- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

3493 Balance courses

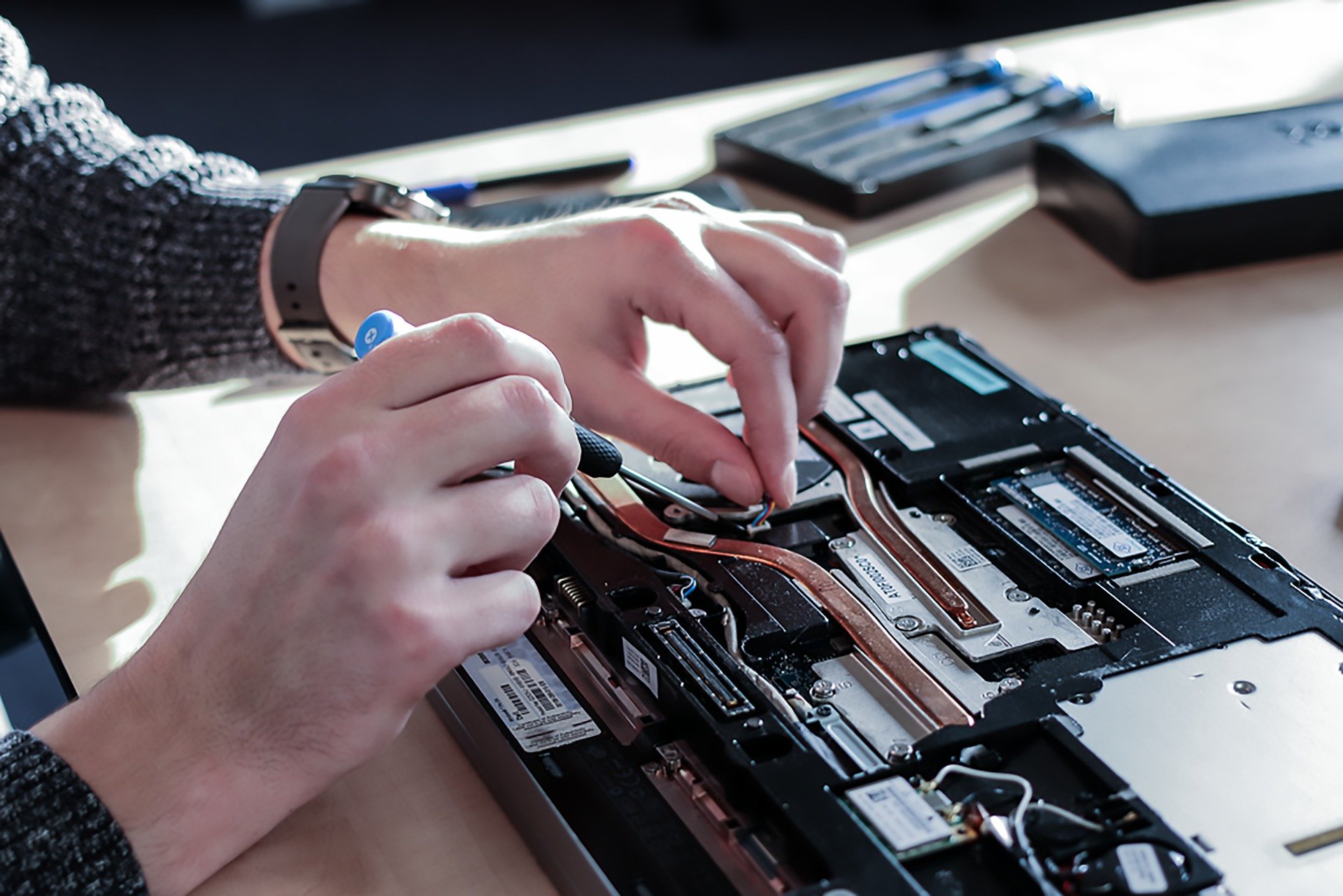

Computer Maintenance and Repair Course

By Hi-Tech Training

The Computer Maintenance & Repair Technician course aims to enable participants to diagnose and repair system level faults in computer-based systems at the foundation level.

