- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

META-Health Foundation Course

By EFT Tapping Training Institute

Uncovering Emotional Root Causes of Health Challenges Instructor Craig Weiner, DC, Licensed MetaHealth Foundation Trainer, EFT Master Trainer of Trainers. Learn to apply a method of analysis that effectively guides the application and integration of EFT, Matrix Reimprinting and other alternative healing modalities you may already currently use for yourself and on your clients. Discover how symptoms and disease are actually an intelligent process that is the body’s attempt to heal stress and trauma. With this knowledge, fear can be greatly reduced and a therapeutic intervention can then be utilized in a more precise way. You and your clients will achieve results faster and will be amazed at the insights, connections and progress they make in their healing journey. META-Health is the science, practice and art of Body-Mind-Social Health with a focus on how specific stress triggers, emotions and beliefs affect specific organ symptoms. META-Health is a methodology based on Integrative Medicine and Prevention and is practiced by all types of health professionals interested in a precise and effective Body-Mind-Social analysis and approach towards most effectively supporting individuals working to find emotional and physical healing. Your trainer for this Foundation weekend will be Craig Weiner, who has worked in the complementary health care field for over 30 years. He brings his professional clinical experience, his years as an educator and certified trainer in the Emotional Freedom Techqniques and Matrix Reimprinting and as a licensed META-Health Foundation Trainer. In the Foundation Course you will get the overview of the META-Health concepts and its implications for self-healing, assistance in transforming disease, and achieving sustainable health and resilience, including: Rhythms of life, and the organism’s self-regulating intelligence How the bio-logical needs change your perception and create life strategies How to decode the language of your organs Recognize the key points and phases of the healing process Experience the powerful META-Analytics questions Use the 8 milestones of META-Health to address the whole system and its soil Find META-meanings to create resilience Demonstrations and practical exercises will lead you to deeply integrate the wisdom of your body, and inspire you to actively claim and support your health. You will understand the natural, dynamic path of healing, and be empowered to lift your – and others’ – consciousness to make use of our potential! During this weekend we will spend time reviewing the core META-Health Principles: Our body-mind is highly intelligent Bio-logical survival and stress strategies, regeneration and resilience are at play in our brain, nervous system and hormonal system Significant emotional experiences shape our beliefs, personality and lifestyle Specific individual stress triggers influence typical organ tissues and functions The cycle of stress, regeneration and learning goes through distinct points and phases Awareness and imagination are capabilities of our brain which can recreate meaning and reprogram body-mind’s reactions There is no pre-requisite to taking this weekend course. Anyone who is interested can participate in the META-Health Foundation Training. The Foundation Training is the first step in becoming a certified META-Health Practitioner. Times: The course is a 12 hours training and will be held from 9:00 to 4:00 Seattle/Pacific time on both Friday and Saturday with a 60 minute lunch break held at approximately 12:30pm.

