- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Overview Learn about HR, Data Protection and Employment Law from industry experts and boost your professional skill. This HR, Data Protection and Employment Law course will enhance your skill and make you ready for the job market. You'll get expert opinions about the best practices and problems of HR, Data Protection and Employment Law. You'll also gain the skills of HR, Data Protection and Employment Law to excel in your job and tips to master professional skills in no time. You'll be connected with the community of HR, Data Protection and Employment Law professionals and gain first-hand experience of HR, Data Protection and Employment Law problem-solving. The HR, Data Protection and Employment Law is self-paced. You can complete your course and attend the examination in your suitable schedule. After completing the HR, Data Protection and Employment Law, you'll be provided with a CPD accredited certificate which will boost your CV and help you get your dream job. This HR, Data Protection and Employment Law will provide you with the latest information and updates of HR, Data Protection and Employment Law. It will keep you one step ahead of others and increase your chances of growth. Why buy this HR, Data Protection and Employment Law? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the HR, Data Protection and Employment Law you will be able to take the MCQ test that will assess your knowledge. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This HR, Data Protection and Employment Law does not require you to have any prior qualifications or experience. You can just enrol and start learning. Prerequisites This HR, Data Protection and Employment Law was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This HR, Data Protection and Employment Law is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Module 01: Basic of Employment Law Basic of Employment Law 00:24:00 Module 02: Legal Recruitment Process Legal Recruitment Process 00:43:00 Module 03: Employment Contracts Employment Contracts 00:25:00 Module 04: Employee Handbook Employee Handbook 00:23:00 Module 05: Disciplinary Procedure Disciplinary Procedure 00:15:00 Module 06: National Minimum Wage & National Living Wage National Minimum Wage & National Living Wage 00:37:00 Module 07: Parental Right, Sick Pay & Pension Scheme Parental Right, Sick Pay & Pension Scheme 00:43:00 Module 08: Discrimination in the Workplace Discrimination in the Workplace 00:39:00 Module 09: Health & Safety at Work Health & Safety at Work 00:19:00 Module 10: Dismissal, Grievances and Employment Tribunals Dismissal, Grievances and Employment Tribunals 00:36:00 Module 11: Workplace Monitoring & Data Protection Workplace Monitoring & Data Protection 00:15:00 Mock Exam Mock Exam - HR, Data Protection and Employment Law 00:20:00 Final Exam Final Exam - HR, Data Protection and Employment Law 00:20:00

24 Hours Left! Don't Let Year-End Deals Slip Away - Enrol Now! This Diploma in Employment Law at QLS Level 5 course is endorsed by The Quality Licence Scheme and accredited by CPDQS (with 150 CPD points) to make your skill development & career progression more accessible than ever! Are you looking to improve your current abilities or make a career move? If yes, our unique Employment Law at QLS Level 5 course might help you get there! It is an expertly designed course which ensures you learn everything about the topic thoroughly. Expand your expertise with high-quality training from the Employment Law at QLS Level 5 course. Due to Employment Law at QLS Level 5's massive demand in the competitive market, you can use our comprehensive course as a weapon to strengthen your knowledge and boost your career development. Learn Employment Law at QLS Level 5 from industry professionals and quickly equip yourself with the specific knowledge and skills you need to excel in your chosen career. The Employment Law at QLS Level 5 course is broken down into several in-depth modules to provide you with the most convenient and rich learning experience possible. Upon successful completion of the Employment Law at QLS Level 5 course, an instant e-certificate will be exhibited in your profile that you can order as proof of your skills and knowledge. Add these amazing new skills to your resume and boost your employability by simply enrolling in this Employment Law at QLS Level 5 course. This Employment Law at QLS Level 5 training can help you to accomplish your ambitions and prepare you for a meaningful career. So, join us today and gear up for excellence! Why Prefer This Employment Law at QLS Level 5 Course? Opportunity to earn a certificate endorsed by the Quality Licence Scheme & another accredited by CPDQS which is completely free. Get a free student ID card! (£10 postal charge will be applicable for international delivery) Innovative and engaging content. Free assessments 24/7 tutor support. Take a step toward a brighter future! *** Course Curriculum *** Here is the curriculum breakdown of the Employment Law at QLS Level 5 course: Module 01: Basic of Employment Law Module 02: Legal Recruitment Process Module 03: Employment Contracts Module 04: Employee Handbook Module 05: Disciplinary Procedure Module 06: National Minimum Wage & National Living Wage Module 07: Parental Right, Sick Pay & Pension Scheme Module 08: Discrimination in the Workplace Module 09: Health & Safety at Work Module 10: Dismissal, Grievances and Employment Tribunals Module 11: Workplace Monitoring & Data Protection Assessment Process After completing an online module, you will be given immediate access to a specially designed MCQ test. The results will be immediately analysed, and the score will be shown for your review. The passing score for each test will be set at 60%. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you have completed all of the Diploma in Employment Law at QLS Level 5 exams. CPD 150 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Employment Law at QLS Level 5 course is perfect for highly motivated people who want to improve their technical skills and prepare for the career they want! Requirements No prior background or expertise is required. Career path The Employment Law at QLS Level 5 course will boost your CV and aims to help you get the job or even the long-awaited promotion of your dreams. Certificates CPDQS Accredited Certificate Digital certificate - Included Diploma in Employment Law at QLS Level 5 Hard copy certificate - Included Show off Your New Skills with a Certificate of Completion After successfully completing the Diploma in Employment Law at QLS Level 5, you can order an original hardcopy certificate of achievement endorsed by the Quality Licence Scheme and also you can order CPDQSAccredited Certificate that is recognised all over the UK and also internationally. The certificates will be home-delivered, completely free of cost.

