- Professional Development

- Medicine & Nursing

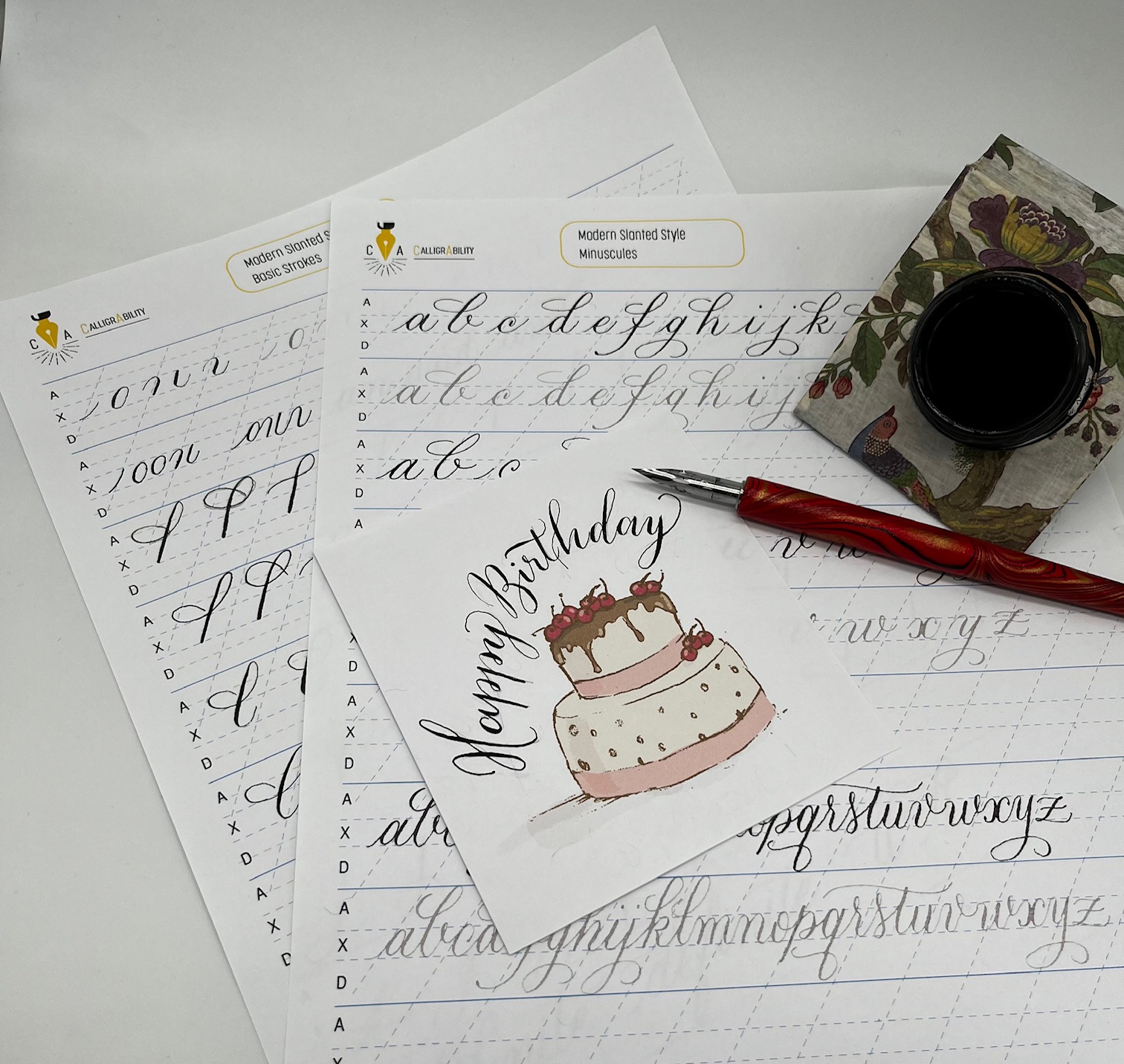

- Arts & Crafts

- Health & Wellbeing

- Personal Development

192 Courses delivered Live Online

Legal Aid - Family Controlled Work Billing Course

By DG Legal

The LAA operates a strict compliance regime when it comes to auditing family controlled work matters, and mistakes can often result in a Contract Notice, corrective action, and further follow-up activity within 6 months. This course will discuss the various aspects of family controlled work billing, with discussions on topics such as how to bill private law, public law, and help with mediation matters; how to evidence whether substantive negotiations and a settlement have taken place in private law matters; how do the LAA audit travel and other disbursement claims; what evidence must be present on files to avoid any issues on audit – including scope, gateway evidence, and forms/evidence of means (rules on evidence of means will be included in brief, however, a separate, more in-depth Civil Means Assessment Guidance Course is available); and the rules on claiming separate matters and escape fees. Key aspects of the Civil Contract and associated LAA Guidance (including the Codes Guidance) will be included, along with a discussion of common errors that are made. Target Audience This online course is aimed at anyone involved in billing Family Controlled Work matters or managing an LAA Family Contract. Resources Course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Steve Keeling, Consultant, DG Legal Steve joined DG Legal after leaving the Legal Aid Agency in August 2016. In his 17 years at the LAA, he worked in the audit team as both auditor and manager and was a Contract Manager for several years. Steve is also a certified SQM auditor and undertakes audits on behalf of Recognising Excellence as well as running training sessions for the SQM Audit Team periodically.

Anti-Money Laundering (AML) Training For Fee Earners Course

By DG Legal

In January 2024 alone, reports were published about the SRA taking enforcement action against 3 firms and 4 individuals for failure to comply with the Money Laundering Regulations 2017. The fines issued for these non-compliances total over £570,000 plus costs. The absence of staff training, or requirement to complete additional training, was noted in a number of these cases. Many of the breaches resulting in enforcement action involved failures by the fee earners to conduct appropriate due diligence, adequately check the source of funds and/or wealth or recognise and report red flags. As highlighted by enforcement action being taken against individuals as well as firms, fee earners cannot hide behind their firm when AML failures occur and may be held personally