- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1211 PM courses

Inclusive Leadership: Working with Equality and Diversity

By Ei4Change

The course gives you practical tools and actions to begin leading inclusively with immediate effect. You will strengthen your relationships with others, build your awareness of unconscious bias, develop your critical thinking skills, and become a senior advocate for inclusive workplace cultures. You can expect to see the results of a more inclusive culture, both internally and externally, very quickly.

Sales and Selling with Emotional Intelligence

By Ei4Change

This highly practical course is unusual because it considers emotional intelligence as a fundamental part of selling. The course doesn't cover prospecting and ways to get a sales appointment, these require the use of emotional intelligence in other ways! The course covers the way that you engage with customers before, during and after a sales meeting through the application of emotional intelligence to make authentic decisions and build quality relationships. The course provides a step-by-step approach to applying emotional intelligence principles to your sales process focusing on working with the emotions of your customer and how these influence their social interactions.

Applied Emotional Intelligence: The Human Side of Leadership

By Ei4Change

This leadership course explores the application of emotional intelligence at work as a core underpinning skill of leadership. Your emotional intelligence helps you to manage your thinking along with your emotions to make authentic decisions and build quality relationships.

Permanent Eyeliner | Fundamental Beginners PMU Training -Small Group Learning

By ID Liner | Permanent Makeup Training & Supplies

The objective of the ID Liner Permanent Eyeliner fundamental course is to teach you how to achieve this look for your clients. It is the perfect solution for clients who struggle to draw on their own eyeliner or who just want an expertly enhanced look 24/7