Fall into Savings. Enjoy the biggest price fall this Holiday! Be prepared for the upcoming Hiring Season by enhancing your professional skillsets with Apex Learning! Get Hard Copy + PDF Certificate + Transcript + Student ID Card as a Gift - Enrol Now Tired of browsing and searching for the course you are looking for? Can't find the complete package that fulfils all your needs? Then don't worry as you have just found the solution. Take a minute and look through this 14-in-1 extensive bundle that has everything you need to succeed in Employment Law and other relevant fields! After surveying thousands of learners just like you and considering their valuable feedback, this all in one Employment Law bundle has been designed by industry experts. We prioritised what learners were looking for in a complete package and developed this in-demand Employment Law course that will enhance your skills and prepare you for the competitive job market. Furthermore, to help you showcase your expertise in Employment Law, we have prepared a special gift of 1 hardcopy certificate and 1 PDF certificate for the title course completely free of cost. These certificates will enhance your credibility and encourage possible employers to pick you over the rest. This Employment Law Bundle Consists of the following Premium courses: Course 01: Employment Law Level 3 Course 02: Law and Contracts - Level 2 Course 03: Paralegal Course 04: Payroll Management - Diploma Course 05: Recruitment Consultant - Level 4 Course 06: HR Management Level 3 Course 07: Resourcing and Managing Talent Course Course 08: Pension UK Course 09: Level 3 Tax Accounting Course 10: Document Control Course 11: GDPR Course 12: Employee Hiring and Termination Training Course 13: Decision Making and Critical Thinking Course 14: Time Management How will I get my Certificate? After successfully completing the course, you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (For The Title Course) Hard Copy Certificate: Free (For The Title Course) Benefits you'll get choosing Apex Learning: Pay once and get lifetime access to 13 CPD courses Certificates, student ID for the title course included in a one-time fee Free up your time - don't waste time and money travelling for classes Accessible, informative modules designed by expert instructors Learn at your ease - anytime, from anywhere Study the course from your computer, tablet or mobile device CPD accredited course - improve the chance of gaining professional skills Curriculum of Employment Law Bundle Course 01: Employment Law Level 3 Basic of Employment Law Legal Recruitment Process Employment Contracts Employee Handbook Disciplinary Procedure National Minimum Wage & National Living Wage Parental Right, Sick Pay & Pension Scheme Discrimination in the Workplace Health & Safety at Work Dismissal, Grievances and Employment Tribunals Workplace Monitoring & Data Protection CPD 140 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Employment Law Anyone from any background can enrol in this Employment Law bundle. Requirements Employment Law Our Employment Law is fully compatible with PC's, Mac's, laptops, tablets and Smartphone devices.. Career path Employment Law Having this various expertise will increase the value of your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Employment Law Level 3) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

