- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

291 Management Accounting courses delivered On Demand

Microsoft OneDrive Course Online

By Lead Academy

This course will help you to enhance your digital skills by learning Microsoft OneDrive A to Z. From this course, you will learn to store, sync and share files securely in the cloud, collaborate with others in real-time, and access documents from anywhere. This Course At A Glance Accredited by CPD UK Endorsed by Quality Licence Scheme Learn what is manual payroll in the UK Payroll System Understand what is benefits in kind Learn how to install Brightpay Know how to find software per HMRC Brightpay Learn how to add employees to Brightpay Understand what is Payroll settings Get familiar with terms such as Directors NI, reports, RTI submissions, 102 schedules, and AEO Learn what is Paye tax, NI2, Pensions, payslips, and journal entries Understand what is total photo scenario and computeEntry Requirements rised systems Microsoft OneDrive Course Overview This extensive Microsoft Onedrive course is beneficial for those who want to learn to create a folder and renaming it, understand Onedrive, its free and paid plans, Onedrive sign up, personal vault, and PC folder backup. You will learn Onedrive functions and interface, Microsoft Word OneDrive, Microsoft project and tables, Microsoft Excel OneDrive, and Microsoft Powerpoint Onedrive. This interactive course will educate you on the steps to create a powerful password for your account and the Onedrive desktop app download and installation.By the end of the course, you will learn everything about Onedrive, sign up, personal vault, pc folder backup, desktop app download and installation, and much more. Who should take this course? This comprehensive Microsoft Onedrive course is suitable for those who want to gain in-depth knowledge in Onedrive functions, applications, interface, and password generation. Entry Requirements There are no academic entry requirements for this Microsoft Onedrive course, and it is open to students of all academic backgrounds. However, you are required to have a laptop/desktop/tablet or smartphone and a good internet connection. Assessment Method This Microsoft Onedrive course for diet assesses learners through multiple-choice questions (MCQs). Upon successful completion of the modules, learners must answer MCQs to complete the assessment procedure. Through the MCQs, it is measured how much a learner could grasp from each section. In the assessment pass mark is 60%. Course Curriculum You Can Master Onedrive The Complete Microsoft Onedrive Course - Mastering Onedrive Promo Quick Reminder - You Can Ask Me Anytime Another Quick Reminder: You Facebook Group Quick Win - Create a Folder and Rename It Another Quick Quick Win - Share and Collaborate What_Is OneDrive OneDrive Free And Paid Plans Onedrive Sign Up Onedrive Personal Vault OneDrive PC folder Backup Onedrive Desktop App Download and Installation Onedrive Mobile App Download and Installation On Drive Function and Interface Quick Win - Change the View of Displayed Files and Folder Another Quick Win Create a New Album Complete Onedrive Environment Upload and Download in Onedrive Creating New File and Folder in Onedrive Selecting Files And Folder In OneDrive Sharing and Collaborating Files and Folder in Onedrive Other Options in Top Bar of the Files and Folder Other Options in Top Bar of the Files and Folder Part 2 Picture Options In OneDrive Right Click Options In OneDrive Personals Valid in OneDrive Personals Valid Options in Onedrive Shared Folder in Onedrive Onedrive Settings - Storage Management OneDrive Settings (cont.) Microsoft Onedrive Mobile Version Microsoft Word OnDrive Complete Microsoft Word Environment Ribbon Guide Menu and Groups Guide Learn Functions and Options Then Projects Microsoft Word Home Menu Tools Microsoft Word Home Reviewing and Viewing Mode Microsoft Word File Menu Microsoft Word Insert Menu - Page Break and Table Microsoft Word Insert Picture Menu Microsoft Word Word Inserting Header and Footer, Symbol and Emoji Microsoft Word Layout Menu Microsoft OneDrive References Menu Microsoft Word Review Menu Microsoft Word View and Help Microsoft Word Project and Tables Practice Timetable Making in Microsoft Word Bill System in Microsoft Word Microsoft Excel OneDrive Microsoft Excel in Onedrive Environment Microsoft Excel Home (Part 1) Microsoft Excel Number Formats Microsoft Excel Conditional Format Microsoft Excel Formatting a Table Microsoft One Drive Insert Microsoft Data, Review and View Microsoft Excel Practice Salary Table in Microsoft Excel Salary Table In Microsoft Excel (Cont.) Microsoft PowerPoint OneDrive Microsoft