- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Online Jalupro Classic | HMW | Super Hydro

By Cosmetic College

Jalupro is used to regenerate the Extra Cellular Matrix (ECM) by stimulating the fibroblasts in the skin to produce a complete mix of collagen and elastin. These products are an excellent option for clients who wish to maintain a more natural look or those who do not want or need Botulinum Toxin or Dermal Fillers. Additional course details Course Prerequisites Be a medical professional registered to a medical body (NMC, GMC, GDC, GPhC, etc.) Have Level 3 NVQ in Beauty Therapy Previous Dermal Filler or Botox training Have six months of experience in SPMU, Microblading, and Microneedling) and six months of Anatomy & Physiology Level 3 Have 12 months of experience in advanced beauty treatments (e.g. SPMU, Microblading, Microneedling) Course Contents Health & Safety Infection Control Sharps disposal Facial Skin Anatomy Skin Ageing Jalupro classic, HMW, Super Hydro Injection Techniques Jalupro Procedure - Video Demonstration Contra action Contraindications Aftercare This course was designed for learners to refresh their subject knowledge and practical skill; with prior skin booster injection experience, we suggest you attend our onsite training course for learners without previous training. Course Features CPD Accredited CourseVetted accredited trainingFully Online TrainingTrain your way on any deviceFull DemonstrationComplete end to end treatment demonstrationImmediate CertificationDelivered immediately after completion Frequently Asked Questions How long do I have to complete the training course? Once you have logged in and started your training course you will have 3 months to complete your training. Can I train straight away after making payment? Yes. Once you have completed payment our system will automatically enrol you onto the training course. You will then receive an email with instructions and a direct link to login and start your course. Can I get insurance once I have completed this training? Our online training courses are CPD accredited. Acquiring insurance based on completion and accreditation from our online training courses is insurer specific and as with most cases also takes into account your personal background and status. We advise that you contact your insurance to ensure your prerequisites meets their requirements and that this training course meets their specific criteria for insurance. We have a relationship with Insync Insurance which we recommend. Is this course accredited? Yes. This training course is accredited by the CPD group. Where is the Cosmetic College The Cosmetic College is located at: 3 Locks Court, 429 Crofton Road, Orpington, BR6 8NL Do you offer in-person training? Yes, we perform in-person training at our training academy in Orpington, Kent. You can find out more details of our in-person Microneedling training here

