- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Adobe Photoshop Training course One to One Weekends

By Real Animation Works

Photoshop pay per hr training flexible time weekend evening

Description: Welcome to the Diploma in Tax Management course. Are you self-employed and want to know how to file taxes online? Do you want better control over your business accounts? This tax training course will give you the practical skills and knowledge you need to handle your taxes faster and more efficiently. This tax management diploma course is designed to provide you with the tools and strategies to manage your tax affairs, prepare your own tax returns and even prepare returns for others. This course includes a wide range of tax-saving ideas and tax-saving measures, teaching you how to save taxes by refinancing your mortgage, spending less on your credit card and investing in life insurance. The advantages of online tax filing, the ins and outs of payroll, and the importance of acquiring a financial planning certificate will also be highlighted in this course. Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. PDF certificate's turnaround time is 24 hours and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognised accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: Diploma in Tax Management is a useful qualification to possess, and would be beneficial for the following careers: Tax consultant Tax accountant Accountant Assistant Accountant manager Accountant Executive Accountant Officer. Diploma in Tax Management Individual Tax Saving Ideas 01:00:00 Tax Saving Measures For Business 01:00:00 The Tax Audit 01:00:00 The Ins And Outs Of Federal Payroll Taxes 02:00:00 Why People File Taxes Online 00:30:00 What Are Your County Property Taxes Used For? 00:30:00 Offering Personal Financial Advice -Ameriprise Financial Services 01:00:00 Using Free Tax Preparation Software 00:30:00 Consulting Tax Attorneys - Tax Law Specialists 00:30:00 Delinquent Property Taxes- Three Steps To Deal With Your Delinquent Property Taxes 01:00:00 Federal Income Taxes - How To Deal With Federal Income Taxes? 01:00:00 File State Taxes- E-File System Is The Best Way To File Your State Taxes 00:30:00 Filing Income Taxes- How To File Income Taxes? 01:00:00 Financial Planning Software- Nine Benefits Of Financial Planning Software 01:00:00 Free Taxes- Benefits Of Filing Free Taxes Online 00:30:00 Income Tax Forms- Three Must To Follow If You Desire To Fill Your Income Tax Forms Yourself 00:30:00 LLC Tax Savings- How To Avail LLC Tax Savings 00:30:00 Benefits Of Online Tax Forms Over Traditional Methods 00:30:00 Save On Taxes By Refinancing Your Mortgage 00:30:00 Save On Taxes By Spending Less On Credit 00:30:00 Save On Taxes By Investing In Life Insurance 00:30:00 Save On Taxes: Hot Tips 01:00:00 Save On Taxes With Tax Deductions 01:00:00 Federal Tax Law 2005 For Nonprofit Organizations 00:30:00 Understanding California State Taxes 00:30:00 Make Your Personal Finances Work for You 01:00:00 The Importance of Acquiring a Financial Planning Certificate 00:30:00 Social Development and Financial Planning 01:00:00 An Overview Of Hennepin County Property Taxes 00:30:00 Kentucky State Taxes 01:00:00 Maryland State Taxes 01:00:00 Ohio State Taxes 00:30:00 UBS Financial Services For Small And Large Business 00:30:00 What Is A VP Financial Planner? 00:15:00 Mock Exam Mock Exam- Diploma in Tax Management 00:20:00 Final Exam Final Exam- Diploma in Tax Management 00:20:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Functional Skills (Math, English, IT)

