- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

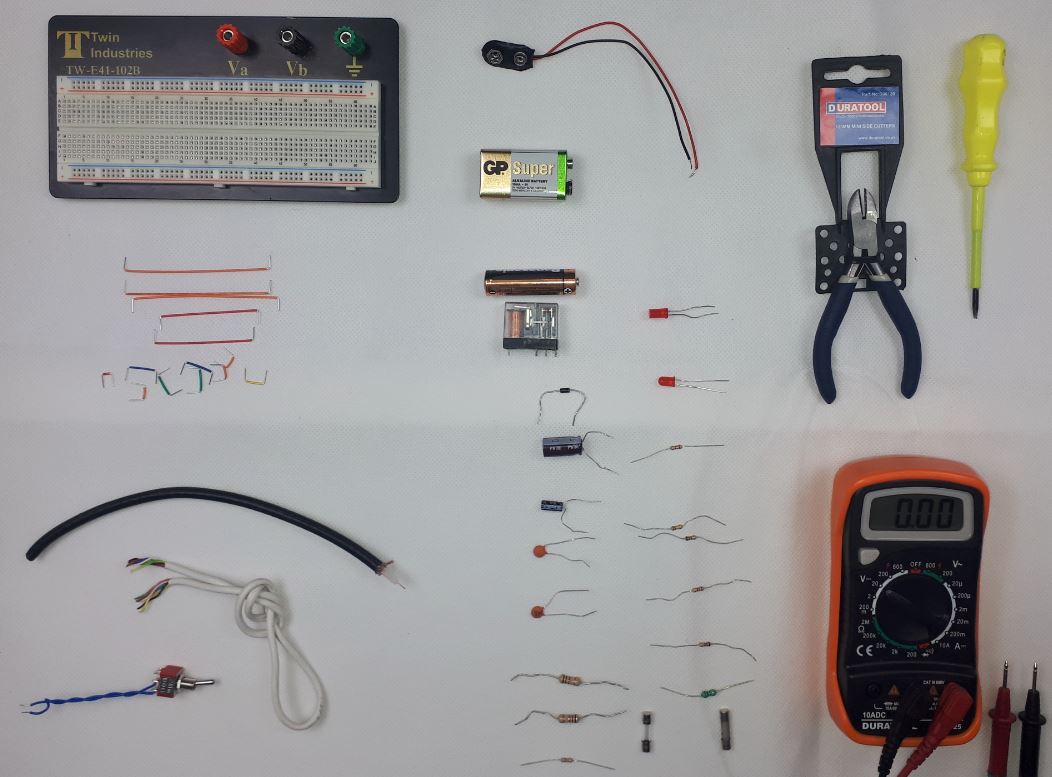

Preliminary Electronic Security Course

By Hi-Tech Training

The Preliminary Electronic Security Course is an introductory (or revision) course designed to provide participants who have no previous Electrical or Electronics experience with the background skills required to attend the CCTV Installation Course, Access Control Course or Fire Alarm Foundation Course. The course gives both an introduction to electronics and electronic security and shows how the two fields merge together. Ideal for a beginner wishing to learn more about this fascinating area. A large practical content is guaranteed. The day will be an excellent learning experience with a skilled instructor. It is a great introduction to the other courses we provide.

Anger Management Energy EFT CourseGet

By EFT Course UK Online Zoom Live

Get Back Control - Shall We Tap That Anger Away?