Do you want a fulfilling career in accountancy? Have you passed AAT Level 3 or an equivalent accounting qualification? We can help you reach your goal by studying AAT Level 4. This level builds on the knowledge you gained in the Level 3 Diploma. You will cover higher accounting tasks including drafting financial statements, managing budgets, and evaluating financial performance. There are also optional specialist units including business tax, personal tax, auditing, credit management, and cash and financial management. After qualifying you can work in accounting roles or progress onto studying chartered accountancy. About AAT Level 4 Diploma in Professional Accounting Entry Requirements To progress comfortably on this course, you’ll need to have good accounting knowledge and be able to perform all the financial and management accounting tasks which are tested on the AAT Level 3 course. Plus you’ll need a good standard of English literacy and basic Maths skills. We recommend you register with AAT before starting this course. This will give you your AAT student number, which enables you to enter for assessments. AAT Level 4 Diploma in Professional Accounting syllabus By the end of this course, you’ll be able to apply complex accounting principles, concepts, and rules to prepare the financial statements of a limited company. You’ll also learn management accounting techniques to aid decision making and control, prepare and monitor budgets, and measure performance. This level consists of compulsory and optional units: Compulsory unitsDrafting and Interpreting of Financial Statements (DAIF) The reporting frameworks that underpin financial reporting How to draft statutory financial statements for limited companies How to draft consolidated financial statements How to interpret financial statements using ratio analysis Applied Management Accounting (AMAC) The organisational planning process How to use internal processes to enhance operational control How to use techniques to aid short-term and long-term decision making How to analyse and report on business performance Internal Accounting Systems and Controls (INAC) The role and responsibilities of the accounting function within an organisation How to evaluate internal control systems How to evaluate an organisation’s accounting system and underpinning procedures The impact of technology on accounting systems How to recommend improvements to an organisation’s accounting system Optional units (choose two)Business Tax (BNTA) How to prepare tax computations for sole traders and partnerships How to prepare tax computations for limited companies How to prepare tax computations for the sale of capital assets by limited companies The administrative requirements of the UK’s tax regime The tax implications of business disposals Tax reliefs, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue and Customs Personal Tax (PNTA) The principles and rules that underpin taxation systems How to calculate UK taxpayers’ total income How to calculate income tax and National Insurance Contributions (NICs) payable by UK taxpayers How to calculate capital gains tax payable by UK taxpayers The principles of inheritance tax Audit and Assurance (AUDT) The audit and assurance framework The importance of professional ethics How to evaluate the planning process for audit and assurance How to evaluate procedures for obtaining sufficient and appropriate evidence How to review and report findings Cash and Financial Management (CSFT) How to prepare forecasts for cash receipts and payments How to prepare cash budgets and monitor cash flows The importance of managing finance and liquidity Ways of raising finance and investing funds Regulations and organisational policies that influence decisions in managing cash and finance Credit and Debt Management (CRDM) The relevant legislation and contract law that impacts the credit control environment How information is used to assess credit risk and grant credit in compliance with organisational policies and procedures The organisation’s credit control processes for managing and collecting debts Different techniques available to collect debts How is this course assessed? The Level 4 course is assessed by unit assessments. Unit assessment The Level 4 course is assessed by unit assessments. A unit assessment only tests knowledge and skills taught in that unit. At Level 4 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the AAT and the results are released after six weeks Getting your results Assessment results will be available in your MyAAT account when they are released. Grading To be awarded the AAT Level 4 Diploma in Accounting qualification you must achieve at least a 70% competency level in each unit assessment. Resits You can resit an assessment to improve your grade. Results from the assessment with the highest marks will be used to calculate your final grade. There are no resit restrictions or employer engagement requirements for any fee paying student on any of our AAT courses. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe. Unlimited access to the AAT Level 4 content with the use of all other levels, allowing you to recap previous levels at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams. You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you. Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials. What could I do next? After you’ve passed this level, you can work in a variety of jobs including forensic accountant, tax manager, accountancy consultant, or finance analyst, earning salaries of up to £37,000 as you advance and gain experience. AAT full members (MAAT) and fellow members (FMAAT) are eligible for exemptions that allow you to take the fast track route to chartered accountant status. You can stay with the same training provider. Eagle offers affordable courses approved by the ACCA (Association of Chartered Certified Accountants) to which you can subscribe. Additional costs You are required to become a member of the Association of Accounting Technicians (AAT) launch to fulfil your qualification. Fees associated with admission, and exam fees, are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT One off Level 4 Registration Fee: £240 AAT Assessment Fees: £70 to £80 per unit but this can vary depending on where you sit your assessment. Please be aware that these are subject to change.

