- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2840 Courses in Dalgety Bay

Overview This is a 2 day course on understanding credit markets converting credit derivatives, from plain vanilla credit default swaps through to structured credit derivatives involving correlation products such as nth to default baskets, index tranches, synthetic collateralized debt obligations and more. Gain insights into the corporate credit market dynamics, including the role of ratings agencies and the ratings process. Delve into the credit triangle, relating credit spreads to default probability (PD), exposure (EAD), and expected recovery (LGD). Learn about CDS indices (iTRAXX and CDX), their mechanics, sub-indices, tranching, correlation, and the motivation for tranched products. The course also includes counterparty risk in derivatives market where you learn how to managed and price Counterparty Credit Risk using real-world, practical examples Understand key definitions of exposure, including Mark-to-Market (MTM), Expected Exposure (EE), Expected Positive Exposure (EPE), Potential Future Exposure (PFE), Exposure at Default (EAD), and Expected Loss (EL) Explore the role of collateral and netting in managing counterparty risk, including the key features and mechanics of the Credit Support Annex (CSA) Briefly touch upon other XVA adjustments, including Margin Valuation Adjustment (MVA), Capital Valuation Adjustment (KVA), and Collateral Valuation Adjustment (CollVA). Who the course is for Credit traders and salespeople Structurers Asset managers ALM and treasury (Banks and Insurance Companies) Loan portfolio managers Product control, finance and internal audit Risk managers Risk controllers xVA desk IT Regulatory capital and reporting Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview 1 day course on forensic accounting and analysis to unearth financial manipulation by companies Who the course is for Investors and analysts – equity and credit; public and private Bank loan officers M&A advisors Restructuring advisors Auditors Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Interest Rate Options are an essential part of the derivatives marketplace. This 3-Day programme will equip you to use, price, manage and evaluate interest rate options and related instruments. The course starts with a detailed review of option theory, from a practitioner’s viewpoint. Then we cover the key products in the rates world (caps/floors, swaptions, Bermudans) and their applications, plus the related products (such as CMS) that contain significant ’hidden’ optionality. We finish with a detailed look at the volatility surface in rates, and how we model vol dynamics (including a detailed examination of SABR). The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview 1 day course covering mechanics, pricing and applications of cross currency swaps (CCS) and cross currency basis swaps (CCBS) Who the course is for Corporate treasurers and financial institution asset-liability management staff Interest rate and FX derivative traders, salespeople and quants Multi-lateral development banks Fixed income asset managers Risk management Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This 2 day course focuses on best practice bank ALM in today’s environment of a multiplicity of regulatory constraints on the balance sheet Who the course is for Asset Liability Committee (ALCO) members Treasury Risk Finance and internal audit capital management Funding management Liquidity buffer investment team Derivative structurers and salespeople; IT software providers Regulators Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

This 3 Days programme will equip you to use, price, manage and evaluate interest rate and cross-currency derivatives. The course starts with the building blocks of money markets and futures, through yield curve building to interest-rate and cross-currency swaps, and applications. The approach is hands-on and learning is enhanced through many practical exercises covering hedging, valuation, and risk management. This course also includes sections on XVA, documentation and settlement. The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation.

Overview This is a 2 day applied course on XVA for anyone interested in going beyond merely a conceptual understanding of XVA and wants practical examples of Monte Carlo simulation of market risk factors to create exposure distributions and profiles for derivatives used for XVA pricing Learn how to do Monte Carlo simulation of key market risk factors across major asset classes to create exposure distributions and profiles (with and without collateral) for derivatives used for XVA pricing. Learn how to calculate each XVA. Learn sensitivities of each XVA and how XVA desks manage these. Learn regulatory capital treatment of counterparty credit risk (both for CCR and CVA volatility) and how to stress test this within ICAAP or system-wide external, supervisor-led capital stress test. Who the course is for Anyone involved in OTC derivatives XVA traders XVA quants Derivatives traders and salespeople Risk management Treasury staff Internal audit and finance Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