Do you want to be able to develop your skills and at the same have a career growth? If so, then this course will be perfect for you and your needs. Description: Do you always feel burned out because of work? Are you feeling that you are stuck with your work and being burdened by it? If you are feeling like this, then this course will help you learn the necessary skills you need for career development. You will also be educated on the skills where you need improvement and help you taking assessment tests for your chosen career. This course will also help you in getting help through mentoring and taking online and offline classes. This course will also teach you valuable life lessons and the importance of esteem for career development. Who is the course for? Professionals or anyone who helps people with their dilemmas in career development. People who have an interest in developing their career developing skills. Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. PDF certificate's turnaround time is 24 hours and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognised accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: The Career Developing Skills would be beneficial for the following careers: Career Coaches Human Resource Specialist Human Resource Managers Life Coaches Managers Mentors Top Executives. Career Developing Skills Introduction 00:15:00 Ways To Improve Your Performance At Work 00:30:00 Career Aptitude Tests And Career Assessments 00:30:00 Get Mentoring 01:00:00 Importance Of Online Courses 00:30:00 Advantages To Take Offline Courses 00:30:00 Benefits Of Life Lessons 00:30:00 Self Esteem 01:00:00 Professional CV & Resume Writing Techniques INTRODUCTION 00:15:00 EFFECTIVE RESUME AND COVER LETTER WRITING 00:30:00 THE PURPOSE OF YOUR RESUME 01:00:00 RESUME PRESENTATION IS THE KEY 01:00:00 WOW THE EMPLOYER 01:00:00 ELEMENTS OF A RESUME THAT WILL IMPRESS 01:00:00 WRITING YOUR OBJECTIVE 01:00:00 WRITING YOUR SUMMARY 01:00:00 WRITING THE SKILLS AND ACCOMPLISHMENTS SECTION 01:00:00 RESUME FORMATTING 01:00:00 WRITING AN ELECTRONIC RESUME 01:00:00 PUT YOUR BEST FOOT FORWARD 00:15:00 YOUR RESUME - A WORK OF ART 01:00:00 WRITING THE HISTORY/ EXPERIENCE SECTION 01:00:00 WRITING YOUR EDUCATION SECTION 01:00:00 WRITING A PROFESSIONAL AFFILIATIONS SECTION 00:15:00 WRITING A PUBLICATIONS and PERSONAL INTERESTS SECTION 01:00:00 WRITING A REFERENCES SECTION 00:30:00 YOUR RESUME - A WORK OF ART 01:00:00 DO NOT PUT IN YOUR RESUME 00:15:00 A VARIETY OF RESUME SAMPLES 00:30:00 THE IMPORTANCE OF WRITING COVER LETTERS 01:00:00 COVER LETTER OUTLINE: HOW TO WRITE A GOOD COVER LETTER 01:00:00 KEY PHRASES TO BE USED IN YOUR COVER LETTER 00:15:00 COVER LETTER SAMPLE 01:00:00 BASIC COVER LETTER TEMPLATE EXAMPLE 00:30:00 CONCLUSION 00:15:00 How to Face an Interview Successfully Importance of Knowing The Tips And Tricks for Interviews 00:15:00 The Different Types of Interviews 01:00:00 Skill Building to Crack Interviews 00:15:00 Tools and Miscellaneous You Need To Have 00:15:00 The Perfect 'Resume' - Significance and Importance 00:30:00 Preparing Properly for an Interview 00:30:00 What Role Does Appearance Play? 00:30:00 Tips To Gear Up - Pre-Interview 00:30:00 Modern Tips By Interview Experts 00:30:00 Microsoft Word Module One - Getting Started 00:30:00 Module Two - Opening 01:00:00 Module Three - Working with the Interface 01:00:00 Module Four - Your First Document 01:00:00 Module Five - Basic Editing Tasks 01:00:00 Module Six - Basic Formatting Tasks 01:00:00 Module Seven - Formatting Paragraphs 01:00:00 Module Eight - Advanced Formatting Tasks 01:00:00 Module Nine - Working with Styles 01:00:00 Module Ten - Formatting the Page 01:00:00 Module Eleven - Sharing Your Document 01:00:00 Module Twelve - Wrapping Up 00:30:00 Microsoft PowerPoint Module One - Getting Started 00:30:00 Module Two - Opening PowerPoint 01:00:00 Module Three - Working with the Interface 01:00:00 Module Four - Your First Presentation 01:00:00 Module Five - Working with Text 01:00:00 Module Six - Formatting Text and Paragraphs 01:00:00 Module Seven - Adding Pictures 01:00:00 Module Eight - Advanced Formatting Tasks 01:00:00 Module Nine - Working with Transitions and Animations 01:00:00 Module Ten - Setting Up Your Slide Show 01:00:00 Module Eleven - Showtime! 01:00:00 Module Twelve - Wrapping Up 00:30:00 Microsoft Excel Module One - Getting Started 00:30:00 Module Two - Opening Excel 01:00:00 Module Three - Working with the Interface 01:00:00 Module Four - Your First Worksheet 01:00:00 Module Five - Viewing Excel Data 01:00:00 Module Six - Building Formulas 01:00:00 Module Seven - Using Excel Functions 01:00:00 Module Eight - Using Quick Analysis 01:00:00 Module Nine - Formatting Your Data 01:00:00 Module Ten - Using Styles, Themes, and Effects 01:00:00 Module Eleven - Printing and Sharing Your Workbook 01:00:00 Module Twelve - Wrapping Up 01:00:00 Mock Exam Mock Exam- Career Developing Skills 00:30:00 Final Exam Final Exam- Career Developing Skills 00:30:00

