- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1473 Management courses in Aveley

Overview The most significant network between the organisation and their investors is Financial Statements and annual reports. It is very important to understand the role of these factors to have better communication channels. This course will give you intense knowledge to prepare financial statements according to International Financial Reporting Standards. IFRS regulates financial reporting standards and according to it the company's financial reporting should be transparent. Thus, if it is as per IFRS rules, its credibility can be trusted. It will also help to analyse the financial statement and annual reports. It will enable you to evaluate corporate accounts and make strong decisions and judgements about the company's status.

Foundations of Positive Behaviour Support

By Guardian Angels Training

Gain a comprehensive understanding of positive behavior support principles, strategies, and techniques with our course. Ideal for educators, caregivers, and professionals working with individuals with developmental disabilities, mental health issues, or behavioral challenges.

SIA Security Guard Course London

By London Construction College

Take The SIA CCTV Course This Will Take You 3 Days To Complete. Enroll Now On To The Course! What is the SIA Security Guard Course? The SIA Security Guard Course is a comprehensive 4-day training program meticulously designed to equip individuals with the essential knowledge and skills needed to obtain a security guard license in the UK. This course delves into a diverse array of subjects, encompassing the roles and responsibilities of security guards, honing customer service skills, effective conflict management, physical intervention awareness, emergency procedures, and much more. Practical training sessions are also integrated to enable participants to apply their learning in real-world scenarios. Course Overview: 4 Days Course | Course Fee: £250 Payment Structure: £70 deposit and £180 payment in the office What Are The Duties Of An SIA Security Guard? Providing a visible security presence Security guards are frequently tasked with patrolling an area or stationed at a specific location to discourage criminal activity and offer reassurance to the public. Responding to incidents The event of an incident, such as a fire or a security breach, security guards are required to respond promptly and efficiently to reduce harm and prevent additional damage. Conducting searches Security guards may need to conduct searches of people or vehicles entering premises to ensure that prohibited items are not brought in. Monitoring CCTV and alarms Security guards may have the responsibility of overseeing CCTV systems and alarm systems to identify and address potential security threats. Who Is The SIA Security Guard Course For? The SIA Security Guard Course is tailored for individuals aspiring to establish a career in the security industry within the UK. This comprehensive course caters to those who aim to work as security guards or in related roles within the private security sector, excluding door supervision. SIA Security Guard Course Content Do I Need First Aid To Renew My Security Guard Top Up Training? Obtaining an emergency first aid certificate is a mandatory requirement for renewing your Security Guard license. To renew your SIA security guard license, you must complete both the Emergency First Aid and the Security Guard Top-Up training, which can be accomplished in a single day. Please note that the SIA has introduced changes in the license renewal process for Security Guard and Door Supervisor Licenses, effective from the 1st of October. We offer a 1-Day SIA Security Guard Top-Up Training + First Aid course in Stratford, East London. This course is essential for renewing your security guard license and consists of half a day of training, concluding with multiple-choice exams. The results may take up to two weeks to be released. Unit 1: Principles Of Working In The Private Security Industry Acquire knowledge of the key characteristics and objectives of the Private Security Industry. Comprehend the application of relevant legislation to security operatives. Familiarize with arrest procedures pertinent to security operatives. Recognize the significance of adhering to safe work practices. Grasp the workplace fire procedures. Comprehend emergencies and the significance of emergency protocols. Learn effective communication skills as a security operative. Understand the importance of record-keeping in the role of a security operative. Recognize the aspects of handling terror threats and the role of a security operative in response to such threats. Learn how to ensure the safety of vulnerable individuals. Understand best practices for post-incident management. Unit 2: Principles Of Working As A Security Officer In The Private Security Industry Understand the roles and responsibilities of security officers. Understand the control of access and egress. Know the different types of electronic and physical protection systems in the security environment. Know how to minimize risk to personal safety at work. Understand drug-misuse legislation, issues, and procedures relevant to the role of a security officer. Know how to conduct effective search procedures. Understand how to patrol designated areas safely. Unit 3: Application Of Conflict Management In The Private Security Industry Understand the principles of conflict management appropriate to the role. Understand how to recognize, assess, and reduce risk in conflict situations. Understand the use of problem-solving techniques when resolving conflict. Be able to communicate to de-escalate conflict.