PowerPoint Environment Microsoft PowerPoint Home and Insert Menu Microsoft PowerPoint Insert and Design Menu Microsoft Power Point Animation and Transition and More Microsoft PowerPoint Practice Projects of PowerPoint Other Apps in OneDrive and Setting OneNote in OneDrive Forms Survey in Onedrive Plain Text in Onedrive OneDrive Profile Management Account OneDrive Settings Quick Win - Create Unknown Password Security Is Everything Create Powerful Password for Your Account Quick Win - Insecurity is Coming from You and Others Understand Security Type or Category Life Savers - You Should Know These Have Proper Password - Start Securing You Now Don't Use the Same Password Anymore Should You Use Longer Password or Complicated. The Best and Only Solution to Make and Keep Password Un-Crack-Able Lastpass Setup and Configure Last-Pass Options Part 1 Last-Pass Options Part 2 Last-Pass Option Part 3 2FA Makes You Even Stronger in Password Last-Pass & Authy Mobile App Security is Everything, Keep Secured Your Devices Security on Your Data and Privacy Conclusion Congratulations - You Are Now a Master of OneDrive Assessment Assessment - Microsoft OneDrive Recognised Accreditation CPD Certification Service This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Many organisations look for employees with CPD requirements, which means, that by doing this course, you would be a potential candidate in your respective field. Quality Licence Scheme Endorsed The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. It will give you a competitive advantage in your career, making you stand out from all other applicants and employees. Certificate of Achievement Endorsed Certificate from Quality Licence Scheme After successfully passing the MCQ exam you will be eligible to order the Endorsed Certificate by Quality Licence Scheme. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. It will give you a competitive advantage in your career, making you stand out from all other applicants and employees. There is a Quality Licence Scheme endorsement fee to obtain an endorsed certificate which is £65. Certificate of Achievement from Lead Academy After successfully passing the MCQ exam you will be eligible to order your certificate of achievement as proof of your new skill. The certificate of achievement is an official credential that confirms that you successfully finished a course with Lead Academy. Certificate can be obtained in PDF version at a cost of £12, and there is an additional fee to obtain a printed copy certificate which is £35. FAQs Is CPD a recognised qualification in the UK? CPD is globally recognised by employers, professional organisations and academic intuitions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD-certified certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Are QLS courses recognised? Although QLS courses are not subject to Ofqual regulation, they must adhere to an extremely high level that is set and regulated independently across the globe. A course that has been approved by the Quality Licence Scheme simply indicates that it has been examined and evaluated in terms of quality and fulfils the predetermined quality standards. When will I receive my certificate? For CPD accredited PDF certificate it will take 24 hours, however for the hardcopy CPD certificate takes 5-7 business days and for the Quality License Scheme certificate it will take 7-9 business days. Can I pay by invoice? Yes, you can pay via Invoice or Purchase Order, please contact us at info@lead-academy.org for invoice payment. Can I pay via instalment? Yes, you can pay via instalments at checkout. How to take online classes from home? Our platform provides easy and comfortable access for all learners; all you need is a stable internet connection and a device such as a laptop, desktop PC, tablet, or mobile phone. The learning site is accessible 24/7, allowing you to take the course at your own pace while relaxing in the privacy of your home or workplace. Does age matter in online learning? No, there is no age limit for online learning. Online learning is accessible to people of all ages and requires no age-specific criteria to pursue a course of interest. As opposed to degrees pursued at university, online courses are designed to break the barriers of age limitation that aim to limit the learner's ability to learn new things, diversify their skills, and expand their horizons. When I will get the login details for my course? After successfully purchasing the course, you will receive an email within 24 hours with the login details of your course. Kindly check your inbox, junk or spam folder, or you can contact our client success team via info@lead-academy.org