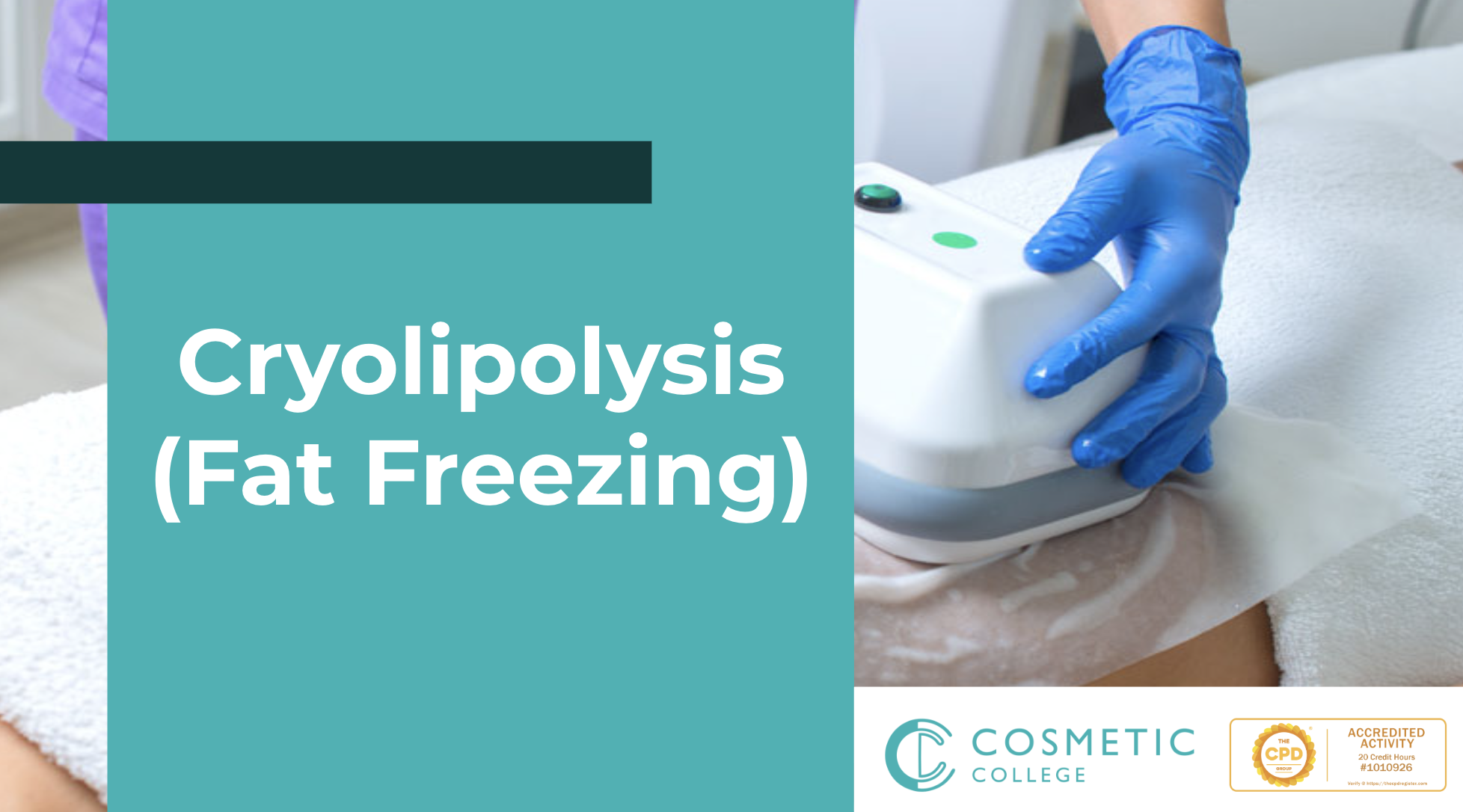

Online Cryotherapy (Fat Freezing) Training Course

By Cosmetic College

Our accredited Cryotherapy (fat freezing) training course will give you in-depth training on what Cryotherapy is and how to safely and effectively perform the treatment on clients. Additional course details Course Contents What Cryotherapy is How our weight affects our health How Cryotherapy works Introduction to the operation of your machine Client Consultation Client Safety Contraindications to treatment Areas that can be treated How to perform a treatment Handset positioning for all areas Side Effects Pre and Post-treatment advice Machine Maintenance General Troubleshooting FAQs This course was designed for learners to refresh their subject knowledge and practical skill; we suggest you attend our onsite training course for learners without prior training. Course Features CPD Accredited CourseVetted accredited trainingFully Online TrainingTrain your way on any deviceFull DemonstrationComplete end to end treatment demonstrationImmediate CertificationDelivered immediately after completion Frequently Asked Questions How long do I have to complete the training course? Once you have logged in and started your training course you will have 3 months to complete your training. Can I train straight away after making payment? Yes. Once you have completed payment our system will automatically enrol you onto the training course. You will then receive an email with instructions and a direct link to login and start your course. Can I get insurance once I have completed this training? Our online training courses are CPD accredited. Acquiring insurance based on completion and accreditation from our online training courses is insurer specific and as with most cases also takes into account your personal background and status. We advise that you contact your insurance to ensure your prerequisites meets their requirements and that this training course meets their specific criteria for insurance. We have a relationship with Insync Insurance which we recommend. Is this course accredited? Yes. This training course is accredited by the CPD group.

