- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Give your staff market-leading delivery skills and intercultural communication techniques with our unique course. TILT has been delivered to military and commercial clients and is seen as best-practice for those training internationally.

Credit control and debt recovery - legal issues (In-House)

By The In House Training Company

It is essential that those charged with responsibility for credit control and debt recovery have a full appreciation of the relevant law: no-one can negotiate effectively to recover a debt if they don't understand the ultimate sanctions they can apply. This programme is designed to give them a practical, up-to-date understanding of the law as it applies to your particular organisation. This course will help ensure that participants: Understand the relevant laws Know how and when to invoke legal processes Avoid legal pitfalls in debt collection negotiations Specific, practical learning points include: Definition of 'harassment' How to set up an in-house collection identity Whether cheques in 'full and final settlement' are binding The best steps to trace a 'gone away'... and many, many more. 1 Data protection and debt recovery There are a whole range of things which can be checked on members of the public and which are not affected by the restraints of the Data Protection Act. These will be explained in simple, clear terms so that staff can use this information immediately. 2 County Court suing The expert trainer will show how to sue for money owed, obtain judgment and commence enforcement action without leaving your desk. This module is aimed at showing how to make the Courts work for you instead of the other way around! 3 Enforcement of judgments There are many people who have a County Court Judgment (CCJ) against their debtor but who still remain unpaid. This session explains each of the enforcement methods and how to use them to best effect. Enforcement methods covered include: Warrant of Execution Using the sheriff (now known as High Court Enforcement Officers) Attachment of earnings Third Party Debt Orders Charging Orders (over property and goods) Winding-up companies and making individuals bankrupt 4 Office of Fair Trading rules on debt recovery Surprisingly few people are aware of the Office of Fair Trading rules on debt recovery and many of those that do know think they don't apply to them - but they do. Make sure you know what you need to! 5 New methods to trace elusive, absentee and 'gone away' debtors Why write the money off when you can trace the debtor and collect the money you are owed? 6 Credit checking of new and existing customers It makes sense to credit check would-be, new and existing customers to evaluate the likelihood of payment delays or perhaps not being paid at all. This session shows a range of credit checking steps, many of which can be done completely free of charge, including a sample credit application/ account opening form. 7 Late Payment of Commercial Debts Regulations Do your staff understand this legislation and how to use it to make people pay quicker than ever before? The trainer shows how. 8 The Enterprise Act The Enterprise Act made some startling changes to corporate and personal insolvency. What are the implications for credit control and debt recovery within your organisation?

Internal Workplace Mediation Skills Course (5 days)

By Buon Consultancy

Workplace Mediation

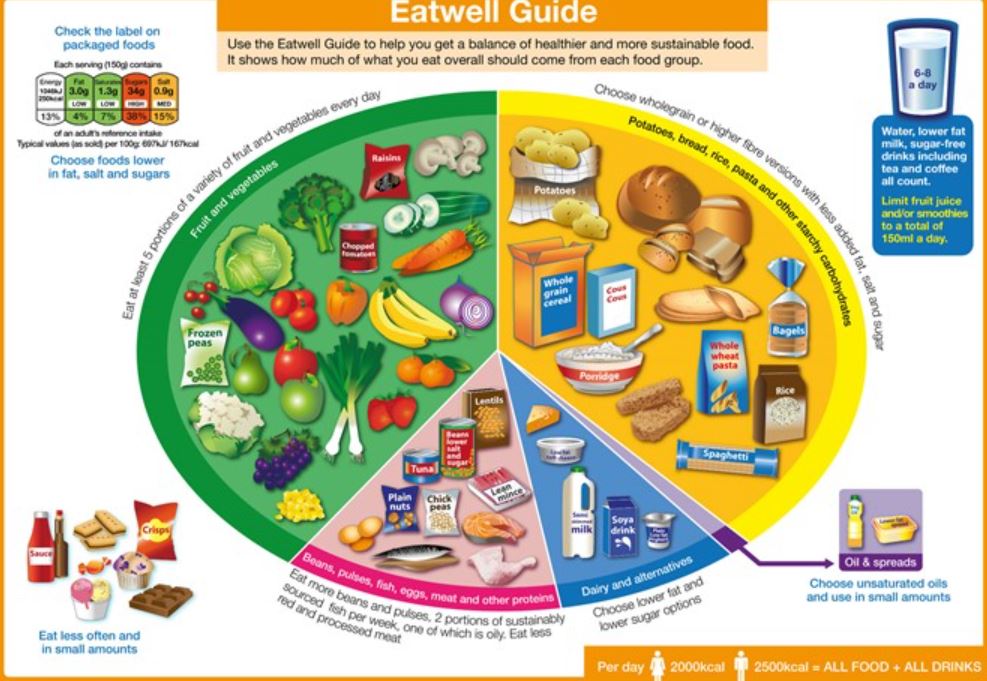

Nutrition Trainer - On-site Training - Nationwide - Level 2 Nutrition and Health Course

