- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

IOSH - Working safely course

By Airborne Environmental Consultants Ltd

Planned changes to the Construction Skills Certification Scheme mean that from September 2017, Construction Related Occupation (CRO) cards will be phased out. Without registration on an accepted course, or an industry-recognised qualification for your trade, you will not be able to apply for a CSCS card, unless you apply for the CSCS Labourer Card, to access construction sites. An IOSH Working Safely Certificate, along with a CITB Health & Safety Certificate, allows you to apply for a Labourer Card. Therefore, from September 2017, without a CSCS card, you won't get on site. The Labourer Card may be the only way you can get on site.

Parents of adult children at risk

By Huntington's Disease Association

Virtual course for parents of adult children at risk/pre manifest. We are pleased to invite you to our virtual course for parents of adult children at risk/pre manifest. This is an opportunity to improve your knowledge of the issues surrounding your adult child at risk, share your experiences and gain ideas of support available for yourself and your adult child. This is a 5 week course running from Thursday 22 February 2024 10am -11.30am until Thursday 21 March, with the final session being an extended session narrative therapy session facilitated by Riverbank Psychology. There will be the opportunity to join a follow up support group. Week 1 – Thursday 22 February 2024 10am Welcome and overview of support available from the Huntington Disease Association. Speaker: James O’Connor – Team Leader HDYES – Huntington’s Disease Association Week 2 – Thursday 29 February 2024 10am Genetics: How to access testing, the process and family planning options Speaker: Chris Platt – SHDA – Huntington’s Disease Association Week 3 – Thursday 7 March 2024 10am Research update and what next Speaker: Nataile Saad - Research Sister - Welcome Trust Southampton University Hospital Week 4 – Thursday 14 March 2024 10am Finances planning ahead Speaker: Lisa Pearson - Financial Advisor - Asset management Week 5 – Thursday 21 March 2024 9.30 -12.30pm (note longer session)* Narrative Therapy: Coping with Feelings, supporting a loved one and self-care. Mariangels Ferrer – Clinical Psychologist – Riverbank Psychology * We will invite previous course participants to this part of the course but can only accommodate a maximum of 12/14 people on the day. The focus of Narrative Therapy in this group is to participate in a creative activity that explores identity through values, beliefs, and support systems, enabling us to make connections to our external lives which will be sustainable in our everyday lives. Mariangels Ferrer Duch is a Clinical Psychologist trained in Narrative Therapy who will be facilitating a three-hour Narrative Therapy session. The focus of the session will be upon the many small things that are important to us in life which can often be overlooked in times of stress. We hope the conversation will help to mutually inspire us all! We take your privacy seriously and promise to never sell your data. You can find out more about your rights, how we use your personal information and how we keep your details safe and secure by reading our privacy policy here. For more information email info@hda.org.uk or call 0151 331 5444.

Managing Mental Health & Wellbeing in Law Webinar

By Authentically Speaking

With the ongoing impact post pandemic and the shift to more remote working longer term, managing the mental health and well-being of our lawyers has become more important than ever. We know that as a HR professional / Head of People, you play a crucial role in ensuring the mental health and well-being of your firm. Often juggling this alongside many other responsibilities and demands on your time. A Head of People recently commented on what a lonely role this can be and we want to offer some support. That's why we're excited to invite you to our upcoming webinar on managing mental health and well-being in your firm. Webinar host, lawyer, coach and trainer specialising in lawyer wellbeing for the last 7 years, will offer valuable insights and practical tips on how you can support your lawyers' mental health during increasingly challenging times.

