- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

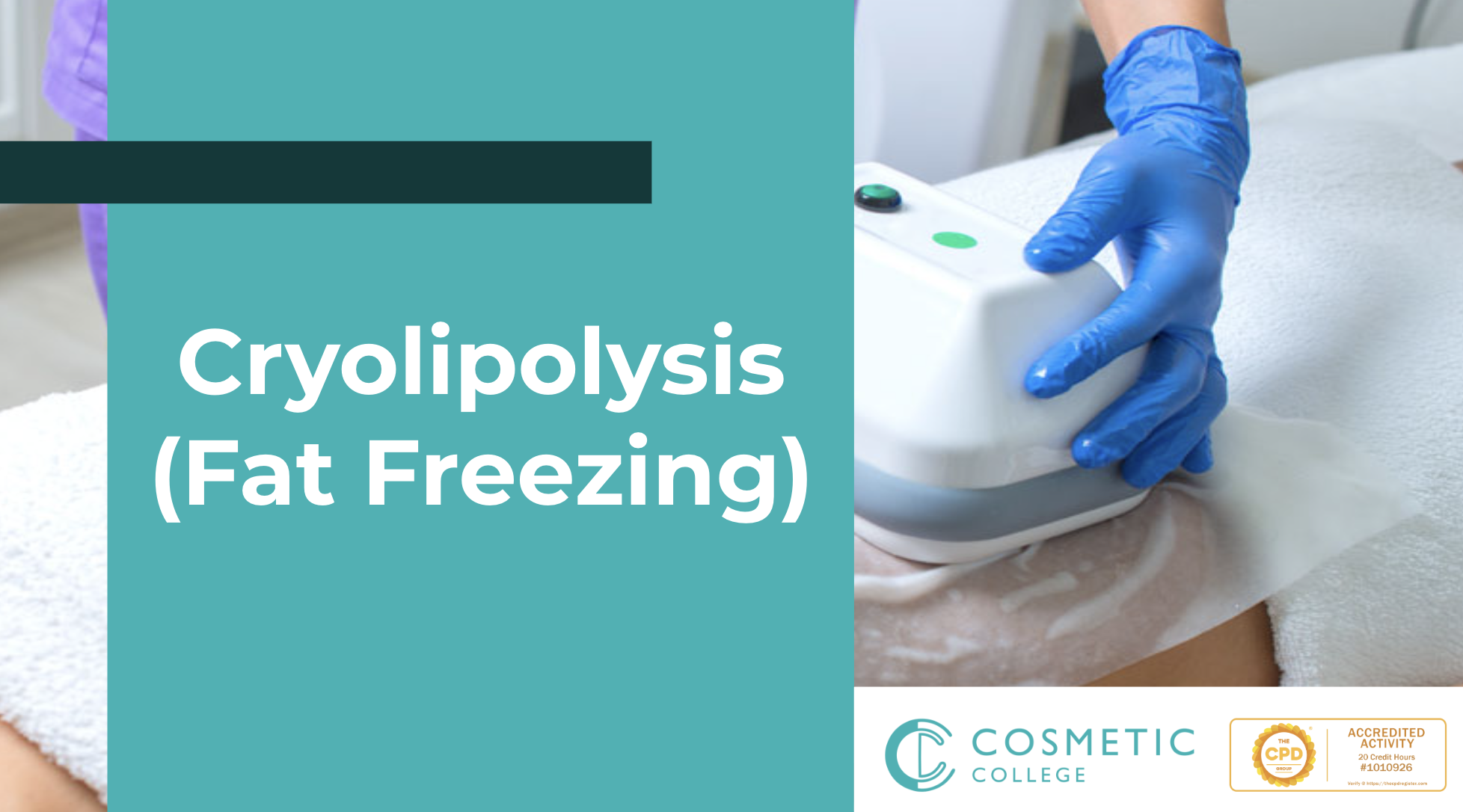

Online Cryotherapy (Fat Freezing) Training Course

By Cosmetic College

Our accredited Cryotherapy (fat freezing) training course will give you in-depth training on what Cryotherapy is and how to safely and effectively perform the treatment on clients. Additional course details Course Contents What Cryotherapy is How our weight affects our health How Cryotherapy works Introduction to the operation of your machine Client Consultation Client Safety Contraindications to treatment Areas that can be treated How to perform a treatment Handset positioning for all areas Side Effects Pre and Post-treatment advice Machine Maintenance General Troubleshooting FAQs This course was designed for learners to refresh their subject knowledge and practical skill; we suggest you attend our onsite training course for learners without prior training. Course Features CPD Accredited CourseVetted accredited trainingFully Online TrainingTrain your way on any deviceFull DemonstrationComplete end to end treatment demonstrationImmediate CertificationDelivered immediately after completion Frequently Asked Questions How long do I have to complete the training course? Once you have logged in and started your training course you will have 3 months to complete your training. Can I train straight away after making payment? Yes. Once you have completed payment our system will automatically enrol you onto the training course. You will then receive an email with instructions and a direct link to login and start your course. Can I get insurance once I have completed this training? Our online training courses are CPD accredited. Acquiring insurance based on completion and accreditation from our online training courses is insurer specific and as with most cases also takes into account your personal background and status. We advise that you contact your insurance to ensure your prerequisites meets their requirements and that this training course meets their specific criteria for insurance. We have a relationship with Insync Insurance which we recommend. Is this course accredited? Yes. This training course is accredited by the CPD group.