accountable by the SRA for non-compliances with the MLR 2017. This course will cover the following to assist fee earners in the application of AML in their casework. How to comply with your obligations and stay compliant Written CRA & MRA Client Booms Risks – what to consider? PCPs – CDD &EDD POCA / TA SOF and SOW On going monitoring Reporting to MLRO/MLCO Tipping off Target Audience The online course is suitable for fee earners or legal practitioners that want to improve their AML knowledge. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Helen Torresi, Consultant, DG Legal Helen is a qualified solicitor with a diverse professional background spanning leadership roles in both the legal and tech/corporate sectors. Throughout her career, she has held key positions such as COLP, HOLP, MLCO, MLRO and DPO for law firms and various regulated businesses and services. Helen’s specialised areas encompass AML, complaint and firm negligence handling, DPA compliance, file review and auditing, law management, and operational effectiveness in law firms, particularly in conveyancing (CQS).

Supervising Your Team Course

By DG Legal

Managing people and teams is consistently the biggest challenge raised by new managers (and even many experienced managers). This 3 hour course is aimed at introducing new and existing supervisors and managers to key supervisory skills, allowing them to develop their competence as supervisors. The course covers: Understanding your role as a supervisor SRA obligations and competence expectations Setting expectations and effective delegation Monitoring progress and quality Managing performance in difficult situations Top tips for impactful feedback By the end of this course participants will have had an opportunity to consider their current skills; develop new skills; and think about further development needs. Target Audience This online course is aimed at managers, team leaders and other supervisors. Please note that this course does NOT meet the LAA requirements as a Supervisor Course. If you need a Legal Aid Supervisor course, then please check out our Supervision & Managing Performance Course. Resources Course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Matthew Howgate, Consultant, DG Legal Matt is a non-practising solicitor who has considerable experience in regulatory issues and advising on complex issues of compliance and ethics. He is also an expert in data protection, UK GDPR and on the civil legal aid scheme. Matthew is a lead trainer on and co-developed the LAPG Certificate in Practice Management (a training programme for legal managers and law firm owners) as well as regularly providing training on legal aid Supervision, costs maximisation, data protection and security and on general SRA compliance.

