- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

3124 Management courses in Cowdenbeath delivered Live Online

Overview There are many companies that have designed a creative environment for their employees to help them relax and spark creative thinking to enhance the performance of the people working in the organisation. The creative way help boost the mind of the employees and thereby generate a positive attitude. This course will help organizations to do regular brainstorming sessions when working on a project to allow employees to contribute and build on a project. This will create an immense engagement as their team members are involved in the creative process.

Overview This course is for PR Professionals and for those looking to make a career in PR. Through this course, you will be able to enhance your Communication skills and will learn new Public Relations techniques. Have Effective communication skills is very important if you want to achieve success in PR. PR is all about making relationships within the corporate sector or with the consumers and maintaining them with effective communication skills and techniques.

Project appraisal and risk management (In-House)

By The In House Training Company

Where should management effort be directed? In controlling costs and ensuring proper engineering in live projects? - yes, of course, but true cost control comes by understanding, eliminating and minimising risk prior to a business committing any funds. This course studies the stages required for practical financial and business appraisals of projects and capital expenditure. This course has two primary objectives: To impart the knowledge and skills required to ensure as risk-free as possible expenditure of that scarce resource, cash - the investors', governments' or shareholders' money must not be squandered To improve the quality of the appraisal process in the widest sense - demonstrating how the process of project and capital expenditure appraisal can be used to dramatically improve cost control and deliver as risk-free as possible expenditure As a result of the course, participants will be able to: Understand the economics of appraisal Be in control of their projects from the start Understand the economics of their projects - and devise the most appropriate mode Carry out sensitivity analysis and identify risk Improve their methods of appraisal and approach Focus on the risk areas and take out risk and control costs before they over-run The benefits of attending this course will be demonstrable from day one. Thorough appraisals and risk assessment follow through to success in project management and detailed cost control and project management. 1 Introduction Why appraise? Taking risk out of investment The short- and long-term results of not appraising business expenditure 2 Developing an appraisal process The process - overall and stage-by-stage objectives Understand business and technical risks Manage resources and time Do you invest enough time and effort at this stage? Take out the risks - control costs before you are committed to contracts and action Checklists 3 Appraisal arithmetic Review of the arithmetic of appraisalThe time value of moneyThe effects of different interest or required ratesThe effects of inflation (or deflation) in prices and costs Understanding the economics of appraisal is essential 4 Appraisal measures Meaning and use of appraisal measures Identifying the most appropriate measures for your particular business Payback Discounted cash flow measures - NPV and IRR Other measures - FW, AW, Profitability Index The meaning of the measures and their application in practice 5 Cost benefit analysis The effect on decision-making of more intangible benefits Cost benefit analysis Ensuring costs are genuine Measuring intangible benefits Environmental issues Consideration of intangible benefits in the appraisal decision-making process 6 Developing appropriate models Developing models - examples of spreadsheet models and measures for many different situations Modelling investment opportunities - summarising outcomes Sensitivity analysis - identifying, quantifying and taking out risk 7 Developing an appraisal process The process - managing risk from the outset Using the process in risk management, negotiating and project management Take out risk by thoroughly knowing your project - developing your own process

