- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Introduction to Gemmology with Stuart Pool from Nineteen 48 Ltd. Sunday 29th September 10-4.30pm

5.0(21)By Workshop 925

This one-day workshop will give you a solid overview of many of the key topics relating to gems and gemmology, covering scientific aspects of the subject, the journey of a gemstone and the practical side of gem properties and identification. You will learn to use some of the main gemmologist’s tools and have a chance to examine a wide range of gemstones. A gemstone reference book RRP £10 will be included in the price WHEN: Sunday 29th September 10 – 4.30pm WHERE: Workshop 925 based at The Mayford Centre, just outside of Woking and very close to Guildford. Unit F9 The Mayford Centre, Mayford Green Woking, Surrey GU22 0PP TUTOR: Stuart Pool from Nineteen 48 WHAT DOES THE DAY INVOLVE? This one-day workshop will give you a solid overview of many of the key topics relating to gems and gemmology, covering scientific aspects of the subject, the journey of a gemstone and the practical side of gem properties and identification. You will learn to use some of the main gemmologist’s tools and have a chance to examine a wide range of gemstones. The main areas covered are: – General Introduction – The World of Gemstones – Properties & Identification – Grading & Buying This course is suitable for complete beginners to the subject and will also interest those with some previous knowledge, such as jewellery makers who want to learn more about the materials they use. Students need only bring their energy and enthusiasm, plus something for making notes. Everything else will be provided. The main areas covered are: How gemmology covers different scientific disciplines Gem basics Definition of a gemstone Inorganic / organic material Gemstone formation Physical and optical properties (overview) Responsible sourcing Environmental concerns Traceability Disclosure Diamond producers Diamond mining Sources of coloured gemstones Coloured stone mining Mining in Sri Lanka – history, process, structure, tradition, etc. Gem identification Gemstone properties – rough and faceted Inclusions – various examples of typical inclusions Tools & instruments – descriptions and usage Practical tasks for gem identification Gem grading and valuation – The factors that affect price – Diamonds – Coloured gemstones – Buying tips A gemstone reference book RRP £10 will be included in the price WHAT TO BRING: Bring along a note book. We will provide light refreshments, however you might want to bring some lunch. We have a fridge, microwave and kettle in the workshop. PAYMENT OPTIONS: You can pay via our website or in our workshop in person using our card machine. If you prefer to pay directly, you can email us on hello@workshop925.com and we can invoice you manually to arrange a bank transfer. For classes over £80, instalment options are also available. Please email us on hello@workshop925.com to arrange. Gift Voucher – if you have a voucher to redeem, please email us before booking on hello@workshop925.com Please check your dates carefully before booking a class as we are unable to offer refunds. See our Terms & Conditions for full details.

Intellectual property - the business perspective (In-House)

By The In House Training Company

This one-day programme explores the role of intellectual property (IP) in relation to innovation and creativity. It examines the different forms as well as the key processes, together with some of the oddities and idiosyncrasies of the legal regime that protects IP. It delves into the various IP models you should be aware of as well as key IP facts and figures and current IP trends across the global economy. This session is designed to give you a deeper understanding of: The main forms of intellectual property The importance of IP - both to your organisation and to the wider economy The key processes in the creation, commercial exploitation, and legal protection of IP The different models for the use of IP Some more advanced concepts for reviewing, valuing and managing IP 1 Main forms of intellectual property (IP) Patents Trademarks Copyright Design Trade secrets 2 Global IP business context Global IP facts and figures Figures for key jurisdictions Analysis of a company using IP data IP trends Overview of the key entities in the IP sector 3 Key IP processes IP creation IP portfolio management IP enforcement IP exploitation IP risk management 4 IP models IP models explained IP licensing IP litigation 5 IP concepts The IP maturity ladder Relative IP value and risk Axis of control 6 IP as an asset class Costs Valuation Financial perspective

Advanced financial analysis (In-House)

