- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1531 Development courses in London

Leadership & Team Dynamics in Oil & Gas

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course One of the main challenges for today's managers is effectively leading and successfully communicating vision that inspires employees to perform. Good leadership engages people and employees who feel both engaged and enabled contribute to higher levels of growth and productivity. They will remain longer with the organisation, perform better and ultimately deliver better service to your customers. This popular 3 full-day course will equip you with key skills that you can utilise to maximise your staff's performance in line with the company's objectives. This interactive course will also empower you with strategic approaches to overcome the people challenges that you may encounter while enabling you to optimise your business strategies successfully. An ILM Recognised programme. Training Objectives What are the benefits that you will gain from attending this course? * Enhance your personal effectiveness and decision-making * Learn how to boost your influencing capability * Inspire enthusiasm, motivation and commitment * Communicate effectively across a multi-cultural team * Nurture your relationships and strengthen your team * Develop an empowering partnership team culture Target Audience Who should attend this course? Anyone involved in leading a business unit or a project team can attend. It covers relationships with host governments, contractors, suppliers and local communities which constitute critical alliances for the development of a project. This course is essential for team leaders, supervisors or managers from the following functions: Project management engineers from various technical disciplines Ad-hoc or special project team leaders in legal, technical & financial disciplines Country managers or business development officers of contractors JV management executives or officers Government officials or industry liaison officers Procurement or contracts executives or officers Trainer Your course leader is the author of Spirit IntelligenceTM and specialises in executive leadership facilitation and management development. He gained a first class honours degree in chemical engineering from Edinburgh University in Scotland and has undertaken postgraduate studies in psychology at Macquarie University in Sydney, Australia. Your course leader's corporate career spanned 14 years in Oil and Gas with BP, Amoco and AGL. Since 1993, he has worked across five continents with more than 170 clients including Rothschild, QBE, AT&T, Intel, Towers Perrin, Thomas Cook, Fujitsu, Nortel, Frank Russell, Electrolux, Arab Bank, Cable and Wireless, GSK, Merck, Sharpe and Dome, World Vision, Ericsson, IBM, Placer Dome Gold, Jim Beam, Ernst & Young and Commonwealth Bank of Australia. He focuses on what he calls tapping The Hidden Advantage to unleash the power of the whole person - the power of the body and mind, the passion of the emotions and the enthusiasm, motivation, commitment, initiative, creativity, resilience and persistence of the spirit in business. He is very experienced internationally in both skills enhancement and the strategic facilitation of tough and intractable client challenges. His approach is pragmatic. He provides his clients with a powerful range of practical tools and approaches to enable management to tap The Hidden Advantage latent in their staff and achieve optimum performance and results. A powerful and compelling speaker, he combines humour, energy and passion. He draws on a wealth of personal experience and thorough research. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Management of Value (MoV) Practitioner

By IIL Europe Ltd

Management of Value (MoV®) Practitioner This interactive MoV® Practitioner course provides a modular and case-study-driven approach to learning Management of Value (MoV). The core knowledge is structured and comprehensive; and well-rounded modules cover the methodology and various techniques. A case study is used to help appreciate the relevance of MoV in its practical application. What you will Learn The MoV Practitioner Course prepares you for the MoV Practitioner exam. Individuals certified at the MoV Practitioner level will be able to: Apply Management of Value (MoV) principles, processes and techniques, and advocate the benefits of this application appropriately to the senior Management. Develop a plan of MoV activities for the whole lifecycle of small and large projects and programs. Plan an MoV study, tailoring it to particular projects or programs and developing practical study or workshop handbooks as required. Understand and articulate value in relation to organizational objectives. Prioritize value drivers using function analysis and use these to demonstrate how value might be improved. Quantify monetary and non-monetary value using the Value Index, Value Metrics and the Value for Money ratio. Describe and comment on the application of various techniques relevant to MoV. Monitor improvements in value realized throughout a project lifecycle and capture learning which can be transferred to future projects. Offer suggestions and guidance about embedding MoV into an organization, including policy issues, undertake a health check, assess maturity and competence, and provide guidance on typical roles and responsibilities. Understand and articulate the use of MoV within other Best Management Practice methods and its contributions to them Benefits of Taking This Course Upon successful completion of this course, you will be able to: Organise and contribute constructively to a Management of Value (MoV) Study Demonstrate a knowledge of MoV principles, processes, approach, and environment Analyse a company, programme or project to establish its organisational value includes identification and weighting of Value Drivers Pass the AXELOS Practitioner Examination Function Analysis Customer FAST Diagram Value Tree Development Weighting Attributes Paired Comparisons Developing a Value Profile Developing a Value Index Value for Money Ratio Stimulating Innovation Value Engineering Option Evaluation and Selection Evaluation Matrix Value and Value for Money Timing and Planning Teams and Stakeholders MoV in the Organization Integrating with Best Management Practice Relationship between Process and Approach

