- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2707 Technician courses in Mountsorrel delivered Online

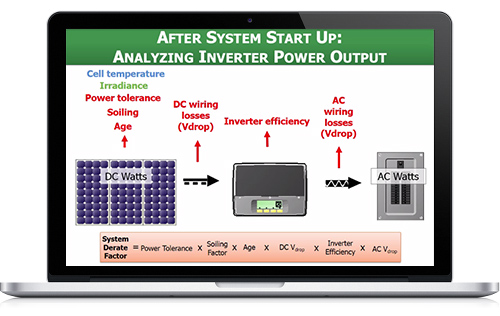

PVOL350: Solar Training - PV Systems - Tools and Techniques for Operations and Maintenance - Online

By Solar Energy International (SEI)

Discuss preventative and reactive maintenance plans and activities. Summarize safety procedures and PPE requirements for O&M technicians. Describe the field procedures required to evaluate the performance of PV systems. List appropriate requirements for meters, tools, and other equipment used in O&M activities. Define the theory, procedures, and processes behind insulation resistance testing, IV curve tracing, infrared cameras and thermal imaging, and other tools of the trade. Analyze test results to determine performance, compare baseline data, and pinpoint system issues. Describe inspection requirements for preventative maintenance inspections. Illustrate methods for locating and troubleshooting common PV array and system faults using appropriate methodologies and testing tools.

Legionella & Legionnaires Awareness

By Wise Campus

Legionella and Legionnaires' Disease Awareness Training Do you care about spreading awareness about Legionnaires' disease and Legionella? You will learn everything you ought to know about legionella as a duty holder in this Legionella and Legionnaires' Disease Awareness Training Course. You will learn how to control and prevent legionella from invading your workplace from the five modules of the Legionella and Legionnaires' Disease Awareness Training Course. This Legionella and Legionnaires' Disease Awareness Training Course might help you better comprehend the relevant laws. You will discover where legionella can be located, as well as the warning signs and symptoms, during this Legionella and Legionnaires' Disease Awareness Training Course. You will comprehend legionella and legionnaires' illness better after completing this Legionella and Legionnaires' Disease Awareness Training Course. Participate in our Legionella and Legionnaires' Disease Awareness Training Course course to avoid getting Legionnaires' illness and spreading it to others. Learning Objectives After completing this Legionella and Legionnaires' Disease Awareness Training Course, the learner will be able to: Understand what Legionella and its symptoms and treatment are. Know the legal responsibilities. Gain a thorough understanding of hazardous environments. Understand legionella risk assessment. Know how to control the risks. Main Course: Legionella and Legionnaires' Disease Awareness Training Course Along with The Legionella Awareness: Legionella Awareness Course, We Offer a free ADHD Awareness course Along with The Legionella Awareness: Legionella Awarenessv Course, We Offer a free Drug and Alcohol Awareness Course Special Offers of this Legionella Awareness Course This Legionella Awareness Course includes a FREE PDF Certificate. Lifetime access to this Legionella Awareness Course Instant access to this Legionella Awareness Course Get FREE Tutor Support to this Legionella Awareness Course Legionella and Legionnaires' Disease Awareness Training All the information you require to understand legionella as a duty holder will be covered in this training course on Legionella and Legionnaires Disease Awareness. You'll get a better grasp of the relevant laws and discover how to manage and stop legionella from getting into your place of business. Who is this course for? Legionella Awareness Training Taking the Legionella and Legionnaires' Disease Awareness Training Course can open up a number of professional options, such as: Legionella Risk Assessor Water Hygiene Technician Facilities Manager Environmental Health Officer Health and Safety Consultant Requirements Legionella Awareness Training To enrol in this Legionella & Legionnaires Awareness Course, students must fulfil the following requirements. To join in our Legionella Awareness Course, you must have a strong command of the English language. To successfully complete our Legionella Awareness Course, you must be vivacious and self driven. To complete our Legionella Awareness Course, you must have a basic understanding of computers. A minimum age limit of 15 is required to enrol in this Legionella Awareness Course. Career path Legionella Awareness Training Legionella and Legionnaires' Disease Awareness Training Course will help you to get a job in this relevant field.