Moments of Truth are 'touch points' in time that a customer evaluates when giving you a service 'score.' Apply our 10 tips for great greetings md introductions. Discover why it is important to choose your opening words selectively. We will show you how to strike the perfect balance between professionalism and 'personalism'. Learning Objectives Describe the Primary Effect's influence on first impressions, Implement effective greeting words choices, Balance professionalism with personalism Target Audience Managers, Team Leaders, Young Professionals, Sales Professionals, Customer Service Teams

48-Hour Knowledge Knockdown! Prices Reduced Like Never Before! Get FREE 1 QLS Endorsed Certificate Course with 10 Additional CPD Accredited Bundle Courses In A Single Payment. If you wish to gain a solid and compact knowledge of Accountancy and boost yourself for your desired career, then take a step in the right direction with this industry-standard, comprehensive course designed by professionals. This bundle package includes 1 premium, The Quality Licence Scheme-endorsed course, 10 additional CPD accredited certificate courses, with expert assistance, and a FREE courses assessment included. Learn a range of in-demand technical skills to help you progress your career with 12 months of unlimited access to this bundle of courses. If you enrol in this package, you will not be charged any extra fees. This Bundle Package includes: Diploma in Accountancy at QLS Level 5 10 Additional CPD Accredited Premium Courses- Tax Accounting Certificate - CPD Certified Managerial Accounting Training Xero Advisor Financial Management Corporate Finance Training Financial Advisor Finance and Financial Analysis Microsoft Excel - Beginner, Intermediate & Advanced Decision-Making in High-Stress Situations Time Management Success becomes a lot simpler with this bundle package, which allows you to monetise your skills. This bundle is appropriate for both part-time and full-time students, and it can be completed at your own pace. This premium online bundle course, supports your professional growth with Quality Licence Scheme endorsement, as well as CPD accreditation. You'll be able to practice on your own time and at your own speed while still gaining an endorsed certificate. You'll get an unrivalled learning experience, as well as a free student ID card, which is included in the course price. This ID card entitles you to discounts on bus tickets, movie tickets, and library cards. With this high-quality package, all students have access to dedicated tutor support and 24/7 customer service. Throughout the extensive syllabus of this package, you'll find the required assistance and also the answers to all of your questions. The course materials of the Accountancy are designed by experts and you can access these easily from any of your smartphones, laptops, PCs, tablets etc. Master the skills to arm yourself with the necessary qualities and explore your career opportunities in relevant sectors. Why Prefer this Bundle Course? Upon successful completion of the Accountancy bundle, you will receive a completely free certificate from the Quality Licence Scheme. Option to receive 10 additional certificates accredited by CPD to expand your knowledge. Student ID card with amazing discounts - completely for FREE! (£10 postal charges will be applicable for international delivery) Our bundle's learning materials have an engaging voiceover and visual elements for your convenience. For a period of 12 months, you will have 24/7 access to all bundle course material. Complete the bundle, at your own pace. Each of our students gets full 24/7 tutor support After completing our Bundle, you will receive efficient assessments and immediate results. Course Curriculum *** Diploma in Accountancy Level 5 *** Module 01: Introduction to Accounting What Is Accounting? Accounting and Bookkeeping Who Uses Accounting Information? Financial Statements How Different Business Entities Present Accounting Information Module 02: The Role of an Accountant What Is an Accountant? Roles and Responsibilities Important Skills Accounting Automation Transparency and Security Data Analysis Module 03: Accounting Concepts and Standards Introduction to Accounting Concepts Introduction to Accounting Standards Accounting Standards in the UK International Accounting Standards International Financial Reporting Standards Module 04: Double-Entry Bookkeeping Introduction of Double-Entry Bookkeeping What Does the Account Show? Account NameDebits and CreditsAccount Details Rules for Double-Entry Transactions Accounting for Inventory Double-Entry Transactions for Inventory Returns of Inventory Drawings Income and Expenses How Many Different Expense Accounts Should Be Opened? Balancing Accounts General Rules for Balancing