- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

96 Japanese courses

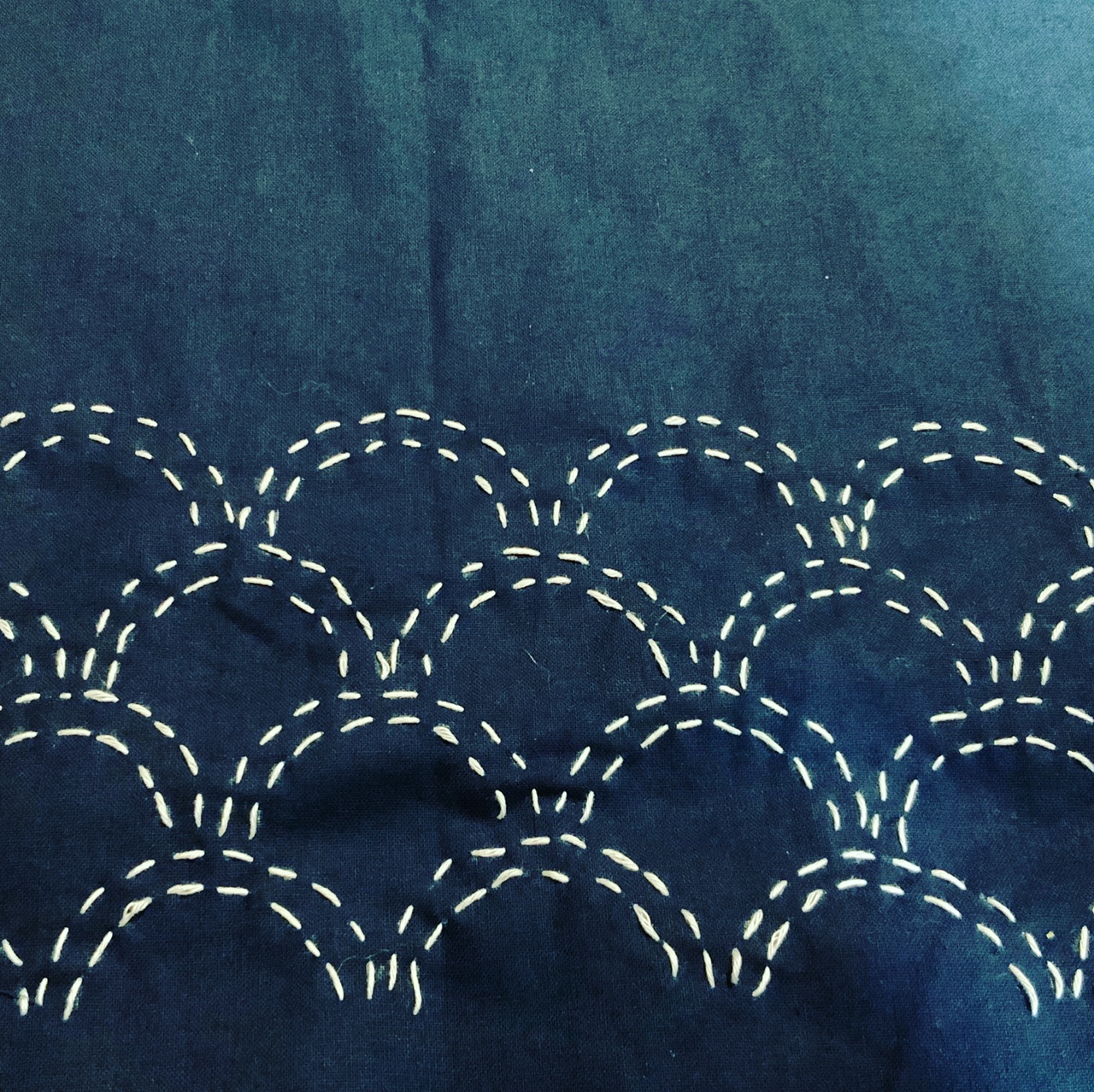

Japanese Sashiko

By Loudwater Community Arts

Sashiko is a beautiful form of embroidery that uses white stitches on an indigo blue background. Have a go at this beautiful and rewarding hand embroidery technique, which is all done with the simplest of stitches – running stitch. Together we will look at the basic patterns and you can choose one to make into a book cover to take home. This could be the start of something big. No experience necessary, all materials included.

