- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Appreciative Inquiry

By Inovra Group

Overview Appreciative Inquiry is a form of action research that collects people’s stories of best practices. We can use these best practices as a way to initiate organisational change. This course will guide attendees through the process of Appreciative Inquiry (AI) and give them the techniques to succeed in using the AI system. This course will benefit anyone that leads change and wants to create positive dialogue that leads to improvements within their organisation. Description David Cooperrider, Suresh Srivastva, and their colleagues at Case Western Reserve University developed AI in the 1980s. According to them, the aim of Appreciative Inquiry is to help the organisation in: Envisioning a collectively desired future Realising that vision in ways that successfully translate intention into reality and beliefs into practices The AI approach can be applied in almost all groups of people and once the process starts, the change is put in motion. The appreciative approach works in individual conversations among colleagues, managers and employees. AI consultants around the world are increasingly using an appreciative approach to bring about collaborative and strengths-based change. This course will provide attendees with the means to effectively develop the skills of managers for the benefit of their organisation. They will be taken through the full process of appreciative inquiry; developing a wide understanding of the tools and techniques required to effectively improve communication and affect change. What can Appreciative Inquiry achieve? Well, just imagine you were better able to: Solve problems within an organisation in a positive and forward-thinking way. Be more curious and excited about the challenges faced within the business. Ask unconditional, positive questions to strengthen the organisations capacity to increase potential. Approach change in an affirmative mindset. Use questions to create movement and change within the company. Simply apply core communication skills, for overall organisational success Topics covered: What is Appreciative Inquiry? – A review of the subject with an activity that helps embed understanding and a case study that explains the process in action. Benefits of Appreciative Inquiry to the Organisation – Establishing how AI can aid and improve the way an organisation works and how people communicate within it. Exploring how specific organisational issues can be viewed positively. Appreciative Inquiry Questions – Understanding how questions can be used to identify positive organisational improvements and refocus our approach to business issues. Appreciative Inquiry Interviews – A set process for performing AI interviews and framing consultations to get the best out of those involved. A chance to practice the given approach and hone personal skills. The 4D Model – An overview of the AI 4D Model (Discovery, Dream, Design, Destiny) and how it is applied. The 4D Model: Topic – Demonstrating how selecting the topic is the beginning of the 4D model process. Choosing the participants own topic to work on throughout the training. The 4D Model: Discovery – Showing how positive discussions are kick-started at this stage and taking a chance to look at, ‘the best there is and what has been’. The 4D Model: Dream – ‘Thinking big and beyond what they have in the past’. Creating an amazing and positive vision for the future. The 4D Model: Design – Laying the foundation with a design of the vision, principles, and set of propositions that describe the ideal end state. Defining the desired state by creating a hierarchy and blueprint for success. The 4D Model: Destiny – Defining clear actions that will help the organisation and individuals achieve what they have set out to. The output is the self-reinforcing nature of using positive and affirmative inquiry to improve the business. The 4D Model: Summary Task – Review of learning and knowledge check. The Change Process – Exploring Dr. Kotter’s 8-step change process and how it can support the AI approach. Rooms of Change – Understanding feelings and attitudes to change, using this interesting and memorable model. Using an activity to help participants consider their own ‘change position’ and what this might mean for them. Strategies for Managing Change – A simple set of skills to help overcome the challenges faced by people trying to implement change. Applying these strategies to the 4D Model and Appreciative Inquiry. Recall Quiz – A chance to review learning in an engaging way. Summary – Developing actions and key points to take away. Who should attend Managers who want to learn about and practice the Appreciative Inquiry approach to drive positive changes. Requirements for Attendees None.

Yoga Module 3 - Jade Lady Weaving (1:1)

By Tim Cummins Yoga

The Jade Lady is another name for the Kundalini Shakti. This kriya uses hand and arm movements, coordinated with the breath to harmonise the prānic force and direct it inward for the subtle practices of hatha yoga

