- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

3837 Courses in Epsom

UNIX fundamentals training course description An introduction to using the UNIX operating system focussing on the command line. Appropriate for all versions of UNIX. The starting point for all UNIX work, we concentrate on the technical aspects rather than issues such as using browsers. The course is heavily practical in nature. What will you learn Describe UNIX. Log in and use UNIX commands to perform a variety of tasks from manipulating and printing files to looking at and killing processes. Create and edit files with vi. Recognise the role of the administrator. Write simple shell scripts. Customise the user environment. UNIX fundamentals training course details Who will benefit: Anybody who needs to use a UNIX system. Prerequisites: None. Duration 3 days UNIX fundamentals training course contents What is UNIX? Operating systems, UNIX flavours, UNIX features. Getting started Logging in, changing passwords, logging out. UNIX basics Command structure. The UNIX manuals, basic commands (who, date, tty, uname, echo, banner...) Filesystem commands Home directories, manipulating files and directories, Filesystem layout, Pathnames, hard and symbolic links. The UNIX Editors ed, vi, shell escapes, .exrc Extracting data from files grep, find, cut, sort and paste Permissions Theory, chmod, chown, newgrp.. Processes ps, kill, background processes, at, exec, priorities. The Shell Metacharacters, piping and redirection. Basic shell scripting What are shell scripts? Simple scripts, control structures. Variables. Arguments. Customising your environment Environmental variables, stty, .profile and other startup files More shell features Bash and other shells, the history facility, command line editing, aliases, job control, miscellaneous features. Introduction to administration The root user, su and tar Archiving files Backups, tar, cpio, dd, gzip. Unix and hardware Main hardware components, Unix device drivers. Connecting to a network IP configuration, ifconfig, ping, netstat, traceroute, dig.

Advanced UNIX shell scripting training course description A follow on hands on course from the Introduction to shell programming course covering the powerful sed and awk tools along with the extra Korn shell programming features. What will you learn Use regular expressions within grep, ed and many other utilities. Use awk and sed. Integrate sed and awk into shell scripts. Recognise the role of shell scripts within the UNIX system. Write shell scripts using new Korn shell features including: The select construct Arrays Arithmetic evaluation Advanced UNIX shell scripting training course details Who will benefit: Programmers developing applications under UNIX. Administrators who need time saving utilities. Technical personnel who wish to make the most out of the Korn Shell. Prerequisites: UNIX shell scripting Duration 3 days Advanced UNIX shell scripting training course contents Regular Expressions What are REs? How can they be used? How to write REs More REs e REs Tagging, matching words, repetitions. The sed editor Basic usage: Saving output, options. sed script files, sed commands, Specifying lines to edit, Hold space and pattern space, advanced commands Awk Basic usage, nawk script files, Patterns, Records and fields, Actions if, while, do, for... System variables NF, NR, RS... Arrays Functions length, printf, cos, user defined... Using nawk in shell scripts Korn shell scripts Review of Bourne shell scripts functions... Variables typeset, manipulating strings Arrays Arithmetic evaluation the let command, (( )), typeset -i The select construct Syntax, workings, REPLY, PS3 Miscellaneous Enhanced I/O, ${10}

Microsoft Access training course description A hands on course providing a solid grounding in Microsoft Access. What will you learn Use and customise the Microsoft Access environment. Select, use and customise queries. Define tables. Design forms and reports. Recognise the use of macros. Microsoft Access training course details Who will benefit: Anyone wishing to work with Microsoft Access. Prerequisites: Database fundamentals Duration 3 days Microsoft Access training course contents Introducing databases Flat file databases, Relational databases, the objects defined in an Access database, planning a simple relational database. Open Access and create a database The database wizards, tables, creating and amending tables, using field properties to improve the quality of data entry and system performance, the primary key. Working in datasheet view View, add, modify and delete records, find records. Advantages and disadvantages of entering data directly into a table. Queries Sort and select records form a single table, advantages and disadvantages of entering data via a query, define simple calculated expressions, use 'Totals' queries. Forms Use the form wizards, basic editing of objects created using the form wizards, Data-entry in form view. Reports Use the report wizard, basic editing of objects created using the report wizard, print reports. The multi table environment Plan and create a related table, define a one-to-many relationship, write multi-table queries and use the 'AutoLookup' feature, use the form wizard to create a subform and carry out data-entry in a main/subform, print and amend reports, use the report wizard to create reports based on multi-table. Relationships Working with one-to-one and one-to-many relationships, recognising and handling many-to-many relationships, referential integrity. Select queries Select queries based on related tables, parameter queries, Crosstab, find unmatched queries and Find Duplicate, the implications of the Join properties in a relational query, conditional expressions, and working with the expression builder. Action queries Make table queries, append queries, update queries, delete queries. Customising forms. Using the Toolbox, calculated controls, Combo and List boxes, query by form, working with form and control properties, domain aggregate functions. Reports Report and control properties, customising sorting and grouping, calculated controls on reports, Sub-reports, editing and altering a report's source. Macros Introduction to macros.