The three day course allows us to focus on the more refined shapes of a knife specifically designed for cooking, on this course we will forge a matched pair of knives, a small pairing knife and a larger kitchen knife both with a hidden tang and two part handle in the Wa style. The extended length of the course allows students to focus on getting a clean shape and flowing lines as well as a thing and practical blade for cooking. Please note this course is only held once a year. I run a strict cancellation policy. If you cannot attend the date you have booked please contact me within three weeks and I will rebook your course for free, If you contact me after this deadline you will lose your place. Refunds are not available. Courses dates can only be moved once. Courses valid for one year from date of purchase. No under 18s If you have a physical gift voucher it must be presented on the first day of a course. Course dates must be determines in advance. Vouchers not exchangeable for monetary value. If the course cost is larger than the face value of the voucher(s) the difference must be made up in advance, if it is less no change is given. Vouchers cannot be replaced if lost, stolen or destroyed. *Gift vouchers are valid for one year from date of purchase

Accounting & Finance Level 5

By Training Tale

***Accounting & Finance - Level 5*** Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This Accounting & Finance - Level 5 course has been designed to provide a thorough introduction to business Accounting and Finance as both an idea and a profession. This Accounting & Finance - Level 5 course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting and finance sector. Our Accounting & Finance - Level 5 course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting and finance sector. ***Others Benefits of this Accounting & Finance - Level 5 Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course ] ***Accounting & Finance - Level 5*** Detailed Course Curriculum of this Accounting & Finance - Level 5 Course: Module 1: Essentials of Accounting and Finance Identify the Non-Financial Manager's Concern with Finance The Importance of Finance Financial and Operating Environment Module 2: Types of Cost Data and Cost Analysis The Importance of Cost Data Types of Costs How Do Your Costs Behave? Segregating Fixed Cost and Variable Cost Cost Allocation Cost Analysis What You Can Learn from the Japanese? Module 3: Contribution Analysis Should You Accept a Special Order? How Do You Determine a Bid Price? Determining Profit from Year to Year Are You Utilising Capacity? Module 4: Break-Even and Cost-Volume-Profit Analysis What is Cost-Volume-Profit Analysis? What and Why of Break-Even Sales? What is the Margin of Safety? Cash Break-Even Point What is Operating Leverage? Sales Mix Analysis Module 5: Relevant Cost and Making Short-Term Decisions What Costs Are Relevant to You? Accepting or Rejecting a Special Order Pricing Standard Products Determining Whether to Sell or Process Further Adding or Dropping a Product Line Utilising Scarce Resources Don't Forget the Qualitative Factors Module 6: Forecasting Cash Needs and Budgeting Forecasts Using Forecasts Preparing Financial Forecasts Budgets The Sales Budget The Production Budget The Direct Material Budget The Direct Labour Budget The Factory Overhead Budget The Ending Inventory The Selling and Administrative Expense Budget The Cash Budget The Budgeted Income Statement The Budgeted Balance Sheet A Shortcut Approach to Formulating the Budget Module 7: Cost Control and Variance Analysis Defining a Standard The Usefulness of Variance Analysis Setting Standards Determining and Evaluating Sales Variances Cost Variances Labour Variances Overhead Variances The Use of Flexible Budgets in Performance Reports Standards and Variances in Marketing Sales Standards Variances in Warehousing Costs Module 8: Managing Financial Assets Working Capital Financing Assets Managing Cash Properly Getting Money Faster Delaying Cash Payments Opportunity Cost of Foregoing a Cash Discount Volume Discounts Module 9: Managing Accounts Receivable and Credit Credit References Credit Policy Analysing Accounts Receivable Module 10: Managing Inventory Inventory Management Considerations Inventory Analysis Determining the Carrying and Ordering Costs The Economic Order Quantity (EOQ) Avoiding Stock Outs Determining the Reorder Point or Economic Order Point (EOP) The ABC Inventory Control Method Supply Chain Management Module 11: The Time Value of Money Future Values - How Money Grows Future Value of an Annuity Present Value - How Much Money is Worth Now? Present Value of Mixed Streams of Cash Flows Present Value of an Annuity Perpetuities Applications of Future Values and Present Values Module 12: Capital Budgeting Decisions Types of Investment Projects What Are the Features of Investment Projects? Selecting the Best Mix of Projects With a Limited Budget Income Taxes and Investment Decisions Types of Depreciation Methods How Does MACRS Affect Investment Decisions? The Cost of Capital Module 13: Improving Managerial Performance What is Return on Investment (ROI)? What Does ROI Consist of? - Du Pont Formula ROI and Profit Objective ROI and Profit Planning ROI and Return on Equity (ROE) Module 14: Sources of Short-Term Financing Trade Credit Cash Discount When are Bank Loans Advisable? Working with a Bank Issuing Commercial Paper Using Receivables for Financing Using Inventories for Financing Module 15: Considering Term Loans and Leasing Intermediate-Term Bank Loans Using Revolving Credit Insurance Company Term Loans Financing with Equipment Leasing Module 16: Long-Term Debt and Equity Financing Types of Long-Term Debt Equity Securities How Should You Finance? Module 17: Accounting Conventions and Recording Financial Data Double Entry and the Accounting Equation Assessment Method After completing each module of the Accounting & Finance - Level 5 course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Accounting & Finance - Level 5 course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Accounting & Finance - Level 5 This Accounting & Finance - Level 5 course is ideal for: Candidates interested to start a career in accountancy Business owners seeking to look after their own accounts Existing accountancy workers in seeking higher positions or promotion Accountancy workers with no formal qualifications Anyone wishing to boost their career prospects. Requirements Accounting & Finance - Level 5 There are no specific requirements for Accounting & Finance - Level 5 course because it does not require any advanced knowledge or skills. Students who intend to enrol in this Accounting & Finance - Level 5 course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Accounting & Finance - Level 5 This Accounting & Finance - Level 5 course may lead you to a variety of career opportunities. Accounts Assistant Accounts Payable & Expenses Supervisor Accounts Payable Clerk Audit Trainee Payroll Administrator / Supervisor Tax Assistant / Accountant. Accounting Clerk Auditing Clerk Accounts Receivable Clerk Certificates Certificate of completion Digital certificate - Included

