- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

54073 AR courses

AAT Bookkeeping Course

By Osborne Training

AAT Bookkeeping Course If you want to become a certified bookkeeper with AATQB (AAT Qualified Bookkeeper) status, then you must complete the AAT bookkeeping course successfully. This bookkeeping course is broken down into two levels, Foundation Certificate in Bookkeeping Advanced Certificate in Bookkeeping Once you pass all 5 exams successfully, you can gain AATQB status giving you leading edge to build a successful career in bookkeeping. Next steps after qualifying You will be awarded with Foundation Certificate in Bookkeeping and Advanced Certificate in Bookkeeping from Association of Accounting Technicians (AAT) once you have passed all the exams. Therefore, you will be eligible for Certified Bookkeeper Status. It gives you greater recognition and professional approval. What you will gain? Firstly, this course will help you develop your skills in double entry bookkeeping and give you an understanding of management and administrative processes. You'll learn how to use manual bookkeepin systems and to work with the purchase ledger, sales ledger and general ledger. You would also get better understanding about VAT system and how to do VAT Return. You will be awarded with Foundation Certificate in Bookkeeping and Advanced Certificate in Bookkeeping from Association of Accounting Technicians (AAT) once you have passed all the exams. Therefore, you will be eligible for Certified Bookkeeper Status. It gives you greater recognition and professional approval. The AAT bookkeeping course covers the following areas: Bookkeeping transactions Bookkeeping Controls Advanced Bookkeeping Final Accounts Preparation Indirect Tax

Introduction to Data Science - free for Medway residents

By futureCoders SE

Learn the basics of Data Science, combining a supported #CISCO Skills for All online course with practical learning and a project to help consolidate the learning.

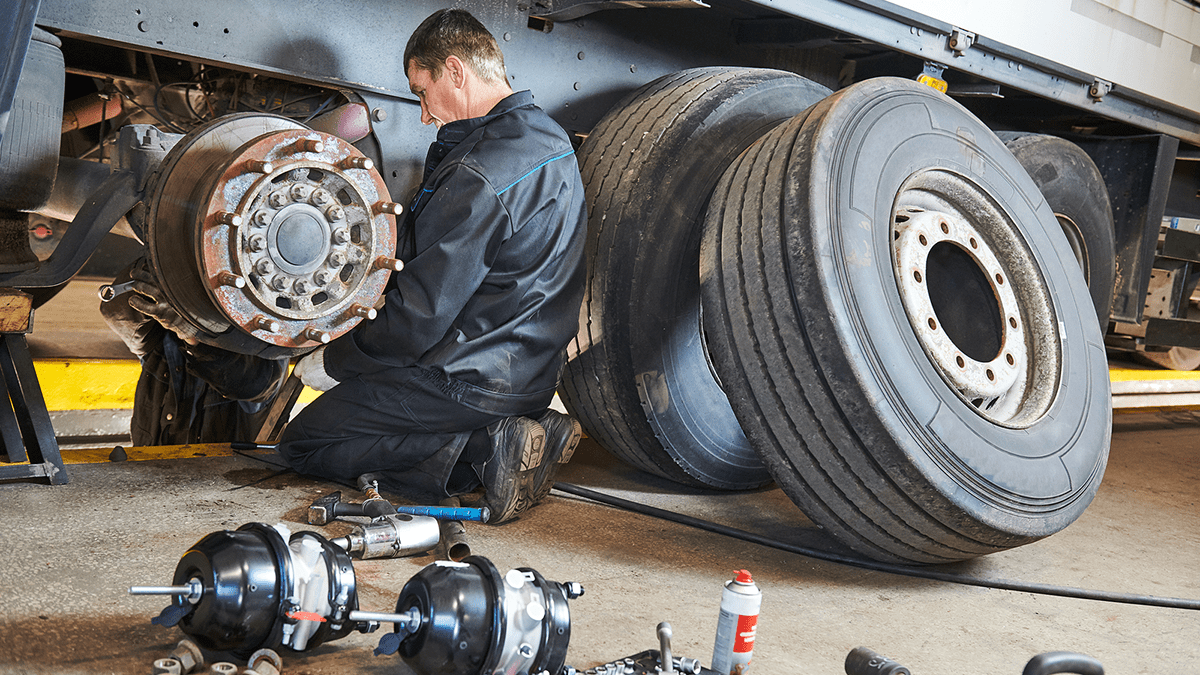

Licensed Commercial Tyre Technician (LCTT)