A Computer Maintenance Specialist keeps computers in a good state of repair. They may run diagnostic programs to determine the causes of and help to resolve problems. The Computer Maintenance Specialist Training Level 2 course is designed for the people who want to pursue the lucrative career of computer maintenance specialists. Topics included in the course are the types of computer, computer basics, the anatomy of a PC, how a PC works, input and output devices, and more. In short, the course covers almost everything that you need to know about becoming a computer specialist. Why choose this course Earn an e-certificate upon successful completion. Accessible, informative modules taught by expert instructors Study in your own time, at your own pace, through your computer tablet or mobile device Benefit from instant feedback through mock exams and multiple-choice assessments Get 24/7 help or advice from our email and live chat teams Full Tutor Support on Weekdays Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Mock exams Multiple-choice assessment Certification After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for £9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for £15.99, which will reach your doorsteps by post.

Medical Terminology Training Courses - Level 2

By Mediterm Training

This course leads to the Mediterm Intermediate Award in Medical Terminology (Level 2), studied over approximately 12 weeks (taking more or less time dependent on learner requirements). This course is suitable for those already working in healthcare or those who wish to start a new career in healthcare.

Do you want to become a bookkeeper and work in any business sector you like? No experience but eager to learn? Well then this is the qualification for you. This qualification will give you the skills to become a bookkeeper, and you’ll gain an industry-recognised qualification. Plus, with Eagle you’ll have the option to move onto the full AAT qualification when you finish at no extra cost. The course is made up of two units: Introduction to Bookkeeping (ITBK) and Principles of Bookkeeping Controls (POBC). Recommended study time: 6 to 8 hours per week Estimated completion time: 3 to 5 months About AAT Level 2 Certificate in Bookkeeping Entry requirementsYou don’t need any previous accounting experience or qualifications to start studying AAT bookkeeping, just a willingness to learn. It’s ideal if you’re a school or university leaver, or thinking of changing career.Syllabus By the end of the AAT Level 2 Bookkeeping course, you will be able to confidently process daily business transactions in a manual and computerised bookkeeping system. This course provides comprehensive coverage of the traditional double-entry bookkeeping system which underpins accounting processes world-wide. It usually takes 3-5 months to complete if you spend 6-8 hours a week studying. Topics covered:Introduction to Bookkeeping (ITBK) How to set up bookkeeping systems How to process customer transactions How to process supplier transactions How to process receipts and payments How to process transactions into the ledger accounts Principles of Bookkeeping Controls (POBC) How to use control accounts How to reconcile a bank statement with the cash book How to use the journal How to produce trial balances How is this course assessed? The course is assessed by two exams – one for each unit. Unit assessment A unit assessment only tests knowledge and skills taught in that unit. For Bookkeeping they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the computer Getting your results Assessment results are available in your MyAAT account within 24 hours after you have sat your assessment. AAT approved venuesYou can search for your nearest venue via the AAT websitelaunch.What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe Unlimited access to the AAT Level 2 content with the use of all other levels. Empowering you to progress when you’re ready at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials What could I do next? You could start work as an entry-level bookkeeper. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can continue your studies and move onto the AAT Level 3 Certificate in Bookkeeping at no extra cost. Additional costs If you would like to, you can become a member of the Association of Accounting Technicians (AAT) launch. Fees associated with admission and exam fees are in addition to the cost of the course. Admission and membership fees are payable directly to AAT. Exam fees are paid to the exam centre. AAT one-off Level 2 Certificate in Bookkeeping Registration Fee: £65 AAT Assessment Fees: £70 to £80 per unit Please be aware that these are subject to change.