By Compliance Central

Are you looking forward to Functional Skills packages, the most demanding skills, for the ongoing year and beyond? Then you are in the perfect place. Let's explore! The development of a learner's capacity to resolve issues in practical situations is referred to as a functional skill. The essential English, mathematics, and ICT abilities required for success in both the professional and personal spheres are known as functional skills. You may build these abilities with the aid of our functional skills course. Courses you'll get: Course 01: Functional Skills Maths Course 02: Functional Skills English Course 03: Functional Skills IT We provide beginner-level functional skills training in English, Maths, and ICT. The Functional Skills course contents are divided into modules and subjects, and learning evaluations are placed at regular intervals to test the level of understanding. You are supposed to learn the basics of arithmetic, computers, databases, and other subjects in the Functional Skills. Learning Outcome of Functional Skills course: Understand foundational Functional Skills maths Grasp the fundamentals of Functional Skills English Learn how to use computer hardware and software. Explore sharing and controlling software for data storage IT troubleshooting training Key Highlights for Functional Skills Course: CPD Accredited Functional Skills Course Unlimited Retake Exam & Tutor Support Easy Accessibility to the Functional Skills Course Materials 100% Functional Skills Learning Satisfaction Guarantee Lifetime Access & 24/7 Support with the Functional Skills Course Self-paced Functional Skills Course Modules Curriculum Breakdown of the Maths, English & IT Bundle Take a look at the training modules of the Functional Skills English Course: Basics of Grammar The Basics of Sentence Structure of Sentence Punctuation & Capitalisation Spelling Take a look at the training modules of the Functional Skills Maths Level 2 bundle: Numbers and Negative Numbers Multiples Factors Fractions and Power Percentages Expressions Decimals Ratio and Proportion Exponents and Radicals Graphs The Profit and Loss Perimeter and Area Averages Probability Take a look at the training modules of the IT course: Section 01: How People Use Computers Section 02: System Hardware Section 03: Device Ports and Peripherals Section 04: Data Storage and Sharing Section 05: Understanding Operating Systems Section 06: Setting Up and Configuring a PC Section 07: Setting Up and Configuring a Mobile Device Section 08: Managing Files Section 09: Using and Managing Application Software Section 11: IT Security Threat Mitigation Section 12: Computer Maintenance and Management Section 13: IT Troubleshooting Section 14: Understanding Databases CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in Functional Skills course. Besides, this course particularly recommended for- Anyone who is interested in reviewing or studying the fundamentals of IT, English, or mathematics. Whoever wants to be successful in functional skills. Anyone wishing to enhance their maths, English, or IT skills in order to increase their work prospects. Applicants for higher education. Requirements Learners seeking to enrol for Functional skills course should meet the following requirements; Basic knowledge of English Language, which already you have Be age 16 years or above Basic Knowledge of Information & Communication Technologies for studying online or digital platform. Stable Internet or Data connection in your learning devices. Career path After completing Functional Skills course, you can explore trendy and in-demand jobs related to this course, such as- Department Head Teacher Teaching Assistant Maths Teacher English Teacher IT Teacher Deputy Chief Explore each of the roles available and how you can start your career in Functional sectors. Certificates Certificate of completion Digital certificate - Included After successfully completing the course, you can get 3 CPD accredited digital PDF certificate for free. Certificate of completion Hard copy certificate - Included After successfully completing this course, you get 3 CPD accredited hardcopy certificate for free. The delivery charge of the hardcopy certificate inside the UK is £3.99 and international students need to pay £9.99 to get their hardcopy certificate.

[vc_row][vc_column][vc_column_text] Description: Want to fast-track your career in computer engineering? After learning the programming basics of C++, it's time to take your coding skills to the next level with this Level 3 diploma in C++ Programming Course. C++ is one of the most useful object-oriented programming languages out there, and is the leading language for video game and web development. This online course is designed for those who have prior programming experience. C++ is an object-oriented (OO) programming language which offers greater reliability and efficiency than older, more structured programming methods. It is a well-established, mainstream language used across a broad range of applications. This course covers key topics such as array indexing, unions, function pointers, standard library strings, building blocks and more. Certify your skills in software engineering, join the community of C++ coders and start learning essential computer programming skills from the comfort of your own home! Assessment: At the end of the course, you will be required to sit for an online MCQ test. Your test will be assessed automatically and immediately. You will instantly know whether you have been successful or not. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? Level 3 Diploma in C++ Programming is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Level 3 Diploma in C++ Programming is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market.[/vc_column_text][/vc_column][/vc_row] Level 3 Diploma in C++ Programming Classes and Structs FREE 00:22:00 Enums 00:14:00 Unions 00:16:00 Introduction to Pointers 00:11:00 Pointers and Array Indexing 00:12:00 Using Const with Pointers 00:09:00 Pointers to String Literals 00:12:00 References 00:14:00 Smart Pointers 00:22:00 Arrays 00:15:00 Standard Library Strings 00:13:00 More Standard Library Strings 00:18:00 Functions 00:18:00 More Functions 00:16:00 Function Pointers 00:15:00 Control Statements 00:18:00 Mock Exam Mock Exam- Level 3 Diploma in C++ Programming 00:20:00 Final Exam Final Exam- Level 3 Diploma in C++ Programming 00:20:00 Order Your Certificates and Transcripts Order Your Certificates and Transcripts 00:00:00