Better Business Cases Practitioner: Virtual In-House Training

By IIL Europe Ltd

Better Business Cases™ Practitioner: Virtual In-House Training Better Business Cases™ is based on the Five Case Model - which is the UK government's best practice approach to structuring spending proposals and making effective business decisions. Using this best-practice approach will allow organizations to reduce unnecessary spending and improve the decision-making process which gives you a greater chance of securing necessary funding and support for initiatives. The goal of the practitioner course is to develop a candidate's ability to deliver a comprehensive business case, through encouraging expanded knowledge to guide the practical application of theoretical foundations. Upon the completion of this Practitioner course, a candidate will be able to start applying the model to a real business case development project. What You Will Learn At the end of this program, you will be able to: Develop the lifecycle of a business case and to establish the relationships between the five cases Apply the steps in the business case development framework, in order to support the production of a business case, using the Five Case Model, for a given scenario Overview of Better Business Cases Alignment with the strategic planning process Importance of the Business Case using the Five Case Model Overview of the Five Case Model Purpose of the key stages in the development of a spending proposal Purpose of a Business Justification Case Business Case Development Process Purpose of project / programme assurance and assurance reviews Responsibility for producing the Business Case Determining the Strategic Context and Undertaking the Strategic Assessment Scoping the Scheme and Preparing the Strategic Outline Case Planning the Scheme and Preparing the Outline Business Case Procuring the Solution and Preparing the Full Business Case Implementation and monitoring Evaluation and feedback Making the Case for Change Agree on the strategic context Determine spending objectives, existing arrangements, and business needs Determine potential business scope and key service requirements Determine benefits, risks, constraint, and dependencies Exploring the Preferred Way Forward Agree on critical success factors Determine long list options and SWOT analysis Recommend a preferred way forward Determining Potential Value for Money Revisit the short list Prepare the economic appraisal for short-listed options Undertake benefits appraisal Undertake risk appraisal Select preferred option and undertake sensitivity analysis Preparing for the Potential Deal Determine the procurement strategy Determine service streams and required outputs Outline potential risk apportionment Outline potential payment mechanisms Ascertain contractual issues and accountancy treatment Ascertaining Affordability and Funding Requirement Prepare the financial model Prepare the financial appraisals Planning for Successful Delivery Plan programme / project management Plan change and contract management Plan benefits realization Plan risk management Plan programme / project assurance and post project evaluation Procuring the Value for Money Solution Revisit the case for change Revisit the OBC options Detail procurement process and evaluation of best and final offers (BAFOs) Contracting for the Deal Set out the negotiated deal and contractual arrangements Set out the financial implications of the deal Ensuring Successful Delivery Finalize project management arrangements and plans Finalize change management arrangements and plans Finalize benefits realization arrangements and plans Finalize risk management arrangements and plans Finalize contract management arrangements and plans Finalize post-project evaluation arrangements and plans

Better Business Cases Foundation and Practitioner

By IIL Europe Ltd

Better Business Cases™ Foundation and Practitioner Using this best-practice approach will allow organizations to reduce unnecessary spending and improve the decision-making process which gives you a greater chance of securing necessary funding and support for initiatives. The goal of the combined foundation and practitioner course is to develop a candidate's ability to deliver a comprehensive business case through encouraging expanded knowledge to guide the practical application of theoretical foundations. Upon the completion of this course, a candidate will be able to start applying the model to a real business case development project. The outline presented in the course overview will be addressed in the first 2 days, with the Foundation exam conducted on the morning of Day 3. Then the topics will be revisited at a deeper level, for 2 more days, with the Practitioner exam conducted on the afternoon of Day 5. What you will Learn At the end of this program, you will be able to: Develop the lifecycle of a business case and establish the relationships between the five cases Apply the steps in the business case development framework, in order to support the production of a business case, using the Five Case Model, for a given scenario. Overview of Better Business Cases Alignment with the strategic planning process Importance of the Business Case using the Five Case Model Overview of the Five Case Model Purpose of the key stages in the development of a spending proposal Purpose of a Business Justification Case Business Case Development Process Purpose of project / programme assurance and assurance reviews Responsibility for producing the Business Case Determining the Strategic Context and Undertaking the Strategic Assessment Scoping the Scheme and Preparing the Strategic Outline Case Planning the Scheme and Preparing the Outline Business Case Procuring the Solution and Preparing the Full Business Case Implementation and monitoring Evaluation and feedback Making the Case for Change Agree on the strategic context Determine spending objectives, existing arrangements, and business needs Determine potential business scope and key service requirements Determine benefits, risks, constraints, and dependencies Exploring the Preferred Way Forward Agree on critical success factors Determine long list options and SWOT analysis Recommend a preferred way forward Determining Potential Value for Money Revisit the short list Prepare the economic appraisal for short-listed options Undertake benefits appraisal Undertake risk appraisal Select preferred option and undertake sensitivity analysis Preparing for the Potential Deal Determine the procurement strategy Determine service streams and required outputs Outline potential risk apportionment Outline potential payment mechanisms Ascertain contractual issues and accountancy treatment Ascertaining Affordability and Funding Requirement Prepare the financial model Prepare the financial appraisals Planning for Successful Delivery Plan programme / project management Plan change and contract management Plan benefits realization Plan risk management Plan programme / project assurance and post-project evaluation Procuring the Value for Money Solution Revisit the case for change Revisit the OBC options Detail procurement process and evaluation of best and final offers (BAFOs) Contracting for the Deal Set out the negotiated deal and contractual arrangements Set out the financial implications of the deal Ensuring Successful Delivery Finalize project management arrangements and plans Finalize change management arrangements and plans Finalize benefits realization arrangements and plans Finalize risk management arrangements and plans Finalize contract management arrangements and plans Finalize post-project evaluation arrangements and plans