SketchUp Training Course for Interior Designers and Architects

By London Design Training Courses

Why choose SketchUp Training Course for Interior Designers and Architects? Course info During this training course, you will begin with an introduction to SketchUp, exploring its interface, fundamental concepts, including design tools, component, color and texture, and importing from 3D Warehouse related to interior design. Duration: 6 hrs. Method: 1-on-1, Personalized attention. Schedule: Tailor your own schedule by pre-booking a convenient hour of your choice, available from Mon to Sat between 9 am and 7 pm. Advantages of SketchUp: Intuitive and Fast: Compared to other 3D modeling software, SketchUp is simple, fast, and easy to use. Quick Learning Curve: Within a few hours, users can create simple models and get started with SketchUp. Efficient Modeling: SketchUp allows for the creation of models with fewer faces, optimizing performance. Versatility: Its non-parametric modeling principle makes SketchUp suitable for various applications. Rich Component Library: Access a vast collection of free components in the 3D Warehouse. Extensive Plugins: Benefit from numerous free plugins. Interior Designers' SketchUp Training Course Course Duration: 6 hours I. Introduction to SketchUp (1 hour) Overview of SketchUp for interior design Familiarization with the interface and essential tools Navigating the 3D environment efficiently Project creation and management II. Creating Floor Plans (1 hour) Importing and drawing floor plans accurately Wall, window, and door precision Effective floor level management Organizing designs with Layers and Scenes III. Furniture and Fixtures (2 hours) Accessing 3D Warehouse for furniture and fixtures Crafting custom elements for unique designs Strategic arrangement within the space Materials and textures customization IV. Advanced Modeling (1 hour) Utilizing advanced tools for intricate 3D models Organizing models with groups and components Adding details and finishes for high-quality design V. 3D Visualization (1 hour) Creating immersive 3D models Applying textures to walls, floors, ceilings Mastering rendering for realistic presentations VI. Importing and Exporting (30 minutes) Seamless collaboration with other software File formats and compatibility understanding Preparing models for 3D printing VII. Conclusion and Next Steps (30 minutes) Comprehensive review and key takeaways Further learning resources and improvement avenues Interactive Q&A and feedback collection SketchUp - SketchUp trial https://www.sketchup.com Unlock Your Design's Full Potential With SketchUp's Powerful 3D Software. VR Model Viewing. Free Trial Available. Secure Payment Options. Types: SketchUp Go, SketchUp Pro.

Microsoft Project Introduction/Intermediate - In-company

By Microsoft Office Training

Price £750 inc VAT Finance options In Company training - £750 for groups of up to 8 delegates. Discounts for Nonprofits/Charities... Study method On-site Duration 2 days, Full-time Qualification No formal qualification Certificates Certificate of completion - Free Additional info Tutor is available to students Course Objectives At the end of this course you will be able to: Identify the components of the Microsoft Project environment Create a new project plan Create the project schedule Use different views to analyse the project plan Create, allocate and manage resources in a project plan Finalise a project plan Track progress View and report project plan information ' 1 year email support service Customer Feedback Very good course. Learnt a lot. Looking forward to the next level. Alexandra - CIAL 1 year email support service Take a closer look at the consistent excellent feedback from our growing corporate clients visiting our site ms-officetraining co uk With more than 20 years experience, we deliver courses on all levels of the Desktop version of Microsoft Office and Office 365; ranging from Beginner, Intermediate, Advanced to the VBA level. Our trainers are Microsoft certified professionals with a proven track record with several years experience in delivering public, one to one, tailored and bespoke courses. Our competitive rates start from £550.00 per day of training Tailored training courses: You can choose to run the course exactly as they are outlined by us or we can customise it so that it meets your specific needs. A tailored or bespoke course will follow the standard outline but may be adapted to your specific organisational needs. Description Introduction to Microsoft Project Recap on project management concepts Project environment overview The 3 databases: Tasks, Resources and Assignments Different ways of displaying the Project Plan Access Help Creating a Project Plan Create a New Project Plan Project Information Create and apply the project calendar Defining recurring exceptions to the calendar Defining the calendar's work weeks Create the Summary tasks Create the Work Breakdown Structure Task creation and scheduling Exploring the Entry Table and its fields Task editing and the Task Information window Task Durations Defining Milestones Manual Scheduling vs Automatic Scheduling Changing the Task's Calendar Create a split in a Task Create Task Relationships Adding Lag or Lead to a Relationship Identifying the Critical Path Adding Constraints and Deadlines to Tasks Create Recurring Activities Adding Notes and links to Tasks Managing Resources Exploring the Entry Table and its fields Resource editing and the Resource Information window Resource Types Fixed Costs vs Variable Costs Adding Resource Costs Defining when costs accrue Changing the Resource Calendar and Availability Project calendar vs Resource and Task Calendar Assigning Resources to Tasks Effort Driven Scheduling Resolving Resource Overallocation Tracking the Project Progress Setting a Project Baseline Entering Actuals Different ways of viewing the Progress Checking if the Project is on track Viewing and Reporting Project Detail Adding Tasks to the Timeline and sharing it Modifying the Timescale and Zoom level Formatting the Gantt View Filtering and Grouping Tasks Print and Troubleshoot the Gantt View Using built-in Reports in Microsoft Project Who is this course for? This course is designed for a person who has an understanding of project management concepts, who is responsible for creating and modifying project plans, and who needs a tool to manage these project plans. Requirements General knowledge of the Windows OS Career path Microsoft Office know-how can instantly increase your job prospects as well as your salary. 80 percent of job openings require spreadsheet and word-processing software skills