48-Hour Knowledge Knockdown! Prices Reduced Like Never Before! This Diploma in Mini MBA at QLS Level 4 course is endorsed by The Quality Licence Scheme and accredited by CPDQS (with 120 CPD points) to make your skill development & career progression more accessible than ever! Are you looking to improve your current abilities or make a career move? If yes, our unique Mini MBA at QLS Level 4 course might help you get there! It is an expertly designed course which ensures you learn everything about the topic thoroughly. Expand your expertise with high-quality training from the Mini MBA at QLS Level 4 course. Due to Mini MBA at QLS Level 4's massive demand in the competitive market, you can use our comprehensive course as a weapon to strengthen your knowledge and boost your career development. Learn Mini MBA at QLS Level 4 from industry professionals and quickly equip yourself with the specific knowledge and skills you need to excel in your chosen career. The Mini MBA at QLS Level 4 course is broken down into several in-depth modules to provide you with the most convenient and rich learning experience possible. Upon successful completion of the Mini MBA at QLS Level 4 course, an instant e-certificate will be exhibited in your profile that you can order as proof of your skills and knowledge. Add these amazing new skills to your resume and boost your employability by simply enrolling in this Mini MBA at QLS Level 4 course. This Mini MBA at QLS Level 4 training can help you to accomplish your ambitions and prepare you for a meaningful career. So, join us today and gear up for excellence! Why Prefer This Mini MBA at QLS Level 4 Course? Opportunity to earn a certificate endorsed by the Quality Licence Scheme & another accredited by CPDQS which is completely free. Get a free student ID card! (£10 postal charge will be applicable for international delivery) Innovative and engaging content. Free assessments 24/7 tutor support. Take a step toward a brighter future! *** Course Curriculum *** Here is the curriculum breakdown of the Mini MBA at QLS Level 4 course: Module 01: Appreciating the Mini MBA Module 02: The Foundations of Business Module 03: Understanding Business Law Module 04: Competitive Business Strategies Module 05: Departments in Business Module 06: Planning the Right Strategy for Business Module 07: Managing Human Resources in Business Module 08: Economics Influences on Business Module 09: Business Accounting Module 10: Finance in Business Module 11: Business Marketing Module 12: Advertising and Promotion Module 13: The Art of Negotiation Module 14: Communication and Presentation Module 15: Organisational Behaviour in Business Module 16: Building Teams in Business Module 17: Business Leadership Module 18: Operations Management Module 19: The Importance of Risk Management Module 20: Project Management Module 21: Quantitative Research and Analysis Module 22: Qualitative Research and Analysis Module 23: Becoming an Entrepreneur Module 24: Corporate Social Responsibility (CSR) Module 25: Avoiding Management Mistakes Assessment Process You have to complete the assignment questions given at the end of the course and score a minimum of 60% to pass each exam. Our expert trainers will assess your assignment and give you feedback after you submit the assignment. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you have completed all of the Diploma in Mini MBA at QLS Level 4 exams. CPD 120 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Mini MBA at QLS Level 4 course is perfect for highly motivated people who want to improve their technical skills and prepare for the career they want! Requirements No prior background or expertise is required. Career path The Mini MBA at QLS Level 4 course will boost your CV and aims to help you get the job or even the long-awaited promotion of your dreams. Certificates CPDQS Accredited Certificate Digital certificate - Included Diploma in Mini MBA at QLS Level 4 Hard copy certificate - Included Show off Your New Skills with a Certificate of Completion After successfully completing the Diploma in Mini MBA at QLS Level 4, you can order an original hardcopy certificate of achievement endorsed by the Quality Licence Scheme andalso you can order CPDQSAccredited Certificate that is recognised all over the UK and also internationally. The certificates will be home-delivered, completely free of cost.