By PFTP Ltd

This route is aimed as commercial vehicle tyre technicians and covers the following competencies: Truck tyre fitting Specialist and multi-piece wheels Agricultural tyre fitting Earth mover tyre fitting Industrial tyre fitting INTERESTED? PFTP are proud to have been awarded approval by the NTDA to offer this valuable licence to our customers. To find out more, please either telephone us on 024 76325880, use the live talk function to talk to one of our sales operatives or visit our contact page to leave a message. We look forward to hearing from you!

Skills for Workplace Health Champions (Level 3 Award)

By Active Lancashire

Thanks for expressing interest in the course. Please note this is a provisional booking and confirmation of your place is subject to completion and approval of eligibility forms which will be sent to you via email shortly This qualification provides learners with the knowledge they need to become health champions in their workplace. The qualification also involves the planning and delivery of activities within their own workplace and includes a practical assessment. The course is designed for learners who are involved in promoting positive health choices at work or who would like to learn more about workplace health and wellbeing and how to champion it. *Eligibility criteria applies to employer and employee. This training is fully funded by the ESF for Lancashire-based businesses. What will it cover? Introduce the concept of workplace health and the role of the Workplace Health Champion Recognise the leading factors affecting physical and mental health Understand key behaviour change principles Recognise the need to safeguard adults as a Workplace Health Champion Understand how to plan a physical activity in the workplace Understand the concepts of mental and physical health Plan and deliver a workplace health campaign Plan and deliver a sport and/ or physical activity session in the workplace This is a 3-day training course. Learners will be required to attend each training day to complete the course

Dealing with Difficult Situations with Confidence

By Dickson Training Ltd

At times, everyone involved with a business will find themselves in a position where they are faced with difficult decisions. Being able to deal with these situations effectively and confidently is an important interpersonal skill. This is especially true for managers who will be forced to make tough decisions on a regular basis, but need to ensure that the business continues to perform both during and after the difficult decisions have been made. The manner in which they approach and implement these decisions can sometimes be the difference between success and failure. Course SyllabusThe syllabus of the Dealing with Difficult Situations with Confidence course is comprised of four modules, covering the following: Module OneSelf Awareness Attitude towards challenges - self-resilience Going into a challenging scenario - how to prepare Recognising the signs of contention Giving feedback constructively Module TwoHaving Difficult Conversations with Confidence Behaviour labelling - preparing the approach Assertiveness techniques Dealing with a difficult issue focussing on behaviour & consequences Keeping objective and professional throughout Module ThreeExamining Your Preferred Communication Style Recognising the different communication styles Analysing your preferred style - Paradigm FitIn Profiler review Identifying the most appropriate situations for each style Module FourHelpful Interpersonal Skills Effective questioning techniques Active listening Body language Recognising and dealing with behaviours Displaying and creating positive attitudes Remaining Assertive and in control

Licensed Retail Tyre Technician (LRTT)

By PFTP Ltd

A licensed retail tyre technician is likely to come from a number of backgrounds, e.g. apprentice, trainee or from another company where they have gained experience, but may not hold the relevent qualification or where the qualificatiion is old and out of date. For an individual to apply for the LRTT, they must be assessed as a competent practitioner and have the relevent knowledge in the following covering car, light van and 4×4: Tyre fitting Tyre repair Wheel balancing Four-wheel alignment Tyre pressure monitoring systems (TPMS) Manual handling and safe working practices. INTERESTED? PFTP are proud to have been awarded approval by the NTDA to offer this valuable licence to our customers. To find out more, please either telephone us on 024 76325880, use the live talk function to talk to one of our sales operatives or visit our contact page to leave a message. We look forward to hearing from you!