Accounts Module 05: Balance Sheet Introduction of Balance Sheet The Components of a Balance Sheet AssetsLiabilitiesNet Worth or Equity The Accounting Equation Understanding the Balance Sheet What Does the Date on the Balance Sheet Mean? Module 06: Income statement Understanding the Income Statement The Accrual Concept Revenue Expenses Net Income Interest and Income Taxes Bad Debt Expense Module 07: Financial statements Introduction of Financial Statements Trial Balance Statement of Comprehensive Income Calculation of Profit Difference between Gross and Net Profits Trading Account Profit and Loss Account Statement of Financial Position Non-Current AssetsCurrent AssetsCurrent LiabilitiesNon-Current LiabilitiesCapital Module 08: Cash Flow Statements What Is a Statement of Cash Flows? What Is the Purpose of the Cash Flow Statement? Cash and Cash Equivalents Operating Activities Investing Activities Financing Activities Module 09: Understanding Profit and Loss Statement Introduction of Profit and Loss Account Measurement of Income Relation Between Profit and Loss Account and Balance Sheet Preparation of Profit and Loss Account Module 10: Financial Budgeting and Planning What Is a Budget? Planning and Control Advantages of Budgeting Developing the Profit Strategy and Budgeted Profit and Loss Statement Budgeting Cash Flow from Profit for the Coming Year Capital Budgeting Module 11: Auditing What Is an Audit? Types of Audits External AuditsInternal AuditsInternal Revenue Service (IRS) Audits Why Audits? Who's Who in the World of Audits What's in an Auditor's Report How is the Accountancy Bundle Assessment Process? We offer an integrated assessment framework to make the process of evaluation and accreditation for learners easier. You have to complete the assignment questions given at the end of the course and score a minimum of 60% to pass each exam. Our expert trainers will assess your assignment and give you feedback after you submit the assignment. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you have completed all of the exams. Show off Your New Skills with a Certification of Completion Endorsed Certificate of Achievement from the Quality Licence Scheme After successfully completing the course, you can order an original hardcopy certificate of achievement endorsed by the Quality Licence Scheme. The certificate will be home-delivered, with completely free of charge in this package. For Additional the Quality Licence Scheme Endorsed Certificate you have to pay the price based on the Level of these Courses: Level 1 - £79 Level 2 - £99 Level 3 - £119 Level 4 - £129 Level 5 - £139 Level 6 - £149 Level 7 - £159 Certification Accredited by CPD Upon finishing the course, you will receive an accredited certification that is recognised all over the UK and also internationally. The pricing schemes are - 10 GBP for Digital Certificate 29 GBP for Printed Hardcopy Certificate inside the UK 39 GBP for Printed Hardcopy Certificate outside the UK (international delivery) CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Accountancy package training is perfect for highly motivated people who want to improve their technical skills and prepare for the career they want! This package is also ideal for those who want to learn more about this subject in-depth and stay up to date with the latest details. From the comfort of your own home, study this package and expand your professional skillset! Requirements The Accountancy Bundle has no formal entry criteria, and everyone is welcome to enrol! Anyone with a desire to learn is welcome to this course without hesitation. All students must be over the age of 16 and have a passion for learning and literacy. You can learn online using any internet-connected device, such as a computer, tablet, or smartphone. You can study whenever it's convenient for you and finish this bundle package at your own speed. Career path Studying the Accountancy bundle is intended to assist you in obtaining the job of your dreams, or even the long-awaited promotion. With the support and guidance of our package, you will learn the important skills and knowledge you need to succeed in your professional life. Certificates Accountancy (Accountant Training) Diploma - CPD Certified Hard copy certificate - Included CPD QS Accredited Certificate Digital certificate - Included Upon successfully completing the Bundle, you will need to place an order to receive a PDF Certificate for each course within the bundle. These certificates serve as proof of your newly acquired skills, accredited by CPD QS. Also, the certificates are recognised throughout the UK and internationally. CPD QS Accredited Certificate Hard copy certificate - Included International students are subject to a £10 delivery fee for their orders, based on their location.

