- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

M.D.D MY GIRLFRIEND LEFT ME FOR A RICHER GUY (MEN DATING SERVICES)

4.9(27)By Miss Date Doctor Dating Coach London, Couples Therapy

Assess past issues Organise new dates Training to avoid materialistic characters Analyse needs Dating/relationship training Advice pamphlet Eradicate defences in order to move on Support Assistance Coaching Bespoke programme relevant to clients specific case 3 phone sessions x 40 mins https://relationshipsmdd.com/product/m-d-d-my-girlfriend-left-me-for-a-richer-guy/

Mental Health First Aid Course

By Cavity Dental Training

Train as a Mental Health First Aider (MHFAider®) and receive three years of certification, plus access to ongoing benefits. This course is ideal for individuals who would like to become an MHFAider® to gain the knowledge and skills to spot signs of people experiencing poor mental health, be confident to start a conversation and signpost a person to appropriate support. In addition to the course, you will become part of the largest MHFAider® community in England, gaining access to resources, ongoing learning and 24/7 digital support through our MHFAider Support App®, to give you the tools and knowledge you need to carry out the role effectively and confidently, whether that be in your workplace, a volunteer role, or in the community. Choose between our upcoming courses dates, which include 4 half day morning sessions: March 4th including 5th 6th 7th April 15th including 16th 17th 18th Course Outcomes As an MHFAider® you will be able to: Recognise those that may be experiencing poor mental health and provide them with first-level support and early intervention Encourage a person to identify and access sources of professional help and other supports Practise active listening and empathy Have a conversation with improved mental health literacy around language and stigma Discuss the MHFAider® role in depth, including boundaries and confidentiality Practise self-care Know how to use the MHFAider Support App® Know how to access a dedicated text service provided by Shout and ongoing learning opportunities with MHFA England Course Format Online course structured across four flexible sessions. Each session is a maximum of 3hrs 45mins Learners will be trained over four live sessions with an MHFA England Instructor Member, covering 14 hours of content in total. Learning takes place through a mix of instructor led training, group discussions, individual and group activities. Each session builds on the previous, enabling the learner to gain confidence in supporting others with a Mental Health First Aid action plan. We limit numbers to 16 people per course so that instructors can keep people safe and supported while they learn. We strive for all of our learning content to be as accessible and inclusive as possible. Course Takeaways Everyone who completes this course gets: A hard copy workbook to support their learning throughout the course A digital manual to refer to whenever they need it after completing the course A wallet-sized reference card with the Mental Health First Aid action plan A digital MHFAider® certificate Access to the MHFAider Support App® for three years Access to ongoing learning opportunities, resources and exclusive events The opportunity to be part of the largest MHFAider® community in England

Leadership: Self-doubts into Self-Beliefs

By Mpi Learning - Professional Learning And Development Provider

Being a leader can take you into vulnerable places - the unfamiliar, high expectations and high visibility, with everyone looking to you for guidance in the big moments. It is natural for doubts to creep in, including the echoes of past knock-backs, put-downs, pressures, stereotyping and internalised oppression.

About this course This practical course will help primary teachers to understand the purpose of assessment in history and consider current best practice. We will explore ways of continuing to improve the quality of teaching and learning in history through effective assessment strategies. We will go through practical ideas and resources to enliven teaching and learning in history and provide opportunities for assessment. This course will provide guidance and support to help develop the accuracy of teacher judgements. During the course, we will look at examples of writing and outcomes from different schools and consider how these outcomes demonstrate progress and attainment in history. Outcomes • understand the purpose of assessment in history • consider current best practice • explore ways of continuing to improve the quality of teaching and learning in history through effective assessment strategies • explore practical ideas and resources to enliven teaching and learning in history and provide opportunities for assessment • provide guidance and support to help develop the accuracy of teacher judgements Course leader The course is led by Steven Kenyon. Steven is a member of the Historical Association’s primary committee, having worked as a primary school teacher and then Deputy Head Teacher between 2004 and 2018. He joined Lancashire Professional Development Service in April 2018 as a Teaching and Learning Consultant for Primary History and English. He works closely with Lancashire Archives to promote and develop local history work in primary schools. This year he is a judge for the Historical Association's Young Quills Awards.