By Kitchen Tonic Training Company and Food Safety Consultants

Nutrition and Health Training Courses

Essential Selling Skills

By Dickson Training Ltd

Some people naturally possess an ability to sell and others over time develop their own style. We have created a highly practical course to give you the confidence and ability to sell over the phone or face to face. We focus the exercises, theory and discussion on your own job role and experiences to ensure you can return to the workplace to deliver tangible results. This 2-day course is designed for individuals who are new to selling, those in a sales role but have not received any formal training, or professionals who would like to brush up and enhance their current selling skills and learn some new techniques. Course Syllabus The syllabus of the Essential Selling Skills course is comprised of seven modules, covering the following: Module One Understanding the Customer The importance of good customer care Selling vs. selling attitude The reasons people buy Adopting a positive approach Module Two Self-Awareness Understanding your selling style Adapting your selling style to your customer Understanding your customers buying style Module Three Effective Communication and Rapport Building Why does communication need to be effective? Actively listening to your customers' needs Right question at the right time The impact of positive and emotive language Module Four Taking a Consultative Approach Different styles of selling Taking a consultative approach to selling Preparation techniques Buyer behaviour and motivation A selling approach to match the buyers mind Module Five Presenting the Solution Selling the benefits Sales tool kit Unique sales points Advanced questioning techniques Module Six Gaining Commitment Recognising and acting upon buying signals Dealing with customers concerns No means no? How to cope in stressful situations Module Seven Confirming the Sale Confirming or closing? Effective confirming techniques Going the extra mile Benefits For you as an individual This course will increase your confidence and ability to sell, having provided you with tools and techniques to achieve maximum results. Delegates always leave with fresh ideas, energy and motivation to succeed. For an employer The attitude of the delegates and the results they deliver will speak for themselves. All techniques are easy to apply back into the workplace for an immediate impact. What will I learn? By the end of the course, participants will be able to: Appreciate the need for preparation before a sales appointment Effectively identify and meet needs with advanced questioning techniques Identify verbal and non-verbal buying signals Construct professional answers to questions and possible objections Present your products and/or services with the buyer in mind Identify and use a selling style appropriate to capture the buyer's attention Recognise and overcome major objection types How to apply effective confirmation techniques with the buyer in mind Real Play Option We offer an innovative solution to engage the learners and bring real negotiation and closing scenarios to life. We use actors who improvise scenarios which have been specified by the group. The group is split the group into 2 sub-groups, one with the actor, the other with the trainer. Each group has a brief and has to instruct their trainer/actor on how to approach the scenario supplied. The actor and trainer perform the role play(s) as instructed by their respective teams; however during the action they can be paused for further recommendations or direction. The outcome is the responsibility of the team(s) - not the performers. Scheduled Courses This course is not one that is currently scheduled as an open course, and is only available on an in-house basis. For more information please contact us.

We supply Fire Marshal, Warden, Awareness training at your location and tailor it to your work sector, as such your staff will have no travelling or subsistence expenses minimising disruption for your organisation. Our trainer will bring all materials so you only need to provide a room with a plug socket. There is a practical element with extinguishers outside using our propane burners, which are fully insured and environmentally friendly. We require approximately 4 car parking spaces for this, if you do not have enough space we provide extinguisher discharge only. The training is accredited by the Institute of Fire Safety Managers, all attendees will receive individual Electronic Certificates and our Fire Warden Quick Guide, in addition a Group Certificate will be sent with all names on for audit purposes and your central records.

Minuting virtual meetings (In-House)

By The In House Training Company

Taking minutes is a much under-rated skill. It can be challenging at the best of times. So how do you do it for virtual meetings? This trainer-led session will help. It's a very practical programme which explores the issues specific to minuting on-line meetings and gives solutions to some of the trickier problems. Full of useful tips, the session will enable participants to: Identify how to adapt their current minute-taking skills to on-line meetings Plan and prepare for a meeting Follow a line of discussion Work in partnership with a remote Chair Deal confidently with minute-taking challenges. 1 Welcome Programme objectives Personal introductions 2 Adapting minute-taking to virtual meetings How is it different? What changes in approach are needed? 3 Preparation Preparing for the meeting Technology and equipment Dress and personal presentation Liaising with the Chair Practical preparation tips 4 Minuting tips Managing the 'techie' elements, eg. poor sound/visual quality Knowing who is speaking Following a line of discussion What if I don't hear or understand? Tips for producing a set of minutes 5 Session review Summary, key learning points, feedback and close

Agile product development: an introduction (In-House)