IT Security Training Course - CPD Certified

By Wise Campus

IT Security: IT Security Open up your IT passion by unlocking our IT security course! Do you want to begin a career as a professional in IT security? Do you want to expand your knowledge about IT security? With the help of this IT Security course, you'll be more determined than ever to advance your professional career and broaden your knowledge in this IT security area. Although they sound similar, information security and IT security refer to different types of security. Information security refers to the practices and tools used to prevent unauthorised access to sensitive corporate data, whereas IT security is the protection of digital data through computer network security. Even though maintaining IT security may be expensive, a significant breach may cost a company far more. This IT Security Course will provide you with a solid foundation so that you can develop the confidence to become an expert in IT Security and acquire more sophisticated skills to fill in the gaps for increased effectiveness and productivity. If you think you have what it takes to enter this IT security field, an IT security course can help you with your initial training and job preparation. IT Security is ready with all the necessary data that is meant to instruct and direct people in the requirements for this position. Don't wait any longer. Enrol in our IT security course to become a certified IT security professional. Main Course: IT security Course Free Courses are including with this IT Security: IT Security Course Along with The IT Security: IT Security Course, We Offer a free Cyber Security Course Special Offers of this IT Security: IT Security Course This IT Security: IT Security Course includes a FREE PDF Certificate. Lifetime access to this IT Security: IT Security Course Instant access to this IT Security: IT Security Course Get FREE Tutor Support to this IT Security: IT Security Course IT Security: IT Security Operating environments are a prerequisite for success in the IT security field for an IT security specialist. Experts in the field have created our IT Security Training Course to give you a complete grasp of the subject, including important ideas, practical tips, and in-depth knowledge. Who is this course for? IT Security: IT Security Anyone who wants to work in the IT industry can take our It Security course. Requirements IT Security: IT Security To enrol in this IT Security: IT Security Course, students must fulfil the following requirements. To join in our IT Security: IT Security Course, you must have a strong command of the English language. To successfully complete our IT Security: IT SecurityCourse, you must be vivacious and self driven. To complete our IT Security: IT SecurityCourse, you must have a basic understanding of computers. A minimum age limit of 15 is required to enrol in this IT Security: IT SecurityCourse. Career path IT Security: IT Security Many doors in the job market will be made available by the IT Security course. For instance, an IT technician, a cyber security analyst, or a penetration tester.The average salary for IT security professionals in the UK ranges between £60,000 and £100,000 per annum.

Bricklaying With Health and Safety in a Construction Environment

By Wise Campus

Bricklaying: Bricklaying Training Course Online Would you like to learn the abilities that will enable you to operate or oversee a hectic construction site with more confidence? Introducing the Bricklaying Training Course that will teach you how to build bricks like an expert! The Bricklaying Training Course will give a brief introduction to bricklaying and all the basic principles of bricklaying. Also, the Bricklaying Training Course teaches bricklaying techniques and construction fundamentals. Moreover, the Bricklaying Training Course describes the speciality bricklaying techniques, mortar types and mixing. The Bricklaying Training Course is perfect for learning about repairing and restoration. Furthermore, the Bricklaying Training Course elaborates on the building codes, regulations and planning for estimation. Enrol the Bricklaying Training Course now to discover everything you need to know about bricklaying and the skills to improve your talents in this field! Learning Outcome of Bricklaying Training Course After completing the Bricklaying Training Course, learners will know about: Introduction to bricklaying and its basic principles. Bricklaying techniques and construction fundamentals are described in this Bricklaying Training Course. This Bricklaying Training Course explains specialty bricklaying techniques. Mortar types and mixing are part of this Bricklaying Training Course. The Bricklaying Training Course elaborates the repair and restoration process. Building codes and regulations are clearly explained in the Bricklaying Training Course. Project planning and estimation are also included in the learning modules of the Bricklaying Training Course. Main Course: Bricklaying Training Course Free Courses are including with this Bricklaying: Bricklaying Training Course Along with The Bricklaying Training Course, We Offer a free Health and Safety in a Construction Environment Course Special Offers of this Bricklaying: Bricklaying Training Course This Bricklaying Training Course includes a FREE PDF Certificate. Lifetime access to this Bricklaying Training Course Instant access to this Bricklaying Training Course Get FREE Tutor Support to this Bricklaying Training Course Bricklaying: Bricklaying Training Course Online The Bricklaying Training Course will provide you a comprehensive rundown of all the core ideas in bricklaying. The bricklaying training course also covers the principles of building and bricklaying techniques. Specialized bricklaying techniques, mortar types, and mixing are all covered in the bricklaying training course. The Bricklaying Training Course is the best way to learn about repairing and restoring. In-depth information on building codes, regulations, and estimating planning is also covered in the bricklaying training course. Who is this course for? Bricklaying: Bricklaying Training Course Online This Bricklaying Training Course course is perfect for Homeowners, builders, contractors or any aspiring individual who is looking to improve their DIY skills and build their own walls or structures. Requirements Bricklaying: Bricklaying Training Course Online To enrol in this Bricklaying: Bricklaying Training Course, students must fulfil the following requirements. To join in our Bricklaying Training Course, you must have a strong command of the English language. To successfully complete our Bricklaying Training Course, you must be vivacious and self driven. To complete our Bricklaying Training Course, you must have a basic understanding of computers. A minimum age limit of 15 is required to enrol in this Bricklaying Training Course. Career path Bricklaying: Bricklaying Training Course Online You can look into careers like technician bricklaying, bricklaying, site supervisor, or site manager after finishing this Bricklaying Training Course.