PVOL203: Solar Training - PV System Fundamentals (Battery-Based) - Online

By Solar Energy International (SEI)

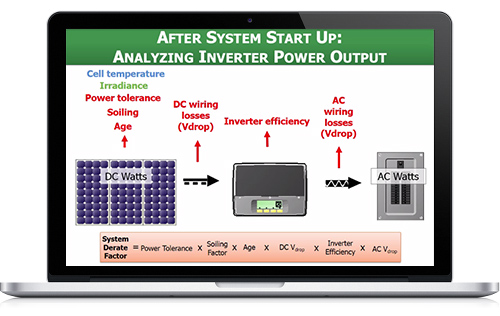

Students who complete PVOL203 will be able to: Recognize demand and PV production curves Identify the common types of PV systems and their major components Describe DC and AC coupled systems Discuss load profiles and modes of operation, including: peak load shaving, time-of-use, zero-sell, self-consumption prioritization, demand-side management Introduce utility-scale storage and microgrids Explain the relationship between real power, apparent power, and reactive power Complete a load estimate for different system types and for seasonal loads; evaluate electrical requirements of loads Identify phantom loads and efficiency upgrades Estimate starting surge and power factor requirements Describe the differences when sizing battery-based systems compared to grid-direct systems Choose a peak sun hour value based on design criteria for various systems Review battery basics and terminology Describe and compare different battery chemistries and technologies Find the capacity and voltage of different batteries; determine state of charge List safety precautions and hazards to be aware of when working with batteries; list appropriate personal protective equipment (PPE) Identify appropriate battery enclosures Calculate values for current, voltage, and energy for different battery bank configurations Review battery bank design parameters Complete a lithium-ion battery bank design example Review and compare different design example costs List features, options, and metering available for different types of battery chargers Explain basics of lithium battery charging Compare generator types and duty cycle ratings, including fuel options Identify specifications critical for choosing appropriate battery-based inverters Discuss different overcurrent protection devices and equipment disconnects and when/where they are required Define the maximum voltage drop slowed for the proper functioning of a battery-based PV system Identify safe installation procedures List basic commissioning tests which should be completed before and after a system is operating

PVOL304: Solar Training - Advanced PV Stand-alone System Design (Battery-Based) - Online

By Solar Energy International (SEI)