By The In House Training Company

In today's competitive business world firms are under unprecedented pressure to deliver value to their shareholders and other key stakeholders. Senior executives in all parts of the organisation are finding that they need some degree of financial know how to cope with the responsibility placed on them as business managers and key decision-makers; monitoring and improving business performance, investing in capital projects, mergers and acquisitions: all require some degree of financial knowledge. The key financial skills are not as difficult to learn as many people believe and in the hands of an experienced senior executive they can provide a formidable competitive advantage. After completing this course delegates will be able to: Understand fundamental business finance concepts; understand, analyse and interpret financial statements: Profit Statement, Balance Sheet and Cashflow Statement Understand the vital difference between profit and cashflow; identify the key components of working capital and how they can be managed to generate strong cashflow Evaluate pricing decisions based on an understanding of the nature of business costs and their impact on gross margin and break-even sales; managing pricing, discounts and costs to generate strong business profits; understand how lean manufacturing methods improve profit Use powerful analytical tools to measure and improve the performance of their own company and assess the effectiveness of their competitors Apply and interpret techniques for assessing and comparing investment opportunities in capital projects, business acquisitions and other ventures; understand and apply common methods of business valuation Understand the role of business finance in formulating and implementing competitive business strategy; the role of budgeting as part of the planning process and the various approaches to budgeting and performance measurement 1 Basic principles Delivering value to key stakeholders Accounting concepts, GAAP, IFRS and common terms Understanding and using the balance sheet Understanding and using the profit statement Recognising the vital difference between profit and cashflow Understanding and using the cashflow statement What financial statements can and cannot tell us 2 Managing and improving cashflow Sources of finance and their advantages and disadvantages What is working capital and why is it so important? Managing stocks, debtors and creditors Understanding how working capital drives business growth Understanding and avoiding the over-trading trap Unlocking the funds tied up in fixed assets: asset backed loans and leasing 3 Managing and improving profit Understanding how profits generate cashflow The fundamental nature of costs: fixed and variable business costs Understanding gross margin and break-even How common pricing methods affect gross margin and profit Effective strategies to improve gross margin Using value chain analysis to reduce costs Lean manufacturing methodsUnderstanding Just-in-time, 6 Sigma and Kaizen methods Improving profitEffective and defective strategies 4 Measuring and managing business performance Measures of financial performance and strength Investor behaviour: the risk and reward relationship Return on investment (ROI): the ultimate measure of business performance How profit margin and net asset turnover drive return on net assets Why some companies are more profitable that others Understanding competitive advantage: cost and differentiation advantage Why great companies failWhat happened to Kodak? Using a 'Pyramid of Ratios' to improve business performance Using Critical Success Factors to develop Key Performance Indicators 5 Budgeting and forecasting methods Using budgets to support strategy Objectives and methods for effective budgets Using budgets to monitor and manage business performance Alternative approaches to budgeting Developing and implementing Balanced Scorecards Beyond Budgeting Forecasting methods and techniques Identifying key business drivers Using rolling forecasts and 'what-if' models to aid decision-making

Access to Sage 50 Accounts Training in London | Sage Courses Online

By Osborne Training

Course description Sage 50 Accounting / Bookkeeping Training - Fast Track Overview Want to open the door to working in Finance and Accountancy Industry? Starting Sage Line 50 Accounting Fast Track Training course will enhance your career potentials and give you the skills and knowledge you need to get started in Finance and Accountancy Industry. Get a new direction for your career in Accountancy, according to statistics, the average salary for Accountants is £50,000 (Source: Reed), it is the sector where the employability rate is higher than any other sector. With the right skills and practical experience, you would be able to fast track your career in Accountancy and exactly that's where Osborne Training can fill the gap. The intensive programmes include all the skills required to fast track your career in professional Accountancy. Duration 6 Weeks Study Options Classroom Based - Osborne Training offers Daytime or Weekend sessions for Sage 50 Bookkeeping Training Course from London Campus. Online Live - Osborne Training offers online Evening sessions for Sage 50 Bookkeeping Training Classes through the Virtual Learning Campus. Distance Learning - Self Study with Study Material and access to Online study Material through Virtual Learning Campus. Certification You will receive a certificate from Osborne Training once you finish the course. You have an option to get an IAB Certificate subject to passing the exams. What qualification will I gain? You could Gain the following IAB qualifications provided that you book and register for IAB exams and pass the exams successfully: IAB Level 1 Award in Computerised Bookkeeping (QCF) 500/9405/1 IAB Level 2 Award in Computerised Bookkeeping (QCF) 500/9261/3 IAB Level 3 Award in Computerised Bookkeeping (QCF) 500/9407/5 Awarding body International Association of Book-Keepers Sage 50 accounts Course Syllabus Creating a Chart of Accounts to Suit Company Requirements Sole Trader Accounts preparation The Trial Balance preparation Errors in the Trial Balance Disputed Items Use of the Journal Prepare and Process Month End Routine Contra Entries The Government Gateway and VAT Returns Bad Debts and Provision for Doubtful Debts Stock Valuation, Stock Control, Work in Progress and Finished Goods Prepare and Produce Final Accounts Extended Trial Balance Exporting Data including Linking to Other Systems Management Information Reports Making Decisions with Reports Using Sage Prepare and Process Year End Accounts and Archive Data Final Accounts for Partnerships including Appropriation Accounts The Fixed Asset Register and Depreciation Accruals and Prepayments Cash Flow and Forecast Reports Advanced Credit Control

This 3 Days programme will equip you to use, price, manage and evaluate interest rate and cross-currency derivatives. The course starts with the building blocks of money markets and futures, through yield curve building to interest-rate and cross-currency swaps, and applications. The approach is hands-on and learning is enhanced through many practical exercises covering hedging, valuation, and risk management. This course also includes sections on XVA, documentation and settlement. The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation.