Level 5 Diploma in Supply Chain Management - QLS Endorsed

By Kingston Open College

QLS Endorsed + CPD QS Accredited - Dual Certification | Instant Access | 24/7 Tutor Support | All-Inclusive Cost

24 Hours Left! Don't Let Year-End Deals Slip Away - Enrol Now! Food safety training is required for a wide range of employment in a wide range of sectors. Workers, from those directly involved in food production to those who sell it at retail, must learn how to operate safely with food meant for consumption. This is where HACCP Food Safety comes in. HACCP (Hazard Analysis Critical Control Points) is a globally recognised method for identifying and controlling food safety. As a result, we provide the HACCP Food Safety at QLS Level 5 course to help you learn important information and get a head start in the linked business. Learners will obtain a thorough grasp of food hygiene best practices in this extensive HACCP Food Safety course, ensuring that their firm receives a five-star exceptional national hygiene food rating. You will learn how to keep foods hazard-free. You will also comprehend the core concepts of hazard analysis and control points. This course will even help you improve your personal hygiene. You will also receive specialised lessons on HACCP and food premises. It is legally needed to know and understand the foundations of food safety and hygiene in order to avoid contaminating food and to always be safe at work. This course provides up-to-date knowledge on food hygiene through a range of lessons to ensure that you have a thorough awareness of your duties surrounding food safety and HACCP. So, what are you waiting for? Enrol Right Now! Learning Outcomes Upon successful completion of this HACCP Food Safety at QLS Level 5 course, you will be able to: Learn all there is to know about the HACCP system and food safety regulations. Learn about the many sorts of food safety hazards and how to avoid them. Determine the actions required to create and implement the HACCP system. Acquire a deep grasp of critical control points. Understand the HACCP criteria and how to begin using your HACCP system. Experts created the course to provide a rich and in-depth training experience for all students who enrol in it. Enrol in the course right now and you'll have immediate access to all of the HACCP Food Safety course materials. Then, from any internet-enabled device, access the course materials and learn when it's convenient for you. Start your learning journey straight away with this course and take a step toward a brighter future! Why Prefer this Course? Opportunity to earn a certificate endorsed by the Quality Licence Scheme and another certificate accredited by CPD after completing this course Student ID card with amazing discounts - completely for FREE! (£10 postal charges will be applicable for international delivery) Standard-aligned lesson planning Innovative and engaging content and activities Assessments that measure higher-level thinking and skills Complete the program in your own time, at your own pace Each of our students gets full 24/7 tutor support *** Course Curriculum *** Here is the curriculum breakdown of the course: Module 01: Introduction Module 02: HACCP and Food Safety Legislation Module 03: Food Safety Hazards Module 04: Planning a HACCP System Module 05: Creating the System Module 06: Principle 1: Hazard Analysis Module 07: Principle 2: Critical Control Points Module 08: Principle 3: Critical Limits Module 09: Principle 4: Monitoring Critical Control Points Module 10: Principle 5: Corrective Action Module 11: Principle 6: Verification of the System Module 12: Principle 7: Documentation Module 13: Implementing the System Module 14: Alternatives Assessment Process We offer an integrated assessment framework to make the process of evaluation for learners easier. After completing an online module, you will be given immediate access to a specially designed MCQ test. The results will be immediately analyzed, and the score will be shown for your review. The passing score for each test will be set at 60%. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you have completed all of the exams. CPD 150 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Is This Course Right for You? Food industry professionals Quality control and assurance personnel Food safety supervisors, managers, or auditors Individuals aspiring to work in the food industry Entrepreneurs or business owners in the food sector Requirements The HACCP Food Safety program does not require any prior knowledge; everyone may participate! This HACCP Food Safety course is open to anyone interested in learning from anywhere in the world. This 100% online course can be accessed from any internet-connected device, such as a computer, tablet, or smartphone. Career path HACCP Food Safety at QLS Level 5 course is a helpful certificate to have. It is advantageous for many professions, including: Quality Supervisor Hygiene Manager Food Safety Advisor Hotel and Restaurant Service Staff In the UK, these professions earn an average salary of £22,000 - £60,000 per annum. Certificates Level 5 QLS Endorsed Certificate Hard copy certificate - Included CPD Accredited Certificate Digital certificate - £10

