- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

918 Business courses in Birmingham

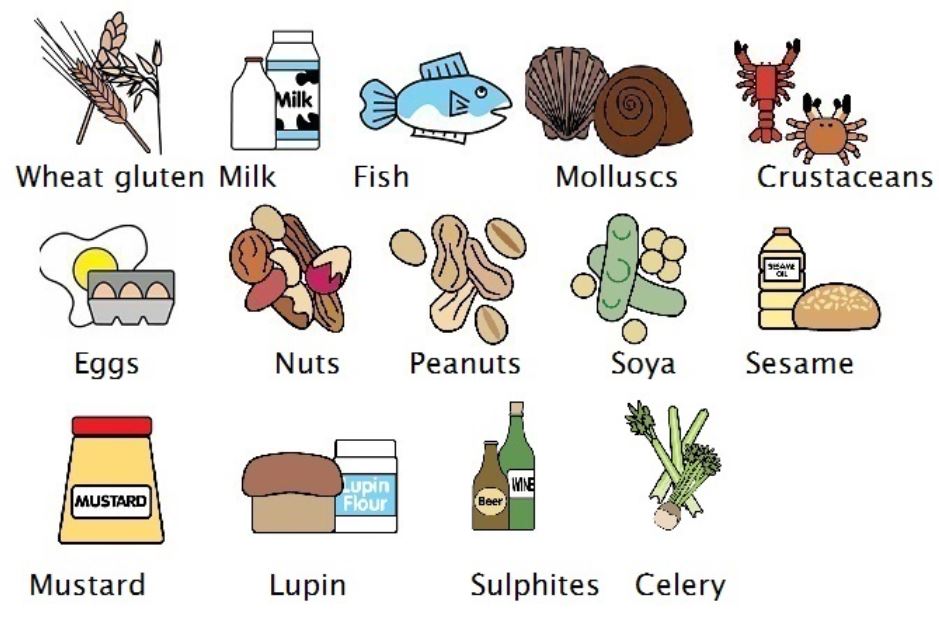

RSPH level 2 Identifying and Controlling Food Allergy Risks Training Course

By Kitchen Tonic Training Company and Food Safety Consultants

RSPH level 2 Identifying and Controlling Food Allergy Risks Training Course Do you need an allergy trainer to come to your food business and teach your staff face to face about food and drink allergens, their dangers and how to control them? Our allergy trainer can come to your business and deliver this course at your business premises. Although we are based in London, we are happy to travel and deliver this course at your business location. (Trainer travel fees may be applicable depending on your location). Staff will receive interactive training and coaching on allergens and intolerances with an experienced trainer. We can also tweak the training to include issues you would like to cover. See our website for more details. Special offer for on-site allergy training. £250 plus £20pp includes RSPH exam fees (usually £350 plus £30pp) This course is suitable for any catering business such as restaurants, pubs, hotels, cafes, catering companies, cooks, self employed, artisans, event caterers and more. This course is also important for staff who are Front of House, who take customer orders and relay the orders to cooks and chefs and other people who are preparing food for customers who have allergies and or intolerances. This is a short one day training course, typically 9am-3pm. Topics covered include- Allergens, Allergen Identification, Cross contact, Cross Contamination, Allergic Reactions, Food Intolerances, Coeliac, Anaphylaxis, Natasha's Law, UK Food Safety Regulations, Allergy Controls, Substituting ingredients, Customer Communication and what to do in an Emergency. Contact us to book training.

Appointment setting (In-House)

By The In House Training Company

This course has a simple objective: to help gain appointments with potential clients. In most consultative selling situations clients won't commit to purchases over the telephone. This means setting up a meeting to discuss the options with them face-to-face. But getting 'face time' can be tricky. This practical workshop can help. Participants will acquire essential tools, skills and methods; discuss specific organisational issues; and identify areas for improvement. They will discover how to: Increase their effectiveness through proper preparation Construct attention-grabbing opening statements Help potential clients feel comfortable agreeing to a meeting Develop tactics for responding to difficult excuses and objections Stress the benefits of a face-to-face consultation Develop and enhance their questioning and listening skills Prevent customers cancelling booked appointments 1 Introduction to appointment setting Key trends that have changed the way people buy today - and will buy tomorrow Why many sales people avoid picking up the phone The difference that makes a difference - what makes a good appointment-maker? 2 Before you pick up the telephone It all starts with a plan... Who and what to focus our attention How much research should we undertake and why? Setting primary and secondary objectives 3 Making your approach Key considerations Every call is an opportunity - creating a positive mind-set Using a structured approach Using partnership language 4 Gaining an insight into the customer's needs How to quickly 'tune in' to your customers, so that you can serve them more easily Developing speech patterns that put customers at their ease Using effective questioning and listening skills Finding and building pain points 5 Dealing with excuses and objections Pre-empting potential excuses Developing techniques for responding to client objections Keeping the door open for future contact 6 Securing the appointment Selling the benefits of a consultancy meeting Techniques for avoiding cancelled appointments Gaining commitment 7 Action plans Course summary and presentation of action plans

Bid writing (In-House)

