- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

432 Professional Development courses in Coalville

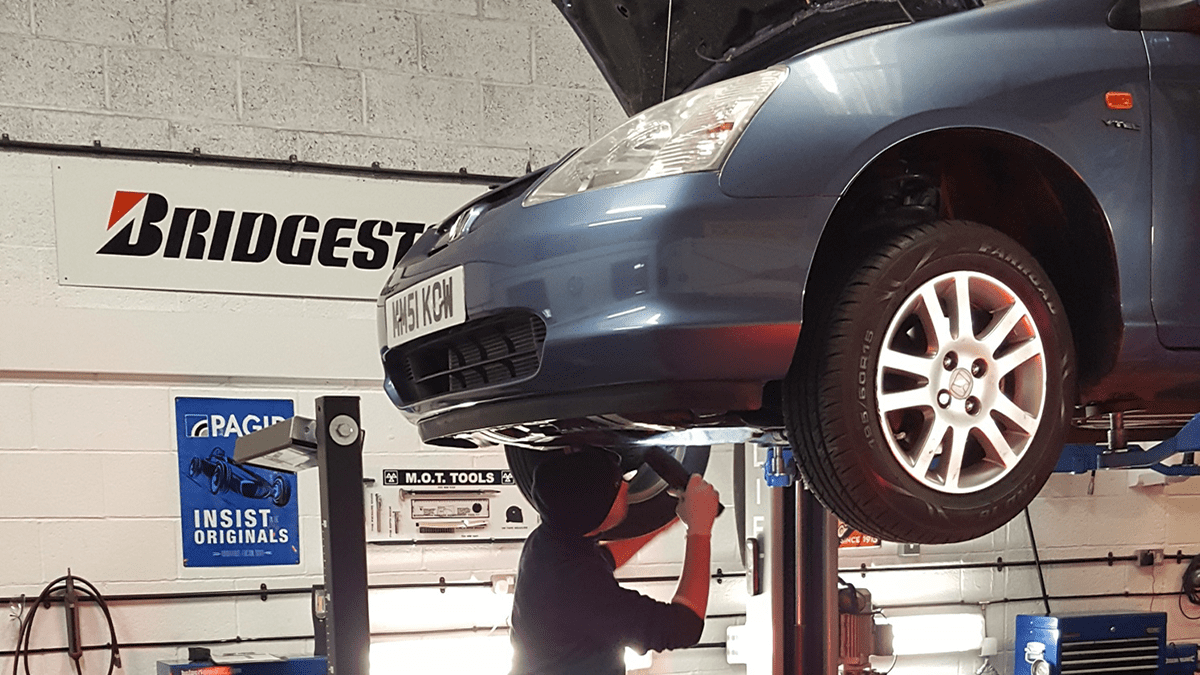

Light Vehicle Inspection Technician Accreditation

By PFTP Ltd

The IMI Light Vehicle Inspection Technician Accreditation is for experienced mechanics who would like to gain recognition for their skills and knowledge. It is also accepted by the Driver and Vehicle Standards Agency (DVSA) as the stage 1 entry qualification for mechanics and technicians who wish to train to become an MOT Tester for class 4 and 7 vehicles (cars and vans) It is normally valid for 3 years and successful candidates, as well as receiving a certifcate, photo card and pin badge, will also be entered on to the IMI Professional Register. This is a public-facing register to showcase individuals working in the motor industry, who have been recognised for their experience, professionalism and commitment to ethical working practices. However, there will be no requirement for you to re-accredit if you go on to complete your IMI Level 2 Award in MOT testing (classes 4 & 7) within the 3 year period. As an Inspection Technician you must be able to work unsupervised – ideally, you should be in full time employment with at least 3 years experience (4 years if you wish to become an MOT tester) to ensure you are familiar with the techniques for vehicle servicing, inspection and system(s) diagnosis. There are 5 practical assessments for this route and two online exams, one containing 30 questions and a second containing 10 questions. Please click on the links below to get an overview of the contents of each assessment. AOM – 071 – Emissions System – Inspection AOM – 072 – Electrical System – Inspection AOM – 073 – Braking Systems – Inspection AOM – 074 – Steering and Suspension Systems – Inspection AOM – 075 – Vehicle Structure – Inspection AOM – 076 – Vehicle Appraisal – Inspection 5 Day Training and Assessment. This training is aimed at experienced technicians who might need some training input prior to assessment. The assessments will take place over a 5 day period with the online assessment taking place mid week to allow for any re-sits that may be necessary. You will receive a copy of Tom Denton’s 4th edition Advanced Automotive Fault Diagnosis book which you can use in the intervening period to study and practice your knowledge and skills prior to attending the course. PLEASE NOTE THESE ASSESSMENTS ARE TO A LEVEL 3 STANDARD AND ARE DESIGNED TO BE TOUGH. THEY CONCENTRATE ON FAULT FINDING WITHIN A GIVEN TIMESCALE. SUCCESSFUL CANDIDATES WILL FIND ALL OF THE FAULTS WITHIN 1 HOUR. The next step If this accreditation is of interest to you, particularly if you wish to become an MOT tester, have a go at our initial assessment test. Our administrator will be in touch with you once we receive your result so that we can best advise you on the way forward.