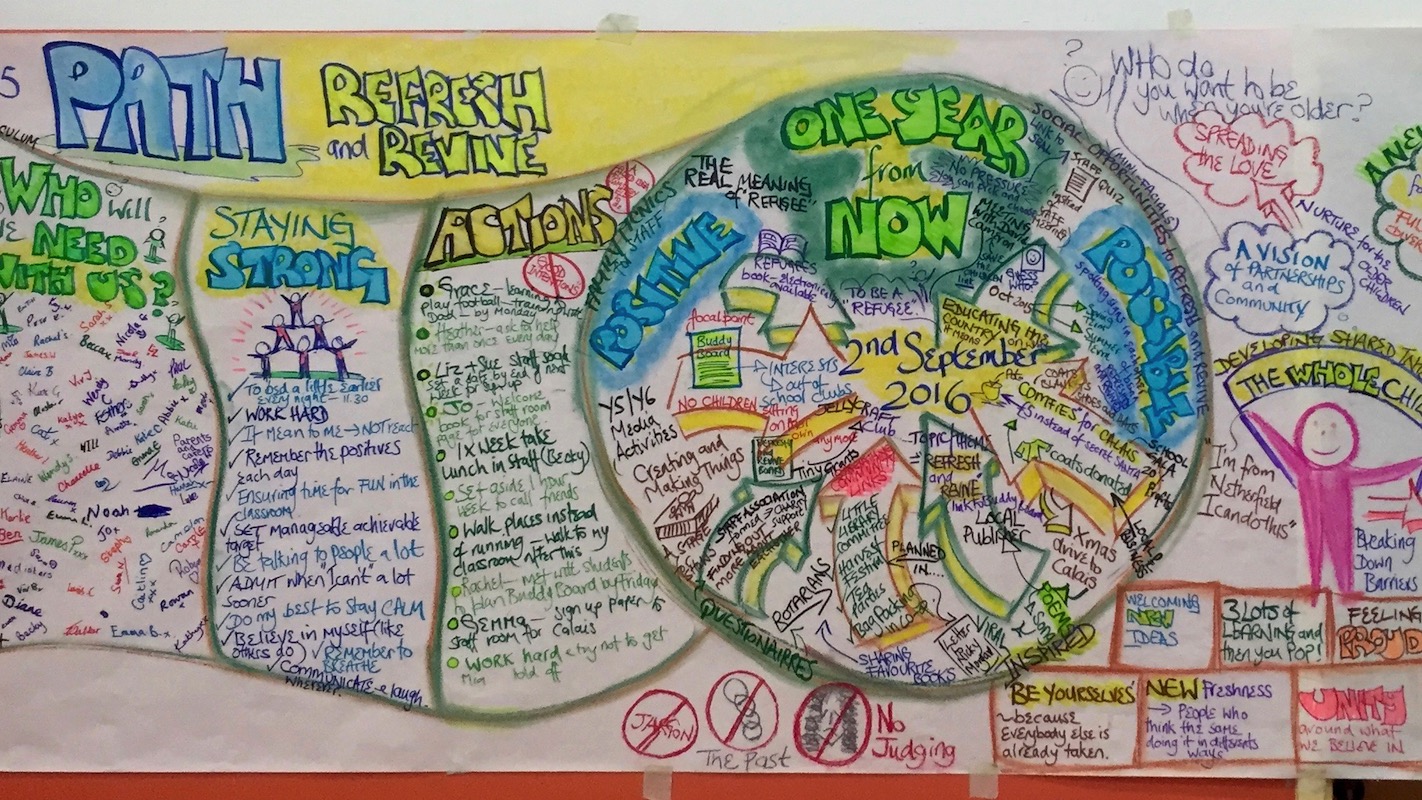

PATH – PERSON CENTRED PLANNING IN ACTION

By Inclusive Solutions

Need a PATH? A person-centred plan? This is a planning process not a training day. Let us facilitate your planning and refocus your story whilst strengthening you and your group, team, family, staff or organisation. This tool uses both process and graphic facilitation to help any group develop a shared vision and then to make a start on working out what they will need to do together to move towards that vision. Is your team or family stuck? Want to move on, but haunted by the past and cannot get any useful dialogue started about the future? Facing a challenging transition into a new school or setting? Leaving school? Bored with annual reviews, transition plans and review meetings? Want to find a way of making meetings and planning feel more real and engaging? Need an approach, which engages a young person respectfully together with his or her family and friends? Want the ultimate visual record of the process of a meeting, which will help everyone, keep track? Want to problem solve and plan for the future of a small or large group, service or organisation up to the size of an LA Give your team the opportunity to pause and reflect on what matters most to them about the work they do. The act of listening to each other creates relationship and strengthens trust and inclusion within the team – in creating a shared vision, groups of people build a sense of commitment together. They develop images of the future we want to create together, along with the values that will be important in getting there and the goals they want to see achieved along the way. Unfortunately, many people still think vision is the top leader’s job. In schools, the vision task usually falls to the Headteacher and/or the governors or it comes in a glossy document from the local authority or the DfES. But visions based on authority are not sustainable. Using the planning tool PATH (Pearpoint, Forest and OBrien 1997) and other facilitation sources we use both process and graphic facilitation to enable the group to build their picture of what they would love to see happening within their organisation/community