Have you already got some bookkeeping experience and want to build on it? Or have you done Level 2 and now need to cement your learning? Level 3 Bookkeeping is the qualification for you. AAT Level 3 in Bookkeeping is suited for those who want to continue learning more advanced bookkeeping skills, and are looking to work in roles such as accounts manager, professional bookkeeper, or ledger manager. The course is made up of two units: Financial Accounting: Preparing Financial Statements (FAPS), and Tax Processes for Businesses (TPFB). Recommended study time: 6 to 8 hours per week Estimated completion time: 3 – 5 months About AAT Level 3 Certificate in Bookkeeping Entry requirementsAnyone can start at Level 3, but we recommend that you have done Level 2 first, as the qualification builds on existing knowledge.Syllabus By the end of the AAT Level 3 Bookkeeping course, you will be able to confidently apply the principles of double-entry bookkeeping, be able to prepare final accounts, and understand VAT legislation, VAT returns, and the implications of errors. There are three areas to study, made up of various subjects. It usually takes 3-5 months to complete if you spend 6-8 hours a week studying. Topics covered:Financial Accounting: Preparing Financial Statements (FAPS) The accounting principles underlying financial accounts preparation The principles of advanced double-entry bookkeeping How to implement procedures for the acquisition and disposal of non-current assets How to prepare and record depreciation calculations How to record period end adjustments How to produce and extend the trial balance How to produce financial statements for sole traders and partnerships How to interpret financial statements using profitability ratios How to prepare accounting records from incomplete information Tax Processes for Businesses (TPFB) The legislation requirements relating to VAT How to calculate VAT How to review and verify VAT returns The principles of payroll How to report information within the organisation How is this course assessed? This Level 3 course is assessed with unit assessments. Unit assessment A unit assessment tests knowledge and skills taught in that unit. At Level 3 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the computer Getting your results Assessment results are available in your MyAAT account within 24 hours for computer marked assessments. AAT approved venues You can search for your nearest venue via the AAT website launch. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe Unlimited access to the AAT Level 3 content with the use of all other levels. Empowering you to progress when you’re ready at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials What could I do next? You can now work as a qualified bookkeeper. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can move onto the full AAT qualification at no extra cost. Additional costs If you would like to, you can become a member of the Association of Accounting Technicians (AAT) launch. Fees associated with admission, and exam fees are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT one-off Level 3 Certificate in Bookkeeping Registration Fee: £90 AAT Assessment Fees: £70 to £80 per unit Please be aware that these are subject to change.