48-Hour Knowledge Knockdown! Prices Reduced Like Never Before! This Diploma in Waiter Training at QLS Level 4 course is endorsed by The Quality Licence Scheme and accredited by CPDQS (with 120 CPD points) to make your skill development & career progression more accessible than ever! Imagine a busy restaurant with customers waiting to be seated and served. The waiters are rushing around, taking orders, delivering food, and ensuring customer satisfaction. As a customer, you appreciate the efficient service and professionalism of the waiters. You wonder how they manage to handle everything so smoothly. The answer lies in proper training, which is precisely what our Waiter Training at QLS Level 4 offers. Our Waiter Training is designed to equip you with all the skills and knowledge necessary to excel in the food service business. In this comprehensive Waiter Training at QLS Level 4 course, you will learn about the essential elements of food service, such as personal hygiene, sanitary food handling, and product knowledge. You will also develop essential personal skills such as calmness, friendliness, and professionalism, which are crucial for providing exceptional customer service. This Waiter Training at QLS Level 4 course covers a range of topics, including service sequences, additional responsibilities apart from food serving, supervisory responsibilities, and safety considerations. With our waiter training, you will learn how to manage your time efficiently, handle customer complaints tactfully, and supervise a team of waiters. You will also understand the importance of safety in the food service industry and learn how to maintain a safe working environment for both employees and customers. Our Waiter Training at QLS Level 4 course is suitable for anyone looking to start a career in the food service industry or improve their existing skills. Whether you are a school leaver, a career changer, or an experienced waiter looking to upskill, our Waiter Training at QLS Level 4 course is perfect for you. Our waiter training is also ideal for employers who want to provide their staff with the necessary skills and knowledge to excel in their roles. After this waiter training course, you will be able to learn: Understand the essential elements of food service and the role of waiters Develop personal skills such as calmness, friendliness, and professionalism Learn about personal hygiene and sanitary food handling Gain product knowledge and understand service sequences Understand supervisory responsibilities and additional responsibilities apart from food serving Understand safety considerations in the food service industry Why Prefer This Waiter Training at QLS Level 4 Course? Opportunity to earn a certificate endorsed by the Quality Licence Scheme & another accredited by CPDQS which is completely free. Get a free student ID card! (£10 postal charge will be applicable for international delivery) Innovative and engaging content. Free assessments 24/7 tutor support. Take a step toward a brighter future! *** Course Curriculum *** Here is the curriculum breakdown of the Waiter Training at QLS Level 4 course: Module 01: Facts about Food Service Business and Waiters Module 02: The First Impression You Make Module 03: Calmness & Friendliness Module 04: Personal Health and Hygiene Module 05: Sanitary Food Handling Module 06: Personal Skills Module 07: Product Knowledge and Service Module 08: Service Sequences Module 09: Additional Responsibilities Apart from Food Serving Module 10: Supervisory Responsibilities Module 11: Safety Considerations Assessment Process You have to complete the assignment questions given at the end of the course and score a minimum of 60% to pass each exam. Our expert trainers will assess your assignment and give you feedback after you submit the assignment. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you have completed all of the Diploma in Waiter Training at QLS Level 4 exams. CPD 120 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Waiter Training course is suitable for: School leavers interested in the food service industry Career changers looking to start a new career in the food service industry Experienced waiters looking to upskill Employers who want to train their staff in food service Requirements No prior background or expertise is required. Career path Waiter/Waitress: £17,000 to £20,000 per annum Assistant Restaurant Manager: £19,000 to £24,000 per annum Restaurant Manager: £25,000 to £30,000 per annum Food and Beverage Manager: £26,000 to £40,000 per annum Hotel Manager: £28,000 to £50,000 per annum Hospitality Operations Manager: £30,000 to £60,000 per annum Certificates CPDQS Accredited Certificate Digital certificate - Included Diploma in Waiter Training at QLS Level 4 Hard copy certificate - Included Show off Your New Skills with a Certificate of Completion After successfully completing the Diploma in Waiter Training at QLS Level 4, you can order an original hardcopy certificate of achievement endorsed by the Quality Licence Scheme and also you can order CPDQSAccredited Certificate that is recognised all over the UK and also internationally. The certificates will be home-delivered, completely free of cost.