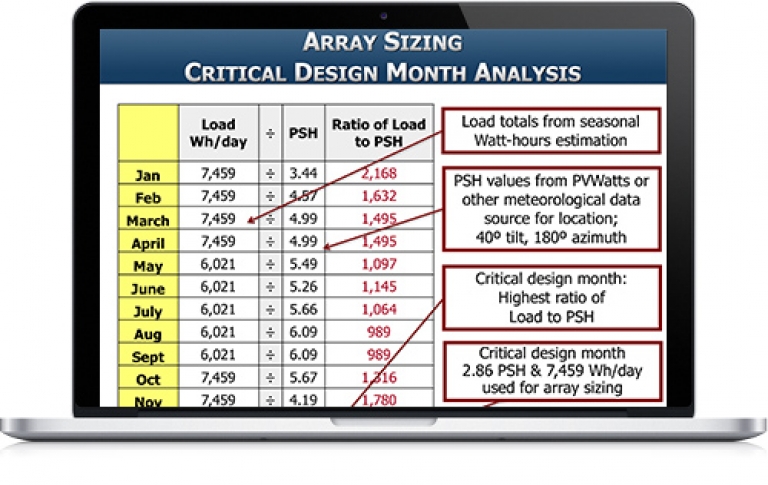

Define terms used in stand-alone systems Name common applications for stand-alone systems; describe basic component layouts Describe differences between AC and DC coupling State principle elements of a microgrid Define the importance of an accurate load analysis Review load analysis procedures; perform a load analysis based on daily data Review battery bank sizing for lead-acid and lithium-ion battery types Define array sizing variables and how they affect design for both MPPT and non-MPPT charge controllers Explain charge controller types and describe maximum power point tracking and voltage step-down Examine the calculations for PV array sizing Describe the difference between sizing for a non-MPPT and an MPPT charge controller Complete array configuration calculations for a system with a non-MPPT and an MPPT charge controller Summarize the parameters to check when selecting a charge controller Explain the purpose of DC load control and the three ways it can be implemented Identify design variables, advantages, and disadvantages of DC-only PV systems Describe how to size and integrate components for a recreational vehicle (RV) application Identify installation and maintenance considerations specific to mobile applications Identify applications and considerations for DC lighting systems Specify a battery-based inverter given electrical load and surge requirements Describe various configurations for stacking and clustering multiple inverters Examine inverter / charger size considerations Describe multiwire branch circuit wiring and concerns with single-phase supplies Describe the purpose and function of a generator Identify considerations that impact generator selection Solve for location-based performance degradation Specify a generator given electrical load, battery charging, and surge requirements Estimate approximate generator run time List generator maintenance Describe the National Electrical Code (NEC®) Articles that apply to the different parts of PV and energy storage systems (ESS) Identify NEC® requirements for workspace clearances, disconnects, and overcurrent protection devices (OCPD) that apply to PV systems Locate and apply specific requirements for storage batteries, stand-alone systems, and energy storage systems Identify labeling requirements List relevant building and fire codes Review installation considerations and best practices for stand-alone systems as related to batteries, design strategies, monitoring and metering, balance of system (BOS) equipment Review DC-coupled stand-alone residential system design Define operating modes of off-grid AC coupled PV systems Explain charge regulation of AC coupled PV inverters in a stand-alone system Discuss AC coupled PV system design strategies; evaluate equipment options for AC coupled off-grid applications Design a stand-alone microgrid system with PV (AC and DC coupled) and generator power sources Distinguish between isolated and non-isolated microgrids Compare concepts of centralized versus decentralized generation and controls Identify different types of microgrid analysis and planning software Review isolated microgrid use case examples Identify general PPE for battery system maintenance Develop a battery maintenance plan Identify methods to measure battery state of charge Identify common causes of battery problems and how to avoid them Identify PPE for lead-acid battery maintenance Develop a battery maintenance plan for lead-acid batteries Describe how to correctly add water to a flooded lead-acid (FLA) battery bank Identify methods to measure battery state of charge of FLA batteries Define when and why equalization is needed Identify common causes of battery problems and how to avoid them Note: SEI recommends working closely with a qualified person and/or taking PV 202 for more information on conductor sizing, electrical panel specification, and grounding systems. These topics will part of this course, but they are not the focus.

PVOL303: Solar Training - Advanced PV Multimode and Microgrid Design (Battery-Based) - Online

By Solar Energy International (SEI)