Actuarial Science : Pension, Tax Accounting & Business Analysis

By Compliance Central

GRAB LATEST ACTUARIAL SCIENCE SKILL WHEELS at the BEST OFFER of the TIME!... Are you looking to enhance your Actuarial Science skills? If yes, then you have come to the right place. Our comprehensive courses on Actuarial Science will assist you in producing the best possible outcome by learning the Actuarial Science skills. This Actuarial Science Bundle Includes Course 01: Pension Course 02: Principles of Insurance & Insurance Fraud Course 03: Insurance: Personal Lines & Commercial Lines Insurance Course 04: Financial Analysis Course 05: Business Analysis Course 06: Tax Accounting So, enrol in our Actuarial Science bundle now! Other Benefits Lifetime Access to All Learning Resources An Interactive, Online Course A Product Created By Experts In The Field Self-Paced Instruction And Laptop, Tablet, And Smartphone Compatibility 24/7 Learning Support Free Certificate After Completion Learn at your own pace from the comfort of your home, as the rich learning materials of this course are accessible from any place at any time. The curriculums are divided into tiny bite-sized modules by industry specialists. And you will get answers to all your queries from our experts. So, enrol and excel in your career with Compliance Central. Pension :- Module 01: Overview of the UK Pension system Module 02: Type of Pension Schemes Module 03: Pension Regulation Module 04: Pension Fund Governance Module 05: Law and Regulation of Pensions in the UK Module 06: Key Challenges in UK Pension System Principles of Insurance & Insurance Fraud :- Module 01: Principles of Insurance Module 02: General Insurance Module 03: Insurance Fraud Module 04: Underwriting Process Insurance: Personal Lines & Commercial Lines Insurance :- Module 01: Personal Lines Insurance Module 02: Commercial Lines Insurance Financial Analysis :- Section-1. Introduction Section-2. Profitability Section-3. Return Ratio Section-4. Liqudity Ratio Section-5.Operational Analysis Section-6. Detecting Manipulation Business Analysis :- Module 1: Introduction to Business Analysis Module 2: Business Environment Module 3: Business Processes Module 4: Business Analysis Planning and Monitoring Module 5: Strategic Analysis and Product Scope Module 6: Solution Evaluation Module 7: Investigation Techniques Module 8: Ratio Analysis Module 9: Stakeholder Analysis and Management Module 10: Process Improvement with Gap Analysis Module 11: Documenting and Managing Requirements Module 12: Business Development and Succession Planning Module 13: Planning & Forecasting Operations Module 14: Business Writing Skills Tax Accounting :- Module 1: Capital Gain Tax Module 2: Import and Export Module 3: Double Entry Accounting Module 4: Management Accounting and Financial Analysis Module 5: Career as a Tax Accountant in the UK CPD 60 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Actuarial Science bundle. Requirements To enrol in this Actuarial Science, all you need is a basic understanding of the English Language and an internet connection. Career path After completing this course, you can explore trendy and in-demand jobs related to Actuarial Science, such as- Insurance Project Manager Insurance Claims Handler Financial Analyst Tax Compliance Accountant Lead Business Analyst Certificates Certificate of completion Digital certificate - Included Get 6 CPD accredited PDF certificate for Free. Certificate of completion Hard copy certificate - £9.99 Get 6 CPD accredited Hardcopy certificate for £9.99 each. The delivery charge of the hardcopy certificate inside the UK is £3.99 each, and international students need to pay £9.99 each to get their hardcopy certificate.

