- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Overview Learn how to price equity options and the features that make them different from other asset classes. Explore how to use these products for taking equity risk, yield enhancement and portfolio protection Who the course is for Risk managers Bank treasury professionals Finance Internal Audit Senior management Fixed Income, FX, Credit and Equities traders Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview 2 day course on scorecards, rating agency frameworks, regulation and integration and quantification of Environmental, Social and Governance (ESG) analysis into equity and credit investing / lending for / to corporates, banks and other financial institutions, applied to many case study companies and industries Who the course is for Investors and analysts – equity and credit; public and private Bank loan officers M&A advisors Restructuring advisors Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Visual Analytics Best Practice

By Tableau Training Uk

This course is very much a discussion, so be prepared to present and critically analyse your own and class mates work. You will also need to bring a few examples of work you have done in the past. Learning and applying best practice visualisation principles will improve effective discussions amongst decision makers throughout your organisation. As a result more end-users of your dashboards will be able to make better decisions, more quickly. This 2 Day training course is aimed at analysts with good working knowledge of BI tools (we use Tableau to present, but attendees can use their own software such as Power BI or Qlik Sense). It is a great preparation for taking advanced certifications, such as Tableau Certified Professional. Contact us to discuss the Visual Analytics Best Practice course Email us if you are interested in an on-site course, or would be interested in different dates and locations This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course includes the following topics: WHAT IS VISUAL ANALYSIS? Visual Analytics Visual Analytics Process Advantages of Visual Analysis Exercise: Interpreting Visualisations HOW DO WE PROCESS VISUAL INFORMATION? Memory and Processing Types Exercise: Identifying Types of Processing Cognitive Load Exercise: Analysing Cognitive Load Focus and Guide the Viewer Remove Visual Distractions Organise Information into Chunks Design for Proximity Exercise: Reducing Cognitive Load SENSORY MEMORY Pre-attentive Attributes Quantitatively-Perceived Attributes Categorically-Perceived Attributes Exercise: Analysing Pre-attentive Attributes Form & Attributes Exercise: Using Form Effectively Colour & Attributes Exercise: Using Colour Effectively Position & Attributes Exercise: Using Position Effectively ENSURING VISUAL INTEGRITY Informing without Misleading Gestalt Principles Visual Area Axis & Scale Colour Detail Exercise: Informing without Misleading CHOOSING THE RIGHT VISUALISATION Comparing and Ranking Categories Comparing Measures Comparing Parts to Whole Viewing Data Over Time Charts Types for Mapping Viewing Correlation Viewing Distributions Viewing Specific Values DASHBOARDS AND STORIES Exercise: Picking the Chart Type Exercise: Brainstorming Visual Best Practice Development Process for Dashboards and Stories Plan the Visualisation Create the Visualisation Test the Visualisation Exercise: Designing Dashboards and Stories This training course includes over 20 hands-on exercises to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives an extensive training manual which covers the theory, practical applications and use cases, exercises and solutions together with a USB with all the materials required for the training. The course starts at 09:30 on the first day and ends at 17:00. On the second day the course starts at 09:00 and ends at 17:00. Students must bring their own laptop with an active version of Tableau Desktop 10.5 (or later) pre-installed. What People Are Saying About This Course "Steve was willing to address questions arising from his content in a full and understandable way"Lisa L. "Really enjoyed the course and feel the subject and the way it was taught was very close to my needs"James G. "The course tutor Steve was incredibly helpful and taught the information very well while making the two days very enjoyable."Bradd P. "The host and his courses will give you the tools and confidence that you need to be comfortable with Tableau."Jack S. "Steve was fantastic with his knowledge and knowhow about the product. Where possible he made sure you could put demonstrations in to working practice, to give the audience a clear understanding."Tim H. "This was a very interesting and helpful course, which will definitely help me produce smarter, cleaner visualisations that will deliver more data-driven insights within our business."Richard A. "Steve is very open to questions and will go out of his way to answer any query. Thank you"Wasif N. "Steve was willing to address questions arising from his content in a full and understandable way"Lisa L. "Really enjoyed the course and feel the subject and the way it was taught was very close to my needs"James G.

Overview Understand the role of corporate structure, dividends and equity indices in equity markets. Become familiar with the building blocks of repos / stock lending, futures and forwards – and how to use these products. Understand how to price, and risk manage equity swaps and dividend swaps. Gain experience in their uses in trading, corporate finance and portfolio management. Learn how to price equity options and the features that make them different from other asset classes, explore how to use these products for taking equity risk, yield enhancement and portfolio protection. Understand strategies designed to trade / hedge volatility using options. Who the course is for Risk management Finance Sales and trading Treasury Technology Financial Engineering Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Professional Customer Care

By Dickson Training Ltd

Any team member with Customer interaction (including internal) are the 'Ambassadors' of the company/organisation. If they project positive professionalism - they win others' confidence. If they appear or sound like they are in any way indifferent or unprofessional - they will cost sales and lose clients/customers. With this 2 day Training course, that will be tailored to your company/organisation, each person attending will upgrade their professional standards in people skills, telephone manner and email etiquette. No training in this area may well be a false economy as there is a much greater risk of disenfranchised customers and team members - and probably increases your competitors to win business at your expense. Professional customer care is all too frequently regarded as a token issue in most induction sessions for employees. Surprisingly it is very rarely considered as a key priority, despite being essential for ensuring customer commitment is secure and supplier/partnerships are robust. Excellent customer care is paramount in our ever increasingly competitive market and making customers feel valued and looked after is often a differentiator. This 2-day course will help you understand your customers and the vital importance of customer care in any organisation. You will gain the tools and techniques to apply your learning directly back into the workplace and deliver excellent customer care. Course Syllabus The syllabus of the Professional Customer Care course is comprised of four modules, covering the following: Module One What is Excellent Customer Care? Internal versus external customers Why customer care is important Meeting customer expectations Module Two Making a Personal Difference How do you measure customer care? Making a difference Taking ownership Positive mental attitude Displaying professionalism both face-to-face and over the telephone Using positive language Module Three Gathering Information and Offering Solutions Asking the right questions Active listening skills Summarising and clarifying skills Module Four Dealing with Difficult Situations How to give a 'service' no Demonstrating empathy Assertiveness techniques Handling a complaint Problem solving Saying 'sorry' Making realistic promises and keeping them Real Play Scenarios with a Professional Actor (Optional Extra) This programme benefits significantly from our innovative training feature: Real Play. Using a professional actor who performs role plays as different customer characters in carefully devised situations, the delegates have the opportunity to 'pause' the role play to coach and control their character to improve their skill sets and practice the theory delivered. These scenarios can deal with difficult situations and enacting options to ensure good customer relations are intact. The outcome of the scenario is the responsibility of the delegates, not the trainer and actor. The actor will remain in character throughout the de-brief in order to bring to life the impact and possible next steps. Objectives By the end of the course participants will be able to Adopt a professional telephone manner Communicate assertively by taking control and directing the conversation Deliver information positively by offering options and alternatives Develop a range of versatile behaviours to use when dealing with difficult situations by: Listening actively Using empathy Gathering relevant information through effective questioning Finding solutions to concerns/problems quickly and efficiently Speaking positively and assertively What Is The Benefit? For individuals this course will increase confidence and ability to deal with customers in all situations, which will in turn create customer loyalty and raise their profile. For an employer, ensuring that all customer facing employees are demonstrating excellent customer care instils confidence in the customers and promotes a positive image of the company. In-House Courses Every single team member or employee that has a role which involves engaging with a customer, client and/or a key partner/supplier has a responsibility for projecting a positive image of the organisation which they represent. That may sound obvious, but how many hundreds of experiences have you had as a customer where you were treated with indifference and a distinct lack of professionalism by the receptionist, the retail assistant, the tele-agent, the delivery person, the credit controller or the departmental manager of the operation that you were dealing with? Far too many to count? This is because professional customer care is regarded as a token issue in most induction sessions for employees - and it is very rarely considered as a key priority to ensure customer commitment is secure and supplier/partnerships are robust. Yet the hugely expensive churn in customer/client commitments and staff is enormously expensive and immensely disruptive to any organisation. The Importance of Customers and Clients Every client/customer engaging person needs to recognise that it is ultimately the client or customer that pays their wages. If they gain a basic understanding of the clients' motivations and behaviours, coupled with some core skills in how to care for them, they will attain the status of 'professional'. This will very quickly translate into increased revenues, retained loyalty, high commitment and far greater security for all parties. The foundation has to be based on the authentic commitment to both the customer and also to the organisation they work for. Disenfranchisement readily curdles into sloppy behaviours cloaked in unprofessional attitudes and demeanours; plenty there to repel the most loyal of customers. If your company or organisation relies on repeat business and retaining the confidence and commitment of your clients, then all of your team members - perhaps including managers who set the example and have the biggest influence on the where the needle points to in relation to professionalism - need to be trained on the core basics of professional customer care. Customer Care Programmes from Dickson Training Ltd We are delighted to boast about the many successes we have had in providing effective and long lasting improvements for many clients, where awards have been won and, more importantly, talent has been retained because their clients and customers keep on coming back. Professional customer care extends to suppliers and partners that you value and need to get the best service and rates from, as well as any 'internal clients' such as other departments where you need to rely on their support and collaboration in order to achieve your goals. It is amazing what effective professional customer care training can do for any organisation. Without it your organisation may be vulnerable, with it you are much more likely to see increased performances and much greater security and growth. Scheduled Courses Unfortunately this course is not one that is currently scheduled as an open course, and is only available on an in-house basis. Please contact us for more information.