Basin Analysis and Petroleum Systems

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course This 5 full-day course will focus on geological fundamentals: how different basin types differ in subsidence mechanisms, basin cycles, heat flow through time, depositional systems, structural styles and their type of petroleum systems. This will allow participants to make realistic interpretations in new areas; interpretations that are consistent with the specific basin type and to be expected depositional systems and structural styles. In addition, through simple paper-based exercises, the course will provide background and understanding of how some of the typical PBE products are made: creaming curves, Field-size plots and Yet-to-find. Finally, the essentials of commercial assessments will be covered. Training Objectives To provide participants with a sound understanding how, and under which conditions different basin types develop, and what the impact of their development is on the typical petroleum systems of these different basin types. To teach evaluation techniques that assist in the regional understanding and illustration of sedimentary basins and their development. While some of these techniques can be done using computers, in the course these will be done 'by hand' for maximum understanding. Target Audience This course is designed in the first place for geoscientists working in exploration and their direct supervisors. The course is also very instructive for specialist staff working closely with exploration staff such as (bio)stratigraphers, geochemists, basin modelers, structural geologists, geophysicists, reservoir engineers and petrophysicists. Course Level Intermediate Training Methods Each topic is introduced by a lecture, and leaning is re-enforced by practical exercises (on paper). There is ample time for discussions of general issues and any specific questions participants may have. For several exercises participants will be invited to do exercises on a basin of their choice, which will make the course more impactful for the participants. Participants will be provided with the following pre-read material: Concepts of Conventional Petroleum Systems. De Jager, J. (2020). Invited contribution for Regional Geology and Tectonics Volume 1: Global Concepts, Techniques and Methodology (eds: Adam, J., Chiarelly, D. & Scarselli, N. Play-Based Exploration of the petroleum potential of the Tremp-Graus, Ainsa and eastern Jaca Sub-basins in the southern De Jager, J & van Winden, M. (2020). invited contribution for Digital Learning - Multi-scale analysis of depositional systems and their subsurface workflows (eds: Grötsch, J. & Pöppelreiter, M.), EAGE. Trainer Your expert course leader has a PhD in Geology from the University of Utrecht. He worked for 31 years (1979 -2010) with Shell as an exploration geologist in a variety of functions across the globe. As Principle Technical Expert, he was responsible for ensuring that Risk & Volume assessments were carried out consistently and correctly in all of Shell's exploration units. In this capacity, he led and participated in countless prospect review sessions and developed and conducted a successful in-house course on Risks & Volume assessment. As manager of the Exploration Excellence Team, he performed in depth analysis of basins and plays and provided advice on exploration opportunities to senior management. Together with his team, he visited most of Shell's exploration offices, working hands-on with Shell's local exploration teams to generate new play and prospect ideas and to suggest evaluation techniques and technologies to apply. In 2010, he was appointed as extraordinary professor Regional and Petroleum Geology at the VU university of Amsterdam and in 2012 also at the University of Utrecht. He was visiting professor at the University of Malaya (Malaysia). Through his own consultancy, as of 2010, he provides advice on exploration activities to several companies and is regularly invited to carry out technical reviews. Activities cover all continents and include Portfolio Reviews, Prospect assessment, Play-based Exploration, and Geothermal activities. He conducts courses on several topics including Risk & Volume Assessment, Prospect Maturation, Basin Analysis, Play-based Exploration, Trap & Seal Analysis, Petroleum Geology for Non-geologists. Some of his recent publications include: De Jager, J. & van Winden, M. (2020): Play-Based Exploration of the petroleum potential of the Tremp-Graus, AÃnsa and eastern Jaca Sub-basins in the southern Pyrenees. Invited contribution for Digital Geology, EAGE special publication (eds: Grötsch, J. & Pöppelreiter, M.) De Jager, J. (2020). Concepts of Conventional Petroleum Systems. Invited contribution for Regional Geology and Tectonics Volume 1: Global Concepts, Techniques and Methodology (eds: Adam, J., Chiarelly, D. & Scarselli, N.) De Jager, J. (2021): Handbook Risk & Volume Assessment. Self-published De Jager, J., Van Ojik, K & Smit, R. (2023 - in preparation): Geological Development of The Netherlands. In: Geology of The Netherlands (eds: Ten Veen, J., Vis, G-J., De Jager, J. @ Wong, T.) POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Power BI® - Business Data Analytics