LNG Value Chain & Economics - Optimise Your LNG Projects and Supply Strategies

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course Liquefied Natural Gas (LNG) has provided intercontinental mobility to natural gas, which now provides about 25% of the global primary energy. Being the cleanest fossil fuel, natural gas/LNG consumption is forecasted to grow in all future scenarios. With the entry of various players, including Trading companies, the LNG value chain is becoming increasingly complex, and a solid understanding of its economics and management of its interfaces have become crucial to identify and assess investment opportunities and risks. Recent market disturbances caused by COVID-19, Oil & Gas price instabilities - coupled with the political (Ukraine/Russia) challenges - make a deep understanding of LNG Value Chain Logistics and Economics even more essential to ensure the security of energy supplies sustainably and profitably. This intermediate level 3 full-day course starts with a concise introduction to the LNG business. Thereafter, the elements of the LNG value chain are described, and their individual economics analysed. A Business Activity Model along the value chain will be developed and discussed in depth, covering the following key processes: 'Buy Gas - Transport Gas - Liquefy Gas - Sell LNG/Products - Ship LNG - Regasify LNG' The integrated chain economics will then be developed and quantified. A hands-on group workshop/exercise developing the economic case of a full-sized Liquefaction project will be carried out, considering the forecasted cash flows throughout the project life, the location of the plant, its markets, project sensitivities and profitability assessment. Participants will be provided with Excel based tools/models (LNG Liquefaction project development Net Present Value (NPV) analyses, Shipping Freight Calculations and Economics) to work through the exercises and also for their future personal use. Training Objectives After the completion of this course, participants will be able to: Understand how the LNG Value Chain operates, bound by the relevant Contracts and Agreements. Learn the basic economic parameters (operating, capital costs, financing, profitability) of each major element of the value chain. Appreciate the complexity of the value chain, and the associated opportunities and risks. Develop quantitative project evaluation skills. Explore options to maximise profitability in a given LNG value chain. Discuss best practices on how to manage, steer and govern these activities. Target Audience Technical, Operational, Shipping, Commercial, Project and Governance professionals who are already active in a specific section of the LNG Value Chain will directly benefit in developing a wider and deeper perspective on how the LNG Value Chain operations and can be optimised. Managers (Technical, Financial, Legal and Governance) less familiar with the specifics of the LNG Industry will also benefit from attending this VILT course, as they will obtain the required background to be able to set sharper targets, suitable performance indicators, and governance and performance assessment guidelines for units engaged in the chain. The course is most relevant for professionals engaged in the LNG industry at: National and International Oil & Gas/Energy Companies LNG Importers/Exporters/Traders/Shippers Government & Regulatory Agencies Finance Institutions It will also apply to the following audience: Business Development Managers Corporate Planning Professionals Project Developers Supply Planners & Scheduling Professionals Regulators Tax & Finance Advisors Compliance Officers Equity Analyst and Bankers Joint Venture Representatives, Board Directors Negotiators and Contracting Staff Trading Professionals Course Level Intermediate Trainer Your expert course leader is an Oil & Gas/LNG professional with more than 35 years of international experience, majority of which was gained at Shell International Joint Ventures engaged in Oil Refining, Supply / Trading, Gas Supply and LNG Businesses in the Netherlands, France, Thailand, Dominican Republic and Nigeria. Since 2004, he has had several roles in the management of the LNG Value Chain including the Commercial Operational Management of Nigeria LNG (NLNG). He played an active role in the start-up and integration of LNG trains 4, 5 and 6 with NLNG becoming the 3rd largest LNG producer in the world in 2007. Commercial operations spanned 4 Gas Supply, 11 LNG Sales & Purchase Agreements, ad-hoc LPG and Condensate Sales and LNG Ship Chartering contracts. Under his supervision, more than 2,000 LNG cargoes were exported. He was part of the organizational transformation of the company from a Project-based set-up to a Production / Commercial based structure and implemented an 'Integrated Planning and Scheduling Department' in which he optimized the value chain (Buy-Gas - Liquify Gas to LNG - Sell - Ship LNG). Staff competence management was one of his focus areas during this period. He was also the NLNG representative on JV Technical, Commercial, Shipping Committees where he interfaced with Government & Regulatory authorities. In 2014, he was appointed as Shell Shareholder representative to NLNG and became a Non-Executive Board member to NLNG companies, including Bonny Gas Transport (BGT) managing 24 LNG Ships. During this period, he was involved in the Economic and Technical steering of the Shipping Fleet and Liquefaction Plant Rejuvenation projects and a further capacity expansion of liquefaction plant which resulted in the achievement of NLNG train 7 project FID in 2019. Since 2016, he has been active as an independent consultant. He co-authored 2 patents and more than 30 published papers/presentations. He holds a PhD from Delft University of Technology in the Netherlands and a MSc and BSc in Chemical Engineering from the University of Birmingham, UK. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Upstream Petroleum Economics, Risk and Fiscal Analysis