Are you looking to progress your career in accountancy? Have you got a solid understanding of accounting processes? Studying AAT Level 3 Diploma in Accounting could be the next step in your journey to becoming a qualified accountant. This course is suitable if you have previous accountancy experience, through study or work experience, and you’re looking to develop your skills further so you can become qualified and work in a variety of accounting roles. Entry requirements If you work in accounts or have studied accountancy before (such as AAT Level 2 Certificate), you may be able to start at this level. If you don’t have any previous accountancy experience, we recommend starting at Level 2. You’ll also need a good grasp of Maths and English skills to complete the course. We recommend that you register with AAT before starting this course. You’ll be given your AAT student number, which enables you to enter for assessments. AAT Level 3 Diploma syllabus By the end of the AAT Level 3 Diploma course, you will be able to prepare Sole Traders and Partnership Financial Statements, do depreciation calculations, understand management accounting techniques, and know how to apply VAT legislation. You’ll also learn about different business types and how technology impacts business. Financial Accounting: Preparing Financial Statements (FAPS) The accounting principles underlying financial accounts preparation The principles of advanced double-entry bookkeeping How to implement procedures for the acquisition and disposal of non-current assets How to prepare and record depreciation calculations How to record period end adjustments How to produce and extend the trial balance How to produce financial statements for sole traders and partnerships How to interpret financial statements using profitability ratios How to prepare accounting records from incomplete information Management Accounting Techniques (MATS) The purpose and use of management accounting within organisations The techniques required for dealing with costs How to attribute costs according to organisational requirements How to investigate deviations from budgets Spreadsheet techniques to provide management accounting information Management accounting techniques to support short-term decision making Principles of cash management Tax Processes for Businesses (TPFB) The legislation requirements relating to VAT How to calculate VAT How to review and verify VAT returns The principles of payroll How to report information within the organisation Business Awareness (BUAW) Business types, structures and governance, and the legal framework in which they operate The impact of the external and internal environments on businesses, their performance and decisions How businesses and accountants comply with the principles of professional ethics. The impact of new technologies in accounting and the risks associated with data security How to communicate information to stakeholders How is this course assessed? The Level 3 course is assessed by unit assessments. A unit assessment only tests knowledge and skills taught in that unit. At Level 3 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Mostly marked by the computer Getting your results Computer marked assessment results are available in your MyAAT account within 24 hours.* For assessments marked by the AAT, you can expect to receive your results within six weeks. * For a short period, Q2022 results may take up to 15 days. Grading To be awarded the AAT Level 3 Advanced Diploma in Accounting qualification you must achieve at least a 70% competency level in each unit assessment. Resits You can resit an assessment to improve your grade. Results from the assessment with the highest marks will be used to calculate your final grade. There are no resit restrictions or employer engagement requirements for any fee paying student on any of our AAT courses. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe. Unlimited access to the AAT Level 3 content with the use of all other levels. Empowering you to progress when you’re ready, or recap previous levels at no extra cost. Instant access to our unique comprehensive Study Buddy learning guide. Access to Consolidation and Progress Tests, and computer and self marked Mock Exams. You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours. You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you. Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials. What could I do next? After completing this level, you could go onto job roles such as a finance officer, assistant accountant and an advanced bookkeeper, earning salaries of up to £25,000. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can continue your studies and move onto the AAT Level 4 Diploma in Professional Accounting at no additional cost. Additional costs You are required to become a member of the Association of Accounting Technicians (AAT) launch to fulfil your qualification. Fees associated with admission and exam fees are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT One off Level 3 Registration Fee: £225 AAT Assessment Fees: £70 to £80 per unit but this can vary depending on where you sit your assessment. Please be aware that these are subject to change.