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course This 3 full-day training course will introduce participants to the Microsoft Power BI® software solution for extracting, manipulating, visualising and analysing data. This is a very practical, hands-on course that takes participants through a series of exercises which help users understand the Power BI® environment, how to use the key areas of functionality, and how to apply the tools it contains to design and produce analyses of their own data. The first two days focus on learning the key concepts and practising these using clean, simple datasets. The third day provides participants with the opportunity to apply what they've learned to their own data. This makes the course far more relevant and meaningful for them, it allows our facilitator to help them structure their data models, queries and DAX formulas correctly, and it allows our facilitator to help them solve any additional problems that may arise but which were not covered as part of the standard the course. In addition, at the end of the day, each participant walks away with something of real, practical use for their job role. Many previous participants have remarked that they obtained the most value from the course during the third day because otherwise, they wouldn't be able to do what they need to do. This is an introductory course and although it does not assume any prior experience with Power BI®, participants will gain much more from the course if they have at least used Power BI® a little prior to attending. Participants who have taught themselves Power BI® will also benefit from attending as the course will fill-in a number of gaps in their knowledge and will also extend what they know. A general understanding of databases, Excel formulas, and Excel Pivot Tables is useful though not essential. Comprehensive course notes, exercises and completed solutions are included. Microsoft® PowerBI® is a trademark of Microsoft Corporation in the United States and/or other countries. Training Objectives Upon completion of this training course, participants will be able to: Confidently use the Power BI® solution, including Power BI® Desktop, PowerBI®.com and the Power BI® Gateway Extract data from a variety of data sources and manipulate the data extracted so it is ready for analysis Combine data sources together and gain an introductory understanding of the M language Write formulas using the DAX language for generating custom columns, measures and tables Design reports and dashboards using a wide range of both built-in and custom visuals Publish reports and dashboards to PowerBI®.com Share reports and dashboards with others using PowerBI®.com Customize reports and dashboards so that different user groups automatically see their own personalized views Target Audience This training course is intended for: Financial Analysts Accountants Budgeting and planning specialists Treasury Risk Managers Strategic Planners This is an introductory course and although it does not assume any prior experience with Power BI®, participants will gain much more from the course if they have at least used Power BI® a little prior to attending. Participants who have taught themselves Power BI® will also benefit from attending as the course will fill-in a number of gaps in their knowledge and will also extend what they know. A general understanding of databases, Excel formulas, and Excel Pivot Tables is useful though not essential. Comprehensive course notes, exercises and completed solutions are included. Course Level Basic or Foundation Trainer Your expert course leader has a Masters (Applied Finance & Investment), B.Comm (Accounting & Information Systems), CISA, FAIM, F Fin and is a Microsoft Certified Excel Expert. He has over 20 years' experience in financial modelling, forecasting, valuation, model auditing, and management reporting for clients throughout the world. He is skilled in the development and maintenance of analytical tools and financial models for middle-market companies to large corporates, at all levels of complexity, in both domestic and international settings. He has trained delegates from a wide variety of Oil & Gas companies including Chevron, Woodside, BHP Billiton, Petronas, Carigali, Shell, Nippon, Eni, Pertamina, Inpex, and many more. He provides training in financial modelling for companies throughout the Asia, Oceania, Middle East and African regions. Before his current role, he spent 6 years working in the Corporate and IT Consulting divisions of a large, multinational Chartered Accounting firm. He is the author of a number of white papers on financial modelling on subjects such as Financial Modelling Best Practices and Financial Model Auditing. Highlights from his oil and gas experience include: Development of economic models to assist Decision Analysts modelling for a wide range of scenarios for multinational oil & gas assets. Auditing and further development of life of project models for Chevron's Strategic Planning Division analysing their North West Shelf assets. Development of business plan and budgeting models for multinational oil & gas assets. Development of cash flow and taxation models for a variety of oil gas companies. Consulting on Sarbanes Oxley spreadsheet remediation and risk assessment. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Subsea Production Engineering - Incorporating Subsea Tie-backs - Virtual Instructor Led Training