Are you looking to progress your career in accountancy? Have you got a solid understanding of accounting processes? Studying AAT Level 3 Diploma in Accounting could be the next step in your journey to becoming a qualified accountant. This course is suitable if you have previous accountancy experience, through study or work experience, and you’re looking to develop your skills further so you can become qualified and work in a variety of accounting roles. Entry requirements If you work in accounts or have studied accountancy before (such as AAT Level 2 Certificate), you may be able to start at this level. If you don’t have any previous accountancy experience, we recommend starting at Level 2. You’ll also need a good grasp of Maths and English skills to complete the course. We recommend that you register with AAT before starting this course. You’ll be given your AAT student number, which enables you to enter for assessments. AAT Level 3 Diploma syllabus By the end of the AAT Level 3 Diploma course, you will be able to prepare Sole Traders and Partnership Financial Statements, do depreciation calculations, understand management accounting techniques, and know how to apply VAT legislation. You’ll also learn about different business types and how technology impacts business. Financial Accounting: Preparing Financial Statements (FAPS) The accounting principles underlying financial accounts preparation The principles of advanced double-entry bookkeeping How to implement procedures for the acquisition and disposal of non-current assets How to prepare and record depreciation calculations How to record period end adjustments How to produce and extend the trial balance How to produce financial statements for sole traders and partnerships How to interpret financial statements using profitability ratios How to prepare accounting records from incomplete information Management Accounting Techniques (MATS) The purpose and use of management accounting within organisations The techniques required for dealing with costs How to attribute costs according to organisational requirements How to investigate deviations from budgets Spreadsheet techniques to provide management accounting information Management accounting techniques to support short-term decision making Principles of cash management Tax Processes for Businesses (TPFB) The legislation requirements relating to VAT How to calculate VAT How to review and verify VAT returns The principles of payroll How to report information within the organisation Business Awareness (BUAW) Business types, structures and governance, and the legal framework in which they operate The impact of the external and internal environments on businesses, their performance and decisions How businesses and accountants comply with the principles of professional ethics. The impact of new technologies in accounting and the risks associated with data security How to communicate information to stakeholders How is this course assessed? The Level 3 course is assessed by unit assessments. A unit assessment only tests knowledge and skills taught in that unit. At Level 3 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Mostly marked by the computer Getting your results Computer marked assessment results are available in your MyAAT account within 24 hours.* For assessments marked by the AAT, you can expect to receive your results within six weeks. * For a short period, Q2022 results may take up to 15 days. Grading To be awarded the AAT Level 3 Advanced Diploma in Accounting qualification you must achieve at least a 70% competency level in each unit assessment. Resits You can resit an assessment to improve your grade. Results from the assessment with the highest marks will be used to calculate your final grade. There are no resit restrictions or employer engagement requirements for any fee paying student on any of our AAT courses. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe. Unlimited access to the AAT Level 3 content with the use of all other levels. Empowering you to progress when you’re ready, or recap previous levels at no extra cost. Instant access to our unique comprehensive Study Buddy learning guide. Access to Consolidation and Progress Tests, and computer and self marked Mock Exams. You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours. You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you. Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials. What could I do next? After completing this level, you could go onto job roles such as a finance officer, assistant accountant and an advanced bookkeeper, earning salaries of up to £25,000. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can continue your studies and move onto the AAT Level 4 Diploma in Professional Accounting at no additional cost. Additional costs You are required to become a member of the Association of Accounting Technicians (AAT) launch to fulfil your qualification. Fees associated with admission and exam fees are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT One off Level 3 Registration Fee: £225 AAT Assessment Fees: £70 to £80 per unit but this can vary depending on where you sit your assessment. Please be aware that these are subject to change.

ONLINE. Icon Painting Course - Beginners. With live demonstrations.

4.4(18)By Edinburgh School of Icon Painting

We are excited to announce the Online version of the Step by Step Course. It will include live demonstrations of the process that you will then follow. Unique opportunity to be guided step by step and experience meditative practice of icon painting.