Dealing with Angry or Rude Customers

By Ideas Into Action

Dealing with Angry or Rude Customers Course Description Copyright Ross Maynard 2021 Course Description If you work in customer service in any way, then, from time to time, you are going to have to deal with angry or rude customers. This course will help you manage those stressful situations and support the customer as best you can. Anger is a normal and relatively common emotion caused by a perceived hurt or provocation. In some cases a customer’s anger or rude behaviour may be driven by the failings of your organisation or its products and services. In other cases, the problem may be outside your control but you still have to deal with the impact. In this course we look at anger in a customer service situation and how to deal with it. We review the nature and causes of anger; we look at how poor customer service can cause anger and what you can do to prepare your organisation to deal with anger. We cover the warning signs for anger and present a 12 step approach to dealing with an angry customer. We cover questions and short scripts that can help you start a discussion with an angry customer, and we consider why customers might be rude. Finally we look at managing the stress of dealing with an angry customer and finish the course with a review of the key learning points. I hope you find the course helpful. Key Learning Points On completion of the course, delegates will be able to: Understand the nature and causes of anger as an emotion. Consider their objectives when dealing with an angry customer. Help prepare their organisation for dealing with angry customers. Identify appropriate customer service metrics Work through a series of steps to deal with an angry customer. Use questions and short scripts to try to help a customer bring their anger under control . Consider why a customer might be rude, and how to deal with that rudeness. Understand how to manage the stress of dealing with angry or rude customers. Curriculum L1: Anger as an Emotion L2: Your Objectives when Dealing with Anger L3: Poor Customer Service L4: Preparing your Organisation L5: Warning Signs and What Not to Do L6: The 12 Steps to Dealing with Anger L7: Example Scripts for Angry Customers L8: Dealing with Rude Customers L9: Dealing with Stress, and Key Learning Points Pre-Course Requirements There are no pre-course requirements Additional Resources Copy of customer behaviour policy Course Tutor Your tutor is Ross Maynard. Ross is a Fellow of the Chartered Institute of Management Accountants in the UK and has 30 years’ experience as a process improvement consultant specialising in business processes and organisation development. Ross is also a professional author of online training courses. Ross lives in Scotland with his wife, daughter and Cocker Spaniel

Professional Certificate Course in Fundamental of Managerial Accounting in London 2024

4.9(261)By Metropolitan School of Business & Management UK

The aim of the Fundamentals of Managerial Accounting course is to provide students with a strong foundation in the principles and practices of managerial accounting, with a focus on how accounting information can be used to support business decision-making. The course aims to help students develop a critical understanding of cost concepts, budgeting, and performance evaluation, and how these tools can be used by managers to improve organizational efficiency and effectiveness.After the successful completion of the course, you will be able to learn about the following, Understand Basics of Managerial Accounting. Explore Cost terminology and concepts. Analyze Inventory terminology and concepts. Explore Costing Methods. Understand Job Order Costing. Explore Process Costing. Analyze Activity-based Costing. This course provides a comprehensive understanding of cost behavior, budgeting, performance evaluation, decision-making using relevant costs and benefits, product costing and pricing, and capital budgeting and investment. The course covers the principles and practices of managerial accounting, focusing on how accounting information can be used to support business decision-making and improve organizational efficiency and effectiveness. Students learn to analyze costs, create budgets and forecasts, evaluate performance, and make decisions using relevant financial information. They also learn about product costing and pricing, capital budgeting and investment analysis, and how to apply these tools to real-world managerial accounting scenarios. The Fundamentals of Managerial Accounting course is designed to provide students with an understanding of the role of accounting in business decision-making. The course covers topics such as cost behavior, budgeting, and performance evaluation, with a focus on how managers can use accounting information to make informed decisions. The course will cover various cost concepts such as variable, fixed, and mixed costs, and how they impact business operations. Students will also learn about cost-volume-profit analysis, which helps managers make decisions based on sales revenue, costs, and profit. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Introduction to Managerial Accounting Self-paced pre-recorded learning content on this topic. Fundamentals of Managerial Accounting Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. CEO, Director, Manager, Supervisor Accountant Financial analyst Business analyst Operations manager Project manager Cost analyst Management consultant Business owner or entrepreneur Budget analyst Financial manager Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Master the art of hybrid team management with our comprehensive course. Learn effective techniques for transitioning, team building, and driving high performance in a hybrid work environment. Elevate your leadership skills and optimize your team’s effectiveness in today’s dynamic work landscape.