By EnergyEdge - Training for a Sustainable Energy Future

About this Virtual instructor Led Training (VILT) The Subsea Production Engineering Virtual instructor Led Training (VILT) course provides an overview of all of the functionalities and key interfaces of subsea equipment. The VILT course will refer to relevant industry engineering standards for subsea equipment, subsea tie-backs and critical operational requirements. The sessions will cover challenges associated with equipment design and installability, as well as a new module on subsea tie-backs. The primary learning objectives for this VILT course are met through a combination of interactive presentations, discussion and exercises. Training Objectives By the end of this VILT course, participants will be able to: Apply the requirements of related industry standards (API 6A/ 17D, API 17A etc.) engineering standards Understand the barrier and qualification requirements Identify the barriers in place given a specific mode of operation Evaluate and select which tree alternatives are valid based on the key design drivers Identify and describe the key design drivers Explain the importance of well kill rate Describe which tree alternatives are valid for certain scenarios based on an evaluation of the key tree design requirements Examine what effects subsurface requirements may have on tree design Understand the challenges associated with designing equipment for manufacturability and installability Recognise the implications of design changes to specific components and the effects on transportation and installation (such as what type of vessels, lifting equipment, and tools to use and the logistical requirements) Recognise the implication of design changes on manufacturability of subsea equipment Target Audience This VILT course provides a comprehensive understanding of the equipment used in subsea production systems. It is designed for petroleum engineers, production engineers, subsea project engineers and is also highly suitable for cost, planning, offshore installation and offshore operations engineers. Anyone directly or indirectly involved with subsea equipment will benefit from attending this VILT course - from engineers installing the equipment to procurement staff looking to understand more. Training Methods The VILT course will be delivered online in 4 half-day sessions comprising 4 hours per day, with 2 breaks of 10 minutes per day. Course Duration: 4 half-day sessions, 4 hours per session (16 hours in total). Trainer Most of his working life, your expert course leader has been in a role that has enabled him to pass on skills and knowledge to others. A full-time role in Training and Development came about in 1996 with the offer to take up a full-time teaching post at Aberdeen College. In 1998, he was recruited by Kvaerner Oilfield Products, an Oil & Gas industry company, specialising in Subsea Control Systems, to develop and implement a Training & Competence program acceptable for its staff of over 600 and their client companies - a challenge he could not resist. In 2003, he broadened his horizons and became an independent Training & Development consultant. Building a reputation for delivering training and development to the Oil & Gas industry to the highest standards, he later joined Jee Ltd, a leading subsea engineering and training company based in Aberdeen. He was tasked with a wide portfolio of training, coaching & mentoring to achieve high levels of competence for the client's staff and customers. He is also a Science and Engineering Ambassador (Scotland), promoting the need for engineers and technicians for Scotland's industries, a frequent consultant to the European Economic & Social Committee for standardising Vocational Skills training and competence throughout the EU. He holds memberships in the Society of Operations Engineers, Chartered Institute of Personnel & Development and Society of Underwater Technologies. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information about post training coaching support and fees applicable for this. Accreditions And Affliations