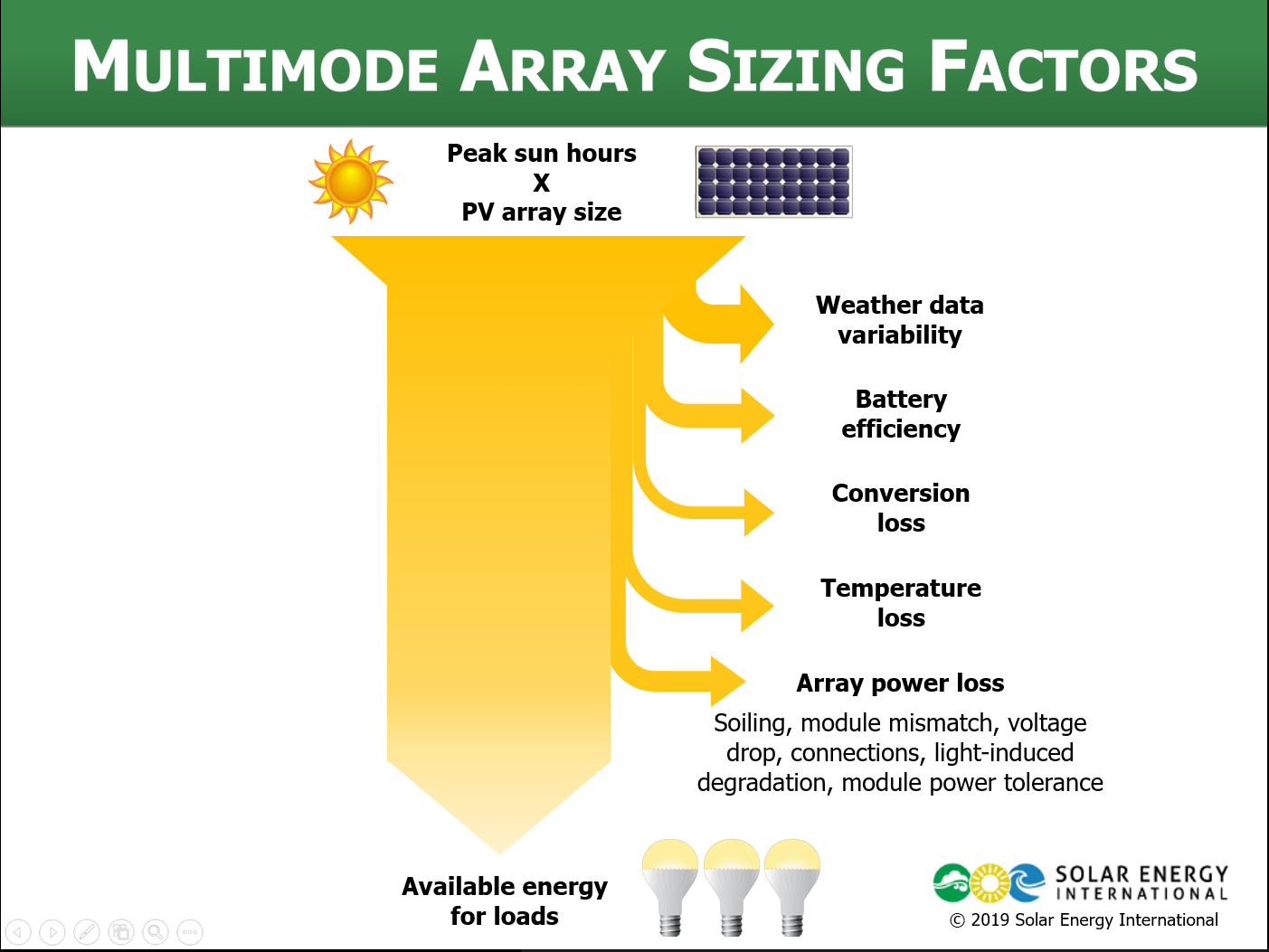

Define multimode system terminology Describe goals and applications of multimode systems Detail basic component layouts of multimode systems Define microgrid systems and diagram component layouts for microgrid applications List applications for multimode systems Distinguish between back-up and self-consumption use cases Examine daily and annual data to perform a load analysis Review battery bank sizing Identify PV array sizing methods and variables for multimode systems Calculate minimum PV array size to meet load requirements Calculate what percentage of overall annual consumption will be offset by selected PV array size Analyze data required to specify a multimode inverter Differentiate between sizing considerations for internal and external AC connections Describe various configurations for stacking and clustering multiple inverters Describe when and why advanced inverter functions are used Discuss the equipment and designs needed for advanced multimode functions Analyze each advanced multimode function List data needed to perform an accurate financial analysis of systems that use advanced multimode functions Describe factors that can affect the financial analysis of systems using advanced multimode functions Describe the National Electrical Code (NEC®) Articles that apply to the different parts of PV and energy storage systems (ESS) Identify specific requirements for ESS and systems interconnected with a primary power source List relevant building & fire codes Communicate specific requirements for workspace clearances, disconnects, & OCPD Describe PV system requirements that affect ESS installation List ESS labeling requirements Review DC coupled systems, including advantages and disadvantages Discuss MPPT charge controller operations and options Review charge controller sizing for grid-tied systems Design a DC coupled multimode PV system for a residential application Define operating modes of an AC coupled PV system while grid-connected or in island mode Explain charge regulation methods of grid-direct inverter output Review AC coupled PV system design strategies Evaluate equipment options for AC coupled multimode applications Design an AC coupled multimode PV system for a residential application Define Energy Storage System (ESS) Describe criteria for evaluating energy storage system configurations and applications Design ESS system for back-up power Describe large-scale energy storage system applications and functions; review use case examples Analyze equipment configuration options for large-scale AC and DC coupled systems Formulate questions to enable design optimization of large-scale energy storage systems Note: SEI recommends working closely with a qualified person and/or taking PV 202 for more information on conductor sizing, electrical panel specification, and grounding systems. These topics will be part of this course, but they are not the focus.

PVOL350: Solar Training - PV Systems - Tools and Techniques for Operations and Maintenance - Online

By Solar Energy International (SEI)

Discuss preventative and reactive maintenance plans and activities. Summarize safety procedures and PPE requirements for O&M technicians. Describe the field procedures required to evaluate the performance of PV systems. List appropriate requirements for meters, tools, and other equipment used in O&M activities. Define the theory, procedures, and processes behind insulation resistance testing, IV curve tracing, infrared cameras and thermal imaging, and other tools of the trade. Analyze test results to determine performance, compare baseline data, and pinpoint system issues. Describe inspection requirements for preventative maintenance inspections. Illustrate methods for locating and troubleshooting common PV array and system faults using appropriate methodologies and testing tools.