Functional Skills Maths Level 1 Online Course with Exam

By Lead Academy

Course Highlights: This qualification is equivalent to GCSE grade C or 4 Take the Exam from Home – Guaranteed Fast Track Results Exam Booking within 2 Working Days of Enrolment Remote Exam Online or Paper based both option available Course Duration: 55 hours Unlimited Access to Course Materials Get Free Mock Tests & Free Past Papers Extra 25% Time for people with Learning Difficulties NCFE, Pearson Edexcel, Open Awards and TQUK are all OFQUAL-regulated and nationally recognised Level 1 Functional Skills Maths Course Overview Our expert designed Online Level 1 Maths Course has smart learning options that provide the necessary numeracy knowledge and skills to excel in Functional Skills Maths. Our Level 1 online Functional Skills Maths course is tailored to meet your specific needs and help you achieve your academic and career goals from the comfort of your home. You also get the opportunity to book Live 1:1 tutor support via Microsoft Teams. With interactive lessons, FREE mock test, personalised feedback and remote exams, our Level 1 Maths Course ensures a comprehensive and engaging learning experience. Christmas Holiday Information For our remote invigilation service of Functional Skills qualifications, the last accepted booking will be on 19th December 2024. We will reopen for bookings from 3rd January 2025. Results Release For Open Awards: Any results from assessments taken after 30th November 2024 will be published after 2nd January 2025. For NCFE Exams: Results from assessments taken after 11th December 2024 will also be published after 2nd January 2025. Additionally, the period between 20th December 2024 and 2nd January 2025 will not be counted as “working days” for the result release timeframes. Please plan your assessment bookings accordingly. Our last results release prior to Christmas will be on 20th December 2024, with the next results release taking place on 3rd January 2025. The Level 1 Maths Course & Exam Details Exam Details Exam slots are available 24*7 from Monday to Sunday. If you are in a rush and would like to book your exam sooner, then you can book your remote online exam within 3 working days for Open Awards, 1 working day of enrolment for NCFE, 2 working days of enrolment for TQUK and within 7 working days for Pearson Edexcel. Please note the exam price advertised on the website for the Open Awards remote invigilation exam is applicable for weekdays (Monday to Friday between 9 am to 5 pm). If you would like to book the Open Awards remote invigilation exam at the weekend then there is an additional £25+Vat applicable. EXAM Booking & Results Details You can decide the exam date and place according to your convenience. Awarding Body Paper-Based Exam in Centre On-Screen Exam in Centre Remote Online Exam – From Home Results Edexcel Book within 15 days Book within 24 Hours Book within 7 working days Get results in 20 working days NCFE Book within 10 working days Book within 24 Hours Book within 2 working days Get results in only 7 days Open Awards N/A N/A Book within 2 working days Get results in only 16 working days TQUK Book within 7 working days Book within 24 Hours Book within 2 working days Get results in only 6 working days *Offline examinations will be held at our Swindon and London centres. Please get in touch with us for more information. The new assessment and result dates by NCFE is: (Only applicable if you are attending the exam in between the following assessment date). Delivery mode: On-screen and RI Assessment date to and from: 16/09/2024 – 25/10/2024 Results release: 01/11/2024 The new assessment and result dates by Open Awards is: (Only applicable if you are attending the exam in between the following assessment date). Delivery mode: Remote Assessment date to and from: 02/09/2024 – 13/09/2024 Results release: 11/10/2024 Assessment date to and from: 04/11/2024 – 15/11/2024 Results release: 13/12/2024 (Note that this only applies to the mentioned exam type and if you book the exam during the dates mentioned above. Also, this will not affect the schedule of the other exam types and results.) Difference between NCFE, Pearson Edexcel, Open Awards and TQUK NCFE, TQUK, Pearson Edexcel and Open Awards are OFQUAL-regulated and nationally recognised; however, the only difference lies in the exam booking and result turn-around time. You can book your remote online exam within 2 working days of enrolment for NCFE, within 7 working days for Pearson Edexcel, 2 working days of enrolment for TQUK and within 3 working days for Open Awards. You can get your NCFE results in 7 days, your Edexcel results in 20 working days, your TQUK results in 6 working days and your Open Awards results within 16 working days. Universities and apprenticeships accept all of the awarding bodies. This distinction allows learners to choose the awarding body that aligns best with their educational and career goals. How This Course Will Work? This Level 1 Functional Skills Maths course will help you build a solid foundation in mathematics. Throughout the course, it will provide you with various learning materials and activities to enhance your understanding of these subjects. Initial Assessment: To identify the current level of a student's abilities and recommend the appropriate course to enrol in upon completion. Diagnostic Assessment: Identifies skill gaps and produces an individual learning plan Learning Resources: Comprehensive video tutorials, practice quizzes & topic-based tests Progress Tracker: To record your progress in the course Free Mock Test: Access our free mock test facility for professional feedback and to prepare for the final exam. Entry Requirement This level 1 maths qualification is available to all students of all academic backgrounds; no experience or previous qualifications are required. However, you will require a laptop/desktop computer and a good internet connection. Exam Structure The Functional Skills NCFE, Pearson Edexcel and Open Awards Qualification in Mathematics at Level 1 consist of one externally assessed assessment that comprises two sections- a non-calculator section (calculator prohibited) and a calculator section (calculator permitted). The assessments are available as paper-based and onscreen, on-demand assessments. Section A (Non-calculator) Awarding Body Exam Duration Total Marks Questions Cover Edexcel 25 minutes 16 25% NCFE / Open Awards / TQUK 30 minutes 15 25% Section B (Calculator) Awarding Body Exam Duration Total Marks Questions Cover Edexcel 1 hour 30 minutes 48 75% NCFE / Open Awards / TQUK 1 hour 30 minutes 45 75% Pass Mark (Edexcel): Learners are required to achieve an overall (from sections A and B) (59%) mark to pass the exam. Pass Mark (NCFE): Learners are required to achieve an