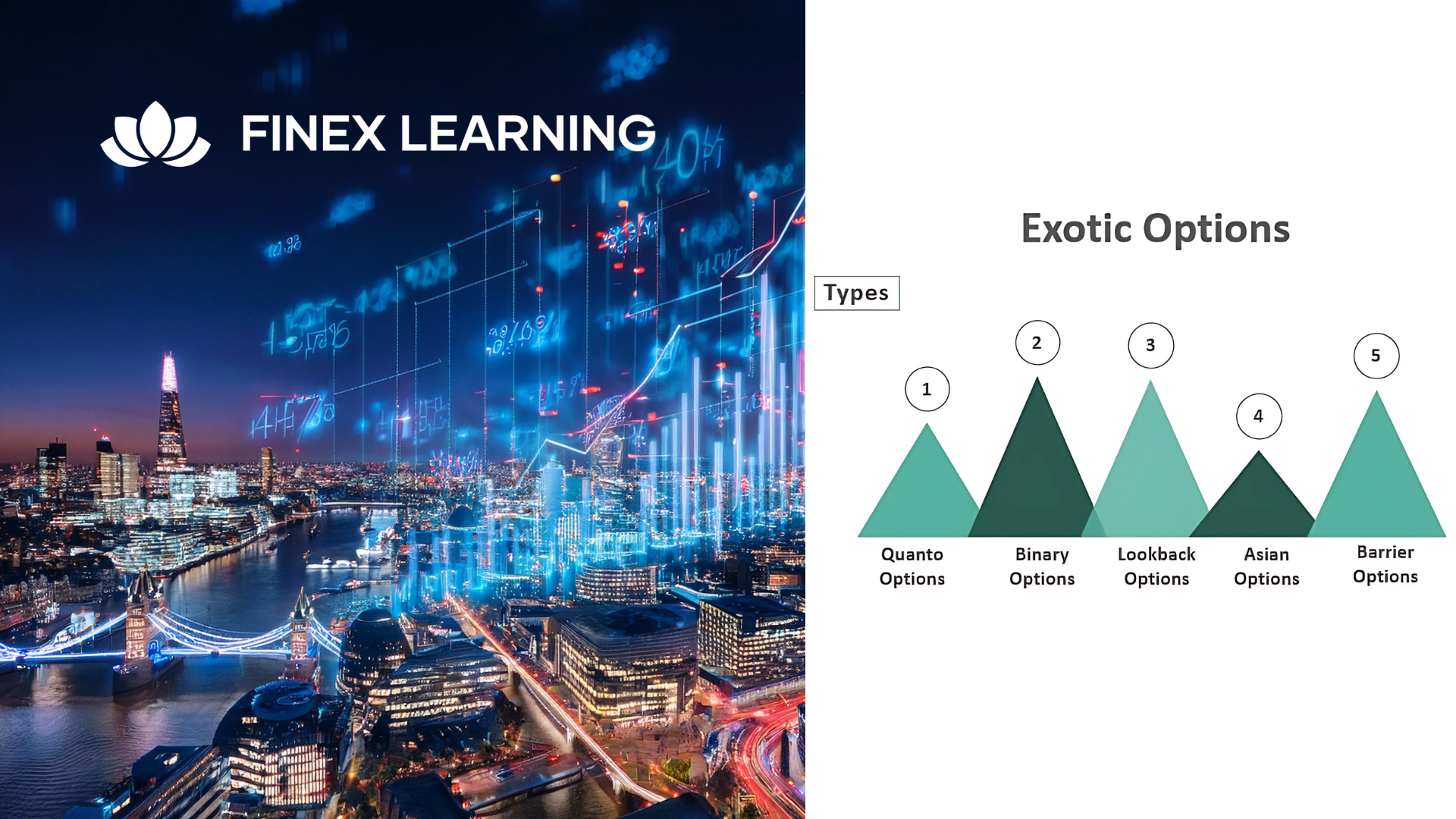

Overview This is a 1 Day Product course and as such is designed for participants who wish to improve the depth of their technical knowledge surrounding Exotic Options. Who the course is for Equity and Derivative sales Equity and Derivative traders Equity & Derivatives structurers Quants IT Equity portfolio managers Insurance Company investment managers Risk managers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

CS3 - Introduction to Working as a Member of a Confined Space Rescue Team

By Vp ESS Training

This course is designed to provide delegates that intend to work as part of a confined space rescue team with an introduction to planning and executing casualty rescue procedures and the equipment which may be required. This is intended for delegates who already hold a high risk (full Breathing apparatus) qualification such as our CS2. Note: A pre-requisite qualification is required to complete this course. The ESS CS2 course (https://www.vp-ess.com/training/confined-spaces/cs2-(high-risk)-confined-space-entry-full-breathing-apparatus,-self-rescue-and-ba-control/) must have been completed within 6 months as a pre-requisite for this CS3 course. Book via our website @ https://www.vp-ess.com/training/confined-spaces/cs3-introduction-to-working-as-a-member-of-a-confined-space-rescue-team/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Confined Space Risk Management and Permits

By Vp ESS Training

Confined Space Risk Management and Permits - This course includes a basic level of confined space knowledge with the opportunity to use confined space equipment in a simulated environment and a team exercise of creating and reviewing a safe system of work. Note: A pre-requisite qualification is required to complete this course. Day 1 is a CS1 course and the Confined Space Risk Management (CSRM) can be completed as a 1 Day add-on. Any of following courses can be completed as a pre-requisite within 12 weeks of the CSRM; CS1, CS2, 6160-09. Book via our website @ https://www.vp-ess.com/training/confined-spaces/confined-space-risk-management-and-permits/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Search By Location

- Courses in London

- Courses in Birmingham

- Courses in Glasgow

- Courses in Liverpool

- Courses in Bristol

- Courses in Manchester

- Courses in Sheffield

- Courses in Leeds

- Courses in Edinburgh

- Courses in Leicester

- Courses in Coventry

- Courses in Bradford

- Courses in Cardiff

- Courses in Belfast

- Courses in Nottingham