- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Neurodiversity Workshop Retaining: Reward, Change, Communication

By Mpi Learning - Professional Learning And Development Provider

A four-hour workshop on how to retain your talented Neurodiverse colleagues and ensure equality in employment opportunities.

LAN training course description A concise overview course covering Local Area Networks with particular emphasis on the use of Ethernet and Wireless LANS. As well as explaining buzzwords we cover how the technology works at a simple level. After defining LANs the course moves onto Ethernet and switching also covering VLANs. WiFi is then covered, with coverage of 802.11 standards and frequencies along with integrating WiFi with Ethernet. The course then covers routers and their role in connecting networks and the course finishes with a comparison of Ethernet vs WiFi and when to use them. What will you learn Describe how Ethernet works (in simple terms) and when to use Ethernet. Explain the difference between a switch and a router. Describe how WiFi works (in simple terms). Describe the role of Access points. Evaluate wireless technologies and when to use them. List the speeds of various LAN technologies. LAN training course details Who will benefit: Sales staff, managers and other non technical staff. Prerequisites: None. Duration 1 day LAN training course contents LANS What is a LAN? LAN standards, LAN choices, choosing the media, copper, UTP, cat5e, fibre, RF, bandwidth speeds, link aggregation, Full/half duplex. Ethernet What is Ethernet? 802.3, parts of Ethernet, Ethernet evolution, MAC addresses, frames, broadcasts. Ethernet switches What are switches, switches versus hubs, how switches work, ways to configure switches, Loops, STP. VLANs What are VLANs? Why have VLANs, impact of VLANs, Tagging (aka trunking), 802.1Q Wireless LANS Type of wireless LAN, RF frequencies, 2.4GHz, 5GHz, others, interference, standards, 802.11 and variants, CSMA/CA. Wireless LANS NICs, Access points, integration with Ethernet, multiple access points, mesh networks, WiFi security. Interconnecting LANs Routers, connecting networks, interconnecting VLANs, IP addressing, Layer 3 switches. Summary WiFi vs Ethernet.

Promoting Best Practice in Basic Life Support Instruction

By Guardian Angels Training

Learn to teach basic life support effectively with our "Promoting Best Practice in Basic Life Support Instruction" course. Ideal for healthcare professionals, educators, and individuals interested in life-saving interventions.

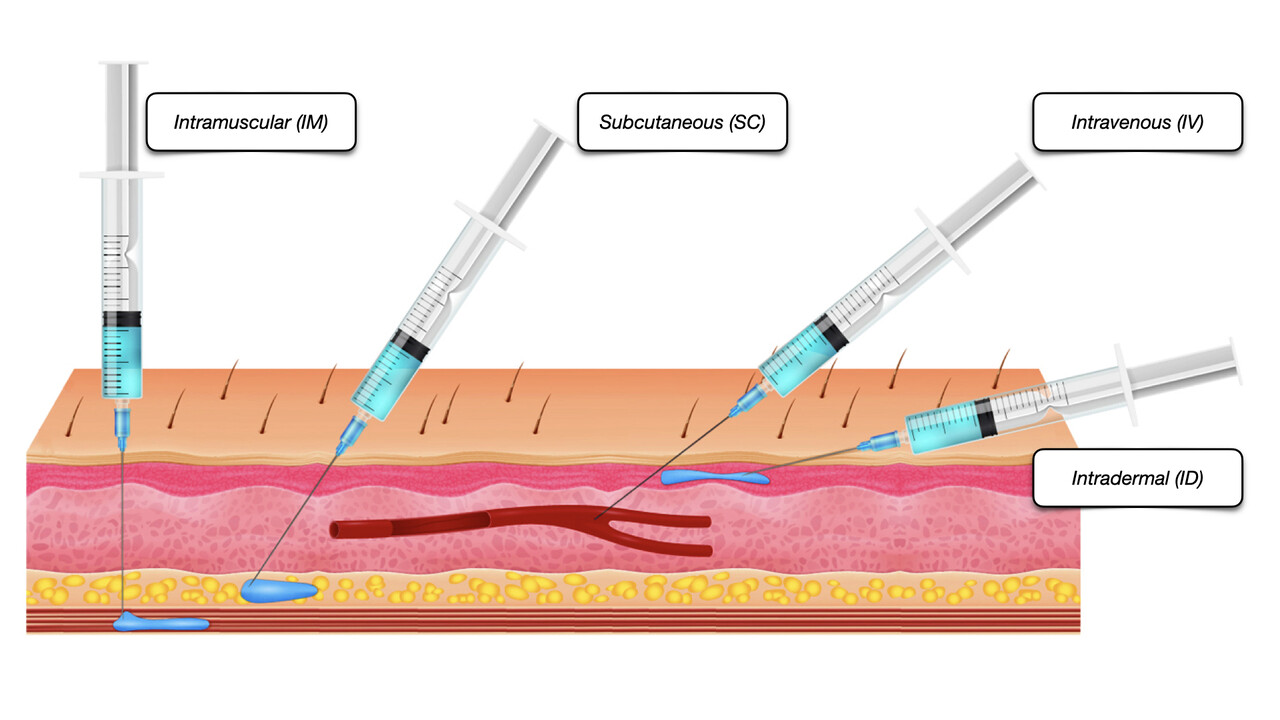

An Understanding of Injectable LHRH agonists

By Guardian Angels Training

Gain comprehensive knowledge on injectable LHRH agonists with our course. Learn about mechanisms, clinical applications, administration techniques, and more.

