- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

6034 Courses

Creating Screenshots and Images for User Guides Course

By Cherryleaf

Efficient ways to create professional-looking diagrams, images and screenshots Cherryleaf’s elearning course on creating screenshots and images for user guides gives you the foundations for creating professional images in an efficient way. The course includes exercises and model answers for the delegates to complete and review. Why attend this course? Creating screenshots, diagrams and images is something that every technical communicator needs to do, but very few have had any formal training in how to do it. Sometimes, the result is that the user guides and online Help contain images that are unclear, inconsistent, and frankly, unprofessional. They can make the product look like it's poor quality. Creating them can also tie up the Technical Writer's time, especially if they need to be changed frequently. Who is this course for? Anyone developing user guides and online Help who wants: A foundational understanding of how to use diagrams, screenshots and images, in an effective and efficient way. To see practical, real-world examples. It’s ideal for you if you’re: Creating screenshots, diagrams or images, but you’ve never had any proper training in how to do this well. Looking for more efficient ways to create or change screenshots, diagrams or images for end user or developer documentation. We’ll take you from first principles, so all you need is a basic understanding of what is a user guide. What you'll learn Cherryleaf's e-learning course on creating screenshots and images for user guides gives you the foundations for creating professional images in an efficient way. The goal of the course is to enable you to use diagrams, images and screenshots to communicate to your audience, with a focus on simplicity and ease of understanding. This is accomplished through a mix of design theory, best practices, software, and practical application. Please note, we don’t focus on highly detailed technical illustrations or 3D drawings that you might find in the aerospace or automotive industries. Also, the course does not cover Augmented Reality or Virtual Reality. You'll go through the key stages in developing screenshots, diagrams, and other images:in developing images. You’ll learn to understand the context, choose an effective visual display method, focus the user's attention, apply design best practices, and use the appropriate software tools to communicate your message. Introduction Understand the context Choose an appropriate visual display methodScreenshotsSimplified User InterfaceDiagramsAspect ratioIconsImage mapsWordless guides Focus attention where you want itGestalt theoryWhite space Think like a designerLayoutColourAccessibilityStyle guides SoftwareSoftware toolsSVGAutomating tasksStock imagesPresentation applications Animations Summary The course contains 22 exercises (and suggested answers) for you to practice your skills. Delivery format The course comprises eight modules in total, which you can complete at your own pace. The course will take delegates approximately 1 day to complete. You will have access to the modules from the moment you subscribe. You can download the course handouts. The courses are hosted and sold by via the Teachable platform. From a VAT perspective, they are the “Merchant of Record”, and receipts contain their VAT number. You have the option of taking the course on an iPhone or iPad, using the MyTeachable app in the Apple App Store. Prerequisites We'll take you from first principles, so all you need is a basic understanding of what is a user guide. You'll need access to PowerPoint, or a similar application, in order to complete some of the exercises. And it will help if you have a copy of Snagit. Our expertise As well as teaching technical communication, we also create end-user documentation, Help and UI text for clients. This means every course is based on practical experience of technical communication in today’s environment. Your Instructor Cherryleaf Cherryleaf is a technical writing services company formed in 2002 by people with a passion for technical communication and learning development. Cherryleaf is recognised as a leader within the technical communication profession. Our staff have written articles for the Society for Technical Communication's (STC) Intercom magazine, the Institute of Scientific and Technical Communicator's Communicator journal and tekom's TCWorld magazine. They've also written books on technical communication. We've presented webinars for Adobe, Madcap Software or the STC, and we've spoken at various conferences around the world. Today, organisations throughout Europe use Cherryleaf’s services so they can provide clear information that enables users and staff to complete tasks productively. Course Curriculum First Section Introduction (2:37) Understand the context (14:22) Choose an appropriate visual display method (55:15) Focus attention where you want it (10:39) Think like a designer (32:18) Software (70:12) Animations (21:09) Summary (1:59) Answers Frequently Asked Questions When does the course start and finish? The course starts now and never ends! It is a completely self-paced online course - you decide when you start and when you finish.How long do I have access to the course?How does lifetime access sound? After enrolling, you have unlimited access to this course for as long as you like - across any and all devices you own.What if I am unhappy with the course?We would never want you to be unhappy! If you are unsatisfied with your purchase, contact us in the first 30 days and we will give you a full refund.

Dive Into Ansible - From Beginner to Expert in Ansible

By Packt

This concise and comprehensive course takes you through the basic and advanced topics of Ansible, explaining all the concepts clearly and thoroughly. You will not only master the concepts but also learn how to use Ansible with cloud services and containers.