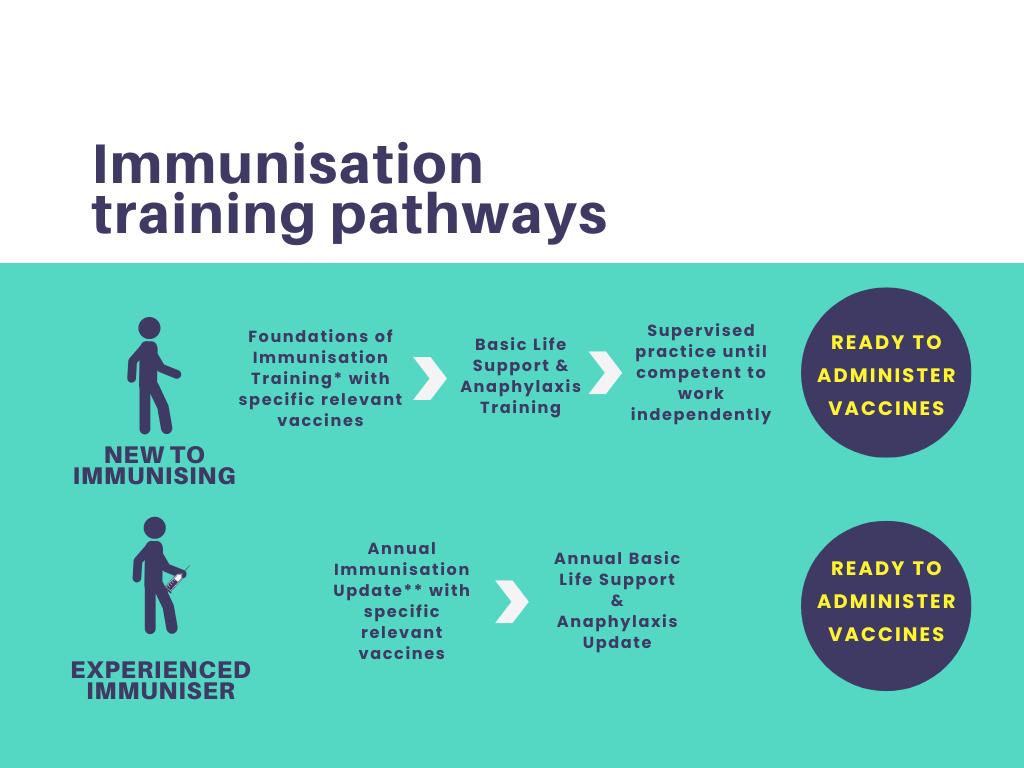

Foundations of Immunisation and Vaccines

By Guardian Angels Training

Gain a comprehensive understanding of immunisation and vaccines with our "Foundations of Immunisation and Vaccines" course. Designed for healthcare professionals, public health workers, and individuals interested in immunisation, this course covers vaccine development, administration, safety, and the role of vaccines in preventing infectious diseases.