3ds Max Basic to Intermediate Training

By London Design Training Courses

Why Choose 3ds Max Basic to Intermediate Training Course? Course info Looking to take your 3D modelling and animation skills to the next level then Our Intermediate 3DS Max course is designed to help you do just that! A bespoke course ideal for anyone who has a solid understanding of modelling in the 3D environment for films & games. Duration: 20 hrs Method: 1-on-1, Personalized attention. Schedule: Tailor your own schedule and hours of your choice, available from Mon to Sat between 9 am and 7 pm. Why Opt for Our 3ds Max Basic to Intermediate Course? Elevate your 3D modeling and animation skills with our tailored Intermediate 3DS Max course, perfect for those proficient in 3D modeling for films and games. 3ds Max Interface: Familiarize yourself with essential interface areas, tool names, and shortcuts. Master the Scene Explorer for comprehensive scene control. Learn initial software settings for an efficient workflow. Organize your project folder for streamlined work management. Enhance workflow through scene navigation shortcuts and visual styles setup. Understand scene unit configuration for precision. Foundations of 3D Modeling: Acquire industry-standard 3D modeling techniques. Implement compositing modeling with procedural geometry. Utilize non-destructive methods via Modifiers to enhance base geometries. Create 3D models using Splines and modifiers like Extrude, Sweep, and Lathe. Explore Boolean operations for complex shape creation. Delve into Mesh Modeling, enabling manual mesh editing for customized objects. Mesh Modeling: Navigate mesh modeling tools in 3ds Max. Model hard surface objects using mesh modeling and other techniques. Unleash creativity in modeling various objects. Material Creation and Application: Understand material basics and texture application. Create, apply, and resize materials on models. Utilize pictures as references for modeling. Apply multiple materials to one object. Incorporate transparency, reflection, and self-illuminating textures. Utilize images with transparency for intricate texture designs. Camera Control Techniques: Learn camera creation and viewpoint adjustment. Modify camera focal length and lock settings for stability. Adjust camera exposure for desired image brightness. Explore cameras with and without targets, understanding their differences. Lighting: Create realistic lighting using daylight systems. Fine-tune daylight settings based on geographical location. Optimize render settings for high-quality output. Utilize various light types for interior illumination. Master light distribution and apply color filters and textures. Implement HDRI environment images for realistic lighting effects. Animation Essentials: Gain a basic understanding of animation principles. Animate objects manually through keyframing. Create walkthrough animations using cameras and paths. Construct efficient camera rigs for path-based animations. Render animations as video output. Advanced Rendering Techniques: Explore rendering with V-Ray Simulate daylight systems and interior lighting in V-Ray Set up studio lighting configurations in both V-Ray advanced rendering. Course Requirements: A computer with 3ds Max and Vray installed (trial versions available on Autodesk and Chaos Group websites) Basic familiarity with 3D modeling concepts is beneficial but not mandatory Enthusiasm for learning 3ds Max and Vray to create impressive 3D models, visualizations, and animations

FULL SOLAR ENERGY Design Course(With SketchUp & PVSYST)

By iStudy UK

Learn how to design your PV system and take steps to become a fully qualified solar panel engineer with the FULL SOLAR ENERGY Design Course(With SketchUp & PVSYST). This course is an in-depth training program designed to provide an insight into the solar industry and solar PV installation. In this course, you will develop practical knowledge and skills to become an expert in the field of energy consumption. You will start by learning how modern technology converts solar energy into electricity, and on completion will have full knowledge of how to design a photovoltaic system. Throughout the course, you will make use of expert solar design software PVSYST and SketchUp, to analyse your data and utilise specialist tools. System pricing, technical reports, and payback period are also discussed in detail. What you'll learn Develop your knowledge of solar energy systems and its main components Learn how to build your own solar energy system at home Fast track your career in engineering and develop the required skills Understand the fundamentals of solar radiation and PV solar energy Learn how to conduct a solar energy site survey and technical report Explore renewable energy consumption and the benefits of solar energy Gain an understanding of how solar energy is measured and its units of power Get step-by-step guidance on how to use specialist design software PVSYST & SketchUp Requirements Passion to learn! Basic computer skills Who this course is for Engineering students Beginner Engineers in this field Beginner Solar energy worker Anyone who wants to enter this sector Introduction See what will you learn FREE 00:02:00 What is Solar Energy 00:02:00 Power & Units 00:03:00 The components of the system ( Detailed explination) Solar Penels 00:04:00 Inverter 00:03:00 Peak sun hours and Shading effect 00:04:00 Mounting Structure 00:03:00 Circuit Breaker 00:02:00 Design Stage & Installation Procedure Site Survey 00:03:00 Design Steps Part 1 00:05:00 Design Steps part 2 00:08:00 Installation Procedure 00:03:00 Design softwares SketchUp Tools part 1 00:07:00 SketchUp Tools part 2 00:06:00 Skelion Plugin For PV panels Integration 00:09:00 Design A system 00:07:00 Introduction to PVSYST 00:08:00 Design a system with PVSYST 00:04:00 Pricing, Payback Period, Technical and Financial Reports Pricing 00:06:00 Payback Period 00:02:00 Technical & finanical reports 00:04:00 Additional Resources Resources File: FULL SOLAR ENERGY Design Course(With SketchUp & PVSYST) 00:00:00