Are you someone who is in the business industry and is part of the management? Or are you someone who has the potential to become part of the executive team? Or do you want to become one in the future? If one of these situations you are in, then you will surely benefit from this. Description: Management is important in the organisation of any business or institution. To be able to be an expert in this field, you have to acquire the right skills. In this course, you will be learning about how managers must be developed and what skills they need. Strategies and the importance of management will be thoroughly discussed. Learning about the roles and competencies of a manager will be taught. This will help you understand that development for managers is a never-ending process and you will be able to apply what you've learned to your organization. Who is the course for? Professionals who are in the top management or supervisory positions. People who have the interest to know and acquire management skills. Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam, you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hard copy at the cost of £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognized accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: The Advanced Management Diploma Course is a useful qualification to possess, and would be beneficial for the following careers: Businessmen Entrepreneur Manager Supervisor Team Leader. Organizational Management Module One - Getting Started 00:30:00 Module Two - Managers are Made, Not Born 01:00:00 Module Three - Create a Management Track 01:00:00 Module Four - Define and Build Comptencies 01:00:00 Module Five - Managers Learn by Being Managed Well 01:00:00 Module Six - Provide Tools 01:00:00 Module Seven - Provide Support 01:00:00 Module Eight - Identify Strong Candidates Early 01:00:00 Module Nine - Clearly Define the Management Track 01:00:00 Module Ten - Empower New Managers 01:00:00 Module Eleven - Provide Growth Opportunities 01:00:00 Module Twelve - Wrapping Up 01:00:00 Business Management Designing Your Organizational Structure 00:30:00 Introduction to Operations Management 00:15:00 Understanding Financial Terms 00:30:00 Getting the Right People in Place 00:15:00 Getting Your Product Together 00:15:00 Building a Corporate Brand 00:30:00 Marketing Your Product 01:00:00 Selling Your Product 00:15:00 Planning for the Future 00:15:00 Goal Setting and Goal Getting 00:30:00 Succession Planning 101 00:15:00 Managing Your Money 00:15:00 Ethics 101 00:15:00 Building a Strong Customer Care Team 00:15:00 Training Employees for Success 00:15:00 Leadership Essentials 00:15:00 Business Process Management The Fundamentals of Business Process Management 00:30:00 Defining Business Process Management 00:30:00 The Business Process Life Cycle 00:15:00 The Vision Phase 00:15:00 The Design Phase 01:00:00 The Modeling Phase 00:30:00 The Execution Phase 01:00:00 The Monitoring Phase 00:30:00 The Optimizing Phase 01:00:00 Business Leadership About the Learning Organization 00:15:00 Achieving Personal Mastery 00:15:00 Analyzing Our Mental Models 00:30:00 Achieving a Shared Vision 00:15:00 Team Learning 00:15:00 Systems Thinking 00:15:00 Five Practices 00:15:00 Building Trust 00:15:00 Managing Change 00:30:00 Managers vs. Leaders 00:15:00 Influence Strategies 00:15:00 Managing Relationships 01:00:00 Strategic Planning 00:00:00 Doing Delegation Right 00:15:00 Criteria for Useful Feedback 00:15:00 Feedback Techniques 00:15:00 Mastering Your Body Language 00:15:00 Meeting Management 00:30:00 Pumping up a Presentation 00:15:00 Business Ethics What are Ethics? 00:15:00 Taking Your Moral Temperature 00:15:00 Why Bother with Ethics? 00:30:00 Some Objective Ways of Looking at the World 00:30:00 What Does Ethical Mean? 00:30:00 Avoiding Ethical Dilemmas 00:30:00 Pitfalls and Excuses 00:15:00 Developing an Office Code of Ethics 00:30:00 22 Keys to an Ethical Office 00:15:00 Basic Decision Making Tools 01:30:00 Ethical Decision-Making Tools 00:45:00 Dilemmas with Company Policy 00:15:00 Dilemmas with Clients 00:15:00 Dilemmas and Supervisors 00:30:00 What to Do When You Make a Mistake 00:30:00 Taking Your Moral Temperature II 00:15:00 Activities Advanced Management Diploma- Activities 00:00:00 Mock Exam Mock Exam- Advanced Management Diploma 00:20:00 Final Exam Final Exam- Advanced Management Diploma 00:20:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