Spring Clean Your Qi

By Sunhouse

Spring Clean Your Qi – 2024 Eight Week Online Qigong Course For Spring Feel healthy vibrant and get your zing back for spring When: Tuesday Evenings 6-7.15pm and Thursday mornings 8-8.30am (via Zoom) All classes are recorded so you can catch up in your own time. Dates: Tuesdays 6-7.15pm: March 5th, 12th, 19th, and 26th and April 9th, 16th, 23rd and 30th Thursdays 8-8.30am: March 7th, 14th, 21st, 28th and April 11th, 25th and May 2nd Suitable for everyone no matter your experience Spring can be a tricky time for us, as our bodies are moving from the most still Yin restful time of the year to a very Yang active energy of new growth. It’s a massive about-turn for our whole energy system and it can be bumpy! In Chinese medicine the liver is responsible for the smooth flow of Qi or energy in our body, and in the spring this liver Qi is being challenged, as we come out of the winter stillness it can take a while for us to feel lively and able to take on the new challenges. If our Liver Qi is struggling it can leave us feeling grumpy, irritated and restless, with headaches and brain fog, we may have sore, dry or itchy eyes and tired stiff achey joints. During this course we will use Qigong exercises, meditations, sounds and breath practices, to help bring us into our healthy balance, giving our liver the support it needs so we can move from Winter to Spring, feeling healthy and vibrant and ready to take on the new. Together we will learn “The Eight Brocades” a simple and easy to practice Qigong form you can use every day to improve your energy and feel great. “The Eight Brocades” is one of the most popular Qigong practices dating back nearly 1000 years in China. it is made up of eight Qigong movements, each opening different meridian or energy pathways in the body, to release fatigue and harness our healthy Qi. Benefits include improved energy, vitality, bone density, strength, flexibility, balance, coordination, and longevity to name a few. Also, a great practice for reducing blood pressure, cancer support, thyroid issues, back pain, arthritis, and more. What is included: Eight live 75min evening zoom classes Eight live 30min morning WAKE UP YOUR QI classes on zoom Access to replays of all classes so you can catch up in your own time. Learn “The Eight Brocades” A simple and powerful Qigong form to help you feel amazing Weekly supporting material for home practice including: – 10min video Guided Qigong Practice – Learn how to clear meridian pathways in the body for greater balance – Key acupuncture points for self massage – Weekly nutrition tips for a healthy spring body cleanse What will i get out of this course? Reconnect with your body Clear your mind A healthy detox for your organs Increased flexibility for all your joints Improved circulation Healthy hormonal balance Clear vision – bright eyes Better sleep Reduced pain Improved mood More energy Less stress

Follow our guidelines for controlling paperwork and emails. We will show you how to implement the six guidelines to achieve more in less time with less effort. Understand how to effectively delegate work to others and know what to delegate. Uncover the secret to convert obstacles into opportunities and balance your home and career by attending to the eight areas of a balanced life. Learning Objectives Control paperwork and emails, Control file organization, Get more done in less time with less effort, Balance home and career Target Audience Managers, Team Leaders, Young Professionals, Sales Professionals, Customer Service Teams

'Procrastination makes easy things hard, and hard things harder' - Mason Cooley. Learn how to avoid procrastination and finalize your tasks with ease. Learn how to apply the most effective guidelines for delegation and ensuring responsibilities get taken care of. You will learn how to get more done, in less time and we will teach you how to balance your precious home life with that of a stressful career life. Learning Objectives Control paperwork and emails, Demonstrate file organization, Effectively delegate work to others, Balance home and career Target Audience Managers, Team Leaders, Young Professionals, Sales Professionals, Customer Service Teams

M.D.D RELATIONSHIP COUNSELLING FOR SINGLES PACKAGE (SINGLES)

4.9(27)By Miss Date Doctor Dating Coach London, Couples Therapy

Experience transformative relationship counselling tailored specifically for singles with our exceptional package: “Relationship Counselling for Singles with Miss Date Doctor.” Discover the power of self-discovery, personal growth, and fostering healthy connections under the expert guidance of Miss Date Doctor, a renowned relationship coach. In this comprehensive package, you’ll embark on a journey of self-exploration and gain invaluable insights to enhance your dating life and prepare yourself for meaningful relationships. Our specialized approach focuses on addressing the unique challenges faced by singles in their pursuit of love and companionship. Here’s what our “Relationship Counselling for Singles with Miss Date Doctor” package Self-Discovery and Relationship Readiness Assessment: Gain a deep understanding of yourself, your values, and your relationship goals. Explore topics like self-reflection, self-awareness, and relationship readiness to align your desires with your personal growth journey. Building Confidence and Self-Esteem: Boost your confidence and develop a positive self-image. Discover strategies for overcoming insecurities and self-doubt while embracing your unique qualities. Learn and gain insight on “self-confidence exercises,” “building self-esteem,” and “self-empowerment techniques.” Effective Communication Skills: Master the art of communication to establish meaningful connections. Learn active listening techniques, assertiveness, and non-verbal communication skills. In depth coaching on the following areas “effective conversation skills,” “empathetic listening,” and “non-verbal cues in dating.” Understanding Relationship Patterns: Uncover patterns that may be hindering your dating success. Gain insights into attachment styles, relationship dynamics, and common pitfalls in dating. Explore related topics like “attachment theory,” “relationship patterns,” and “identifying toxic relationships.” Overcoming Dating Challenges: Tackle common dating obstacles with resilience and grace. Learn how to navigate rejection, deal with online dating fatigue, and manage expectations. We also teach you how to be better at “handling dating rejection,” “managing online dating burnout,” and “maintaining realistic dating expectations.” Developing Healthy Boundaries: Establish clear boundaries to protect your emotional well-being. Understand the importance of self-care, setting limits, and maintaining a healthy work-life-dating balance. Explore the following areas such as “self-care practices,” “boundary-setting in relationships,” and “maintaining work-life balance.” With our “Relationship Counselling for Singles with Miss Date Doctor” package, you’ll gain the tools and guidance necessary to navigate the dating world with confidence, authenticity, and a deeper understanding of yourself and your desires. Invest in your personal growth, enhance your dating experiences, and set the foundation for fulfilling relationships. Enroll in our transformative “Relationship Counselling for Singles with Miss Date Doctor” package today and embark on a journey toward lasting love and happiness. 3 sessions x 1 hour https://relationshipsmdd.com/product/relationship-counselling-for-singles-package/