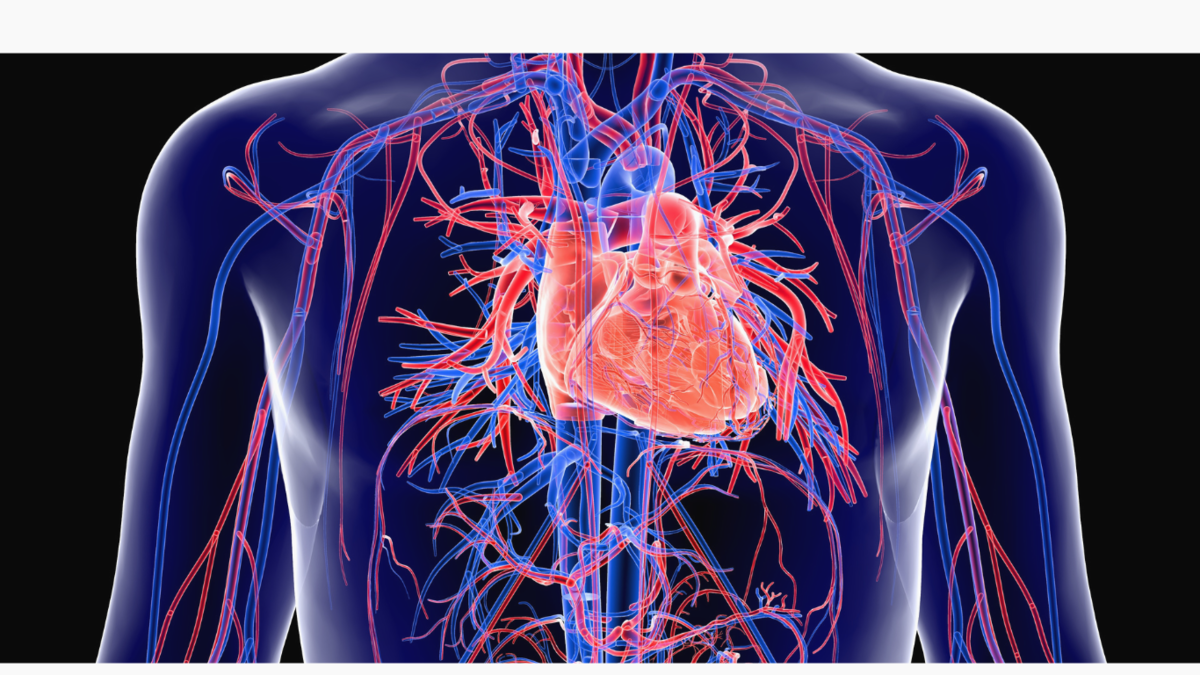

Introduction to Cardiovascular Disease

By BBO Training

Introduction to Cardiovascular Disease (2-Day Course)Course Description:BBO Training has responded to numerous requests for a course focused on cardiovascular disease, following the success of our previous courses, such as Introductions to COPD/Asthma/Diabetes and Minor Illness. In response, we have developed a comprehensive two-day agenda on this critical subject.These days are designed to provide a holistic approach to cardiovascular diseases, encompassing Coronary Heart Disease (CHD), Stroke, Heart Failure, and Hypertension. Participants will gain the knowledge and skills necessary to perform annual reviews for patients with these conditions.This course is particularly well-suited for Nurse Associates, Practice Nurses, Nurse Practitioners (NPs), Emergency Nurse Practitioners (ENPs), Paramedics, and Pharmacists. Dr. Tamara Cunningham, an experienced GP Trainer, will lead these interactive online sessions.Day One09.15 - Coffee and Registration09.30 - Introduction and Course Objectives09.45 - Setting the Scene: - Screening, Diagnosis, Pathophysiology, and Symptoms10.30 - Q-Risk Assessment10.45 - Coffee Break11.00 - Diet & Cardiovascular Disease: - Healthy Eating - Range of Dietary Approaches - Weight Management Services (PH25)11.45 - Benefits of Activity for Cardiovascular Disease12.30 - Lunch01.30 - Hypertension - A Review of NICE Guidelines (NG136): - Targets - Risk Assessment - Medications - Assessing Target Organ Damage02.45 - Lipid Modification - A Review of Nice Guidelines (NG181): - How Lipids Affect Cardiovascular Risk03.15 - Case Studies03.30 - Action Plan, Evaluation, and Resources03.45 - CloseDay Two09.15 - Coffee and Registration09.30 - Heart Failure - How to Perform a Safe Annual Review (NG106)10.45 - Coffee Break11.00 - CHD - Performing an Annual Review and Including Assessment of Angina12.30 - Lunch01.30 - Stroke - Secondary Prevention and Management of Long-Term Complications02.30 - Case Studies - Group Work to Consolidate Learning03.30 - Competencies, Training, and Resources03.45 - CloseKey Learning Outcomes for Both Days:Upon completing this course, participants will be able to:1. Explain the basic physiology of cardiovascular disease.2. Perform risk assessments with patients and discuss modifiable factors such as diet and exercise.3. Describe the targets for blood pressure and cholesterol and how these affect primary and secondary prevention of CVD.4. Describe the basic anti-hypertensive and cholesterol-lowering medications involved in CVD.5. Name the major complications that may arise in people with a long duration of CVD and measures that may limit or prevent them.6. Describe the key advice to patients regarding Heart Failure and recognition of when to escalate/refer.7. Perform a safe review for stroke, CHD, and HF, recognizing how to work within your professional limits and when to signpost.8. Provide examples of referral pathways to other services, e.g., weight management, secondary care, activity, and psychological services.9. Explain the key components and process of an annual review and a self-management plan.Join us for this comprehensive 2-day course via Zoom and enhance your ability to provide effective cardiovascular disease care within primary care settings.

Diabetes Essentials for HCAs

By M&K Update Ltd

Aimed at health care assistants working in General Practice who want to develop themselves and the wider team in the care and management of the patient with diabetes.

Customer Service: Get All Basics Right to Elevate Your Customer Experience

By Beyond Satisfaction - Customer service Training

If you want your employees to improve their customer service skills and deliver an amazing experience to your customers, feel free to check out my Training course focusing on the core values of customer service.