This course provides practical training in all areas of sustainable energy, including renewable energy sources, photovoltaic systems and sustainable energy technologies. You will learn about the impact of sustainable energy on the environment and will explore wind, solar, ocean and geothermal energy in detail. This course is ideal for those who are looking to fast track their career in the energy sector. It includes case studies and practical exercises that are designed for those who have little knowledge of sustainable technologies in this field. Learning Objective: Be able to identify the different types of non-renewable energy Demonstrate an understanding of sustainable energy technologies & systems Understand how wind, solar, ocean and geothermal energy works Learn about the potential applications of different renewable energy sources Broaden your understanding of the environmental impacts of renewable energy technologies Fast track your career with an endorsed certificate in Sustainable Energy Explore the idea of hydrogen fuel cells as a source of renewable power Develop your understanding of the future of energy systems Learn about photovoltaic systems and how solar energy is harnessed Who is This Course for? This endorsed training course in Sustainable Energy is ideal for those who are interested in working in the sustainable and renewable energy sector, as well as those who would like to gain a more in-depth understanding of sustainable energy sources. Our online courses are specially designed for distance learning, offering flexible virtual classroom modules that you can study at your own convenience. There are no specific entry requirements for the course, which can be studied part-time or full-time. Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the course. Good understanding of English language, numeracy and ICT are required to attend this course. Career Path This introductory to sustainable energy course is designed to equip you with the skills and practical knowledge to work in the following professions: Sustainable Energy Consultant Graduate Energy Specialist Energy and Utilities Analyst Energy Engineer Course Curriculum Module 1: History of Energy Consumption Module 1: History of Energy Consumption 00:35:00 Assessment Module 1 Module 01 Final Quiz Exam - Sustainable Energy 00:10:00 Module 2: Non-Renewable Energy Module 2: Non-Renewable Energy 00:30:00 Assessment Module 2 Module 02 Final Quiz Exam - Sustainable Energy 00:10:00 Module 3: Basics of Sustainable Energy Module 3: Basics of Sustainable Energy 00:30:00 Assessment Module 3 Module 03 Final Quiz Exam - Sustainable Energy 00:10:00 Module 4: Fuel Cell Module 4: Fuel Cell 00:45:00 Assessment Module 4 Module 04 Final Quiz Exam - Sustainable Energy 00:10:00 Module 5: Solar Energy Module 5: Solar Energy 00:50:00 Assessment Module 5 Module 05 Final Quiz Exam - Sustainable Energy 00:10:00 Module 6: Wind Energy Module 6: Wind Energy 01:20:00 Assessment Module 6 Module 06 Final Quiz Exam - Sustainable Energy 00:10:00 Model 7: Ocean Energy Module 7: Ocean Energy 00:30:00 Assessment Module 7 Module 07 Final Quiz Exam - Sustainable Energy 00:10:00 Module 8: Geothermal Energy Module 8: Geothermal Energy 00:35:00 Assessment Module 8 Module 08 Final Quiz Exam - Sustainable Energy 00:10:00 Module 9: Application of Renewable Energy Module 9: Application of Renewable Energy 00:15:00 Assessment Module 9 Module 09 Final Quiz Exam - Sustainable Energy 00:10:00 Module 10: Being Environment-Friendly Module 10: Being Environment-Friendly 00:25:00 Assessment Module 10 Module 10 Final Quiz Exam - Sustainable Energy 00:10:00 Order Your Certificate

Weight Management Consultancy Diploma

By Plaskett International

LEARN HOW TO BECOME A WEIGHT MANAGEMENT CONSULTANT WITH THE CLIENT'S HEALTH & WELLBEING AT THE CORE. A MESSAGE FROM THE AUTHOR As you enter into this study, I want you to be fully aware of what lies before you. If you save people from overweight, you will also increase life-expectancy and/or prevent the onset of serious debilitating diseases. There will also be those clients whose life has been long limited in a psychological sense and you will be able to help them to restore their sense of verve and vitality so they can again live life to the fullest extent. This will be done through learning special expertise both technically and in person-to-person relations. With these words of encouragement, I warmly welcome you to this course of study where the amount of potential job satisfaction is incalculable. DR. LAWRENCE PLASKETT Course Duration 12 months Study Hours 200 hours Course Content 13 sections Course Fee £475 Course Overview The Plaskett Weight Management Consultancy course will provide you with a detailed, systematic and scientifically-based training, fuller than any other we know of in the field. It will enable you to practise as a well-informed Weight Management Consultant and most importantly, you will be able to help and support individuals in their quest to lose weight whilst maintaining health and well-being. Learn the Basic Elements of Nutrition You will gain an understanding of the basic elements of nutrition with a focus on the key nutrients in order to avoid deficiencies when working with weight loss clients. Create Individualised Weight Loss Programmes You will develop the confidence to be able to make informed choices from a wide span of weight loss options and avoid the use of rigidly fixed methods, thereby delivering programmes best suited to individual needs. Become a Skilled Adviser You will learn the skills to be able to counsel on a one-to-one basis, we believe that this favours the resolution of individual circumstances and problems. You will receive the training to see your clients through every stage of the process, thereby maximising their chances of success. Expand Practice of Current Health Professionals In addition to those wanting to set up practice as a Weight Management Consultant, this course is ideally suited to current health & fitness professionals looking to enhance their practice. BREAKDOWN OF THE COURSE SECTIONS The Weight Management Consultancy Diploma includes the following 13 sections: SECTION 1 BASIC SCIENCE SUPPORT Whilst our main concern will be with weight loss, we need to understand some of the basic aspects of nutrition. These deal with the key nutrients that we have to control to reduce weight. They will also help us to understand how to lose weight without developing deficiencies. In Section 1, we begin the study of nutrients and foods by looking at the main bulk nutrients that our diets contain: protein, carbohydrate and fat. Before one can consider individual vitamins and minerals, one has to know about the nutrients that make up most of our diets, namely the bulk nutrients. These are the suppliers of food energy and ultimately help to decide an individual's size. You will need to understand these so as to manipulate them with skill. Areas Covered What are the bulk nutrients? Chemical elements contained in the bulk nutrients Proteins Carbohydrates Fibre Fats The energy reserve role of fat The lipoproteins of the blood SECTION 2 UNDERSTANDING THE FIELD & NATURE OF THE PROBLEM This section introduces the basic ideas of the training. The purpose of this course of training is to enable the student to help others who are overweight or obese to lose weight, and to do so in a professional manner. At the same time, it aims to motivate you and empower you to set up a practice as a ‘Weight Management Consultant’ that will lead to your gaining a good reputation in this field, developing a panel of satisfied clients and bringing you both status and income. Since losing weight is not easy, one has to be aware of all the different methods and ramifications that are a part of this intriguing subject. The professionalism comes from knowing a number of different “ways in” to help the clients and also from being able to develop awareness of the individuality of each client. This will put you in a position to find the best and most successful route to weight loss for each person who consults you. This will mean giving individual advice, not just the same advice to everyone. By recognising individuality we earn the client’s trust and appreciation and we also increase the chances of achieving the fullest possible success by being in a position to find individual solutions to each client’s problem. Areas Covered The aims of the work The clients’ motives The clients themselves The clients’ knowledge of nutrition The place of psychology The arithmetical equation of body weight Ways of working Getting fat is all too easy – we review how it happens Definition and classification: criteria for weight normality SECTION 3 THE THEORY OF THE CAUSES OF OVERWEIGHT & OBESITY In this section we explore 'The Theory of what Causes Overweight and Obesity'. We look at the underlying reasons for this current epidemic scale of the problem in developed societies throughout the world. Understanding this will give you an insight into what needs to be done. The Weight Management Consultant clearly needs to understand as fully as possible the causes of obesity in order to be able to formulate good advice. It is necessary to understand that, although the ultimate cause is always eating more than the body requires, that factor is modified by many subsidiary factors. One, that always interests clients, is whether or not one may be predisposed by one’s inheritance to put on and retain weight, so we deal with this question. Areas covered Relative effect of genetics and environment Hormonal disturbance in obesity Slower than normal rates of energy expenditure The role of fat cells Role of the enzyme lipoprotein lipase SECTION 4 THE HEALTH CONSEQUENCES OF EXCESS WEIGHT It is well known that being overweight or obese increases the chances of contracting chronic illnesses. This section examines the types of illnesses involved and the way that their incidence is affected by body weight. From the standpoint of a Weight Management Consultant, the use of this information is to present clearly the vital benefits that your work can bring to your clients in terms of freedom from illness. This knowledge can augment your job satisfaction, especially when you can see the client’s health condition improving as weight comes down. That can be expected to happen sometimes, but of course not always. So, potentially this information can serve to inform your clients about the degree to which slimming down from an overweight or obese condition can help them to avoid very negative health consequences. By passing on parts of this data to some carefully selected clients, you may perhaps either improve their flagging motivation, or increase their satisfaction level with their early results or with the efforts they are making. Areas covered The connection between overweight and ill health The risk of early death Illness and death from cardiovascular disease Illness and death from diabetes mellitus Illness and death from hypertension Illness and death from respiratory problems Illness and death from gallbladder disease Illness and immobility from arthritis Illness from gout Illness and death from cancer SECTION 5 FIRST PRINCIPLES OF CORRECTING EXCESS WEIGHT In this section we approach the practical side of the Weight Management Consultant’s job. The greatest skill required of the Consultant is that of formulating the advice in a way that combines efficacy with client acceptability. The mistake most often made in the approach to weight reduction is to employ only one method yet in pursuing reduction in a person’s weight, it is best to come at the problem from multiple angles simultaneously. The person’s diet may well have to be the first and foremost approach however, the main alternative approaches involve several different ways of preventing excess food materials from being stored, leading to overweight. If control of the diet is the only method one employs, then so much depends upon strict dietary control that the will and the motivation of the client may be too severely tested. However, an approach in which dietary control takes pride of place, but is supported by a number of other approaches, is more likely to find client acceptability and is therefore more likely, ultimately, to be successful. In this section we list these “prevention of storage” approaches before dealing more fully with the diet. Areas covered Strategy of weight control Reduction of food intake The use of balanced hypocaloric diets Strategies for reducing food intake in practice Using foods intended to increase metabolic rate Mixtures of the various strategies SECTION 6 REDUCING WEIGHT THROUGH DIET & DIETARY COMPOSITION The principal purpose of this section is to understand the scope that we have to reduce food calories in the diet without necessarily reducing the total weight of food consumed. It looks closely at understanding and measuring food energy. Working in this way with diet is kindest to the clients and makes fewer demands upon their efforts and their will to succeed. Areas covered Understanding food energy The make-up of daily diets What does the body have to do with tis energy? Water content of foods The differing energy contents of food dry matter Substituting low-calorie for high-calorie foods The first stage of calorie reduction Combining diet with exercise A further stage of calorie reduction SECTION 7 SELECTING INDIVIDUAL FOODS The previous section talks mainly about the first principles of reducing calorie intake while keeping the weight of daily food dry matter level. This is done mainly by varying the extent to which each food class contributes to the overall diet; we simply reduce the proportions of those food classes with the higher calorie content. This section now looks within food classes to pick out those foods that, individually, have lower calorie content than the average for foods within the class concerned and make the best contribution to an individual client’s diet. This is a further step to calorie reduction without loss of food bulk. Areas covered Different foods within any given class have different calorific values Choosing foods within food classes for calorie reduction Specific recommendations for individual foods within each class Care needed in using the information Calorie contents of the “more suitable foods” Dietary results from substituting individual foods The necessary provision of dietary fat The quality of dietary protein The quantity of dietary protein Choosing foods for overall dietary suitability SECTION 8 BUILDING YOUR KNOWLEDGE OF FOODS INTO DIETS In the Sections that have gone before, we have noted several key strategies aimed at reducing the client’s intake of calories. This section gets down to the key job of building and structuring a diet to help each particular client - the aim now is to address the actual prescribing of diets to enable you to build upon the principles already learned and to give the client a workable diet that can achieve his or her aims. Areas Covered The adjusting and re-balancing of the food classes Calculating the food replacements Targeting individual foods SECTION 9 FIRST LOOK AT CONDUCTING CONSULTATIONS This section takes you through managing the consultation, helping you to structure the activity to provide a satisfactory experience for your clients. This is the basis for a good approach to weight reduction. The section culminates in the provision of example diet sheets with guidelines according to food classes and guidelines according to mealtimes and considers the benefits of both. Areas Covered The consultant’s surroundings and manner Direction of the early conversation Collection of the dietary data Weight-loss ideas come to you during the data collection Identifying the largest food contributions to overweight Balancing the food classes Writing down the guidelines Substitution of individual foods Reduction in the food bulk eaten Integrating the entire diet Example diet sheets SECTION 10 COUNTING CALORIES. BENEFITS OF EXERCISE. THE KETO DIET. In section 10 we cover the method of calculating the calories in everyday life. We look at the benefits of exercise for suitable clients and discuss more specific diets such as the ketogenic diet. Areas Covered Calculating the calories The benefits of exercise The ketogenic diet SECTION 11 PROMOTING GOOD HEALTH. UNDERSTANDING DRUG TREATMENTS. FOLLOW-UP GUIDELINES. Brings us to the section where we set about designing slimming programmes that are not only effective at weight loss, but also promote good health. To give you an insight into the potential problems, we also look at the drug treatments given for overweight by doctors. We also take you through the guidelines for follow-ups after the first consultation. Areas Covered Slimming programmes to promote good health Understanding drug treatments for overweight Follow-up guidelines SECTION 12 USE OF SUPPLEMENTS TO PROMOTE LOSS OF WEIGHT This section deals with non-food substances, or supplements that with help with weight loss. It looks at how they actually achieve this and discuss their effectiveness and safety implications for the individual. These include some micronutrients, herbs, enzyme inhibitors and sequestering agents. Areas Covered Inhibition of fat absorption Changing body composition Substances encouraging increased thermogenesis Appetite suppressants Enzyme inhibition Prevention of fat synthesis Nutrients that may accelerate metabolism Appendix 1 – some abstracts of key articles Appendix 2 – summary of modes of action SECTION 13 MANAGING This rather substantial last section deals with a fuller and final part on “Managing the Consultations”. This further develops your consultation skills and objective setting in weight management practice. It also addresses the tricky question of compliance and weight regain and how to avoid it. Finally, it looks at “Running your Practice as a Business” to ensure that you have a grasp of the business principles that you will need. Areas Covered Managing the consultations – basic methodology Note on progressive reduction in energy needs Construction of the overall prescription – different components Running your practice as a business Appendix (more about why the slimming process slows down) TESTIMONIALS Here's what students have to say about the course Mrs E. Marriott UK “The Plaskett course in Weight Management Consultancy has been a really good introduction into the importance of nutrition and balancing food groups to make up a healthy diet plan for those who are obese and wishing to lose weight. It would be good if you want to do it for your own understanding or if you are looking for a step into a professional qualification or practicing yourself. The tutors communicate with you and give you detailed feedback on assignments and the work is achievable within a year, quicker if your apply yourself. There is a lot of information in the course surrounding basic nutrients, composition of foods and on how to set up and run your own practice”.

Certified Six Sigma Yellow Belt Training

By Packt

This is the only Six Sigma Yellow Belt Certification course that covers all the 15 steps of the Six Sigma Yellow Belt DMAIC roadmap comprehensively, which are needed to be successful in the competitive market. You learn using a project-based approach: the Six Sigma Yellow Belt project evolves as you progress through this Six Sigma Yellow Belt training.

BEHAVIORAL INTERVIEWING: BUILDING A CONSISTENT FRAMEWORK AND PROCESS

5.0(4)By Improving Communications Uk

LEARN ABOUT BEHAVIORAL VS. TRADITIONAL INTERVIEWING, AND HOW TO INCORPORATE AND DEVELOP INTERVIEWING SKILLS TO ENSURE THAT YOU FIND THE RIGHT CANDIDATE FOR THE JOB. Behavioral Interviewing means asking candidates questions that will help you to discover how the interviewee acted in specific employment-related situations. Because past performance is a good indicator of how someone will act in the future, this style of interviewing is extremely useful, and the method of choice for recruiting teams. In this session, you will learn about behavioral vs. traditional interviewing, and how you can incorporate and develop your interviewing skills to ensure that you have the right candidate for the job. OBJECTIVES Participants will be able to: Build a consistent framework and process to ensure an unbiased candidate experience; Choose job specifications and determine how success will be measured (skills); Identify characteristics and qualities that will support the required skills; Prepare questions to elicit descriptions of behaviors, attitudes, and skills necessary for the job; Review legal and appropriate interviewing etiquette/guidelines, including social media research; Screen candidates, using resumes and phone interviews; and Conduct successful role-play Behavioral Interviews in class. CLASSES WILL INCLUDE: Workbooks for future reference and study. Workshop / role play with actual interview scenarios to assist in internalizing data. Time for individual questions and concerns to aid in personalizing tactics. Online Format—Behavioral Interviewing is a 4-hour interactive online class for up to six people. Register for this class and you will be sent ONLINE login instructions prior to the class date. Rich has an engaging presentation style. The New Mexico chapter of the International Society for Performance Improvement (NMISPI) gave high marks to his interactive and lively Improving Customer Service workshop. There were opportunities to share ideas and analyze different techniques, and 87% of attendees said that they would recommend this workshop to others. Ildiko OraveczNew Mexico International Society for Performance Improvement

Career Development Skills Training Course

By iStudy UK

Do you want to improve your ability based on your career? Do you want to get promoted by showing expertise in your field? The course is designed for the people who want to develop their professional skills for their career enhancement. Are you bored and burned off your work? This course will help you to get rid of the problem. The course teaches the way to gain skill about the respective area. In the course, you will learn the necessary skills about career development. The course will teach you the skill that you need for your career development. An assessment test for the chosen career will also be taken for your need analysis. Course Highlights Career Development Skills Training Course is an award winning and the best selling course that has been given the CPD Certification & IAO accreditation. It is the most suitable course anyone looking to work in this or relevant sector. It is considered one of the perfect courses in the UK that can help students/learners to get familiar with the topic and gain necessary skills to perform well in this field. We have packed Career Development Skills Training Course into 80 modules for teaching you everything you need to become successful in this profession. To provide you ease of access, this course is designed for both part-time and full-time students. You can become accredited in just 2 days, 16 hours and it is also possible to study at your own pace. We have experienced tutors who will help you throughout the comprehensive syllabus of this course and answer all your queries through email. For further clarification, you will be able to recognize your qualification by checking the validity from our dedicated website. Why You Should Choose Career Development Skills Training Course Lifetime access to the course No hidden fees or exam charges CPD Accredited certification on successful completion Full Tutor support on weekdays (Monday - Friday) Efficient exam system, assessment and instant results Download Printable PDF certificate immediately after completion Obtain the original print copy of your certificate, dispatch the next working day for as little as £9. Improve your chance of gaining professional skills and better earning potential. Who is this Course for? Career Development Skills Training Course is CPD certified and IAO accredited. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic backgrounds. Requirements Our Career Development Skills Training Course is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path You will be ready to enter the relevant job market after completing this course. You will be able to gain necessary knowledge and skills required to succeed in this sector. All our Diplomas' are CPD and IAO accredited so you will be able to stand out in the crowd by adding our qualifications to your CV and Resume. Introduction 00:15:00 Ways To Improve Your Performance At Work 00:30:00 Career Aptitude Tests And Career Assessments 00:30:00 Get Mentoring 01:00:00 Importance Of Online Courses 00:30:00 Advantages To Take Offline Courses 00:30:00 Benefits Of Life Lessons 00:30:00 Self Esteem 01:00:00 Professional CV & Resume Writing Techniques INTRODUCTION FREE 00:15:00 EFFECTIVE RESUME AND COVER LETTER WRITING FREE 00:30:00 THE PURPOSE OF YOUR RESUME 01:00:00 RESUME PRESENTATION IS THE KEY 01:00:00 WOW THE EMPLOYER 01:00:00 ELEMENTS OF A RESUME THAT WILL IMPRESS 01:00:00 WRITING YOUR OBJECTIVE 01:00:00 WRITING YOUR SUMMARY 01:00:00 WRITING THE SKILLS AND ACCOMPLISHMENTS SECTION 01:00:00 RESUME FORMATTING 01:00:00 WRITING AN ELECTRONIC RESUME 01:00:00 PUT YOUR BEST FOOT FORWARD 00:15:00 YOUR RESUME - A WORK OF ART 01:00:00 WRITING THE HISTORY/ EXPERIENCE SECTION 01:00:00 WRITING YOUR EDUCATION SECTION 01:00:00 WRITING A PROFESSIONAL AFFILIATIONS SECTION 00:15:00 WRITING A PUBLICATIONS and PERSONAL INTERESTS SECTION 01:00:00 WRITING A REFERENCES SECTION 00:30:00 YOUR RESUME - A WORK OF ART 01:00:00 DO NOT PUT IN YOUR RESUME 00:15:00 A VARIETY OF RESUME SAMPLES 00:30:00 THE IMPORTANCE OF WRITING COVER LETTERS 01:00:00 COVER LETTER OUTLINE: HOW TO WRITE A GOOD COVER LETTER 01:00:00 KEY PHRASES TO BE USED IN YOUR COVER LETTER 00:15:00 COVER LETTER SAMPLE 01:00:00 BASIC COVER LETTER TEMPLATE EXAMPLE 00:30:00 CONCLUSION 00:15:00 How to Face an Interview Successfully Importance of Knowing The Tips And Tricks for Interviews 00:15:00 The Different Types of Interviews 01:00:00 Skill Building to Crack Interviews 00:15:00 Tools and Miscellaneous You Need To Have 00:15:00 The Perfect 'Resume' - Significance and Importance 00:30:00 Preparing Properly for an Interview 00:30:00 What Role Does Appearance Play? 00:30:00 Tips To Gear Up - Pre-Interview 00:30:00 Modern Tips By Interview Experts 00:30:00 Microsoft Word Module One - Getting Started FREE 00:30:00 Module Two - Opening Word FREE 01:00:00 Module Three - Working with the Interface 01:00:00 Module Four - Your First Document 01:00:00 Module Five - Basic Editing Tasks 01:00:00 Module Six - Basic Formatting Tasks 01:00:00 Module Seven - Formatting Paragraphs 01:00:00 Module Eight - Advanced Formatting Tasks 01:00:00 Module Nine - Working with Styles 01:00:00 Module Ten - Formatting the Page 01:00:00 Module Eleven - Sharing Your Document 01:00:00 Module Twelve - Wrapping Up 00:30:00 Microsoft PowerPoint Module One - Getting Started FREE 00:30:00 Module Two - Opening PowerPoint FREE 01:00:00 Module Three - Working with the Interface 01:00:00 Module Four - Your First Presentation 01:00:00 Module Five - Working with Text 01:00:00 Module Six - Formatting Text and Paragraphs 01:00:00 Module Seven - Adding Pictures 01:00:00 Module Eight - Advanced Formatting Tasks 01:00:00 Module Nine - Working with Transitions and Animations 01:00:00 Module Ten - Setting Up Your Slide Show 01:00:00 Module Eleven - Showtime! 01:00:00 Module Twelve - Wrapping Up 00:30:00 Microsoft Excel Module One - Getting Started FREE 00:30:00 Module Two - Opening Excel FREE 01:00:00 Module Three - Working with the Interface 01:00:00 Module Four - Your First Worksheet 01:00:00 Module Five - Viewing Excel Data 01:00:00 Module Six - Building Formulas 01:00:00 Module Seven - Using Excel Functions 01:00:00 Module Eight - Using Quick Analysis 01:00:00 Module Nine - Formatting Your Data 01:00:00 Module Ten - Using Styles, Themes, and Effects 01:00:00 Module Eleven - Printing and Sharing Your Workbook 01:00:00 Module Twelve - Wrapping Up 01:00:00 Mock Exam Mock Exam- Career Development Skills Training Course 00:30:00 Final Exam Final Exam- Career Development Skills Training Course 00:30:00