Massage Therapy Bundle - QLS Endorsed Training

By Imperial Academy

10 QLS Endorsed Courses for Massage Therapy | 10 Endorsed Certificates Included | Lifetime Access

Do you want to become a bookkeeper and work in any business sector you like? No experience but eager to learn? Well then this is the qualification for you. This qualification will give you the skills to become a bookkeeper, and you’ll gain an industry-recognised qualification. Plus, with Eagle you’ll have the option to move onto the full AAT qualification when you finish at no extra cost. The course is made up of two units: Introduction to Bookkeeping (ITBK) and Principles of Bookkeeping Controls (POBC). Recommended study time: 6 to 8 hours per week Estimated completion time: 3 to 5 months About AAT Level 2 Certificate in Bookkeeping Entry requirementsYou don’t need any previous accounting experience or qualifications to start studying AAT bookkeeping, just a willingness to learn. It’s ideal if you’re a school or university leaver, or thinking of changing career.Syllabus By the end of the AAT Level 2 Bookkeeping course, you will be able to confidently process daily business transactions in a manual and computerised bookkeeping system. This course provides comprehensive coverage of the traditional double-entry bookkeeping system which underpins accounting processes world-wide. It usually takes 3-5 months to complete if you spend 6-8 hours a week studying. Topics covered:Introduction to Bookkeeping (ITBK) How to set up bookkeeping systems How to process customer transactions How to process supplier transactions How to process receipts and payments How to process transactions into the ledger accounts Principles of Bookkeeping Controls (POBC) How to use control accounts How to reconcile a bank statement with the cash book How to use the journal How to produce trial balances How is this course assessed? The course is assessed by two exams – one for each unit. Unit assessment A unit assessment only tests knowledge and skills taught in that unit. For Bookkeeping they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the computer Getting your results Assessment results are available in your MyAAT account within 24 hours after you have sat your assessment. AAT approved venuesYou can search for your nearest venue via the AAT websitelaunch.What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe Unlimited access to the AAT Level 2 content with the use of all other levels. Empowering you to progress when you’re ready at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials What could I do next? You could start work as an entry-level bookkeeper. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can continue your studies and move onto the AAT Level 3 Certificate in Bookkeeping at no extra cost. Additional costs If you would like to, you can become a member of the Association of Accounting Technicians (AAT) launch. Fees associated with admission and exam fees are in addition to the cost of the course. Admission and membership fees are payable directly to AAT. Exam fees are paid to the exam centre. AAT one-off Level 2 Certificate in Bookkeeping Registration Fee: £65 AAT Assessment Fees: £70 to £80 per unit Please be aware that these are subject to change.