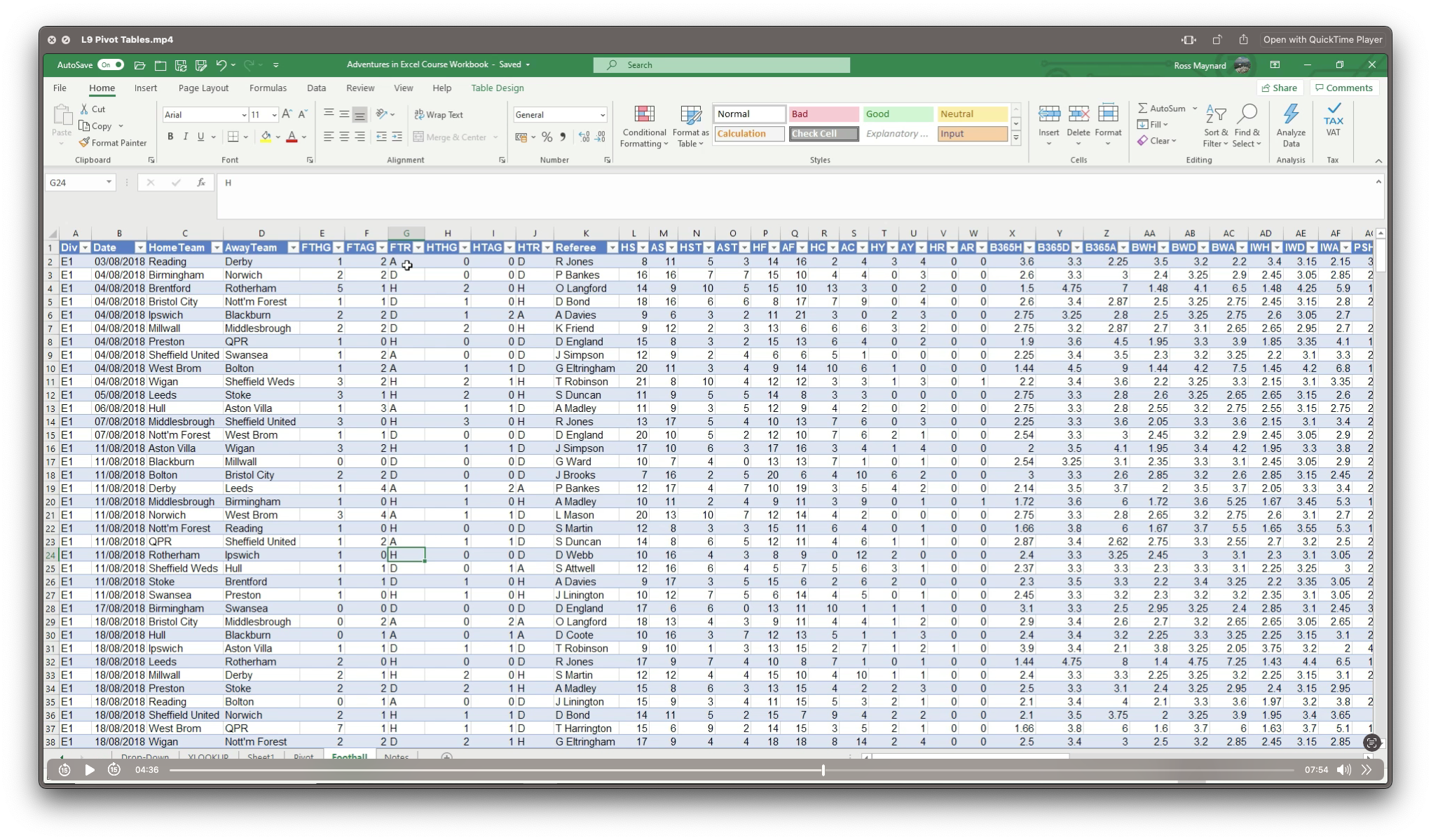

Adventures in Excel

By Ideas Into Action

Description Microsoft Excel has hundreds, if not thousands, of functions and features. This course aims to cover some of the best – that is the ones I find most useful. In “Adventures in Excel”, I cover the simple-to-use but powerful functions that I use most often: Basic features including products and powers Key date functions including the calculation of due dates and days past due Generating random numbers and random dates The new IFS functions (new to Office365) Text functions The most useful logical functions and IS functions How to create a drop-down list The new XLOOKUP function Pivot tables These functions are easy to use, and, unless your role is extremely specialised, they are probably the ones you’ll use 90% of the time. I hope you find the course helpful. Learning Outcomes Participants in this course will learn: Basic Excel functions including SUM, AVERAGE, MIN, MAX, PRODUCT, POWER and SQRT Useful date functions including TODAY, EOMONTH, EDATE, and DAYS Generating random numbers using RAND and RANDBETWEEN; generating random dates; and randomly picking an item from a list or table The new RANDARRAY function in Office365 The new IFS functions in Office365 including AVERAGEIFS, MAXIFS, MINIFS, COUNTIFS, and SUMIFS Text functions including TRIM, LOWER, UPPER, PROPER, LEFT, MID, RIGHT, FIND, TEXTJOIN and CONCATENATE Logical functions AND, OR, and NOT and IS functions ISTEXT, ISNUMBER, ISBLANK and ISERROR How to create a drop-down list The new SORT and FILTER functions in Office365 VLOOKUP and the new XLOOKUP function How to create a Pivot table and analyse data with one Course Requirements There are no pre-course requirements. Additional Resources Course Spreadsheet with the examples covered. About Ross Ross Maynard is a Fellow of the Chartered Institute of Management Accountants in the UK. He is director of Ideas2Action Process Excellence Ltd and has 30 years’ experience as a process improvement consultant and facilitator. Ross is also a professional author of online training courses for accountants. Ross lives in Scotland with his wife, daughter and Cocker Spaniel

New Excel Functions

By Ideas Into Action