Performance management conversations for managers (In-House)

By The In House Training Company

Recognising the value of, and practising, clear and open communication at all levels is the first step to improving performance, whether at an individual, team, management, leadership or organisational level. We all know this, but why is it so difficult? This unique programme will make it much, much easier for you by giving you a robust framework to use - and the opportunity to practise your skills in a safe, supportive environment. It will help you have conversation that deliver tangible results. The programme will help you: Overcome the barriers to effective performance conversations Handle feedback conversations effectively Improve working relationships with your staff Set realistic expectations and targets (and get 'buy-in' for them) Improve your communication style Plan and prepare for honest conversations in the workplace 1 What is an honest conversation? Why don't we have them more often? What stops us? The cost of not having them 2 The feedback conversation Dealing with the impact of feedback conversations 3 Preparing for conflict 4 Effective working relationships 5 The expectations conversation 6 The targets conversation 7 Your communication styles 8 Planning and preparing for an honest conversation 9 Giving and receiving feedback skills

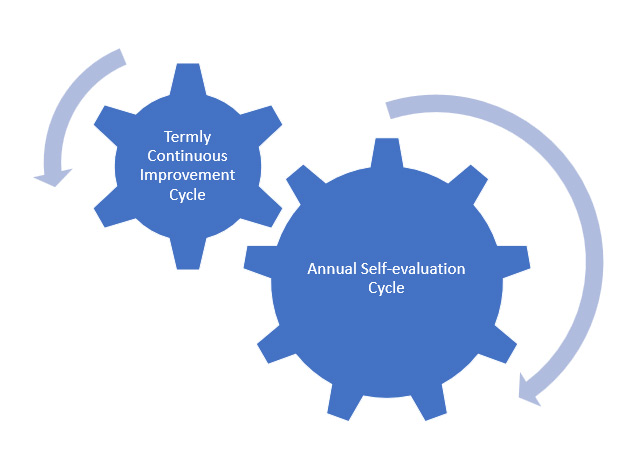

How to build a system that drives school improvement

By Marell Consulting Limited

If you want to be able to offer a consistently better quality of education for your pupils without the stress that comes with worrying about Ofsted all the time, this workshop is for you.

Overview It is very important to analyse financial operations within financial functions or outside financial functions. If they are utilized and implemented properly it will contribute towards the success of the business. This program will give you in-depth knowledge of financial operations and reporting supported by important aspects of theory together with practical methods and techniques. This course is specially designed by experts who have a wealth of experience in the related field. In this course, you'll gain knowledge in financial operations and reporting as well as its foundations, methods and techniques.

Overview Accounting is the methodical approach of updating and keeping track of all the required information related to financial transactions. This course is designed to gain knowledge of how to interpret and analyse financial statements effectively. This course will emphasize in-depth knowledge of financial reporting elements used in Advance Accounting highlighting transactions recognizing, differentiating and efficiently recording information. Advanced Accounting Techniques course covers difficult complex accounting topics like forecasting, hedging, data aggregation, interval accounting, segment reporting and many more including deeply understanding the financial statement Advanced accounting techniques were developed to provide information appropriate for decision-making in changing internal and external environments.

Overview This course will provide you with the skills and knowledge required by Non-Accounts Managers to understand Finance and Accounting processes they face in their daily work schedule. The main objective of this course is to highlight accounting, understand the framework of accounting, and stages of accounts and also to elaborate rules and principles of accounting. With a lot of Case studies and open discussions with live examples, participants will gain detailed knowledge to understand their company from a financial perspective and also to help manage financial matters. At the end of the course, you will learn how to apply financial techniques, understand financial reports and annual reports, the relationship between accounting and finance thereby gaining knowledge of the use of debits and credits and last but not least to identify limitations of financial statements. At the end of this training course, participants will: Be able to Record Transactions in the Accounting System Understand the Format and Contents of Financial Statements Use Accounting Information to Interpret and Evaluate a Business Make Efficient and Profitable Decisions, based on Cost Information Apply Budgetary Control Techniques to ensure that Targets are Achieved

Overview This training will give you the platform to learn everything you need to carry out effective cost-benefit analyses, the risk and uncertainty involved, and how to handle the various different types of information available. The skills you will gain will allow the administration of more accurate and reflective cost-benefit analyses through improved methods and processes.

Overview Corporate frauds have the inherent power to bring large organizations to their knees, cause huge monetary loss, prompt lawsuits followed by significant legal expenses, lead to the imprisonment of employees and deteriorate confidence in the market, governments, and institutions. In response, corporations and governments across the globe have stepped up their effort to inspect, prevent and penalize fraudulent practices; resulting in a greater emphasis on the domains of forensic auditing and accounting in the current economy. This training course will empower you to recognize the root causes of fraud and white-collar crime in the current economy, understand the categories of fraud, equip you with methodologies of fraud detection and prevention, and heighten your ability to detect potential fraudulent situations. In addition to the fundamentals of fraud investigation and detection in a digital environment; profit-loss evaluation, analysis of accounting books, legal concepts, and quantification of financial damages are also examined in this course

Search By Location

- Management Courses in London

- Management Courses in Birmingham

- Management Courses in Glasgow

- Management Courses in Liverpool

- Management Courses in Bristol

- Management Courses in Manchester

- Management Courses in Sheffield

- Management Courses in Leeds

- Management Courses in Edinburgh

- Management Courses in Leicester

- Management Courses in Coventry

- Management Courses in Bradford

- Management Courses in Cardiff

- Management Courses in Belfast

- Management Courses in Nottingham