- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2235 Insurance courses

Online Phlebotomy Training

By Cosmetic College

Throughout the phlebotomy refresher course, you will look at the theory behind phlebotomy and be allowed to develop your practical skill using the most up-to-date techniques and equipment. Additional course details Course Contents A background to phlebotomy Health and safety in phlebotomy Infection control Informed consent Anatomy and physiology of the arm Site selection - good and bad veins Complications can arise when taking blood Needlestick Injuries; what they are and what to do How and where to correctly apply a tourniquet What is expected of a phlebotomist The importance of correct patient identification and informed consent Assessment: Learners must complete online theory and multiple choice assessments before sending in a case study of their work. The Learner has 12 weeks to complete and provide a case study. Once the case study has been approved, a certificate will be uploaded to the student's account. This course was designed for learners to reshes their subject knowledge and practical skill; if you have no prior qulification would need to attend our onsite training course. Course Features CPD Accredited CourseVetted accredited trainingFully Online TrainingTrain your way on any deviceFull DemonstrationComplete end to end treatment demonstrationImmediate CertificationDelivered immediately after completion Frequently Asked Questions How long do I have to complete the training course? Once you have logged in and started your training course you will have 3 months to complete your training. Can I train straight away after making payment? Yes. Once you have completed payment our system will automatically enrol you onto the training course. You will then receive an email with instructions and a direct link to login and start your course. Can I get insurance once I have completed this training? Our online training courses are CPD accredited. Acquiring insurance based on completion and accreditation from our online training courses is insurer specific and as with most cases also takes into account your personal background and status. We advise that you contact your insurance to ensure your prerequisites meets their requirements and that this training course meets their specific criteria for insurance. We have a relationship with Insync Insurance which we recommend. Is this course accredited? Yes. This training course is accredited by the CPD group.

Online Foundation Anti Wrinkle Injections Training Course

By Cosmetic College

Anti wrinkle injections are big business - and growing! This course provides you with the knowledge and techniques to offer these new services to your clients. Additional course details Course prerequisites One or more of the following: Be a medical professional registered to a medical body (NMC, GMC, GDC, GPhC, etc.) Have Level 3 NVQ in Beauty Therapy Have six months of experience in SPMU, Microblading, and Microneedling) and six months of Anatomy & Physiology Level 3 Have 12 months of experience in advanced beauty treatments (e.g. SPMU, Microblading, Microneedling) Course Contents Anatomy and physiology of the skin, muscles and blood Infection control Sharps and hazardous waste training First aid and anaphylaxis training Pre-study of botulinum toxin theory Botulinum Toxin Preparation and Dosage Management How to achieve safe and predictable outcomes Patient management - expectations Practical training Clinical setup Professional end-to-end demonstrations This course was designed for learners to refresh their subject knowledge and practical skill; we suggest you attend our onsite training course for learners without prior training. Course Features CPD Accredited CourseVetted accredited trainingFully Online TrainingTrain your way on any deviceFull DemonstrationComplete end to end treatment demonstrationImmediate CertificationDelivered immediately after completion Frequently Asked Questions How long do I have to complete the training course? Once you have logged in and started your training course you will have 3 months to complete your training. Can I train straight away after making payment? Yes. Once you have completed payment our system will automatically enrol you onto the training course. You will then receive an email with instructions and a direct link to login and start your course. Can I get insurance once I have completed this training? Our online training courses are CPD accredited. Acquiring insurance based on completion and accreditation from our online training courses is insurer specific and as with most cases also takes into account your personal background and status. We advise that you contact your insurance to ensure your prerequisites meets their requirements and that this training course meets their specific criteria for insurance. We have a relationship with Insync Insurance which we recommend. Is this course accredited? Yes. This training course is accredited by the CPD group.