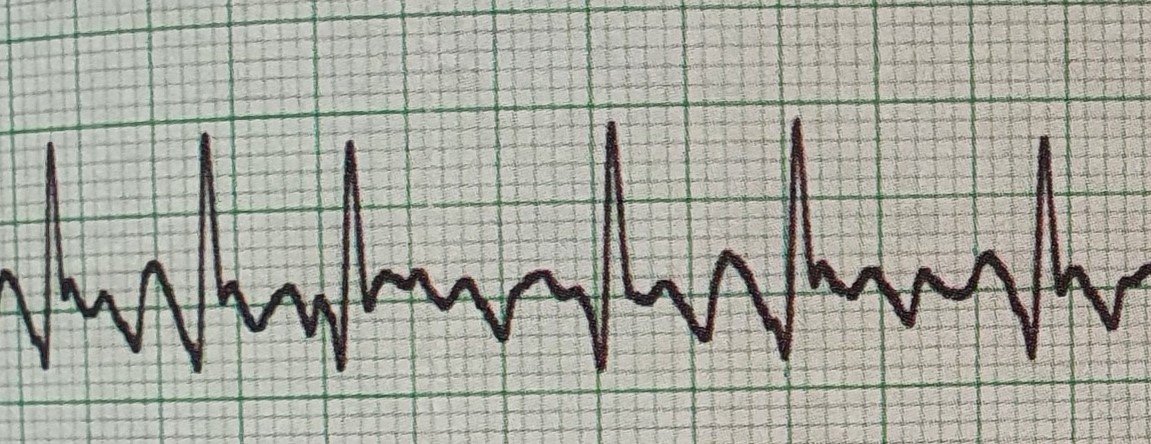

Basic ECG interpretation ECG basics for beginners ECG course for healthcare professionals ECG training for nurses Beginner ECG reading skills Introduction to ECG interpretation Understanding ECG rhythms Identifying common ECG abnormalities ECG strip reading practice ECG lead placement ECG graph paper essentials Interpreting normal sinus rhythms Recognizing cardiac arrhythmias Practical ECG exercises Hands-on ECG interpretation Expert instructors in ECG training CPD accredited ECG course 7 hours toward nursing revalidation Healthcare professional ECG certification Real-world ECG scenarios

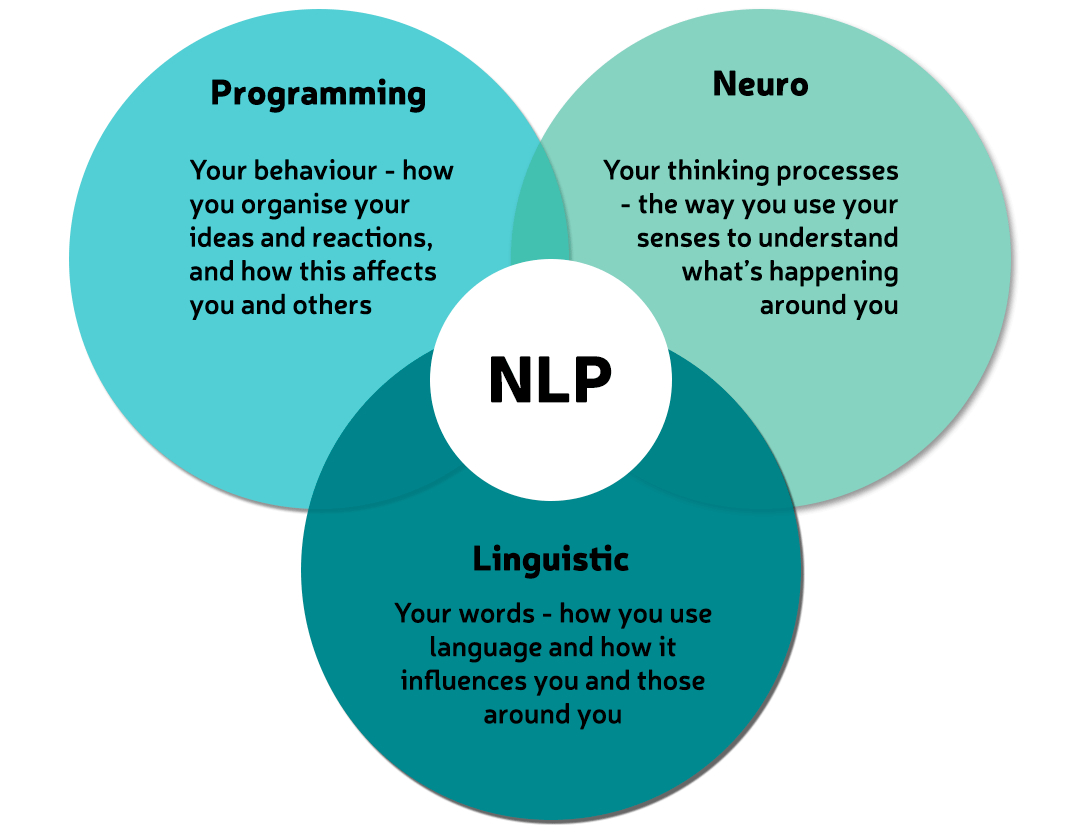

NLP Business Diploma (Fundamentals of Collaborative Working)