Level 3 & 5 Site Management Safety Training Scheme (SMSTS) - QLS Endorsed

4.7(47)By Academy for Health and Fitness

24-Hour Limited Time Deal! Prices Reduced Like Never Before Every year, thousands of accidents occur on construction sites in the UK. Did you know that in 2022 alone, there were 43 fatal injuries reported to the Health and Safety Executive (HSE) in the construction industry? This is a stark reminder of the importance of safety in this sector. Are you committed to improving safety standards and building a successful career in construction? If so, this Site Management Safety Training Scheme (SMSTS) Level 3 & 5 at QLS bundle is for you. Our Site Management Safety Training Scheme (SMSTS) bundle equips you with the knowledge and skills to excel in the construction industry, focusing on safety, project management, regulations, and various specialised areas. With this comprehensive Site Management Safety Training Scheme (SMSTS) bundle, you can achieve your dreams and train for your ideal career. This Site Management Safety Training Scheme (SMSTS) bundle covers essential aspects in order to progress in your chosen career. With a single payment, you will gain access to our premium Level 3 & 5 Site Management Safety Training Scheme (SMSTS) course bundle along with an original Hardcopy & PDF certificate, Transcript and a Student ID Card for Free. This Site Management Safety Training Scheme (SMSTS) Bundle Contains 20 of Our Premium Courses for One Discounted Price: Course 01: Site Management Safety Training Scheme (SMSTS) at QLS Level 5 Course 02: Diploma in Construction Industry Scheme (CIS): QLS Endorsed Course 03: Diploma in Site Management at QLS Level 5 Course 04: Diploma in Construction Safety at QLS Level 5 Course 05: Certificate in Construction Site Supervisor at QLS Level 3 Course 06: CSCS Health and Safety in a Construction Environment (Leading to CSCS Green Card) Course 07: Construction Project Management Level 4 Course 08: Workplace First Aid Level 4 Course 09: Electrical & Fire Risk Assessment With Health and Safety Training Course 10: Diploma in Operations Management at QLS Level 5 Course 11: Working in Confined Spaces Course 12: Working at Height Course 13: RIDDOR Training Course 14: LOLER Regulations and LOLER Inspection Training Course 15: Ladder Safety Course 16: Lone Worker Safety Course 17: Noise and Hearing Protection Course 18: Asbestos Awareness Diploma Course 19: Career Development Plan Fundamentals Course 20: Professional CV Writing Learning Outcomes of this Bundle Understand and apply health and safety legislation in construction. Conduct risk assessments and implement control measures. Promote a positive safety culture on construction sites. Manage construction projects effectively. Respond to emergencies with confidence, including administering first aid. Comply with regulations like RIDDOR, LOLER, and working at height. Enrol today in Site Management Safety Training Scheme (SMSTS) and take the first step towards a successful career in construction. Why Choose Our Site Management Safety Training Scheme (SMSTS) Course? Get a Free QLS QLS-endorsed certificate upon completion of this Bundle Get instant access to this Bundle course. Learn from anywhere in the world This Bundle is affordable and simple to understand This Bundle is an entirely online, interactive lesson with voiceover audio Lifetime access to the Site Management (SMSTS) course materials The Site Management (SMSTS) comes with 24/7 tutor support Start your learning journey straightaway with Site Management Safety Training Scheme (SMSTS)! This Site Management (SMSTS)'s curriculum has been designed by Site Management (SMSTS) experts with years of Site Management (SMSTS) experience behind them. The Site Management (SMSTS) course is extremely dynamic and well-paced to help you understand Site Management (SMSTS) with ease. You'll discover how to master the Site Management (SMSTS) skill while exploring relevant and essential topics. Assessment Process Once you have completed all the courses in the Site Management (SMSTS) bundle, you can assess your skills and knowledge with an optional assignment. Our expert trainers will assess your assignment and give you feedback afterwards. CPD 350 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Site Management Safety Training Scheme (SMSTS) bundle is suitable for everyone. Special Note: For professional certification, you can enrol following courses: citb site management safety training scheme (smsts) CITB Site Supervisors' Safety Training Scheme (SSSTS) Level 2 NVQ Diploma in Plastering (Construction) (RQF) Level 2 NVQ Diploma in Cladding Occupations ProQual Level 6 NVQ Diploma in Construction Site Management ProQual Level 4 NVQ Diploma in Construction Site Supervision ProQual Level 4 NVQ Diploma in Construction Site Supervision (Construction) ProQual Level 6 NVQ Diploma in Construction Site Management (Construction) Level 4 Diploma in Construction Site Management Level 3 Diploma in Construction Site Supervisory Studies Requirements Site Management Safety Training Scheme (SMSTS) You will not need any prior background or expertise in this Site Management (SMSTS). Career path Site Management Safety Training Scheme (SMSTS) This Site Management (SMSTS) bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates Digital certificate Digital certificate - Included CPD Accredited Hard Copy Certificate Hard copy certificate - Included