Specialist Quality Mark (SQM) Standard Training Requirements Course

By DG Legal

This training is designed for lawyers and covers key topics to ensure compliance with the Specialist Quality Mark (SQM) and other regulations.

What to expect during standard Ofsted inspections of Independent Schools (for upto 20 people)

By Marell Consulting Limited

Gain the clarity and confidence to take on inspections successfully with this actionable workshop.

How to ensure consistent compliance with the Independent School Standards (for upto 20 people)

By Marell Consulting Limited

A workshop for independent schools that are inspected by Ofsted. Providing a proven strategy for ensuring compliance with the independent school standards.

Anti-Money Laundering (AML) Training For MLROs, MLCOs And Law Firm Management Course

By DG Legal

In January 2024 alone, reports were published about the SRA taking enforcement action against 3 firms and 4 individuals for failure to comply with the Money Laundering Regulations 2017. The fines issued for these non-compliances total over £570,000 plus costs. The absence of staff training, or requirement to complete additional training, was noted in a number of these cases. As a manager of a law firm, or more crucially an MLRO or MLCO, the ultimate responsibility for the firm's compliance, including with the MLR 2017, lies with you. It is your responsibility to ensure that the firm puts in place, reviews and updates compliant policies, controls and procedures. You must ensure that the firm maintains an up to date practice wide risk assessment. You are required to ensure that your employees are regularly given training on the MLR 2017 and associated risks. If a breach occurs, the SRA will take a wider look at the firm and identify any supervisory deficiencies that may have contributed to failures by fee earners or support staff. It has proven that it will not shy away from holding to account managers, compliance officers and MLRO/MLCOs for failures by their firms to comply with requirements of the MLR 2017. This course will cover the following to assist firms MLROs, MLCOs and Management with fulfilling their AML management responsibilities: How to comply with your obligations and stay compliant FWRA – linked with PCPs Mandatory AML Policies and Procedures - SRA have concerns Training and supervising staff Audits SRA requirements Reporting SARS POCA/TA Fulfilling reporting officer and compliance officer duties Target Audience The online course is suitable for MLROs, MLCOs, firm management and those supporting these roles. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Helen Torresi, Consultant, DG Legal Helen is a qualified solicitor with a diverse professional background spanning leadership roles in both the legal and tech/corporate sectors. Throughout her career, she has held key positions such as COLP, HOLP, MLCO, MLRO and DPO for law firms and various regulated businesses and services. Helen’s specialised areas encompass AML, complaint and firm negligence handling, DPA compliance, file review and auditing, law management, and operational effectiveness in law firms, particularly in conveyancing (CQS).

Masterclass Market Research

By Geoffrey Prince

Online Masterclass: How to Carry Out Market Research to Maximize Business Success Could you turn your brilliant business idea into a viable business? Do you wonder if your proposed new product or service will be a hit with customers? How can you find out before launching? This online Market Research Masterclass will empower you to: • Save time and money by carrying out market research effectively by yourself (without a big budget and without engaging a market research agency) • Design a market research questionnaire that will deliver the answers you are seeking • Analyse the results of your market research and estimate the size of the market • Use the results to fine-tune your business, product, or service so that it provides the benefits that potential customers are seeking Before launching a business, product, or service, it is important to evaluate your potential customer's wants and needs so that you don’t make costly mistakes. Market research allows you to discover exactly what your potential customers are looking for. Then, you'll be able to design and launch products or services that meet those needs, boosting your chances of business success. Join this masterclass if: • You have an idea for a business and want to test it first • You are starting up a business and evaluating one or more potential products or services • You have a well-established business and are thinking of launching a new product or service • You want to find out how to carry out your own market research for your small business. This interactive masterclass will take place on Zoom on Tuesday 15th March 2022 (5-30 pm – 7 pm) and on the following two Tuesdays. A handout will be emailed to you after each session. Further support is available on a 1-2-1 basis if required. This 3-session masterclass normally costs £149. The price has been reduced to £95 for February only. Places are limited. Book now at the special price of £95. If you would like to find out more about the Masterclass, book a free, 15-minute call with me.