Embark on your journey with our comprehensive QLS Endorsed Payroll, Pension, and Tax Accounting Bundle! This course bundle, which includes eight enlightening courses, is your gateway to mastering the theoretical concepts of HR, Payroll, PAYE, TAX, Pension, and Tax Accounting. Three of these courses are QLS-endorsed and delve deep into HR, Payroll, PAYE, TAX, Pension, and Tax Accounting. Upon successful completion, you'll be rewarded with a hardcopy certificate as proof of your newfound knowledge. The bundle also comprises five CPD QS accredited courses, which focus on Accountancy, Sage 50 Payroll for Beginners, Advanced Tax Accounting, Xero Accounting and Bookkeeping Online, and Sage 50 Accounts. This bundle is a treasure trove of theoretical knowledge in payroll, pension, and tax accounting. So, why wait? Empower yourself with this QLS endorsed bundle today! Key Features of the QLS Endorsed Payroll, Pension and Tax Accounting Bundle: 3 QLS-Endorsed Courses: We proudly offer 3 QLS-endorsed courses within our QLS Endorsed Payroll, Pension and Tax Accounting bundle, providing you with industry-recognized qualifications. Plus, you'll receive a free hardcopy certificate for each of these courses. QLS Course 01: HR, Payroll, PAYE, TAX QLS Course 02: Pension QLS Course 03: Tax Accounting 5 CPD QS Accredited Courses: Additionally, our bundle includes 5 relevant CPD QS accredited courses, ensuring that you stay up-to-date with the latest industry standards and practices. Course 01: Accountancy Course 02: Sage 50 Payroll for Beginners Course 03: Advanced Tax Accounting Course 04: Xero Accounting and Bookkeeping Online Course 05: Sage 50 Accounts In Addition, you'll get Five Career Boosting Courses absolutely FREE with this Bundle. Course 01: Professional CV Writing Course 02: Job Search Skills Course 03: Self Esteem & Confidence Building Course 04: Professional Diploma in Stress Management Course 05: Complete Communication Skills Master Class Convenient Online Learning: Our QLS Endorsed Payroll, Pension and Tax Accounting courses are accessible online, allowing you to learn at your own pace and from the comfort of your own home. Learning Outcomes of the QLS Endorsed Payroll, Pension and Tax Accounting Bundle: Acquire a comprehensive understanding of HR, Payroll, PAYE, and TAX. Learn the intricacies of Pension and Tax Accounting. Gain knowledge about the basics of Accountancy. Understand Sage 50 Payroll and how it's used in businesses. Explore the advanced concepts of Tax Accounting. Discover the benefits and functionalities of Xero Accounting and Bookkeeping Online. Learn how to navigate and utilise Sage 50 Accounts. The QLS Endorsed Payroll, Pension, and Tax Accounting Bundle is a meticulously curated program designed for individuals looking to gain a solid theoretical understanding of payroll, pension, and tax accounting. This bundle provides an in-depth exploration of HR, Payroll, PAYE, TAX, Pension, and Tax Accounting, alongside additional insights into accountancy, Sage 50 payroll and accounts, Xero accounting and bookkeeping, and advanced tax accounting. This all-encompassing package of knowledge is an excellent choice for anyone keen to expand their knowledge horizon in these subjects. CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Individuals interested in gaining theoretical knowledge in payroll, pension, and tax accounting. Professionals in HR, payroll, or taxation looking to further their knowledge. Aspiring accountants and bookkeepers. Anyone interested in using accounting software like Sage 50 and Xero. Career path Payroll Administrator: Salary Range - £18,000 - £30,000 Pension Specialist: Salary Range - £25,000 - £50,000 Tax Accountant: Salary Range - £25,000 - £55,000 HR and Payroll Manager: Salary Range - £30,000 - £60,000 Xero Certified Advisor: Salary Range - £22,000 - £40,000 Sage 50 Accounts Manager: Salary Range - £22,000 - £45,000 Certificates Digital certificate Digital certificate - Included Hard copy certificate Hard copy certificate - Included