overall (from sections A and B) (57% – 62%) mark to pass the exam. Please note that the marks vary for individual exam papers, so for all the exam papers, the pass marks are not fixed for the NCFE exam. Pass Mark (Open Awards): Pass Marks for L 2 functional skills maths assessments vary per assessment version and are set following standardisation and awarding activities. Each Maths assessment is designed to enable a minimally competent learner to achieve a pass mark of 36 out of 60. However, the awarding process will determine specifically where the pass mark sits for each assessment version. Therefore, the pass mark may vary between assessments. Pass Mark (TQUK): Pass Marks for level 1 functional skills maths assessments vary per assessment version and are set following standardisation and awarding activities. Recognised Accreditation This Functional Skills Maths Level 1 has been independently accredited by Pearson Edexcel, NCFE, TQUK and Open Awards, also regulated by Ofqual. The Office of Qualifications and Examinations Regulation (Ofqual) is responsible for regulating qualifications, assessments, and examinations in England. Pearson Edexcel is the most prestigious awarding body, for an academic and vocational qualifications. Pearson Edexcel qualifications are regulated by Ofqual and recognised by universities and employers across the world. NCFE is a charity and awarding organisation that provides qualifications in England, Wales, and Northern Ireland. It is regulated by Ofqual in England and recognised in Wales and Northern Ireland. Open Awards is an awarding organisation that offers a wide range of qualifications across various sectors, including education, health and social care, and business. Their qualifications are regulated by Ofqual and are designed to meet the needs of learners and employers. Open Awards also works closely with educational institutions and employers to ensure their qualifications are relevant and up-to-date. TQUK is an awarding organisation approved by Ofqual and offers RQF courses in a variety of sectors. RQF courses have different credit values that can be applied to the National Credit Transfer System. TQUK accredits courses developed by industry experts and collaborates with organisations to ensure the quality and value of the courses provided. Additional Features Access to On-Demand Classes Opportunity to Book 1:1 Live Tutor Support via Zoom Enrol in Our Course and Prepare for the Exam from Home Get a Free Mock Test with Professional Feedback Course Curriculum Unit 1: Number Lesson 1.1: Numbers and the Number System The number system gives you a general insight into the mathematical operations regarding the given numbers. You will acquire skills in division, multiplication, addition and subtraction, which require steps in real-life contexts. Lesson 1.2: Fractions and Decimals You will be learning many types of fractions, including improper fractions, proper fractions, equivalent fractions and more. Along with this, you will learn Ordering Decimal Numbers, Subtracting Decimals, multiplying and dividing decimals and more, which enables you to apply real-world problem-solving. Lesson 1.3: Percentages You will learn to calculate the Percentage and how to express a Number as a Percentage of Another. Interpreting the Original Value, Calculating Percent Increase and Decrease, and so on. This learning you can easily apply in real-life counting issues along with increasing your rational thinking. Lesson 1.4: Ratio and Proportion You will be learning to calculate the Total Amounts using Ratios, direct Proportion, Inverse Proportion and many more things, which help you in doing comparisons, learning science and engineering, and more. Lesson 1.5: Formula You will learn the definition of formulas Formula Using Words, Multi-Step Formulas, Formula Using Letters and so on. Learning formulas has a large impact on real life as these formulas are used extensively in measuring, building infrastructure and more. Unit 2: Measures, Shapes and Space Lesson 2.1: Money Math You will be mastering Solving Money Related Questions, including percentage-based discounts, discounts Related to Fractions, Profit and Percentage, etc. This money math learning will help you to understand money-earning and saving-related issues that you face in daily activities. Lesson 2.2: Units You will learn units and Types of Units, Units of Weight, Units of Length, Units of Capacity, etc. Also, you will gain knowledge about steps to convert between Metric Units, Imperial to Imperial Conversions, and Other Unit Conversions will help pursue a higher university degree. Lesson 2.3: Speed and Density You will be clearing the concept of speed, calculations to find out distance and time, density, Relation between Density, Weight and Volume. Lesson 2.4: Perimeter You will learn to find perimeter and area, Circle, perimeter of triangle etc. which require in measurement, design and planning and so on. Lesson 2.5: Area and Shapes You will gain skills in formulas for calculating area, finding areas of complex shapes, applying area calculations in complex questions, different Types of 3D Shapes, surface area, finding the surface area of complex 3D Shapes, using nets, plans and elevations, etc. learning about area and shapes will certainly help you in building your dream home and more. Lesson 2.6: Volume In the volume classes, you will learn Formulas for calculating volume, Questions based on volumes of different 3D Shapes, finding the Scale in a Diagram, Making Scale Drawings, which are required in building critical thinking skills and more. Lesson 2.7: Coordinates & Angles You will be learning necessary things about the coordinate Grid, How to Read Coordinates on a Grid? Plotting Points on a Grid and more which extensively requires in making video games, medical imaging, physics and more. Unit 3: Handling Data and Information Lesson 3.1: Median and Mode You will be learning about median and mode, which is one of the most interesting mathematical chapters. As you will know how to find the median and mode from the sets of numbers, you can easily implement such learning in household work and other places as well. Lesson 3.2: Mean and Range You will be able to find the mean, median and mode. Knowing how to find these is highly important in all aspects of life. Lesson 3.3: Probability You will learn Probability: Definition and Meaning, Calculating Probabilities, Probability of Something Happening and Something Not Happening, etc. Once you know how to find probability, you can easily detect business profit loss and implement other parts of your life. FAQs The Functional Maths level 1 Course is equivalent to? The Level 1 course is a fundamental level of proficiency in English, Maths, and ICT that is equivalent to a GCSE grade 1 to 3 (formerly