Strategic Commercial Awareness

By Underscore Group

Develop the commercial awareness, financial knowledge and strategic thinking capabilities, to influence the direction of the business Course overview Duration: 2 days (13 hours) This course is aimed at managers who want to develop their commercial awareness, financial knowledge and strategic thinking capabilities, so that they can influence the direction of their business and deliver to their full potential. Day one of the course provides the skills and insights to make sense of your company’s financial position and performance. Day two helps delegates to consider the strategic thinking tools required to plot the forward course needed to maximise the potential of the business. As well as looking at how to make effective business decisions, this course gives a good grounding in finance and profitability. As a two day programme, day one provides the skills and insights to make sense of the company’s financial position and performance. Day two then considers the strategic thinking tools needed to plot the forward course needed to maximise the potential of the business. Objectives By the end of the course you will be able to: An understanding of the balance sheet, profit and loss account, cash flow and statutory and management accounts Learnt to correctly employment key financial ratios to analyse your business A practical definition of strategy analysis tools to examine the current environment and capabilities Steps to devise a mission and vision statement Recognition of the skills and resources needed to achieve the vision Generation of appropriate strategic and tactical commercial objectives Content What is Strategy Defining Strategy Strategic thinking Strategic models Commercial thinking – what is money? Where are we now STEEPLE analysis SWOT Analysis P&E forces at work Political distortions in capitalist markets Where are we trying to get to Setting the mission and vision Creating a BHAG Strategies for deflation and inflation The role of banks Commercial and investment banking Fractional reserving Securitisation How to get there Skill gap analysis Business Process Re engineering The role of creativity How to get there Getting the team on board Individual and team motivation The power of the brand Overcoming challenges Debt and deleveraging Change management Creating value Discounted Cash Flows Building the business case Asset Valuation techniques Making it happen Turning Strategic Thinking into Strategic Plans Scenario planning for an uncertain future Creating commitments and lock in Discussion and review Time will be set aside during the course for review sessions with time for questions, answers and action learning.