New Excel Functions Course Description Ross Maynard Description In the second half of 2020 Microsoft released a significant upgrade to the most used spreadsheet programme in the world. Microsoft Excel now offers the ability to handle dynamic arrays – functions that return a range of results that update as the source data changes. In this course, we discuss the power of dynamic arrays and introduce the new functions. The functions I am going to cover are: RANDARRAY- creating a table of random numbers or random dates UNIQUE – identifying the distinct items in a list SEQUENCE – listing numbers with a set interval SORT and SORTBY – new ways of dynamically sorting data FILTER – building the ability to filter data into formulae XLOOKUP – replacing VLOOKUP with greater flexibility IFS and SWITCH making it easier to construct IF statements The new CONCAT, and TEXTJOIN text functions If you have an earlier version of Microsoft Excel then these functions will not be available to you and this course might not be for you. But if you do have a subscription to Office365 – either personally or through your work – I think you will find this course extremely useful. Learning Outcomes Participants in this course will learn: What the new dynamic arrays feature in Microsoft Excel means How the new RANDARRAY function works How the new UNIQUE function works How the new SEQUENCE function works How the new SORT and SORTBY functions work How the new FILTER function works How the new XLOOKUP function can replace VLOOKUP How to build IF statements with the new IFS function How the new SWITCH function works How the new TEXTJOIN function can replace CONCATENATE and CONCAT How the new functions can be used in management reporting Course Requirements There are no pre-course requirements. Additional Resources Course Spreadsheet with the examples covered. About Ross Ross Maynard is a Fellow of the Chartered Institute of Management Accountants in the UK. He is director of Ideas2Action Process Excellence Ltd and has 30 years’ experience as a process improvement consultant and facilitator. Ross is also a professional author of online training courses for accountants. Ross lives in Scotland with his wife, daughter and Cocker Spaniel