Digital, Text & Voice Communicators Course

By Hi-Tech Training

The Hi-Tech Training Digital Text & Voice Communicator Course is designed to provide participants with the skills required to connect Digital, Text & Voice Communicators to an Alarm Control Panel for transmission of Digital status signals via the telephone line, GSM Network or IP network to a central monitoring station. The Digital Communicator Course’s practical application and our highly experienced trainers ensure that this course is second to none. The course is technical and practical in nature and is suitable for participants who have successfully completed the Hi-Tech Training Intruder Alarm Installation Course or equivalent.

HR: Human Resources Management (5-in-1 QLS Endorsed Diploma)

By Imperial Academy

FREE 5 QLS Endorsed Certificate | 5-in-1 Exclusive Bundle | CPD Accredited | Career Guided Program | Lifetime Access

PVOL202: Solar Training - Advanced PV System Design and the NEC (Grid-Direct) - Online

By Solar Energy International (SEI)

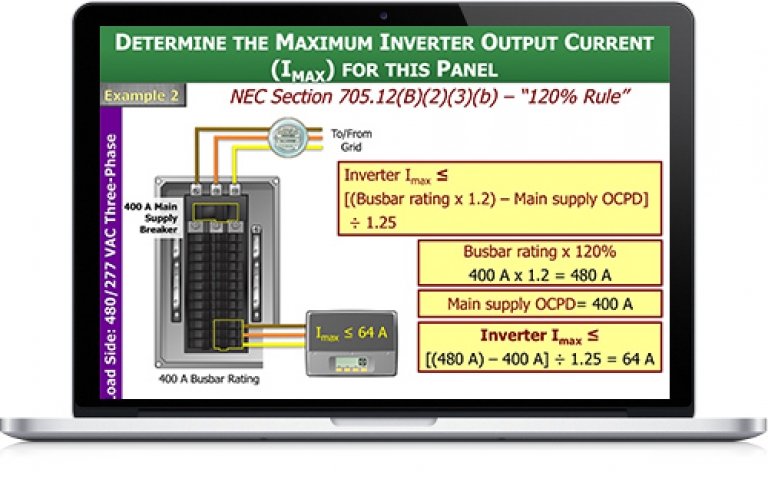

Students who complete PVOL202 will be able to: Define the purpose of the National Electrical Code (NEC®) and NEC® terminology for PV equipment Determine procedures for proper installation of equipment and conductors, including minimum requirements for working space Examine methods for PV wire management and determine where expansion fittings are required Describe and identify electrical services, including split-phase and three-phase Wye (Y) and Delta (â) Evaluate electrical service details to collect and record during solar site evaluation Identify options for NEC®-compliant PV system interconnection to the utility grid and determine whether a supply side, load side, or additional service connection is appropriate Identify code-compliant methods for connecting an inverter to an existing AC feeder Calculate PV module voltage based on temperature to ensure compatibility with system components and NEC® Section 690.7, and explore other options for maximum PV system DC voltage calculations Identify NEC® requirements and sizing of disconnects and overcurrent protection devices (OCPDs) in grid-direct PV systems Define inverter grounding configurations Evaluate inverter choices and system configurations, including string inverters, central inverters, and module level power electronics (MLPE) Identify requirements for equipment grounding, equipment grounding conductors (EGC), and grounding electrode conductors (GEC), and size the conductors according to the NEC® Identify common causes of ground-faults and arc-faults Describe ground-fault and arc-fault protection devices Describe benefits and appropriate locations of surge protection devices (SPD) Demonstrate the use of sun charts and perform calculations to determine row spacing and minimize inter-row shading Identify how Codes detailing access for first responders impact PV array roof layout Examine fire classifications that affect racking and module selection Detail NEC rapid shutdown requirements and options for implementation Identify load and structural considerations for low- and steep-slope roof-mounted PV systems Calculate wind uplift force and select appropriate lag bolts Review issues related to planning, design, and installation of ground-mount PV arrays Review PV system circuit terminology, definitions, and conductor types Calculate minimum overcurrent protection device (OCPD) size and conductor ampacity using appropriate adjustment and correction factors Calculate voltage drop and verify system operation within acceptable limits Examine requirements for PV system labeling Calculate the maximum and minimum number of modules per PV source circuit, and number of PV source circuits per inverter Determine size of residential grid-direct PV system based on site and customer-specific considerations including the number and wiring layout of modules, conductor and OCPD sizes, and the AC interconnections Determine the size of a large, multiple inverter, grid-direct PV system based on site and customer-specific considerations, including the quantity and layout of modules and inverters and the AC interconnection Define large-scale PV and review associated NEC® allowances and requirements Describe importance of Data Acquisition Systems (DAS) Identify common DAS equipment and hardware Review DAS design, installation, and commissioning processes and common problems associated with DAS Show how reports can be generated and utilized to remotely assess health of system

