- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Level 2 NVQ Diploma in Construction Plant or Machinery Maintenance

By Dynamic Training and Assessments Ltd

Level 2 NVQ Diploma in Construction Plant or Machinery Maintenance

Level 2 NVQ Certificate in Highways Maintenance - Excavation and Reinstatement Operations

By Dynamic Training and Assessments Ltd

Level 2 NVQ Certificate in Highways Maintenance - Excavation and Reinstatement Operations

Combined Level 3 First Aid At Work & Paediatric First Aid (RQF)

By NR Medical Training

The Combined First Aid at Work and Paediatric First Aid course has been specifically designed for those who work in settings that require both First Aiders and Paediatric First Aiders, such as schools, sports clubs, or other childcare settings, and has been perfectly streamlined to avoid the duplication of topics associated with attending both the First Aid at Work and Paediatric First Aid courses separately.

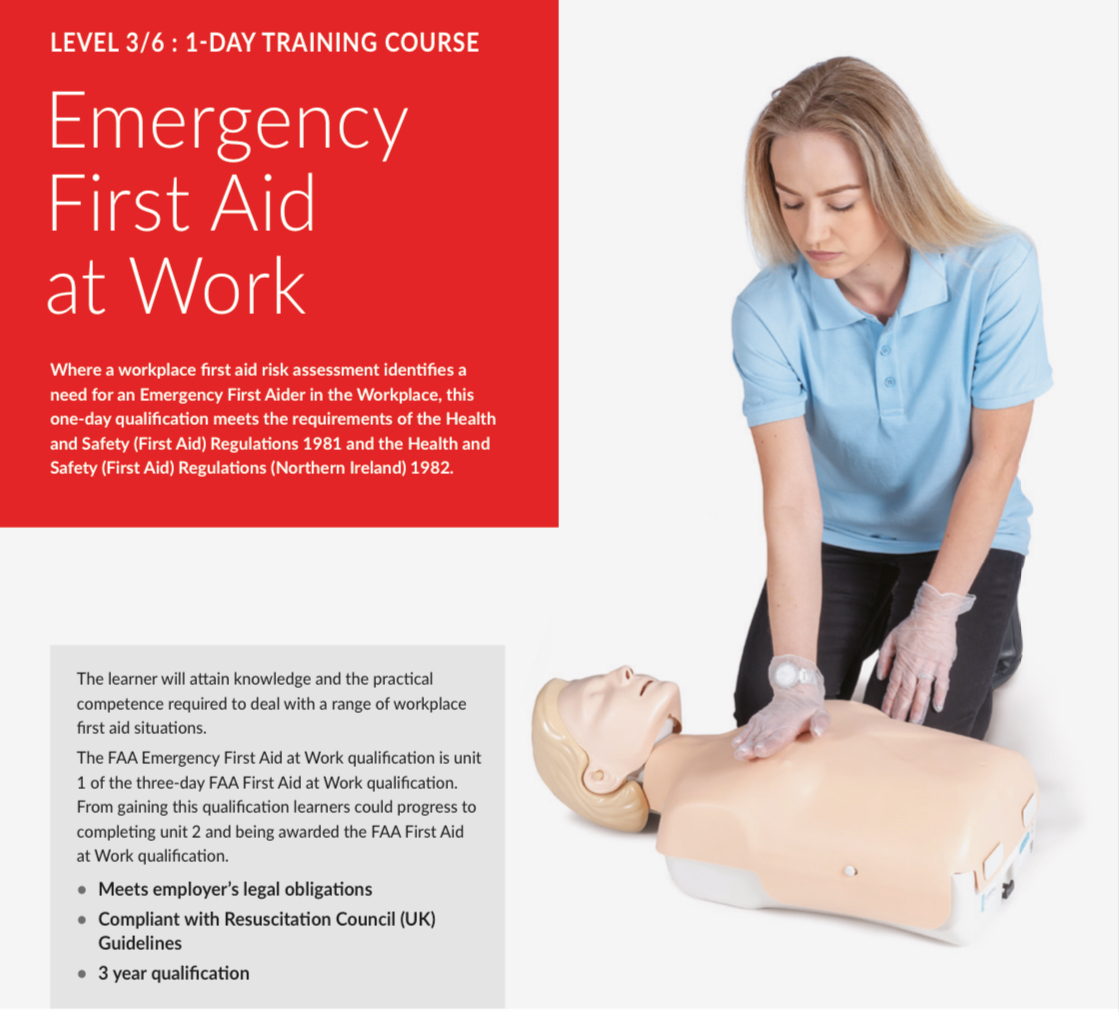

Emergency First Aid at Work (RQF) EFAW

By Emergency Medics

Emergency First Aid at Work delivered by healthcare professionals - Educating through Experience

An Introduction to Emotional Intelligence (EI) (£395 total for the half-day course for up to 12 participants)

By Buon Consultancy

Emotional Intelligence Training

M.D.D SELF AWARENESS PACKAGE (SELF IMPROVEMENT)

4.9(27)By Miss Date Doctor Dating Coach London, Couples Therapy

Miss Date Doctor’s Self-Awareness coaching is designed to help individuals develop a deeper understanding of themselves, their needs, and their values. Self-awareness is a critical component of personal growth and development, and our coaching can provide you with the tools and insights needed to enhance your self-awareness and improve your relationships. Our Self-Awareness coaching includes a range of techniques and strategies, such as mindfulness, self-reflection, goal-setting, and identifying and managing limiting beliefs. We can help you develop a clearer understanding of your strengths and weaknesses, your values and priorities, and the ways in which your past experiences may be impacting your present relationships. With our Self-Awareness coaching, you can learn to become more present and grounded in your interactions with others, communicate more effectively, and build deeper, more meaningful