Transform your human resource and payroll management skills with our comprehensive "Payroll, HR & HR Systems" course bundle! Gain a solid theoretical grounding with three QLS-endorsed courses: Payroll Management, HR (Human Resource), and Complete Guide to HR Systems. On successful completion, enjoy the prestige of owning a hardcopy certificate for each, showcasing your dedication and knowledge. But the learning doesn't stop there. Our bundle includes five additional CPD QS accredited courses, handpicked for their relevance to modern HR operations. Sage 50 Payroll for Beginners provides a thorough introduction to the popular payroll software, while Organisational Behaviour, HR and Leadership unpacks the intricacies of organisational dynamics. With Certificate in HR Audit, you can dive deep into internal HR procedures, and with Virtual Interviewing for HR and Safer Recruitment Training, you'll master the art of virtual recruitment and talent acquisition, a skill crucial in today's digital age. Key Features of the Payroll, HR & HR Systems Bundle: 3 QLS-Endorsed Courses: We proudly offer 3 QLS-endorsed courses within our Payroll, HR & HR Systems bundle, providing you with industry-recognized qualifications. Plus, you'll receive a free hardcopy certificate for each of these courses. QLS Course 01: Payroll: Payroll Management QLS Course 02: HR (Human Resource) QLS Course 03: Complete Guide to HR systems 5 CPD QS Accredited Courses: Additionally, our bundle includes 5 relevant CPD QS accredited courses, ensuring that you stay up-to-date with the latest industry standards and practices. Course 01: Sage 50 Payroll for BeginnersCourse 02: Organizational Behaviour, HR and LeadershipCourse 03: Certificate in HR AuditCourse 04: Virtual Interviewing for HRCourse 05: Safer Recruitment Training In Addition, you'll get Five Career Boosting Courses absolutely FREE with this Bundle. Course 01: Professional CV WritingCourse 02: Job Search SkillsCourse 03: Self Esteem & Confidence BuildingCourse 04: Professional Diploma in Stress ManagementCourse 05: Complete Communication Skills Master Class Convenient Online Learning: Our courses are accessible online, allowing you to learn at your own pace and from the comfort of your own home. This incredible, comprehensive 8-course bundle guarantees a holistic understanding of Payroll, HR Systems, equipping you with the theoretical knowledge to make a mark in your professional journey. Learning Outcomes: Gain a strong theoretical foundation in payroll management. Understand the principles and practices of Human Resource Management. Learn the use and application of HR systems. Comprehend the basics of Sage 50 Payroll. Develop insights into Organisational Behaviour and Leadership in HR context. Master the techniques of HR Audit. Equip yourself with virtual interviewing skills and safer recruitment practices. Our Payroll, HR & HR Systems course bundle delivers an in-depth, theoretical understanding of key HR topics. It brings together knowledge from various fields like payroll management, HR audit, and HR systems, providing a holistic perspective on the overall management of human resources. The bundle further highlights the importance of organisational behaviour, leadership, and safer recruitment practices - pivotal aspects in maintaining a harmonious and productive work environment. CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This bundle is ideal for: Students seeking mastery in this field Professionals seeking to enhance their skills Anyone who is passionate about this topic Career path HR Manager (Salary range: £35,000 - £60,000) Payroll Specialist (Salary range: £25,000 - £40,000) HR Systems Analyst (Salary range: £30,000 - £50,000) Recruitment Specialist (Salary range: £22,000 - £35,000) Organisational Development Manager (Salary range: £45,000 - £70,000) Certificates Digital certificate Digital certificate - Included Hard copy certificate Hard copy certificate - Included

