- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

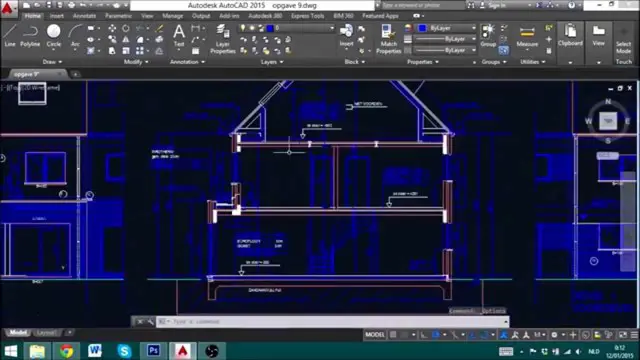

AutoCAD On Demand One to One Courses

By Real Animation Works

AutoCad Pay per Hour Training Course

On-Demand SketchUp Training Course: Enhance Your 3D Design Skills

By Real Animation Works

Personalized SketchUp Training: Pay-As-You-Go One-to-One Sessions

GCSE Tuition - English Language & Literature - In Person, London, Lambeth, Wandsworth, Merton, Southwark, Kensington & Chelsea

5.0(8)By GLA Tutors Home or Online

Subject content Students will draw upon a range of texts as reading stimulus and engage with creative as well as real and relevant contexts. Students will have opportunities to develop higher-order reading and critical thinking skills that encourage genuine enquiry into different topics and themes. We can help students to read fluently and write effectively. Students will be able to demonstrate a confident control of Standard English and write grammatically correct sentences, deploying figurative language and analysing texts. For GCSE English Language students should: read fluently, and with good understanding, a wide range of texts from the 19th, 20th and 21st centuries, including literature and literary non-fiction as well as other writing such as reviews and journalism read and evaluate texts critically and make comparisons between texts summarise and synthesise information or ideas from texts use knowledge gained from wide reading to inform and improve their own writing write effectively and coherently using Standard English appropriately use grammar correctly and punctuate and spell accurately acquire and apply a wide vocabulary, alongside a knowledge and understanding of grammatical terminology, and linguistic conventions for reading, writing and spoken language listen to, and understand, spoken language and use spoken Standard English effectively. Texts GCSE English Language is designed on the basis that students should read and be assessed on high-quality, challenging texts from the 19th, 20th and 21st centuries. Each text studied represents a substantial piece of writing, making significant demands on students in terms of content, structure and the quality of language. The texts, across a range of genres and types, support students in developing their own writing by providing effective models. The texts include literature and extended literary non-fiction, and other writing such as essays, reviews and journalism (both printed and online). We can provide assistance for everything you need to prepare students for exams, including: past papers, mark schemes and examiners’ reports specimen papers and mark schemes for new courses exemplar student answers with examiner commentaries guidance in planning and writing cohesively high quality revision guides

Baby & Child First Aid - Private Class

By Mini First Aid North Nottinghamshire, Grantham & Sleaford

The 2-hour Baby & Child First Aid class covers CPR, Choking, Bumps, Burns, Breaks, Bleeding, Febrile Seizures and Meningitis & Sepsis Awareness and will give everyone who attends the peace of mind they deserve.

Baby Proofing - Private Class

By Mini First Aid North Nottinghamshire, Grantham & Sleaford

Our *NEW* Mini First Aid Baby Proofing class is our second class, designed for parents and carers of babies and children over 3 months. It can be taken after our 2 hour Baby and Child First Aid class, or in isolation for those parents who are starting their weaning journey, or have a baby on the move!