Nail Class

By KEMP CENTER

Nail technician and styling class with certificate, conducted by expert female nail artists Looking to become a highly skilled nail artist? 24/01/2024 384 Course Participants 4,9 average rating Nail styling and art is a trending fashion and profitable business. Nail technicians and artists earn money by simply providing manicures, pedicures, or a fresh coat of paint to their customers’ nails. Whether you want beautiful nail art for yourself or intended to learn these new skills for enhancing your salon business: This nail styling and technician course will teach you everything to become an expert nail technician. Following the course modules, one by one will enable you to create stunning nail designs and to provide professional nail care services to your clients. The course is professionally designed into modules by expert trainers to provide you with a premium learning experience. Whether you are a new nail fashionista or a veteran nail technician, the course is loaded with lots of knowledge, techniques, and researched-backed tips and tricks for you. The course also offers a completion certificate that will serve as proof of your competence. Create amazing nail art Learn to create beautiful nail art with gel and air-dry polish. Our experts will teach you both traditional and modern techniques for creating amazing nail art. Learn the chemistry behind colors Our instructors are not focused on simply teaching nail techniques, but the science behind them; understand the chemistry behind colors, their ingredients, and combinations to come up with wonderful nail designs. Get professional nail design skills Learn to win your client’s heart by giving them a highly professional manicure and pedicure. Meet the people behind your favorite celebrity nail art We believe in providing ‘the best, hence our trainers are famous nail technicians for well-known celebrities. Get a chance to learn from the one behind your favorite person. Learn with Flexibility The course content is optimized to provide you with the best learning experience. Assignments, quizzes, unlimited access, and quick-knowledge recap allow you to learn and evaluate yourself anywhere and anytime. Join the nail artist course and get the benefits: Learning from a professional nail artist24/7 access from any devicePractical exercisesTests, quizzes and recapsCertificate of completionExtra materials and downloadable bonuses100% satisfaction guarantee Your Singing Instructor: Brittany Pustelnik World class nail artist Brittany is a licensed nail artist and a certified trainer with over ten years of experience in the nail styling industry. She has been working as a nail technician for the last 14 years with a well-known celebrity makeup artist and has provided nail art services to famous celebrities. Since 2009, she has been successfully dedicating herself to the passion of professional nail styling. She is a graduate of first and second degree studies in cosmetology and runs her renowned salon. Every year, she shares her knowledge with dozens of individuals in personal training sessions. Her postgraduate education in Teaching Qualifications makes Brittany not only a virtuoso in nail styling, but also an outstanding theorist and trainer. As a lecturer in cosmetology studies, she shares her passion and knowledge. She is also the author of articles in the industry magazines, exploring the art of nail decoration. Anna Kanikowska World class nail artist Anna, a renowned figure in the beauty scene, owns a famous nail styling salon. With over a decade of expertise, she has become the go-to manicurist for celebrities. Since 2010, her salon has been a hub of creativity, producing numerous awe-inspiring nail designs. A graduate in Cosmetology, Anna’s work embodies classic elegance. She excels in creating flawless French manicures and striking compositions in bold reds and blacks. Anna is one of two seasoned experts whose contributions have enriched our nail styling course with extensive practical and industry insights. Her guidance not only nurtures passion but also paves the way for aspiring experts to join the elite circle of manicurists. Overview of the course: Detailed Video presentations 1. Essential knowledge for Nail class participants: ♦ Fundamentals of nail styling ♦ Health and safety while doing someone’s nails ♦ Exploring career opportunities and what this industry can offer ♦ How to be a successful nail artist 2. Various techniques of nail styling ♦ Mechanical manicure ♦ Hybrid manicure 3. Safety and taking care of nails ♦ Nails diseases ♦ How to clean your workspace and tools? ♦ How to care about natural nails? ♦ Tricks and tips for keeping your nails in good condition ♦ Safety procedures in a nail salon Training videos 1. Introduction to being a nail artist ♦ Summarizing the preparation for nail stylization ♦ Fundaments of nail styling ♦ Hand and nail care ♦ Fundamental knowledge about natural nails 2. Different techniques in nail art ♦ Gel nail painting ♦ Varnish nail painting ♦ Nail lamp 3. Manicure- basic techniques ♦ Japanese Manicure ♦ Mechanical Manicure ♦ Hybrid Manicure Tests 1. Tests and repetitions Test your knowledge and what you have learned with our specially designed test that will help you memorize all the information from the course. 2. Final Exam ♦ Final test Tasks Practical tasks: ♦ Analyzing and grasping client’s needs ♦ Preparing and setting up workspace ♦ Performing a classic manicure ♦ Performing an advanced manicure with tools ♦ Getting your first clients and creating a thriving business Course materials ♦ Nail design idea ♦ Viral trends in nail art ♦ What is the difference between holo, glitter, rainbow, and multi-chrome nail polishes Self-paced Course Learn how to perform professional nail designs with this unique nail class. You will see firsthand how professionals work and learn everything in practice. We reveal all the products, tools, techniques and professional methods and secrets in one comprehensive course. With interactive learning modules, exercise sessions and high quality video content available 24/7, you will be able to learn every detail of the best nail techniques. You will also have the opportunity to exercise and learn everything in practice. We will help you develop your practical skills – even if you’re just starting out.