in the future and we encourage this to be a positive naming, not just a list of the things they want to avoid. Outcomes To create a shared vision To name shared goals To enrol others To strengthen the group To explore connections and needs To specify an Action Plan To create a visual graphic record of the whole event Process Content PATH is a creative planning tool that utilises graphic facilitation to collect information and develop positive future plans. PATH goes directly to the future and implements backwards planning to create a step by step path to a desirable future. (Inclusion Press, 2000). These tools were developed by Jack Pearpoint, Marsha Forest and John O’Brien to help marginalised people be included in society and to enable people to develop a shared vision for the future. PATH can be used with individuals and their circle of support, families teams and organisations. Both MAP and PATH are facilitated by two trained facilitators – one process facilitator who guides people through the stages and ensures that the person is at the centre and one graphic facilitator who develops a graphic record of the conversations taking place in the room. Follow the link below to read a detailed thesis by Dr Margo Bristow on the use of PATH by educational Psychologists in the UK. AN EXPLORATION OF THE USE OF PATH (A PERSON-CENTRED PLANNING TOOL) BY EDUCATIONAL PSYCHOLOGISTS WITH VULNERABLE AND CHALLENGING PUPILS The findings indicate that PATH impacted positively and pupils attributed increased confidence and motivation to achieve their goals to their PATH. Parents and young people felt they had contributed to the process as equal partners, feeling their voices were heard. Improved pupil- parent relationships and parent-school relationships were reported and the importance of having skilled facilitators was highlighted. Although participants were generally positive about the process, many felt daunted beforehand, possibly due to a lack of preparation. Pre-PATHplanning and post-PATH review were highlighted as areas requiring further consideration by PATH organisers. Recommendations to shape and improve the delivery of PATH are outlined together with future research directions.