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course The 3-day hands-on petroleum economics training course provides a comprehensive overview of the practices of exploration and development petroleum economics and its application in valuing oil and gas assets to aid corporate decisions. Participants will gain a thorough understanding of the principles of economic analysis as well as practical instruction in analytical techniques used in the industry. The participants will learn how to construct economic models, to include basic fiscal terms, production and cost profiles and project timing. The resulting model will provide insights of how the various inputs affect value. Example exercises will be used throughout the course. Training Objectives Upon completion of this course, participants will be able to: Understand and construct petroleum industry cash flow projections Calculate, understand and know how to apply economic indicators Learn and apply risk analysis to exploration and production investments Evaluate and model fiscal/PSC terms of countries worldwide Target Audience The following oil & gas company personnel will benefit from the knowledge shared in this course: Geologists Explorationists Reservoir Engineers Project Accountants Contract Negotiators Financial Analysts New Venture Planners Economists Course Level Basic or Foundation Intermediate Trainer Your expert trainer has over 40 years' experience as a petroleum economist in the upstream oil and gas industry. He has presented over 230 oil and gas industry short courses worldwide on petroleum economics, risk, production sharing contracts (PSC) and fiscal analysis. In over 120 international oil industry consulting assignments, he has advised companies and governments in the Asia Pacific region on petroleum PSC and fiscal terms. He has prepared many independent valuations of petroleum properties and companies for acquisition and sale, as well as economics research reports on the oil and gas industry and including commercial support for oil field operations and investments worldwide. He has been involved in projects on petroleum royalties, design of petroleum fiscal terms, divestment of petroleum assets, and economic evaluation of assets and discoveries since the early 1990s to date. He has been working on training, consultancy, research and also advisory works in many countries including USA, UK, Denmark, Switzerland, Australia, New Zealand, Indonesia, India, Iran, Malaysia, Thailand, Vietnam, Brunei, Egypt, Libya, and South Africa. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Best Practices Procurement for Carbon Offsets in the Energy Industry