By The In House Training Company

The aim of this course is to provide an overview of Agile approaches to product development. It explains what Agile is and when and why to use it. The scope of the programme includes: The course emphasises the collaborative nature of Agile and the flexibility it offers to customers. The principal training objectives for this programme are to help participants understand: Why and when to use Agile How to use Agile The roles involved in Agile development The cultural factors to take into account How to manage Agile developments 1 Introduction (Course sponsor and trainer) Why this programme has been developed Review of participants' needs and objectives 2 Background to Agile Issues with traditional approaches to product development How Agile helps Roots of Agile Agile lifecycles Product v project 3 How Agile works The Agile Manifesto Agile principles Process control: defined v empirical Different Agile methods The Scrum framework DSDM Atern 4 Managing Agile When to use Agile Managing Agile projects Team organisation 5 Agile techniques Daily stand-ups User stories Estimating MoSCoW prioritisation 6 Course review and action planning (Course sponsor present) Are there opportunities to use Agile? What actions should be implemented to adopt Agile? Conclusion

Credit control training 'menu' (In-House)

By The In House Training Company

This is not a single course but a set of menu options from which you can 'pick and mix' to create a draft programme yourself, as a discussion document which we can then fine-tune with you. For a day's training course, simply consider your objectives, select six hours' worth of modules and let us do the fine-tuning so that you get the best possible training result. Consider your objectives carefully for maximum benefit from the course. Is the training for new or experienced credit control staff? Are there specific issues to be addressed within your particular sector (eg, housing, education, utilities, etc)? Do your staff need to know more about the legal issues? Or would a practical demonstration of effective telephone tactics be more useful to them? Menu Rather than a generic course outline, the expert trainer has prepared a training 'menu' from which you can select those topics of most relevance to your organisation. We can then work with you to tailor a programme that will meet your specific objectives. Advanced credit control skills for supervisors - 1â2 day Basic legal overview: do's and don'ts of debt recovery - 2 hours Body language in the credit and debt sphere - 1â2 day County Court suing and enforcement - 1â2 day Credit checking and assessment - 1 hour Customer visits and 'face to face' debt recovery skills - 1â2 day Data Protection Act explained - 1â2 day Dealing with 'Caring Agencies' and third parties - 1 hour Debt counselling skills - 2 hours Elementary credit control skills for new staff - 1â2 day Granting credit and collecting debt in Europe - 1â2 day Identifying debtors by 'type' to handle them accurately - 1 hour Insolvency: Understanding bankruptcy / receivership / administration / winding-up / liquidation / CVAs and IVAs - 2 hours Late Payment of Commercial Debts Interest Act explained - 2 hours Liaison with sales and other departments for maximum credit effectiveness - 1 hour Suing in Scottish Courts (Small Claims and Summary Cause) - 1â2 day Telephone techniques for successful debt collection - 11â2 hours Terms and conditions of business with regard to credit and debt - 2 hours Tracing 'gone away' debtors (both corporate and individual) - 11â2 hours What to do if you/your organisation are sued - 1â2 day Other topics you might wish to consider could include: Assessment of new customers as debtor risks Attachment of Earnings Orders Bailiffs and how to make them work for you Benefit overpayments and how to recover them Cash flow problems (business) Charging Orders over property/assets Credit policy: how to write one Council and Local Authority debt recovery Consumer Credit Act debt issues Using debt collection agencies Director's or personal guarantees Domestic debt collection by telephone Exports (world-wide) and payment for Emergency debt recovery measures Education Sector debt recovery Forms used in credit control Factoring of sales invoices Finance Sector debt recovery needs Third Party Debt Orders (Enforcement) Government departments (collection from) Harassment (what it is - and what it is not) Health sector debt recovery skills Hardship (members of the public) Insolvency and the Insolvency Act In-house collection agency (how to set up) Instalments: getting offers which are kept Judgment (explanation of types) Keeping customers while collecting the debt Late payment penalties and sanctions Letter writing for debt recovery Major companies as debtors Members of the public as debtors Monitoring of major debtors and risks Negotiation skills for debt recovery Old debts and how to collect them Out of hours telephone calls and visits Office of Fair Trading and collections Oral Examination (Enforcement) Pro-active telephone collection Parents of young debtors Partnerships as debtors Positive language in debt recovery Pre-litigation checking skills Power listening skills Questions to solicit information Retention of title and 'Romalpa' clauses Sale of Goods Act explained Salesmen and debt recovery Sheriffs to enforce your judgment Students as debtors Statutory demands for payment Small companies (collection from) Sundry debts (collection of) Terms and Conditions of Contract Tracing 'gone away' debtors The telephone bureau and credit control Taking away reasons not to pay Train the trainer skills Utility collection needs Visits for collection and recovery Warrant of execution (enforcement)

Search By Location

- Trainer Courses in London

- Trainer Courses in Birmingham

- Trainer Courses in Glasgow

- Trainer Courses in Liverpool

- Trainer Courses in Bristol

- Trainer Courses in Manchester

- Trainer Courses in Sheffield

- Trainer Courses in Leeds

- Trainer Courses in Edinburgh

- Trainer Courses in Leicester

- Trainer Courses in Coventry

- Trainer Courses in Bradford

- Trainer Courses in Cardiff

- Trainer Courses in Belfast

- Trainer Courses in Nottingham