Do you want a fulfilling career in accountancy? Have you passed AAT Level 3 or an equivalent accounting qualification? We can help you reach your goal by studying AAT Level 4. This level builds on the knowledge you gained in the Level 3 Diploma. You will cover higher accounting tasks including drafting financial statements, managing budgets, and evaluating financial performance. There are also optional specialist units including business tax, personal tax, auditing, credit management, and cash and financial management. After qualifying you can work in accounting roles or progress onto studying chartered accountancy. About AAT Level 4 Diploma in Professional Accounting Entry Requirements To progress comfortably on this course, you’ll need to have good accounting knowledge and be able to perform all the financial and management accounting tasks which are tested on the AAT Level 3 course. Plus you’ll need a good standard of English literacy and basic Maths skills. We recommend you register with AAT before starting this course. This will give you your AAT student number, which enables you to enter for assessments. AAT Level 4 Diploma in Professional Accounting syllabus By the end of this course, you’ll be able to apply complex accounting principles, concepts, and rules to prepare the financial statements of a limited company. You’ll also learn management accounting techniques to aid decision making and control, prepare and monitor budgets, and measure performance. This level consists of compulsory and optional units: Compulsory unitsDrafting and Interpreting of Financial Statements (DAIF) The reporting frameworks that underpin financial reporting How to draft statutory financial statements for limited companies How to draft consolidated financial statements How to interpret financial statements using ratio analysis Applied Management Accounting (AMAC) The organisational planning process How to use internal processes to enhance operational control How to use techniques to aid short-term and long-term decision making How to analyse and report on business performance Internal Accounting Systems and Controls (INAC) The role and responsibilities of the accounting function within an organisation How to evaluate internal control systems How to evaluate an organisation’s accounting system and underpinning procedures The impact of technology on accounting systems How to recommend improvements to an organisation’s accounting system Optional units (choose two)Business Tax (BNTA) How to prepare tax computations for sole traders and partnerships How to prepare tax computations for limited companies How to prepare tax computations for the sale of capital assets by limited companies The administrative requirements of the UK’s tax regime The tax implications of business disposals Tax reliefs, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue and Customs Personal Tax (PNTA) The principles and rules that underpin taxation systems How to calculate UK taxpayers’ total income How to calculate income tax and National Insurance Contributions (NICs) payable by UK taxpayers How to calculate capital gains tax payable by UK taxpayers The principles of inheritance tax Audit and Assurance (AUDT) The audit and assurance framework The importance of professional ethics How to evaluate the planning process for audit and assurance How to evaluate procedures for obtaining sufficient and appropriate evidence How to review and report findings Cash and Financial Management (CSFT) How to prepare forecasts for cash receipts and payments How to prepare cash budgets and monitor cash flows The importance of managing finance and liquidity Ways of raising finance and investing funds Regulations and organisational policies that influence decisions in managing cash and finance Credit and Debt Management (CRDM) The relevant legislation and contract law that impacts the credit control environment How information is used to assess credit risk and grant credit in compliance with organisational policies and procedures The organisation’s credit control processes for managing and collecting debts Different techniques available to collect debts How is this course assessed? The Level 4 course is assessed by unit assessments. Unit assessment The Level 4 course is assessed by unit assessments. A unit assessment only tests knowledge and skills taught in that unit. At Level 4 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the AAT and the results are released after six weeks Getting your results Assessment results will be available in your MyAAT account when they are released. Grading To be awarded the AAT Level 4 Diploma in Accounting qualification you must achieve at least a 70% competency level in each unit assessment. Resits You can resit an assessment to improve your grade. Results from the assessment with the highest marks will be used to calculate your final grade. There are no resit restrictions or employer engagement requirements for any fee paying student on any of our AAT courses. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe. Unlimited access to the AAT Level 4 content with the use of all other levels, allowing you to recap previous levels at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams. You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you. Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials. What could I do next? After you’ve passed this level, you can work in a variety of jobs including forensic accountant, tax manager, accountancy consultant, or finance analyst, earning salaries of up to £37,000 as you advance and gain experience. AAT full members (MAAT) and fellow members (FMAAT) are eligible for exemptions that allow you to take the fast track route to chartered accountant status. You can stay with the same training provider. Eagle offers affordable courses approved by the ACCA (Association of Chartered Certified Accountants) to which you can subscribe. Additional costs You are required to become a member of the Association of Accounting Technicians (AAT) launch to fulfil your qualification. Fees associated with admission, and exam fees, are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT One off Level 4 Registration Fee: £240 AAT Assessment Fees: £70 to £80 per unit but this can vary depending on where you sit your assessment. Please be aware that these are subject to change.