By Proactive NLP Ltd

NLP Business Diploma - The Fundamentals of Collaborative Relationships training & certification with Proactive NLP Ltd is your first step towards developing collaborative leadership and collaborative cultures. Start transforming your projects now!

Geomechanics

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course This five-day course provides an intermediate level of understanding of the geomechanical factors that affect wellbore instability, sand production and hydraulic fracture design. The course is structured such that upon completion, participants will have understood the value that geomechanics can bring to drilling, completion and production operations and will be able to leverage this value wherever it applies. The course emphasis will be on integrating the topics presented through a combination of lectures, case-studies and hands-on exercises. A special focus will be on how geomechanics knowledge is extracted from routinely acquired well data and how it is applied in the prediction and prevention of formation instability. Course Highlights The course is essentially non-mathematical and makes wide use of diagrams, pictures and exercises to illustrate the essential concepts of geomechanics Essential Rock Mechanics Principles Wellbore Stability Analysis Anisotropic Rock Properties for unconventional projects Lost Circulation and Wellbore Strengthening applications Sand Production Management Input to Hydraulic Fracture design Salt instability Training Objectives By attending this training, you will be able to acquire the following: Apply the basic concepts of geomechanics to identify, predict and mitigate against formation instability during drilling, completion and production Target Audience This course is intended for Drilling Engineers, Well Engineers, Production Technologists, Completion Engineers, Well Superintendents, Directional Drillers, Wellsite Supervisors and others, who wish to further their understanding of rock mechanics and its application to drilling and completion. There is no specific formal pre-requisite for this course. However, attendees are requested to have been exposed to drilling, completions and production operations in their positions and to have a recommended minimum of 3 years of field experience. Trainer Your Expert Course Instructor is an operational geomechanics advisor with over 46 years of experience in exploration, development and production in the upstream oil and gas industry. After obtaining a BSc (Hons) Physics degree from Aberdeen University, he worked for a variety of oil service companies in wireline operations, management and formation evaluation, before joining Schlumberger in 1995. Since 2000 he has worked principally in real-time geomechanics operations and developing acousto-geomechical applications, taking on the role of geomechanics advisor and technical manager within the Europe-Africa area of operations. Before forming his own company in 2014, Your Expert Course Instructor was one of Schlumberger's principal instructors, delivering cross-discipline internal and external geomechanics training to petrophysicists, geologists, reservoir, petroleum, well construction and drilling engineers at operating company locations, training centers and operational centers worldwide. Through extensive operational and wellsite experience gained in the North Sea, Europe, Africa, South America and the Far East, he has gained a broad based knowledge of drilling, production, log data acquisition, analysis and interpretation that has allowed him to develop and deliver pragmatic solutions to the geomechanical challenges of drilling, sand production, fracturing and unconventional reservoirs, faced by operators. His principal interests include the development and application of acousto-geomechanical techniques for the evaluation of anisotropic formations and fracture systems and the identification and prevention of wellbore instability POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information about post training coaching support and fees applicable for this. Accreditions And Affliations

Drilling Essentials for New Engineers and Non-Technical Professionals in Oil & Gas