Leveraged Buyout Modelling

By Capital City Training & Consulting Ltd

Enroll today and master LBO modelling - a vital competency for careers in private equity, investment banking, corporate development, and finance. 3.5+ Hours of Video 5+ Hours to Complete15+ Interactive Exercises1 Recognised Certificate Course Overview Our comprehensive LBO Modelling certification program teaches the essential skills needed to model leveraged buyouts and prepare investment pitches. Through step-by-step video lessons and hands-on exercises, this course provides the necessary concepts, tools, and methods to become an expert in LBO analysis. With a focus on hands-on learning and real-world applications, this course will set you up for success in investment banking, private equity, mergers and acquisitions, business valuation, and corporate finance roles. With over 4 hours of content and 35+ exercises, our program provides all the necessary concepts, tools, and methods to become an expert on valuation. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Introduction to LBOs and Leveraged Finance Sources and Uses Framework for Funding Strategies Debt Structuring, Repayments, and Cash Flow Analysis Returns Analysis Across Multiple Scenarios Quantifying Value Creation with the Value Bridge 15+ Practice Exercises with Solutions Certificate Upon Completion

Awareness of First Aid for Mental Health Course - Half Day Classroom Setting

By Samina Arshad

Directions to The Warehouse: The address is: Travel and Parking arrangements: Paid parking is available (attendees are responsible for paying parking fees) From New St Station, follow signs to Moor St station. When you get to Moor St, go down the hill to the side of the station towards the multi-storey car park. At the car park, go left under the railway bridge. Immediately after the railway bridge turn right onto shaws passage, which is quite short. We're on the corner at the end of shaws Passage - walk round the corner onto Allison Street and along past the Cafe to the full glass door with the Birmingham Friends of the Earth hanging sign.

