- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

6713 Compliance courses in Ryton delivered Online

EU Customs and Compliance Mini Bundle

By Compete High

The EU Customs and Compliance Mini Bundle is your shortcut to high-demand roles in international trade, logistics, and regulatory affairs. If you're looking to break into careers involving Export/Import, KYC, GDPR compliance, Customer Service, or Administrative Skills, this bundle was designed with one goal: to get you hired faster. Every major company dealing with the EU needs experts in Export/Import, GDPR, and KYC. Customer Service and Administrative Skills tie it all together—making this bundle the ideal choice for those ready to enter or elevate within compliance-heavy sectors. Miss this opportunity, and you may be watching others get hired into roles you could’ve easily qualified for. Description The EU Customs and Compliance Mini Bundle combines some of the most employment-relevant skill areas in today’s cross-border and regulatory job market. Export/Import expertise is critical for logistics, freight, and customs-related roles, especially as EU regulations tighten. Whether it’s trade documentation or shipping logistics, Export/Import knowledge is a job market essential. KYC—Know Your Customer—is now a requirement in banking, fintech, insurance, and beyond. Add GDPR and you're instantly valuable to companies managing sensitive EU data. GDPR isn’t optional—it’s law, and recruiters are actively searching for those who understand how it applies across industries. Customer Service and Administrative Skills complement your compliance profile by proving that you can manage workflow, handle clients, and support daily operations in complex environments. Whether your goal is to work in a customs office, a logistics firm, a legal compliance team, or a finance department, the Export/Import, KYC, GDPR, Customer Service, and Administrative Skills foundation this bundle provides is a powerful launchpad. FAQ Q: Is this bundle relevant to careers in EU trade and compliance? A: Absolutely. Export/Import, KYC, and GDPR are core compliance topics across the EU job market. Q: Will this help in landing Customer Service or Admin roles in regulated sectors? A: Yes. Customer Service and Administrative Skills are crucial across logistics, trade, and finance industries. Q: Is this bundle suitable for someone looking to work in shipping or freight? A: Definitely. Export/Import knowledge is essential in shipping and freight roles. Q: Do GDPR and KYC really increase employability? A: Yes—these are legal compliance essentials and appear in thousands of EU job listings. Q: Why choose this bundle over individual courses? A: You get five highly employable skills—including Export/Import, GDPR, and KYC—for a fraction of the cost. Q: Is it beginner-friendly? A: Yes. No prior knowledge needed to start benefiting from the skills in this bundle.

