liverpool

- OV Courses in Bristol

- OV Courses in Manchester

- OV Courses in Sheffield

- OV Courses in Leeds

- OV Courses in Edinburgh

- OV Courses in Leicester

- OV Courses in Coventry

- OV Courses in Bradford

- OV Courses in Cardiff

- OV Courses in Belfast

- OV Courses in Nottingham