Description: A certificate in Information technology from an internationally recognized institution will increase your career opportunity very much. The Certified Information Systems Professional - Complete Video Training course provides you extensive lessons about the Information System field. Divided into four parts, the course teaches you how to be a certified auditor, security manager, security officer and security professional. Certified Information Systems Auditor (CISA) section illustrates you the process of auditing information systems while the Certified Information Security Manager (CISM) part deals with the information security issues. Here, you will learn the system of information security program development, incident management, and risk management. Next, Certified Information Systems Security Officer (CISSO) course teaches how to be an excellent information system security officer by utilising the information system in the security field. Finally, the Certified Information Systems Security Professional (CISSP) section shows you the path for becoming a security professional by focusing the security issues such as asset security, communication and network security, security operations, etc. In short, the bundle video course will help you to achieve certification in above four fields and helps you to know the practical knowledge about Information System. Assessment: At the end of the course, you will be required to sit for an online MCQ test. Your test will be assessed automatically and immediately. You will instantly know whether you have been successful or not. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? Certified Information Systems Professional - Complete Video Training is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Certified Information Systems Professional - Complete Video Training is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. The Process of Auditing Information Systems Management of the Audit Function FREE 00:20:00 ISACA IT Audit and Assurance Standards and Guidelines 01:16:00 Risk Analysis 00:21:00 Internal Controls 00:17:00 Performing An IS Audit 01:07:00 Control Self-Assessment 00:09:00 The Evolving IS Audit Process 00:12:00 Governance and Management of IT Corporate Governance 00:06:00 IT Governance 00:02:00 IT Monitoring and Assurance Practices for Board and Senior Management 00:40:00 Information Systems Strategy 00:05:00 Maturity and Process Improvement Models 00:01:00 IT Investment and Allocation Practices 00:05:00 Policies and Procedures 00:17:00 Risk Management 00:31:00 IS Management Practices 00:50:00 IS Organizational Structure and Responsibilities 00:17:00 Auditing IT Governance Structure and Implementation 00:06:00 Business Continuity Planning 00:37:00 Information Systems Acquisition, Development and Implementation Business Realization 01:21:00 Project Management Structure 00:08:00 Project Management Practices 00:18:00 Business Application Development 00:42:00 Business Application Systems 00:38:00 Alternative Forms of Software Project Organization 00:03:00 Alternative Development Methods 00:10:00 Infrastructure Development/Acquisition Practices 00:09:00 Information Systems Maintenance Practices 00:09:00 System Development Tools And Productivity Aids 00:05:00 Business Process Reengineering And Process Change Projects 00:08:00 Application Controls 00:07:00 Auditing Application Controls 00:14:00 Auditing Systems Development, Acquisition And Maintenance 00:08:00 Information Systems Operations, Maintenance and Support Information Systems Operations 00:19:00 Information Systems Hardware 00:13:00 IS Architecture and Software 00:39:00 Network Infrastructure 01:16:00 Disaster Recovery Planning 00:19:00 Protection of Information Assets Importance Of Information Security 00:43:00 Logical Access 00:37:00 Network Infrastructure Security 00:39:00 Auditing Information Security Management Framework 00:03:00 Auditing Network Infrastructure Security 00:13:00 Environmental Exposures and Controls 00:02:00 Physical Access Exposures and Controls 00:05:00 Mobile Computing 00:05:00 Information Security Governance Information Security Governance Overview FREE 00:25:00 Effective Information Security Governance 00:24:00 Information Security Concepts and Technologies 00:20:00 Information Security Manager 00:09:00 Scope and Charter of Information Security Governance 00:10:00 Information Security Governance Metrics 00:23:00 Information Security Strategy Overview 00:02:00 Creating Information Security Strategy 00:36:00 Determining Current State Of Security 00:06:00 Information Security Strategy Development 00:10:00 Strategy Resources 00:40:00 Strategy Constraints 00:07:00 Action Plan to Implement Strategy 00:20:00 Information Risk Management Risk Management Overview 00:16:00 Good Information Security Risk Management 00:15:00 Information Security Risk Management Concepts 00:13:00 Implementing Risk Management 00:17:00 Risk Assessment 00:39:00 Controls Countermeasures 00:23:00 Recovery Time Objectives 00:18:00 Risk Monitoring and Communication 00:04:00 Information Security Program Development Development of Information Security Program 00:11:00 Information Security Program Objectives 00:09:00 Information Security Program Development Concepts 00:14:00 Scope and Charter of Information Security Program Development 00:22:00 Information Security Management Framework 00:16:00 Information Security Framework Components 00:12:00 Information Security Program Resources 01:04:00 Implementing an Information Security Program 00:27:00 Information Infrastructure and Architecture 00:14:00 Information Security Program 00:14:00 Security Program Services and Operational Activities 00:45:00 Information Security Incident Management Incident Management Overview 00:28:00 Incident Response Procedures 00:29:00 Incident Management Organization 00:19:00 Incident Management Resources 00:36:00 Incident Management Objectives 00:14:00 Incident Management Metrics and Indicators 00:17:00 Current State of Incident Response Capability 00:11:00 Developing an Incident Response Plan 00:32:00 BCP DRP 00:36:00 Testing Response and Recovery Plans 00:10:00 Executing the Plan 00:27:00 Information Systems Security Officer Risk Management FREE 00:58:00 Security Management 00:58:00 Authentication 01:01:00 Access Control 01:20:00 Security Models 01:01:00 Operations Security 01:10:00 Symmetric Cryptography and Hashing 01:19:00 Asymmetric Cryptography and PKI 01:31:00 Network Connections 01:28:00 Network Protocols and Devices 01:31:00 Telephony, VPNs and Wireless 01:13:00 Security Architecture 01:02:00 Software Development Security 01:05:00 Database Security and System Development 01:00:00 Malware and Software Attacks 00:17:00 Business Continuity 00:44:00 Disaster Recovery 00:53:00 Incident Management, Law, and Ethics 01:06:00 Physical 00:38:00 Information Systems Security Professional Security and Risk Management FREE 00:24:00 Asset Security 00:12:00 Security Engineering 00:15:00 Communication and Network Security 00:10:00 Identity and Access Management 00:10:00 Security Assessment and Testing 00:12:00 Security Operations 00:36:00 Software Development Security 00:13:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