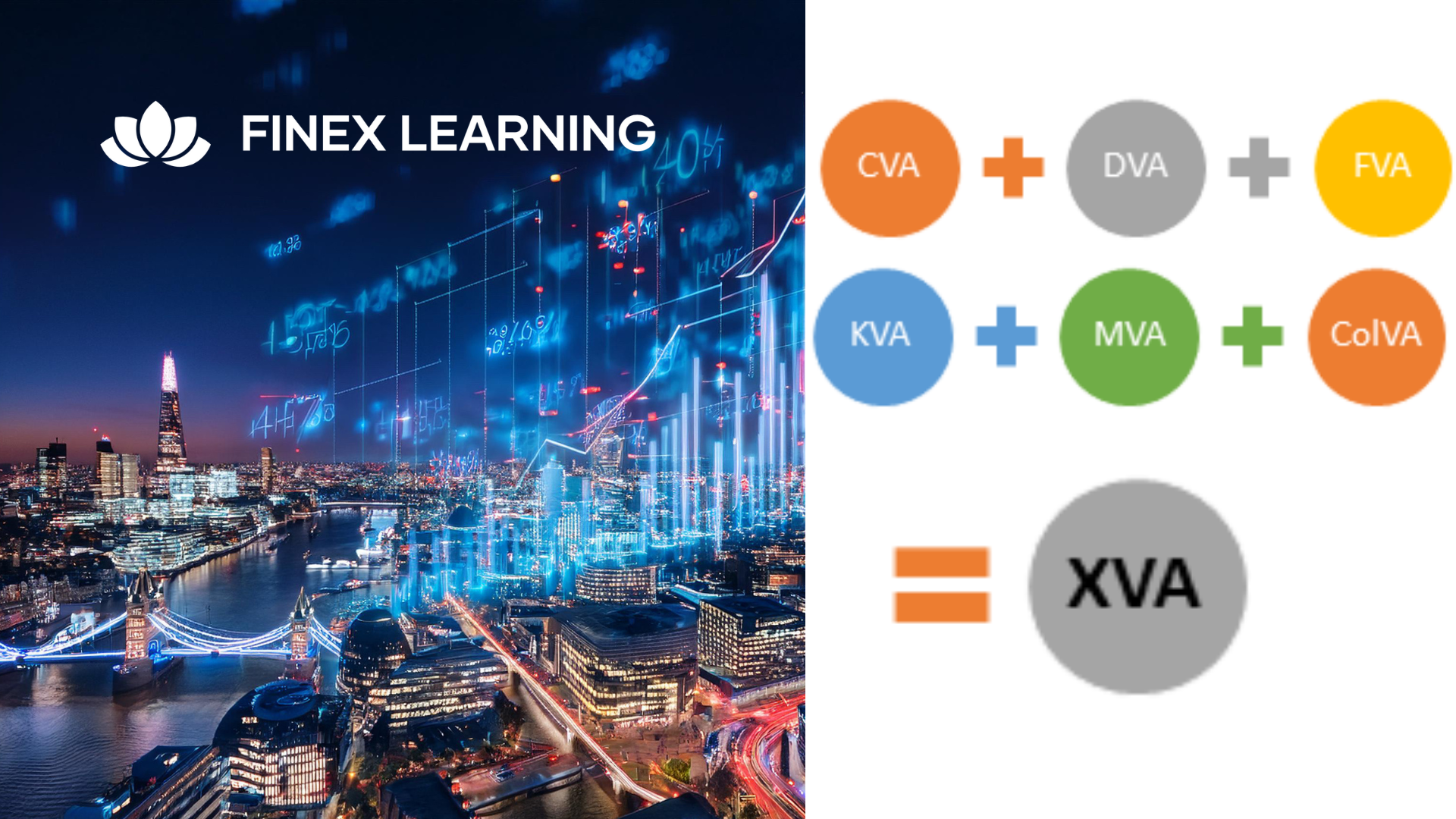

Overview This 1 day course focus on comprehensive review of the current state of the art in quantifying and pricing counterparty credit risk. Learn how to calculate each xVA through real-world, practical examples Understand essential metrics such as Expected Exposure (EE), Potential Future Exposure (PFE), and Expected Positive Exposure (EPE) Explore the ISDA Master Agreement, Credit Support Annexes (CSAs), and collateral management. Gain insights into hedging strategies for CVA. Gain a comprehensive understanding of other valuation adjustments such as Funding Valuation Adjustment (FVA), Capital Valuation Adjustment (KVA), and Margin Valuation Adjustment (MVA). Who the course is for Derivatives traders, structurers and salespeople xVA desks Treasury Regulatory capital and reporting Risk managers (market and credit) IT, product control and legal Quantitative researchers Portfolio managers Operations / Collateral management Consultants, software providers and other third parties Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This is a 2 day course on understanding credit markets converting credit derivatives, from plain vanilla credit default swaps through to structured credit derivatives involving correlation products such as nth to default baskets, index tranches, synthetic collateralized debt obligations and more. Gain insights into the corporate credit market dynamics, including the role of ratings agencies and the ratings process. Delve into the credit triangle, relating credit spreads to default probability (PD), exposure (EAD), and expected recovery (LGD). Learn about CDS indices (iTRAXX and CDX), their mechanics, sub-indices, tranching, correlation, and the motivation for tranched products. The course also includes counterparty risk in derivatives market where you learn how to managed and price Counterparty Credit Risk using real-world, practical examples Understand key definitions of exposure, including Mark-to-Market (MTM), Expected Exposure (EE), Expected Positive Exposure (EPE), Potential Future Exposure (PFE), Exposure at Default (EAD), and Expected Loss (EL) Explore the role of collateral and netting in managing counterparty risk, including the key features and mechanics of the Credit Support Annex (CSA) Briefly touch upon other XVA adjustments, including Margin Valuation Adjustment (MVA), Capital Valuation Adjustment (KVA), and Collateral Valuation Adjustment (CollVA). Who the course is for Credit traders and salespeople Structurers Asset managers ALM and treasury (Banks and Insurance Companies) Loan portfolio managers Product control, finance and internal audit Risk managers Risk controllers xVA desk IT Regulatory capital and reporting Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Search By Location

- Valuation Courses in London

- Valuation Courses in Birmingham

- Valuation Courses in Glasgow

- Valuation Courses in Liverpool

- Valuation Courses in Bristol

- Valuation Courses in Manchester

- Valuation Courses in Sheffield

- Valuation Courses in Leeds

- Valuation Courses in Edinburgh

- Valuation Courses in Leicester

- Valuation Courses in Coventry

- Valuation Courses in Bradford

- Valuation Courses in Cardiff

- Valuation Courses in Belfast

- Valuation Courses in Nottingham