The vital role of CFOs in business exit preparation

By FD Capital

he role of a CFO extends beyond day-to-day financial management and plays a pivotal role in preparing a business for an exit. The role of a CFO extends beyond day-to-day financial management and plays a pivotal role in preparing a business for an exit, whether it be through a merger, acquisition, or other strategic transaction. Here are some key points to consider: Financial Due Diligence: CFOs play a crucial role in conducting financial due diligence to assess the company’s financial health and identify any potential risks or issues. This involves reviewing financial statements, accounting practices, contracts, and other financial data to ensure accuracy and transparency. Valuation and Financial Modeling: CFOs work closely with the executive team, external advisors, and investment bankers to determine the company’s valuation. They develop financial models, assess growth projections, and analyze market comparables to arrive at a fair and realistic valuation range. Financial Documentation and Reporting: CFOs ensure that financial documentation and reporting are in order, accurate, and compliant with regulatory requirements. This includes preparing financial statements, management reports, and other financial disclosures necessary for the exit process. Negotiation and Deal Structuring: CFOs collaborate with legal and executive teams to negotiate the terms of the exit transaction. They provide financial insights and expertise to structure the deal in a way that maximizes value for the company and its stakeholders. Tax Planning and Optimisation: CFOs work closely with tax advisors to develop tax-efficient strategies for the exit transaction. They assess potential tax implications, explore tax-saving opportunities, and ensure compliance with applicable tax laws and regulations. Financial Communication and Investor Relations: CFOs play a critical role in communicating the financial aspects of the exit to internal and external stakeholders. They work with investor relations teams to ensure that key messages are effectively conveyed, providing transparency and clarity throughout the exit process. https://www.fdcapital.co.uk/podcast/the-vital-role-of-cfos-in-business-exit-preparation/ Tags Online Events Things To Do Online Online Seminars Online Business Seminars #business #cfo #preparation #exit #vital