AAT Level 4 Diploma in Professional Accounting

By London School of Science and Technology

This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Course Overview This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Students will gain competencies in drafting financial statements for limited companies, recommending accounting systems strategies and constructing and presenting complex management accounting reports. Study the Level 4 Diploma in Professional Accounting to master complex accounting tasks and qualify for senior finance roles, as well as AAT full membership. The jobs it can lead to: • Accounts payable and expenses supervisor • Assistant financial accountant • Commercial analyst • Cost accountant • Fixed asset accountant • Indirect tax manager • Payroll manager • Payments and billing manager • Senior bookkeeper • Senior finance officer • Senior fund accountant • Senior insolvency administrator • Tax supervisor • VAT accountant Entry Requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Applied Management Accounting (mandatory): This unit allows students to understand how the budgetary process is undertaken. Students will be able to construct budgets and then identify and report on both areas of success and on areas that should be of concern to key stakeholders. Students will also gain the skills required to critically evaluate organisational performance. Learning outcomes: • Understand and implement the organisational planning process. • Use internal processes to enhance operational control. • Use techniques to aid short-term and long-term decision making. • Analyse and report on business performance. Drafting and Interpreting Financial Statements (mandatory): This unit provides students with the skills and knowledge for drafting the financial statements of single limited companies and consolidated financial statements for groups of companies. It ensures that students will have a proficient level of knowledge and understanding of international accounting standards, which will then be applied when drafting the financial statements. Students will also have a sound appreciation of the regulatory and conceptual frameworks that underpin the preparation of limited company financial statements. Learning outcomes: • Understand the reporting frameworks that underpin financial reporting. • Draft statutory financial statements for limited companies. • Draft consolidated financial statements. • Interpret financial statements using ratio analysis. Internal Accounting Systems and Controls (mandatory): This unit teaches students to consider the role and responsibilities of the accounting function, including the needs of key stakeholders who use financial reports to make decisions. Students will review accounting systems to identify weaknesses and will make recommendations to mitigate identified weaknesses in future operations. Students will apply several analytical methods to evaluate the implications of any changes to operating procedures. Learning outcomes: • Understand the role and responsibilities of the accounting function within an organisation. • Evaluate internal control systems. • Evaluate an organisation’s accounting system and underpinning procedures. • Understand the impact of technology on accounting systems. • Recommend improvements to an organisation’s accounting systems. Business Tax (optional): This unit introduces students to UK taxation relevant to businesses. Students will understand how to compute business taxes for sole traders, partnerships and limited companies. They will also be able to identify tax planning opportunities while understanding the importance of maintaining ethical standards. Learning outcomes: • Prepare tax computations for sole traders and partnerships. • Prepare tax computations for limited companies. • Prepare tax computations for the sale of capital assets by limited companies. • Understand administrative requirements of the UK’s tax regime. • Understand the tax implications of business disposals. • Understand tax relief, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs. Personal Tax (optional): This unit provides students with the fundamental knowledge of the three most common taxes that affect taxpayers in the UK: Income Tax, Capital Gains Tax and Inheritance Tax. With this knowledge students will be equipped to not only prepare the computational aspects of taxes, where appropriate, but also appreciate how taxpayers can legally minimise their overall taxation liability. Learning outcomes: • Understand principles and rules that underpin taxation systems. • Calculate UK taxpayers’ total income. • Calculate Income Tax and National Insurance contributions (NICs) payable by UK taxpayers. • Calculate Capital Gains Tax payable by UK taxpayers. • Understand the principles of Inheritance Tax. Audit and Assurance (optional): This unit aims to give a wider understanding of the principles and concepts, including legal and professional rules of audit and assurance services. The unit will provide students with an awareness of the audit process from planning and risk assessment to the final completion and production of the audit report. Students will also get a practical perspective on audit and assurance, with an emphasis on the application of audit and assurance techniques to current systems. Learning outcomes: • Demonstrate an understanding of the audit and assurance framework. • Demonstrate the importance of professional ethics. • Evaluate the planning process for audit and assurance. • Review and report findings. Cash and Financial Management (optional): This unit focuses on the important of managing cash within organisations and covers the knowledge and skills to make informed decision on financing and investment in accordance with organisational policies and external regulations. Students will identify current and future cash transactions from a range of sources, learn how to eliminate non-cash items and use various techniques to prepare cash budgets. Learning outcomes: • Prepare forecasts for cash receipts and payments. • Prepare cash budgets and monitor cash flows. • Understand the importance of managing finance and liquidity. • Understand the way of raising finance and investing funds. • Understand regulations and organisational policies that influence decisions in managing cash and finance. Credit and Debt Management (optional): This unit provides an understanding and application of the principles of effective credit control systems, including appropriate debt management systems. Students will be introduced to techniques that can be used to assess credit risks in line with policies, relevant legislation and ethical principles. Learning outcomes: • Understand relevant legislation and contract law that impacts the credit control environment. • Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures. • Understand the organisation’s credit control processes for managing and collecting debts. • Understand different techniques available to collect debts. DURATION 420-440 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Electricity Pricing and Marginal Cost Analysis - Virtual Instructor Led Training (VILT)

By EnergyEdge - Training for a Sustainable Energy Future

Develop a deep understanding of electricity pricing and marginal cost analysis with EnergyEdge's virtual instructor-led training course. Enroll now for a rewarding learning journey!

Search By Location

- groups Courses in London

- groups Courses in Birmingham

- groups Courses in Glasgow

- groups Courses in Liverpool

- groups Courses in Bristol

- groups Courses in Manchester

- groups Courses in Sheffield

- groups Courses in Leeds

- groups Courses in Edinburgh

- groups Courses in Leicester

- groups Courses in Coventry

- groups Courses in Bradford

- groups Courses in Cardiff

- groups Courses in Belfast

- groups Courses in Nottingham