Licensed Vehicle Service Technician Course (LVST)

By PFTP Ltd

This route is considered a progression for the tyre technician. To qualify for the LVST vehicle Technician course, you must already hold the LRTT and in addition be assessed as a competent practitioner with the relevant knowledge in the following covering car, light van and 4×4: Customer liaison Vehicle inspection and appraisal Battery and related components Exhaust systems Braking systems Computer-based testing equipment. We evaluate your current skills and certifications to create a training package perfectly suited to you. Each LVST course is unique as we provide additional training, where required, to complement your current certifications and knowledge. The light vehicle service technician license shows that you have all the know-how and skills required to proficiently and independently diagnose and repair light vehicles. On achieving this auto technician license, you will be able to practically and proficiently demonstrate the skills required for repairing light vehicles. Offered by our fully licensed and experienced technicians, this license has been designed for mechanics/technicians that do not necessarily hold any formal qualifications. With decades of experience delivering high-quality automotive training courses, we are a small business that takes pride in the value and quality of service we provide. INTERESTED? PFTP is proud to have been awarded approval by the NTDA to offer this valuable licence to our customers. To find out more, please either telephone us on 024 76325880 or enquire below. We look forward to hearing from you!

Payroll Accounting Training Fast Track

By Osborne Training

Payroll Accounting Training Fast Track (Level 1-3): This course brings you the skills you need to use this popular payroll program to confidently process any businesses payroll. Being able to use Sage 50 Payroll should lead to greater productivity. But it also helps the business conform to employment legislation and data security requirements. Furthermore, broken down into practical modules this course is a very popular and well-received introduction to moving from manual payroll to computerised payroll. Moreover, it incorporates all the new government requirements for RTI reporting. Finally, Payroll is a vital role within any organisation. A career in payroll means specialising in a niche field with excellent progression opportunities. In this course, you will be learning from Level 1 to Level 3 of Sage Computerised Payroll which could help you to land your dream job in the Payroll sector. As Osborne Training is a Sage (UK) Approved training provider, you could gain the following qualifications provided that you book and register for exams and pass the exams successfully: Sage 50c Computerised Payroll Course (Level 1) Sage 50c Computerised Payroll Course (Level 2) Sage 50c Computerised Payroll Course (Level 3) All exams are conducted online through Sage (UK). Level 1: Introduction to payroll Introduction to Real-Time Information (RTI) Preparing employee records Starters - new employees Calculation of Gross Pay The PAYE and National Insurance systems Creating Payslips and analysis Creating Backups and Restoring data Payment analysis Processing National Insurance contributions Voluntary deductions Processing Leavers Completing the Payroll Procedures Level 2: Introduction to Payroll Introduction to Real Time Information (RTI) Preparing employee records Creating Backup and Restoring Data Starters - new employees Calculation of Gross Pay Deductions - Pension schemes and pension contributions Processing the payroll - introduction to the PAYE system Processing the payroll - income tax National Insurance contributions - Processing in the payroll Voluntary deductions Student Loan repayments Attachment of Earnings Orders & Deductions from Earnings Orders Processing Leavers Introduction to statutory additions and deductions Processing Statutory sick pay (SSP) Processing Statutory Paternity Pay (SPP) Statutory paternity pay and paternity leave Completing the processing of the payroll Creating Payslips and analysis Reports and payments due to HMRC Level 3: Advanced processing of the payroll for employees Preparation and use of period end preparation of internal reports Maintaining accuracy, security and data integrity in performing payroll tasks. Deductions - Pension schemes and pension contributions Processing the payroll -complex income tax issues Payroll Giving Scheme processing Processing Statutory Adoption Pay (SAP) Advanced Income tax implications for company pension schemes Student Loan repayments Processing Holiday Payments Processing Car Benefit on to the Payroll System Attachment of Earnings Orders & Deductions from Earnings Orders Leavers with complex issues Advanced processing of statutory additions and deductions Recovery of statutory additions payments - from HMRC Completing the processing of the payroll Complex Reports and payments due to HMRC Cost Centre Analysis Advanced, routine and complex payroll tasks Calculation of complex gross pay