The Birth of the Industrial Revolution

By Ideas Into Action

The Birth of the Industrial Revolution in Britain 1707 to 1830 Course Description Introduction The Industrial Revolution started in Britain in the eighteenth century. A number of factors converged to create the conditions for developments in industry and science. Agricultural improvements created a cadre of wealthy landowners with money to invest. Improved educational opportunities, particularly in Scotland, created a broader set of young people with ideas and ambition. Greater religious freedom allowed individuals of talent to develop businesses. Interest in science and technology blossomed and the birth of the coffee house culture brought people with ideas into the orbit of those with money. But it was not all rosy. The new culture of ideas and experimentation was almost entirely limited to men. A woman’s place was seen to be in the home. At the same time the slave trade flourished providing much of the wealth for investment and, shamefully, Britain was a key facilitator in this odious business – and there were few voices of dissent at the time. And the poor lived short and brutish lives of hard physical work in grim conditions with an inadequate diet and very little healthcare. In this course I am going to take you through the key milestones of the early industrial revolution – in the textile industry, in coal mining and iron production, in civil engineering; in the development of steam power and the birth of the railways. Course Pre-Requisites There are no course pre-requisites. What Students will Learn The history of the industrial revolution in Britain from 1707 to 1830 The factors that created the conditions for the industrial revolution Developments in the textile industry in the eighteenth century The development of steam as a source of power The birth of steam locomotion Developments in coal, coke and iron Civil engineering in the eighteenth century Scientific developments in the eighteenth century Curriculum SS1 The Birth of the Industrial Revolution 6 mins SS2 The Textiles Revolution 13 min SS3 The Birth of the Steam Engine 10 mins SS4 The Age of Steam Locomotion 14 mins SS5 Fuelling the Industrial Revolution 10 mins SS6 The Engineering Revolution 6 mins SS7 The Scientific Revolution 18 mins SS8 Black Lives during the Industrial Revolution 5 mins SS9 The Birth of the Industrial Revolution 2 mins SS10 The Industrial Revolution History Quiz 19 mins Total time: 1 hour 44 minutes Additional Resources None Course Tutor Your tutor is Ross Maynard. Ross is a Fellow of the Chartered Institute of Management Accountants in the UK and has 30 years’ experience as a process improvement consultant specialising in finance processes. Ross is also a professional author of online training courses for accountants. Ross lives in Scotland with his wife, daughter and Cocker Spaniel