Level 5: Accounting & Finance

By Training Tale

***Level 5: Accounting & Finance*** Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This Level 5: Accounting & Finance course has been designed to provide a thorough introduction to business Accounting and Finance as both an idea and a profession. This course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting and finance sector. Our Level 5: Accounting & Finance course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting and finance sector. Learning Outcomes After completing this Level 5: Accounting & Finance course, learner will be able to: Understand the essentials of accounting and finance Understand the types of cost data and cost analysis Gain a thorough understanding of contribution analysis Understand break-even and cost-volume-profit analysis Understand relevant cost and know to make short-term decisions Know how to manage financial assets Understand forecasting cash needs and budgeting Cost control and variance analysis Know how to manage accounts receivable and credit Know how to manage inventory Understand the time value of money Know how to improve managerial performance Understand capital budgeting decisions Understand improve managerial performance Understand sources of short-term financing Know how to consider term loans and leasing Understand long-term debt and equity financing Understand accounting conventions and recording financial data Why Choose Level 5 Accounting & Finance Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course ] ***Level 5: Accounting & Finance*** Detailed Course Curriculum Module 1: Essentials of Accounting and Finance Identify the Non-Financial Manager's Concern with Finance The Importance of Finance Financial and Operating Environment Module 2: Types of Cost Data and Cost Analysis The Importance of Cost Data Types of Costs How Do Your Costs Behave? Segregating Fixed Cost and Variable Cost Cost Allocation Cost Analysis What You Can Learn from the Japanese? Module 3: Contribution Analysis Should You Accept a Special Order? How Do You Determine a Bid Price? Determining Profit from Year to Year Are You Utilising Capacity? Module 4: Break-Even and Cost-Volume-Profit Analysis What is Cost-Volume-Profit Analysis? What and Why of Break-Even Sales? What is the Margin of Safety? Cash Break-Even Point What is Operating Leverage? Sales Mix Analysis Module 5: Relevant Cost and Making Short-Term Decisions What Costs Are Relevant to You? Accepting or Rejecting a Special Order Pricing Standard Products Determining Whether to Sell or Process Further Adding or Dropping a Product Line Utilising Scarce Resources Don't Forget the Qualitative Factors Module 6: Forecasting Cash Needs and Budgeting Forecasts Using Forecasts Preparing Financial Forecasts Budgets The Sales Budget The Production Budget The Direct Material Budget The Direct Labour Budget The Factory Overhead Budget The Ending Inventory The Selling and Administrative Expense Budget The Cash Budget The Budgeted Income Statement The Budgeted Balance Sheet A Shortcut Approach to Formulating the Budget Module 7: Cost Control and Variance Analysis Defining a Standard The Usefulness of Variance Analysis Setting Standards Determining and Evaluating Sales Variances Cost Variances Labour Variances Overhead Variances The Use of Flexible Budgets in Performance Reports Standards and Variances in Marketing Sales Standards Variances in Warehousing Costs Module 8: Managing Financial Assets Working Capital Financing Assets Managing Cash Properly Getting Money Faster Delaying Cash Payments Opportunity Cost of Foregoing a Cash Discount Volume Discounts Module 9: Managing Accounts Receivable and Credit Credit References Credit Policy Analysing Accounts Receivable Module 10: Managing Inventory Inventory Management Considerations Inventory Analysis Determining the Carrying and Ordering Costs The Economic Order Quantity (EOQ) Avoiding Stock Outs Determining the Reorder Point or Economic Order Point (EOP) The ABC Inventory Control Method Supply Chain Management Module 11: The Time Value of Money Future Values - How Money Grows Future Value of an Annuity Present Value - How Much Money is Worth Now? Present Value of Mixed Streams of Cash Flows Present Value of an Annuity Perpetuities Applications of Future Values and Present Values Module 12: Capital Budgeting Decisions Types of Investment Projects What Are the Features of Investment Projects? Selecting the Best Mix of Projects With a Limited Budget Income Taxes and Investment Decisions Types of Depreciation Methods How Does MACRS Affect Investment Decisions? The Cost of Capital Module 13: Improving Managerial Performance What is Return on Investment (ROI)? What Does ROI Consist of? - Du Pont Formula ROI and Profit Objective ROI and Profit Planning ROI and Return on Equity (ROE) Module 14: Sources of Short-Term Financing Trade Credit Cash Discount When are Bank Loans Advisable? Working with a Bank Issuing Commercial Paper Using Receivables for Financing Using Inventories for Financing Module 15: Considering Term Loans and Leasing Intermediate-Term Bank Loans Using Revolving Credit Insurance Company Term Loans Financing with Equipment Leasing Module 16: Long-Term Debt and Equity Financing Types of Long-Term Debt Equity Securities How Should You Finance? Module 17: Accounting Conventions and Recording Financial Data Double Entry and the Accounting Equation Assessment Method After completing each module of the Level 5: Accounting & Finance course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Level 5: Accounting & Finance course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Level 5: Accounting & Finance This Level 5: Accounting & Finance course is ideal for: Candidates interested to start a career in accountancy Business owners seeking to look after their own accounts Existing accountancy workers in seeking higher positions or promotion Accountancy workers with no formal qualifications Anyone wishing to boost their career prospects. Requirements Level 5: Accounting & Finance There are no specific requirements for Level 5: Accounting & Finance course because it does not require any advanced knowledge or skills. Career path Level 5: Accounting & Finance This Level 5: Accounting & Finance course may lead you to a variety of career opportunities. Accounts Assistant Accounts Payable & Expenses Supervisor Accounts Payable Clerk Audit Trainee Payroll Administrator / Supervisor Tax Assistant / Accountant. Accounting Clerk Auditing Clerk Accounts Receivable Clerk Certificates Certificate of completion Digital certificate - Included