Online Chemical Skin Peels Training Course

By Cosmetic College

Our Chemical Skin Peel online training course is an engaging and interactive way to learn advanced facial skincare that will teach you to deliver these in-demand treatments with confidence. As huge innovations within skin technology and products are made, making these treatments more effective but also more comfortable on client's skin; skin peels are seeing a huge revival in popularity. Skin peels, often known also as 'chemical' peels work to exfoliate the skin and remove dead skin cells using specialised products applied topically to the skin. Additional course details Course Contents Bespoke First Aid for the Beauty Sector Health, Safety and Hygiene for the Beauty Sector Anatomy and Physiology History of Facial Peels What are Facial Peels? Benefits of Facial Peels Different types of Facial Peels Facial Peels Products and Equipment Treatment Set Up Client Consultation Process and Procedure Facial Peels Step by Step Procedure Facial Peels Video Demonstration Aftercare Course Features CPD Accredited CourseVetted accredited trainingFully Online TrainingTrain your way on any deviceFull DemonstrationComplete end to end treatment demonstrationImmediate CertificationDelivered immediately after completion Frequently Asked Questions Is this course accredited? Yes. This training course is accredited by the CPD group. Can I get insurance once I have completed this training? Our online training courses are CPD accredited. Acquiring insurance based on completion and accreditation from our online training courses is insurer specific and as with most cases also takes into account your personal background and status. We advise that you contact your insurance to ensure your prerequisites meets their requirements and that this training course meets their specific criteria for insurance. We have a relationship with Insync Insurance which we recommend. Can I train straight away after making payment? Yes. Once you have completed payment our system will automatically enrol you onto the training course. You will then receive an email with instructions and a direct link to login and start your course. How long do I have to complete the training course? Once you have logged in and started your training course you will have 3 months to complete your training.

Online Lidocaine Infusion Training

By Cosmetic College

The Lidocaine Infusion course is designed for aesthetic practitioners who would like the option to administer extra pain relief for their clients during treatments. Additional course details Course Prerequisites Be a medical professional registered to a medical body (NMC, GMC, GDC, GPhC, etc.) Have Level 3 NVQ in Beauty Therapy Previous Dermal Filler or Botox training Have six months of experience in SPMU, Microblading, and Microneedling) and six months of Anatomy & Physiology Level 3 Have 12 months of experience in advanced beauty treatments (e.g. SPMU, Microblading, Microneedling) Course Contents The Lidocaine Infusion course consists of the following theoretical and practical components. Structure of Lidocaine Suitability for Lidocaine Nerves Side effects Consent forms Aftercare Managing expectations Client consultation Hygiene, sharps disposal and legal aspects This course was designed for learners to refresh their subject knowledge and practical skill; with prior injection experience, we suggest you attend our onsite training course for learners without previous training. Course Features CPD Accredited CourseVetted accredited trainingFully Online TrainingTrain your way on any deviceFull DemonstrationComplete end to end treatment demonstrationImmediate CertificationDelivered immediately after completion Frequently Asked Questions How long do I have to complete the training course? Once you have logged in and started your training course you will have 3 months to complete your training. Can I train straight away after making payment? Yes. Once you have completed payment our system will automatically enrol you onto the training course. You will then receive an email with instructions and a direct link to login and start your course. Can I get insurance once I have completed this training? Our online training courses are CPD accredited. Acquiring insurance based on completion and accreditation from our online training courses is insurer specific and as with most cases also takes into account your personal background and status. We advise that you contact your insurance to ensure your prerequisites meets their requirements and that this training course meets their specific criteria for insurance. We have a relationship with Insync Insurance which we recommend. Is this course accredited? Yes. This training course is accredited by the CPD group.