ACCA Accountancy

By Compete High

ð Unlock Your Path to Success with ACCA Accountancy Course! ð Are you ready to embark on a rewarding journey in the world of accountancy? Look no further than our comprehensive ACCA Accountancy course! Designed to equip you with the essential knowledge and skills needed to excel in the field of accounting, this course is your key to unlocking countless opportunities in the dynamic world of finance. Whether you're a fresh graduate looking to kickstart your career or a seasoned professional seeking to enhance your expertise, our ACCA Accountancy course is the perfect choice for you. Join us and pave the way for a successful career in accountancy! ð Why Choose ACCA Accountancy Course? ð Comprehensive Curriculum: Our ACCA Accountancy course covers all the essential topics and principles of accounting, providing you with a solid foundation to build upon. ð©âð¼ Expert Instruction: Learn from seasoned accounting professionals who bring years of industry experience and expertise to the classroom, ensuring that you receive top-notch instruction and guidance. ð¼ Practical Applications: Gain hands-on experience through real-world case studies, practical exercises, and simulations, allowing you to apply theoretical knowledge to real-life scenarios. ð Career Advancement: Expand your career opportunities and open doors to exciting roles in finance, auditing, taxation, and more with a recognized ACCA qualification. ð Global Recognition: ACCA is a globally recognized qualification, respected by employers worldwide, making it the ideal choice for those looking to pursue international career opportunities. ð Who is this for? ð Recent Graduates: Kickstart your career in accounting with a solid foundation provided by our ACCA Accountancy course. ð¨âð¼ Working Professionals: Enhance your expertise and advance your career in finance with a recognized ACCA qualification. ð©âð» Career Switchers: Transition into a rewarding career in accounting and finance with the comprehensive knowledge and skills gained from our ACCA Accountancy course. ð Career Path ð¹ Accountant: Prepare financial statements, analyze financial data, and provide valuable insights to businesses and organizations as an accountant. ð¹ Auditor: Conduct audits, assess financial records, and ensure compliance with regulations as an auditor in public practice or industry. ð¹ Tax Consultant: Provide tax planning and advisory services to individuals and businesses, helping them optimize their tax strategies and minimize liabilities. ð¹ Financial Analyst: Analyze financial data, evaluate investment opportunities, and provide recommendations to investors and stakeholders as a financial analyst. ð¹ Management Accountant: Work closely with management teams to analyze financial performance, develop budgets, and support strategic decision-making as a management accountant. ð¹ Forensic Accountant: Investigate financial fraud, analyze financial records, and provide expert testimony in legal proceedings as a forensic accountant. ð¡ FAQs (Frequently Asked Questions) ð¹ Q: Is this course suitable for beginners? A: Yes, our ACCA Accountancy course is suitable for individuals at all levels, including beginners who are new to the field of accounting. Our comprehensive curriculum covers all the essential topics and principles, providing a solid foundation for beginners to build upon. ð¹ Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of our ACCA Accountancy course, you will receive a certificate of completion, demonstrating your mastery of the essential concepts and principles of accounting. ð¹ Q: How long does it take to complete the course? A: The duration of our ACCA Accountancy course may vary depending on factors such as your prior knowledge and experience, study pace, and course format. Generally, students can expect to complete the course within a few months to a year. ð¹ Q: Can I study the course online? A: Yes, our ACCA Accountancy course is available in both online and in-person formats, providing you with the flexibility to choose the learning mode that best suits your schedule and preferences. ð¹ Q: Will this course help me advance my career in accounting? A: Absolutely! Our ACCA Accountancy course is designed to equip you with the knowledge and skills needed to excel in the field of accounting and finance. Whether you're looking to kickstart your career, enhance your expertise, or switch to a new role, our course will help you achieve your career goals. ð¹ Q: Is ACCA a globally recognized qualification? A: Yes, ACCA (Association of Chartered Certified Accountants) is a globally recognized qualification, respected by employers worldwide. Holding an ACCA qualification opens doors to exciting career opportunities in finance, auditing, taxation, and more, both locally and internationally. ð¹ Q: What support do you provide to students during the course? A: We offer comprehensive support to our students throughout the duration of the course, including access to experienced instructors, online resources, study materials, and academic support services. Our goal is to ensure that every student receives the guidance and assistance they need to succeed in their studies. ð Enroll Today and Take Your First Step Towards a Successful Career in Accounting! Don't miss out on the opportunity to embark on a rewarding career in accounting and finance. Enroll now in our ACCA Accountancy course and unlock your potential for success. With our comprehensive curriculum, expert instruction, and globally recognized qualification, you'll be well-equipped to thrive in the dynamic world of finance. Your journey to a successful accounting career begins here! ððð Course Curriculum Module 1 Introduction to Financial Accounting Introduction to Financial Accounting 00:00 Module 2 Double-Entry Bookkeeping and Recording Transactions Double-Entry Bookkeeping and Recording Transactions 00:00 Module 3 Trial Balance and Financial Statements Preparation Trial Balance and Financial Statements Preparation 00:00 Module 4 Financial Ratio Analysis and Interpretation Financial Ratio Analysis and Interpretation 00:00 Module 5 Ethical Considerations in Accounting Ethical Considerations in Accounting 00:00 Module 6 Financial Reporting Standards and International Convergence Financial Reporting Standards and International Convergence 00:00

Professional Certificate in Concepts and Tools of Cost Accounting in London 2024

4.9(261)By Metropolitan School of Business & Management UK

This course is designed to provide the learner with the conceptual foundation of understanding cost accounting. The learner will be able to explore the key concepts to identify the process and peculiarities of cost accounting and differentiate it from financial accounting. After the successful completion of this lecture, the learner will be able to understand the following: An introduction to cost accounting. The objectives of cost accounting. Understanding the features of cost accounting. Understanding the importance of cost accounting. Understandung the difference between cost accounting and financial accounting. Understanding the various tools of cost accounting. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Concepts and Tools of Cost Accounting Self-paced pre-recorded learning content on this topic. Quiz: Concepts And Tools Of Cost Accounting Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the knowledge of the learner in the field. This certificate is for everyone eager to know more and gets updated on current ideas in their respective field. We recommend this certificate for the following audience. CEO, Director, Manager, Supervisor Learning and Development Manager Finance Manager Accountant Organizational Behaviour Specialist Operations Manager Team Lead Business owner Average Completion Time 2 Weeks Accreditation 1 CPD Hour Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Accounting for Chartered Accountants