G to D grades). It is a nationally recognised qualification in the UK that provides an alternative to GCSEs for individuals who still need to pass these subjects during their secondary education. Why should I take the Functional Skills Maths instead of the GCSE Maths? The functional maths course is comparatively easier than the GCSE math and additionally the value of it is also more than the GCSE math course. However, you should select the course that suits your needs, as both courses provide different values at different places. Which one is more difficult between Functional and GCSE Maths courses? The functional skills Maths course is more flexible than the GCSE math course since you have to sit for the official exam in the GCSE courses. What is the Difference between Functional Skills and GCSE? A Functional skills course develops for the one who wants to learn Math, English and ICT for individual achievement in daily work place and on the other hand, GCSE focuses on theories and tests your academic ability. How will I access the functional skills Maths level 1 course after payment? A confirmation email will be sent to your registered email after payment. Hereafter anytime, you can start your learning journey with Lead Academy. Will I get access to the Course if my location is outside the UK? Yes, you can. Since it is an e-learning course, anyone from anywhere can enrol in our courses. What is an Accredited course? The professional body approves the procedures if any e-learning platform claims its courses are accredited. What is the benefit of doing an accredited course? You will only realize the benefit of having an accredited certificate once you face the corporate world. As employees, job places, and more value the accredited certificate, you must own this certificate by doing the course with us. What are the system requirements for remote exam? For Pearson Edexcel and NCFE: To sit your assessment, you’ll need: A laptop/desktop with webcam and microphone; you can’t sit the assessment on a tablet or smartphone a good Wi-Fi connection – recommended minimum 1Mbit/s Upload, minimum 10Mbit/s Download. You MUST use google chrome browser for the exam, as this is recommended by the awarding body. A smartphone or tablet (Apple iOS 8.0 / Android 4.1 or higher) - this will be used to record you taking the assessment. A suitable environment - quiet room with no distractions The link for the assessment sent to your email; remember to check your spam/junk folder. You must activate Airplane mode on your smartphone however you need to be connected to Wi-Fi, so turn on Airplane mode then reactivate your Wi-Fi. Please familiarise yourself with the potential violations as these can potentially lead to the assessment being voided. Ensure ALL equipment is plugged in (including phone for the recording of sessions). Loss of power at any point could lead to the assessment being voided. You must brief other members of your household/workplace that you’re sitting an assessment, and they must not enter the room at any point. There is a 24-hour live chat function within the assessment software for technical support should you need it at any time. For Open Awards: In order to take your exam, you need to have the following equipment: A good quality laptop or PC with a minimum screen size of approx. 14” and minimum resolution of 1024 x 768. A stable internet connection with at least 3mbps. An integrated (i.e., fixed) webcam on your PC/ laptop or a portable webcam. If using a PC/ laptop with an integrated webcam, a reflective surface (e.g., a mirror) must be available. This will be used to show the invigilator the space immediately surrounding your screen and keyboard. A basic (non-scientific) calculator for maths assessments. You will have access to an on-screen calculator but may feel more comfortable using a separate calculator. Please note that all workings need to be added to the assessment platform if you use a separate calculator so that your workings can be marked. Plain paper. You will need to show this to your invigilator at the beginning of the exam to assure them that you do not have access to notes. A dictionary (where allowed). Supported Browsers Chrome: 34.0.1847 or above Microsoft Edge: Version 88.0.705.81 or newer Firefox: 31.0 or above Safari: 6.2 or above Safe Exam Browser 2.0.2 or above Please note: Chromebooks are not compatible with the Safe Exam Browser Browser settings Popups must be allowed. Guidance on how to do this below: Chrome Edge Firefox Safari For TQUK: Exam conditions All remote exams must take place in a controlled environment. Training Qualifications UK (TQUK) defines a controlled environment as a quiet, appropriate space conducive to the undertaking of a remotely invigilated exam. The environment must be: populated only by you, the learner, and no other parties well-lit to allow maximum webcam visibility free from distractions that may cause you to divert your attention away from the computer screen or move outside of the webcam’s viewing range free from notes and posters on the wall free from noise free from personal or sensitive material free from visual or physical access to supporting materials (such as educational texts) free from electronic devices, other than the computer used to undertake the exam. The space, as described above, must meet these requirements throughout the entire duration of the exam. If the exam conditions requirements are not met, the exam may be voided. If, for any reason, you are unable to undertake the exam in a space that meets these requirements, you should inform your training provider/recognised centre at the earliest opportunity and arrange your exam at a time when these conditions can be met. You must have a desktop or laptop computer that is equipped with a working webcam, a stable internet connection, and the Google Chrome web browser (available here). Requirements and guidance for materials: The following relates to materials within the controlled environment and must be followed to ensure compliance: Mobile phones and electronic devices, except for the computer you are using to undertake the exam, must be switched off and stored in an inaccessible location. Smartwatches and other wearable technological devices must be switched off and removed. Headphones must not be worn. Water must be stored in a clear glass or a clear bottle with the labels removed. No other food or drink is permitted. Second monitors are not permitted. Identification must be clearly presented to the camera at the start of an exam. If identification is not provided, or is unclear, at the start of the exam, this will result in the exam being voided. A room sweep must be completed at the start of an exam. If a room sweep is not completed, the exam will be voided. has context menu