Cardiac Catheterisation

By M&K Update Ltd

This course enables participants to develop essential patient management skills that are necessary for identifying and managing the safe care of a patient requiring cardiac catheterisation.

Git and GitHub course description This course covers version control using Git but also using GUI frontends such as GitHub. The course starts with a tour of using GitHub but then quickly moves onto using git from the command line. All elements of git version control are covered including creation of repositories, adding and editing files, branches and merging, rewriting history and handling merge conflicts. Hands on sessions are used throughout the course. What will you learn Install git. Add and edit files in a repository. Create branches and perform merges. Handle merge conflicts. Git and GitHub course details Who will benefit: Anyone requiring version control. Prerequisites: None. Duration 1 day Git and GitHub course contents Introduction Version control for software, configuration management. Other uses. Version control systems. What is git? What is GitHub? Distributed version control. Comparison of git to other systems. GitHub Getting started, creating an account, account types, repositories, access control, bug tracking, feature requests. Alternatives to GitHub. Hands on Using GitHub. Installing git Linux install, Windows install, git config, levels, user.name, user.email. Hands on Installing and configuring git. Creating repositories git clone, github, git remote, git init. Hands on Creating a repository. Adding and editing files Staging and adding, git add, git commit, git push, git pull, git status, git log. Two stage process. File states: Working, staging, history, untracked. git mv, git rm, .gitignore, git diff, git difftool. Undoing changes. Hands on Adding and editing files in git. Branching and merging What is a branch, HEAD label, master branch, git branch, git checkout. Feature branches, bux fix branches, integration branches, production branches, fast forward merges, 3 way merges, git merge, git status, git log, tags. Hands on Making branches, merging. Rewriting history git reset, git rebase, advantages. Hands on Reset commits, rebase a branch. Merge conflicts What is a conflict, conflict resolution process, resolving merges, rebasing, git log, merge tools, configuring merge tools, avoiding conflicts. Hands on Merge resolution.

Talent Management and Succession Planning

By FD Capital

Talent Management and Succession Planning,” the podcast where we explore the critical aspects of attracting and retaining top finance talen Talent management is the lifeblood of any organisation, and finance departments are no exception. In a competitive business landscape, attracting and retaining top finance talent can make a significant difference. Highly skilled and motivated professionals drive innovation, improve financial performance, and contribute to strategic decision-making. By investing in talent management, CFOs ensure their organisations have the right people in the right roles, which is vital for sustainable growth and success. Talent management also enables CFOs to build a culture of continuous learning and development. By nurturing the skills and capabilities of finance professionals, we create an environment that fosters innovation and adaptability. This is crucial in today’s rapidly changing business landscape, where finance teams need to keep pace with evolving technologies, regulations, and industry trends. Talent management provides a foundation for building a resilient and agile finance function. Succession planning is an integral part of talent management. How do CFOs approach succession planning, particularly in finance leadership roles? Succession planning is a proactive approach to ensure a smooth transition of leadership roles. CFOs need to identify high-potential individuals within their finance teams and provide them with opportunities for growth and development. This includes mentorship, training programs, and exposure to cross-functional experiences. By preparing a pipeline of future finance leaders, CFOs can mitigate the risks associated with unexpected departures or retirements, ensuring continuity and stability in finance leadership. Additionally, succession planning should encompass diversity and inclusion. CFOs recognize the importance of building diverse finance teams that reflect the broader talent pool. By providing equal opportunities for underrepresented groups and promoting inclusivity, we foster a culture of belonging and tap into a wider range of perspectives and ideas. Diverse teams drive innovation and improve decision-making, contributing to the overall success of the organisation. How do CFOs create a talent development culture within their finance teams, and what initiatives can be implemented to foster continuous growth? CFOs can create a talent development culture by prioritizing learning and development initiatives. This includes offering ongoing training programs, supporting professional certifications, and providing access to resources that enhance technical and soft skills. CFOs should encourage finance professionals to take ownership of their own development and provide opportunities for them to stretch their capabilities. This may involve cross-functional projects, exposure to different areas of the business, or participation in industry conferences and networking events. Additionally, mentorship and coaching programs play a crucial role in talent development. CFOs can pair experienced finance leaders with up-and-coming talent, fostering knowledge transfer, and providing guidance and support. Encouraging regular feedback and performance discussions helps finance professionals understand their strengths and areas for improvement, enabling targeted development plans. By creating a culture that values continuous learning and growth, CFOs empower their finance teams to reach their full potential. https://www.fdcapital.co.uk/podcast/talent-management-and-succession-planning/ Tags Online Events Things To Do Online Online Classes Online Business Classes #leadership #development #successionplanning #employees #talentmanagement