The core principles gained from this course will help delegates have a better understanding of how to manage the relationships between sales and marketing stakeholders on the demand side and the manufacturing and other operational stakeholders on the supply side. PARTICIPANTS WILL LEARN HOW TO: • Take a different perspective on traditional data such as sales history and forecasts, as well as time-phased inventory projections and production capacity. • Recognise how their forecasts impact manufacturing schedules and inventory levels. • Assess whether they are producing enough products to meet sales demand. • Recognise how production is tied to finance and see the financial impact of production decisions, so appropriate adjustments may be then undertaken. COURSE TOPICS INCLUDE: What is S&OP? – Introduction – Definition and benefits S&OP processes – What information is required? – The stages of the S&OP process (including inputs & outputs) The integration of S&OP into a business – Critical success factors for an effective implementation – Typical roles and responsibility matrix

Tableau Desktop Training - Analyst

By Tableau Training Uk

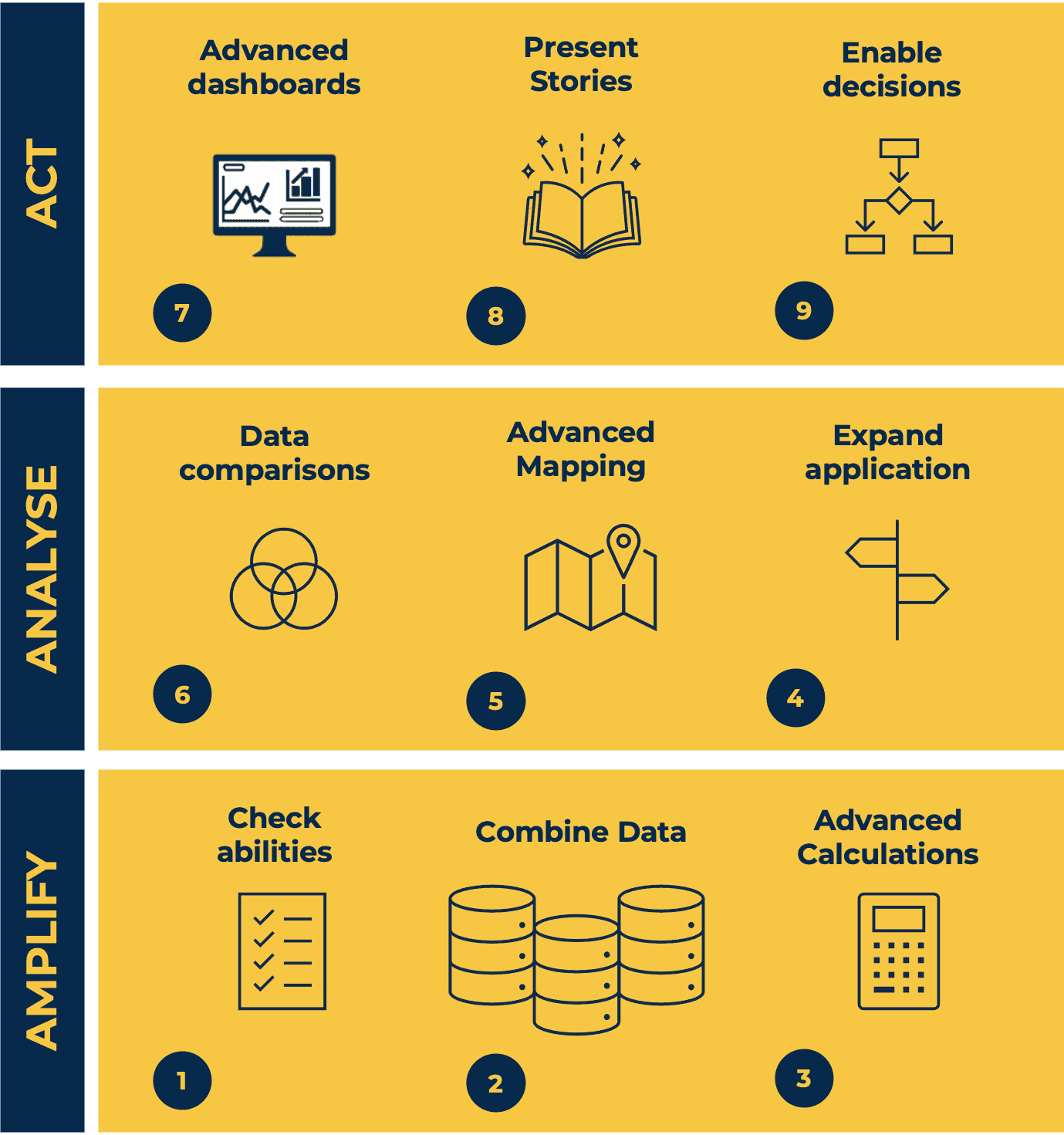

This Tableau Desktop Training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course is split into 3 phases and 9 modules: Phase 1: AMPLIFY MODULE 1: CHECK ABILITIES Revision – What I Should Know What is possibleHow does Tableau deal with dataKnow your way aroundHow do we format chartsHow Tableau deals with datesCharts that compare multiple measuresCreating Tables MODULE 2: COMBINE DATA Relationships Joining Tables – Join Types, Joining tables within the same database, cross database joins, join calculations Blending – How to create a blend with common fields, Custom defined Field relationships and mismatched element names, Calculated fields in blended data sources Unions – Manual Unions and mismatched columns, Wildcard unions Data Extracts – Creating & Editing Data extracts MODULE 3: ADVANCED CALCULATIONS Row Level v Aggregations Aggregating dimensions in calculations Changing the Level of Detail (LOD) of calculations – What, Why, How Adding Table Calculations Phase 2: ANALYSE MODULE 4: EXPAND APPLICATION Making things dynamic with parameters Sets Trend Lines How do we format charts Forecasting MODULE 5: ADVANCED MAPPING Using your own images for spatial analysis Mapping with Spatial files MODULE 6: DATA COMPARISONS Advanced Charts Bar in Bar charts Bullet graphs Creating Bins and Histograms Creating a Box & Whisker plot Phase 3: ACT MODULE 7: ADVANCED DASHBOARDS Using the dashboard interface and Device layout Dashboard Actions and Viz In tooltips Horizontal & Vertical containers Navigate between dashboards MODULE 8: PRESENT STORIES Telling data driven stories MODULE 9: ENABLE DECISIONS What is Tableau Server Publishing & Permissions How can your users engage with content This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must bring their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium “Steve not only provided a comprehensive explanation of the content of the course, but also allowed time for discussing particular business issues that participants may be facing. That was really useful as part of my learning process.”Juan C., Financial Conduct Authority “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium

Overview A 1-day course on inflation-linked bonds and derivatives, focusing on the UK market in particular. We examine how inflation is defined and quantified, the choice of index (RPI vs. CPI), and the most common cash flow structures for index-linked securities. We look in detail at Index-linked Gilts, distinguishing between the old-style and new-style quotation conventions, and how to calculate the implied breakeven rate. Corporate bond market in the UK, and in particular the role of LPI in driving pension fund activity. Inflation swaps and other derivatives, looking at the mechanics, applications and pricing of inflation swaps and caps/floors. The convexity adjustment for Y-o-Y swaps is derived intuitively. Who the course is for Front-office sales product control research Traders Risk managers Fund managers Project finance and structured finance practitioners Accountants, auditors, consultants Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Using an excavator as a crane is a common practice in certain construction and lifting operations. Using the digger as a crane requires appropriate training and skills However, it’s important to note that excavators are primarily designed for digging and earthmoving, not lifting. Using an Excavator as a Crane involves some inherent risks, and it’s crucial to follow safety guidelines and manufacturer recommendations. To book the NPORS Excavator as a Crane training or test please contact us to schedule your Training Here are some general considerations and steps you might take when using an excavator as a crane: 1. Check Manufacturer Guidelines: Always consult the manufacturer’s guidelines and specifications for the specific excavator model you are using. Manufacturers provide load charts and other essential information to ensure safe operation. 2. Understand Load Capacities: Know the lifting capacities of your excavator at various boom lengths and angles. Exceeding these capacities can lead to instability and accidents. 3. Use Proper Attachments: If your excavator is equipped with a lifting attachment, make sure it is designed and rated for lifting operations. Using inappropriate attachments can compromise safety. 4. Stabilise the Excavator: Ensure that the excavator is on stable ground. Extend the outriggers or stabilisers to provide additional support and prevent tipping. 5. Inspect the Excavator: Regularly inspect the excavator for any signs of wear, damage, or malfunction. Pay particular attention to the boom, hydraulics, and other critical components. 6. Position the Excavator: Position the excavator in a way that allows for a stable lifting operation. Avoid working on slopes or uneven surfaces. 7. Rigging and Lifting Techniques: Use proper rigging techniques, and ensure that the load is properly secured. Lift the load smoothly and avoid sudden movements. 8. Maintain Clear Communication: Establish clear communication between the operator and any ground personnel involved in the lifting operation. Use hand signals or radios to coordinate movements. 9. Avoid Exceeding Reach Limits: Do not exceed the excavator’s reach limits. Lifting loads beyond the recommended reach can lead to instability. 10. Training and Certification: Ensure that operators are properly trained and certified for lifting operations. Holding the NPORS Excavator As A Crane bolt on is essential for lifting operations Operating an excavator as a crane requires specific skills and knowledge. 11. Weather Conditions: Consider weather conditions, especially wind speeds, as they can affect the stability of the excavator during lifting operations. Always prioritise safety when using equipment for tasks it wasn’t originally designed for. If the lifting requirements are frequent or extensive, it may be more appropriate to use a dedicated crane with the necessary capacity and features. Remember, safety is paramount in any construction or lifting operation. Frequently Asked Questions 1. What is Excavator As A Crane Training, and why is it necessary? Excavator As A Crane Training provides individuals with the skills and knowledge required to safely and effectively use excavators for lifting operations. Although excavators are primarily designed for digging and earthmoving, this training ensures operators can perform lifting tasks safely, minimizing risks and accidents on job sites. 2. Who should undergo Excavator As A Crane Training? This training is essential for anyone involved in using excavators for lifting operations, including machine operators, construction workers, and site supervisors. Proper training ensures that individuals understand equipment operation procedures, load capacities, and safety protocols. 3. What topics are covered in Excavator As A Crane Training programs? Training programs cover a range of topics, including: Manufacturer guidelines and load charts Understanding load capacities at various boom lengths and angles Proper use of lifting attachments Excavator stabilization techniques Rigging and lifting techniques Positioning and communication strategies Safety procedures and weather considerations Regular inspection and maintenance of equipment 4. Is Excavator As A Crane Training mandatory in certain industries? While not legally mandated in all areas, many employers in the construction and lifting industries require operators to undergo training as part of their occupational health and safety policies. Compliance with excavator as a crane training requirements helps prevent accidents and ensures regulatory compliance. 5. Where can I find reputable Excavator As A Crane Training courses? Reputable Excavator As A Crane Training Courses are offered by various institutions, including industry associations, equipment manufacturers, and specialized training providers like Vally Plant Training. It is important to choose a program that offers accredited certification and covers relevant industry standards and best practices.

Overview This is a 2 day course on understanding credit markets converting credit derivatives, from plain vanilla credit default swaps through to structured credit derivatives involving correlation products such as nth to default baskets, index tranches, synthetic collateralized debt obligations and more. Gain insights into the corporate credit market dynamics, including the role of ratings agencies and the ratings process. Delve into the credit triangle, relating credit spreads to default probability (PD), exposure (EAD), and expected recovery (LGD). Learn about CDS indices (iTRAXX and CDX), their mechanics, sub-indices, tranching, correlation, and the motivation for tranched products. The course also includes counterparty risk in derivatives market where you learn how to managed and price Counterparty Credit Risk using real-world, practical examples Understand key definitions of exposure, including Mark-to-Market (MTM), Expected Exposure (EE), Expected Positive Exposure (EPE), Potential Future Exposure (PFE), Exposure at Default (EAD), and Expected Loss (EL) Explore the role of collateral and netting in managing counterparty risk, including the key features and mechanics of the Credit Support Annex (CSA) Briefly touch upon other XVA adjustments, including Margin Valuation Adjustment (MVA), Capital Valuation Adjustment (KVA), and Collateral Valuation Adjustment (CollVA). Who the course is for Credit traders and salespeople Structurers Asset managers ALM and treasury (Banks and Insurance Companies) Loan portfolio managers Product control, finance and internal audit Risk managers Risk controllers xVA desk IT Regulatory capital and reporting Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Search By Location

- Other Courses in London

- Other Courses in Birmingham

- Other Courses in Glasgow

- Other Courses in Liverpool

- Other Courses in Bristol

- Other Courses in Manchester

- Other Courses in Sheffield

- Other Courses in Leeds

- Other Courses in Edinburgh

- Other Courses in Leicester

- Other Courses in Coventry

- Other Courses in Bradford

- Other Courses in Cardiff

- Other Courses in Belfast

- Other Courses in Nottingham