Online Dermaplaning Training Course

By Cosmetic College

Dermaplaning is a cosmetic procedure that removes the top layers of your skin. The procedure aims to remove fine wrinkles and deep acne scarring, as well as make the skin's surface look smooth with ongoing training. Dermaplane training is an excellent way to add more options for your clients' beauty needs. Through our interactive and engaging e-learning platform with comprehensive study materials and video tutorials, this online course will take you through the process for these highly effective treatments, as well as ensuring you have confident knowledge of the essential health and safety, and anatomy and physiology related to these treatments. Additional course details Course Contents Health & Safety Contraindications Client Consultation Preparation of skin Anatomy How to manage the blade Stretching the skin Exfoliating the full face Applying a mask Aftercare This course was designed for learners to refresh their subject knowledge and practical skill; we suggest you attend our onsite training course for learners without prior training. Course Features CPD Accredited CourseVetted accredited trainingFully Online TrainingTrain your way on any deviceFull DemonstrationComplete end to end treatment demonstrationImmediate CertificationDelivered immediately after completion Frequently Asked Questions Is this course accredited? Yes. This training course is accredited by the CPD group. Can I get insurance once I have completed this training? Our online training courses are CPD accredited. Acquiring insurance based on completion and accreditation from our online training courses is insurer specific and as with most cases also takes into account your personal background and status. We advise that you contact your insurance to ensure your prerequisites meets their requirements and that this training course meets their specific criteria for insurance. We have a relationship with Insync Insurance which we recommend. How long do I have to complete the training course? Once you have logged in and started your training course you will have 3 months to complete your training. Can I train straight away after making payment? Yes. Once you have completed payment our system will automatically enrol you onto the training course. You will then receive an email with instructions and a direct link to login and start your course.

Insurance Compliance Training Mini Bundle

By Compete High

Insurance and accuracy go hand in hand—and this bundle doesn’t miss a beat. With topics including payroll, forensic accounting, report writing, data analysis and accounting, this course is structured to help learners handle numbers and write about them with precision (and without snore-inducing reports). Each subject is tailored to add another layer to your understanding of financial processes that matter to insurers, regulators, and auditors alike. The goal? To make compliance feel less like a chore and more like a skill you’ve got under control—with data you can trust and reporting you can defend. Learning Outcomes: Learn to manage payroll processes with professional accuracy. Understand forensic accounting and its detailed applications. Develop financial reporting and structured writing techniques. Use data to support business and insurance analysis. Recognise errors and inconsistencies in financial records. Strengthen accounting knowledge for business insurance sectors. Who is this Course For: Professionals working in insurance or finance administration. Beginners wanting to understand insurance and data basics. Individuals managing payroll or report documentation. Bookkeepers exploring wider insurance-related skills. Students aiming for finance or insurance-related careers. Analysts needing structured reporting knowledge. Office workers supporting compliance departments. Anyone keen to write financial reports without guesswork. Career Path: Insurance Claims Officer – Average Salary: £32,000 Report Writer (Finance) – Average Salary: £34,000 Payroll Officer – Average Salary: £28,000 Accounting Clerk – Average Salary: £25,000 Forensic Accounting Assistant – Average Salary: £39,000 Data & Reporting Analyst – Average Salary: £41,000

UK Insurance Corporate Training Mini Bundle

By Compete High

Boost your insurance career with payroll, Excel, accounting, data entry, and Tableau-led data analytics skills. Navigating the corporate side of UK insurance requires more than just policy talk. This mini bundle neatly ties together the essentials—think payroll, accounting, data entry, Excel, and Tableau. Whether you’re brushing up your spreadsheets or deciphering financials, you’ll gain the structured knowledge to operate with precision. From managing numbers to visualising them, this collection delivers the core knowledge behind successful insurance operations. It’s designed for those who want to make insurance sound less... dull. (It’s not. There are spreadsheets. They're thrilling.) All courses are online, self-paced, and geared to help you move confidently through the essentials of corporate insurance functions. Learning Outcomes: Understand payroll functions within a corporate insurance context. Explore accounting processes used across insurance firms. Input, organise and manage insurance data accurately. Use Excel for reporting and insurance data management tasks. Visualise data clearly using Tableau’s dashboard features. Identify ways to optimise internal insurance operations with data. Who Is This Course For: Staff in insurance admin or back-office support roles. Payroll clerks needing sector-specific understanding. Accounting assistants in the insurance sector. Excel users looking to manage data more efficiently. Those moving into data-based insurance roles. Data entry professionals in insurance firms. Business support staff in insurance environments. Team leaders needing digital insurance fluency. Career Path (UK Average Salaries): Insurance Administrator – £24,000 per year Payroll Officer – £28,000 per year Data Entry Clerk – £21,500 per year Accounts Assistant – £26,000 per year Excel Data Analyst – £30,000 per year Tableau Reporting Analyst – £35,000 per year