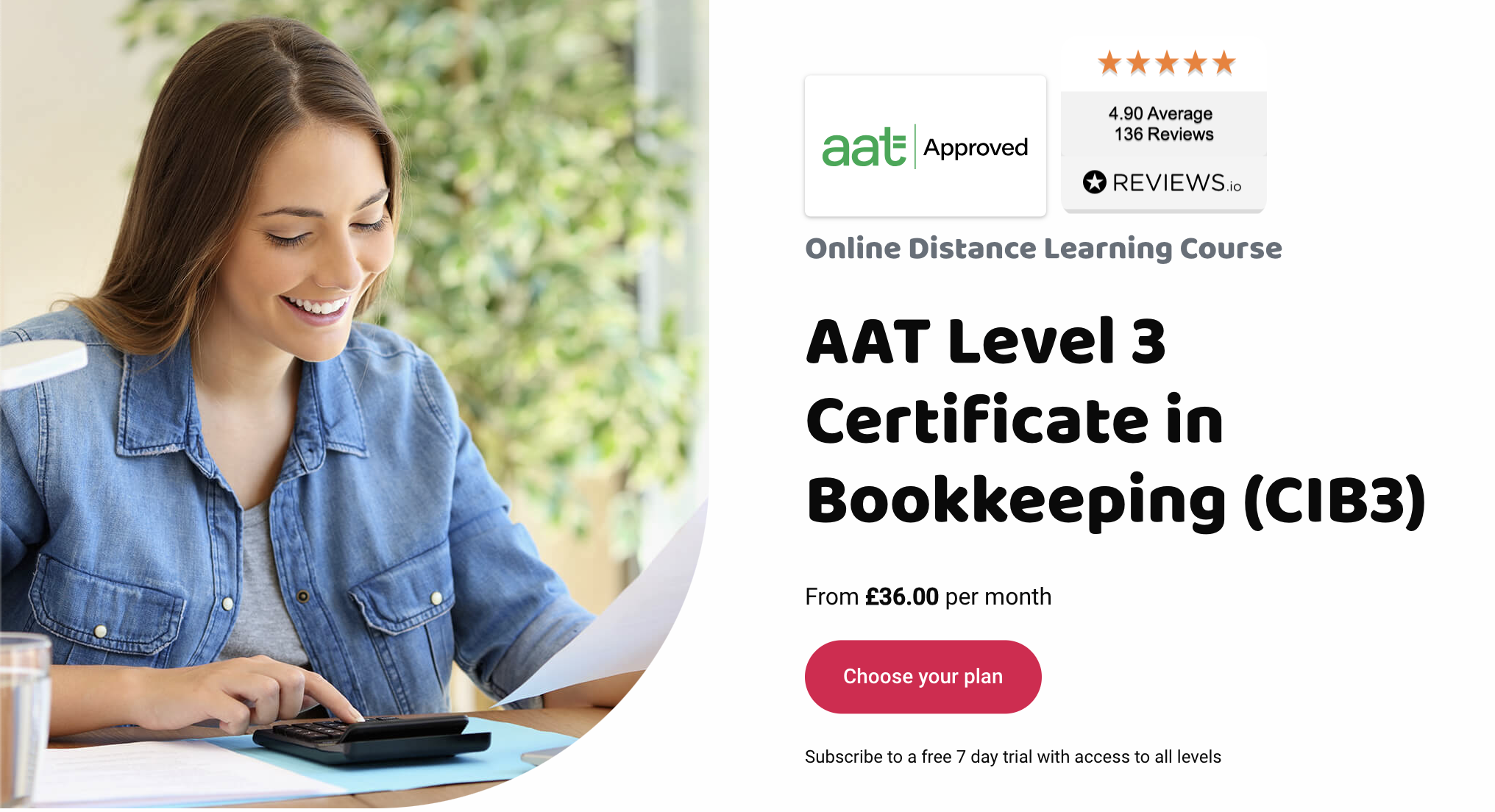

Have you already got some bookkeeping experience and want to build on it? Or have you done Level 2 and now need to cement your learning? Level 3 Bookkeeping is the qualification for you. AAT Level 3 in Bookkeeping is suited for those who want to continue learning more advanced bookkeeping skills, and are looking to work in roles such as accounts manager, professional bookkeeper, or ledger manager. The course is made up of two units: Financial Accounting: Preparing Financial Statements (FAPS), and Tax Processes for Businesses (TPFB). Recommended study time: 6 to 8 hours per week Estimated completion time: 3 – 5 months About AAT Level 3 Certificate in Bookkeeping Entry requirementsAnyone can start at Level 3, but we recommend that you have done Level 2 first, as the qualification builds on existing knowledge.Syllabus By the end of the AAT Level 3 Bookkeeping course, you will be able to confidently apply the principles of double-entry bookkeeping, be able to prepare final accounts, and understand VAT legislation, VAT returns, and the implications of errors. There are three areas to study, made up of various subjects. It usually takes 3-5 months to complete if you spend 6-8 hours a week studying. Topics covered:Financial Accounting: Preparing Financial Statements (FAPS) The accounting principles underlying financial accounts preparation The principles of advanced double-entry bookkeeping How to implement procedures for the acquisition and disposal of non-current assets How to prepare and record depreciation calculations How to record period end adjustments How to produce and extend the trial balance How to produce financial statements for sole traders and partnerships How to interpret financial statements using profitability ratios How to prepare accounting records from incomplete information Tax Processes for Businesses (TPFB) The legislation requirements relating to VAT How to calculate VAT How to review and verify VAT returns The principles of payroll How to report information within the organisation How is this course assessed? This Level 3 course is assessed with unit assessments. Unit assessment A unit assessment tests knowledge and skills taught in that unit. At Level 3 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the computer Getting your results Assessment results are available in your MyAAT account within 24 hours for computer marked assessments. AAT approved venues You can search for your nearest venue via the AAT website launch. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe Unlimited access to the AAT Level 3 content with the use of all other levels. Empowering you to progress when you’re ready at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials What could I do next? You can now work as a qualified bookkeeper. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can move onto the full AAT qualification at no extra cost. Additional costs If you would like to, you can become a member of the Association of Accounting Technicians (AAT) launch. Fees associated with admission, and exam fees are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT one-off Level 3 Certificate in Bookkeeping Registration Fee: £90 AAT Assessment Fees: £70 to £80 per unit Please be aware that these are subject to change.

