- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2461 Business courses in Caister-on-Sea delivered Live Online

II Part Vision Experience - Build a life you love

By The Motivation Clinic

Vision Boarding

Effective Leadership through Coaching

By Nexus Human

Duration 2 Days 12 CPD hours This course is intended for Anyone managing the performance of others, including executives, managers, supervisors and team leaders will benefit from this course. Overview Explain how coaching can help employees achieve their full potential Recognize common coaching challenges Explain the key principles of the Thought model Explain the four steps of the GROW model Identify important guidelines for providing feedback Apply strategies that will motivate employees In the face of rapid, disruptive change, companies understand that command-and-control leadership is no longer viable. As a result, many firms are moving toward a coaching model in which managers facilitate problem solving and encourage employees? development by asking questions and offering support and guidance rather than giving orders and making judgments. Leaders can use the GROW and Thought models of coaching to become more skilled at listening, questioning, and drawing insights out of the people they supervise. This course will help you develop coaching skills that motivate employees to reach their full potential. Private classes on this topic are available. We can address your organization?s issues, time constraints, and save you money, too. Contact us to find out how. Prerequisites While there are no prerequisites for this course, please ensure you have the right level of experience to be successful in this training. 1. The Purpose and Effect of Coaching What is Coaching? Characteristics and Beliefs of the Effective Coach Coaching Obstacles Knowing When to Manage and When to Coach 2. Coaching and The Thought Model The CFTAR Thought Model Point of View and Belief Systems Applying The Thought Model Facts vs. Stories 3. Coaching with the GROW Model Goals in the Context of GROW Clarifying the Current Reality Exploring the Past Developing Options and Choosing the Approach Creating the Final Plan 4. Navigating The Coaching Process Dimensions of Trust Identifying Obstacles and the SPAR Process Overcoming Resistance Giving Feedback Effectively Motivating Your Employee

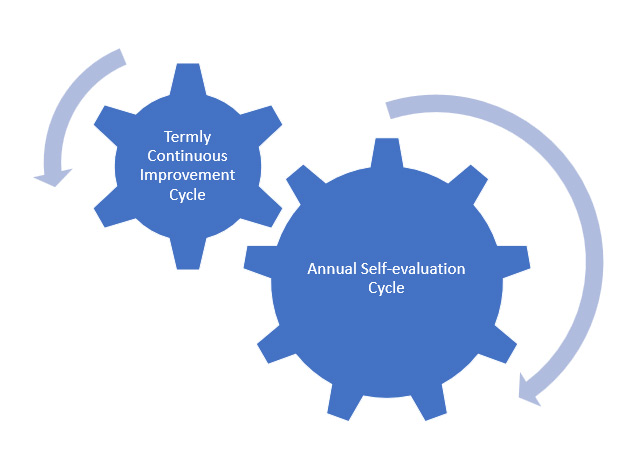

How to build a system that drives school improvement

By Marell Consulting Limited

If you want to be able to offer a consistently better quality of education for your pupils without the stress that comes with worrying about Ofsted all the time, this workshop is for you.

CertNexus Data Ethics for Business Professionals (DEBIZ)

By Nexus Human

Duration 1 Days 6 CPD hours This course is intended for This course is designed for business leaders and decision makers, including C-level executives, project and product managers, HR leaders, Marketing and Sales leaders, and technical sales consultants, who have a vested interest in the representation of ethical values in technology solutions. Other individuals who want to know more about data ethics are also candidates for this course. This course is also designed to assist learners in preparing for the CertNexus DEBIZ⢠(Exam DEB-110) credential. The power of extracting value from data utilizing Artificial Intelligence, Data Science and Machine Learning exposes the learning differences between humans and machines. Humans can apply ethical principles throughout the decision-making process to avoid discrimination, societal harm, and marginalization to maintain and even enhance acceptable norms. Machines make decisions autonomously. So how do we train them to apply ethical principles as they learn from decisions they make? This course provides business professionals and consumers of technology core concepts of ethical principles, how they can be applied to emerging data driven technologies and the impact to an organization which ignores ethical use of technology. Introduction to Data Ethics Defining Data Ethics The Case for Data Ethics Identifying Ethical Issues Improving Ethical Data Practices Ethical Principles Ethical Frameworks Data Privacy Accountability Transparency and Explainability Human-Centered Values and Fairness Inclusive Growth, Sustainable Development, and Well-Being Applying Ethical Principles to Emerging Technology Improving Ethical Data Practices Sources of Ethical Risk Mitigating Bias Mitigating Discrimination Safety and Security Mitigating Negative Outputs Data Surveillance Assessing Risk Ethical Risks in sharing data Applying professional critical judgement Business Considerations Data Legislation Impact of Social and Behavioral Effects Trustworthiness Impact on Business Reputation Organizational Values and the Data Value Chain Building a Data Ethics Culture/Code of Ethics Balancing organizational goals with Ethical Practice Additional course details: Nexus Humans CertNexus Data Ethics for Business Professionals (DEBIZ) training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the CertNexus Data Ethics for Business Professionals (DEBIZ) course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

#BusComm Friday Breakfast Networking Meeting

By The Business Community

Are you an ambitious, entrepreneurial business owner with a collaborative mindset? You are? Good! You're in the right place. Running your own business can be tough and the odds are against you - but don't worry! The support you need is on your doorstep - at next to no cost!

Overview Financial Analysis and reporting play a very important role within the organisation and its stakeholders. This course is designed to analyse the functions of financial reporting in communication and its effects on decision-making processes or managerial decisions. It will highlight the accounting and financial standards-setting process and its implication on the organisation globally. Financial Analysis and reporting discuss how accountants act as processors and purveyors of information for decision-making and the needs of those who use accounting information. It also looks at the role performed by accountants and notes the need to be aware of relevant regulatory and conceptual frameworks.

Overview In this course you will learn to build a financial model by working in Excel and how to perform sensitivity analysis in Excel. You will also learn the formulas, functions and types of financial analysis to be an Excel power user. By attending this course, you will be able to effectively prepare and build financial models. Objectives Harness Excel's tools within a best practice framework Add flexibility to their models through the use of switches and flexible lookups Work efficiently with large data volumes Model debt effectively Approach modelling for tax, debt, pensions and disposals with confidence Build flexible charts and sensitivity analysis to aid the presentation of results Learn and apply Excel tools useful in financial forecasting Understand and design the layout of a flexible model Forecast financial statements of a public or private company Apply scenario analysis to the forecasted financial statements and prepare charts for data presentation

Overview The comprehensive course will cover the fundamentals of portfolio management, and delve deeper into risk and return. Participants will develop their understanding of how and why investors allocate money to fixed income, the numerous issues that impact risk and return, and the mechanics of portfolio construction.

Overview This course is designed to evaluate the financial statement, budget and making an effective decision. It will help to understand Discounted Cash Flow and its techniques, applications of financial statements and decision-making process. In this programme, you will challenge representatives to learn how to make use of financial statements to assess the strategic or financial performance of an organization. It will help to understand DCF Discounted Cash Flow techniques along with their apps for financial making decisions and making use of ratios in order to identify the major areas of concern. Find out the elements like weaker financial signals, major success factors, and robust financial signals within your own industry. It Projects future performance assuredly through real-world budgeting.

Overview This course is specially designed, this 5-day Financial Risk Management training course works to expand delegate's understanding and practical skills in the field of financial risk management. Specifically, this training course investigates the inter connection of risk in terms of markets, credit, operations, liquidity and reputation. Via intensive instruction and practical exercises, delegates will explore relevant techniques and methodologies, such as value-at-risk, credit modelling and stress testing.