MBA Top-Up - Inclusive of Level 7 Pathway Diploma

By School of Business and Technology London

Getting Started With highly experienced tutors guiding the completion of an MBA, this programme fosters personal and managerial development, encouraging students to make unique contributions. The MBA programme has earned an excellent reputation among employers in private, public and voluntary sectors, enabling graduates to pursue senior positions within organisations or even continue their academic journey with a Doctor of Business Administration (DBA) degree. For those seeking to specialise, the Research Specialisation Certificate is an optional add-on, allowing students to choose a management area of interest, such as finance, marketing, human resources, or operations and conduct in-depth research. Successful completion of the MBA Dissertation module earns students this exclusive certificate, recognised by the University and emphasises their commitment to academic research and specialised knowledge. The programme comprises two phases; the first is the Qualifi Level 7 Diploma in Strategic Management and Leadership, awarded by Qualifi and delivered by the School of Business and Technology London. The second phase is the MBA Top Up, awarded and delivered by the University of Central Lancashire through distance learning. This programme offers the same high-quality education as its on-campus counterparts, with access to video lectures, interactive assessments and online discussion forums. Students also benefit from comprehensive support services, including academic and technical assistance and access to online resources. School of Business and Technology London partners with Chestnut Education Group to promote this programme. About Awarding Body Founded in 1828, the University of Central Lancashire is a public university based in Preston, Lancashire, England. Today, UCLAN is one of the largest in the United Kingdom, with a student and staff community of nearly 38,000. At present, the University has academic partners in all regions of the globe, and it is on a world stage that the first-class quality of its education was first recognised. In 2010, UCLAN became the first UK modern Higher Education institution to appear in the QS World University Rankings. In 2018, the Centre for World University Rankings estimated Central Lancashire to be in the top 3.7 per cent of all global universities, highlighting the growth the University has made in offering students real-world learning experiences and reflecting the University's extensive pool of academic talent. Ranked in the top 7% of universities worldwide. Student Communities from more than 100 countries WES Recognised Qualifi is a UK Government (Ofqual.gov.uk) regulated awarding organisation and has developed a reputation for supporting relevant skills in a range of job roles and industries, including Leadership, Enterprise and Management, Hospitality and catering, Health and Social Care, Business Process Outsourcing and Public Services. Qualifi is also a signatory to BIS international commitments of quality. The following are the key facts about Qualifi. Regulated by Ofqual.gov.uk World Education Services (WES) Recognised Assessment Assignments and Project No examinations Entry Requirements Applicants should normally have a good first degree or equivalent and be working in or have recently worked within business management area. If English is not your first language, you will be expected to demonstrate a certificated level of proficiency of at least IELTS 6.5 (Academic level) or equivalent English Language qualification. Progression An MBA graduate can pursue a fruitful career in many industries. MBA can open career opportunities in various sectors such as banking and financial services, investment banking, management consulting, insurance, hospitality, media, information technology (IT) and marketing. An MBA is often a pathway to promotion or a career change as you will gain a professional reputation and develop essential skills in the sector you choose to pursue. Learners must request before enrolment to interchange unit(s) other than the preselected units shown in the SBTL website because we need to make sure the availability of learning materials for the requested unit(s). SBTL will reject an application if the learning materials for the requested interchange unit(s) are unavailable. Learners are not allowed to make any request to interchange unit(s) once enrolment is complete. Structure Phase 1 - Qualifi Level 7 Diploma in Strategic Management and Leadership Programme Structure To attain 120 credits, learners must complete the six compulsory units and select at least two optional units. Mandatory Units Unit 702: Manage Team Performance to Support Strategy Unit code: Y/506/9067 TQT : 150 Credit: 15 This unit's objective is to enable learners to delve into the evaluation and enhancement of team performance to achieve strategic goals. Additionally, learners will be introduced to various management models, concepts, and ideas that can assist in establishing objectives for departments, projects, teams, and individual performance. Unit 704: Information Management and Strategic Decision Taking Unit code: H/506/9068 TQT : 150 Credit: 15 This unit aims to tackle the abundance and intricacy of data and information accessible to organisations and to teach how to analyse, apply, and ascertain its value in shaping strategic decisions. Unit 705: Leading a Strategic Management Project Unit code: L/506/9065 TQT : 150 Credit: 15 This unit will engage the learner in crafting research and methodologies to bolster a strategic management project. They will need to assess options and data sources critically before presenting the outcomes of the project. Unit 706: Strategic Direction Unit code: D/506/9068 TQT : 150 Credit: 15 The purpose of this unit is to delve into the strategic aims and objectives of an organisation and to understand their importance in defining direction, as well as gauging success and progress for the organisation. Additionally, the unit will examine how various strategic options may lead the organisation to alter its course. Unit 711: Strategic Planning Unit code: Y/506/9070 TQT : 150 Credit: 15 This unit focuses on the significance of the strategic planning process in crafting suitable strategies and creating a plan that garners support from stakeholders and other organizational leaders. Learners will also engage in a critical evaluation of the program and its subsequent success. Unit 724: Development as a Strategic Manager Unit code: J/506/9064 TQT : 150 Credit: 15 This unit aims to foster organizational and self-awareness in learners. It lays the groundwork for a self-critical and reflective approach to personal development, which is essential when operating strategically. Additionally, it considers broader contextual factors within the organization and the environment, recognizing their role in contributing to the overall strategic success of both the individual and the organization. Optional Units Unit 703: Finance for Managers Unit code: D/506/9071 TQT : 150 Credit: 15 The purpose of this unit is to assist learners in comprehending and applying financial information and data. This unit holds significance for learners as it aids in making informed financial decisions. Unit 708: Strategic Marketing Unit code: M/506/9074 TQT : 150 Credit: 15 This unit will explore the foundational models, techniques, and theories that form the basis of marketing and can contribute to achieving strategic objectives. It will also give learners a critical comprehension of the marketing function within intricate organizations. Unit 710: Organisational Change Strategies Unit code: K/506/9073 TQT : 150 Credit: 15 The primary objective of this unit is to equip learners with the knowledge and skills to understand, plan, and execute organizational change effectively. While prevailing wisdom in the business world often emphasizes the need for fast, large-scale, and transformative change for corporate survival, there is evidence to suggest that many successful organizations adopt a slower and more cautious approach. Moreover, change initiatives have a reported failure rate of around 70%. This underscores the complexity of managing organizational change, making it a critical skill for successful leaders and organizations. This unit will scrutinize the evolving nature of organizations and the associated challenges they encounter. It will explore the key approaches to change management and demonstrate how these align with the various types of changes organizations undergo, particularly concerning individual, group, and organizational behaviour. Unit 712: Human Resource Planning Unit code: H/506/9072 TQT : 150 Credit: 15 This unit will cover key considerations in planning for and acquiring a workforce capable of achieving strategic objectives. It will also examine the limitations and external factors that impact an organization's HR practices. Phase 2 - MBA Top-Up Programme Structure Dissertation Module Delivery Methods The programme comprises two phases; the first is the Level 7 Diploma in Strategic Management and Leadership awarded by Qualifi and delivered by the School of Business and Technology London. The School of Business and Technology London offers flexible learning methods, including online and blended learning, allowing students to choose the mode of study that suits their preferences and schedules. The programme is self-paced and facilitated through an advanced Learning Management System. Students can easily interact with tutors through the SBTL Support Desk Portal System for course material discussions, guidance, assistance, and assessment feedback on assignments. School of Business and Technology London provides exceptional support and infrastructure for online and blended learning. Students benefit from dedicated tutors who guide and support them throughout their learning journey, ensuring a high level of assistance. The second phase is the MBA Top Up, awarded and delivered by the University of Central Lancashire through distance learning. The University of Central Lancashire (UCLan) offers a range of distance learning options for students who require the flexibility to study remotely. These options include online courses, blended learning, and supported distance learning. UCLan's distance learning courses are designed to provide students with the same high-quality education as on-campus courses, with access to resources such as video lectures, online discussion forums, and interactive assessments. The University also provides a range of support services for distance learning students, including academic support, technical support, and access to the University's library and online resources. Resources and Support School of Business & Technology London is dedicated to offering excellent support on every step of your learning journey. School of Business & Technology London occupies a centralised tutor support desk portal. Our support team liaises with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receives a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and streamline all the support processes efficiently. Quality learning materials made by industry experts is a significant competitive edge of the School of Business & Technology London. Quality learning materials comprised of structured lecture notes, study guides, practical applications which includes real-world examples, and case studies that will enable you to apply your knowledge. Learning materials are provided in one of the three formats, such as PDF, PowerPoint, or Interactive Text Content on the learning portal. How does the Online Learning work at SBTL? We at SBTL follow a unique approach which differentiates us from other institutions. Indeed, we have taken distance education to a new phase where the support level is incredibly high.Now a days, convenience, flexibility and user-friendliness outweigh demands. Today, the transition from traditional classroom-based learning to online platforms is a significant result of these specifications. In this context, a crucial role played by online learning by leveraging the opportunities for convenience and easier access. It benefits the people who want to enhance their career, life and education in parallel streams. SBTL's simplified online learning facilitates an individual to progress towards the accomplishment of higher career growth without stress and dilemmas. How will you study online? With the School of Business & Technology London, you can study wherever you are. You finish your program with the utmost flexibility. You will be provided with comprehensive tutor support online through SBTL Support Desk portal. How will I get tutor support online? School of Business & Technology London occupies a centralised tutor support desk portal, through which our support team liaise with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receive a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and to streamline all the support process efficiently. Learners should expect to receive a response on queries like guidance and assistance within 1 - 2 working days. However, if the support request is for assessment feedback, learners will receive the reply with feedback as per the time frame outlined in the Assessment Feedback Policy.