Level 5 Accounting & Finance

By Training Tale

***Level 5 Accounting & Finance*** Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This Level 5 Accounting & Finance course has been designed to provide a thorough introduction to business Accounting and Finance as both an idea and a profession. This course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting and finance sector. Our Level 5 Accounting & Finance course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting and finance sector. Learning Outcomes After completing this Level 5 Accounting & Finance course, learner will be able to: Understand the essentials of accounting and finance Understand the types of cost data and cost analysis Gain a thorough understanding of contribution analysis Understand break-even and cost-volume-profit analysis Understand relevant cost and know to make short-term decisions Know how to manage financial assets Understand forecasting cash needs and budgeting Cost control and variance analysis Know how to manage accounts receivable and credit Know how to manage inventory Understand the time value of money Know how to improve managerial performance Understand capital budgeting decisions Understand improve managerial performance Understand sources of short-term financing Know how to consider term loans and leasing Understand long-term debt and equity financing Understand accounting conventions and recording financial data Why Choose Level 5 Accounting & Finance Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Level 5 Accounting & Finance Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course ] ***Level 5 Accounting & Finance*** Detailed Course Curriculum of this Level 5 Accounting & Finance Course: Module 1: Essentials of Accounting and Finance Identify the Non-Financial Manager's Concern with Finance The Importance of Finance Financial and Operating Environment Module 2: Types of Cost Data and Cost Analysis The Importance of Cost Data Types of Costs How Do Your Costs Behave? Segregating Fixed Cost and Variable Cost Cost Allocation Cost Analysis What You Can Learn from the Japanese? Module 3: Contribution Analysis Should You Accept a Special Order? How Do You Determine a Bid Price? Determining Profit from Year to Year Are You Utilising Capacity? Module 4: Break-Even and Cost-Volume-Profit Analysis What is Cost-Volume-Profit Analysis? What and Why of Break-Even Sales? What is the Margin of Safety? Cash Break-Even Point What is Operating Leverage? Sales Mix Analysis Module 5: Relevant Cost and Making Short-Term Decisions What Costs Are Relevant to You? Accepting or Rejecting a Special Order Pricing Standard Products Determining Whether to Sell or Process Further Adding or Dropping a Product Line Utilising Scarce Resources Don't Forget the Qualitative Factors Module 6: Forecasting Cash Needs and Budgeting Forecasts Using Forecasts Preparing Financial Forecasts Budgets The Sales Budget The Production Budget The Direct Material Budget The Direct Labour Budget The Factory Overhead Budget The Ending Inventory The Selling and Administrative Expense Budget The Cash Budget The Budgeted Income Statement The Budgeted Balance Sheet A Shortcut Approach to Formulating the Budget Module 7: Cost Control and Variance Analysis Defining a Standard The Usefulness of Variance Analysis Setting Standards Determining and Evaluating Sales Variances Cost Variances Labour Variances Overhead Variances The Use of Flexible Budgets in Performance Reports Standards and Variances in Marketing Sales Standards Variances in Warehousing Costs Module 8: Managing Financial Assets Working Capital Financing Assets Managing Cash Properly Getting Money Faster Delaying Cash Payments Opportunity Cost of Foregoing a Cash Discount Volume Discounts Module 9: Managing Accounts Receivable and Credit Credit References Credit Policy Analysing Accounts Receivable Module 10: Managing Inventory Inventory Management Considerations Inventory Analysis Determining the Carrying and Ordering Costs The Economic Order Quantity (EOQ) Avoiding Stock Outs Determining the Reorder Point or Economic Order Point (EOP) The ABC Inventory Control Method Supply Chain Management Module 11: The Time Value of Money Future Values - How Money Grows Future Value of an Annuity Present Value - How Much Money is Worth Now? Present Value of Mixed Streams of Cash Flows Present Value of an Annuity Perpetuities Applications of Future Values and Present Values Module 12: Capital Budgeting Decisions Types of Investment Projects What Are the Features of Investment Projects? Selecting the Best Mix of Projects With a Limited Budget Income Taxes and Investment Decisions Types of Depreciation Methods How Does MACRS Affect Investment Decisions? The Cost of Capital Module 13: Improving Managerial Performance What is Return on Investment (ROI)? What Does ROI Consist of? - Du Pont Formula ROI and Profit Objective ROI and Profit Planning ROI and Return on Equity (ROE) Module 14: Sources of Short-Term Financing Trade Credit Cash Discount When are Bank Loans Advisable? Working with a Bank Issuing Commercial Paper Using Receivables for Financing Using Inventories for Financing Module 15: Considering Term Loans and Leasing Intermediate-Term Bank Loans Using Revolving Credit Insurance Company Term Loans Financing with Equipment Leasing Module 16: Long-Term Debt and Equity Financing Types of Long-Term Debt Equity Securities How Should You Finance? Module 17: Accounting Conventions and Recording Financial Data Double Entry and the Accounting Equation Assessment Method After completing each module of the Level 5 Accounting & Finance course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Level 5 Accounting & Finance course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Level 5 Accounting & Finance This Level 5 Accounting & Finance course is ideal for: Candidates interested to start a career in accountancy Business owners seeking to look after their own accounts Existing accountancy workers in seeking higher positions or promotion Accountancy workers with no formal qualifications Anyone wishing to boost their career prospects. Requirements Level 5 Accounting & Finance There are no specific requirements for Level 5 Accounting & Finance course because it does not require any advanced knowledge or skills. Students who intend to enrol in this Level 5 Accounting & Finance course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Level 5 Accounting & Finance This Level 5 Accounting & Finance course may lead you to a variety of career opportunities. Accounts Assistant Accounts Payable & Expenses Supervisor Accounts Payable Clerk Audit Trainee Payroll Administrator / Supervisor Tax Assistant / Accountant. Accounting Clerk Auditing Clerk Accounts Receivable Clerk Certificates Certificate of completion Digital certificate - Included