By The In House Training Company

This workshop is very practical in its nature and aims to give delegates an opportunity to not only learn about the key aspects of successful bid writing, but to also put them into practice. The workshop helps delegates understand what is most important to buyers and how to successfully convey they proposition to them. 1 Welcome and introductions 2 The mindset of successful bid writing The mindset needed for successful bid writing Thinking from the buyer's perspective and not your own 3 Decision making The way buyers make decisions - rational and emotional Understanding buying motives Looking at how to present ideas against those motives The idea of cognitive fluency How to pitch an idea in a way that leads to a positive decision 4 To bid or not to bid? Writing a bid is a big commitment; a clear understanding of the chances of winning is required Understanding of the implications of winning and the impact it will have on the organisation 5 Understanding your value proposition Framework to help identify unique proposition and how that fits in with the requirements of the bid 6 The tender process Understanding the process to enable a successful chance of winning the bid Different types of tender processes Evaluation of criteria and the impact on bid writing 7 Writing skills Different ways of writing and structuring bids to ensure their messages gets across well in a way that will be looked on favourably by the buyer 8 Summarise 9 Close

On-Site Experienced Operator Forklift Course Gloucestershire

By Gl Training Services

Novice Forklift Training Counter Balance Training Forklift Training Crane Training MEWP Training

On-Site Novice Forklift Course Gloucestershire

By Gl Training Services

Novice Forklift Training Counter Balance Training Forklift Training Crane Training MEWP Training

One Day Forklift Refresher Course On-Site

By Gl Training Services

Forklift Training Gloucestershire Counter Balance Training Crane Training MEWP Training

Power BI - introduction to intermediate (2 days) (In-House)

By The In House Training Company

This course starts with the basics then moves seamlessly to an intermediate level. It includes a comprehensive yet balanced look at the four main components that make up Power BI Desktop: Report view, Data view, Model view, and the Power Query Editor. It also demonstrates how to use the online Power BI service. It looks at authoring tools that enables you to connect to and transform data from a variety of sources, allowing you to produce dynamic reports using a library of visualisations. Once you have those reports, the course looks at the seamless process of sharing those with your colleagues by publishing to the online Power BI service. The aim of this course is to provide a strong understanding of the Power BI analysis process, by working with real-world examples that will equip you with the necessary skills to start applying your knowledge straight away. 1 Getting started The Power BI process Launching Power BI Desktop The four views of Power BI Dashboard visuals 2 Connecting to files Connect to data sources Connect to an Excel file Connect to a CSV file Connect to a database Import vs. DirectQuery Connect to a web source Create a data table 3 Transforming data The process of cleaning data Column data types Remove rows with filters Add a custom column Append data to a table Fix error issues Basic maths operations 4 Build a data model Table relationships Manage table relationships 5 Merge queries Table join kinds Merging tables 6 Create report visualisations Creating map visuals Formatting maps Creating chart visuals Formatting chart Tables, matrixes, and cards Control formatting with themes Filter reports with slicers Reports for mobile devices Custom online visuals Export report data to Excel 7 The power query editor Fill data up and down Split columns by delimiter Add conditional columns Merging columns 8 The M formula Creating M functions Create an IF function Create a query group 9 Pivot and unpivot tables Pivot tables in the query editor Pivot and append tables Pivot but don't summarise Unpivot tables Append mismatched headers 10 Data modelling revisited Data model relationships Mark a calendar as a date table 11 Introduction to calculated columns New columns vs. measures Creating a new column calculation The SWITCH function 12 Introduction to DAX measures Common measure categories The SUM measure Adding measures to visuals COUNTROWS and DISINCTCOUNT functions DAX rules 13 The CALCULATE measure The syntax of CALCULATE Things of note about CALCULATE 14 The SUMX measure The SUMX measure X iterator functions Anatomy of SUMX 15 Introduction to time intelligence Importance of a calendar table A special lookup table The TOTALYTD measure Change year end in TOTALYTD 16 Hierarchy, groups and formatting Create a hierarchy to drill data Compare data in groups Add conditional formatting 17 Share reports on the web Publish to the BI online service Get quick insights Upload reports from BI service Exporting report data What is Q&A? Sharing your reports 18 Apply your learning Post training recap lesson

Take your organisation’s presentations to the next level by truly engaging second language English speakers with our specific techniques. Help them communicate key messages with confidence and clarity to the whole audience. With lots of opportunities for practice in a very safe space, participants will build their skills in the guiding hands of our experts. This bespoke course will include: Presenter self-awareness Essential cultural etiquette Powerful PowerPoint strategies for second-language speakers Linguistic mindfulness A new understanding of ‘less is more’

HACCP Trainer - On site Level 3 HACCP Training - Nationwide

By Kitchen Tonic Training Company and Food Safety Consultants

HACCP Trainer. on site delivery nationwide

HACCP Trainer - HACCP Level 2 RSPH - Onsite Training Nationwide

By Kitchen Tonic Training Company and Food Safety Consultants

HACCP Trainer and HACCP Training Courses

Search By Location

- Business Courses in London

- Business Courses in Birmingham

- Business Courses in Glasgow

- Business Courses in Liverpool

- Business Courses in Bristol

- Business Courses in Manchester

- Business Courses in Sheffield

- Business Courses in Leeds

- Business Courses in Edinburgh

- Business Courses in Leicester

- Business Courses in Coventry

- Business Courses in Bradford

- Business Courses in Cardiff

- Business Courses in Belfast

- Business Courses in Nottingham