Scalp Micropigmentation | Fundamental Beginners PMU Training - Without Kit

By ID Liner | Permanent Makeup Training & Supplies

SCALP MICROPIGMENTATION (SMP) IS BECOMING ONE OF THE MOST SOUGHT-AFTER TREATMENTS IN THE HAIR LOSS INDUSTRY AND IS THE FASTEST GROWING SECTOR OF THE PERMANENT MAKEUP INDUSTRY.

Skill Up Training | Intermediate PMU Training - 3 Days

By ID Liner | Permanent Makeup Training & Supplies

ID LINER RUN ONE SKILL UP PERMANENT MAKEUP TRAINING COURSE PER QUARTER TO HELP TRAINEES HONE AND DEVELOP THEIR SKILLSET. THESE COURSES REVIEW AND IMPROVE HOW YOU CURRENTLY WORK, INTRODUCING MORE ADVANCED TECHNIQUES TO TAKE YOU TO THE NEXT LEVEL.

Microblading to Digital Conversion Course | Intermediate PMU Training

By ID Liner | Permanent Makeup Training & Supplies

MICROBLADING HAS BECOME ONE OF THE MOST POPULAR TREATMENTS IN RECENT YEARS, BUT RESULTS ARE LIMITED TO HAIRSTROKE BROWS AND FREQUENTLY CLIENTS WILL REQUEST SOME SHADING WHICH IS MORE EASILY ACHIEVED WITH DIGITAL PERMANENT MAKEUP.