***24 Hour Limited Time Flash Sale*** LOLER, PUWER & Construction Safety Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Introducing our premium bundle, "LOLER, PUWER & Construction Safety", your theoretical guide to a safer, more efficient construction site! Within this compilation, you'll find three QLS-endorsed courses focusing on LOLER Training, PUWER, and Construction Safety. These courses will expand your knowledge of the essential legal requirements in operating lifting equipment, the use of work equipment, and the critical safety protocols in construction. Each of these QLS-endorsed courses comes with a hardcopy certificate upon completion, a physical testament to your dedication. Additionally, enhance your learning journey with our five CPD QS accredited courses. Learn about Building Quantity Surveying, Construction Site Management, the Construction Industry Scheme (CIS), LEED V4.1 - Building Design and Construction, and the WELL Building Standard. A comprehensive grasp of these subjects will enable you to navigate the construction industry with confidence. Key Features of the LOLER, PUWER & Construction Safety Bundle: 3 QLS-Endorsed Courses: We proudly offer 3 QLS-endorsed courses within our LOLER, PUWER & Construction Safety bundle, providing you with industry-recognized qualifications. Plus, you'll receive a free hardcopy certificate for each of these courses. QLS Course 01: LOLER Training QLS Course 02: PUWER QLS Course 03: Construction Safety 5 CPD QS Accredited Courses: Additionally, our bundle includes 5 relevant CPD QS accredited courses, ensuring that you stay up-to-date with the latest industry standards and practices. Course 01: Building Quantity Surveyor Course 02: Construction Site Management Course 03: Construction Industry Scheme (CIS) Course 04: LEED V4.1 - Building Design and Construction Course 05: WELL Building Standard In Addition, you'll get Five Career Boosting Courses absolutely FREE with this Bundle. Course 01: Professional CV Writing Course 02: Job Search Skills Course 03: Self-Esteem & Confidence Building Course 04: Professional Diploma in Stress Management Course 05: Complete Communication Skills Master Class Convenient Online Learning: Our LOLER, PUWER & Construction Safety courses are accessible online, allowing you to learn at your own pace and from the comfort of your own home. Learning Outcomes: Understand the legal requirements under LOLER and PUWER regulations. Gain knowledge about safety practices in the construction industry. Learn about the intricacies of Building Quantity Surveying. Understand the role and responsibilities in Construction Site Management. Familiarise with the Construction Industry Scheme (CIS). Understand the principles of LEED V4.1 - Building Design and Construction. Gain insight into the WELL Building Standard and its benefits. The "LOLER, PUWER & Construction Safety" bundle is a comprehensive collection of courses designed to build your theoretical understanding of key construction safety regulations and best practices. The three QLS-endorsed courses provide essential insights into LOLER, PUWER, and Construction Safety, serving as the pillars of your learning journey. Supplementing this foundational knowledge are five CPD QS accredited courses, each focusing on a crucial aspect of construction. From understanding the complexities of Building Quantity Surveying and Construction Site Management to getting a grip on the Construction Industry Scheme (CIS), the bundle also covers sustainable building practices through LEED V4.1 and the WELL Building Standard. With this bundle, equip yourself with the theoretical knowledge to improve your understanding of safety and efficiency in construction. CPD 260 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Individuals interested in the theoretical aspects of LOLER, PUWER, and Construction Safety. Aspiring professionals in the construction industry looking to enhance their knowledge base. Existing professionals wishing to gain an understanding of construction site management. Anyone interested in sustainable building practices and building quantity surveying. Career path Building Quantity Surveyor: Estimating costs and ensuring budget compliance (£30,000 - £60,000 per annum). Health and Safety Officer: Implementing safety standards as per LOLER and PUWER regulations (£25,000 - £50,000 per annum). Certificates Digital certificate Digital certificate - Included Hard copy certificate Hard copy certificate - Included