Learning Outcomes Grasp the core principles of the UK employment law Familiarise yourself with the legal recruitment process and employment contracts Enrich your knowledge of parental rights, sick pay, and pension scheme Develop the skills to deal with discrimination in the workplace Gain in-depth knowledge of workplace monitoring and data protection Description Understanding the employment law allows you to learn about your role, responsibilities and your rights. So, whether you are an employee or an employer, you must get a clear understanding of the legislation regarding employment. The UK Employment Law Course can help you out. It will educate you on employment law and assist you in pursuing a career in the relevant sectors. In this online training, you will get introduced to the legal process of recruitment. The course will deliver detailed lessons on employment contracts, employment handbooks, disciplinary procedures and much more. The course will help you grasp the fundamentals of sick pay, and pension schemes. It will also teach you the strategies to handle workplace discrimination. In addition, you will get to enrich your understanding of workplace monitoring and data protection. This course will also help you elevate your resume with a CPD-accredited certificate of achievement. So, join today and start learning! Certificate of Achievement After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for 9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for 15.99, which will reach your doorsteps by post. Method of Assessment At the end of the course, there will be an online MCQ assessment. In order to pass this exam, you must score at least 60%. When you submit the assessment, you will get the results immediately and can apply for your QLS-endorsed certificate. Career path This course is designed to help you extant your knowledge and understanding of this sector. After completing the course, you will be able to explore career options such as Lawyer Solicitor Legal Advisor HR Professional Course Content Module 01: Basics of Employment Law Basics of Employment Law 00:17:00 Module 2: Legal Recruitment Process Legal Recruitment Process 00:45:00 Module 3: Employment Contracts Employment Contracts 00:21:00 Module 4: Employee Handbook Employee Handbook 00:21:00 Module 5: Disciplinary Procedure Disciplinary Procedure 00:19:00 Module 6: National Minimum Wage & National Living Wage National Minimum Wage & National Living Wage 00:33:00 Module 7: Parental Right, Sick Pay & Pension Scheme Parental Rights, Sick Pay, & Pension Scheme 00:44:00 Module 8: Discrimination in Workplace Discrimination in the Workplace 00:50:00 Module 9: Health & Safety at Work Health & Safety at Work 00:16:00 Module 10:Dismissal, Grievances and Employment Tribunals Dismissal, Grievances and Employment Tribunals 00:37:00 Module 11: Workplace Monitoring & Data Protection Workplace Monitoring and Data Protection 00:12:00 Mock Exam Mock Exam - UK Employment Law Certification Course 00:20:00 Final Exam Final Exam - UK Employment Law Certification Course 00:20:00 Order your Certificates & Transcripts Order your Certificates & Transcripts 00:00:00 Order your Certificates & Transcripts Order your Certificates & Transcripts 00:00:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Overview Master the art of using your intelligence and critical thinking ability to analyse crimes and criminals with the Intelligence Analysis Training course. This course aims to help you develop your abilities to pursue a career in the field of criminal investigation. Our online training course will help you grasp the essentials of intelligence analysis in no time. The course will help you grasp a clear understanding of the intelligence cycle. Then, the course will describe the analysis process in detail. Furthermore, you will be able to learn about intelligence and national security. By the end of the course, you will acquire the key skills to fill the role and responsibilities of an intelligence analyst. So, if you have the passion to build a fruitful career, enrol today and build your skills! Course Preview Learning Outcomes Understand the core concepts of intelligence analysis Enhance your knowledge of the intelligence cycle Build your expertise in the analysis process Learn about the legal issues and ethics related to Familiarise yourself with the role and responsibilities of an intelligence analyst Why Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Meticulously crafted engaging and informative tutorial videos and materials Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email What Skills Will You Learn from This Course? Intelligence analysis Critical thinking Problem-solving Who Should Take This Intelligence Analysis Training? Whether you're an existing practitioner or an aspiring professional, this course is an ideal training opportunity. It will elevate your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Intelligence Analysis Training is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Intelligence Analysis Training Certification After completing and passing the Intelligence Analysis Training successfully, you will be able to obtain a Recognised Certificate of Achievement. Learners can obtain the certificate in hard copy at £14.99 or PDF format at £11.99. Career Pathâ This exclusive Intelligence Analysis Training will equip you with effective skills and abilities and help you explore career paths such as Crime Investigator Police Detective Criminal Intelligence Analyst Module 01: Defining Intelligence Analysis Defining Intelligence Analysis 00:46:00 Module 02: Development Of Intelligence Analysis Development of Intelligence Analysis 00:49:00 Module 03: The Intelligence Cycle The Intelligence Cycle 00:35:00 Module 04: Critical Thinking And Structuring Critical Thinking and Structuring 00:39:00 Module 05: Analysis Process And Best Practice Intelligence Analysis and Best Practice 01:00:00 Module 06: Intelligence And National Security Intelligence and National Security 00:45:00 Module 07: Legal Issues And Ethics Legal Issues and Ethics 00:42:00 Module 08: Your Role, Responsibilities, And Functions As An Analyst Your Role, Responsibilities, and Functions as an Analyst 00:45:00 Assignment Assignment - Intelligence Analyst Certification Course 00:00:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Employment Law Training Course