Introduction to Cardiovascular Disease

By BBO Training

Introduction to Cardiovascular Disease (2-Day Course)Course Description:BBO Training has responded to numerous requests for a course focused on cardiovascular disease, following the success of our previous courses, such as Introductions to COPD/Asthma/Diabetes and Minor Illness. In response, we have developed a comprehensive two-day agenda on this critical subject.These days are designed to provide a holistic approach to cardiovascular diseases, encompassing Coronary Heart Disease (CHD), Stroke, Heart Failure, and Hypertension. Participants will gain the knowledge and skills necessary to perform annual reviews for patients with these conditions.This course is particularly well-suited for Nurse Associates, Practice Nurses, Nurse Practitioners (NPs), Emergency Nurse Practitioners (ENPs), Paramedics, and Pharmacists. Dr. Tamara Cunningham, an experienced GP Trainer, will lead these interactive online sessions.Day One09.15 - Coffee and Registration09.30 - Introduction and Course Objectives09.45 - Setting the Scene: - Screening, Diagnosis, Pathophysiology, and Symptoms10.30 - Q-Risk Assessment10.45 - Coffee Break11.00 - Diet & Cardiovascular Disease: - Healthy Eating - Range of Dietary Approaches - Weight Management Services (PH25)11.45 - Benefits of Activity for Cardiovascular Disease12.30 - Lunch01.30 - Hypertension - A Review of NICE Guidelines (NG136): - Targets - Risk Assessment - Medications - Assessing Target Organ Damage02.45 - Lipid Modification - A Review of Nice Guidelines (NG181): - How Lipids Affect Cardiovascular Risk03.15 - Case Studies03.30 - Action Plan, Evaluation, and Resources03.45 - CloseDay Two09.15 - Coffee and Registration09.30 - Heart Failure - How to Perform a Safe Annual Review (NG106)10.45 - Coffee Break11.00 - CHD - Performing an Annual Review and Including Assessment of Angina12.30 - Lunch01.30 - Stroke - Secondary Prevention and Management of Long-Term Complications02.30 - Case Studies - Group Work to Consolidate Learning03.30 - Competencies, Training, and Resources03.45 - CloseKey Learning Outcomes for Both Days:Upon completing this course, participants will be able to:1. Explain the basic physiology of cardiovascular disease.2. Perform risk assessments with patients and discuss modifiable factors such as diet and exercise.3. Describe the targets for blood pressure and cholesterol and how these affect primary and secondary prevention of CVD.4. Describe the basic anti-hypertensive and cholesterol-lowering medications involved in CVD.5. Name the major complications that may arise in people with a long duration of CVD and measures that may limit or prevent them.6. Describe the key advice to patients regarding Heart Failure and recognition of when to escalate/refer.7. Perform a safe review for stroke, CHD, and HF, recognizing how to work within your professional limits and when to signpost.8. Provide examples of referral pathways to other services, e.g., weight management, secondary care, activity, and psychological services.9. Explain the key components and process of an annual review and a self-management plan.Join us for this comprehensive 2-day course via Zoom and enhance your ability to provide effective cardiovascular disease care within primary care settings.