Start your journey towards financial expertise with our comprehensive bundle of 17 CPD-accredited and QLS-endorsed courses! Designed for both new and seasoned investors, this Introduction to Investment Risk and Taxation package offers a unique learning experience. From the Fundamentals of Investment and Financial Risk Management to the intricacies of UK Tax Accounting and Anti-Money Laundering (AML) Training, each course is expertly designed to enhance your knowledge and skills. Dive deep into specialised subjects like Investing in Recession, Capital Budgeting, Technical Analysis for Trading, and the dynamic world of Cryptocurrency. Whether you're planning your retirement with our Stock Market Investment course or mastering the art of Corporate Finance, this bundle equips you with the tools to make informed decisions and powerful investor pitches. But here's the real value! Upon completion of each course, you'll receive not just one but two sets of certificates - both in PDF and Hardcopy formats. That's a total of 34 certificates - 17 CPD and 17 QLS - acknowledging your commitment and expertise in each area. These prestigious certificates are recognised across various industries and will significantly enhance your professional profile, opening doors to new opportunities and recognition. You will also get Full Study Assistance and Career Support. So don't worry about a thing, and get started. We got your back. Don't miss this chance to elevate your investment expertise and taxation knowledge. Enroll in the Introduction to Investment Risk and Taxation bundle today and start transforming your potential into success! Courses Included In this Introduction to Investment Risk and Taxation Course 01: Investment Course 02: Financial Risk Management Course 03: Investing in Recession Course 04: UK Tax Accounting Course 05: Anti-Money Laundering (AML) Training Course 06: Business Management and Finance Course Course 07: Financial Analysis: Finance Reports Course 08: Capital Budgeting & Investment Decision Rules Course 09: Fundamentals to Making a Powerful Investor Pitch Course 10: Create a Compelling Company Overview for Investors Course 11: Technical Analysis Masterclass for Trading & Investing Course 12: Stock Trading: Quick Start Guide To Stock Trading Course 13: Stock Market Investment: Plan for Retirement Course 14: Stock Trading Analysis with Volume Trading Course 15: Cryptocurrency: Wallets, Investing & Trading Course 16: Investing In Gold & Gold Mining Stocks Course Course 17: Corporate Finance: Working Capital Management What Will You Learn? Upon completing this Introduction to Investment Risk and Taxation bundle, you will be able to: Master the fundamentals of Investment strategies. Gain expertise in Financial Risk Management. Navigate investments confidently even in a recession. Understand the nuances of UK Tax Accounting. Become proficient in Anti Money Laundering (AML) compliance. Develop essential Business Management and Finance skills. Analyse financial reports like a pro. Make informed investment decisions with Capital Budgeting. Achieve financial mastery with our Introduction to Investment Risk and Taxation bundle, featuring 17 CPD-accredited and QLS-endorsed courses. Whether you're a newbie or a seasoned investor, this comprehensive package covers everything from investment basics to risk management, tax accounting, and anti-money laundering. Gain confidence in financial analysis, investor pitches, and even learn about cryptocurrency trading. What sets us apart? Upon course completion, you'll receive not just one but two sets of certificates - PDF and Hardcopy for each of the 17 courses, totalling 34 prestigious Certificates. Elevate your financial expertise and open doors to new opportunities today! CPD 180 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Introduction to Investment Risk and Taxation bundle is perfect for: Aspiring and experienced investors. Financial analysts and risk managers. Tax professionals and accountants. Compliance officers and AML specialists. Entrepreneurs seeking financial proficiency. Requirements Minimum level 3 qualifications It is recommended that students complete Introduction to UK Regulation and Professional Integrity prior to starting this course. Career path Upon completion of the courses in this Introduction to Investment Risk and Taxation bundle, you can pursue many career paths, such as: Investment Analyst: £30,000 - £60,000 Financial Risk Manager: £40,000 - £90,000 Tax Accountant: £25,000 - £60,000 AML Compliance Officer: £30,000 - £70,000 Financial Director: £60,000 - £150,000 Entrepreneur/Investor: Varies widely, potential for high earnings. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included

Computer System Validation Training Course (ONLINE). Extend Your Role to CSV Projects. Get Certified and Become a CSV Professional

By Getreskilled (UK)

Has the Computer System Validation Engineer left and you’ve been handed their responsibilities? Do the thoughts of your next audit fill you with dread? CSV can be frustrating but this program will show you how to manage electronic data in a regulated manufacturing/laboratory/clinical environment using the GAMP framework and ensure compliance with FDA’s 21 CFR Part 11, EU Annex 11 or other regulatory guidelines.

Overview of Managing Fraud Course Fraud management involves identifying illegal activities to stop important information from falling into the wrong hands. This Managing Fraud Course will guide you through the fundamentals of fraud management and its various strategies to mitigate risks and reduce financial losses. In this Managing Fraud course, you'll walk through a step-by-step process to implement an effective fraud policy for your business. First, the training will educate you about the importance of fraud management and its legal and ethical considerations. Then, it will introduce you to the various types of fraud and different techniques used in fraud detection and prevention. You'll also understand what to include in your fraud response plan and how to maintain regulatory compliance to mitigate risks. Course Preview Learning Outcomes Familiarise yourself with various fraud awareness techniques and tools Understand what is evidence and how to deal with exhibits Gain insights into the fraud risk management process Learn how to implement fraud management strategies to detect and prevent fraud Enrich your knowledge of fraud incident reporting and monitoring Why Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Meticulously crafted engaging and informative tutorial videos and materials Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email Who Should Take this Managing Fraud Course? Whether you're an existing practitioner or an aspiring professional, this course is an ideal training opportunity. It will elevate your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Managing Fraud Course is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Certificate of Achievement After completing this course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates & Transcripts can be obtained either in Hardcopy at £14.99 or in PDF format at £11.99. Career Pathâ Managing Fraud Course provides essential skills that will make you more effective in your role. It would be beneficial for any related profession in the industry, such as: Fraud Investigator Risk Manager Compliance Officer Forensic Accountant Internal Auditor Financial Crimes Analyst Legal Consultant in Fraud Management Fraud Management Specialist Module 1: Introduction to Fraud Management Introduction to Fraud Management 00:13:00 Module 2: Types of Fraud Types of Fraud 00:10:00 Module 3: Fraud Prevention Techniques Fraud Prevention Techniques 00:14:00 Module 4: Fraud Detection Methods Fraud Detection Methods 00:13:00 Module 5: Unveiling Fraudulent Evidence Unveiling Fraudulent Evidence 00:08:00 Module 6: Responding to Fraud Incidents Responding to Fraud Incidents 00:16:00 Module 7: Investigating Fraud Investigating Fraud 00:09:00 Module 8: Fraud Mitigation and Compliance Fraud Mitigation and Compliance 00:15:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Fire Marshal Training (UK) - Level 3 CPD Certified Course offers essential skills and knowledge for individuals aiming to take on the critical role of fire marshals within various industries. This training is paramount in ensuring the safety and well-being of occupants in buildings by effectively managing fire risks and executing evacuation procedures. With stringent safety regulations in place, the demand for qualified fire marshals remains robust in the UK. The sector has witnessed a steady increase in demand, with a 10% rise in the number of trained fire marshals required across diverse sectors such as hospitality, healthcare, and commercial establishments. Pursuing this certification not only enhances one's employability but also contributes to safeguarding lives and property. On average, professionals holding Fire Marshal Training certification can expect to earn between £22,000 to £30,000 annually in the UK, depending on factors such as experience and location. Don't miss the opportunity to embark on a fulfilling career path while making a significant impact on fire safety standards. Key Features This Fire Marshal Training (UK) - Level 3 CPD Certified Course Includes : This Fire Marshal Training Course is CPD Certified Free Certificate Level 3 Diploma Developed by Specialist Lifetime Access Course Curriculum Fire Marshal Training (UK) - Level 3 CPD Certified Course : Module 01: Fundamentals of Fire Safety Module 02: Fire Warden Introduction Module 03: Preventive Responsibilities Module 04: Emergency Tasks and Attributes Module 05: Fire Safety Protocols Module 06: Evacuation Tactics Module 07: Regulatory Compliance and Risk Assessment Learning Outcomes Fire Marshal Training (UK) - Level 3 CPD Certified Course: Identify fire hazards and apply basic safety protocols. Demonstrate understanding of fire warden roles and responsibilities. Execute preventive duties to minimise fire risks effectively. Exhibit emergency response skills and essential qualities during crises. Implement approved fire safety measures in diverse settings. Develop comprehensive evacuation strategies adhering to regulations and risk assessment. Certification After completing this Fire Marshal Training (UK) - Level 3 CPD Certified course, you will get a free Certificate. CPD 10 CPD hours / points Accredited by The CPD Quality Standards (CPD QS) Who is this course for? Fire Marshal Training (UK) - Level 3 CPD Certified Individuals seeking fire safety certification for workplace responsibilities. Employees designated or aspiring to be fire wardens. Safety officers and managers responsible for preventive measures. Personnel involved in emergency response planning and execution. Facilities management professionals ensuring fire safety compliance. Career path Fire Marshal Training (UK) - Level 3 CPD Certified Fire Warden Coordinator - £30K to 45K/year. Facilities Compliance Specialist - £25K to 40K/year. Fire Marshal - £25K to 35K/year. Health and Safety Officer - £30K to 40K/year. Emergency Response Coordinator - £28K to 38K/year. Fire Safety Inspector - £32K to 42K/year. Risk Assessment Specialist - £28K to 38K/year. Certificates Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

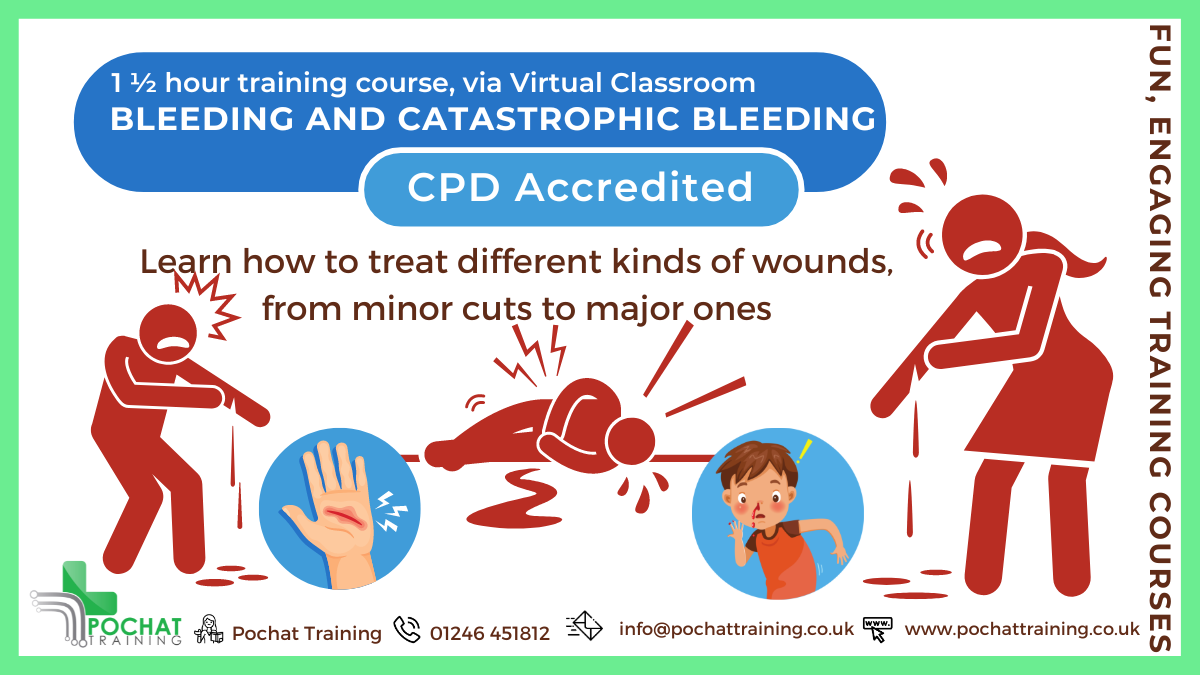

CPD Accredited, Interactive Short Course 1½ hr session Learn to deal with bleeding, from minor bleeds to catastrophic bleeds Become a life-saving hero if ever someone is seriously injured Course Contents: How to treat minor bleeding How to treat major bleeding Types of bleeding How to treat catastrophic bleeding Tourniquets Why to use a tourniquet How to use a tourniquet How to make an improvised tourniquet How to use a Tourni-Key Wound packing How to use Celox Z-Gauze How to improvise packing a wound How to treat gunshot wounds Practical elements: There is an option of learning how to deal with catastrophic bleeding in person, so you get to practice these skills (and play about with fake blood 😀). For that, see our Catastrophic Bleeding course module. Benefits of this Short Course: We all have regular injuries which cause us to bleed If not properly cared for, even a small cut can turn septic and kill or maim Serious car accidents, machinery accidents at work, weapon wounds, terrorist attacks and more can also lead to catastrophic bleeding Did you know that a person could bleed out in just five minutes..? You're got to act quick, decisive and correctly Please don't do what you see in the movies - you will kill the person even quicker...