OAL Level 3 Award in Epilepsy and Administration of Buccal Midazolam RQF

By Guardian Angels Training

Gain comprehensive knowledge and practical skills to manage epilepsy and administer buccal midazolam with the Level 3 Award in Epilepsy and Administration of Buccal Midazolam (RQF). Ideal for healthcare professionals and caregivers.

Level 3 Endorsed Award in Delivering Health and Social Care Training (Healthcare Train the Trainer)

By Guardian Angels Training

Gain expertise in healthcare training with our Level 3 Endorsed Award in Delivering Health and Social Care Training. Our comprehensive program equips you with the skills and knowledge to become a proficient trainer in the healthcare sector.

Sales, Engaging Your Customers

By Mpi Learning - Professional Learning And Development Provider

A virtual sales training programme aimed at enhancing the skills of the salesperson to have engaging customer conversations which open opportunities and close more business.

Business Intelligence: In-House Training

By IIL Europe Ltd

Business Intelligence: In-House Training Business Intelligence (BI) refers to a set of technology-based techniques, applications, and practices used to aggregate, analyze, and present business data. BI practices provide historical and current views of vast amounts of data and generate predictions for business operations. The purpose of Business Intelligence is the support of better business decision making. This course provides an overview of the technology and application of BI and how it can be used to improve corporate performance. What you will Learn You will learn how to: Specify a data warehouse schema Identify the data and visualization to be used for data mining and Business Intelligence Design a Business Intelligence user interface Getting Started Introductions Agenda Expectations Foundation Concepts The challenge of decision making What is Business Intelligence? The Business Intelligence value proposition Business Intelligence taxonomy Business Intelligence management issues Sources of Business Intelligence Data warehousing Data and information Information architecture Defining the data warehouse and its relationships Facts and dimensions Modeling, meta-modeling, and schemas Alternate architectures Building the data warehouse Extracting Transforming Loading Setting up the data and relationships Dimensions and the Fact Table Implementing many-to-many relationships in data warehouse Data marts Online Analytical Processing (OLAP) What is OLAP? OLAP and OLTP OLAP functionality Multi-dimensions Thinking in more than two dimensions What are the possibilities? OLAP architecture Cubism Tools OLAP variations - MOLAP, ROLAP, HOLAP BI using SOA Applications of Business Intelligence Applying BI through OLAP Enterprise Resource Planning and CRM Business Intelligence and financial information Business Intelligence User Interfaces and Presentations Data access Push-pull data access Types of decision support systems Designing the front end Presentation formats Dashboards Types of dashboards Common dashboard features Briefing books and scorecards Querying and Reporting Reporting emphasis Retrofitting Talking back Key Performance Indicators Report Definition and Visualization Typical reporting environment Forms of visualization Unconstrained views Data mining What is in the mine? Applications for data mining Data mining architecture Cross Industry Standard Process for Data Mining (CISP-DM) Data mining techniques Validation The Business Intelligence User Experience The business analyst role Business analysis and data analysis Five-step approach Cultural impact Identifying questions Gathering information Understand the goals The strategic Business Intelligence cycle Focus of Business Intelligence Design for the user Iterate the access Iterative solution development process Review and validation questions Basic approaches Building ad-hoc queries Building on-demand self-service reports Closed loop Business Intelligence Coming attractions - future of Business Intelligence Best practices in Business Intelligence

