- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1527 Development courses in London

Advanced C++ training course description The course will give a broad overview of the C++ Programming language, focusing on modern C++, up to C++17. This course will cover the use of the Standard Library, including containers, iterator, function objects and algorithms. From the perspective of application development, a number of design patterns will be considered. What will you learn Write C++ programs using the more esoteric language features. Utilise OO techniques to design C++ programs. Use the standard C++ library. Exploit advanced C++ techniques Advanced C++ training course details Who will benefit: Programmers needing to write C++ code. Programmers needing to maintain C++ code. Prerequisites: C++ programming foundation. Duration 5 days Advanced C++ training course contents Study of a string class Create a string class as a means to investigate many issues, involving the use of operator overloading and including overloading new and delete. Creation of the class will also require consideration of 'const correctness'. Exception handling Consider the issues involved in exception handling including the concept of exception safety. Templates Review definition of template functions, including template parameter type deduction. Introduction to template metaprogramming. Newer features including template template parameters and variadic templates. Creation of template classes. Design patterns Introduction to Design Patterns and consideration of a number of patterns, such as, factory method, builder, singleton and adapter. The standard C++ library (STL) Standard Library features, such as, Containers, Iterator, Function Objects and Algorithms. Introduction to Lambda expressions. C++ and performance The writing of code throughout the course will be oriented towards performant code, including use of R Value references and 'move' semantics. Pointers The use of pointers will be considered throughout the course. Smart pointers will be considered to improve program safety and help avoid the use of 'raw' pointers. Threading This section will consider the creation of threads and synchronisation issues. A number of synchronisation primitives will be considered. Async and the use of Atomic will also be considered. New ANSI C++ features Summarising some of the newer features to be considered are: Auto, Lambdas expression, smart pointers, variadic templates and folds, R Value references and tuple together with structured binding.

Overview Understanding the grants coming in and their monitoring, spending and many other factors are directly proportionate to effecting Grant Accounting and Grant Management. Many different funding entities give grants to so many companies, the government sector, and private sectors with the aim to encourage growth and employment and economic viability. It is important to recognise the government grants in the profit and loss account, so at the end, it can match the costs to which they relate. Considering these grants efficiently in the accounts is very important, as many entities (including the grant-making body) may closely monitor the accounts; and any errors will reflect badly on the accountant. Many development projects are funded through grants from donors. Therefore, it becomes the responsibility of the project management team to safeguard that the limited resources are used efficiently to achieve maximum impact. This course is planned to train the participants with best practices and essential skills in effective grants management.