Level 5 Accounting & Finance Course

By Training Tale

***Level 5 Accounting & Finance*** Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This course has been designed to provide a thorough introduction to business Accounting and Finance as both an idea and a profession. This course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting and finance sector. Our Level 5 Accounting & Finance course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting and finance sector. Learning Outcomes After completing this Level 5 Accounting & Finance course, learner will be able to: Understand the essentials of accounting and finance Understand the types of cost data and cost analysis Gain a thorough understanding of contribution analysis Understand break-even and cost-volume-profit analysis Understand relevant cost and know to make short-term decisions Know how to manage financial assets Understand forecasting cash needs and budgeting Cost control and variance analysis Know how to manage accounts receivable and credit Know how to manage inventory Understand the time value of money Know how to improve managerial performance Understand capital budgeting decisions Understand improve managerial performance Understand sources of short-term financing Know how to consider term loans and leasing Understand long-term debt and equity financing Understand accounting conventions and recording financial data Why Choose Level 5 Accounting & Finance Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course ] ***Level 5 Accounting & Finance*** Detailed Course Curriculum Module 1: Essentials of Accounting and Finance Identify the Non-Financial Manager's Concern with Finance The Importance of Finance Financial and Operating Environment Module 2: Types of Cost Data and Cost Analysis The Importance of Cost Data Types of Costs How Do Your Costs Behave? Segregating Fixed Cost and Variable Cost Cost Allocation Cost Analysis What You Can Learn from the Japanese? Module 3: Contribution Analysis Should You Accept a Special Order? How Do You Determine a Bid Price? Determining Profit from Year to Year Are You Utilising Capacity? Module 4: Break-Even and Cost-Volume-Profit Analysis What is Cost-Volume-Profit Analysis? What and Why of Break-Even Sales? What is the Margin of Safety? Cash Break-Even Point What is Operating Leverage? Sales Mix Analysis Module 5: Relevant Cost and Making Short-Term Decisions What Costs Are Relevant to You? Accepting or Rejecting a Special Order Pricing Standard Products Determining Whether to Sell or Process Further Adding or Dropping a Product Line Utilising Scarce Resources Don't Forget the Qualitative Factors Module 6: Forecasting Cash Needs and Budgeting Forecasts Using Forecasts Preparing Financial Forecasts Budgets The Sales Budget The Production Budget The Direct Material Budget The Direct Labour Budget The Factory Overhead Budget The Ending Inventory The Selling and Administrative Expense Budget The Cash Budget The Budgeted Income Statement The Budgeted Balance Sheet A Shortcut Approach to Formulating the Budget Module 7: Cost Control and Variance Analysis Defining a Standard The Usefulness of Variance Analysis Setting Standards Determining and Evaluating Sales Variances Cost Variances Labour Variances Overhead Variances The Use of Flexible Budgets in Performance Reports Standards and Variances in Marketing Sales Standards Variances in Warehousing Costs Module 8: Managing Financial Assets Working Capital Financing Assets Managing Cash Properly Getting Money Faster Delaying Cash Payments Opportunity Cost of Foregoing a Cash Discount Volume Discounts Module 9: Managing Accounts Receivable and Credit Credit References Credit Policy Analysing Accounts Receivable Module 10: Managing Inventory Inventory Management Considerations Inventory Analysis Determining the Carrying and Ordering Costs The Economic Order Quantity (EOQ) Avoiding Stock Outs Determining the Reorder Point or Economic Order Point (EOP) The ABC Inventory Control Method Supply Chain Management Module 11: The Time Value of Money Future Values - How Money Grows Future Value of an Annuity Present Value - How Much Money is Worth Now? Present Value of Mixed Streams of Cash Flows Present Value of an Annuity Perpetuities Applications of Future Values and Present Values Module 12: Capital Budgeting Decisions Types of Investment Projects What Are the Features of Investment Projects? Selecting the Best Mix of Projects With a Limited Budget Income Taxes and Investment Decisions Types of Depreciation Methods How Does MACRS Affect Investment Decisions? The Cost of Capital Module 13: Improving Managerial Performance What is Return on Investment (ROI)? What Does ROI Consist of? - Du Pont Formula ROI and Profit Objective ROI and Profit Planning ROI and Return on Equity (ROE) Module 14: Sources of Short-Term Financing Trade Credit Cash Discount When are Bank Loans Advisable? Working with a Bank Issuing Commercial Paper Using Receivables for Financing Using Inventories for Financing Module 15: Considering Term Loans and Leasing Intermediate-Term Bank Loans Using Revolving Credit Insurance Company Term Loans Financing with Equipment Leasing Module 16: Long-Term Debt and Equity Financing Types of Long-Term Debt Equity Securities How Should You Finance? Module 17: Accounting Conventions and Recording Financial Data Double Entry and the Accounting Equation Assessment Method After completing each module of the Level 5 Accounting & Finance course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Level 5 Accounting & Finance course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Level 5 Accounting & Finance This course is ideal for: Candidates interested to start a career in accountancy Business owners seeking to look after their own accounts Existing accountancy workers in seeking higher positions or promotion Accountancy workers with no formal qualifications Anyone wishing to boost their career prospects. Requirements Level 5 Accounting & Finance There are no specific requirements for because it does not require any advanced knowledge or skills. Students who intend to enrol in this Level 5 Accounting & Finance course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Level 5 Accounting & Finance This Level 5 Accounting & Finance course may lead you to a variety of career opportunities. Accounts Assistant Accounts Payable & Expenses Supervisor Accounts Payable Clerk Audit Trainee Payroll Administrator / Supervisor Tax Assistant / Accountant. Accounting Clerk Auditing Clerk Accounts Receivable Clerk Certificates Certificate of completion Digital certificate - Included