Level 3 Diploma in Construction Industry Scheme (CIS) - QLS Endorsed

4.7(47)By Academy for Health and Fitness

24-Hour Knowledge Knockdown! Prices Reduced Like Never Before Confused about navigating the Construction Industry Scheme (CIS) in the UK? Millions of pounds are lost annually due to CIS errors. Did you know that the construction industry contributed over £108.7 billion to the UK economy in 2023? This comprehensive Diploma in CIS course will equip you with the knowledge and skills to confidently manage CIS requirements within your construction business. Our Diploma in Construction Industry Scheme (CIS) course provides a comprehensive understanding of the scheme. You'll explore its purpose, coverage, and the registration process for contractors. Learn about verification procedures, filing CIS returns, and maintaining accurate records with CIS certificates. By understanding the penalties for non-compliance, you can ensure your business operates smoothly within CIS regulations. This Advanced Certificate in Construction Industry Scheme (CIS) at QLS Level 3 course is endorsed by The Quality Licence Scheme and accredited by CPDQS (with 120 CPD points) to make your skill development & career progression more accessible than ever! Learning Outcomes of Construction Industry Scheme (CIS) Explain the purpose and structure of the Construction Industry Scheme (CIS). Identify activities covered under and excluded from the CIS scheme. Outline the registration process for contractors within the CIS framework. Navigate the CIS verification process and understand its significance. Prepare and submit accurate CIS returns following HMRC regulations. Implement effective record-keeping practices and manage CIS certificates. Imagine the peace of mind knowing CIS is under control! This course is your ticket to streamlined processes, saved money, and complete CIS compliance! Enrol Today and Become a CIS Master! Upon successful completion of this Diploma in Construction Industry Scheme (CIS), you will be able to, Discover the company categories covered by the Construction Industry Scheme (CIS) and the exclusions. Learn how to fulfil the CIS's demands on the contractor. Using examples, you may learn the proper way to compute and subtract payments from payments. Explore the value of maintaining records and how to do it effectively. Discover how to gain gross payment status as well as how to lose it. Determine the three exams that Subcontractors must complete to be eligible for payment certificates. Find out how to get your company ready for the Construction Industry Scheme (CIS). Why Choose Us? Get a Free QLS Endorsed Certificate upon completion of Construction Industry Scheme (CIS) Get a free student ID card with Construction Industry Scheme (CIS) Training program (£10 postal charge will be applicable for international delivery) The Construction Industry Scheme (CIS) is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Get Lifetime access to the Construction Industry Scheme (CIS) course materials The Construction Industry Scheme (CIS) comes with 24/7 tutor support Take a step toward a brighter future! The Diploma in Construction Industry Scheme (CIS) offers a significant toolbox for your construction career. By mastering CIS regulations, you'll gain expertise that sets you apart, increases your chances of landing better jobs, and saves your company money through fewer errors and penalties. The course also empowers you to streamline CIS processes, ensuring compliance and allowing you to focus on core business activities. *** Course Curriculum *** Module 01: Construction Industry Scheme (CIS) Module 02: Coverage of the Scheme Module 03: Contractors and Registration for the Scheme Module 04: Verification Process Module 05: The CIS Returns Module 06: Record Keeping and CIS Certificates Module 07: Penalties Involved in CIS Module 08: Miscellaneous Information How will I get my Certificate? After successfully completing the course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99) CPD Hard Copy Certificate: Free ( Previously it was £29.99) QLS Endorsed Hard Copy Certificate: Free (For The Title Course: Previously it was £89) CPD 120 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Construction Industry Scheme (CIS) is for you: Anyone with an interest in Construction Industry Scheme (CIS). Professionals who require to brush up on their CIS skills. Requirements No prior background or expertise is required. Career path This Diploma in Construction Industry Scheme (CIS) is uniquely designed to benefit the following career options. Construction Compliance Co-ordinator Payroll Executive Accounts Manager Finance Manager In the United Kingdom, the average salary of these professions ranges from £20,000 to £30,000 per annum. Certificates Advanced Certificate in Construction Industry Scheme (CIS) at QLS Level 3 Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee. CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free. CPD Accredited Hard Copy Certificate Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee.

R Programming for Data Science: Level 5 QLS Diploma

By Kingston Open College

QLS Endorsed + CPD QS Accredited - Dual Certification | Instant Access | 24/7 Tutor Support | All-Inclusive Cost