Description Crystal Massage Diploma Delve into the realm of holistic therapies with the unique Crystal Massage Diploma, a comprehensive online course designed to introduce you to the fundamentals of crystal massage and more. This course will guide you on a fascinating journey of understanding the intrinsic value of crystals in massage therapy and holistic health, extending your skills beyond traditional techniques. The Crystal Massage Diploma course embarks with the basics of crystal massage. Here, you'll familiarize yourself with the underlying principles of this therapy, the various types of crystals used, and the benefits they offer. By mastering these basics, you will be able to understand how these mystical stones can promote well-being and relaxation. Progressing further, you'll learn about intuitive massage, an approach that transcends standard methods, allowing you to connect with your clients on a deeper level. This technique combines intuition and the healing power of touch, creating a bond of trust that enhances the therapeutic experience. An important facet of this course is the exploration of the Vital Body. You'll gain insight into the complex energy system within each individual, and learn how the use of crystal massage can enhance and balance this vital force. The course also delves into the remarkable world of amber - a powerful, organic substance that has been used in healing therapies for thousands of years. Amber's unique properties make it a valuable tool in crystal massage, and through this course, you'll gain a thorough understanding of how to harness its potential. A key element of the Crystal Massage Diploma is learning about the properties of crystal stones and wands. Each stone and wand possesses distinct characteristics and energy vibrations. By comprehending these attributes, you can align the right crystal with the specific needs of your clients, thus optimising the benefits of your massage therapy. You will also be trained in Crystal Wand Massage Techniques. These techniques utilise the distinctive shape and energy of crystal wands to stimulate points on the body, creating a massage experience that is both profound and restorative. The Crystal Massage Diploma doesn't limit itself to just traditional massage techniques. It also encompasses 'Crystals and Beauty', an innovative unit teaching you how to integrate crystal therapy into beauty routines. With this knowledge, you can help your clients attain not just inner peace but outward radiance as well. The Crystal Balance Massage and Techniques unit will enable you to fully understand the power of crystals in restoring equilibrium. The course empowers you to harmonise the physical, emotional, and spiritual aspects of your clients, offering them a truly comprehensive wellness solution. Finally, the Crystal Massage Diploma extends its teachings beyond human clients, exploring the exciting realm of Crystal Therapy for Pets. With this knowledge, you'll be able to extend the benefits of crystal massage to our four-legged friends, helping them achieve a state of balance and calm. In conclusion, this online Crystal Massage Diploma course offers a holistic approach to wellness. It blends ancient knowledge with modern techniques, equipping you with the skills to offer an exceptional and unique service to your clients. Enrol today to elevate your massage therapy skills and step into a world of crystal-infused wellness. What you will learn 1:Basics of Crystal Massage 2:Intuitive Massage 3:Vital Body 4:Amber 5:The Properties of Crystal Stones and Wands 6:Crystal Wands 7:Crystal Wand Massage Techniques 8:Crystals and Beauty 9:Crystal Balance Massage and Techniques 10:Crystal Therapy for Pets Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

Search By Location

- Balance Courses in London

- Balance Courses in Birmingham

- Balance Courses in Glasgow

- Balance Courses in Liverpool

- Balance Courses in Bristol

- Balance Courses in Manchester

- Balance Courses in Sheffield

- Balance Courses in Leeds

- Balance Courses in Edinburgh

- Balance Courses in Leicester

- Balance Courses in Coventry

- Balance Courses in Bradford

- Balance Courses in Cardiff

- Balance Courses in Belfast

- Balance Courses in Nottingham