Business Intelligence

By IIL Europe Ltd

Business Intelligence Business Intelligence (BI) refers to a set of technology-based techniques, applications, and practices used to aggregate, analyze, and present business data. BI practices provide historical and current views of vast amounts of data and generate predictions for business operations. The purpose of Business Intelligence is the support of better business decision making. This course provides an overview of the technology and application of BI and how it can be used to improve corporate performance. What you will Learn You will learn how to: Specify a data warehouse schema Identify the data and visualization to be used for data mining and Business Intelligence Design a Business Intelligence user interface Getting Started Introductions Agenda Expectations Foundation Concepts The challenge of decision making What is Business Intelligence? The Business Intelligence value proposition Business Intelligence taxonomy Business Intelligence management issues Sources of Business Intelligence Data warehousing Data and information Information architecture Defining the data warehouse and its relationships Facts and dimensions Modeling, meta-modeling, and schemas Alternate architectures Building the data warehouse Extracting Transforming Loading Setting up the data and relationships Dimensions and the Fact Table Implementing many-to-many relationships in data warehouse Data marts Online Analytical Processing (OLAP) What is OLAP? OLAP and OLTP OLAP functionality Multi-dimensions Thinking in more than two dimensions What are the possibilities? OLAP architecture Cubism Tools OLAP variations - MOLAP, ROLAP, HOLAP BI using SOA Applications of Business Intelligence Applying BI through OLAP Enterprise Resource Planning and CRM Business Intelligence and financial information Business Intelligence User Interfaces and Presentations Data access Push-pull data access Types of decision support systems Designing the front end Presentation formats Dashboards Types of dashboards Common dashboard features Briefing books and scorecards Querying and Reporting Reporting emphasis Retrofitting Talking back Key Performance Indicators Report Definition and Visualization Typical reporting environment Forms of visualization Unconstrained views Data mining What is in the mine? Applications for data mining Data mining architecture Cross Industry Standard Process for Data Mining (CISP-DM) Data mining techniques Validation The Business Intelligence User Experience The business analyst role Business analysis and data analysis Five-step approach Cultural impact Identifying questions Gathering information Understand the goals The strategic Business Intelligence cycle Focus of Business Intelligence Design for the user Iterate the access Iterative solution development process Review and validation questions Basic approaches Building ad-hoc queries Building on-demand self-service reports Closed loop Business Intelligence Coming attractions - future of Business Intelligence Best practices in Business Intelligence

RESILIA Foundation

By IIL Europe Ltd

RESILIA™ Foundation AXELOS RESILIA™: Cyber Resilience Best Practice is designed to help commercial and government organizations around the world prevent, detect, and correct any impact cyber attacks will have on the information required to do business. Adding RESILIA to the existing AXELOS global best practice portfolio, including ITIL® and PRINCE2®, brings a common cyber resilience best practice for security, IT service management, and business. Active cyber resilience is achieved through people, process, and technology. The RESILIA™ Foundation course starts with the purpose, key terms, the distinction between resilience and security, and the benefits of implementing cyber resilience. It introduces risk management and the key activities needed to address risks and opportunities. Further, it explains the relevance of common management standards and best practice frameworks to achieve cyber resilience. Subsequently, it identifies the cyber resilience processes, the associated control objectives, interactions, and activities that should be aligned with corresponding ITSM activities. In the final part of the course, it describes the segregation of duties and dual controls related to cyber resilience roles and responsibilities. What you will Learn At the end of this course, you will be able to: Demonstrate your knowledge of the purpose, benefits, and key terms of cyber resilience Demonstrate your knowledge of the risk management and the key activities needed to address risks and opportunities Demonstrate your knowledge of the purpose of a management system and how best practices and standards can contribute Demonstrate your knowledge of the cyber resilience strategy, the associated control objectives, and their interactions with ITSM activities Demonstrate your knowledge of cyber resilience design, the associated control objectives, and their interactions with ITSM activities Demonstrate your knowledge of cyber resilience transition, the associated control objectives, and their interactions with ITSM activities Demonstrate your knowledge of cyber resilience operation, the associated control objectives, and their interactions with ITSM activities Demonstrate your knowledge of cyber resilience continual improvement, the associated control objectives, and their interactions with ITSM activities Demonstrate your knowledge of the purpose and benefits of segregation of duties and dual controls Course Introduction Course Learning Objectives Course Agenda Activities Course Book Structure RESILIA Certification Introduction to Cyber Resilience What is Cyber Resilience? Defining Cyber Resilience Balancing in Cyber Resilience Characteristics of Cyber Resilience Risk Management Understanding Risk Management: Discussion Defining Risk Management Addressing Risks and Opportunities Managing Cyber Resilience Why and What of Management Systems? Management Systems Common Management Standards and Frameworks Cyber Resilience Strategy What is Strategy? Cyber Resilience Strategy and Activities Security Controls at Cyber Resilience Strategy Interaction Between ITSM Processes and Cyber Resilience Cyber Resilience Design Why Cyber Resilience Design? Cyber Resilience Design Activities Security Controls at Cyber Resilience Design Aligning ITSM Processes with Cyber Resilience Processes Cyber Resilience Transition Why Cyber Resilience Transition? Basics of Cyber Resilience Transition Cyber Resilience Transition: Controls Interaction Between ITSM Processes and Cyber Resilience Cyber Resilience Operation The Purpose of Cyber Resilience Operation Security Controls in Cyber Resilience Operation Interaction Between IT Processes and Cyber Resilience Interaction Between ITSM Functions and Cyber Resilience Cyber Resilience Continual Improvement Continual or Continuous Improvement Maturity Models Continual Improvement Controls The Seven-Step Improvement Process The ITIL CSI Approach Cyber Resilience Roles & Responsibilities Segregating Duties Dual Controls

Search By Location

- impact Courses in London

- impact Courses in Birmingham

- impact Courses in Glasgow

- impact Courses in Liverpool

- impact Courses in Bristol

- impact Courses in Manchester

- impact Courses in Sheffield

- impact Courses in Leeds

- impact Courses in Edinburgh

- impact Courses in Leicester

- impact Courses in Coventry

- impact Courses in Bradford

- impact Courses in Cardiff

- impact Courses in Belfast

- impact Courses in Nottingham