Level 5: Accounting and Finance

By Training Tale

***Level 5: Accounting and Finance*** Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This course has been designed to provide a thorough introduction to business Accounting and Finance as both an idea and a profession. This course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting and finance sector. Our Level 5: Accounting and Finance course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting and finance sector. Learning Outcomes After completing this Level 5: Accounting and Finance course, learner will be able to: Understand the essentials of accounting and finance Understand the types of cost data and cost analysis Gain a thorough understanding of contribution analysis Understand break-even and cost-volume-profit analysis Understand relevant cost and know to make short-term decisions Know how to manage financial assets Understand forecasting cash needs and budgeting Cost control and variance analysis Know how to manage accounts receivable and credit Know how to manage inventory Understand the time value of money Know how to improve managerial performance Understand capital budgeting decisions Understand improve managerial performance Understand sources of short-term financing Know how to consider term loans and leasing Understand long-term debt and equity financing Understand accounting conventions and recording financial data Why Choose Level 5 Accounting and Finance Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course ] ***Level 5: Accounting and Finance*** Detailed Course Curriculum Module 1: Essentials of Accounting and Finance Identify the Non-Financial Manager's Concern with Finance The Importance of Finance Financial and Operating Environment Module 2: Types of Cost Data and Cost Analysis The Importance of Cost Data Types of Costs How Do Your Costs Behave? Segregating Fixed Cost and Variable Cost Cost Allocation Cost Analysis What You Can Learn from the Japanese? Module 3: Contribution Analysis Should You Accept a Special Order? How Do You Determine a Bid Price? Determining Profit from Year to Year Are You Utilising Capacity? Module 4: Break-Even and Cost-Volume-Profit Analysis What is Cost-Volume-Profit Analysis? What and Why of Break-Even Sales? What is the Margin of Safety? Cash Break-Even Point What is Operating Leverage? Sales Mix Analysis Module 5: Relevant Cost and Making Short-Term Decisions What Costs Are Relevant to You? Accepting or Rejecting a Special Order Pricing Standard Products Determining Whether to Sell or Process Further Adding or Dropping a Product Line Utilising Scarce Resources Don't Forget the Qualitative Factors Module 6: Forecasting Cash Needs and Budgeting Forecasts Using Forecasts Preparing Financial Forecasts Budgets The Sales Budget The Production Budget The Direct Material Budget The Direct Labour Budget The Factory Overhead Budget The Ending Inventory The Selling and Administrative Expense Budget The Cash Budget The Budgeted Income Statement The Budgeted Balance Sheet A Shortcut Approach to Formulating the Budget Module 7: Cost Control and Variance Analysis Defining a Standard The Usefulness of Variance Analysis Setting Standards Determining and Evaluating Sales Variances Cost Variances Labour Variances Overhead Variances The Use of Flexible Budgets in Performance Reports Standards and Variances in Marketing Sales Standards Variances in Warehousing Costs Module 8: Managing Financial Assets Working Capital Financing Assets Managing Cash Properly Getting Money Faster Delaying Cash Payments Opportunity