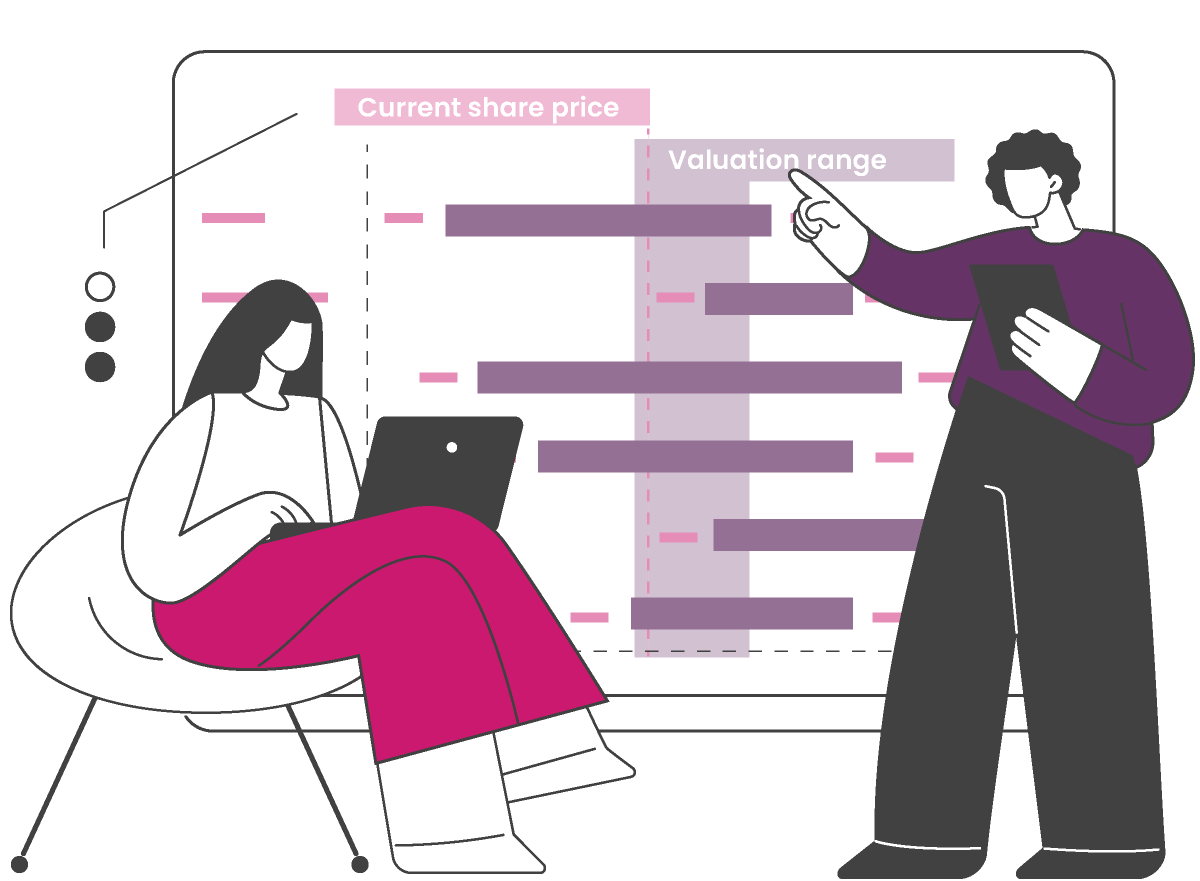

Valuation

By Capital City Training & Consulting Ltd

Enroll today and master the analytical skills needed to perform accurate valuations, evaluate company performance, and make informed investment decisions. 1.5+ Hours of Video 8+ Hours to Complete35+ Interactive Exercises1 Recognised Certificate Course Overview Our intensive Corporate Valuation certification will equip you with the must-have analytical skills to accurately value companies. As a critical input for investment selections, reliable valuation is pivotal for well-informed decisions. Through step-by-step practical training, our curriculum will empower you to value companies confidently and proficiently. With a focus on hands-on learning and real-world applications, this course will set you up for success in investment banking, private equity, mergers and acquisitions, business valuation, and corporate finance roles. With over 4 hours of content and 35+ exercises, our program provides all the necessary concepts, tools, and methods to become an expert on valuation. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Time Value of Money Principles and Calculations Net Present Value and Internal Rate of Return Metrics Calculating Averages and Statistical Measures Understanding and Measuring Financial Risk 16+ Practice Exercises and Applications Certificate Upon Successful Course Completion 4

Mergers & Acquisitions Modelling

By Capital City Training & Consulting Ltd

Enroll today and gain the mergers and acquisitions modelling skills needed to guide high-stakes business decisions and transactions. 1.5+ Hours of Video 3.5+ Hours to Complete20+ Interactive Exercises1 Recognised Certificate Course Overview Our comprehensive M&A Modelling certification program teaches the essential skills needed to build robust financial models for merger and acquisition valuations. Through step-by-step video lessons and hands-on exercises, you will learn to structure flexible models that provide vital insights into deal outcomes. This self-paced online course focuses on real-world applications in investment banking, private equity, and corporate development. The curriculum covers all aspects of M&A models including key concepts like goodwill, accretion/dilution, consolidation of financial statements, and optimal deal structuring. With over 1 hour of content and 20+ exercises, the program provides the necessary tools and techniques to become an expert in merger modelling. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Introduction to M&A Model Components and Framework Step-by-Step Merger Model Recipe and Methods Modelling Goodwill, Purchase Price Allocation, Accretion/Dilution Consolidating Balance Sheets and Financial Statements Optimizing Ownership Structure and Capital Funding Real World Case Studies and Debriefs Certificate Upon Completion

Finance for Non-Financial Managers

By Capital City Training & Consulting Ltd

Enroll today and gain the financial acumen needed to evaluate performance, assess opportunities, and make smart investments. Unlock your career growth potential and contribute to your organization's bottom line. 6+ Hours of Video 15+ Hours to Complete30+ Interactive Exercises1 Recognised Certificate Course Overview Our comprehensive Finance for Non-Finance Managers course cuts through financial jargon to provide business leaders the concepts and tools to evaluate performance and drive better decisions. Financial literacy is no longer just for finance teams - it's an essential skill for managers. This practical course focuses on translating financial statements and analysis into actionable insights. Through real-world cases and hands-on exercises, the self-paced online format allows busy professionals to boost their finance skills on their own time. Whether you're making investment choices or reviewing budget variances, this program will equip you to understand the numbers and take confident action. With over 6 hours of content and 30+ exercises, the program covers financial accounts, ratios, cash flows, capital budgeting, valuation, and more. A completed case study ties together the key concepts. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Introduction to Key Financial Statements and Reports Profitability, Efficiency, and Credit Health Metrics Return on Capital and Cash Flow Analysis Time Value of Money and Investment Appraisal Budgeting, Cost Behaviour, and Decision Making Business Valuation Methods and Value Creation Certificate Upon Successful Course Completion

Python GUI Programming - Building a Desktop Application with Tkinter and SQLite

By Packt

Implement a hands-on Python GUI project: Build a Cryptocurrency portfolio app with Python, Tkinter, SQLite3, and the CoinMarketCap API

Copywriting & Proofreading - Double Endorsed Certificate

By Imperial Academy

2 QLS Endorsed Course | CPD Certified | Free PDF + Hardcopy Certificates | 80 CPD Points | Lifetime Access

Search By Location

- exercise Courses in London

- exercise Courses in Birmingham

- exercise Courses in Glasgow

- exercise Courses in Liverpool

- exercise Courses in Bristol

- exercise Courses in Manchester

- exercise Courses in Sheffield

- exercise Courses in Leeds

- exercise Courses in Edinburgh

- exercise Courses in Leicester

- exercise Courses in Coventry

- exercise Courses in Bradford

- exercise Courses in Cardiff

- exercise Courses in Belfast

- exercise Courses in Nottingham