24-Hour Flash Sale! Prices Reduced Like Never Before!! The IT industry is experiencing a giant boom in this era of Information & Technology! Digital literacy has become as essential as reading and writing. The UK tech sector's growth has been unprecedented, contributing billions to the economy and creating millions of jobs. Yet, a gap persists in skilled IT professionals, who can grasp this opportunity and use it as their advantage. The Computer Technician (Online) Diploma is designed to bridge this gap, offering curriculum that spans from foundational IT skills to offering specialised knowledge in cybersecurity. This diploma bundle consists of carefully designed courses, guiding learners from the basics of Computer Technician to the complexities of Cybersecurity, Cloud Computing, and Ethical Hacking. It offers knowledge on topics like CompTIA A+, Network+, Security+, and more, ensuring a rounded education in IT Fundamentals, Advanced Troubleshooting, and Cybersecurity Law. This program is tailored to equip students with the theoretical knowledge needed to excel in various IT roles, making them indispensable assets in any tech-driven workplace. Courses Included In this Computer Technician (Online) Diploma Training Are: Course 01: Computer Technician (Online) Diploma Course 02: Functional Skills IT Course 03: Advance Windows 10 Troubleshooting for IT HelpDesk Course 04: Computer Maintenance Course 05: Internet of Things Course 06: Encryption Course 07: IT: Ethical Hacking & IT Security Course 08: CompTIA Network Course 09: CompTIA Security+ (SY0-401) Course 10: CompTIA Security+ (SY0-601) Course 11: CompTIA IT Fundamentals ITF+ (FCO-U61) Course 12: Cloud Computing / CompTIA Cloud+ (CV0-002) Course 13: CompTIA A+ (220-1002) Course 14: CompTIA Network+ Certification (N10-007) Course 15: CompTIA CySA+ Cybersecurity Analyst (CS0-002) Course 16: CompTIA PenTest+ (Ethical Hacking) Course 17: Cyber Security Law Course 18: Learning Computers and Internet Course 19: Document Control Course 20: ChatGPT Masterclass: A Complete ChatGPT Zero to Hero! Learning Outcomes of Computer Technician (Online) Diploma - CPD Certified Bundle: Master foundational IT skills and internet navigation techniques. Get to know Windows 10 troubleshooting and computer maintenance. Understand IoT principles and applications in today's tech landscape. Acquire essential knowledge in encryption and cybersecurity measures. Get proficient in CompTIA A+, Network+, and Security+. Develop skills in ethical hacking and cybersecurity analysis. Why Prefer this Computer Technician Course? Get a free CPD Accredited Certificate upon completion of the Computer Technician course Get a Free Student ID Card with Computer Technician Training The Computer Technician course is Affordable and Simple to understand Lifetime Access to the Computer Technician course materials The Computer Technician course comes with 24/7 tutor support Enrol today and gain the skills and knowledge to become a skilled computer technician! Take a step toward a brighter future! With the tech industry's rapid growth and the increasing demand for IT professionals in the UK and globally, this diploma acts as the perfect starting point for anyone looking to secure a prominent role in IT or cybersecurity. Whether you're starting your career, seeking to upgrade your skills, or transitioning to a tech-focused role, this comprehensive course bundle is your key to unlocking a wealth of opportunities in the digital age. Course 01: Computer Technician (Online) Diploma Module 01: Software Module 02: Hardware Module 03: Security Module 04: Networking Module 05: Basic IT Literacy Course 02: Functional Skills IT Module 01: How People Use Computers Module 02: System Hardware Module 03: Device Ports And Peripherals Module 04: Data Storage And Sharing Module 05: Understanding Operating Systems Module 06: Setting Up And Configuring A PC Module 07: Setting Up And Configuring A Mobile Device Module 08: Managing Files Module 09: Using And Managing Application Software Module 10: Configuring Network And Internet Connectivity Module 11: IT Security Threat Mitigation Module 12: Computer Maintenance And Management Module 13: IT Troubleshooting Module 14: Understanding Databases Module 15: Developing And Implementing Software Course 03: Advance Windows 10 Troubleshooting for IT HelpDesk Module 01: Course Introduction Module 02: Prepare Virtual Test Lab Module 03: Installing Windows OS With Multiple Media Module 04: System Troubleshooting Without Reboot Module 05: Optimize System Performance (Fix Slowness Issue) Module 06: Active Directory Server Setup (Optional) Module 07: Active Directory Introduction Module 08: File System Related Troubleshooting =========>>>>> And 17 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*20 = £259.8) CPD Hard Copy Certificate: Free ( For The First Course: Previously it was £29.99) CPD 200 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this bundle. This bundle is ideal for: Aspiring IT professionals Tech enthusiasts Future cybersecurity experts Network administrators Cloud computing specialists Requirements You will not need any prior background or expertise to enrol in this course. Career path After completing this course, you are to start your career or begin the next phase of your career. IT Support Specialist - £30,000 to £40,000 Cybersecurity Analyst - £40,000 to £65,000 Network Engineer - £35,000 to £55,000 Ethical Hacker - £50,000 to £70,000 Certificates CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free. CPD Accredited Hard Copy Certificate Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee.

Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping

4.7(47)By Academy for Health and Fitness

24-Hour Flash Sale! Prices Reduced Like Never Before!! Feeling overwhelmed by numbers and fractions? Do financial statements leave you scratching your head? In the UK, strong financial management is crucial for businesses of all sizes. But with complex accounting software and ever-changing tax regulations, keeping up can feel like a challenge. This comprehensive Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping bundle is your one-stop shop for mastering essential accounting skills and becoming a finance wizard! This extensive curriculum covers everything from complete training in Xero, QuickBooks, and Sage 50, to specialised courses in UK Tax Accounting, VAT, HR, and Payroll Management. Beyond mastering these tools, you'll get into the intricacies of Managerial Accounting, Business Finance, Financial Modelling, and Understanding Financial Statements. The bundle also includes critical topics such as Anti-money Laundering, Commercial Law, Cost Control, and Advanced Excel Skills for Financial Analysis. Each course is tailored to provide relevant theoretical knowledge, making you capable of handling financial challenges. Courses Are Included In this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Training: Course 01: Xero Accounting - Complete Training Course 02: QuickBooks Online Bookkeeping Diploma Course 03: Sage 50 Accounts Course 04: Sage 50 Payroll Complete Course Course 05: UK Tax Accounting Course 06: HR, Payroll, PAYE, TAX Course 07: Introduction to VAT Online Training Course 08: Accounting & Bookkeeping Masterclass Course 09: Managerial Accounting Training Course 10: Level 4 Diploma Accounting and Business Finance Course 11: Corporate Finance: Working Capital Management Course 12: Financial Modelling for Decision Making and Business plan Course 13: Understanding Financial Statements and Analysis Course 14: Finance Assistant Training: Level 1 & 2 Certification Course 15: Making Budget & Forecast Course 16: Commercial Law Course 17: Anti-Money Laundering (AML) Course 18: Cost Control Process and Management Course 19: Advanced Diploma in Microsoft Excel Course 20: Microsoft Excel Training: Depreciation Accounting Refine your existing expertise, expand your skill set, or join in on a new professional path, this course bundle offers the tools and knowledge you need to succeed. By completing this training, you'll not only enhance your resume but also open doors to numerous job opportunities in a field that's crucial to the success of businesses across the UK. Enrol now become a sought-after professional in the world of payroll, tax, VAT, accounting, and bookkeeping! Learning Outcomes of this Course: Master Xero, QuickBooks, and Sage 50 for comprehensive financial management. Apply UK tax, VAT, and PAYE principles accurately in business scenarios. Navigate payroll and HR regulations confidently. Analyse financial statements and contribute to strategic decision-making. Utilise advanced Excel skills for financial modelling and analysis. Understand commercial law and anti-money laundering regulations. Why Choose this Bundle? Get a Free CPD Accredited Certificate upon completion of the course Get a free student ID card with this training program The course is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Lifetime access to the course materials The training program comes with 24/7 tutor support Start your learning journey straight away with Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping! *** Course Curriculum *** Course 01: Xero Accounting - Complete Training Module 01: Getting Started Module 02: Setting up of the System Module 03: Customers and Suppliers Module 04: Fixed Assets Module 05: Bank Payments and Receipts Module 06: Petty Cash Module 07: Bank Reconciliation Module 08: Business Credit Card Account Module 09: Aged Reports Module 10: Payroll and Journals Module 11: Vat Return Module 12: Correction of Error Course 02: QuickBooks Online Bookkeeping Diploma Module 01: Introduction to Bookkeeping Module 02: Manual System Module 03: Computerised Systems Module 04: How it Fits Together Module 05: Bookkeeping Basics Module 06: Ledgers Module 07: Trial Balance and Coding Module 08: PNL Account and Balance Sheet Module 09: AILE Personal Module 10: The Conclusion To The Course Course 03: Sage 50 Accounts Module 01: Sage 50 Bookkeeper Coursebook Module 02: Introduction and TASK 1 Module 03: TASK 2 Setting up the System Module 04: TASK 3 a Setting up Customers and Suppliers Module 05: TASK 3 b Creating Projects Module 06: TASK 3 c Supplier Invoice and Credit Note Module 07: TASK 3 d Customer Invoice and Credit Note Module 08: TASK 4 Fixed Assets Module 09: TASK 5 a and b Bank Payment and Transfer Module 10: TASK 5 c and d Supplier and Customer Payments and DD STO Module 11: TASK 6 Petty Cash Module 12: TASK 7 a Bank Reconciliation Current Account Module 13: TASK 7 b Bank Reconciliation Petty Cash Module 14: TASK 7 c Reconciliation of Credit Card Account Module 15: TASK 8 Aged Reports Module 16: TASK 9 a Payroll Module 17: TASK 9 b Payroll Module 18: TASK 10 Value Added Tax – Vat Return Module 19: Task 11 Entering opening balances on Sage 50 Module 20: TASK 12 a Year end journals – Depre journal Module 21: TASK 12 b Prepayment and Deferred Income Journals Module 22: TASK 13 a Budget Module 23: TASK 13 b Intro to Cash flow and Sage Report Design Module 24: TASK 13 c Preparation of Accountants Report & correcting Errors (1) How will I get my Certificate? After successfully completing the Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously, it was £12.99*20 = £260) CPD Hard Copy Certificate: Free ( For Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7: Previously it was £29.99) QLS Endorsed Certificate: Free (Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7 : Previously it was £159) CPD 200 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping bundle. This bundle is ideal for: Accountants Finance managers Business owners HR professionals Bookkeepers Finance students This Xero accounting software training program has been created to develop your Xero accounting skills and the overall understanding of the software. It has no association with Xero Limited and operates independently. Please note, that the certificate you receive upon completion is CPD accredited and not an official Xero certification. Requirements You will not need any prior background or expertise to enrol in this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping course. Career path After completing this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping course, you are to start your career or begin the next phase of your career. Xero Specialist - £25,000 to £40,000 QuickBooks Certified Pro Advisor - £30,000 to £45,000 Sage 50 Accountant - £28,000 to £42,000 Tax Consultant - £35,000 to £60,000 Financial Analyst - £30,000 to £50,000 Accounting Manager - £40,000 to £70,000 Certificates Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7 Hard copy certificate - Included QLS Endorsed Hard copy certificate - Included Please note that International students must pay an additional £10 as a shipment fee. CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free. CPD Accredited Hard Copy Certificate Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee.