- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

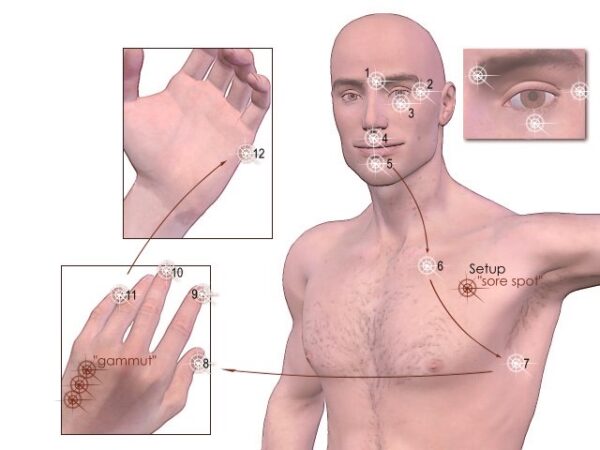

Description Emotional Freedom Technique Diploma Are any physical or emotional blocks holding you from moving on in life? Become an EFT (Emotional Freedom Technique ) Practitioner and learn effective techniques that can be of help to you and others. One of the fastest and simplest methods to heal almost all kinds of trauma, no matter when it happened in your life; EFT or Emotional Freedom Technique is a mind/body tool that uses just your fingers and intentions to clear the physical and emotional obstructions from your energy system. EFT (Emotional Freedom Technique ) is applicable to everyone. EFT (Emotional Freedom Technique ) helps other healing therapies to work better. It can be done through counselling, hypnotherapy, reiki, reflexology, neurolinguistic programming, cognitive behavior therapy, play therapy, and several other therapies. Lots of studies are still going on to find out whether there exists a relationship between a person's behavior and emotions. This is an intricate subject. However, studies have proved that our emotional states are our own creations on the basis of our perspectives about the world. Emotions can be defined as a series of electrical and chemical signals interpreted by the brain to produce a feeling. What you will learn 1: Explaining EFT 2: Understanding Emotions 3: The Basic EFT Tapping Routine 4: Advancing Forwards with EFT 5: Refining Your Technique 6: Overcoming Stumbling Blocks 7: Discovering How to Love Yourself 8: Relating to Relationships 9: Fighting Fears, Phobias, and Anxieties 10: Beating Anger Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

Working with Social Interaction Styles

By Ei4Change

Everybody has their own Social Interaction Style based around their behavioural preferences. Each person instinctively acts according to their inherent style. Team members will act out their styles in team working. Customers will act out their styles in buying situations. Salespeople will feel more comfortable selling according to their natural style. Being able to identify the Social Interaction Style of other people will give you valuable insights that you can use to establish rapport, open lines of communication, build trust, motivate and influence. Ways to work with each Social Interaction Style will be explored along with techniques to enhance and improve your interactions leading to better communication.

Overview: ***Limited Time Flash Sale*** Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £250 as a Gift! - Enrol Now! This Phlebotomy Training bundle consists of courses that are designed to give you step-by-step tutorials on venipuncture and phlebotomy skills along with other medical training. Since the pandemic, the need for medical professionals has skyrocketed. This means there are many jobs that you can apply for. To cater to the high demand and provide an all-inclusive course for those looking to learn skills, we bring you this Phlebotomy Training bundle. As phlebotomy includes the drawing of blood, you need to be very careful and you need to know several things before doing anything. This Phlebotomy Training bundle provides you with the knowledge of venipuncture along with several other medical skills such as clinical coding, laboratory assistant training and much more. All of these skills and knowledge in the medical field will prove extremely useful for you when you apply for medical jobs in the UK. Along with this Phlebotomy Training course, you will get 19 premium courses, an original Hardcopy, 20 PDF Certificates (Main Course + Additional Courses) Student ID card as gifts. This Phlebotomy Training Bundle Consists of the following Premium courses: Course 01: Phlebotomy Diploma Course 02: Immunisation Nurse Course 03: Vaccine Management Course 04: Infection Prevention Training Course 05: Anatomy and Physiology of the Human Body Course 06: Sterile Services Technician Training Level 4 Course 07: Medical Laboratory Assistant Training Level 3 Course 08: Medication Training Course 09: Nursing Assistant Course 10: Nurse Prescribing Diploma Course 11: Medical Transcription Course 12: Medical Terminology Training Course 13: Medical Law Course 14: Level 3 Diploma in Health & Social Care Course 15: Clinical Observations Skills Course 16: Public Health Course 17: Medication Administration Course 18: First Aid Training Course 19: Personal Hygiene Course 20: Communication & Information Handling in Care Learning Outcomes of this Phlebotomy Training bundle: Master the essential techniques and procedures in Phlebotomy for safe practice. Understand the anatomy and physiology relevant to Phlebotomy procedures. Gain proficiency in handling and operating Phlebotomy equipment accurately. Learn proper patient preparation and care during Phlebotomy procedures. Develop skills to prevent and manage complications during Phlebotomy sessions. Acquire knowledge of legal and ethical standards in Phlebotomy practice. Key Features of the Phlebotomy Training Course: FREE Phlebotomy Training CPD-accredited certificate Get a free student ID card with Phlebotomy Training training (£10 applicable for international delivery) Lifetime access to the Phlebotomy Training course materials The Phlebotomy Training program comes with 24/7 tutor support Get instant access to this Phlebotomy Training Course Learn Phlebotomy Training training from anywhere in the world The Phlebotomy Training training is affordable and simple to understand The Phlebotomy Training training is an entirely online So, enroll in our Phlebotomy Training Bundle to kick-start your career! Certificates Digital certificate - Included You will get the PDF Certificate for the title course (Phlebotomy Diploma) absolutely Free! Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Phlebotomy Diploma) absolutely Free! Other Hard Copy certificates are available for £14.99 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost. Description: Enroll in this Phlebotomy Training Bundle today and start your journey to become successful! ★★★ Course Curriculum of Phlebotomy Training Bundle ★★★ Course 01: Phlebotomy Diploma Module 01: Introduction Module 02: Blood Circulation, Function, and Composition Module 03: Phlebotomy Equipment Module 04: Routine Venipuncture Module 05: Venipuncture Complications and Pre-Examination Variables Module 06: Dermal Puncture Module 07: Quality Assessment and Management Module 08: Special Blood Collection Procedure Module 09: Infection Control and Risk Management =========>>>>> And 19 More Related Courses <<<<<========= How will I get my Phlebotomy Training Certificate? After successfully completing the course, you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £9.99*20 = £199.7) Hard Copy Certificate: Free (For The Title Course: Previously it was £14.99) So, enroll now in this Phlebotomy Training Bundle to kickstart your career! Who is this course for? Anyone from any background can enroll in this Phlebotomy Training bundle. Requirements This Phlebotomy Training course has been designed to be fully compatible with tablets and smartphones. Career path This Phlebotomy Training will improve your eligibility for a number of jobs across the healthcare and medical industries such as: Phlebotomists Phlebotomy Nurses Phlebotomy Lab Technicians Phlebotomy Healthcare Workers