***24 Hour Limited Time Flash Sale*** VAT, Tax & Commercial law Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Unlock the world of finance with our superior bundle "VAT, Tax & Commercial law", curated to unfold complex financial and legal facets for you. This impressive bundle includes 8 comprehensive courses designed to sculpt your understanding of VAT, tax accounting, and commercial law. The package includes 3 exceptional QLS-endorsed courses: 'Introduction to VAT', 'Advanced Tax Accounting', and 'Commercial Law'. With these, you'll dive deep into VAT, master the art of tax accounting, and get to grips with commercial law intricacies. What's more? You'll also receive a hardcopy certificate for these QLS-endorsed courses, solidifying your credentials. But the learning doesn't stop there! Five additional CPD QS accredited courses on 'Cost, Revenue & Tax', 'Insurance Agent Training', 'Financial Analysis', 'Financial Investigator', and 'Investment' are included. These will broaden your understanding of VAT, tax & commercial law, making you a sought-after professional in this field. Riding on the twin pillars of relevance and comprehensiveness, this bundle on VAT, Tax & Commercial law is your ticket to knowledge supremacy. Elevate your skill set, build an impressive profile and get ready to shine in the world of finance and law! Key Features of the VAT, Tax & Commercial law Bundle: 3 QLS-Endorsed Courses: We proudly offer 3 QLS-endorsed courses within our [Course_Title] bundle, providing you with industry-recognized qualifications. Plus, you'll receive a free hardcopy certificate for each of these courses. QLS Course 01: Introduction to VAT QLS Course 02: Advanced Tax Accounting QLS Course 03: Commercial law 5 CPD QS Accredited Courses: Additionally, our bundle includes 5 relevant CPD QS accredited courses, ensuring that you stay up-to-date with the latest industry standards and practices. Course 01: Cost, Revenue & Tax Course 02: Insurance Agent Training Course 03: Financial Analysis Course 04: Financial Investigator Course 05: Investment In Addition, you'll get Five Career Boosting Courses absolutely FREE with this Bundle. Course 01: Professional CV Writing Course 02: Job Search Skills Course 03: Self Esteem & Confidence Building Course 04: Professional Diploma in Stress Management Course 05: Complete Communication Skills Master Class Convenient Online Learning: Our VAT, Tax & Commercial law courses are accessible online, allowing you to learn at your own pace and from the comfort of your own home. Learning Outcomes: Gain a comprehensive understanding of VAT, tax accounting, and commercial law. Master techniques for financial analysis and investigation. Grasp fundamental aspects of cost, revenue, and tax. Acquire knowledge on the role of an insurance agent. Learn principles and strategies of investment. Understand the key aspects of commercial law and its implications on business. Obtain QLS-endorsed hardcopy certificates, adding value to your professional credentials. Delve into the complexities of VAT, Tax & Commercial law with our 8-course bundle. This meticulously crafted suite offers both a broad overview and detailed insights into the world of finance and law. In addition, the hardcopy certificates for the QLS-endorsed courses enhance your professional standing. CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Individuals looking to enhance their knowledge of VAT, tax, and commercial law. Finance professionals seeking an in-depth understanding of financial analysis and investigation. Aspiring insurance agents who want to expand their skill set. Anyone interested in investment strategies and principles. Career path VAT Analyst (£25,000 - £45,000) Tax Accountant (£35,000 - £60,000) Commercial Law Consultant (£50,000 - £90,000) Insurance Agent (£20,000 - £45,000) Financial Analyst (£30,000 - £55,000) Investment Advisor (£40,000 - £80,000) Certificates Digital certificate Digital certificate - Included Hard copy certificate Hard copy certificate - Included

Transport Manager CPC Road Haulage Course, Notes & Exams Aug 2025

By Total Compliance

#cpc #cpcexam #driver_training #drivertraining #grantham #hgv #lincolnshire #training_course #transport #transportmanager

Transport Manager - CPC Passenger Transport Course, Notes & Exams Aug 2025

By Total Compliance

#cpc #cpcexam #driver_training #drivertraining #grantham #hgv #lincolnshire #training_course #transport #transportmanager