Fundamentals of Dermatology

By BBO Training

Course Description:This intensive two-day course on the Fundamentals of Dermatology for Primary Care is highly relevant for healthcare professionals in primary care, especially those lacking dermatology in their post-registration training. The course offers an opportunity to advance in practice, gain relevant competencies, and enhance clinical confidence for improved patient care.Introduction:Understanding dermatology care is vital in general practice, given that 10-15% of the primary care workload involves dermatology. Common skin conditions have a significant psychological impact on patients. The course emphasizes the importance of proper skin assessment, accurate diagnosis, and effective patient self-management for better treatment outcomes.Day One:- 09:15 AM: Coffee and registration- 09:30 AM: Introduction and course objectives- 09:40 AM: Anatomy and physiology of normal skin- 10:00 AM: Pathophysiology of acne, eczema, and psoriasis - understanding skin changes- 10:45 AM: Coffee break- 11:00 AM: The language of dermatology - effective description- 11:45 AM: Skin assessment and history-taking - recording observations- 13:00 PM: Lunch break- 13:45 PM: Recognizing skin changes: skin lesions and skin cancer - addressing concerns- 14:00 PM: Hyper and hypo pigmentation - understanding variations- 14:30 PM: Screening for skin cancer and promoting sun safety- 15:00 PM: Dermatology resources and guidelines - accessing information- 16:00 PM: Action plan, evaluation, and resources- 16:15 PM: CloseDay Two:- 09:15 AM: Welcome back and course work review- 09:30 AM: Managing acne in primary care - practical applications and treatments- 10:30 AM: Managing psoriasis in primary care - topical treatment and demonstrations- 10:45 AM: Coffee break- 11:00 AM: Managing eczema in primary care - practical challenges and solutions- 11:45 AM: Understanding patient self-management and psycho-social aspects- 12:30 PM: Lunch break- 13:30 PM: Practical emollient workshop - exploring patient preferences- 14:15 PM: Skin infections - recognition, diagnosis, and management- 14:45 PM: Genital skin conditions - Update on lichen sclerosis recognition and treatment- 15:30 PM: Practice reviews, competencies, and reflective discussion- 16:15 PM: CloseCourse Aim:To equip primary care healthcare professionals with evidence-based knowledge and practical confidence to elevate dermatology care, improve patient support for common skin conditions, and ensure appropriate secondary care referral.Learning Outcomes (Day 1):- Develop a Strong Foundation: Understand skin anatomy and physiology for a comprehensive grasp of normal skin characteristics.- Decipher Pathophysiology: Discern the intricacies of common dermatology conditions, such as acne, eczema, and psoriasis, understanding the underlying skin changes that drive these conditions.- Master the Language of Dermatology: Gain proficiency in describing dermatological observations accurately, facilitating effective communication and reporting.- Harness the Power of Assessment: Elevate skin assessment and history-taking skills, honing the ability to document observations and pertinent patient history with precision.- Recognise Skin Changes: Sharpen the skill of identifying skin lesions and potential indicators of skin cancer, equipped with the expertise to navigate the "when to worry" challenge.- Explore Pigmentation Variations: Delve into hyper and hypo pigmentation, understanding conditions like dermatosis papulosa nigra, sebaceous hyperplasia, solar lentigo, and freckles.- Promote Sun Safety and Dermatology Education: Grasp strategies for skin cancer screening and sun safety healthcare education, contributing to proactive patient care.- Navigate Dermatology Resources: Gain insight into valuable dermatology resources and guidelines, empowering continuous learning beyond the course.Learning Outcomes (Day 2):- Enhance Practical Skills: Gain hands-on experience in managing common skin conditions like acne, psoriasis, and eczema using both over-the-counter and topical treatments.- Empower Patient Support: Engage with patients to gain insights into their experiences of self-managing chronic skin conditions, focusing on psycho-social aspects and effective coping strategies.- Immerse in Practical Emollient Workshop: Participate in a tactile workshop to understand patient preferences and choices in emollient usage.- Refine Diagnostic Skills: Develop the ability to recognize, diagnose, and manage skin infections effectively, improving overall dermatological care.- Master Genital Skin Conditions: Gain updated knowledge on recognising and treating genital skin conditions like lichen sclerosis, enhancing expertise in a specialized area.- Reflect and Consolidate: Engage in reflective discussions, reviewing competencies gained during the course and integrating newfound insights.Course Conclusion:Conclude the two-day course with a profound sense of accomplishment, armed with enriched dermatological knowledge, practical skills, and patient-centered strategies that will positively influence your professional practice.