Overview Overview The purpose of this course is to enable participants to understand and apply the principles of emergency response planning and crisis management. It considers the need for emergency and crisis response planning and an integrated approach to emergency management. Training typically covers: Crisis management structure and staffing an emergency response team Incident reporting and notification Operational processes Guidance of facility response policies and procedures Annual testing and evaluation of the crisis management plan Upcoming Events Online (USD 1950) Online Streaming Live (Flexible Dates) At Venue (USD 4500) Dubai 13 March - 17 March Istanbul 20 March - 24 March London 20 March - 24 March For more dates and Venue, Please email sales@gbacorporate.co.uk

Overview In this course you will learn to build a financial model by working in Excel and how to perform sensitivity analysis in Excel. You will also learn the formulas, functions and types of financial analysis to be an Excel power user. By attending this course, you will be able to effectively prepare and build financial models. Objectives Harness Excel's tools within a best practice framework Add flexibility to their models through the use of switches and flexible lookups Work efficiently with large data volumes Model debt effectively Approach modelling for tax, debt, pensions and disposals with confidence Build flexible charts and sensitivity analysis to aid the presentation of results Learn and apply Excel tools useful in financial forecasting Understand and design the layout of a flexible model Forecast financial statements of a public or private company Apply scenario analysis to the forecasted financial statements and prepare charts for data presentation

Overview The comprehensive course will cover the fundamentals of portfolio management, and delve deeper into risk and return. Participants will develop their understanding of how and why investors allocate money to fixed income, the numerous issues that impact risk and return, and the mechanics of portfolio construction.

Overview This course is specially designed, this 5-day Financial Risk Management training course works to expand delegate's understanding and practical skills in the field of financial risk management. Specifically, this training course investigates the inter connection of risk in terms of markets, credit, operations, liquidity and reputation. Via intensive instruction and practical exercises, delegates will explore relevant techniques and methodologies, such as value-at-risk, credit modelling and stress testing.

Overview Financial Analysis and Decision Making specifies a financial outline to support the life cycle approach of managing tedious projects over a long time scale. This course includes the advanced level of accounting structures which are required to insert knowledgable information in order to make decisions or to support the decision-making process where accounting and financial information overlaps other decision-making processes. In order to manage the growth of the organisation and measure the profitability it is very important to do a financial analysis. This course will take you through different models of accounting and finance which is helpful for the decision-making process thereby helping ensure sustainable growth and success.

Overview Financial Analysis and reporting play a very important role within the organisation and its stakeholders. This course is designed to analyse the functions of financial reporting in communication and its effects on decision-making processes or managerial decisions. It will highlight the accounting and financial standards-setting process and its implication on the organisation globally. Financial Analysis and reporting discuss how accountants act as processors and purveyors of information for decision-making and the needs of those who use accounting information. It also looks at the role performed by accountants and notes the need to be aware of relevant regulatory and conceptual frameworks.

Overview This course is designed to evaluate the financial statement, budget and making an effective decision. It will help to understand Discounted Cash Flow and its techniques, applications of financial statements and decision-making process. In this programme, you will challenge representatives to learn how to make use of financial statements to assess the strategic or financial performance of an organization. It will help to understand DCF Discounted Cash Flow techniques along with their apps for financial making decisions and making use of ratios in order to identify the major areas of concern. Find out the elements like weaker financial signals, major success factors, and robust financial signals within your own industry. It Projects future performance assuredly through real-world budgeting.

How to recover from a poor Ofsted inspection outcome

By Marell Consulting Limited

Get a clear strategy for bouncing back after a poor Ofsted inspection outcome; develop your DfE action plan; know what to expect from a progress monitoring inspection.

Search By Location

- Professional Development Courses in London

- Professional Development Courses in Birmingham

- Professional Development Courses in Glasgow

- Professional Development Courses in Liverpool

- Professional Development Courses in Bristol

- Professional Development Courses in Manchester

- Professional Development Courses in Sheffield

- Professional Development Courses in Leeds

- Professional Development Courses in Edinburgh

- Professional Development Courses in Leicester

- Professional Development Courses in Coventry

- Professional Development Courses in Bradford

- Professional Development Courses in Cardiff

- Professional Development Courses in Belfast

- Professional Development Courses in Nottingham