Business Insurance Mini Bundle

By Compete High

Whether you're managing risk or trying to understand the numbers behind business decisions, this mini bundle is built for clarity, not confusion. The courses are neatly arranged to cover essential areas—payroll, forensic accounting, business analysis, data interpretation, and accounting basics. Each topic complements the others, helping you make better-informed business decisions with fewer surprises. From tracing figures to spotting irregularities, this bundle provides a strong base to better assess business insurance from the inside out. You’ll learn how to dissect data, identify financial trends, and interpret business reports with confidence. Ideal for those who appreciate straight facts and useful tools without the usual industry jargon. Learning Outcomes: Understand the essentials of payroll and business accounting. Learn to analyse financial data and business reports. Explore key concepts in forensic accounting techniques. Develop effective business analysis strategies and approaches. Improve confidence in interpreting data for better decisions. Identify risks through accounting and data-driven insights. Who is this Course For: Individuals interested in business insurance foundations. Aspiring professionals in finance or analysis sectors. Office staff needing better understanding of payroll data. Business owners managing their own insurance processes. Students looking to broaden business knowledge quickly. Bookkeepers wanting broader financial analysis exposure. Entrepreneurs seeking clarity in insurance decisions. Anyone aiming to handle numbers without a headache. Career Path: Insurance Analyst – Average Salary: £37,000 Payroll Administrator – Average Salary: £27,000 Forensic Accountant – Average Salary: £52,000 Business Analyst – Average Salary: £46,000 Accounts Assistant – Average Salary: £26,000 Data Analyst – Average Salary: £42,000

Online Microneedling Training Course

By Cosmetic College

Learn the background, theory, protocols and more with our Microneedling e-learning course from the expert tuition team at the Cosmetic College. Microneedling is one of the fastest-growing treatments in the beauty industry, so this is a great opportunity to learn this popular facial technique. This online training course for Microneedling is specially developed for the advanced facial beauty specialist who wants to offer Microneedling as a new treatment to their clientele. Additional course details Course Contents Bespoke First Aid for the Beauty and Aesthetic Sector Health, Hygiene and safety Anatomy and Physiology What is Microneedling Benefits of Microneedling Products and Trolley set up Client Consultation Process and Procedure Client Suitability and Pricing Different Skin Types Ageing and Healing Processes Insurance and Legal Requirements Treatment Areas and their Techniques Practising Techniques Microneedling Step by Step Microneedling Procedure - Video Demonstration Aftercare Course Features CPD Accredited CourseVetted accredited trainingFully Online TrainingTrain your way on any deviceFull DemonstrationComplete end to end treatment demonstrationImmediate CertificationDelivered immediately after completion Frequently Asked Questions Is this course accredited? Yes. This training course is accredited by the CPD group. Can I get insurance once I have completed this training? Our online training courses are CPD accredited. Acquiring insurance based on completion and accreditation from our online training courses is insurer specific and as with most cases also takes into account your personal background and status. We advise that you contact your insurance to ensure your prerequisites meets their requirements and that this training course meets their specific criteria for insurance. We have a relationship with Insync Insurance which we recommend. Do you offer in-person training? Yes, we perform in-person training at our training academy in Orpington, Kent. You can find out more details of our in-person Microneedling training here Can I train straight away after making payment? Yes. Once you have completed payment our system will automatically enrol you onto the training course. You will then receive an email with instructions and a direct link to login and start your course. How long do I have to complete the training course? Once you have logged in and started your training course you will have 3 months to complete your training.