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course More energy companies today are setting ambitious net-zero targets and are expected to pour billions into the voluntary carbon offset market by the end of this decade. To get to net zero emissions, companies will need to balance emissions with nature and technology-based offsets. Markets are the best tool for connecting carbon sources and sinks. Many countries will not have enough supply inside their borders and will need to co-operate with those who have extra greenhouse gas removal potential. The energy industry is in search of effective climate tools as pressure mounts from investors and consumers for more progress on fighting rising emissions. Corporations fighting to cut their carbon footprint have for years focused on internal reduction measures. Many are now adding to that effort by turning to carbon credits, a process made easier as verification and registration tools mature. One particular category of carbon offsets leads the way: high-quality, nature-based carbon credits. These represent the largest category of carbon credit projects in the voluntary carbon market, comprising nearly half of credits issued. Public concern about this practice focused on the additionality, leakage, and integrity of carbon offsets that are created through reforestation, land preservation, carbon capture and other projects. Lack of standardization and government regulation has also increased uncertainty for all participants in carbon markets, creating risks for developers of credit-generating projects and offset purchasers. Demand for higher-quality offsets will value projects that were subjected to due diligence and rely upon reputable third-party verification. Companies purchasing offsets generated by permanent and quantifiable projects will therefore be in the best position moving forward. In this highly interactive training course, your course instructor will guide you through the latest developments and best procurement practices to successfully operate in the voluntary carbon market. Training Objectives At the end of this course, the participants will be able to: Discover the current state of the carbon economy Gain insights into the voluntary carbon market Learn about the different type carbon credits available Examine how companies can reach net zero target by using carbon offsets Uncover best practices in carbon credit procurement strategy Learn the pricing dynamics carbon credits Examine how to identify and ensure high quality credits Obtain key learning from flawed carbon offset projects Target Audience This course is intended for: Energy transition team leaders Carbon credit procurement professionals ESG strategy team leaders Finance and accounting professionals Low carbon business analysts or economists Corporate business sustainability professionals Legal, compliance and regulatory professionals Carbon trading professionals Course Level Intermediate Trainer Your expert course leader is a skilled and accomplished professional with over 25 years of extensive C-level experience in the energy markets worldwide. He has a strong expertise in all the aspects of (energy) commodity markets, international sales, marketing of services, derivatives trading, staff training and risk management within dynamic and high-pressure environments. He received a Master's degree in Law from the University of Utrecht in 1987. He started his career at the NLKKAS, the Clearing House of the Commodity Futures Exchange in Amsterdam. After working for the NLKKAS for five years, he was appointed as Member of the Management Board of the Agricultural Futures Exchange (ATA) in Amsterdam at the age of 31. While working for the Clearing House and exchange, he became an expert in all the aspects of trading and risk management of commodities. In 1997, he founded his own specialist-consulting firm that provides strategic advice about (energy) commodity markets, trading and risk management. He has advised government agencies such as the European Commission, investment banks, major utilities and commodity trading companies and various energy exchanges and market places in Europe, CEE countries, North America and Asia. Some of the issues he has advised on are the development and implementation of a Risk Management Framework, investment strategies, trading and hedging strategies, initiation of Power Exchanges (APX) and other trading platforms, the set-up of (OTC) Clearing facilities, and feasibility and market studies like for the Oil, LNG and the Carbon Market. The latest additions are (Corporate) PPAs and Artificial Intelligence for energy firms. He has given numerous seminars, workshops and (in-house) training sessions about both the physical and financial trading and risk management of commodity and carbon products. The courses have been given to companies all over the world, in countries like Japan, Singapore, Thailand, United Kingdom, Germany, Poland, Slovenia, Czech Republic, Malaysia, China, India, Belgium and the Netherlands. He has published several articles in specialist magazines such as Commodities Now and Energy Risk and he is the co-author of a book called A Guide to Emissions Trading: Risk Management and Business Implications published by Risk Books in 2004. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

If you have at least 5 years working experience and you would like to attain Gold Card status via the Experienced Worker route by joining the City & Guilds 2346 NVQ Level 3, you will also need to hold the below two pre-requisite qualifications: City & Guilds 2391-52 Inspection and Testing Course C&G 2382-22 BS7671 18th Edition