Online Lash Lift & Tint Training Course

By Cosmetic College

Learn the background, theory, protocols and more with our Lash Lift & Tint e-learning course from the expert tuition team at the Cosmetic College. Lash Lift & Tint's are a popular treatment in the beauty industry, with low costs which is profitable for you so this is a great opportunity to learn this popular facial technique. This online training course for Lash Lift & Tint is specially developed for the beauty specialist who wants to offer Lash Lift & Tint as a new treatment to their clientele. Additional course details Course Contents Bespoke First Aid for the Beauty and Aesthetic Sector Health, Hygiene and safety Anatomy and Physiology What is Lash Lifting & Tinting Benefits of Lash Lifting & Tinting Products and Trolley set up Client Consultation Process and Procedure Client Suitability and Pricing Different Skin Types Ageing and Healing Processes Insurance and Legal Requirements Treatment Areas and their Techniques Practising Techniques Lash Lifting & Tinting Step by Step Lash Lifting & Tinting Procedure - Video Demonstration Aftercare Course Features CPD Accredited CourseVetted accredited trainingFully Online TrainingTrain your way on any deviceFull DemonstrationComplete end to end treatment demonstrationImmediate CertificationDelivered immediately after completion Frequently Asked Questions Can I train straight away after making payment? Yes. Once you have completed payment our system will automatically enrol you onto the training course. You will then receive an email with instructions and a direct link to login and start your course. Can I get insurance once I have completed this training? Our online training courses are CPD accredited. Acquiring insurance based on completion and accreditation from our online training courses is insurer specific and as with most cases also takes into account your personal background and status. We advise that you contact your insurance to ensure your prerequisites meets their requirements and that this training course meets their specific criteria for insurance. We have a relationship with Insync Insurance which we recommend. Is this course accredited? Yes. This training course is accredited by the CPD group. Where is the Cosmetic College The Cosmetic College is located at: 3 Locks Court, 429 Crofton Road, Orpington, BR6 8NL How long do I have to complete the training course? Once you have logged in and started your training course you will have 3 months to complete your training.

Insurance: 8-in-1 Premium Online Courses Bundle

By Compete High

Looking to break into the lucrative world of insurance, finance, banking, or corporate compliance? The Insurance: 8-in-1 Premium Online Courses Bundle gives you the edge employers want — from KYC, AML, and tax compliance to payroll, purchase ledger, and property law. 🚀 Whether you’re applying for a claims analyst, compliance assistant, risk assessor, financial advisor, or insurance administrator role, this bundle helps make your CV stand out fast. With in-demand skills in accounting, financial analysis, anti-money laundering, property legislation, and corporate payroll systems, you’ll be ready for roles in insurance firms, finance departments, legal firms, underwriting, and investment platforms. 🎯 Compete High is rated 4.8 on Reviews.io and 4.3 on Trustpilot — trust the platform built to help you get hired. 📝 Description The insurance industry thrives on precision, regulation, and expertise in risk, regulation, and finance — all covered in this bundle. Whether you’re entering the industry or seeking a pivot into compliance, auditing, or claims management, this qualification helps unlock that next opportunity. Boost your profile in: Payroll processing AML/KYC regulations Property and contract law Financial reporting Insurance accounting 🧾 From brokers to underwriters to claims officers, this bundle ensures you come prepared with the keywords recruiters scan for in today’s financial job market. ❓ FAQ Q: What kinds of jobs can I pursue? A: Roles in insurance administration, claims processing, finance and compliance, property insurance, payroll and accounting, and tax regulation are all viable outcomes. Q: Is this suitable for beginners? A: Yes — no prior experience is required. Perfect for career changers, new entrants, or upskillers. Q: How credible is this training? A: Compete High is trusted with 4.8 on Reviews.io and 4.3 on Trustpilot — join thousands of learners who are now working in the financial sector.