Cost of Foregoing a Cash Discount Volume Discounts Module 9: Managing Accounts Receivable and Credit Credit References Credit Policy Analysing Accounts Receivable Module 10: Managing Inventory Inventory Management Considerations Inventory Analysis Determining the Carrying and Ordering Costs The Economic Order Quantity (EOQ) Avoiding Stock Outs Determining the Reorder Point or Economic Order Point (EOP) The ABC Inventory Control Method Supply Chain Management Module 11: The Time Value of Money Future Values - How Money Grows Future Value of an Annuity Present Value - How Much Money is Worth Now? Present Value of Mixed Streams of Cash Flows Present Value of an Annuity Perpetuities Applications of Future Values and Present Values Module 12: Capital Budgeting Decisions Types of Investment Projects What Are the Features of Investment Projects? Selecting the Best Mix of Projects With a Limited Budget Income Taxes and Investment Decisions Types of Depreciation Methods How Does MACRS Affect Investment Decisions? The Cost of Capital Module 13: Improving Managerial Performance What is Return on Investment (ROI)? What Does ROI Consist of? - Du Pont Formula ROI and Profit Objective ROI and Profit Planning ROI and Return on Equity (ROE) Module 14: Sources of Short-Term Financing Trade Credit Cash Discount When are Bank Loans Advisable? Working with a Bank Issuing Commercial Paper Using Receivables for Financing Using Inventories for Financing Module 15: Considering Term Loans and Leasing Intermediate-Term Bank Loans Using Revolving Credit Insurance Company Term Loans Financing with Equipment Leasing Module 16: Long-Term Debt and Equity Financing Types of Long-Term Debt Equity Securities How Should You Finance? Module 17: Accounting Conventions and Recording Financial Data Double Entry and the Accounting Equation Assessment Method After completing each module of the Level 5: Accounting and Finance course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Level 5: Accounting and Finance course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Level 5: Accounting and Finance This course is ideal for: Candidates interested to start a career in accountancy Business owners seeking to look after their own accounts Existing accountancy workers in seeking higher positions or promotion Accountancy workers with no formal qualifications Anyone wishing to boost their career prospects. Requirements Level 5: Accounting and Finance There are no specific requirements for Level 5: Accounting and Finance course because it does not require any advanced knowledge or skills. Students who intend to enrol in this course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Level 5: Accounting and Finance This course may lead you to a variety of career opportunities. Accounts Assistant Accounts Payable & Expenses Supervisor Accounts Payable Clerk Audit Trainee Payroll Administrator / Supervisor Tax Assistant / Accountant. Accounting Clerk Auditing Clerk Accounts Receivable Clerk Certificates Certificate of completion Digital certificate - Included

Search By Location

- Japanese Courses in London

- Japanese Courses in Birmingham

- Japanese Courses in Glasgow

- Japanese Courses in Liverpool

- Japanese Courses in Bristol

- Japanese Courses in Manchester

- Japanese Courses in Sheffield

- Japanese Courses in Leeds

- Japanese Courses in Edinburgh

- Japanese Courses in Leicester

- Japanese Courses in Coventry

- Japanese Courses in Bradford

- Japanese Courses in Cardiff

- Japanese Courses in Belfast

- Japanese Courses in Nottingham