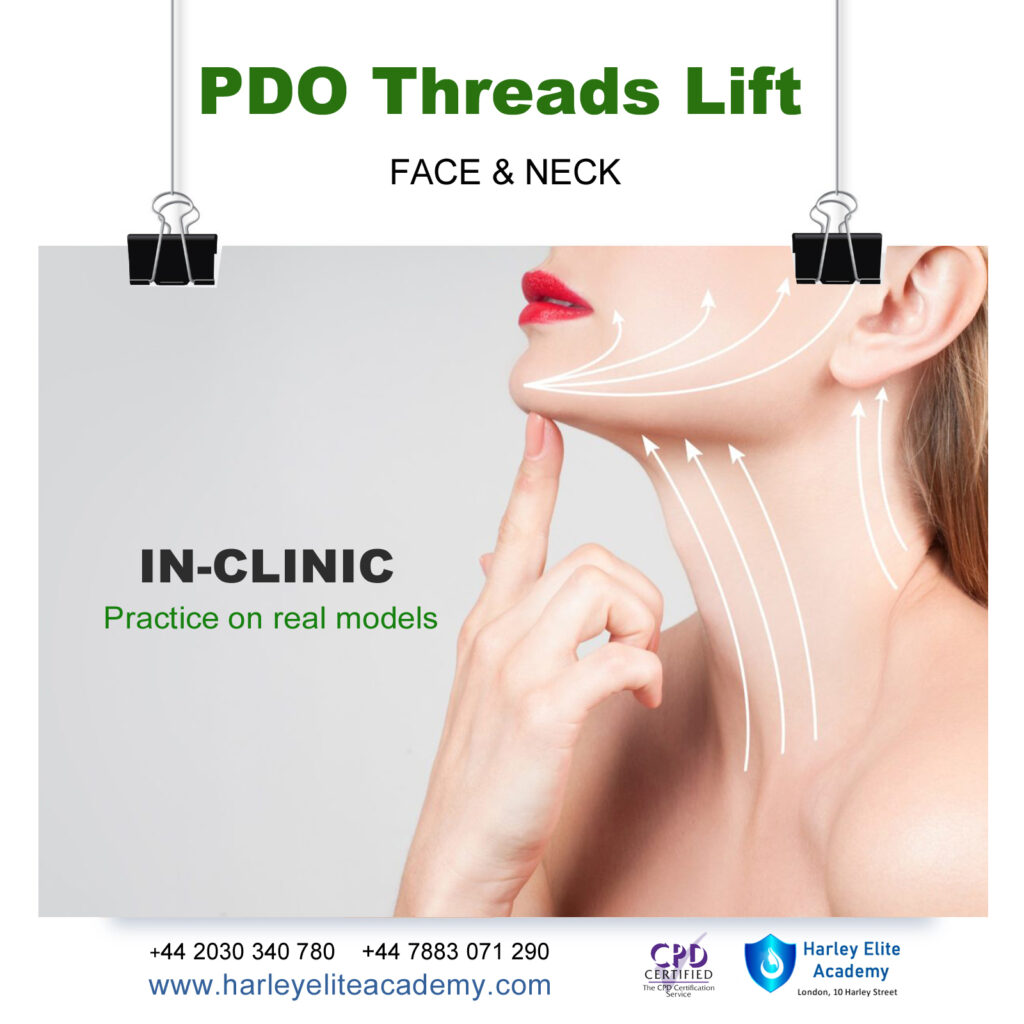

PDO Threads Lift Course

By Harley Elite Academy (HeLa)

MASTERCLASS ONE-2-ONE 8 CPD POINTS 1 DAY INTENSIVE COURSE ONLINE or IN-CLINIC NOTE! After booking we will contact you for scheduling the exact course date! Courses dates are subject to change due to mentors availability. We will inform you via email if a date becomes available! PDO Threads course Our one-day Harley Elite Academy PDO cog thread lift ( Elite Mini Face Lift )training course is providing for Doctors ,Nurses , Dentist looking to further to present non-surgical facelift. It s the newest trend made popular by some of celebrities recently and it is an amazing and effective latest technique to mehanical lift and tighten skin. We provide second option using mono and screw it has the potential to redefine facial contours and induces collagen production. This type threads support structure for the tissue of the face by encouraging natural collagen synthesis with 30 % immediately results that peak at 6 months and more. During the training learn how to safely achieve mid and lower face lift and tight , we aim to help you master class techniquesre-volumisation and lifting using one of the highest quality products on the market PCL Threads. Thread Lift Masterclass Course You will perform this procedure on live models under the supervision You will practice using This master training will teach you how to introduce threads in Body areas including: Inner Thigh | Inner Arm | Knee | Tummy | Buttock Using threads: screw, mono and cogs. During Dermal Filler Masterclass, you will learn the full Anatomy of the face and gain practice.Anatomy, Vascular Supply of the face, Nerves Contraindications Complications Management Post treatment advice Additional information ATTENDANCE ONLINE (theory), IN-CLINIC (Practice) PDO THREADS LIFT AREA BEGINNER Face and Neck Threads Lift, ADVANCED Body Threads Lift, MASTERCLASS Face, Neck, Body Threads Lift, MASTERCLASS Foxy Eyes | Cat Eyes

Search By Location

- Courses in London

- Courses in Birmingham

- Courses in Glasgow

- Courses in Liverpool

- Courses in Bristol

- Courses in Manchester

- Courses in Sheffield

- Courses in Leeds

- Courses in Edinburgh

- Courses in Leicester

- Courses in Coventry

- Courses in Bradford

- Courses in Cardiff

- Courses in Belfast

- Courses in Nottingham