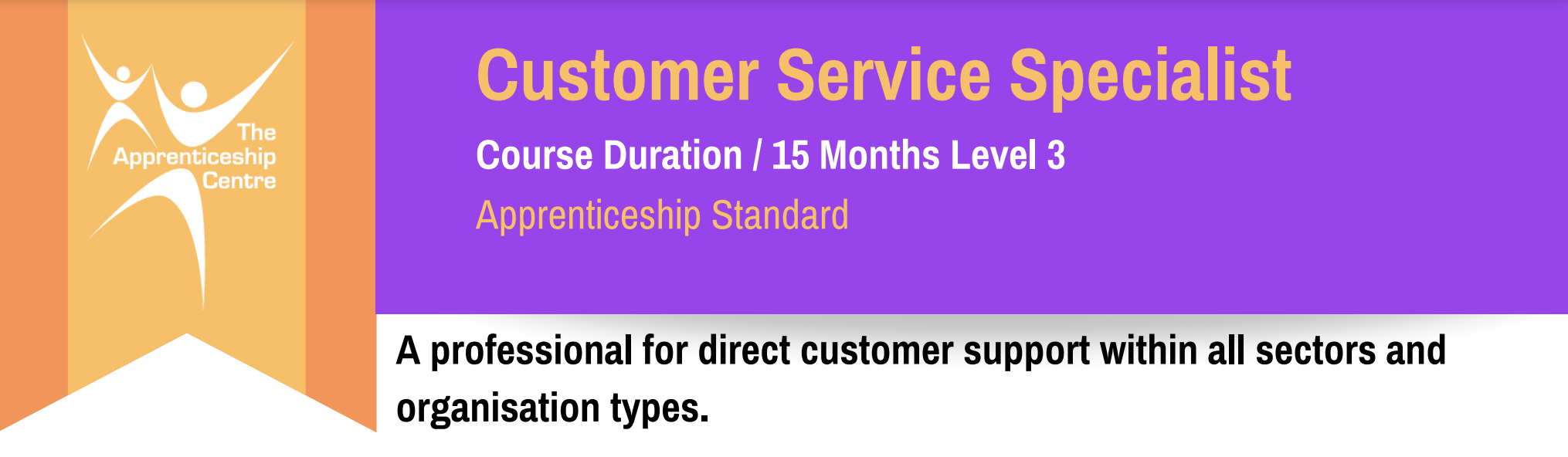

Customer Service Specialist Level 3

By Rachel Hood

A professional for direct customer support within all sectors and organisation types.

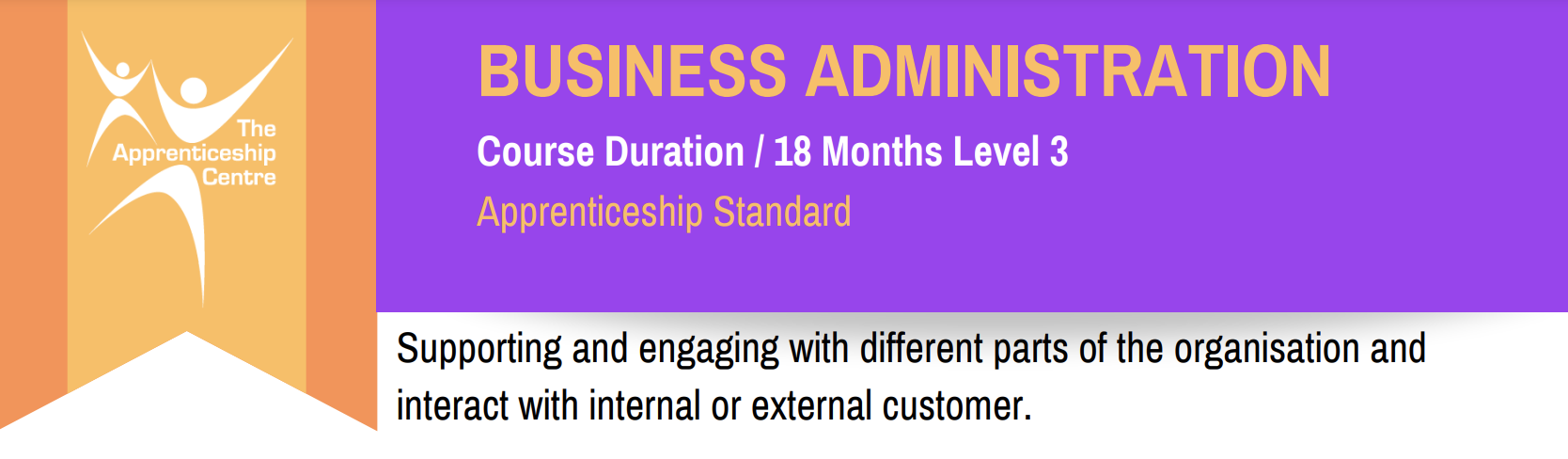

Business Administration Level 3

By Rachel Hood

Supporting and engaging with different parts of the organisation and interact with internal or external customer.

Supply Chain Logistics Operative Level 2

By Rachel Hood

Managing the movement of goods across all sectors and distances for a range of customers from private individuals and sole traders through to large global organisations.

Transport And Warehouse Operations Supervisor Level 3

By Rachel Hood

Manage the day to day operations involved in supply chain.