Programming in HTML5 with CSS course description This course provides an introduction to HTML5, CSS3, and JavaScript. It is an entry point into both the Web application and Windows Store apps training paths. The course focuses on using HTML5 / CSS3 / JavaScript to implement programming logic, define and use variables, perform looping and branching, develop user interfaces, capture and validate user input, store data, and create well-structured application. What will you learn Create and style HTML5 pages. Use JavaScript. Style HTML5 pages by using CSS3. Use common HTML5 APLs in interactive Web applications. Create HTML5 Web pages that can adapt to different devices and form factors. Enhance the user experience by adding animations to the HTML5 page. Programming in HTML5 with CSS course details Who will benefit: Website developers. Prerequisites: HTML5 development fundamentals. Duration 5 days Programming in HTML5 with CSS course contents Overview of HTML and CSS Overview of HTML, Overview of CSS, Creating a Web Application by Using Visual Studio 2012. Hands on Exploring the Contoso Conference Application. Creating and Styling HTML5 Pages Creating an HTML5 Page, Styling an HTML5 Page. Hands on Creating and Styling HTML5 Pages. Introduction to JavaScript Overview of JavaScript Syntax, Programming the HTML DOM with JavaScript, Introduction to jQuery. Hands on Displaying Data and Handling Events by Using JavaScript. Creating Forms to Collect and Validate User Input Overview of Forms and Input Types, Validating User Input by Using HTML5 Attributes, Validating User Input by Using JavaScript. Hands on Creating a Form and Validating User Input. Communicating with a Remote Data Source Sending and Receiving Data by Using XMLHTTPRequest, Sending and Receiving Data by Using jQuery AJAX operations. Hands on Communicating with a Remote Data Source. Styling HTML5 by Using CSS3 Styling Text, Styling Block Elements, CSS3 Selectors, Enhancing Graphical Effects by Using CSS3. Hands on Styling Text and Block Elements using CSS3. Creating Objects and Methods by Using JavaScript Writing Well-Structured JavaScript, Creating Custom Objects, Extending Objects. Hands on Refining Code for Maintainability and Extensibility. Creating Interactive Pages using HTML5 APIs Interacting with Files, Incorporating Multimedia, Reacting to Browser Location and Context, Debugging and Profiling a Web Application. Hands on Creating Interactive Pages by Using HTML5 APIs. Adding Offline Support to Web Applications Reading and Writing Data Locally, Adding Offline Support by Using the Application Cache. Hands on Adding Offline Support to a Web Application. Implementing an Adaptive User Interface Supporting Multiple Form Factors, Creating an Adaptive User Interface. Hands on Implementing an Adaptive User Interface. Creating Advanced Graphics Creating Interactive Graphics by Using Scalable Vector Graphics, Programmatically Drawing Graphics by Using a Canvas. Hands on Creating Advanced Graphics. Animating the User Interface Applying CSS Transitions, Transforming Elements, Applying CSS Key-frame Animations. Hands on Animating User Interface Elements. Web Sockets for Real-Time Communications Introduction to Web Sockets, Sending and Receiving Data by Using Web Sockets. Hands on Implementing Real-Time Communications by Using Web Sockets. Creating a Web Worker Process Introduction to Web Workers, Performing Asynchronous Processing by Using a Web Worker. Hands on Creating a Web Worker Process.

ISO 13485:2016 specifies requirements for a quality management system where an organization needs to demonstrate its ability to provide medical devices and related services that consistently meet customer and applicable regulatory requirements. Such organizations can be involved in one or more stages of the life-cycle, including design and development, production, storage and distribution, installation, or servicing of a medical device and design and development or provision of associated activities (e.g. technical support). ISO 13485:2016 can also be used by suppliers or external parties that provide product, including quality management system-related services to such organizations.