connections with your partner or potential partner. The Miss Date Doctor Self Awareness Package Includes the following: Relationship Self-Awareness, Self-Awareness Coaching, Mindfulness, Self-Reflection, Goal-Setting, Limiting Beliefs, Personal Growth, Developing Self-Awareness, Building Self-Awareness, Communicating Effectively, Relationship Building, Understanding Yourself, Self-Discovery, Self-Awareness Techniques. https://relationshipsmdd.com/product/self-awareness-package/

Even if you have completed a level 3 NVQ or a previous version of the wiring regulations, you still will have to prove you are conversant with the current standards. So therefore, keeping up to date with the latest wiring regulations satisfies these requirements. Although the BS 7671 can be a tricky book to navigate, our course has been designed in such a way as to ensure that you will have the knowledge to identify and find the topics covered in each of the relevant parts of the book. Further information can be found here: C&G 2382-22 BS7671 18th Edition — Optima Electrical Training (optima-ect.com)

Women in Management & Leadership

By Mpi Learning - Professional Learning And Development Provider

A dynamic and interactive one-day or two-half-day live virtual workshop for women leaders in business, government and non-profit organizations.

English language courses

By Mac-International

English courses for all levels are available through Mac International

Key Working

By Prima Cura Training

A key-worker role is to provide the best individual care for people they support and carry out effective assessment and support planning. Staff need to know how to motivate individuals to achieve their personal goals and understand how to advocate on their behalf. Staff also need to know how to improve communication between colleagues, individuals, other professionals, and contribute to service improvement.

Search By Location

- Other Courses in London

- Other Courses in Birmingham

- Other Courses in Glasgow

- Other Courses in Liverpool

- Other Courses in Bristol

- Other Courses in Manchester

- Other Courses in Sheffield

- Other Courses in Leeds

- Other Courses in Edinburgh

- Other Courses in Leicester

- Other Courses in Coventry

- Other Courses in Bradford

- Other Courses in Cardiff

- Other Courses in Belfast

- Other Courses in Nottingham