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course Time is money in the oil business. Drilling time is big money. Whether in a technical, managerial or supporting role, you are a valuable asset to ensuring that project delivery targets are met and profits are realised. As drilling activities continue, professionals like you must grasp the language and technology of drilling operations in order to maximise expenditures throughout the producing life of a well. Drilling equipment and procedures have a unique language that must be conquered for maximum benefit. Clear and understandable explanations of drilling rig equipment, procedures, and their complex interactions provide an excellent foundation for smooth communication and increased efficiency in inter-department project team efforts. Drilling Essentials will help you de-mystify activities around the rig and well planning. It will explain the fundamentals of drilling with an emphasis on key areas such as logistical considerations, costing, and analysis of drilling contracts. Understand the urgency of drilling requests, know more about the cost implications of drilling-related problems, and understand the risks involved in a drilling contract. With the course director's drilling knowledge and skills, this is your opportunity to explore and understand important drilling concepts, principles, and technology which are presented in a reader-friendly format and illustrated with examples. As a non-drilling professional, you too can grow with the drilling industry with a deeper understanding of the critical role you play in contributing to its success! Training Objectives By attending this industry fundamentals Virtual Instructor Led Training (VILT) course, you will be better able to: Understand drilling terminology & drilling processes for completing onshore & offshore wells Appreciate major cost components of drilling operations and its impact for better project planning and management Better visualise major drilling equipment and their technical functions to promote a deeper understanding of the logistical and technical considerations Gain valuable insights on the drilling industry with a synopsis of recent technology developments that impact the drilling process Target Audience This Virtual Instructor Led Training (VILT) course has been developed for new engineers and forward-looking executives in the following fields who are interested in enhancing their knowledge and awareness of the drilling process for increased productivity & contribution to the team they're supporting: Accounting Commercial Finance & Administration General Management Logistics Procurement Tender Contract Administration E & P IT Finance Joint Ventures Materials Planning Sourcing Training Business Development Estimation & Proposal HSE Legal Planning & Budgeting Supply Chain Drilling Fluids Organisational Impact Your expert course leader has over 45 years of experience in the Oil & Gas industry. During that time, he has worked exclusively in the well engineering domain. After being employed in 1974 by Shell, one of the major oil & gas producing operators, he worked as an apprentice on drilling rigs in the Netherlands. After a year, he was sent for his first international assignment to the Sultanate of Oman where he climbed up the career ladder from Assistant Driller, to Driller, to wellsite Petroleum Engineer and eventually on-site Drilling Supervisor, actively engaged in the drilling of development and exploration wells in almost every corner of this vast desert area. At that time, drilling techniques were fairly basic and safety was just a buzz word, but such a situation propels learning and the fruits of 'doing-the-basics' are still reaped today when standing in front of a class. After some seven years in the Middle East, a series of other international assignments followed in places like the United Kingdom, Indonesia, Turkey, Denmark, China, Malaysia, and Russia. Apart from on-site drilling supervisory jobs on various types of drilling rigs (such as helicopter rigs) and working environments (such as jungle and artic), he was also assigned to research, to projects and to the company's learning centre. In research, he was responsible for promoting directional drilling and surveying and advised on the first horizontal wells being drilled, in projects, he was responsible for a high pressure drilling campaign in Nigeria while in the learning centre, he looked after the development of new engineers joining the company after graduating from university. He was also involved in international well control certification and served as chairman for a period of three years. In the last years of his active career, he worked again in China as a staff development manager, a position he nurtured because he was able to pass on his knowledge to a vast number of new employees once again. After retiring in 2015, he has delivered well engineering related courses in Australia, Indonesia, Brunei, Malaysia, China, South Korea, Thailand, India, Dubai, Qatar, Kuwait, The Netherlands, and the United States. The training he provides includes well control to obtain certification in drilling and well intervention, extended reach drilling, high pressure-high temperature drilling, stuck pipe prevention and a number of other ad-hoc courses. He thoroughly enjoys training and is keen to continue taking classes as an instructor for some time to come. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Search By Location

- Development Courses in London

- Development Courses in Birmingham

- Development Courses in Glasgow

- Development Courses in Liverpool

- Development Courses in Bristol

- Development Courses in Manchester

- Development Courses in Sheffield

- Development Courses in Leeds

- Development Courses in Edinburgh

- Development Courses in Leicester

- Development Courses in Coventry

- Development Courses in Bradford

- Development Courses in Cardiff

- Development Courses in Belfast

- Development Courses in Nottingham