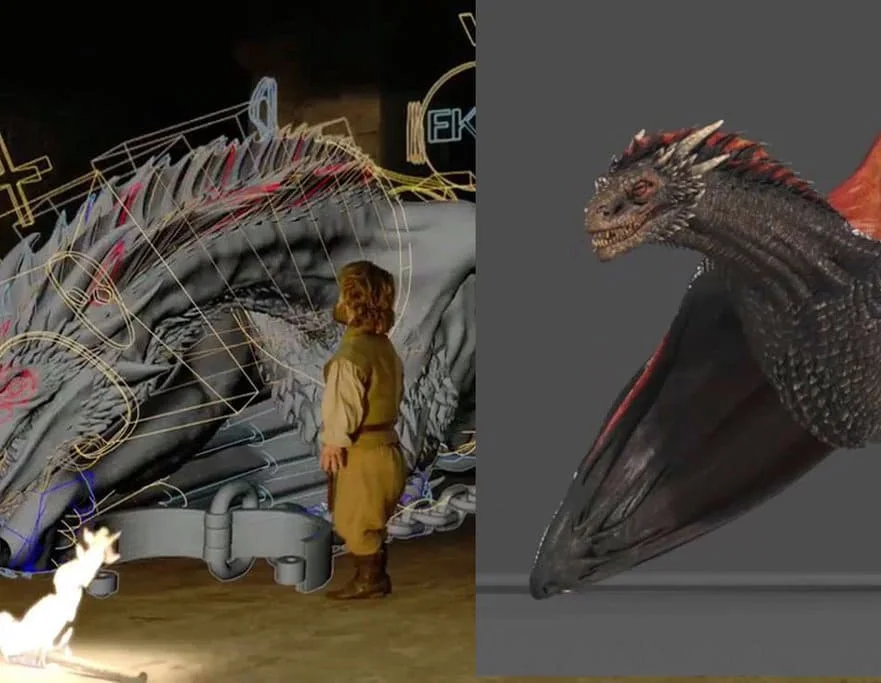

Diploma in Visual Effects for Film and Television Animation

By ATL Autocad Training London

Who is this course for? The Diploma in Visual Effects for Film and Television Animation is tailored for individuals aspiring to work in the Visual Effects, TV, Film, and 3D animation industry. Gain essential skills necessary for a successful career in these fields. Click here for more info: Website Duration: 120 hours of 1-on-1 Training. When can I book: 9 am - 4 pm (Choose your preferred day and time once a week). Monday to Saturday: 9 am - 7 pm (Flexible timing with advance booking). Course Overview for a 120-Hour Diploma Program in Game Design and Development Term 1: Introduction to Game Design and 3D Modeling (40 hours) Module 1: Introduction to Game Design (1 hour) Understanding the game development industry and current trends Exploring game mechanics and fundamental design principles Introduction to the game engines and tools utilized in the program Module 2: 3D Modeling with 3ds Max (25 hours) Familiarization with 3ds Max and its user interface Mastering basic modeling techniques like box modeling and extrusion Advanced modeling skills including subdivision and topology Texturing and shading techniques tailored for game development Module 3: Character Design and Animation (10 hours) Introduction to character design and its developmental process Creating and rigging characters specifically for games Keyframe animation techniques for character movement Term 2: Game Development and Unity 3D (40 hours) Module 4: Unity 3D Basics (20 hours) Navigating Unity 3D and understanding its interface Grasping fundamental game development concepts within Unity Creating game objects, writing scripts, and designing scenes Introduction to scripting using C# Module 5: Advanced Game Development with Unity 3D (10 hours) Constructing game mechanics including UI, scoring, and game states Working with physics and collision systems in Unity Crafting intricate game environments and level designs Module 6: Game Assets with Photoshop (10 hours) Exploring Photoshop tools and features for game asset creation Crafting game elements such as textures, sprites, and icons Optimizing assets for seamless integration into game development Term 3: Advanced Game Design and Portfolio Development (40 hours) Module 7: Advanced Game Design (20 hours) Delving into advanced game design concepts like balancing and difficulty curves Understanding player psychology and methods for engaging audiences Implementing game analytics and user testing for refinement Module 8: Portfolio Development (24 hours) Building a comprehensive portfolio showcasing acquired skills Effective presentation techniques for showcasing work Establishing a professional online presence and networking strategies Final Project: Creating and presenting a collection of best works in collaboration with tutors and fellow students Please note: Any missed sessions or absence without a 48-hour notice will result in session loss and a full class fee charge due to the personalized one-to-one nature of the sessions. Students can request pauses or extended breaks by providing written notice via email. What can you do after this course: Software Proficiency: Master industry-standard design tools for architectural and interior projects. Design Expertise: Develop a deep understanding of design principles and spatial concepts. Visualization Skills: Acquire advanced 2D/3D rendering and virtual reality skills for realistic design representation. Communication and Collaboration: Enhance communication skills and learn to collaborate effectively in design teams. Problem-Solving: Develop creative problem-solving abilities for real-world design challenges. Jobs and Career Opportunities: Architectural Visualizer Interior Designer CAD Technician Virtual Reality Developer 3D Modeler Project Coordinator Freelance Designer Visualization Consultant Students can pursue these roles, applying their expertise in architectural and interior design across various professional opportunities. Course Expectations: Maintain a dedicated notebook to compile your study notes. Schedule makeup sessions for any missed coursework, subject to available time slots. Keep meticulous notes and maintain a design folder to track your progress and nurture creative ideas. Allocate specific time for independent practice and project work. Attain certification from the esteemed professional design team. Post-Course Proficiencies: Upon successful course completion, you will achieve the following: Develop confidence in your software proficiency and a solid grasp of underlying principles. Demonstrate the ability to produce top-tier visuals for architectural and interior design projects. Feel well-prepared to pursue positions, armed with the assurance of your software expertise. Continued Support: We are pleased to offer lifetime, complimentary email and phone support to promptly assist you with any inquiries or challenges that may arise. Software Accessibility: Access to the required software is available through either downloading it from the developer's website or acquiring it at favorable student rates. It is important to note that student software should be exclusively utilized for non-commercial projects. Payment Options: To accommodate your preferences, we provide a range of payment options, including internet bank transfers, credit cards, debit cards, and PayPal. Moreover, we offer installment plans tailored to the needs of our students. Course Type: Certification. Course Level: Basic to Advanced. Time: 09:00 or 4 pm (You can choose your own day and time once a week) (Monday to Friday, 09 am to 7 pm, you can choose anytime by advance booking. Weekends can only be 3 to 4 hrs due to heavy demand on those days). Tutor: Industry Experts. Total Hours: 120 Price for Companies: £3500.00 (With VAT = £4200) For Companies. Price for Students: £3000.00 (With VAT = £3600) For Students.