By Compete High

Unlock Your Potential with 'Accounting for Chartered Accountants' Are you ready to elevate your accounting expertise to the next level? Look no further than our comprehensive text course, 'Accounting for Chartered Accountants.' ð Whether you're a seasoned professional or just starting your journey in the world of finance, this course is designed to empower you with the knowledge and skills needed to excel in your career. Benefits of Taking 'Accounting for Chartered Accountants' Advanced Expertise: Dive deep into advanced accounting principles and techniques tailored specifically for chartered accountants. ð Gain a comprehensive understanding of complex financial concepts and strategies that will set you apart in the competitive field of accounting. Practical Application: Learn through real-world case studies and practical examples that bridge the gap between theory and practice. ð¼ Our course equips you with hands-on experience, ensuring that you're prepared to tackle the challenges of the modern accounting landscape. Career Advancement: Enhance your professional credibility and expand your career opportunities with a certification in accounting for chartered accountants. ð Whether you're seeking a promotion or exploring new job prospects, this course will give you the edge you need to succeed. Flexibility: Study at your own pace and convenience with our flexible online platform. ð Whether you're juggling work commitments or personal obligations, our self-paced format allows you to tailor your learning experience to fit your schedule. Expert Guidance: Benefit from the expertise of industry professionals who are committed to your success. ð Our instructors are seasoned accounting professionals with years of experience, ready to guide you every step of the way. Who is this for? 'Accounting for Chartered Accountants' is ideal for: Chartered accountants looking to enhance their skills and expertise. Accounting professionals seeking advanced training in financial management. Finance professionals aiming to earn a competitive edge in the job market. Individuals aspiring to become chartered accountants and excel in their careers. Career Path Upon completing 'Accounting for Chartered Accountants,' you'll be equipped to pursue a variety of rewarding career paths, including: Financial Controller Chief Financial Officer (CFO) Audit Manager Tax Consultant Financial Analyst Management Accountant Forensic Accountant FAQs Is this course suitable for beginners in accounting? While 'Accounting for Chartered Accountants' is tailored for professionals with a foundational understanding of accounting principles, beginners who are committed to learning and dedicated to their studies can also benefit from this course. How long does it take to complete the course? The duration of the course depends on your individual pace and schedule. On average, students typically complete the course within [insert average duration]. Is there a certification upon completion of the course? Yes, upon successfully completing the course and passing the assessment, you will receive a certification in 'Accounting for Chartered Accountants' to showcase your expertise and enhance your professional credentials. What are the prerequisites for enrolling in the course? While there are no strict prerequisites, a basic understanding of accounting principles and terminology is recommended to fully benefit from the course material. Are there any live sessions or is it entirely self-paced? 'Accounting for Chartered Accountants' is entirely self-paced, allowing you to study at your own convenience and pace. However, we do offer optional live webinars and Q&A sessions to supplement your learning experience and provide additional support. Can I access the course materials after completing the course? Yes, you will have lifetime access to the course materials, allowing you to review and revisit the content at any time. Is financial assistance available for the course? We offer various payment options and financial assistance programs to make the course accessible to individuals from diverse backgrounds. Please contact our support team for more information on available options. Don't miss out on this opportunity to take your accounting career to new heights. Enroll in 'Accounting for Chartered Accountants' today and embark on a journey toward professional excellence! ð Course Curriculum Module 1 Introduction to Accounting Principles Introduction to Accounting Principles 00:00 Module 2 Bookkeeping and Journal Entries Bookkeeping and Journal Entries 00:00 Module 3 Financial Statements Preparation and Analysis Financial Statements Preparation and Analysis 00:00 Module 4 Internal Controls and Fraud Prevention Internal Controls and Fraud Prevention 00:00 Module 5 Budgeting and Financial Planning Budgeting and Financial Planning 00:00 Module 6 International Accounting Standards International Accounting Standards 00:00