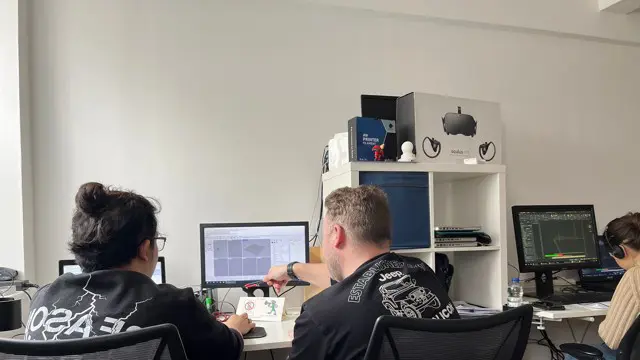

VMware vSAN: Troubleshooting [v7]

By Nexus Human

Duration 2 Days 12 CPD hours This course is intended for Storage and virtual infrastructure administrators who want to be able to perform initial troubleshooting on their software-defined storage with vSAN Overview By the end of the course, you should be able to meet the following objectives: Describe the software components of vSAN and their roles Diagram how the components relate to each other Use Skyline Health to investigate and help determine failure conditions Use the command-line tools to help determine failure conditions In this two-day course, you focus on learning the tools and skills necessary to troubleshoot VMware vSAN? 7 implementations. You gain practical experience with vSAN troubleshooting concepts through the completion of instructor-led activities and hands-on lab exercises. Course Introduction Introductions and course logistics Course objectives vSAN Architecture Describe the vSAN architecture and components Describe the policy-driven, object-based vSAN storage environment Describe the vSAN software components: CLOM, DOM, LSOM, CMMDS, and RDT Explain the relationships between the vSAN software components Explain the relationship between objects and components Determine how specific storage policies affect components Describe component placement Troubleshooting Methodology Use a structured approach to solve configuration and operational problems Apply troubleshooting methodology to logically diagnose faults and optimize troubleshooting efficiency Troubleshooting Tools Discuss the improvements and added capabilities in Skyline Health for vSAN Use Skyline Health for vSAN to identify and correct issues in vSAN Discuss the ways to run various command-line tools Discuss the ways to access VMware vSphere© ESXi? Shell Use commands to view, configure, and manage your vSphere environment Discuss the esxcli vsan namespace commands Discuss when to use Ruby vSphere Console (RVC) commands Explain which log files are useful for vSAN troubleshooting Use log files to help troubleshoot vSAN problems

![VMware vSAN: Troubleshooting [v7]](https://cademy-images-io.b-cdn.net/9dd9d42b-e7b9-4598-8d01-a30d0144ae51/4c81f130-71bf-4635-b7c6-375aff235529/original.png?width=3840)