Understanding Safe Clinical Practice Professional Development and Competence/Resilience/Mental Health and Wellbeing Interprofessional Communication Reflective Practice Health Promotion and Motivational Interviewing Clinical Skills and Chronic Disease-Asthma COPD/B12/Wound Care/Diabetes/Cardiovsacular/ECG's

The “ISO 30414:2018 Lead Auditor” course provides comprehensive training for participants to be able to: Understand to audit each and every ISO 30414:2018 guidelines; Identify measurement opportunities; diagnose HR financial and operational measures, Quantify HR department’s contribution to the overall bottom line, through solid, factual, and verifiable data and analyze toughest workforce decisions with easy-to-use mathematical formulas. Learn fundamental auditing skills;

Overview In this competitive era no matter how much hard work and solid efforts are contributed still, too many projects end up creating unneeded and unsellable products. There is a significant risk that the outcome of the project may not be relevant to the client/user requirements or become outdated when needs change. Here is where Design Thinking and Agile Management play their role. The combination of Agile and Design Thinking should be used in order to achieve impactful outcomes. Agile and design thinking together works well and gives an effective approach to product development, one that results in efficient resolutions to significant problems. In this course, you'll learn how to define and determine what's important to a user primary in the process, to frontload value, by directing your team on testable narratives about the user and generating an effectively shared perspective. For more dates and Venue, Please email sales@gbacorporate.co.uk

AgileBA Foundation and Practitioner

By IIL Europe Ltd

AgileBA® Foundation and Practitioner The AgileBA® Foundation and Practitioner course takes you through a business understanding of the external and internal forces that underline the project from a business perspective, looks at modeling techniques, (As Is - To Be), and also provides an overview to project management (AgilePM) from an 'Agile' perspective. The course explains the role's relevance and involvement throughout the project. What You Will Learn At the end of this program, you will be able to: Understand business analysis in a project environment and the techniques used, as well as knowing more about the role of the business analyst in a project Business Analysis - Business Environment and Organizational Strategy Overview of AgilePM The Business Case Stakeholder Engagement/Analysis Techniques: Requirements and Estimating Prioritization Timeboxing Iterative Development Planning Facilitated Workshops Modeling - 'As Is - To Be' Making the transition to AgileBA

Search By Location

- Development Courses in London

- Development Courses in Birmingham

- Development Courses in Glasgow

- Development Courses in Liverpool

- Development Courses in Bristol

- Development Courses in Manchester

- Development Courses in Sheffield

- Development Courses in Leeds

- Development Courses in Edinburgh

- Development Courses in Leicester

- Development Courses in Coventry

- Development Courses in Bradford

- Development Courses in Cardiff

- Development Courses in Belfast

- Development Courses in Nottingham