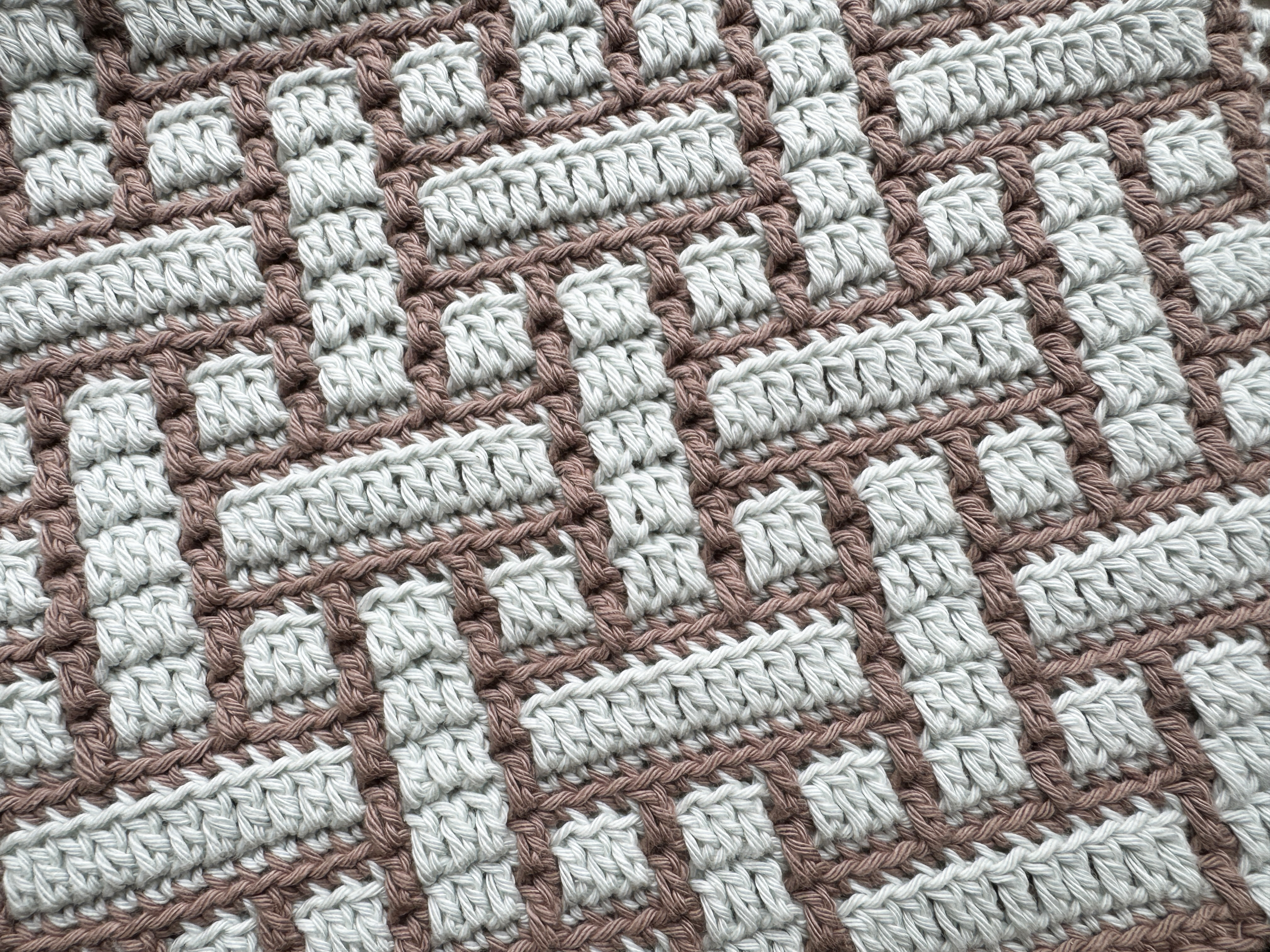

Learn Mosaic Crochet - 4 x2 hour sessions - Monday Evenings - Walton-on-Thames

By Merrian Holland

Learn mosaic crochet in Surrey - this is an immersive 4 x 2 hour course running on Tuesday evenings in Walton-on-Thames.

IFS Annual Lecture: Trade Wars and the Future of Globalisation

By Institute for Fiscal Studies

Professor Meredith A. Crowley, Professor of Economics at Cambridge University, will give the 2025 IFS Annual Lecture on "Trade Wars and the Future of Globalisation". The world enjoyed a dramatic fall in policy barriers to international trade and rising international integration of national markets throughout the 1990s and 2000s. However, since 2010, trade integration has stalled, with the global trade to GDP ratio hovering around 30 percent. Over the last fifteen years, the world has witnessed Britain’s exit from the EU, the 2018 US-China Trade War, major trade sanctions against Russia, and, most recently, the threat of broader American trade restrictions. This lecture will examine recent evidence on exporting firms in multiple countries and suggest new approaches to evaluating the price and welfare impacts of market fragmentation due to Brexit and the US-China Trade War. Meredith A. Crowley is a Professor of Economics at the University of Cambridge, a Fellow of St. John’s College Cambridge, President of the International Economics and Finance Society, and a Research Fellow at the Centre for Economic Policy Research (CEPR – London). Her research, focused on international trade, trade policy, and exchange rates has been published in numerous peer-reviewed journals including the American Economic Review and the Journal of International Economics. She has appeared or been cited in over 100 print and broadcast media outlets including the BBC, The New York Times, The Washington Post, The Economist, The Financial Times, The Guardian, The Telegraph, The Times and National Public Radio (US). Prior to arriving at Cambridge in 2013, Crowley worked in the Research Department of the Federal Reserve Bank of Chicago. She has taught at Georgetown University, the Shanghai University of Finance and Economics, and Nanjing University. She has presented her research at central banks and international institutions around the world, including the International Monetary Fund, the World Bank, and the World Trade Organization. Crowley received her MPP from Harvard University and her PhD in Economics from the University of Wisconsin-Madison.

Community Art Craft Workshop

By Art Craft Studios

If you've been looking for a welcoming space to explore your creativity, come along to our community art & craft workshops. From ceramics to painting, papercraft to hand printing, you're free to explore your creativity, make new friends & relieve some stress in our relaxed, social environment.

This Excel Introduction course is a very good introduction to essential fundamental programming concepts using Excel as programming language. These concepts are daily used by professionals and are essential in most jobs. By the end, you'll be comfortable with Excel concepts, ribbons, formulas, and the Functions Wizard. You will gain hands-on practical experience creating a spreadsheet from scratch on your own.

Total SAGE Training (Sage 50 Accounts + Sage Payroll Training)

By Osborne Training

Total SAGE Training (Sage 50 Accounts + Sage Payroll Training) Want to open the door to working in Finance and Accountancy Industry? Starting our Total Sage Training courses will enhance your career potentials and give you the skills and knowledge you need to get started in Finance and Accountancy Industry. Total Sage Training courses are combined with Sage 50 Accounts and Sage Payroll Training. You will receive a CPD Completion Certificate from Osborne Training once you finish the course. You also have an Option to attain Certificate from SAGE(UK) subject to passing the exams. What qualification will I gain for Sage Training Courses? CERTIFICATION FROM SAGE (UK) As Osborne Training is a Sage (UK) Approved training provider, you could gain the following qualifications provided that you book and register for exams and pass the exams successfully: Sage 50c Computerised Accounting Course (Level 1) Sage 50c Computerised Accounting Course (Level 2) Sage 50c Computerised Accounting Course (Level 3) Sage 50c Computerised Payroll Course (Level 1) Sage 50c Computerised Payroll Course (Level 2) Sage 50c Computerised Payroll Course (Level 3) Level 1 Working with Sage 50 Accounts Program Basics. Creating Account names, Numbers & Bank Payments Financials Bank Reconciliations Generating Customers Invoices Monitoring Customer Activity Generating Product Invoices & Credit Notes Compiling & Sending Customer Statements Creating Customer Receipts & Purchase Invoices Supplier Payments Managing Recurring Entries Generating Reports & Information The Active Set-Up Wizard VAT Changes. Level 2 An overview of the Sage program Entering opening balances, preparing and printing a trial balance Creating customer records Creating supplier records Setting up opening assets, liabilities and capital balances, Producing routine reports Checking data, Entering supplier invoices Posting error corrections, amending records Invoicing, generating customer letters, entering new products, checking communication history Banking and payments, producing statements, petty cash Audit trails, correcting basic entry errors, reconciling debtors and creditors Creating sales credit notes, Processing purchase credit notes Preparing journals Verifying Audit Trail Purchase orders, processing sales orders Processing Trial Balance Creating Backups Restoring data Writing-off bad debts Level 3 Creating a Chart of Accounts to Suit Company Requirements Sole Trader Accounts preparation The Trial Balance preparation Errors in the Trial Balance Disputed Items Use of the Journal Prepare and Process Month End Routine Contra Entries The Government Gateway and VAT Returns Bad Debts and Provision for Doubtful Debts Prepare and Produce Final Accounts Management Information Reports Making Decisions with Reports Using Sage The Fixed Asset Register and Depreciation Accruals and Prepayments Cash Flow and Forecast Reports Advanced Credit Control

Search By Location

- Print Courses in London

- Print Courses in Birmingham

- Print Courses in Glasgow

- Print Courses in Liverpool

- Print Courses in Bristol

- Print Courses in Manchester

- Print Courses in Sheffield

- Print Courses in Leeds

- Print Courses in Edinburgh

- Print Courses in Leicester

- Print Courses in Coventry

- Print Courses in Bradford

- Print Courses in Cardiff

- Print Courses in Belfast

- Print Courses in Nottingham