Workplace Monitoring and Data Protection

By OnlineCoursesLearning.com

Introduction: Learning about workplace monitoring and data protection is absolutely essential for anybody in any organisation of every type and size - whether you're an employer, employee or directly responsible for data collection compliance. This course provides a comprehensive guide to understanding the legal requirements involved with employee data collection and the legally binding stipulations of the new General Data Protection Regulation (GDPR) for all UK organisations. From a comprehensive look into GDPR principles and the definition of 'personal data', to ways to ensure compliance as an employer and the rights and responsibilities involved in workplace monitoring, this course covers everything you need to know about workplace monitoring and data protection. What You Will Learn: The general principles of the GDPR and how they pertain to your organisation A comprehensive definition of 'personal data' and all it entails How to ensure full legal data protection compliance The rights and responsibilities of workplace monitoring for employers and employees Benefits of Taking This Course You will avoid the serious legal implications of non-compliance of the GDPR You will increase productivity by improving employer/employee trust You will avoid the costly process of hiring data protection consultants You will improve your reputation within the industry and attract new business

Description For some years, the UK financial regulators have been placing expectations on firms to treat their customers fairly and with plenty of care. This includes vulnerable clients, or those defined by the FCA as individuals 'who, due to their personal circumstances, [are] especially susceptible to detriment, particularly when a firm is not acting with appropriate levels of care.' Throughout this course, you will gain insight into the definition of vulnerable clients and how your company can better cater to this group's needs, preferences, and personalities. More specifically, by the end of this course, you will be able to: ï Know how vulnerable customer management started. ï Understand what vulnerability means. ï Recognise traits of vulnerability. ï Demonstrate an awareness of the 4 key pillars of vulnerability and how the UK financial regulators think you can help manage vulnerable customers in your organisation. Training Duration This course may take up to 2 hours to be completed. However, actual study time differs as each learner uses their own training pace. Training Method The course is offered fully online using a self-paced approach. The learning units consist of reading material. Learners may start, stop and resume their training at any time. At the end of each session, participants take a Quiz to complete their learning unit and earn a Certificate of Completion upon completion of all units. Accreditation and CPD Recognition This programme has been developed by the London Governance and Compliance Academy (LGCA), a UK-recognised training institution. Registration and Access To register to this course, click on the Get this course button to pay online and receive your access instantly. If you are purchasing this course on behalf of others, please be advised that you will need to create or use their personal profile before finalising your payment. If you wish to receive an invoice instead of paying online, please contact us at info@lgca.uk.

Market abuse may arise in circumstances where financial market investors have been unreasonably disadvantaged, directly or indirectly, by others who: have used information which is not publicly available. Description An online e-learning course to enable those working in FCA-regulated firms to recognise Market Abuse, including insider dealing and market manipulation, and make them aware of the requirements of the FCA. Training Duration This course may take up to 2 hours to be completed. However, actual study time differs as each learner uses their own training pace. Training Method The course is offered fully online using a self-paced approach. The learning units consist of reading material. Learners may start, stop and resume their training at any time. At the end of each session, participants take a Quiz to complete their learning unit and earn a Certificate of Completion upon completion of all units. Accreditation and CPD Recognition This programme has been developed by the London Governance and Compliance Academy (LGCA), a UK-recognised training institution. The syllabus is verified by external subject matter experts and can be accredited by regulators and other bodies for 2 CPD Units that approve education in financial regulation, such as the FCA. The course may be also approved for CPD Units by institutions which approve general financial training, such as the CISI. Eligibility criteria and CPD Units are verified directly by your association, regulator or other bodies which you hold membership. Registration and Access To register to this course, click on the Get this course button to pay online and receive your access instantly. If you are purchasing this course on behalf of others, please be advised that you will need to create or use their personal profile before finalising your payment. If you wish to receive an invoice instead of paying online, please contact us at info@lgca.uk. Access to the course is valid for 365 days.