Online Aqualyx & Deso Fat Dissolving Training

By Cosmetic College

Give your client a great way to reduce fat in the under chin area and body regions. Treat areas of localised fat such as the thighs, stomach, back, chin, knees and chest in adults up to 60 years of age. The treatment takes approximately 30-60 minutes per session, and multiple sessions are usually needed, 4 weeks apart. This course includes in depth theory of the skin, pre and after care for your client. We will provide you with full information on the treatment including what products to use, legislations relating to the process and a full end to end treatment demonstrations on multiple areas of the body. Additional course details Course Contents Cosmetic College and Student Information Health & Safety in the Workplace Blood-borne Pathogens + Needle Stick Injuries Safe Disposal Of Sharps & Hazardous Waste Health & Safety Video Anatomy & Physiology Medication Storage Client consultation and pre-treatment checks Aqualyx fat dissolving Deso Face and Body Deso Face and Body Fat-dissolving Injections Demonstration Understanding Body Fat Weight & Obesity ASEPTIC technique Pre & Post care FAQ This course was designed for learners to refresh their subject knowledge and practical skill; with prior subcutaneous injection experience, we suggest you attend our onsite training course for learners without previous training. Course Features CPD Accredited CourseVetted accredited trainingFully Online TrainingTrain your way on any deviceFull DemonstrationComplete end to end treatment demonstrationImmediate CertificationDelivered immediately after completion Frequently Asked Questions How long do I have to complete the training course? Once you have logged in and started your training course you will have 3 months to complete your training. Can I train straight away after making payment? Yes. Once you have completed payment our system will automatically enrol you onto the training course. You will then receive an email with instructions and a direct link to login and start your course. Can I get insurance once I have completed this training? Our online training courses are CPD accredited. Acquiring insurance based on completion and accreditation from our online training courses is insurer specific and as with most cases also takes into account your personal background and status. We advise that you contact your insurance to ensure your prerequisites meets their requirements and that this training course meets their specific criteria for insurance. We have a relationship with Insync Insurance which we recommend. Is this course accredited? Yes. This training course is accredited by the CPD group.