November 2025 Fundamentals Organisation & Relationship Systems Coaching Training

By CRR UK

CRRUK equips professionals with the concepts, skills and tools to build conscious, intentional relationships, and to coach relationship systems of any size.

IWFM Level 4 Award in Facilities Management

By The Business School (UK) Ltd

Do you want to develop your career in Facilities Management? Are you already working in Facilities Management and want to build your knowledge? This short course offers the opportunity to complete smaller blocks of learning, designed to motivate you to go further.

An Agile Crash Course: Agile Project Management and Agile Delivery

By Packt

Get Agile certified and learn about the key and most important concepts and tools for Agile project management (Scrum)

Description Special Education Needs Diploma This course is aimed at children needing 'Special Educational Needs' who suffer from learning disabilities and learning difficulties. Learning, communication and even behavior are more difficult processes for such children when compared to other children of their age. This 'Special Educational Needs' course discusses various aspects of learning outcomes. If you are someone who would like to work with children having special educational needs, then this is the apt course you should be doing. On completion of this special education needs course, you will be equipped to understand the process involved in the development of a child thoroughly and assist children with special education needs. The course will help you help such children attain their full potential in learning. You will be equipped with the knowledge to support children having speech, communication and learning needs. Above all, you will be able to identify children with such issues. This course is the apt one if you wish to become a Special Education Needs teacher and looking to build your career as a teacher in schools, pupil referral units, nurseries and colleges. What you will learn 1. Frames of Reference 2. Models of Human Learning 3. Special Education Needs 4. Communication and Interaction 5. Cognition and Learning 6. Behavior, Emotional and Social Development 7. Sensory and other Physical Difficulties 8. Planning for Children with SEN 9. Assessment of Children with Special Education Needs (SEN) 10. Support from external agencies Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

Introduction to Phlebotomy Course - Certificate Update and Renewal (GPT003R)

4.6(39)By Geopace Training

Update and renewal option for Geopace Training Certificate holders Update and renew your existing certificate ... Recommended certificate renewal after 18 months Nationally Recognised Dual Accreditations Open College Network Accredited (Advanced Level) CPD Accredited (The CPD Certification Service) Recaps phlebotomy theory incl. legislation Updates your certification and compliancy Awards cumulative credits and CPD points awarded Basic understanding of English language required Download a certificate on completion of your online course APPLICANTS ARE REQUIRED TO HAVE COMPLETED AN ACCREDITED INTRODUCTION TO PHLEBOTOMY COURSE

Microsoft Dynamics 365 Associate Certification Bundle (with 4 Exams)

By Hudson

The Microsoft Certified Associate is a new breed of Microsoft certification. It is referred to as a ‘role-based certification’. According to Microsoft, role-based certifications show that individuals that possess them are keeping pace with today’s technical roles and requirements. They allow a learner to skill up and prove their expertise to employers and peers, plus get the recognition and opportunities they’ve earned

Emotional Intelligence Coaching

By Ei4Change

This course is for you if you work with people as a leader or manager and are looking at ways to help improve performance by developing emotional intelligence through coaching. The GROW (Goal, Reality, Options, Will) Model is a well-respected tool in coaching and this is explored to improve your questioning and listening techniques. It demonstrates the power of coaching through the use of a structure that enables questioning to flow conversationally and in a logical sequence.