By Compliance Central

Discover the essentials of Employment Law with our comprehensive course designed to empower you in navigating the complexities of workplace regulations. Master the legal recruitment process, employment contracts, employee handbooks, disciplinary procedures, and much more to ensure a fair and safe working environment for everyone involved. Delve into the intricacies of employee rights, such as national minimum wage, parental rights, sick pay, and pension schemes. Understand the importance of promoting equality and addressing discrimination in the workplace. Equip yourself with the knowledge to handle dismissals, grievances, and employment tribunals, while also learning about workplace monitoring and data protection. Learning Outcomes: Grasp fundamental employment law principles. Execute compliant recruitment processes. Draft and interpret employment contracts. Develop a comprehensive employee handbook. Implement effective disciplinary procedures. Calculate and manage employee pay and benefits. Address workplace discrimination effectively. Apply health and safety regulations. Along with this course, you also get: Lifetime Access. Unlimited Retake Exam & Tutor Support. Easy Accessibility to the Course Materials- Anytime, Anywhere - From Any Smart Device (Laptop, Tablet, Smartphone Etc.) 100% Learning Satisfaction Guarantee. Learn at your own pace from the comfort of your home, as the rich learning materials of this course are accessible from any place at any time. The curriculums are divided into tiny bite-sized modules by industry specialists. And you will get answers to all your queries from our experts. So, enrol and excel in your career with Compliance Central. Diploma in Employment Law Course Curriculum: Module 01: Basic of Employment Law Module 02: Legal Recruitment Process Module 03: Employment Contracts Module 04: Employee Handbook Module 05: Disciplinary Procedure Module 06: National Minimum Wage & National Living Wage Module 07: Parental Right, Sick Pay & Pension Scheme Module 08: Discrimination in the Workplace Module 09: Health & Safety at Work Module 10: Dismissal, Grievances and Employment Tribunals Module 11: Workplace Monitoring & Data Protection CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? HR professionals Managers and supervisors Small business owners Union representatives Legal advisors Aspiring employment law specialists Requirements To enrol in this Employment Law course, all you need is a basic understanding of the English Language and an internet connection. Career path Employment Law Solicitor - £45-90k/year HR Manager - £35-60k/year Employee Relations Specialist - £30-50k/year Labour Relations Manager - £40-70k/year Trade Union Official - £25-55k/year Employment Law Consultant - £30-60k/year Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each