Map your Customer Journey - pre-recorded webinar

By Back Pocket Office

Whether you're looking to improve your customer experience, streamline with new systems, or delegate to a new team member; understanding your customer journey is the best place to start.

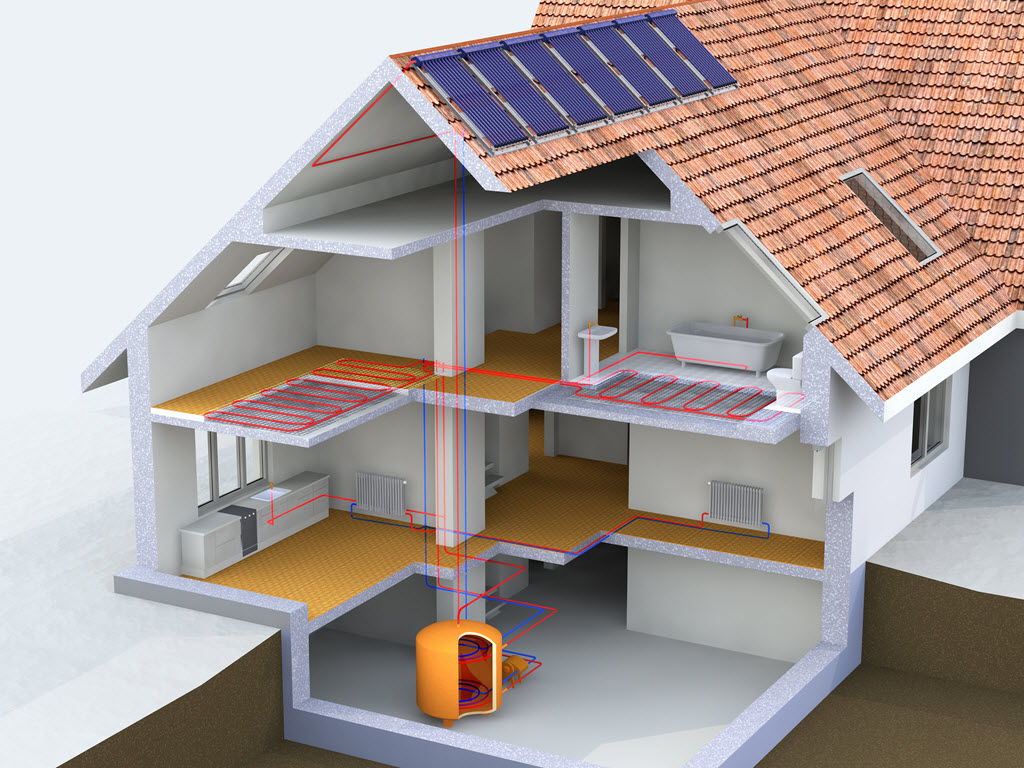

Our new and improved pipe and pump sizing calculator tool. This one hour session will provide an introduction into the following: Justifying the default values (maximum & minimum velocities, pressure loss etc) Preparing a schematic as a reference. Labelling sections and identifying circuits. Picking rooms or radiators for total mass flow rate (kg/s) Selecting flow temperatures and delta temperatures. Selecting pipe sizes for each section. Reviewing the automated velocity checks (m/s) Reviewing the automated maximum pressure drop allowance (Pa/m) Creating circuits Reviewing the index circuit Final results to size your circulation pump. Q & A session after the above is explained and demonstrated.

Search By Location

- PM Courses in London

- PM Courses in Birmingham

- PM Courses in Glasgow

- PM Courses in Liverpool

- PM Courses in Bristol

- PM Courses in Manchester

- PM Courses in Sheffield

- PM Courses in Leeds

- PM Courses in Edinburgh

- PM Courses in Leicester

- PM Courses in Coventry

- PM Courses in Bradford

- PM Courses in Cardiff

- PM Courses in Belfast

- PM Courses in Nottingham