The Ultimate Guide to Event Planning - 1 Day Workshop in Caernarfon

By Mangates

Event Planning 1 Day Training in Caernarfon

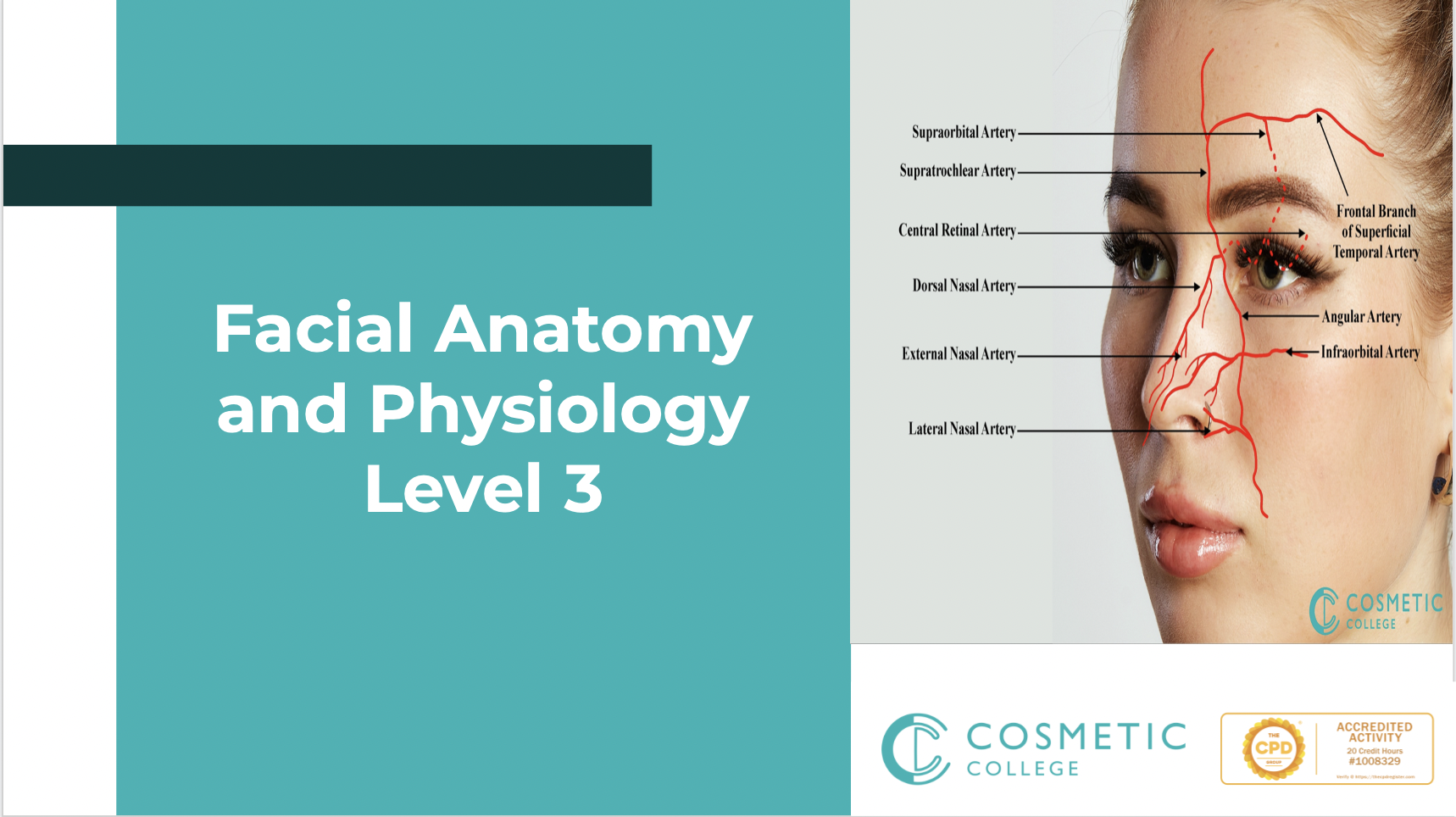

Facial Anatomy and Physiology

By Cosmetic College

In this course, you will learn about the anatomy and physiology of the face. The location and function of the major facial nerve, blood and muscles are covered, including their nerve and blood supply. You will cover the fundamental theory of performing safe aesthetic procedures. Additional course details Course Prerequisites No entry requirements Course Contents Facial Anatomy & Physiology Of The Muscles Facial Anatomy & Physiology Of The Vessel's Facial Anatomy & Physiology Of The Nerves Dermal Filler Danger Zones Course Features CPD Accredited CourseVetted accredited trainingFully Online TrainingTrain your way on any deviceFull DemonstrationComplete end to end treatment demonstrationImmediate CertificationDelivered immediately after completion Frequently Asked Questions How long do I have to complete the training course? Once you have logged in and started your training course you will have 3 months to complete your training. Can I train straight away after making payment? Yes. Once you have completed payment our system will automatically enrol you onto the training course. You will then receive an email with instructions and a direct link to login and start your course. Can I get insurance once I have completed this training? Our online training courses are CPD accredited. Acquiring insurance based on completion and accreditation from our online training courses is insurer specific and as with most cases also takes into account your personal background and status. We advise that you contact your insurance to ensure your prerequisites meets their requirements and that this training course meets their specific criteria for insurance. We have a relationship with Insync Insurance which we recommend. Is this course accredited? Yes. This training course is accredited by the CPD group.

Search By Location

- Insurance Courses in London

- Insurance Courses in Birmingham

- Insurance Courses in Glasgow

- Insurance Courses in Liverpool

- Insurance Courses in Bristol

- Insurance Courses in Manchester

- Insurance Courses in Sheffield

- Insurance Courses in Leeds

- Insurance Courses in Edinburgh

- Insurance Courses in Leicester

- Insurance Courses in Coventry

- Insurance Courses in Bradford

- Insurance Courses in Cardiff

- Insurance Courses in Belfast

- Insurance Courses in Nottingham