- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2235 Insurance courses

The Ultimate Guide to Event Planning - 1 Day Workshop in Canterbury

By Mangates

Event Planning 1 Day Training in Canterbury

UK Insurance Corporate Training Mini Bundle

By Compete High

Boost your insurance career with payroll, Excel, accounting, data entry, and Tableau-led data analytics skills. Navigating the corporate side of UK insurance requires more than just policy talk. This mini bundle neatly ties together the essentials—think payroll, accounting, data entry, Excel, and Tableau. Whether you’re brushing up your spreadsheets or deciphering financials, you’ll gain the structured knowledge to operate with precision. From managing numbers to visualising them, this collection delivers the core knowledge behind successful insurance operations. It’s designed for those who want to make insurance sound less... dull. (It’s not. There are spreadsheets. They're thrilling.) All courses are online, self-paced, and geared to help you move confidently through the essentials of corporate insurance functions. Learning Outcomes: Understand payroll functions within a corporate insurance context. Explore accounting processes used across insurance firms. Input, organise and manage insurance data accurately. Use Excel for reporting and insurance data management tasks. Visualise data clearly using Tableau’s dashboard features. Identify ways to optimise internal insurance operations with data. Who Is This Course For: Staff in insurance admin or back-office support roles. Payroll clerks needing sector-specific understanding. Accounting assistants in the insurance sector. Excel users looking to manage data more efficiently. Those moving into data-based insurance roles. Data entry professionals in insurance firms. Business support staff in insurance environments. Team leaders needing digital insurance fluency. Career Path (UK Average Salaries): Insurance Administrator – £24,000 per year Payroll Officer – £28,000 per year Data Entry Clerk – £21,500 per year Accounts Assistant – £26,000 per year Excel Data Analyst – £30,000 per year Tableau Reporting Analyst – £35,000 per year

crystal singing bowls, crystal singing bells, drums, gongs and frequency tubes. Adding in percussion instruments such as Koshi chimes, chime bars, rain-sticks, brass singing bowls, wahwah, shamanic rattles, waterfall shakers, omni drum, thunder tubes, rain column, aura chimes, tuning forks, wave drum and exploring the use of pyramids with sound.

Insurance: 8-in-1 Premium Online Courses Bundle

By Compete High

Looking to break into the lucrative world of insurance, finance, banking, or corporate compliance? The Insurance: 8-in-1 Premium Online Courses Bundle gives you the edge employers want — from KYC, AML, and tax compliance to payroll, purchase ledger, and property law. 🚀 Whether you’re applying for a claims analyst, compliance assistant, risk assessor, financial advisor, or insurance administrator role, this bundle helps make your CV stand out fast. With in-demand skills in accounting, financial analysis, anti-money laundering, property legislation, and corporate payroll systems, you’ll be ready for roles in insurance firms, finance departments, legal firms, underwriting, and investment platforms. 🎯 Compete High is rated 4.8 on Reviews.io and 4.3 on Trustpilot — trust the platform built to help you get hired. 📝 Description The insurance industry thrives on precision, regulation, and expertise in risk, regulation, and finance — all covered in this bundle. Whether you’re entering the industry or seeking a pivot into compliance, auditing, or claims management, this qualification helps unlock that next opportunity. Boost your profile in: Payroll processing AML/KYC regulations Property and contract law Financial reporting Insurance accounting 🧾 From brokers to underwriters to claims officers, this bundle ensures you come prepared with the keywords recruiters scan for in today’s financial job market. ❓ FAQ Q: What kinds of jobs can I pursue? A: Roles in insurance administration, claims processing, finance and compliance, property insurance, payroll and accounting, and tax regulation are all viable outcomes. Q: Is this suitable for beginners? A: Yes — no prior experience is required. Perfect for career changers, new entrants, or upskillers. Q: How credible is this training? A: Compete High is trusted with 4.8 on Reviews.io and 4.3 on Trustpilot — join thousands of learners who are now working in the financial sector.