Sales Presenting

By Dickson Training Ltd

The main aim of this workshop is to encourage and enable delegates to present their sales messages stylishly and persuasively to expert buying audiences and improve their conversion rates. The focus is placed firmly on performance and creativity in top level presenting. It is aimed at experienced sales professionals who are expert at selling but need to be able to present and pitch for business at high skill levels in order to land major accounts. Delegate numbers will be restricted to 4 people. Delegates should be willing and be prepared to give video-recorded presentations as part of the course. Course Syllabus The syllabus of the Sales Presenting course is comprised of two modules, covering the following: Module One Components of Top Presenting Preparation and performance in presenting Being stylish and compelling Differentiation, risk-taking and presenting Connecting with your audience Achieving impact and drama Creating a buying emotion Getting out of a comfort zone First delegate presentations Module Two Pitching in Teams Getting your act together - the plan Looking and sounding like a team The buyer's perspective Getting your moves right - choreography Dealing successfully with questions Rehearsing to succeed Second delegate presentations Dragon's Den Exercise The delegation is split into two groups, each with a specific product or service to win the Dragons' investment. They have to also present to the Dragon's Den their business case for feedback and negotiate with the Dragons to gain either an "I'm in" or an "I'm out" reply. A full debrief is then conducted covering: Planning Commercial consequences Putting forward a business case Critical thinking Negotiating Selling skills Presentation skills Profile building Scheduled Courses This course is not one that is currently scheduled as an open course, and is only available on an in-house basis. For more information please contact us.

Effective Negotiation Skills Course

By Dickson Training Ltd

Negotiation is an everyday challenge for some whether it be in the office, field or at home. Have you ever walked away from a situation thinking "if I'd only put my thoughts, side, opinion or words across better"? This 2-day course is perfect for managers, supervisors and sales people. It will focus on negotiation skills and the techniques that go with it. In this energy-charged provision you'll learn and practice negotiation, assertiveness and influencing techniques. Course Syllabus The syllabus of the Effective Communication and Influencing course is comprised of seven modules, covering the following: Module One An Introduction to Negotiation Assessment of your current sales and negotiation strengths and improvement areas What is negotiation? Identifying objectives and all factors affecting negotiation The negotiation model - the four stages Module Two The Preparation Stage The significance of preparation and why we need to prepare What do you need to prepare? Preparing a set of objectives: yours and theirs Understanding constants and variables Researching the other party Creating a "win-win" situation Preparing yourself for possible set-backs and objections Module Three The Discussion Stage The importance of rapport building Opening the negotiation The power of effective questioning techniques Improving your listening skills Controlling emotions Spotting the signs - non-verbal communication and voice clues Module Four The Proposing Stage Stating your opening position Responding to offers How to deal effectively with adjournments Module Five The Bargaining and Closing Stage Making concessions - the techniques Adopting key bargaining skills Dealing with objections and underhand tactics Closing techniques Confirming the agreement Creating long term, lasting commitment Scheduled Courses Unfortunately this course is not one that is currently scheduled as an open course, and is only available on an in-house basis. Please contact us for more information.

Search By Location

- AR Courses in London

- AR Courses in Birmingham

- AR Courses in Glasgow

- AR Courses in Liverpool

- AR Courses in Bristol

- AR Courses in Manchester

- AR Courses in Sheffield

- AR Courses in Leeds

- AR Courses in Edinburgh

- AR Courses in Leicester

- AR Courses in Coventry

- AR Courses in Bradford

- AR Courses in Cardiff

- AR Courses in Belfast

- AR Courses in Nottingham