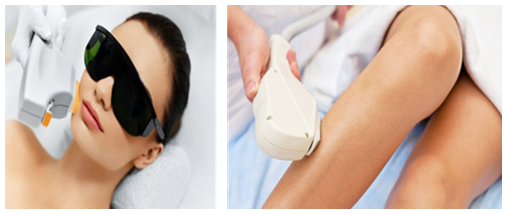

Diode Laser 3-Wave SHR Super-Fast Hair Removal Course

By Academy Of Beauty Training

Diode Laser 3-Wave Painless SHR Hair Removal Course

Risk Management and Insurance Mini Bundle

By Compete High

Build essential insurance and risk knowledge with Excel, payroll, accounting, data entry, and data analysis courses. Insurance is built on numbers, and risk isn’t just about crystal balls and worst-case scenarios. This mini bundle gets to the point with five streamlined courses covering payroll, accounting, Excel, data entry, and foundational data analysis—keeping things sharp, organised, and to the point. Designed with the modern insurance desk in mind, this selection strengthens your grip on the tools that matter. Whether you're crunching claims figures or analysing trends in a spreadsheet, this is the bundle that knows risk isn’t risky when your data game is tight. No drama, no filler—just structured insight into key support functions behind risk and insurance roles. Learning Outcomes: Develop accurate payroll knowledge for insurance workplaces. Gain accounting insights relevant to insurance workflows. Understand how to manage data entry in risk settings. Improve Excel handling for risk and claims analysis. Apply structured data analysis to insurance processes. Learn digital functions that support insurance decisions. Who Is This Course For: Insurance assistants looking to enhance desk skills. Admin staff working in policy and claims teams. Entry-level data handlers in insurance offices. Team members using Excel daily in insurance settings. Payroll staff working in risk-sensitive roles. Account handlers needing back-end knowledge. Risk assistants aiming for confident data handling. Professionals brushing up on digital insurance support tools. Career Path (UK Average Salaries): Insurance Data Analyst – £32,000 per year Risk Administrator – £27,000 per year Claims Processor – £24,000 per year Payroll Coordinator – £28,000 per year Junior Accountant – £26,500 per year Excel and Reporting Clerk – £25,000 per year

Online Lash Lift & Tint Training Course

By Cosmetic College

Learn the background, theory, protocols and more with our Lash Lift & Tint e-learning course from the expert tuition team at the Cosmetic College. Lash Lift & Tint's are a popular treatment in the beauty industry, with low costs which is profitable for you so this is a great opportunity to learn this popular facial technique. This online training course for Lash Lift & Tint is specially developed for the beauty specialist who wants to offer Lash Lift & Tint as a new treatment to their clientele. Additional course details Course Contents Bespoke First Aid for the Beauty and Aesthetic Sector Health, Hygiene and safety Anatomy and Physiology What is Lash Lifting & Tinting Benefits of Lash Lifting & Tinting Products and Trolley set up Client Consultation Process and Procedure Client Suitability and Pricing Different Skin Types Ageing and Healing Processes Insurance and Legal Requirements Treatment Areas and their Techniques Practising Techniques Lash Lifting & Tinting Step by Step Lash Lifting & Tinting Procedure - Video Demonstration Aftercare Course Features CPD Accredited CourseVetted accredited trainingFully Online TrainingTrain your way on any deviceFull DemonstrationComplete end to end treatment demonstrationImmediate CertificationDelivered immediately after completion Frequently Asked Questions Can I train straight away after making payment? Yes. Once you have completed payment our system will automatically enrol you onto the training course. You will then receive an email with instructions and a direct link to login and start your course. Can I get insurance once I have completed this training? Our online training courses are CPD accredited. Acquiring insurance based on completion and accreditation from our online training courses is insurer specific and as with most cases also takes into account your personal background and status. We advise that you contact your insurance to ensure your prerequisites meets their requirements and that this training course meets their specific criteria for insurance. We have a relationship with Insync Insurance which we recommend. Is this course accredited? Yes. This training course is accredited by the CPD group. Where is the Cosmetic College The Cosmetic College is located at: 3 Locks Court, 429 Crofton Road, Orpington, BR6 8NL How long do I have to complete the training course? Once you have logged in and started your training course you will have 3 months to complete your training.

IPL - Intense Pulsed Light SHR Super-Fast Hair Removal & Photo-Rejuvenation (Level 4 Course)

By Academy Of Beauty Training

IPL - Intense Pulsed Light SHR Super-Fast Hair Removal & Photo-Rejuvenation (Level 4 Course)

Search By Location

- Insurance Courses in London

- Insurance Courses in Birmingham

- Insurance Courses in Glasgow

- Insurance Courses in Liverpool

- Insurance Courses in Bristol

- Insurance Courses in Manchester

- Insurance Courses in Sheffield

- Insurance Courses in Leeds

- Insurance Courses in Edinburgh

- Insurance Courses in Leicester

- Insurance Courses in Coventry

- Insurance Courses in Bradford

- Insurance Courses in Cardiff

- Insurance Courses in Belfast

- Insurance Courses in Nottingham